It’s hard to believe Picture Perfect Portfolios is close to celebrating its first birthday on April 7th!

My very first blog post was a WisdomTree review of its capital efficient gold fund – GDE ETF:

It’s only fitting that roughly one year later we review its sibling GDMN ETF.

It’s better known as WisdomTree Efficient Gold Plus Gold Miners Strategy Fund.

Instead of offering investors 90% Gold PLUS 90% Us Equities (which is GDE ETF) it swaps out half of this equation for a Gold Miners strategy.

Hence, with GDMN you’re getting 90% Gold PLUS 90% Gold Miners.

However, it’s more likely the type of capital efficient tactical fund you might use to round things out as a portfolio completion fund as opposed to it being a core holding.

The fund gains its capital efficiency by allocating 90% of its resources to a diversified mix of market cap weighted Global Gold Miners equities (which derive at least 50% of their revenue from the gold mining business) alongside 90% exposure to Gold via futures contracts with 10% remaining as cash capital.

Overall, that looks like this:

90% Global Gold Miners

90% Gold Futures

10% Cash Collateral

The Case For Allocating To Gold

Gold is easily one of the most polarizing asset classes out there!

You have investors who plunk down high conviction allocations (ex: Harry Browne Permanent Portfolio) to those who dabble with just a tiny bit as a diversifier.

On the other hand, you’ll find investors who wouldn’t touch it with a 10 foot pole whilst bolting for the hills anytime the word “Gold” is muttered.

My research has led me down a path where I couldn’t imagine it NOT being in my portfolio.

But I’m not keen on giving up space to make room for it.

That’s where the capital efficiency of GDE and GDMN ETF come into play.

You don’t have to give up “equity” space to potentially fit it in.

Later on in the review you’ll notice a model portfolio where I’ve highlighted a way in which you can keep your traditional 60/40 portfolio whilst adding diversifiers such as gold, gold miners, managed futures and market neutral strategies.

There is simply magic combining US equities and Gold together in a portfolio:

The Magic of Combining Leveraged Stocks and Gold in Your Portfolio

An article I wrote last year unpacks that combination of 50/50 + 90/90 US Equities and Gold allocations throughout the decades.

What did I discover?

No lost decades!

Gold more than picks up the tab in the 70s and 2000s and Equities mop the floor in the 80s, 90s and 2010s.

Here were the results:

1970s CAGR

90/90 US + GOLD: 43.16%

GOLD: 36.08%

50/50 US + GOLD: 23.64%

US LARGE CAP: 4.55%

1980s CAGR

US LARGE CAP: 17.05%

90/90 US + GOLD: 12.35%

50/50 US + GOLD: 7.67%

GOLD: -2.47%

1990s CAGR

US LARGE CAP: 18.07%

90/90 US + GOLD: 13.95%

50/50 US + GOLD: 7.87%

GOLD: -3.12%

2000s CAGR

GOLD: 13.91%

90/90 US + GOLD: 11.65%

50/50 US + GOLD: 6.94%

US LARGE CAP: -1.03%

2010s CAGR

90/90 US + GOLD: 15.19%

US LARGE CAP: 13.40%

50/50 US + GOLD: 8.64%

GOLD: 2.91%

*Please note that the 90/90 allocation simulations do not include cost of borrowing for leverage (which could have been substantial for certain decades) nor account for the the investability in Gold.*

Notice anything interesting?

No lost decades for the 50/50 and 90/90 combinations!

And nothing short of double digit CAGR for 90/90 in every single decade spanning from 1972 until 2020.

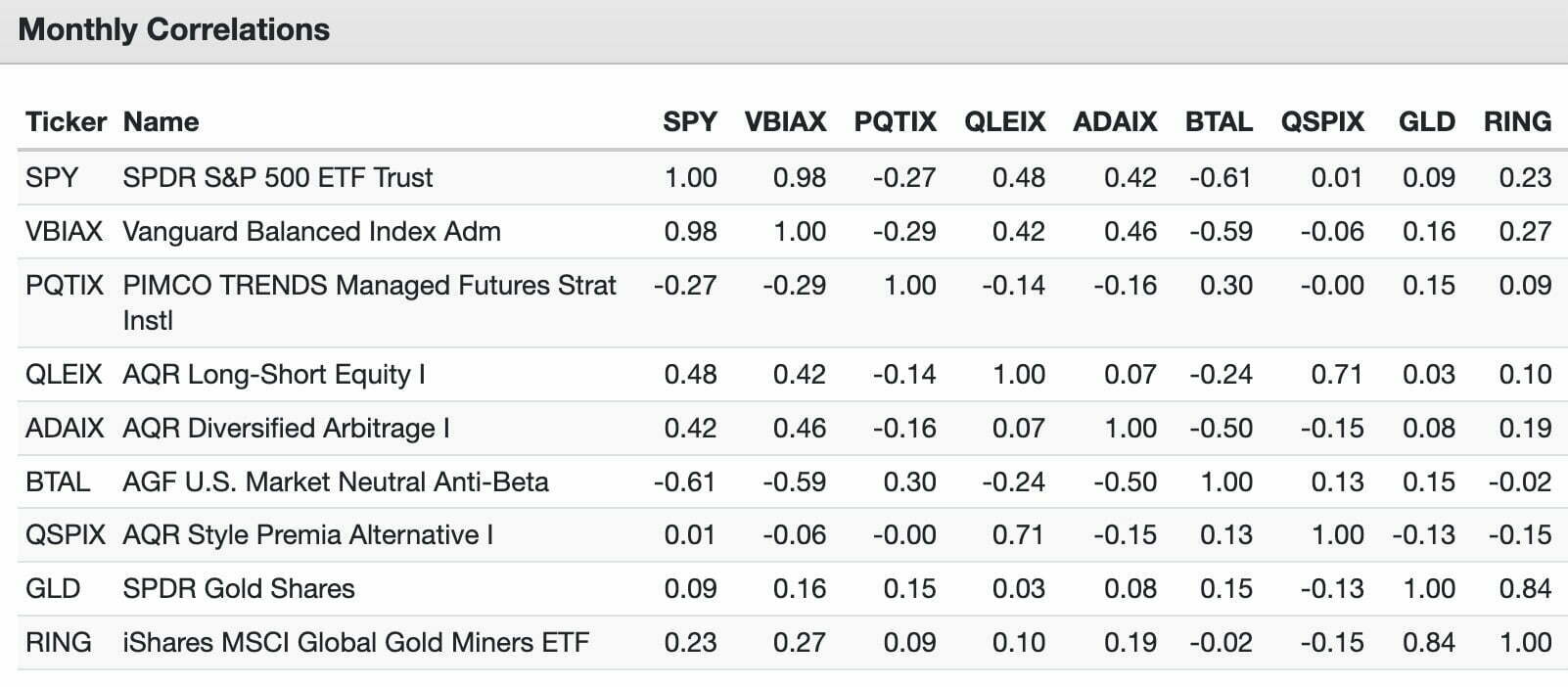

The Correlations Of Gold and Gold Miners With Other Investing Strategies

Now let’s examine the correlations between Gold and Gold Miners with other mainstream investing strategies and other diversifying alternative portfolio solutions.

Rewinding the clock back to 2014 we’re able to see a long-range back-test of monthly correlations.

First let’s check out Gold.

Gold Correlations vs Other Investing Strategies

SPY ETF: SPDR S&P 500 ETF Trust: 0.09

VBIAX Fund: Vanguard Balanced 60/40: 0.16

PQTIX Fund: PIMCO TRENDS Managed Futures: 0.15

QLEIX Fund: AQR Long-Short Equity: 0.03

ADAIX Fund: AQR Diversified Arbitrage: 0.08

BTAL ETF: AGF U.S. Market Neutral Anti-Beta: 0.15

QSPIX AQR Style Premia Alternative: -0.13

Wowzers!

Gold is uncorrelated with everything under the sun you could possibly pair it with!

It’s uncorrelated with the S&P 500 and 60/40 Portfolio!

And it continues its maximum diversification benefits when analyzed alongside all of the alternative strategies as well.

It’s truly the OG alternative out there.

It’s been around as long as anything else and it is still marching to the beat of its own drum.

Gold Miners Correlations vs Other Investing Strategies

SPY ETF: SPDR S&P 500 ETF Trust: 0.23

VBIAX Fund: Vanguard Balanced 60/40: 0.27

PQTIX Fund: PIMCO TRENDS Managed Futures: 0.09

QLEIX Fund: AQR Long-Short Equity: 0.10

ADAIX Fund: AQR Diversified Arbitrage: 0.19

BTAL ETF: AGF U.S. Market Neutral Anti-Beta: –0.02

QSPIX AQR Style Premia Alternative: -0.13

And with Gold Miners we continue our uncorrelated ways!

The two combined together are an attractive diversifying combination.

GDMN Alternative ETF Review | WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Review

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review and Mutual Funds Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

WisdomTree: Efficient Core ETF Providers

Thanks to a concerted effort spearheaded by @JeremyDSchwartz, WisdomTree is now home to no less than five efficient core ETFs!

They’re clearly one of the leading providers of low cost capital efficient ETFs for investors to potentially consider.

Let’s check out the entire roster:

$NTSX – WisdomTree U.S Efficient Core Fund: 90/60 US Equities + Treasuries

$NTSI – WisdomTree International Efficient Core Fund: 90/60 Int-Dev Equities + Treasuries

$NTSE – WisdomTree Emerging Markets Efficient Core Fund: 90/60 Emerging Equities + Treasuries

$GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund: 90/90 US Equities + Gold

$GDMN – WisdomTree Efficient Gold Plus Gold Miners Strategy Fund: 90/90 Gold + Gold Miners

source: WisdomTree Investments on YouTube

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Overview, Holdings and Info

The investment case for “WisdomTree Efficient Gold Plus Gold Miners Strategy Fund” has been laid out succinctly by the folks over at WisdomTree: (source: fund landing page)

Strategy:

The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund seeks total return by investing in gold miners and gold futures contracts.

Why GDMN?

- “Seeks exposure to gold miners equities and enhanced gold exposure through leveraged futures contracts”

- Aims to provide a capital efficient alternative to gold miners strategies with the added potential benefit of exposure to gold futures

- Use to enhance portfolio diversification with gold futures and gold miners acting as a potential inflation hedge”

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom. (source: summary prospectus)

Principal Investment Strategies of the Fund

“The Fund is actively managed using a models-based approach.

The Fund seeks to achieve its investment objective by investing, either directly or through a wholly-owned subsidiary, in a portfolio comprised of (i) U.S.-listed gold futures contracts and (ii) global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“Gold Miners”).

The Fund uses U.S.-listed gold futures contracts to enhance the capital efficiency of the Fund.

Capital efficiency is the ability for an investment to gain exposure to a particular market while using fewer assets.

The Fund will invest in a representative basket of global equity securities issued by Gold Miners generally weighted by market capitalization.

To be eligible for inclusion in the Fund, Gold Miners, including companies in developed and emerging market countries throughout the world, must be listed on an eligible global stock exchange.

As of the date of this Prospectus, the Fund invests a significant portion of its assets in Gold Miners domiciled in Canada.

Under normal circumstances, the Fund will have approximately equal exposure to U.S.-listed gold futures contracts and global equity securities issued by Gold Miners.

The Fund generally will invest approximately 90% of its net assets in global equity securities issued by Gold Miners, while the Fund’s aggregate U.S.-listed gold futures contracts positions typically will represent a notional exposure (i.e., the total underlying amount of exposure created by a derivatives trade) of approximately 90% of the Fund’s net assets.

To the extent exposure of the Fund deviates from this targeted allocation by 5% or greater, it is anticipated that the Fund will be rebalanced to more closely align with the original target allocations.

The Fund may invest in U.S. Treasury securities and other liquid short-term investments as collateral for its U.S.-listed gold futures contracts.

The Fund will not invest directly in physical commodities.

The Fund seeks to gain exposure to the commodity market for gold, in whole or in part, through investments in a subsidiary organized in the Cayman Islands (the “WisdomTree Subsidiary”).

To provide such exposure, the WisdomTree Subsidiary will invest primarily in U.S.-listed gold futures contracts.

The WisdomTree Subsidiary is wholly owned and controlled by the Fund.

The Fund’s investment in the WisdomTree Subsidiary may not exceed 25% of the Fund’s total assets at each quarter-end of the Fund’s fiscal year.

The Fund’s investment in the WisdomTree Subsidiary is intended to provide the Fund with exposure to the investment returns of gold while enabling the Fund to satisfy source-of-income requirements that apply to regulated investment companies (“RICs”) under the Internal Revenue Code of 1986, as amended (the “Code”).

Except as noted, references to the investment strategies and risks of the Fund include the investment strategies and risks of the WisdomTree Subsidiary.

The Fund will concentrate (i.e., invest more than 25% of its net assets) in securities in the metals and mining industry and the gold mining sub-industry.”

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Investment Strategy Key Points

- Actively Managed dual strategy of exposure to US listed Gold Futures Contracts PLUS Gold Miners (Global Equities with 50%+ revenue from Gold Mining Business)

- Capital Efficient 90/90 exposure to US Gold Futures PLUS Global Gold Miners weighted by market capitalization

- Capital Efficient Exposure: 90% Gold Futures + 90% Gold Miners + 10% Cash Collateral

- 5% Rebalancing Bands

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Info

Ticker: GDMN

Adjusted Expense Ratio: 0.45

AUM: 7.8 Million

Inception: 12/16/2021

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Pros and Cons

Let’s move on to examine the potential pros and cons of WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN).

GDMN Pros

- Capital Efficient Exposure To Gold PLUS an additional strategy (Gold Miners) providing two diversifying alternatives

- The ability to combine the fund with its sibling GDE for additional capital efficient gold exposure plus US equities

- A versatile ETF which could be a tactical allocation, satellite diversifier or portfolio completion type of fund

- The ability to combine with the entire roster of WisdomTree “efficient core” ETFs to form a diversified expanded canvas portfolio

- The opportunity to combine gold with other capital efficient funds offering distinct alternative strategies such as managed futures and market neutral to add further layers of portfolio diversification

- Gold historically has been uncorrelated with equities, bonds and managed futures providing a tremendous diversification benefit

- By adding gold in a capital efficient manner you can still fulfill your traditional portfolio mandate requirements (see model portfolio)

- Very reasonable management fee for a capital efficient strategy

- Chance to support a fund provider (WisdomTree) offering unique strategies for investors

GDMN Cons

- Gold and Gold Miners can be volatile and uncorrelated with many mainstream strategies so patience is definitely required

- Gold and Gold Miners strategies have experienced prolonged bear markets ex: Gold = 80s/90s + Gold Miners (2008-2022)

WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

It’s a cinch to add GDMN ETF and the entire roster of WisdomTree Efficient Core Family ETFs to form a powerhouse expanded canvas portfolio that features exposure to traditional balanced assets in tandem with a diversified array of alternative strategies.

10% GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund

10% NTSX – WisdomTree U.S Efficient Core Fund

15% NTSI – WisdomTree International Efficient Core Fund

15% NTSE – WisdomTree Emerging Markets Efficient Core Fund

10% NSPL – NightShares 500 1x/1.5x ETF

10% GDMN – WisdomTree Efficient Gold Plus Gold Miners Strategy Fund

20% RSBT – Return Stacked Bonds & Managed Futures ETF

10% BTAL – AGF US Market Neutral Anti Beta Fund

Expanded Canvas Portfolio: 161%

Overall, we have the following exposures to six distinct strategies:

60% Global Equities

44% Bonds

20% Managed Futures

18% Gold

10% Market Neutral Anti-Beta

9% Gold Miners

Nomadic Samuel Final Thoughts

It’s fascinating to review a capital efficient fund that doesn’t have exposure to bonds, managed futures or a major market global equity index.

Moreover, it’s even more interesting that the fund is not carved out to be a core holding.

The “little things” you do to diversify your expanded canvas portfolio can go a long way at times!

Gold has proven its worth in time periods such as the 1970s or 2000s when US equities were experiencing lost decades.

Hence, I’ve got a place for it permanently in my portfolio.

But at this point in the review I’m more interested in what you’ve got to say.

Do you allocate to Gold?

Why or why not?

And are you interested in capital efficient funds such as GDE and GDMN which offer exposure to gold in an expanded canvas capacity?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.