I’d like to think I’ve got a firm pulse on the capital efficient marketplace.

However, when it came to the release of SPQ ETF, I was totally caught off guard!

And I have to admit, I do love pleasant surprises. Especially when it comes to products providing unique exposures.

As a newly minded ETF, SPQ is the first expanded canvas 150% product that provides exposure to 50% QIS-multi-strategy alternatives plus 100% equities.

In other words, you don’t shave down a single bit of your equity exposure with this ETF whilst adding uncorrelated alternatives in the process.

Now that’s a win in my books.

The fund is better known as Simplify US Equity PLUS QIS ETF.

Ticker SPQ.

And today we’ve thrilled to have Larry Kim of Simplify in the house to discover more about the fund.

Without further ado, let’s turn things over to Larry!

Meet Larry Kim of Simplify

Larry collaborates with financial advisors and institutional investors to enhance their understanding of the Simplify product range, focusing especially on producing written and video content.

In his prior role as a senior consultant at Fidelity Institutional, he provided guidance to major banks and insurance firms on establishing and refining their managed account programs. His experience also extends to mutual fund product management and development, as well as financial planning.

He holds an MBA from the Leonard N. Stern School of Business at New York University and earned his bachelor’s degree from Oberlin College.

Reviewing The Strategy Behind SPQ ETF (Simplify US Equity PLUS QIS ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of SPQ ETF?

For those who aren’t necessarily familiar with a “‘capital efficient multi-strategy” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

“Capital efficiency” is a fancy way of saying leverage.

A capital efficient multi-strategy fund takes more than one strategy and weights them so the total adds up to more than 100%. The oldest type of multi-strategy fund is the traditional balanced fund, which might invest 60% in equities and 40% in bonds.

If you were to gross up each strategy to, say, 90% and 60% in bonds, you would have 150% total gross exposure. The benefit of using leverage is that it enables the investor to get the exposure they desire with a smaller dollar outlay. That leaves them with additional assets that can be invested however you choose.

For example, suppose an investor wanted to devote ⅓ of their portfolio to an alternative asset like managed futures, but they don’t want to give up their 60/40 stock/bond allocation. In that case, they could invest ⅔ of their portfolio to the capital efficient 90/60 stock and bond fund, freeing up ⅓ of their assets to allocate to the managed futures fund.

Unique Features Of Simplify US Equity PLUS QIS Fund SPQ ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

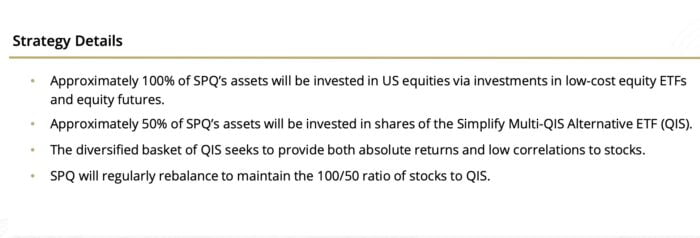

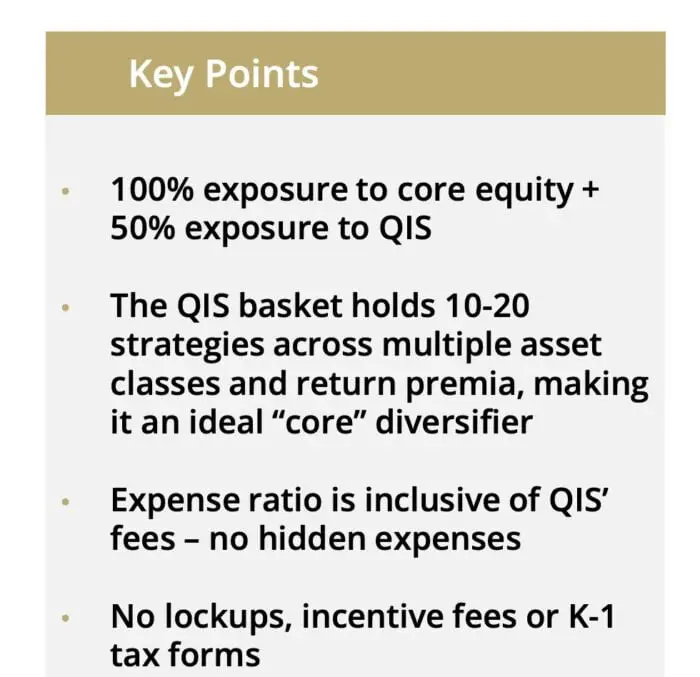

Simplify US Equity PLUS QIS ETF ($SPQ) has approximately 100% exposure to large cap US stocks and 50% exposure to the Simplify Multi-QIS Alternative ETF ($QIS).

Exposure to US stocks is obtained via a combination of a low-cost ETF and stock index futures. Exposure to QIS is obtained by directly owning shares of QIS.

This results in a total of 150% gross exposure so yes, the fund does use leverage.

The fund will be regularly rebalanced to the 100/50 ratio.

source: Simplify Asset Management on YouTube

The US stocks will be passively managed via stock index ETFs and index futures. QIS invests in a portfolio of quantitative investment strategies run by leading strategists. Each strategy is managed using rules-based algorithms. Simplify’s portfolio managers exercise discretion in the ongoing selection and monitoring of the QIS strategies.

SPQ has a 1.00% expense ratio, which includes the underlying expenses of the ETFs that it owns.

What Sets SPQ ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other “capital efficient” funds being offered in the ETF marketplace? What makes it unique?

SPQ is the only fund in the industry which combines a 100% allocation to US equities with a 50% allocation to QIS strategies.

The other capital efficient multi-strategy offerings in the industry focus on some combination of stocks, bonds and managed futures.

What Else Was Considered For SPQ ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

The question of leverage was discussed during the fund’s design phase.

Several options were considered, including allocating larger percentages to QIS.

Ultimately, it was decided that the 100/50 allocation gave the best combination of potential returns, costs, and volatility.

When Will SPQ ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

QIS is essentially uncorrelated with stocks, so determining whether or not its contribution to SPQ will be additive to returns in different market conditions is difficult.

That said, we would expect the absolute return nature of QIS to support improved risk-adjusted returns on the portfolio level, especially during periods of equity market turmoil or underperformance.

Why Should Investors Consider Simplify US Equity PLUS QIS Fund SPQ ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Because of SPQ’s capital efficiency, investors don’t have to choose between low-cost equity beta and an alternative investment. They can have both.

If, for example, the investor decides to allocate 30% of their portfolio to large cap US stocks, they can simply use SPQ to fill that sleeve.

In addition to 30% of large cap stocks, they will also gain 15% exposure to a multi-QIS strategy for additional diversification.

How Does SPQ ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

SPQ is designed as a core holding. The QIS portion of the fund is diversified between 10-20 different quantitative strategies across five asset classes (equities, commodities, currencies, interest rates and credit), four return drivers (carry, trend, volatility and liquidity), and several different third party managers.

That gives it a significant amount of diversification. If an investor was comfortable holding just large cap US equities, then SPQ could conceivably be held as a single, total portfolio solution. If they desired further diversification (international stocks, bonds, managed futures, etc.) then SPQ could be used as their core large cap US position.

A low-conviction allocation would be 10% of a portfolio, giving the investor a 5% allocation to QIS. A high-conviction allocation would be to replace the entire US equity allocation with SPQ.

The Cons of SPQ ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

QIS is itself a brand-new fund, launched in July of 2023. The 100/50 combination of stocks and QIS is even newer, so there is no track record for investors to analyze.

Obviously, that can only be addressed through the passage of time.

The Pros of SPQ ETF

On the other hand, what have others praised about your fund?

Investors who understand the power of capital-efficiency have been enthusiastic about the fund, as it allows them to gain exposure to QIS without sacrificing their equity exposure.

Learn More About SPQ ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

QIS is a truly unique product, as it is a diversified portfolio of quantitative strategies, optimized for their correlation benefits.

As such, it can be considered a “core” alternative strategy.

Adding this to a core equity beta in a capital efficient manner creates a compelling fund that can be used as a stand-alone portfolio solution or as a core building block to a diversified portfolio.

We suggest investors follow Simplify on the “News & Media” tab of the website to hear about all of our upcoming events, research and product news.

To learn more about Simplify or to speak with a Simplify representative, please go to simplify.us.

You can also follow us on YouTube at https://www.youtube.com/@SimplifyAssetManagement

Connect With Simplify ETFs

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: SPQ ETF

Nomadic Samuel Final Thoughts

I want to personally thank Larry Kim at Simplify for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

I need some more leverage

Thinking something like 100% stocks 50% managed futures 50% bonds 50% QIS

Best I can do is something like:

23% UPRO = 69% SPY

50% RSBT = 50% managed futures, 50% bonds

27% SPQ = 27% SPY, 13.5% QIS

—–

96% SPY, 50% managed futures, 50% bonds, 13.5% QIS