A lot of funds have lofty goals and aspirations but kind of fall flat on their face when thrown into the sizzling frying pan.

Standpoint Multi-Asset Fund (BLNDX / REMIX) is the exception to the rule.

Its mandate is clear:

To provide All-Weather performance and risk management with the capacity to thrive in any market environment.

And golly-gee-whiz-jumping-tuna-fish has it even done that.

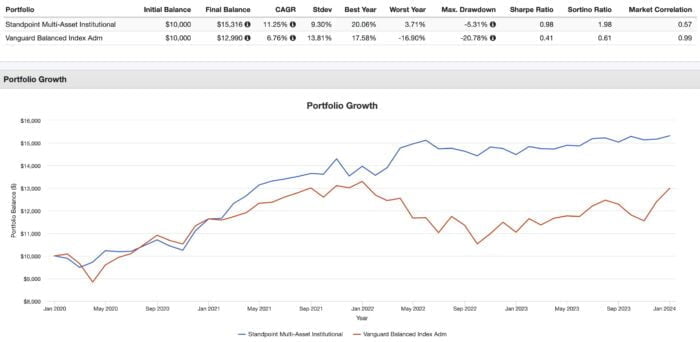

Its biggest tests came during the initial pandemic drawdown in 2020 and during the inflationary crisis in 2022.

And it passed both of those tests with flying colours.

Compared to the lacklustre passive 60/40 it has more than thrived.

And to be perfectly honest, beating the tar out of a 60/40 portfolio is a pastime over here at Picture Perfect Portfolios.

More importantly, we’re thrilled to have the fund’s creator Eric Crittenden explain all of its unique features.

Without further ado, let’s turn things over to Eric.

Meet Eric Crittenden of Standpoint Asset Management

Today I think people would describe me as a practical contrarian, someone who is not entirely out of alignment with my peers but expects the status quo to be horribly wrong at times. In my view, being prepared for hard times might be the most important part of a growth strategy.

In college I studied meteorology, public health, economics, finance, and computer science. The courses/topics that influenced my career most are cognitive biases and critical thinking (psychology), database design and array math (computer science), non-linear systems (meteorology and public health), supply/demand and integrated systems (economics), time value of money and compound interest (finance).

My first jobs out of college were analytical in nature. I worked for a large family office and then a couple of different hedge funds, mainly down in the trenches of accounting, programming, database management, and research. Eventually I realized my passion was in designing complete systems and portfolio management methods that emphasize durability. I had to start my own firm to pursue this fully.

Reviewing The Strategy Behind BLNDX / REMIX (Standpoint Multi-Asset Fund) with its Creator Eric Crittenden

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

What’s The Strategy Of BLNDX / REMIX Mutual Fund?

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

For those who aren’t necessarily familiar with an “All Weather” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

An industry standard definition might sound something like this: “All weather” investing is a strategy that aims to provide consistent returns across various market conditions, including different economic cycles such as growth, recession, inflation, and deflation. This approach involves diversifying investments across a range of asset classes to balance the portfolio’s exposure to different market risks.

The goal is to minimize the impact of market volatility and economic downturns, ensuring steady performance over time. This approach is designed to be more resilient to the changing economic environment, rather than focusing on maximizing returns in a specific market scenario.

Standpoint has its own approach to this; we combine certain elements of global macro style investing with traditional assets like equities and fixed income. Our research has consistently shown that trend-oriented global macro strategies are the most effective diversifiers to traditional assets during hostile market conditions. Case in point, during COVID and for the year 2022, the macro side of our portfolio did very well.

This allowed our overall portfolio to have reasonably low volatility and positive returns. A lot of our research focuses on the 1970s, the last time U.S. investors experienced stagflation, when both equities and fixed income markets lost significant value at the same time, for a long period of time. We want to be able to navigate through difficult environments without giving up too much of the upside during good times like the 1990s.

source: Excess Returns on YouTube

Unique Features Of Standpoint Multi-Asset Fund REMIX / BLNDX

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

Our strategy has three primary exposures. The first is a moderately dynamic allocation to global equities. This is allowed to fluctuate between 33% and 67%. The second exposure is a mixture of 1-to-12-month U.S. treasury bills, and its allocation is generally between 25% and 35%. The third, and most important, allocation is to our global macro program. For this part of the portfolio, we are able to gain 100% macro exposure with only a modest amount of capital thanks to how futures contracts work. Our program also generally holds about 10% in cash.

The equity and treasury bill exposures are essentially strategic, with little tactical activity aside from tax loss harvesting, cash management needs, and yield curve considerations. The macro program is highly tactical and managed with a rules-based process and strict risk budget. The program is trend-oriented and participates in over 65 global markets including grains, soft commodities, energy markets, metals, currencies, bonds, and equity indexes.

The portfolio management process is systematic in nature. Some minor discretion is utilized for anticipated cash management needs and regulatory constraints like position and/or exposure limits.

We view the program as multi-strategy. The macro program uses 3 different trend-oriented systems (short/medium/long-term) to find, and participate in, emerging themes in the global futures markets. The equity strategy is allowed to fluctuate in such a way that exposure tends to be higher during bull markets and lower during bear markets.

The treasury bill program aims to establish and maintain a laddered portfolio of 1-to-12 months depending on anticipated cash-management needs and some simple net present value calculations around current yields and opportunity cost implications.

Standpoint’s net expense ratio is generally expected to be between 1.27% and 1.32%, depending on the size of our allocation to equity ETFs (as they charge a small management fee that is ultimately reflected in ours).

source: Standpoint on YouTube (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

What Sets BLNDX / REMIX Apart From Other Funds?

How does your fund set itself apart from other “alternative asset allocation” funds being offered in what is already a crowded marketplace? What makes it unique?

We are not enthusiastic supporters of most alternative investments in general. Like many advisors we’ve noticed that most alternatives, despite their high fees, have delivered low returns and large tax consequences over time.

Our thesis was that combining a simple, rules-based, macro strategy with a modest amount of traditional assets like equities and t-bills, in a single program, would produce a relatively smooth “all weather” experience that would satisfy what financial advisors desire from an ideal alternative investment.

We believed this could be done at a fee and tax structure that is conducive to long-term investors. Even though we may technically be classified as an alternative investment, under the hood, our strategy is not similar to that of the alternatives crowd.

What Else Was Considered For REMIX / BLNDX Mutual Fund?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

Corporate bonds, in theory, combine nicely with the other assets in our portfolio. However, real-life liquidity and tax considerations rendered them significantly inferior to equities in the context of our business.

source: Standpoint on YouTube (The investment performance results presented here are based on historical backtesting and are hypothetical. Past performance, whether actual or indicated by historical tests of strategies, is not indicative of future results. The results obtained through backtesting are only theoretical and are provided for informational purposes to illustrate investment strategies under certain conditions and scenarios.)

When Will BLNDX / REMIX Fund Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

Well, the whole point of an “All Weather” approach is to minimize the boom/bust nature typical of more concentrated strategies. That being said, a year like 2018, where equities had a difficult fourth quarter at the same time that established macro trends also abruptly reversed, is a good example when a strategy like ours should struggle.

Where we can shine, on a relative basis, is during years like 2022 when macro-trends were significant enough for us to more than offset losses from holding equities. In more normal years we are content to simply be competitive with traditional portfolios. The point of a program like ours is to finish the marathon strong, without taking uncompensated cyclicality or catastrophic risk along the way.

We respect the downside risk of the great depression, the 1970’s, 2008, and 2022. But we equally respect the need to own risk assets that can compound wealth at a rate that meets reasonable financial goals. The only way we can think of to honor both is to adhere to an “All Weather” approach that has an expanded opportunity set and a reasonable cost structure.

The “catch” here is that we are unlikely to win any short or medium-term performance awards or become famous along the way. That’s fine with us.

source: VettaFi on YouTube

Why Should Investors Consider Standpoint Multi-Asset Fund BLNDX / REMIX Fund?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

The team at Standpoint has had thousands of conversations with financial advisors over the years. The reoccurring theme is, what they want from an alternative investment is something that offers effective protection from serious downside risk and reasonably high upside during bull markets, without mind boggling fees, taxes, or credit/operational risk.

Essentially, they want something like 80% upside capture and only 40% downside capture. From a financial engineering perspective someone might attempt this with equities alone through some form of market timing. The empirical evidence for such an approach is beyond dismal; not worth pursuing in my opinion.

A “risk parity” approach with equities and bonds could work if their correlation with each other is always negative and meaningful leverage is utilized. I respect the positive correlation between equities and bonds during the 1970s too much to trust this approach.

Expanding the opportunity set to more uncorrelated sectors like grains, metals, energies, soft commodities, and currencies makes it possible and, in my opinion, reliable. So, if an investor wants something beyond just equities and bonds, and they desire, what is my vision of the “ideal” alternative, they should consider our strategy.

How Does BLNDX / REMIX Mutual Fund Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

For myself, and a few individuals, our fund is a total portfolio solution. But it’s quite rare for a financial advisor to allow a single fund to be more than a 20% allocation. From a compliance and business-risk perspective, it doesn’t make a lot of sense to limit your exposure to a single fund or manager.

During the first 4 years of our existence most advisors have viewed us as an alternative investment, this generally means a satellite holding. However, we are starting to see the evidence mount to argue for core holding status. It is something we are starting to push for.

The Cons of BLNDX / REMIX Mutual Fund

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

We’ve had several advisors offer the same general concern. It’s not obvious where the fund would go in their portfolio, and they are not clear what they should liquidate to make room for it.

Some advisors have an “alternative bucket” and that makes it easy. For others, they struggle to fit the fund neatly into their existing structure.

This is understandable. But there is really no way around it. It’s not an equity fund, or a bond fund, or a real estate fund. Different means change.

The Pros of REMIX / BLNDX Fund

On the other hand, what have others praised about your fund?

Returns, volatility, and drawdowns have been good since we launched at the end of 2019. So, we’ve received positive feedback in that regard. Our tax-drag and expense ratio have been meaningfully lower than people have come to expect from alternatives, so we’ve gotten some praise there too.

Connect With Eric Crittenden and Standpoint Asset Management

Website: Standpoint Asset Management

Fund Page: Standpoint Multi-Asset Fund BLNDX / REMIX

Content Library: Standpoint Content Library

Twitter: @StandpointFunds

Youtube: @standpointfunds

Nomadic Samuel Final Thoughts

I want to personally thank Eric for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

Eric has been generous enough to drop by for a couple of other interviews as well:

- How I Invest With A Multi-Asset Class Trend Following Portfolio

- Trend Following Investing Strategy With Eric Crittenden

I also took a stab at reviewing BLNDX a while ago:

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

IMPORTANT RISK INFORMATION

Past performance data does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month end performance information please call (866) 738-1128. BLNDX gross expense ratio is 1.52% and the net expense ratio after fee waivers contractual through 2/28/24 is 1.30%

Investing involves risk, including loss of principal. There is no guarantee that the fund will achieve its investment objective.

Diversification does not ensure a profit of guarantee against loss.

For the period since the Fund’s inception on 12/30/2019 to 12/31/2023, the Fund (BLNDX) returned 11.24% and the Fund’s primary benchmark (50% MSCI World/50% BAML 3-month T-Bill) returned 6.18%. The 1-year return for BLNDX as of 12/31/2023 is 5.76% and 14.73% for the Fund’s primary benchmark.

Investment in the Fund carries certain risks. Investing in underlying investment companies, including money market funds and ETFs, exposes the Fund to the investment performance (positive or negative) and risks of the investment companies. ETFs are subject to additional risks, including the risk that an ETF’s shares may trade at a market price that is above or below its NAV. The Fund will indirectly bear a portion of the fees and expenses of the underlying fund in which it invests, which are in addition to the Fund’s own direct fees and expenses.

The fund will invest a percentage of its assets in derivatives, such as futures and commodities. The use of such derivatives and the resulting high portfolio turnover may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities and commodities underlying those derivatives. The Fund may experience losses that exceed those experienced by funds that do not use futures contracts. The successful use of futures contracts draws upon the Adviser’s skill and experience with respect to such instruments and are subject to special risk considerations. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market for a forward or futures contract and the resulting inability to close a forward or futures contract when desired;(c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so.

Foreign investing involves risks not typically associated with US investments, including adverse fluctuations in foreign currency values, adverse political, social, and economic developments, less liquidity, greater volatility, less developed or less efficient trading markets, political instability and differing auditing and legal standards.

Investors should carefully consider the investment objectives, risk, charges, and expenses of the Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (866) 738-1128 or at standpointfunds.com. The prospectus should be ready carefully before investing. The Standpoint Multi-Asset Fund is distributed by Ultimus Fund Distributors, LLC.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.