As investors we’d be wise to reread the classic childhood fable “The Tortoise and the Hare”.

We often forget that its a slow and steady approach that wins the race.

I honestly can’t think of a better example of this than the long-term performance of MOAT ETF vs ARKK ETF.

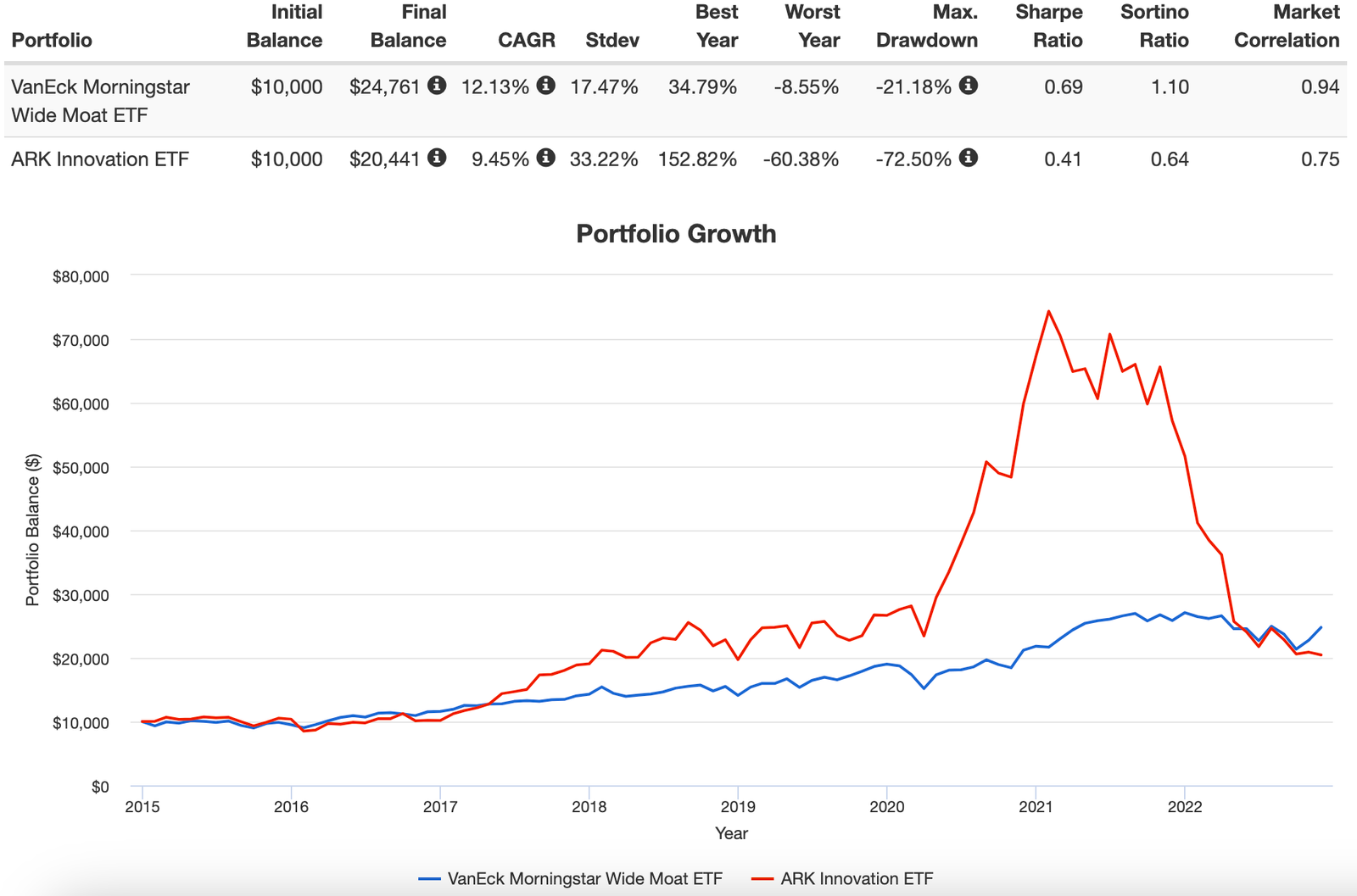

MOAT ETF vs ARKK ETF Performance

If we just glance at the CAGR of VanEck Morningstar Wide Moat ETF we’ll notice it outperforms ARK Innovation ETF by a substantial 268 basis points since 2015.

However, that doesn’t tell the full story.

The real story here is the comparison between what is expedient versus what is stable.

Innovation vs Wide Moats.

FOMO concentrated Narrative Based Investing vs a consistent and Sustainable Competitive Advantage.

New, Exciting and Shiny vs Been Around The Block For A While.

Best Year of 152.82% vs 34.79%.

Worst Year of -60.38% vs -8.55%.

I really could go on and on with this but I think I’ll stop here.

Investing in companies with a consistent sustainable competitive advantage is the specific mandate MOAT ETF pursues.

In this ETF review we’ll attempt to unpack this time-tested yet unique investing strategy to see how it can potentially help investors seeking stability.

Sustainable Competitive Advantage Investment Strategy: VanEck Morningstar Wide MOAT ETF Review

Hey guys! Here is the part where I mention I’m a travel blogger, vlogger and content creator! This investing opinion blog post ETF Review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

source: VanEck on YouTube

VanEck ETFs: Dare To Be Different

VanEck is an ETF provider with an impressive roster of funds and a motto I can get behind:

“Don’t settle for the conventional. Dare to be different.”

Their three most popular strategies from a purely AUM standpoint include GDX Gold Miners ETF, SMH Semiconductor ETF and the one we’re shining the spotlight upon today: MOAT Morningstar Wide Moat ETF.

And for those specifically interested in “wide moat” investing VanEck has 5 funds for investors to consider.

VanEck “Wide Moat” Fund List

MOTE ETF – Morningstar ESG Moat ETF

MOTG ETF – Morningstar Global Wide Moat ETF

MOTI ETF – Morningstar International Moat ETF

SMOT ETF – Morningstar SMID Moat ETF

MOAT ETF – Morningstar Wide Moat ETF

Hence, it is possible for an investor to cobble together a high conviction globally diversified wide moat strategy utilizing the puzzle pieces mentioned above.

The Case For “Wide Moat” Investing

What’s the case for potentially pursuing a wide moat investing strategy?

Firstly, we ought to define what constitutes a “wide moat” or “economic moat”?

In a nutshell, a “wide moat” or “economic moat” is a consistent and durable “sustainable competitive advantage” a company has in order to keep competition at bay while generating considerable economic profits over an extended period of time.

Imagine a castle with a moat designed to prevent others from getting in.

How An Economic Moat Provides A Competitive Advantage

These companies often have some sort of competitive advantage that keeps them head and shoulders above potential competition.

It may be specialized knowledge.

It could also be dominating “older industries” where there isn’t as much incentive for new participants or innovation.

Additionally, certain companies may have an advantage of being able to produce at considerably lower costs.

Warren Buffett Popularized “Economic Moat” Investing

Warren Buffett, the most famous investor of our times, helped popularize “wide economic moat” investing for generations of investors.

The capacity for a business to maintain a competitive advantage over its competition ensures it’ll safeguard its long-term profits and overall market share.

Ultimately, you defend your castle by creating a moat to keep others out.

Insiders vs Outsiders.

They can perish while your company has the capacity to continue thriving.

It’s cutthroat but that’s business.

source: VanEck on YouTube

MOAT ETF Overview, Holdings and Info

The investment case for the “VanEck Morningstar Wide Moat ETF ” has been laid out succinctly by the folks over at VanEck ETFs: (fund landing page)

“VanEck Morningstar Wide Moat ETF (MOAT ) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar Wide Moat Focus Index (MWMFTR), which is intended to track the overall performance of attractively priced companies with sustainable competitive advantages according to Morningstar’s equity research team.”

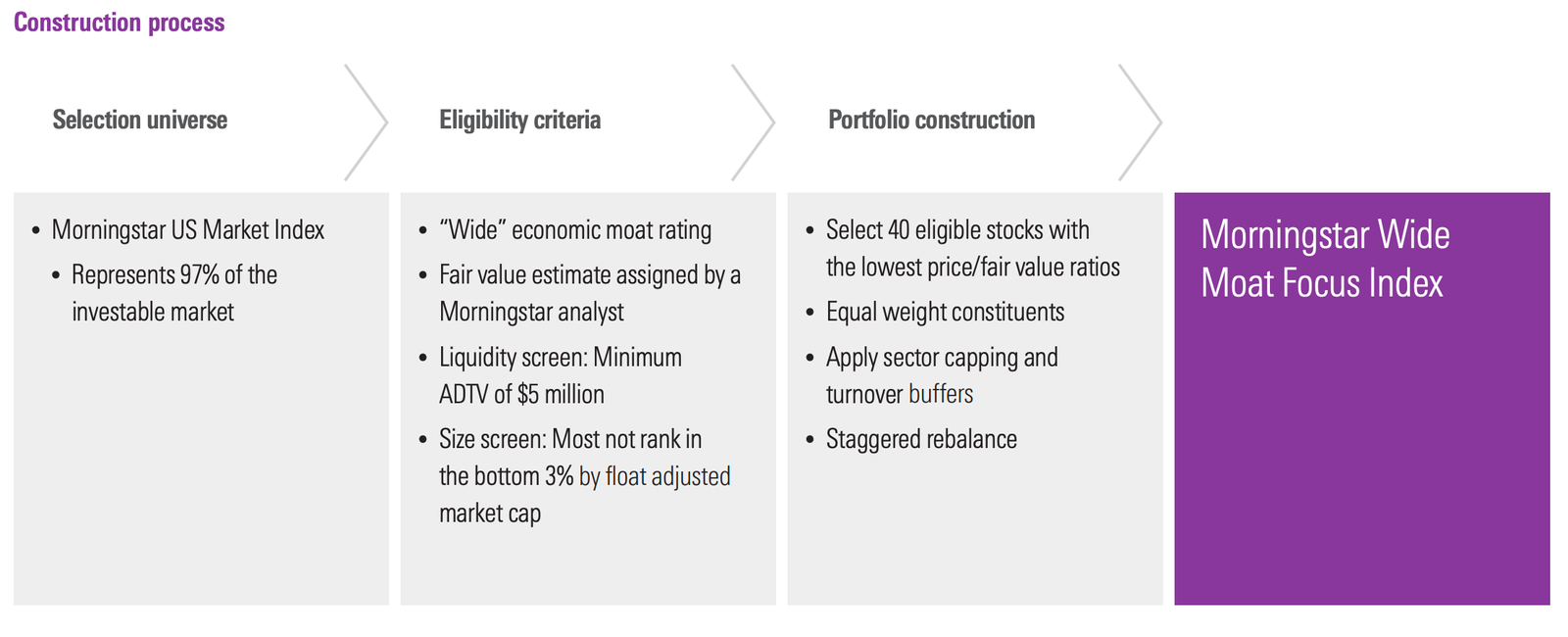

Let’s find out exactly how the fund sifts, sorts and scours to find “attractively priced companies with a sustainable competitive advantage” by consulting the Morningstar Wide Moat Focus Index.

Wide Moat Security Selection Process

“Morningstar’s equity research team assigns one of three economic moat ratings: “wide,” “narrow,” or “none.”

There are two major criteria that must be satisfied for a company to earn a moat rating of “wide”:

1) it must be likely to generate returns on invested capital above its weighted average cost of capital for at least the next twenty years; and 2) it must enjoy one of the following economic moat sources, each of which is a driver of structural competitive advantage:

• Network effect—Present when the value of a network increases for new and existing users as the network grows.

• Cost advantage —Allows a firm to sell at the same price as competition but still enjoy economic profits thanks to lower unit costs of production.

• Efficient scale—When a company serves a market limited in size, new competitors may not have an incentive to enter, particularly when the cost of market entry is high. New entrants would cause returns for all players to fall well below the cost of capital.

• Intangible assets—Brands, patents, and regulatory licenses that block competition and/or convey meaningful pricing power.

• Switching costs—Whether in time or money, the expenses that a customer would incur to change from one producer/ provider to another.

Eligible stocks are ranked in descending order by float adjusted market capitalization, and those that rank in the bottom 3% are removed.

The remaining stocks are then ranked on their price/fair value ratios.

Those trading at the largest discount to fair value are selected until the index reaches its fixed target constituent count (40), with buffers applied to favor existing index members.

The Morningstar Wide Moat Focus Index consists of two sub-portfolios, and the stocks within each sub-portfolio are equally weighted, subject to sector constraints.”

Let’s try to highlight the key points.

Wide Moat Index Key Points

- Target of 40 stocks

- 20 Year Focus on the ability of a company to generate returns on invested capital above its weighted average cost of capital

- Structural Competitive Advantage “economic moat” of at least 1 source:

A) Network Effect – value of network increases for users

B) Cost Advantage – lower unit of cost production versus competition

C) Efficient Scale – cost of entry high for new competition in a niche market

D) Intangible Assets – brands, patents or licenses that block competition

E) Switching Costs – cost of time/money for a custumer to switch to another competitor - Selects 40 companies trading at the largest discount to fair value

VanEck Morningstar Wide Moat ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund normally invests at least 80% of its total assets in securities that comprise the Fund’s benchmark index.

The Wide Moat Focus Index is comprised of securities issued by companies that Morningstar, Inc. (“Morningstar” or the “Index provider”) determines to have sustainable competitive advantages based on a proprietary methodology that considers quantitative and qualitative factors (“wide moat companies”).

Wide moat companies are selected from the universe of companies represented in the Morningstar® US Market IndexSM, a broad market index representing 97% of U.S. market capitalization.

The Wide Moat Focus Index targets a select group of wide moat companies: those that according to Morningstar’s equity research team are attractively priced as of each Wide Moat Focus Index review.

Out of the companies in the Morningstar US Market Index that Morningstar determines are wide moat companies, Morningstar selects companies to be included in the Wide Moat Focus Index as determined by the ratio of Morningstar’s estimate of fair value of the issuer’s common stock to the price.

Morningstar’s equity research fair value estimates are calculated using a standardized, proprietary valuation model.

Wide moat companies may include medium-capitalization companies.

The Fund’s 80% investment policy is non-fundamental and may be changed without shareholder approval upon 60 days’ prior written notice to shareholders.

As of December 31, 2022, the Wide Moat Focus Index included 49 securities of companies with a full market capitalization range of between approximately $5.1 billion and $1,787.7 billion and a weighted average full market capitalization of $142.5 billion.

These amounts are subject to change. The Fund, using a “passive” or indexing investment approach, attempts to approximate the investment performance of the Wide Moat Focus Index by investing in a portfolio of securities that generally replicates the Wide Moat Focus Index.

Unlike many investment companies that try to “beat” the performance of a benchmark index, the Fund does not try to “beat” the Wide Moat Focus Index and does not seek temporary defensive positions that are inconsistent with its investment objective of seeking to replicate the Wide Moat Focus Index.

The Fund may become “non-diversified” as defined under the Investment Company Act of 1940, as amended (the “Investment Company Act of 1940”), solely as a result of a change in relative market capitalization or index weighting of one or more constituents of the Wide Moat Focus Index.

This means that the Fund may invest a greater percentage of its assets in a limited number of issuers than would be the case if the Fund were always managed as a diversified management investment company.

The Fund intends to be diversified in approximately the same proportion as the Wide Moat Focus Index.

Shareholder approval will not be sought when the Fund crosses from diversified to non-diversified status due solely to a change in the relative market capitalization or index weighting of one or more constituents of the Wide Moat Focus Index.

The Fund may concentrate its investments in a particular industry or group of industries to the extent that the Wide Moat Focus Index concentrates in an industry or group of industries.

As of September 30, 2022, each of the information technology, industrials, health care, financials and consumer discretionary sectors represented a significant portion of the Fund.”

MOAT ETF: Holdings

Overall, MOAT ETF has 48 holdings with its Top 10 positions ranging from 3.68% at the very top to 2.56% at the bottom.

You’ll notice companies such as Etsy Inc, Wells Fargo & Co, Blackrock Inc and Boeing Co taking up some of the most valuable real estate space in the fund.

I’m impressed that no position takes up more than 3% overall space.

With a high conviction 48 securities strategy, I think it’s paramount to spread out as much as possible.

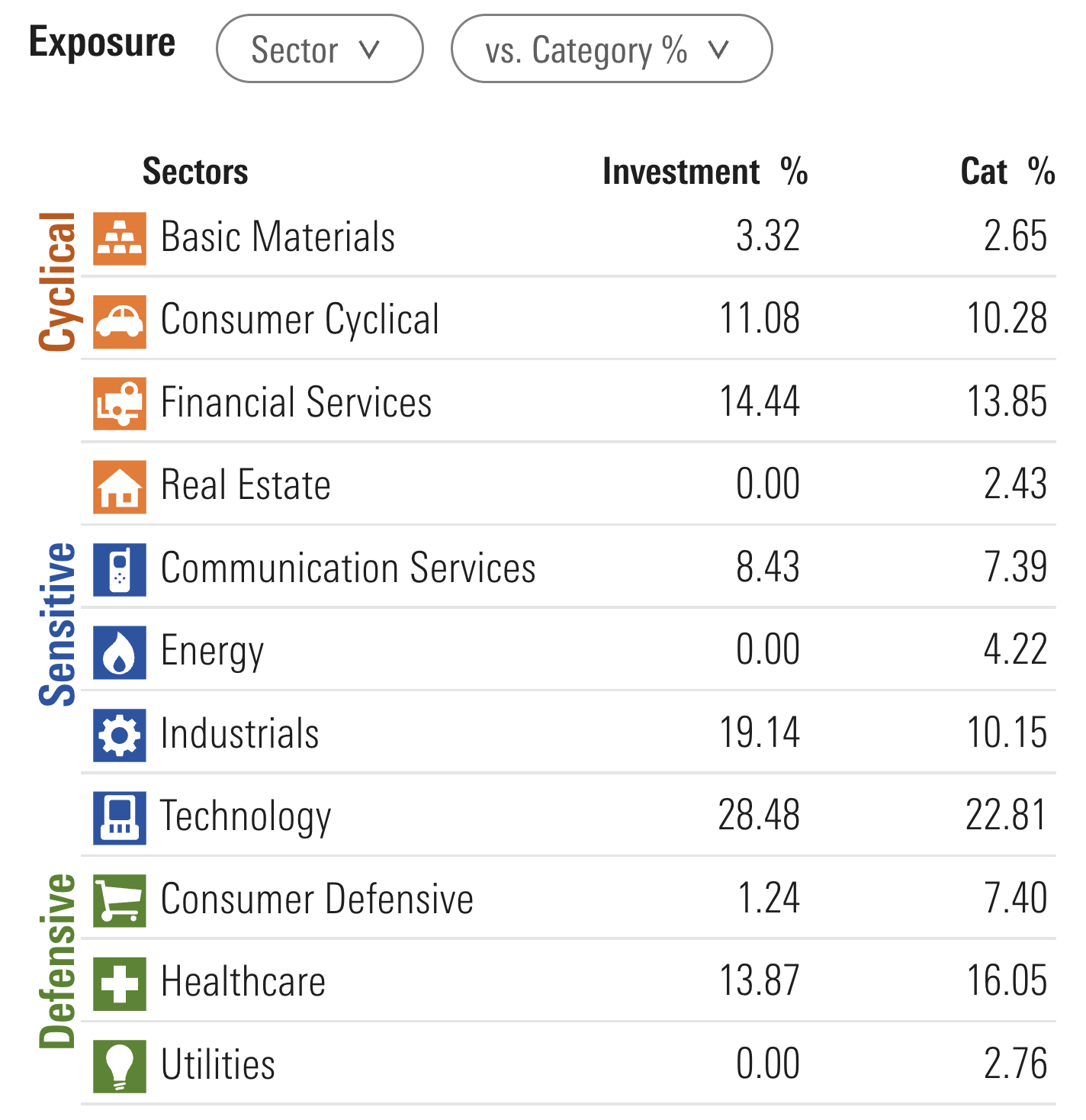

MOAT ETF: Sector Exposure

VanEck Morningstar Wide MOAT ETF is certainly full of surprises when it comes to overall sector exposure!

Noteworthy, is that MOAT ETF currently has ZERO exposure to Utilities, Energy and Real Estate.

It’s significantly overweight Technology and Industrials while being underweight consumer defensive.

If you’re currently seeking exposure to Utilities, Energy, Real Estate and Consumer Defensive equities you’ll need to look elsewhere.

MOAT ETF Info

Ticker: MOAT

Net Expense Ratio: 0.46

AUM: 6.8 Billion

Inception: 04/24/2012

VanEck Morningstar Wide MOAT ETF has been nothing short of a “cash cow” for the fund provider.

Amassing 6.8 Billion in AUM highlights the overall interest level of investors to pursue a “wide economic moat” investment strategy.

It certainly helps that the fund has outperformed the S&P 500 long-term (over the past 5 years) and especially this year in particular (2022).

More on that later in the “performance” section for the fund.

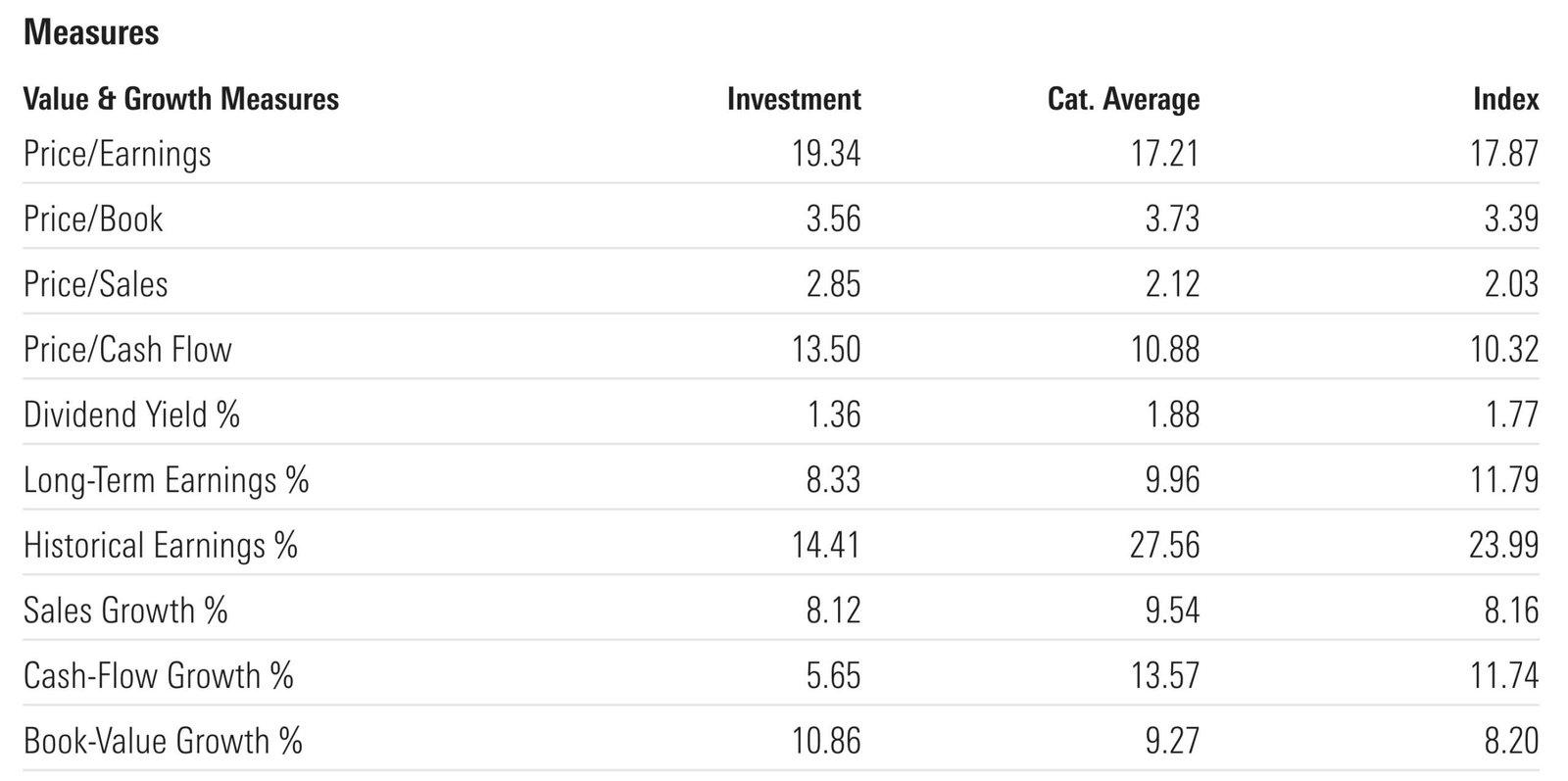

MOAT ETF – Style Measures

Unlike other funds I’ve reviewed on Picture Perfect Portfolios, MOAT ETF does not have a distinct advantage versus its category average when it comes to Morningstar Value & Growth Measures.

In fact, it has slightly higher Price/Earnings, Prices/Sales and Price/Cash Flow where lower is considered better.

It also has less attractive Dividend Yield %, Historical Earnings % and Cash-Flow Growth % where higher is optimal.

Hence, if you’re seeking a fund that provides dominant styles and measures, you won’t be thrilled with the results of MOAT ETF.

MOAT ETF – Stock Style

VanEck Morningstar Wide Moat ETF mostly hangs out in large cap territory (65%) with 29% mid-cap exposure and 7% small-cap coverage.

The fund offers an almost even blend of 32% value, 34% core and 35% growth.

What I find fascinating is that all of its small-cap exposure is pure value whereas it leans to the right hand side of growth for its mid-caps.

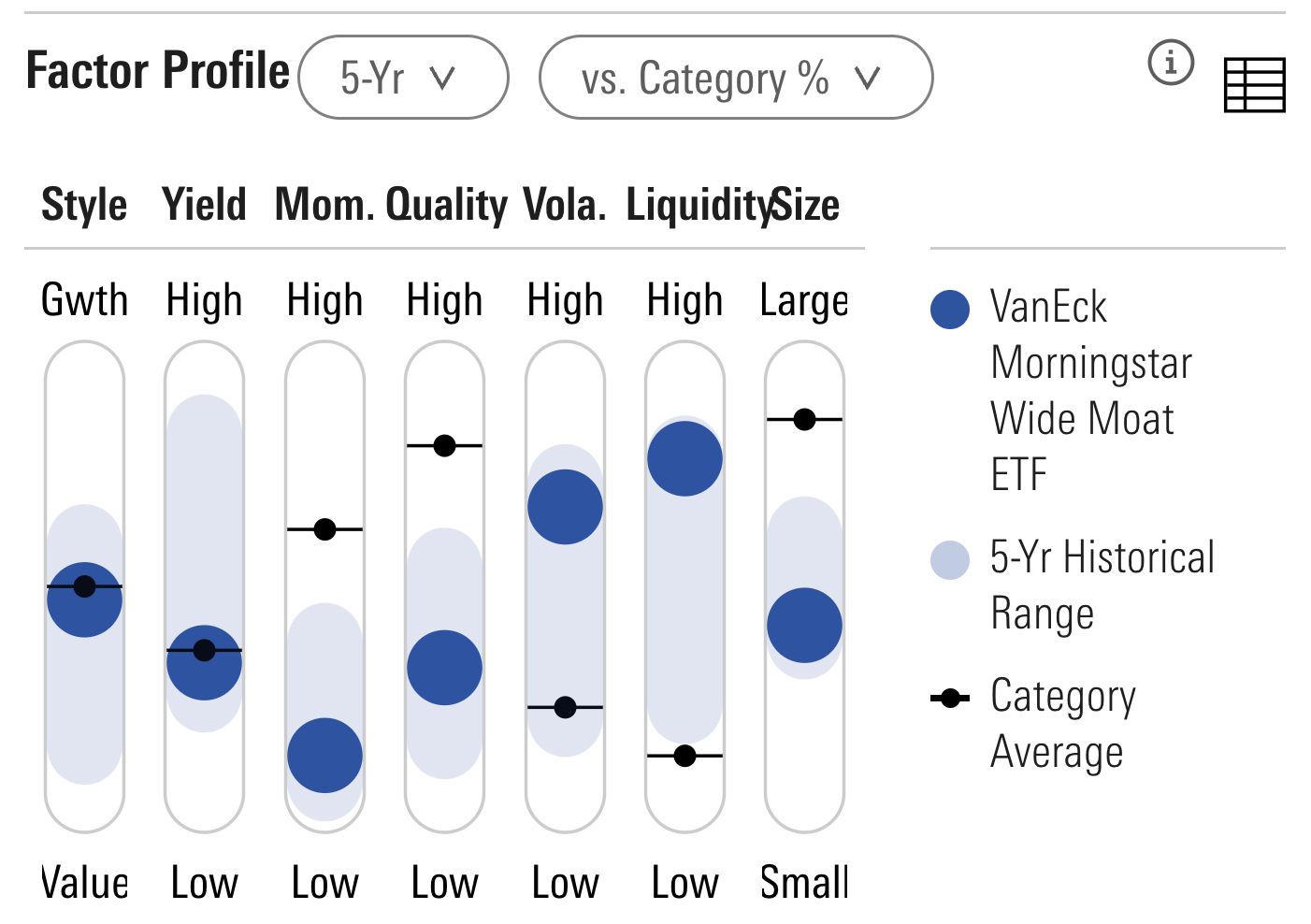

MOAT ETF – Factor Profile

For investors less than thrilled by MOAT ETF’s styles and measures, let’s just say its factor profile doesn’t offer a redemption ark.

The fund features low momentum, yield and quality.

Its volatility score is not impressive either.

Its a blend fund right in the middle of growth and value.

One feather in its cap is that it does provide more exposure to size than its category average.

But factor thirsty investors aren’t going to be thrilled by the results here.

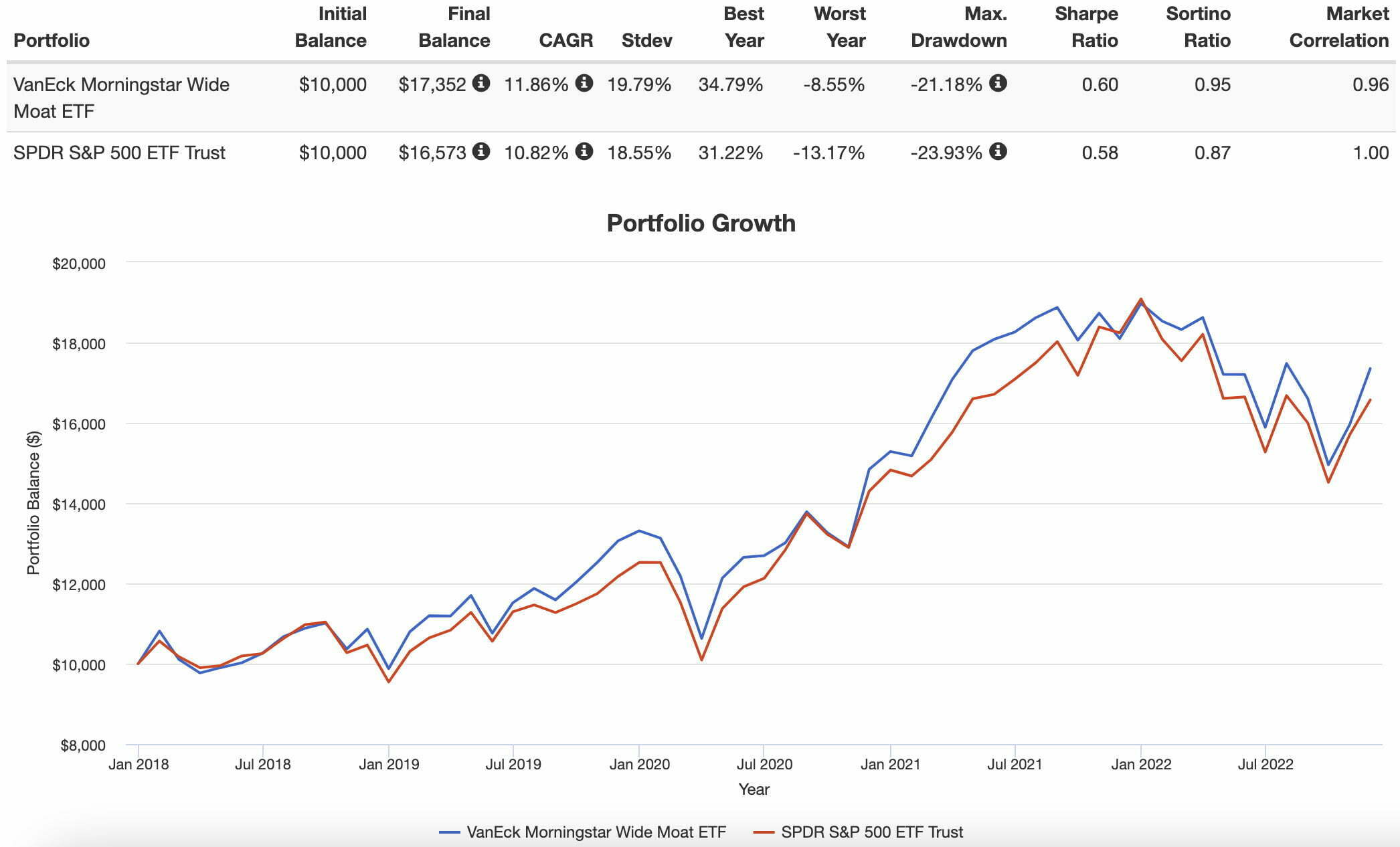

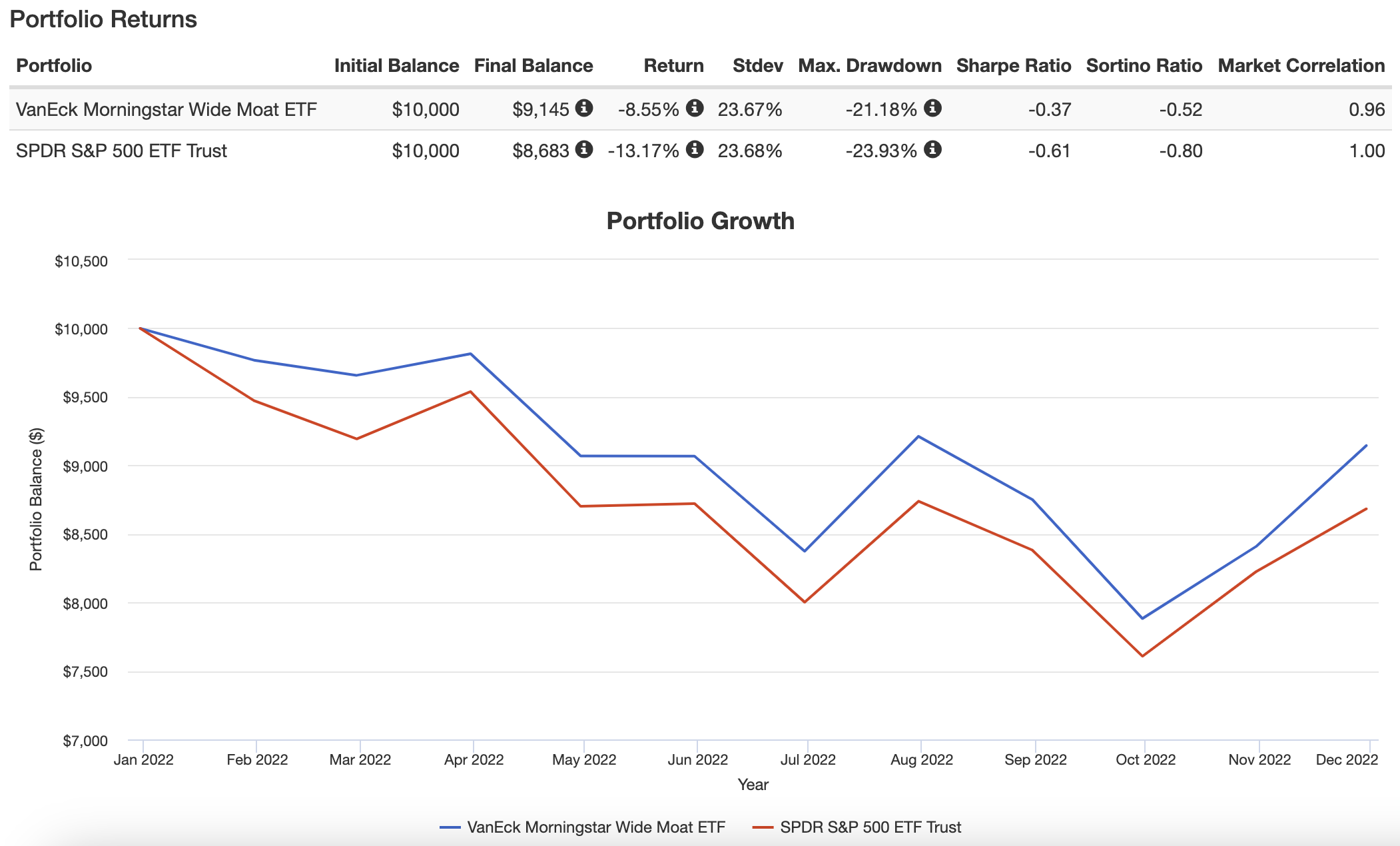

MOAT ETF Performance

MOAT has outperformed the S&P 500 since its inception and also during the 5-year period we’re specifically backtesting.

With 104 basis points of outperformance, the fund has also been more volatile with a 19.87% standard deviation.

This is hardly surprising given that the fund holds 40-something positions versus 500 position SPY.

A clear feather in MOAT’s cap is how the fund has navigated the turbulent waters of 2022 versus the S&P 500.

The higher conviction strategy with less positions, has been considerably more durable posting a -8.55% CAGR vs -13.17% for SPY.

MOAT ETF Pros and Cons

MOAT Pros

- High conviction “wide economic moat” strategy of 40-something positions that screens for companies featuring a “sustainable competitive advantage”

- Long-term vs short-term time horizon screening for companies with a potential for 20-years to generate returns on invested capital above its weighted average cost of capital

- An index process that screens for the following: Network Effect, Cost Advantage, Efficient Scale, Intangible Assets and Switching Costs

- Outperforming the S&P 500 since inception, over the past 5 years and especially during the challenging period of 2022

- A chance for investors to diversify away from “factor strategies” towards something that is completely different

- Reasonable management fee of 0.46

- Opportunity to support a fund provider that is seeking to be different from others (VanEck)

MOAT Cons

- Lacklustre results for investors seeking attractive “styles and measures” and hard-lever “multi-factor” exposure in their portfolio

- A management fee that will make hardcore low-cost indexers likely balk on the strategy

MOAT Potential Portfolio Solutions

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Let’s consider a potential portfolio idea for investors that are keen on pursuing a high conviction “wide economic moat” investment strategy.

40% MOAT

20% MOTI

30% DBMF

10% TYA

For those wanting to go “all in” on a moat style strategy, they have the opportunity to do so by pairing MOAT ETF with its international sister fund MOTI ETF.

To round out this 4 fund portfolio we’ll add capital efficient TYA for treasury exposure and DBMF ETF to cover our managed futures mandate.

Since, we’re not able to roll-the-clock back very far with TYA ETF, we’ll replace it with AGG ETF for the back-test.

Our MOAT and Friends Portfolio has considerably outperformed a typical 60/40 portfolio so far in the 2020s.

It has managed to also be above water this year at 0.42% vs -13.57% for VBIAX.

MOAT investors ought to be pleased with the results.

What Others Have To Say About MOAT ETF

Now that we’ve covered a few different portfolio solutions let’s see what others have to say about the fund for those who prefer video format.

source: Corey On Investing on YouTube

source: Oz Finance Media on YouTube

source: Aktien2Know on YouTube

Nomadic Samuel Final Thoughts

MOAT ETF represents a totally different style of fund from what I typically review on Picture Perfect Portfolios.

I’m often keying in on factor focused funds.

However, this fund did not offer the measures and factors most quant investors are ravenous for.

Instead it keyed in on other intangibles that are often ignored.

And the performance of the fund versus the S&P 500 from a long-term and short-term perspective is quite impressive.

Thus, I’m keen to learn more about “wide moat investing” over the coming weeks and months.

But at this point in the ETF review, I’m more curious about what you have to say.

What do you think of MOAT ETF and “wide economic moat” investing in general?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

Thanks for the detailed review. Looking forward to reading more from your website!