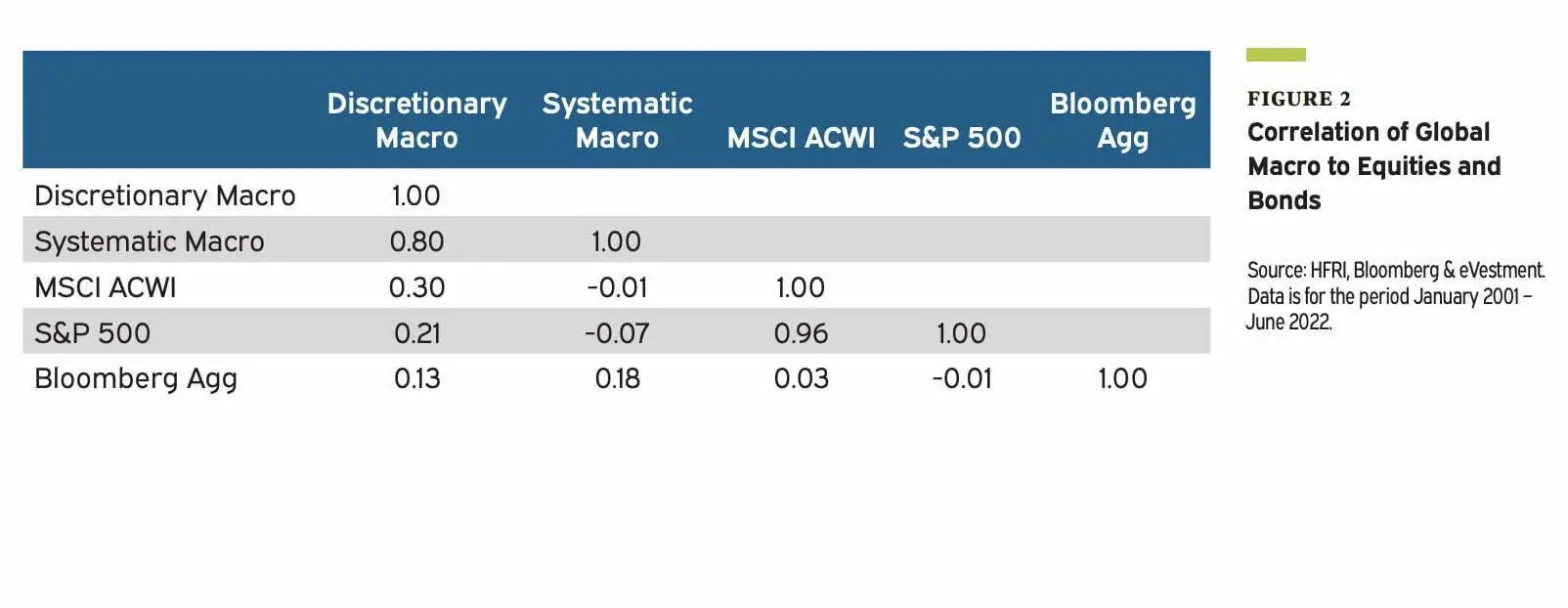

Global systematic macro (GSM) is an investment strategy that has gained significant traction among investors and hedge fund managers. It is a quantitative approach that involves trading in various financial markets, including currencies, commodities, and equities, with the aim of generating returns from market inefficiencies and mispricings.

GSM: Global Systematic Macro Approach

The GSM approach involves using sophisticated computer algorithms and data analysis to identify macroeconomic trends and market anomalies. It then uses these insights to create and execute trading strategies, which may involve taking long or short positions in various financial instruments, depending on the manager’s assessment of market conditions and risk.

The GSM strategy is often favored by investors looking for high returns and diversification in their portfolios. This is because it involves taking positions in multiple markets, spreading the risk and reducing the impact of market volatility. Additionally, the use of leverage can enhance returns, making GSM an attractive investment option for those looking for high returns.

Diversification: Key Advantage Of A Global Systematic Approach

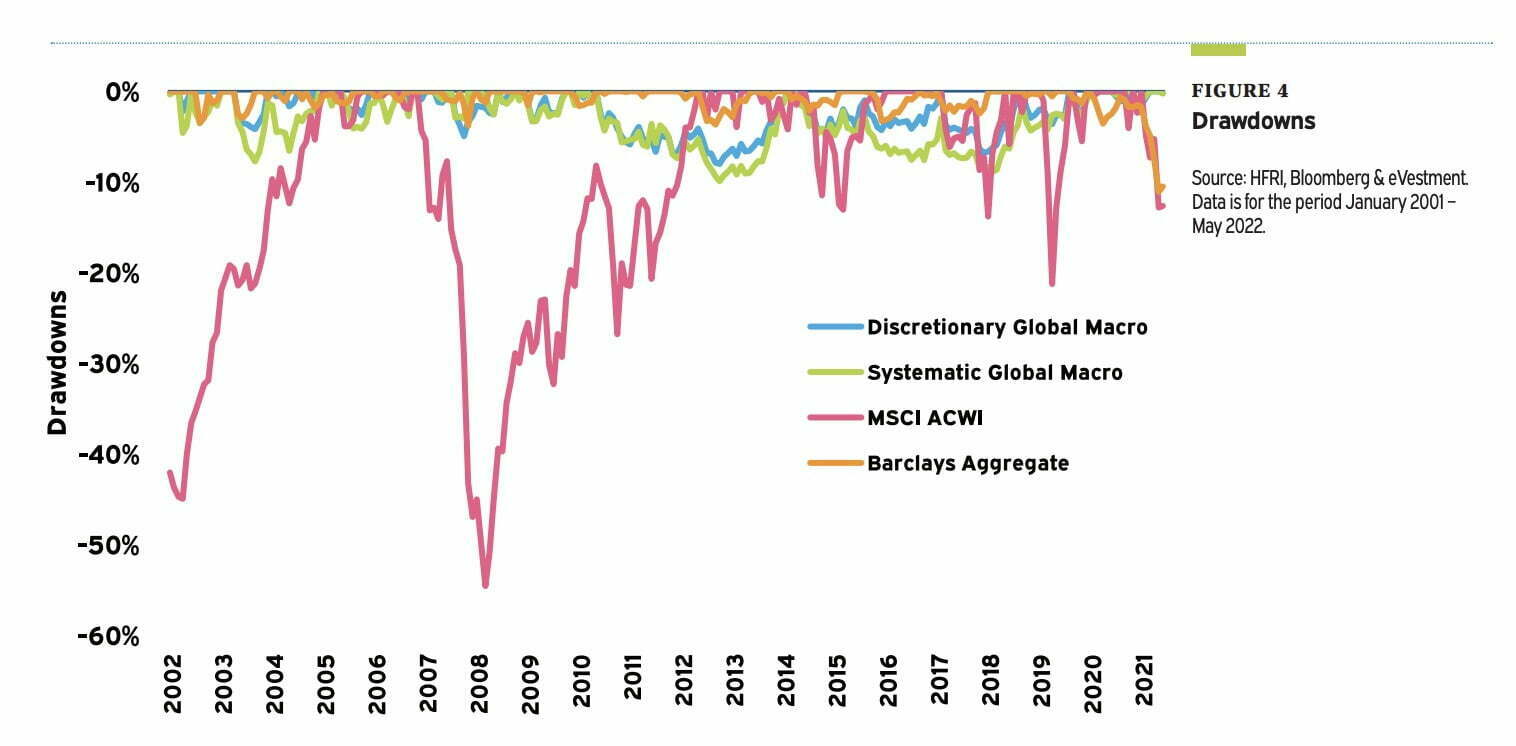

One of the primary advantages of the GSM approach is diversification. Trading in multiple markets allows managers to spread their risk and reduce the impact of market volatility. This diversification can help to mitigate the risks associated with investing in a single asset class or market.

Furthermore, the use of quantitative models and algorithms can provide investors with a systematic approach to trading, which can help to eliminate the emotional biases that can lead to poor investment decisions. These models can also help to identify market anomalies that may not be apparent to the human eye, providing a competitive edge for managers who use this approach.

source: Bridgewater Associates on YouTube

GSM Approach: Potential Challenges

Despite its advantages, the GSM approach is not without its challenges. One of the primary challenges of the GSM approach is the risk of unexpected market events that may not be captured by the models. For example, geopolitical instability, natural disasters, or sudden changes in economic policy can have a significant impact on the financial markets, and these events may not be captured by the models used by GSM managers.

Another potential challenge for GSM managers is the constant need to update and refine their models to keep up with changing market conditions. This requires a significant investment in technology and data analysis, and even with the best models, there is always the risk of unforeseen market events.

Global Systematic Macro Performance Over The Past 20 Years

Despite these challenges, the GSM approach has proven to be a successful investment strategy for many managers. According to data from BarclayHedge, the Barclay Global Macro Index, which tracks the performance of systematic macro hedge funds, has produced an average annual return of 6.4% over the past 20 years.

One of the factors contributing to the success of the GSM approach is the availability of data. Today, there is more data available than ever before, and this data can be used to develop sophisticated models and algorithms that can provide valuable insights into market trends and anomalies.

Furthermore, advances in technology have made it easier for investors to access these data and use them to develop trading strategies. This has led to an increase in the number of quantitative hedge funds that use the GSM approach, as more managers have been able to develop and implement successful trading strategies.

Another factor contributing to the success of the GSM approach is the availability of skilled talent. The development of quantitative models and algorithms requires a highly skilled workforce, and many of the best and brightest minds in the field are drawn to the hedge fund industry.

Furthermore, the highly competitive nature of the industry has led to a focus on innovation and continuous improvement, as managers seek to gain a competitive edge over their peers. This has led to the development of increasingly sophisticated models and algorithms that can provide valuable insights into market trends and anomalies.

source: Blockworks Macro on YouTube

Risks Of Global Systematic Macro Investing

One of the key risks associated with the GSM approach is the risk of overfitting. This occurs when models are developed that are too closely tailored to historical data, making them less effective at predicting future market movements.

To mitigate this risk, many managers use a variety of techniques, such as out-of-sample testing and cross-validation, to ensure that their models are robust and effective at predicting future market movements.

Another risk associated with the GSM approach is the risk of model decay. This occurs when market conditions change in such a way that the models become less effective at predicting future market movements. To mitigate this risk, GSM managers must constantly monitor and update their models to ensure that they remain effective in predicting market movements.

source: Axis Direct on YouTube

GSM Major Players And Top Performers

Despite these risks, the GSM approach has proven to be a successful investment strategy for many managers. One example of a successful GSM manager is Bridgewater Associates, one of the world’s largest hedge funds, which has consistently produced strong returns using a systematic macro approach.

Bridgewater’s success can be attributed to its focus on data and analytics, as well as its commitment to continuous improvement and innovation. The company employs a team of over 150 data scientists and engineers, who are responsible for developing and refining its quantitative models and algorithms.

Another successful GSM manager is Two Sigma Investments, which uses a combination of artificial intelligence and machine learning to develop and execute its trading strategies. Two Sigma’s success can be attributed to its use of cutting-edge technology and its focus on innovation and continuous improvement.

source: Financial Wisdom on YouTube

Global Systematic Strategies That Investors Utilize

There are several different global systematic strategies that investment managers use to trade in the financial markets. Here are some of the main ones:

- Trend-following: Trend-following is a strategy that involves identifying trends in the markets and buying or selling assets based on those trends. For example, if a market is in an uptrend, a trend-following strategy would involve buying assets in that market, while if a market is in a downtrend, the strategy would involve selling assets in that market.

- Systematic macro: Systematic macro is a strategy that involves using quantitative analysis to identify macroeconomic trends and market anomalies. This approach involves analyzing a wide range of economic data, such as GDP, inflation, and interest rates, to identify opportunities to trade in various financial markets.

- Statistical arbitrage: Statistical arbitrage is a strategy that involves identifying pricing discrepancies between related assets and buying or selling those assets to profit from those discrepancies. This approach involves using statistical models to identify relationships between assets and to identify instances where those relationships break down, creating trading opportunities.

- Market-neutral: Market-neutral strategies involve taking long and short positions in different assets to neutralize the overall market exposure of the portfolio. This approach allows investors to profit from the relative performance of different assets, rather than from the direction of the overall market.

- Managed futures: Managed futures is a strategy that involves trading in futures contracts on various assets, such as commodities, currencies, and interest rates. This approach involves using quantitative analysis to identify trends and patterns in the futures markets, with the goal of generating returns from market inefficiencies and mispricings.

- Multi-asset: Multi-asset strategies involve trading in a variety of different asset classes, such as stocks, bonds, commodities, and currencies, with the goal of diversifying the portfolio and reducing overall risk. This approach involves using quantitative analysis to identify opportunities to trade in different asset classes and to optimize the overall portfolio allocation.

- Quantitative equity: Quantitative equity strategies involve using quantitative analysis to identify undervalued and overvalued stocks, with the goal of generating returns from stock selection. This approach involves using factors such as valuation, momentum, and quality to identify stocks that are likely to outperform or underperform the overall market.

- Seasonality: Seasonality is a strategy that involves identifying seasonal patterns in the markets and buying or selling assets based on those patterns. For example, some assets may exhibit a consistent seasonal pattern of outperforming during certain months of the year, and underperforming during others. Seasonality strategies seek to capitalize on these patterns by buying or selling assets at the appropriate times.

- Mean reversion: Mean reversion is a strategy that involves identifying assets that have moved too far away from their long-term average and betting on a return to that average. For example, if a stock price has fallen significantly below its long-term average, a mean reversion strategy would involve buying that stock with the expectation that it will eventually return to its average.

- Momentum: Momentum is a strategy that involves identifying assets that have exhibited strong recent performance and betting on a continuation of that performance. For example, if a stock has exhibited strong positive returns over the past few months, a momentum strategy would involve buying that stock with the expectation that it will continue to perform well in the near future.

- Volatility: Volatility strategies involve trading assets based on their expected level of volatility. For example, a volatility strategy may involve buying assets that are expected to have high volatility in the future, or selling assets that are expected to have low volatility.

- Carry: Carry strategies involve trading assets based on the interest rate differential between two countries. For example, a carry strategy may involve borrowing money in a currency with a low interest rate and investing that money in a currency with a higher interest rate, with the expectation of earning a profit from the interest rate differential.

- Options: Options strategies involve trading options contracts on various assets. For example, an options strategy may involve buying call options on a stock with the expectation of profiting from a rise in the stock price, or buying put options on a stock with the expectation of profiting from a decline in the stock price.

- Event-driven: Event-driven strategies involve trading assets based on specific events or news. For example, an event-driven strategy may involve buying a stock that is expected to benefit from a merger or acquisition, or selling a stock that is expected to be negatively impacted by a regulatory decision.

- Sentiment: Sentiment strategies involve trading assets based on market sentiment and investor psychology. For example, a sentiment strategy may involve buying assets when market sentiment is overly negative, or selling assets when market sentiment is overly positive.

- Risk parity: Risk parity is a strategy that involves allocating investments across different assets based on their risk levels. For example, a risk parity strategy may involve investing more heavily in assets that have lower risk levels, such as bonds, and investing less in assets that have higher risk levels, such as stocks.

- Fundamental: Fundamental strategies involve analyzing the underlying fundamentals of an asset, such as its financial performance, management quality, and industry trends, in order to make investment decisions. For example, a fundamental strategy may involve buying stocks that are undervalued relative to their earnings growth potential.

- Statistical arbitrage: Statistical arbitrage is a strategy that involves identifying pricing discrepancies between related assets and taking advantage of those discrepancies by simultaneously buying and selling those assets. For example, a statistical arbitrage strategy may involve buying one stock and shorting another stock in the same industry, with the expectation that the price differential between the two will eventually converge.

- Systematic value: Systematic value is a strategy that involves identifying undervalued assets based on certain financial metrics, such as price-to-earnings ratio or price-to-book ratio. For example, a systematic value strategy may involve buying stocks that have a low price-to-book ratio, with the expectation that the market will eventually recognize their true value.

- Multi-factor: Multi-factor strategies involve combining multiple quantitative factors, such as value, momentum, and volatility, to create a more comprehensive investment approach. For example, a multi-factor strategy may involve investing in stocks that exhibit both strong value and strong momentum characteristics.

- Machine learning: Machine learning strategies involve using complex algorithms to analyze large datasets and make investment decisions based on patterns and trends in the data. For example, a machine learning strategy may involve analyzing thousands of news articles to identify market trends and sentiment, and then using that information to make investment decisions.

- High-frequency trading: High-frequency trading strategies involve using advanced algorithms and computer programs to execute trades at high speeds in order to take advantage of small price movements in the market. For example, a high-frequency trading strategy may involve buying and selling large volumes of a stock in a matter of milliseconds in order to profit from tiny price fluctuations.

Take consideration that these strategies are not mutually exclusive, and investment managers may use a combination of different strategies to achieve their investment objectives. It is also worth noting that the strategies described above are not the only global systematic strategies used in the financial markets, and new strategies are constantly being developed and refined as technology and data analysis capabilities continue to evolve.

Some of these strategies, such as mean reversion and momentum, can be combined with others, such as seasonality or volatility, to create more complex and nuanced trading approaches. Additionally, the success of any global systematic strategy will depend on a variety of factors, including market conditions, data quality, and the skill and experience of the investment manager.

Each of these strategies can be used to create a unique investment approach, and they can be combined in different ways to create a diversified portfolio. It’s important to note that not all global systematic strategies will be successful in all market conditions, and it’s important to carefully analyze historical data and market conditions before implementing any investment strategy.

source: Excess Returns on YouTube

Global Systematic Macro Final Thoughts

In conclusion, the GSM approach is a quantitative investment strategy that involves trading in various financial markets with the aim of generating returns from market inefficiencies and mispricings. The approach involves using sophisticated computer algorithms and data analysis to identify macroeconomic trends and market anomalies, which are then used to create and execute trading strategies.

The GSM approach has several advantages, including diversification, systematic trading, and the use of leverage to enhance returns. However, it is not without its challenges, including the risk of unexpected market events, the need for constant model refinement, and the risk of overfitting and model decay.

Despite these challenges, the GSM approach has proven to be a successful investment strategy for many managers. The availability of data, advances in technology, and the availability of skilled talent have all contributed to the success of the GSM approach.

Examples of successful GSM managers, such as Bridgewater Associates and Two Sigma Investments, highlight the potential of this approach to generate strong returns and diversify portfolios. However, investors considering the GSM approach should be aware of the risks involved and should carefully evaluate the performance of any manager they are considering before making an investment.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.