Catalyst/Millburn Hedge Strategy is unique in the sense that it is truly one of the Original Gangster capital efficient mutual funds.

With a slew of new capital efficient ETFs recently coming to market including the likes of Return Stacked Bonds & Managed Futures, Ultra Risk Parity and Simplify Macro Strategy, it’s easy to forget some of the old stalwarts out there.

However, this is only meant as a mountain of praise.

It’s anything but easy to survive in the ultra competitive industry of funds where you’re more likely to be destined for a plot in the graveyard than to have endured through the late 20th century up until today.

Not only has the fund survived but it has thrived.

You don’t amass 5.7 Billion in AUM in the alternative investing space without offering a strategy that is uniquely equipped to handle the challenges of today’s markets.

Moreover, the fund has adapted, grown and evolved its strategy throughout the years.

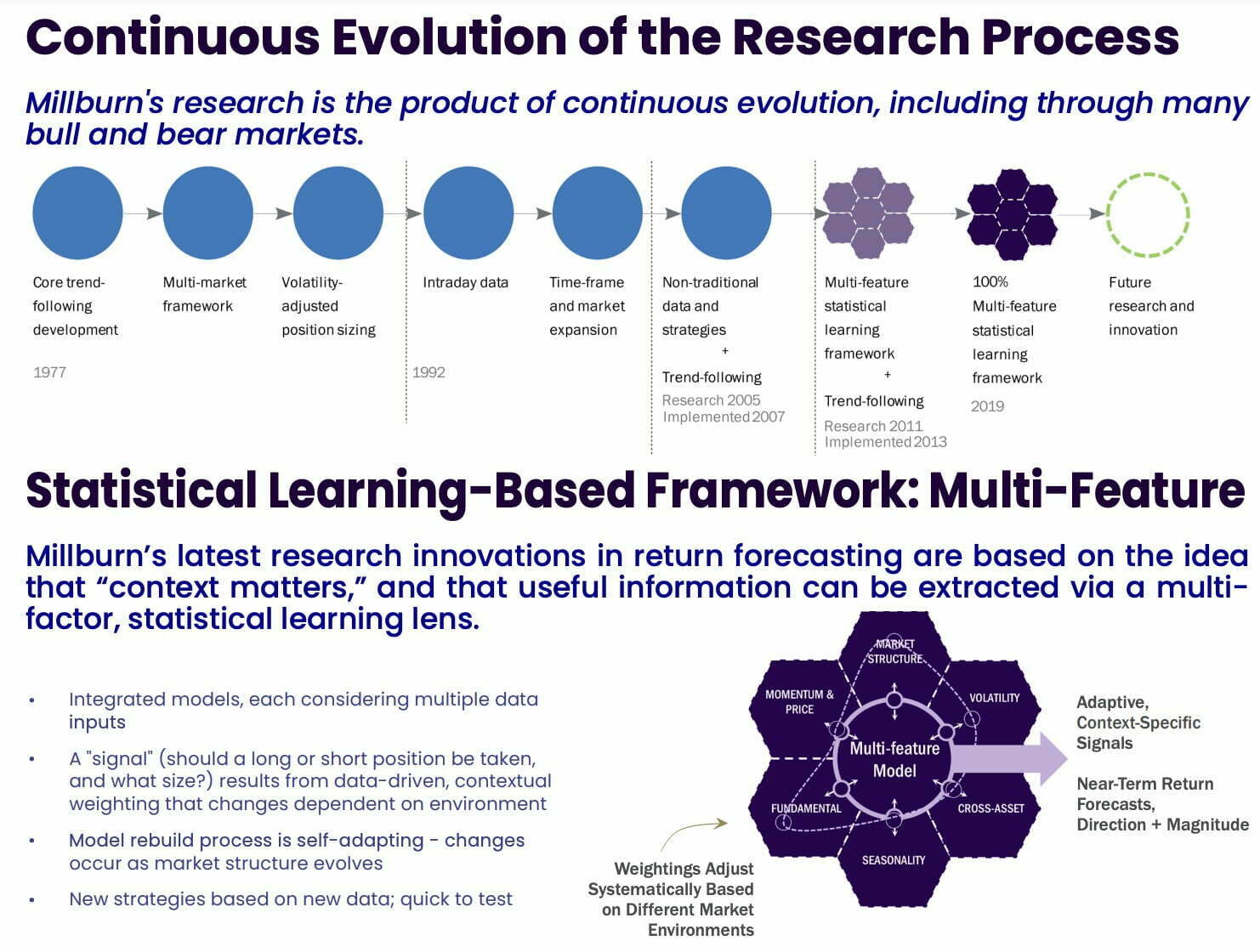

Catalyst/Millburn Evolution Of Research & Strategy

It’s gone from basic trend-following to a multi-strategy managed futures model with the following systems:

- Momentum & Price

- Fundamental

- Seasonality

- Cross-Asset

- Volatility

- Market Structure

In investing parlance we refer to a multi-strategy managed futures program as “Global Systematic Macro”.

There are enough oddball naming conventions in this particular space of esoteric alternative asset management to have my amateur head forever spinning on a dime.

But that’s a rant for another day.

The key point here is that the fund distinguishes itself from other pure trend-following funds by offering a unique multi-strategy approach that has the capacity to go long-short across a massive universe of Global Interest Rates, Energy, Stock Indices, Agricultural and Metals.

Investing Universe: 125 Liquid ETF/Futures Markets

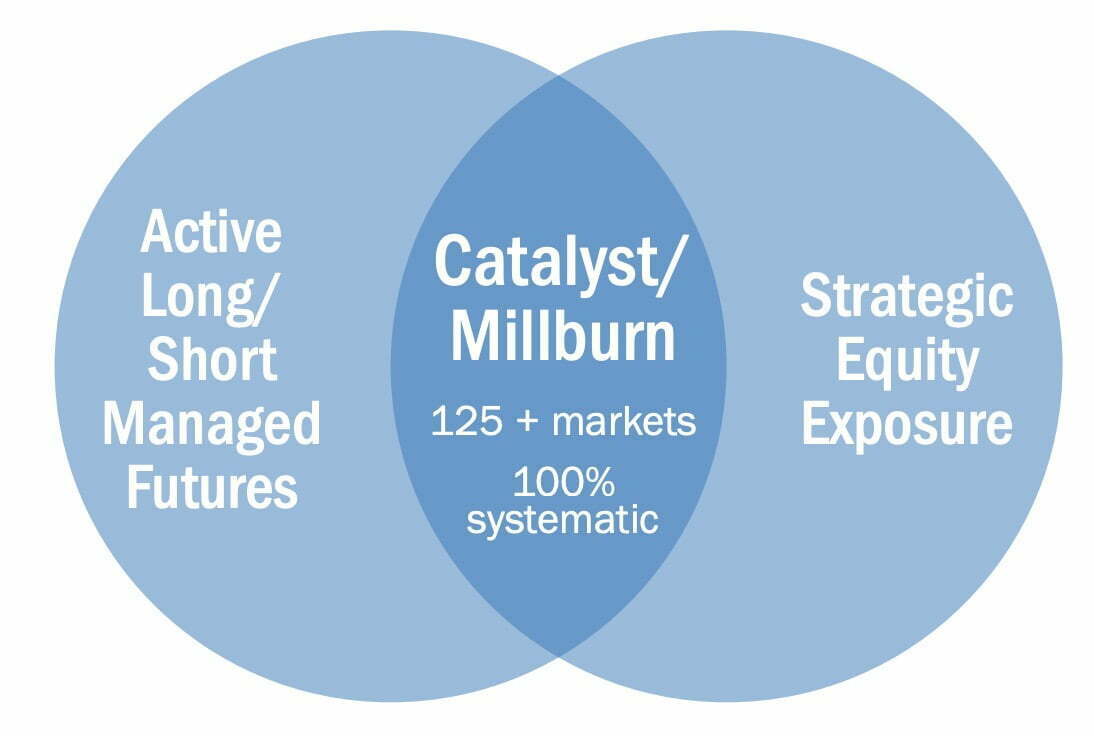

It then combines its multi-strategy futures program with a long-only equity mandate in a neat capital efficient package.

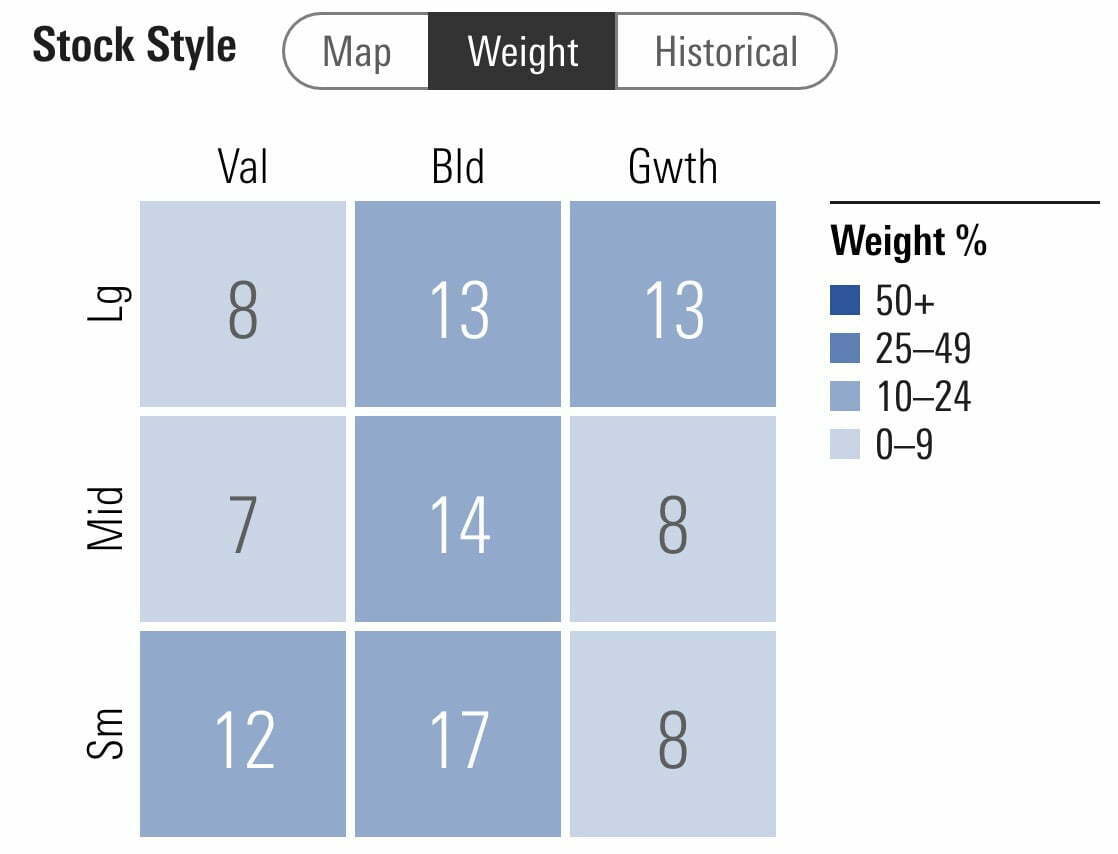

What’s fascinating about its equity strategy is that it isn’t just hanging out in large cap US centric territory.

It has an investing universe of small, mid and large cap funds that is truly global in nature.

We’re able to see it achieves a balanced style box between small, mid and large cap exposure with significant value and growth tilts.

Now let’s move on to its performance.

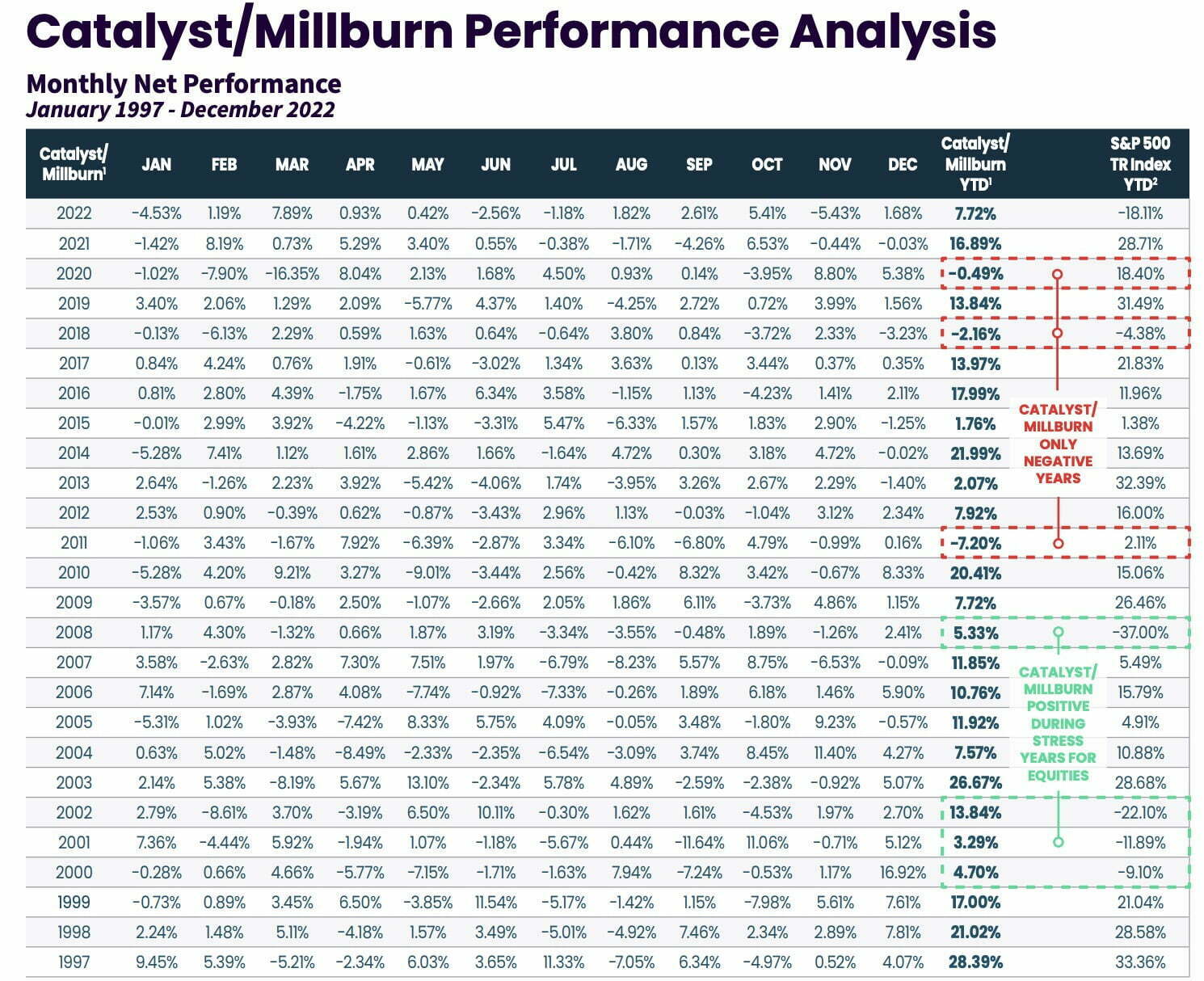

Catalyst/Millburn Annual Performance vs S&P 500

It’s fascinating to see that the fund has only had three negative years since its inception in 1997.

Contrast that with the S&P 500 which offered up 6 annual stinkers.

That’s a remarkable track-record of positive returns.

Moreover, it’s provided above water performance during challenging times for equity markets such as in 2000, 2001, 2002, 2008 and 2022 which is exactly what you ought to be craving from an alternative investment strategy.

MBXIX Alternative Mutual Fund Review | Catalyst/Millburn Hedge Strategy Fund Review

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review and Mutual Fund Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Catalyst Funds: Intelligent Alternatives

Catalyst Funds specializes in alternative investment strategies for advisors keying in specifically on the following mandates:

- Alternative/Hedged Strategies

- Income-Oriented Strategies

- Equity-Oriented Strategies

Catalyst Roster Of Funds

SHIEX, SHINX, SHIIX: Catalyst Buffered Shield Fund

ACXAX, ACXCX, ACXIX: Catalyst Income and Multi-Strategy Fund

CLPAX, CLPCX, CLPFX: Catalyst Nasdaq-100 Hedged Equity Fund

ATRAX, ATRCX, ATRFX: Catalyst Systematic Alpha Fund

DCXAX, DCXCX, DCXIX: Catalyst/Millburn Dynamic Commodity Strategy Fund

MBXAX, MBXCX, MBXIX: Catalyst/Millburn Hedge Strategy Fund

CWXAX, CWXCX, CWXIX: Catalyst/Warrington Strategic Program Fund

Millburn Ridgefield Corporation

As the sub-advisor, Millburn Ridgefield Corporation specializes in uniquely adaptive asset allocation investment strategies.

Some specific mandates include the following:

- Adaptive Allocation Program

- Diversified & Multi-Markets Programs

- Resource Opportunities Program

Source: Catalyst/Millburn Hedge Strategy Fund from Catalyst Funds on Vimeo.

Catalyst/Millburn Hedge Strategy Fund Overview, Holdings and Info

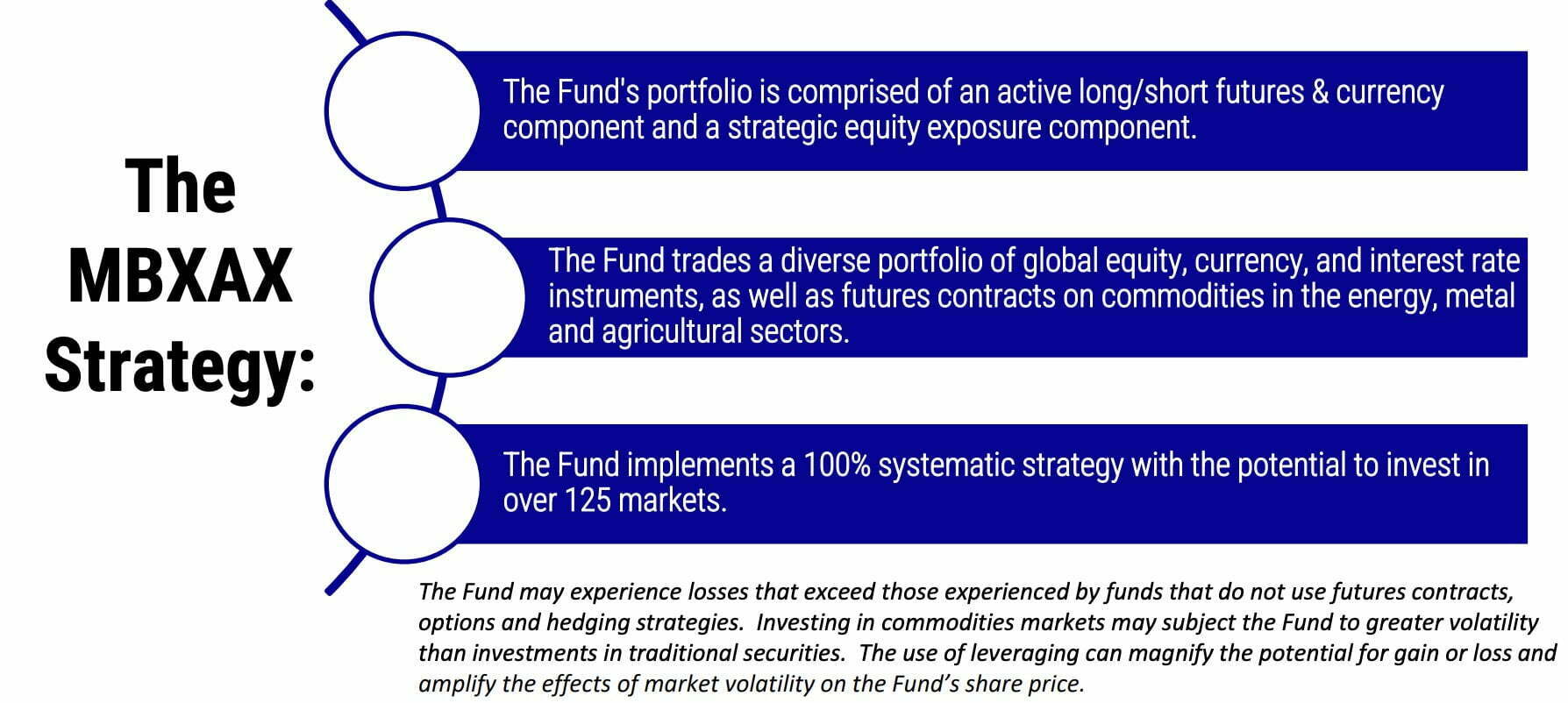

The investment case for “Catalyst/Millburn Hedge Strategy Fund” has been laid out succinctly by the folks over at Catalyst/Millburn Funds: (source: fund landing page)

Reasons To Invest:

The Catalyst/Millburn Hedge Strategy Fund utilizes complementary active and passive investment strategies, with the goal of outperforming typical long-only equity investments, including reducing drawdowns during protracted periods of stress.

Globally Diversified:

“The Fund trades a diverse portfolio of global equity, currency, and interest rate instruments, as well as futures contracts on commodities in the energy, metal and agricultural sectors.”

Systematic Multi-strategy Approach:

“The Fund implements a 100% systematic strategy with the potential to invest in over 125 markets.

The Fund’s portfolio is comprised of an active long/short futures & FX component and a strategic equity exposure component.”

Active Long/Short Futures & FX Component:

“This component yields a portfolio of global liquid instruments and strategies that historically have performed in periods of stress for equities.

The active long/short futures and forward positions in currency, fixed income, stock index and commodity instruments are determined by multi-factor, quantitative and systematic trading and investment strategies, which respond to different market conditions.”

Strategic Equity Exposure Component:

“This component yields a relatively passive portfolio of global and U.S. exchange traded funds (“ETFs”).

The equity positions generally consist of relatively passive buy-and-hold strategies with the goal of maximizing diversification as determined primarily by correlation and risk analysis.

Abbey Catalyst/Millburn Hedge Strategy Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom. (source: summary prospectus)

Principal Investment Strategies:

“The Fund seeks to achieve its investment objective by investing in a portfolio comprised of (i) futures contracts, forward and spot contracts, and/or options on futures contracts on or related to the following sectors: currencies, interest rate instruments, stock indices, metals, energy and agricultural commodities, (the “Futures Component”) and (ii) equity exchange traded funds (“ETFs”), currently implemented via a portfolio of ETFs, but may also be implemented and/or augmented by single-name or baskets of equity securities, and common stocks (the “Equity Component”), intended to capitalize on the non-correlated, long term historical performance of the equities and managed futures asset classes

The Fund also holds a large portion of its assets in cash, money market mutual funds, U.S. Treasury Securities, and other cash equivalents, some or all of which will serve as margin or collateral for the Fund’s investments.

Futures Component:

“The Futures Component of the Fund’s portfolio may hold long and short positions on futures contracts, forward contracts and options on futures contracts, and maintains cash and cash equivalents to be utilized as margin or collateral.

The Fund invests 30% to 70% of its assets in the Futures Component.

The Futures Component of the Fund’s assets are allocated among various asset classes including equity, fixed income, commodities and currencies.

Investments may be made in domestic and foreign markets, including emerging markets.

Investment in these instruments may be made by the Fund directly or indirectly by investing through its Subsidiary (as described below).

The Fund’s sub-advisor, Millburn Ridgefield Corporation (the “Sub-Advisor”), utilizes a set of proprietary trading systems, developed by the Sub-Advisor to determine the Fund’s asset allocations.

The trading systems generate buy or sell decisions in a particular market based on the analysis of technical market information (such as price, liquidity, and transaction costs) and/or non-price economic variables (such as economic statistics, interest rates, and supply/demand measures).

The trading systems analyze these factors over a broad time spectrum that may range from several minutes to multiple years.

The Sub-Advisor analyzes a number of additional factors in determining how the markets traded are allocated in the portfolio including, but not limited to: profitability of an asset class or market; liquidity of a particular market; professional judgement; desired diversification among markets and asset classes; transaction costs; exchange regulations and depth of market.

Decisions whether to trade a particular market require the exercise of judgment.

The decision not to trade certain markets for certain periods, or to reduce the size of a position in a particular market, may result at times in missing significant profit opportunities.

The allocations are reviewed at least monthly, although changes may occur more or less frequently.”

Equity Component:

“The Equity Component is intended to provide the Fund’s portfolio with long-term, strategic exposure to a number of U.S. and international liquid equity securities.

The companies held by the Fund and the ETFs held by the Fund may be of any market capitalization, sector and geographic location (including emerging markets).

The Fund invests 30% to 70% of its assets in the Equity Component.

The Fund’s Equity Component investments are taken on a relatively passive, long-only, “buy-and-hold” basis.

The Fund actively trades its portfolio investments, which may lead to higher transaction costs that may affect the Fund’s performance.

Investments in Subsidiary – The Sub-Advisor executes a portion of the Fund’s strategy by investing up to 25% of its total assets in a wholly-owned and controlled subsidiary (the “Subsidiary”).

The Subsidiary invests the majority of its assets in commodities and other futures contracts.

The Subsidiary is subject to the same investment restrictions as the Fund, when viewed on a consolidated basis.”

Catalyst/Millburn Hedge Strategy Fund Investment Strategy Key Points

- Dual Strategy of a Managed Futures component made up of futures contracts and Equity sleeve made up of ETFs

- Futures Component: Hold long and short positions on futures contracts with up to 30% to 70% of its overall assets

- Futures Asset Classes: Equity, fixed income, commodities and currencies across domestic, foreign and emerging markets

- Millburn Ridgefield utilizes a set of proprietary trading systems considering price, liquidity, costs, economic statistics, interest rates, and supply/demand measures over a broad time spectrum (minutes to multiple years)

- Additional Trading Factors: profitability, market liquidity, professional judgement, desired diversification, transaction costs, exchange regulations and depth of market

- Equity Component: Long-term strategic exposure to US, International Developed and Emerging Markets securities

- Go Anywhere Anytime: Equity ETFs can be of any market capitalization, sector and geographic location investing 30 to 70% of the fund’s resources

Abbey Catalyst/Millburn Hedge Strategy Fund Info

Ticker: MBXIX (I), MBXAX (A), MBXCX (C)

Adjusted Expense Ratio: 1.95 (I)

AUM: 5.7 Billion

Inception: 12/31/1996

Catalyst/Millburn Hedge Strategy Fund Pros and Cons

Let’s move on to examine the potential pros and cons of Catalyst/Millburn Hedge Strategy Fund (MBXIX).

MBXIX Pros

- Highly successful alternative mutual fund with a proven track-record dating back to 1997

- A unique long-equity and multi-strategy managed futures capital efficient combination

- Global Systematic Macro: multi-strategy managed futures approach distinguishes the fund from pure trend-following strategies

- Diverse Global Equity Exposure: Large, Mid and Small cap exposure to global equities with value and growth tilts compared to MCW funds

- A performance track-record of outperforming the S&P 500 since inception

- An incredible above water track record of just three negative years versus six for the S&P 500 over the same time period

- The capacity to pair this capital efficient fund with other capital efficient funds offering different asset class exposures and strategies

- Millburn has decades of experience running alternative investing mandates dating back to the 20th century

MBXIX Cons

- Fees that are higher than what most investors are used to paying relative to other low cost investing strategies (actively managed long-short strategies do cost more)

- Tracking error for when long-only equity strategies are performing better or when a pure trend-following is outperforming a multi-strategy global macro systematic approach

Catalyst/Millburn Hedge Strategy Fund Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

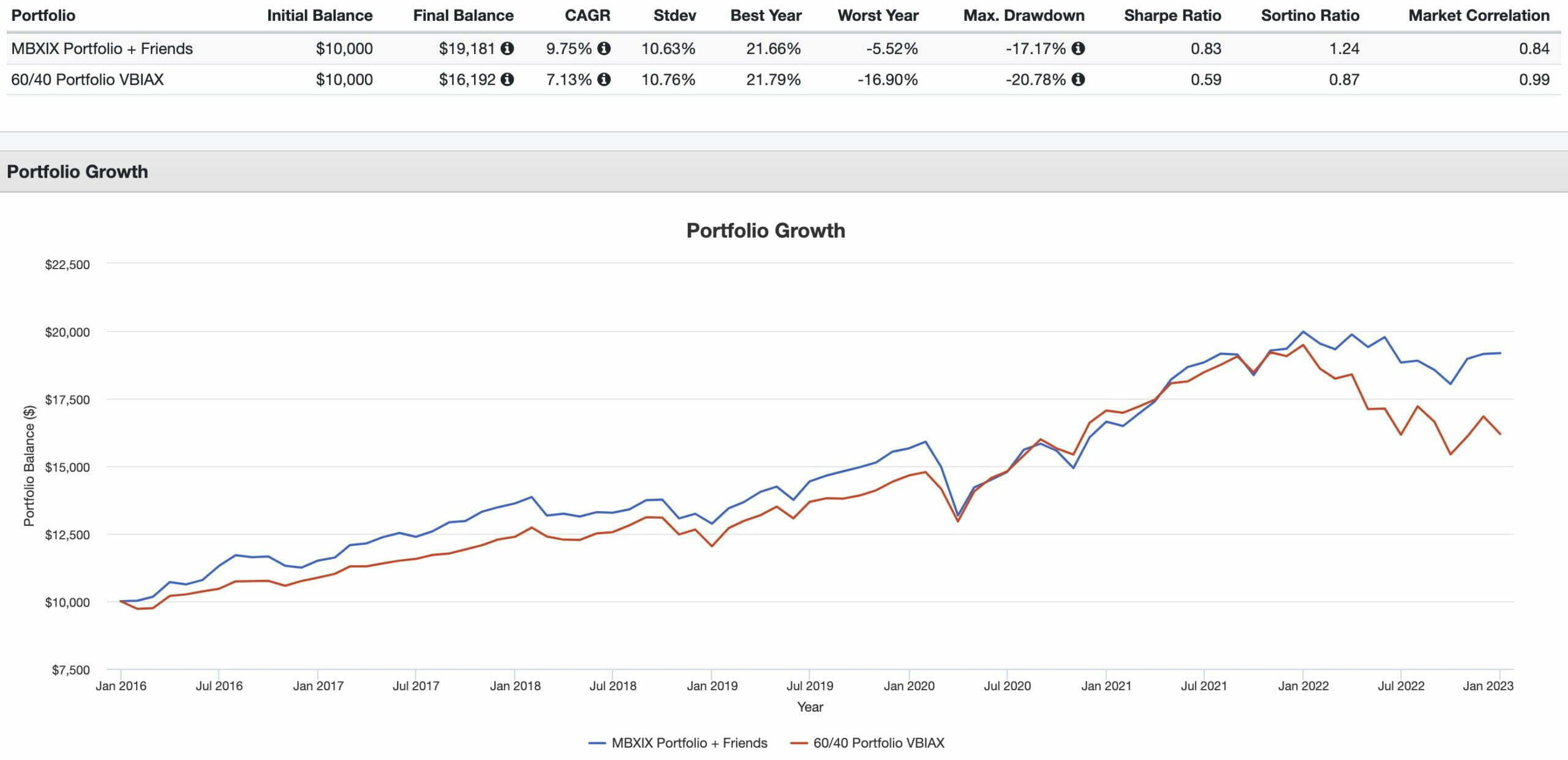

We’re able to assemble a nifty 4 fund portfolio with MBXIX as the centrepiece.

30% PSLDX – PIMCO StocksPLUS Long Duration

40% MBXIX – Catalyst/Millburn Hedge Strategy

20% QLEIX – AQR Long-Short Equity

10% BTAL – AGFiQ US Market Neutral Anti-Beta

Overall, we’d have exposure to five capital efficient strategies:

- Global Stocks

- Bonds

- Managed Futures (Multi-Strategy)

- Long-Short Equity

- Market-Neutral Anti-Beta

Let’s see how our model portfolio compares with an industry standard 60/40.

MBXIX Fund + Friends Portfolio vs 60/40 Portfolio (VBIAX)

CAGR: 9.75% vs 7.13%

RISK: 10.63% vs 10.76%

BEST YEAR: 21.66% vs 21.79%

WORST YEAR: -5.52% vs -16.90%

MAX DRAWDOWN: -17.17% vs -20.78%

SHARPE RATIO: 0.83 vs 0.59

SORTINO RATIO: 1.24 vs 0.87

MARKET CORRELATION: 0.84 vs 0.99

It’s a convincing win across the board for the MBXIX and Friends portfolio versus VBIAX 60/40.

Especially noteworthy is the Worst Year and Sortino Ratio results.

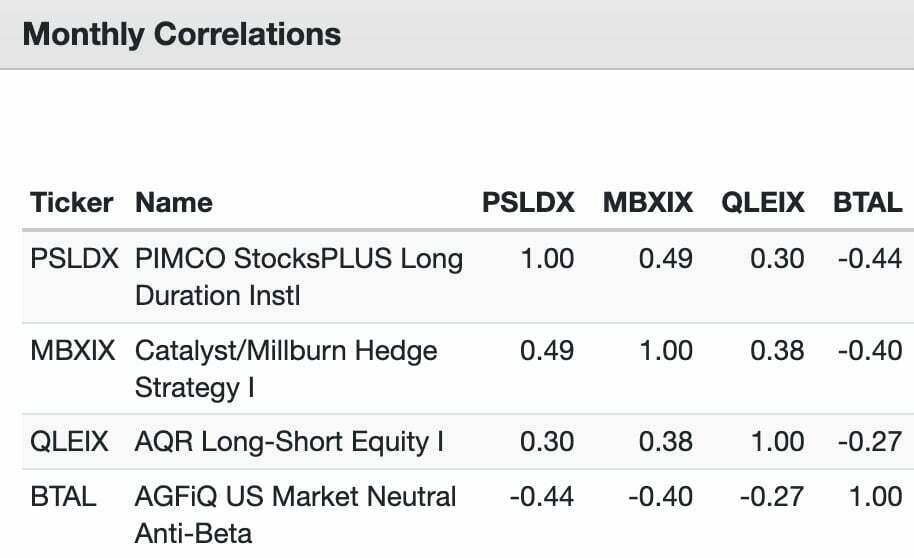

Let’s move on to monthly correlations between the four funds.

Nomadic Samuel Final Thoughts

It’s fascinating for me to have the opportunity to review a fund that dates backs to the late 20th century.

More often than not I’m covering funds that are recently minted or have only been in existence for a short number of months/years.

The fact that the Catalyst/Millburn fund is going strong in 2023 is a testament to its durability and capacity to evolve strategically throughout the years.

It is a fund that made it into the impressive Return Stacked 60/40 Absolute Index offering investors Equity and Global Macro exposure.

It’s one of only three or four mutual funds (that I’m aware of – please correct me if I’m wrong) currently available to US investors that offers a unique combination of capital efficient Equites + Managed Futures.

So overall the fund has proven to stand the test of time, adapt and offer investors a unique combination of strategies.

That’s without a doubt impressive.

But at this point in the fund review I’m more interested in what you’ve got to say.

What do you think of the Catalyst/Millburn Hedge Strategy Fund?

Is it on your radar?

Please let me know in the comments below.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.