So Trendy is an expanded canvas portfolio solution composed of global momentum equities, trend-following long/short alternatives and long-term treasury bonds. It melds together the best of time-series and cross-section momentum strategies all under one roof.

Put simply, momentum investing is a strategy that captures what is recently performing well (including) and either avoiding (not including) and/or shorting (against) what is not.

So Trendy!

Hey guys! Here is the part where I mention I’m a travel blogger! This portfolio review is entirely for entertainment purposes only. Do your own due diligence and research. Consult with a financial advisor.

Seriously, I’m a travel blogger not a financial professional, so take what I say with a grain of salt; okay? Cheers!

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

So Trendy Portfolio Review | Investing with Momentum and Trend-Following Strategies

Let’s rewind the clock to the mid 1970s when disco was ever so groovy and oh so trendy.

All that glitters is gold. The disco ball hangs above your head. You should be dancing – yeah!

You’re a peak 70s stud with your flashy corduroy flared pants, loose multi-color button-down shirt, rhinestone belt and cowboy boots.

So trendy.

You’re gaining momentum and riding it for a few years.

But then BAM. Disco sucks! Disco Demolition Night!

It’s now mid-1979. Sentiment has changed.

A New Wave has emerged with synthesizer sounds and spiked hair.

Are you following the trend or stuck in the past?

By the way, as a personal aside, I’ve never been trendy myself, so this style of investing is maybe a last chance to redeem myself?

Long Equity Momentum Strategy

Let’s use this cheesy analogy in the context of our long only momentum strategy.

For equities, utilizing a cross-sectional momentum strategy, we’d be capturing the most recent 2-12 month trend of what is popular (recently doing well) and avoiding what isn’t.

A momentum strategy of this nature seeks to ride assets that have performed well recently into the future.

If disco were a hypothetical business (stock), so long as it is still trendy (popular) it will be a part of the momentum equity fund.

As soon as it isn’t and has negative momentum (unpopular) it’s no longer part of the momentum equity index.

The latest trend of New Wave being popular and gaining momentum (hypothetical stock) replaces it.

Long live disco! Just not in your early 1980s equity portfolio.

TL;DR = Long Momentum Equities strategy = what’s recently rising will continue to rise in the future

Long/Short Trend-Following Strategy

Keeping with the Disco and New Wave theme let’s examine time-series momentum, also known as trend-following or the managed futures component of the alternative sleeve of our So Trendy asset allocation.

Before we begin, our managed future long/short trading system covers futures markets for equities, bonds, commodities and currencies markets around the world.

If disco, in this particular example, represented a hypothetical commodity such as gold and New Wave (silver), we’d be long disco (gold) in the mid-70s when it was popular and trending upward and short disco (gold) in the early 80s when it was unpopular and trending downward.

What about New Age (silver)?

Using the early 80s example again, we’d be long New Age (silver) as it was gaining momentum and trending upward.

To summarize in the early 80s we’d be long New Age (silver) and short (disco) capturing both the positive and negative trends of each.

The key point is with a time-series trend-following strategy we’re long what is doing well and short what is not.

In other words, you’re FOR (long) and AGAINST (short) what is currently trending capturing BOTH sides of the equation = what is positive and what is negative.

TL;DR = Long/Short Trend-Following strategy = long what is rising (trending-up); short what is falling (trending-down)

My sincerest apologies, If I’ve melted your brain like a grilled cheese. For some reason, compared to other investing strategies, that can easily be summarized in a short sentence, time-series and cross-section momentum are harder concepts to explain.

My feeble attempts with analogies should be supplemented by further reading for those interested in momentum/trend: https://www.etf.com/sections/index-investor-corner/swedroe-momentum-factors (Legendary Larry Swedroe to the rescue once again!)

So Trendy Portfolio Strategy

The So Trendy Portfolio strategy is an extension of the expanded-canvas 200% series holding 80% Equities, 80% Trend-Following and 40% Long-Term Treasury:

80% MSCI Global Momentum Stocks + 80% SG Trend-Following Managed Futures + 20% Long-Term Treasury

So Trendy Portfolio uses MSCI World Index as its benchmark and has the following mandate:

- Considerably outperform MSCI World Index at the 200% canvas-level

- Offer an All-Weather Solution that seeks to limit negative annual drawdowns at a cap < -20%

- Provide an equity + alternative combined solution for investors seeking maximum diversification

- Offer a 1-2-3 approach to diversification with Stocks + Alternatives + Bonds

Why Global Momentum Equities?

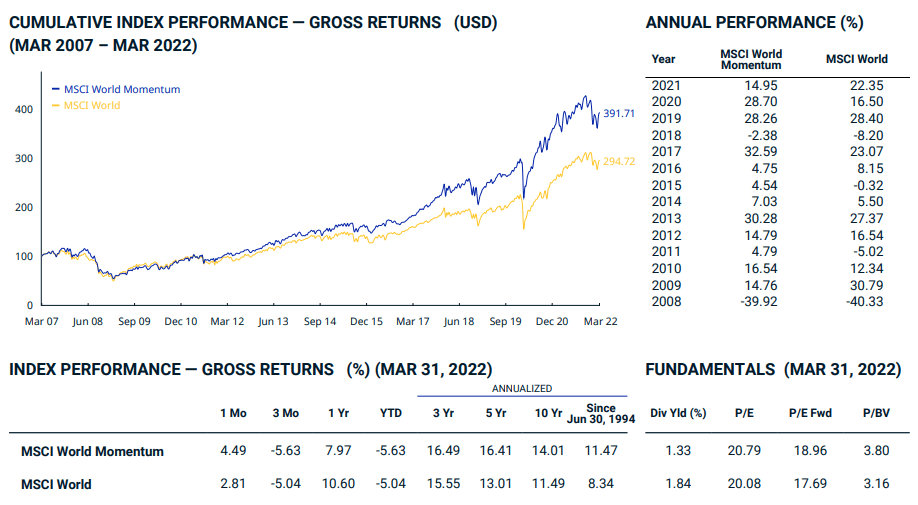

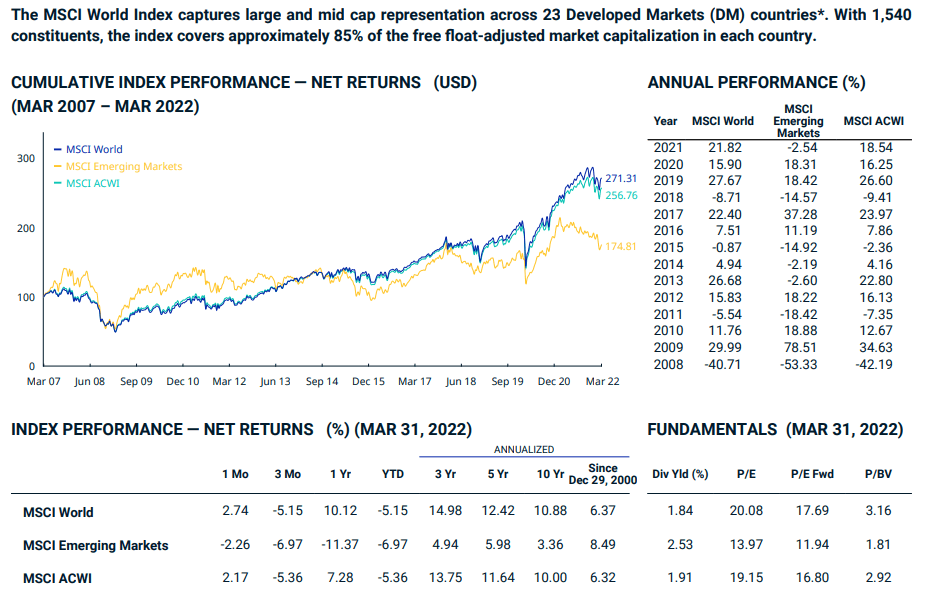

Why have we chose Global Momentum Equities vs a typical market cap-weighted index? In a word: performance. Long momentum strategies are one of the key equity factors that historically drive returns.

If you compare the results of the MSCI Global Momentum Index vs its parent index there is a clear performance advantage 11.47% vs 8.34% (since June 30, 1994).

Even though momentum is well established as a phenomenon there isn’t a consensus reason as to why it exists is as persistent, robust and pervasive of a factor through the lens of the efficient market hypothesis.

Considered a market anomaly, one proposed theory is that the advantage may be behavioural as momentum investors exploit investor herding, investor over and under education, confirmation bias and disposition effects. Source: https://en.wikipedia.org/wiki/Momentum_investing

Why Trend-Following Managed Futures?

Trend-Following strategies are often used by sophisticated investors as an alternative strategy that is uncorrelated with boths stocks and bonds.

The ability to go long-short equities, bonds, commodities and currency futures has been used for over 30 years by those seeking to diversify into different asset classes.

The stronger the trend (positive, negative or both) the better the results. Consider this legendary but brief video by Eric Crittenden of Standpoint Funds entitled ‘Blind Taste Test’ and let’s pick things back up after you’ve watched it:

Source: Standpoint “Blind Taste Test” (Eric Crittenden) on YouTube (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

How many of you chose stocks/trend vs stocks/bond as your first choice? If we further explore the data we notice the uncorrelated relationship between long momentum stocks and SG Trend following strategies over the course of many years.

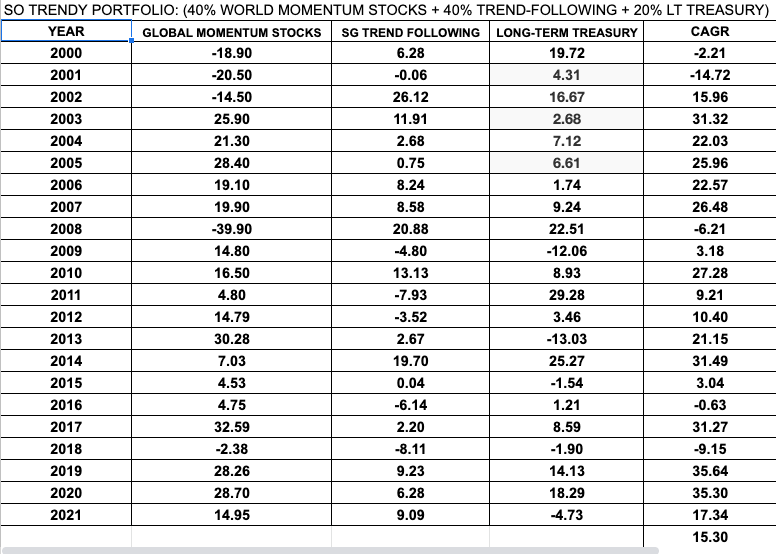

In particular 2000, 2002 and 2008 come to mind. When Global Momentum stocks had a challenging -14.50% CAGR in 2002, SG Trend Following returned CAGR 26.12%.

In 2008, during the biggest bear market year of the 21st Century Global Momentum stocks returned a CAGR -39.90% vs CAGR 20.88% SG Trend.

If we rewind the clock back to 2000 SG trend had a CAGR 6.28% vs CAGR -18.90% momentum equities.

Out of a 22 year sample size momentum stocks and trend-following were only down together annual twice: 2001 and 2018.

In a nutshell, a trend-following strategy combined with stocks can provide a potential alternative all-weather approach to diversification in a portfolio.

Why Long-Term Treasury?

Bonds play an important role in building an efficient portfolio. With only two asset classes (stocks + alternatives) there are numerous years where SG Trend wouldn’t have been enough to counter the serious drawdowns of equities.

In particular we’ll look closely at 2000, 2008 and 2011.

When Global Momentum stocks had CAGR returns of -18.90%, -39.90% and 4.80% Long-Term Treasury returned CAGR of 19.72%, 22.51% and 29.28%.

Given Long-Term Treasury had the strongest performance compared to other treasury (short, intermediate and 10 year) it’s been included in the portfolio for its defensive aspects.

Furthermore, it outperforms short, intermediate and 10 year treasury from a long-term CAGR perspective.

1-2-3 Diversification = Only 1 Year Of All Assets Down Together

The 1-2-3 approach to diversification with So Trendy, the Picture Perfect Portfolio and the Nomadic Samuel Portfolio is what allows us to use a sensible amount of leverage to obtain superior results.

It’s risk management meets performance.

Consider the only time the three asset shared a negative annual year was in 2018.

Furthermore the portfolio at this level of leverage experienced a worst year of -14.72% vs its parents index of -40.17.

SO TRENDY 200% CANVAS RESULTS

80% World Momentum Stocks + 80% SG Trend Following + 20% Long-Term Treasury

CAGR = 15.30%

Worst Year = -14.72%

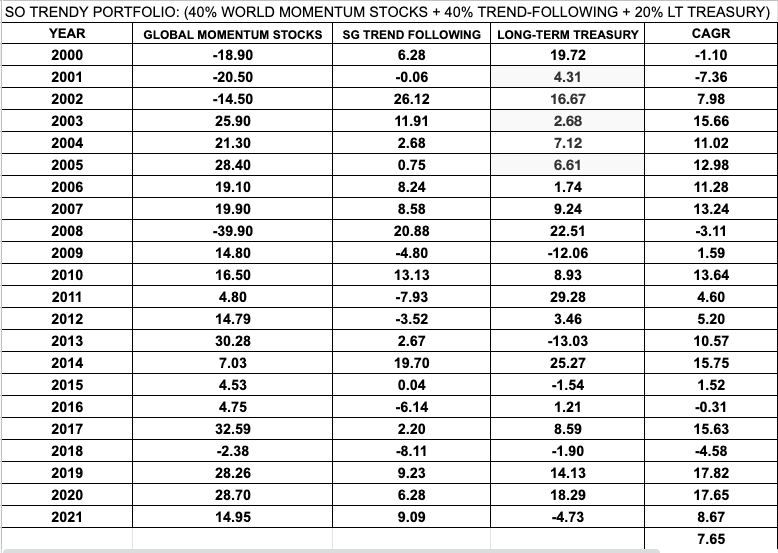

SO TRENDY 100% CANVAS RESULTS

CAGR = 7.65%

Worst Year = -7.36%

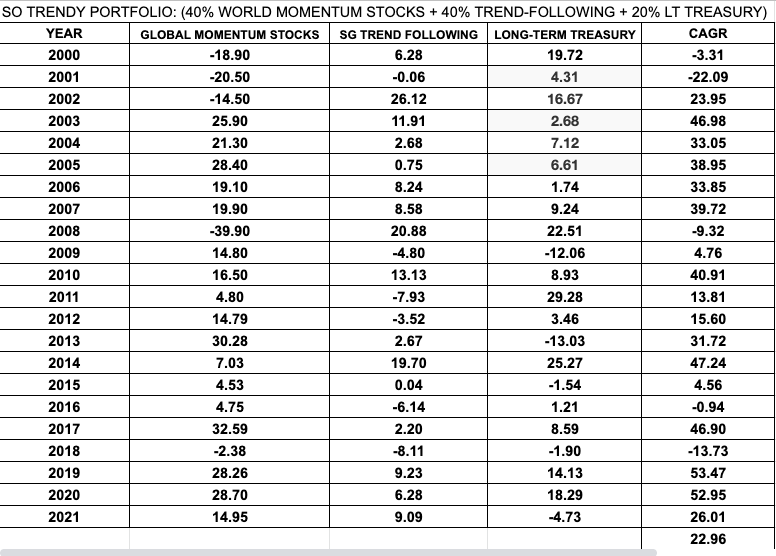

SO TRENDY 300% CANVAS RESULTS

CAGR = 22.96%

Worst Year = -22.09%

BENCHMARK = MSCI WORLD EQUITY

CAGR = 6.37% (since Dec 29, 2000)

Worst Year = -40.71%

So Trendy Portfolio Pros and Cons

Pros

- All Weather Approach to Investing with 1-2-3 layer of diversification between equities, alternatives and bonds

- Results of 1X, 2X and 3X = 22 year CAGR that is always > than the worst year of performance for the portfolio

- Unique alternative combination of long momentum equity strategy + trend-following

- Only 1 Year (2018) when all 3 asset classes down together at the same time

- Can be used a total portfolio solution or as diversifier

- Crushes its benchmark at the 200% canvas level with 15.3% vs 6.37%

Cons

- Investors prone to behavioural biases such as loss aversion and recency bias should only consider the 1X version

- Involves strategies that investors typically don’t understand as well (two different momentum strategies)

- Trend-Following, the alternative sleeve, can underperform for long stretches as it it did in the 2010s. Ex: 2016

So Trendy Total Portfolio Solution

For those seeking a 1-2-3 all-weather / all-seasons alternative investment strategy So Trendy is a viable solution. Its impressive returns at the 200% Canvas level of 15.3% and worst year of only 14.72% offer hope for a bright future. It is globally diversified and offers significant exposure to a unique alternative strategy: trendy-following

100% So Trendy

So Trendy Combined Portfolio Solution

Consider pairing this portfolio with the Nomadic Samuel Portfolio. You’ll add uncorrelated equity exposure to US small-cap value stocks, bulk up your position in long-term treasury and add gold to your total portfolio equation. This 50-50 split gives you a multi-equity and a multi-alternative approach worth considering.

50% So Trendy

50% Nomadic Samuel

So Trendy Partial Portfolio Solution

Use So Trendy as only a small-part diversifier in a portfolio that is lacking diversification in equity and alternative strategies. This would especially work well with a market-cap weighted index and aggregate bond portfolio.

5%, 10%, 15% or 20% So Trendy

Nomadic Samuel Final Thoughts

Out of all of the Portfolios I’ve created So Trendy might be the most contrarian. Compared to other factor equity strategies, Momentum is quite underrated.

You’ll find more hardcore nerdy value investors than you will momentum equity geeks.

Furthermore, this portfolio has the largest allocation (80%) to an alternative asset class (trend-following) than any of the other 2 portfolios.

I have to admit I’m excited about this one:

So Trendy!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.