With a long enough time horizon it’s hard to argue that an all-equity investment strategy won’t reign supreme over other asset classes.

If we’re comparing market cap weighted equity strategies versus value and momentum factor tilted approaches, the historical evidence is clear.

Factor strategies are vastly superior.

Hence, I’m thrilled to welcome Scott Wimmer to our “How I Invest” series to unpack how he invests with a high conviction all equity factor tilted strategy.

Let’s turn things over to Scott!

All Equity Factor Strategy (Value and Momentum): How I Invest with Scott Wimmer, CFA, CFP®

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Buy Companies You Would Buy Products From

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Investing Influences

- My father

- Warren Buffett

- Charlie Munger

- Larry Swedroe

- Ed Thorp

- Jack Bogle

Yes, I’ve certainly evolved since the early days of getting into investing and studying the history of markets.

My first investment was in a small cap value mutual fund back when I was in grade school.

I used money I had saved up from cutting grass.

The fund was picked by my father who worked as a portfolio manager for a regional bank and he was the first to explain to me what stocks were and how people made money from them.

“Buy companies you would buy products from..”

Was very similar to a Peter Lynch mentality of buy what you know.

It wasn’t until I got to college that I really began diving into investing and learning about how markets worked.

I had heard of Buffett but I didn’t really know how he made his money.

What attracted me to him was that he was just one man in Omaha, NE and didn’t live in NYC or live the life of a typical Wall Street money manager.

From my senior year of college (2009) and the first few years after, I tried to get my hands on every investing book or article I could that was discussing Buffett, Ben Graham or the idea of valuing companies.

I actually made it through Security Analysis by Graham and Dodd but it was a long haul reading that behemoth.

It wasn’t long after that I came across one of Larry Swedroe’s books and how he explained things just made too much sense to me.

From there I started looking into the world of academic finance and grasping how they approached investing compared to the common investor reading news on CNBC or The Wall Street Journal.

I’ve evolved over the years. I went from a full-on stock picker to thinking markets were perfectly efficient and couldn’t be beaten and now I’ve come back a bit to the idea that while markets are highly efficient, there are certainly anomalies and returns to be had by investors who can apply a systematic approach consistently.

And survive costs and taxes of course… The funniest thing is that I had amazing success in picking stocks for my first 3 years but fortunately, I realized how lucky I was getting!

Investing Resources: Books + Blogs + Podcasts

Investing Books

- “Your Complete Guide to Factor-Based Investing” Swedroe & Berkin

- “The Incredible Shrinking Alpha” – Swedroe & Berkin

- “The Quest for Alpha” – Swedroe

- “Efficiently Inefficient – Lasse Pederson

- “Adaptive Markets” – Andrew Lo

- “Finance for Normal People” – Meir Statman

Investing Blogs

- Alpha Architect Blog

- The MAN Group

- AQR website – research library

- Quantipedia

- Rationale Reminder

Investing Podcasts

- Excess Returns

- Rationale Reminder

EQ Is So Much More Important Than IQ When It Comes To Investing

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I used to work in trading and PM at a national private bank and I would see portfolios and trades from both employees and clients.

There was one client who would call in everyday just for market updates, never to sell any of his stocks.

His 4 stock portfolio had a 10-year track record that was crushing many of our securities analysts and top leaders portfolios.

I thought, in what other profession can a complete amateur run circles around professionals???

I also saw a client’s spouse day trade right after the Facebook IPO.

She placed shorts on the stock and accumulated 99.8% unrealized losses on the portfolio.

Another client was a successful day trader for years until a pharmaceutical company he was leveraged in didn’t get FDA approval.

He had to go take out a mortgage on his mother’s home in FL to cover the margin call and was wiped out in minutes.

I saw a major TV personality news anchor on a prime-time political talk show call me the day after Trump won in 2016 and tell me that Trump winning the election was the best thing for ISIS and that we would be at war within months, so we needed to go all cash that Wednesday after

the election.

I told him we couldn’t change his allocation that quickly and could only go one notch down on the investment policy statement in a quarter. (this actually wasn’t true…)

He was very reluctant but followed my idea and a month later it saved him a million or so.

He never called me again.

All of these made me realize that even people with incredible knowledge in a field or industry still have no ability to predict with consistent accuracy what the markets will do and the most important word there is consistent!

EQ is so much more important than IQ when it comes to investing.

So many people can’t differentiate between getting lucky in an investment and being rewarded for skill in an investment.

When you see people with big gains in a stock, it is luck……or insider trading.

There Is No Perfect Investing Strategy: Save First And Spend Later

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

Well fortunately I’m not too old yet but I’m getting into that mid-life crisis stage.

I feel as though I’ve always had a consistent approach and ignore 99% of what’s out there.

I would tell my younger self that there is no perfect investment strategy and that everything you come across you should read with a bit of skepticism.

I wouldn’t change much in my investment strategy from what I was doing 10 years ago but I would tell my younger self that the biggest contributor to wealth creating is not your portfolio’s growth rate but your savings rate.

Figure out a way to live below your means, save first and spend later, what you don’t save today is simply taking away from your future self.

Its not hard to live a great life with amenities in America.

All Equity Factor Tilted Portfolio: Value + Momentum

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

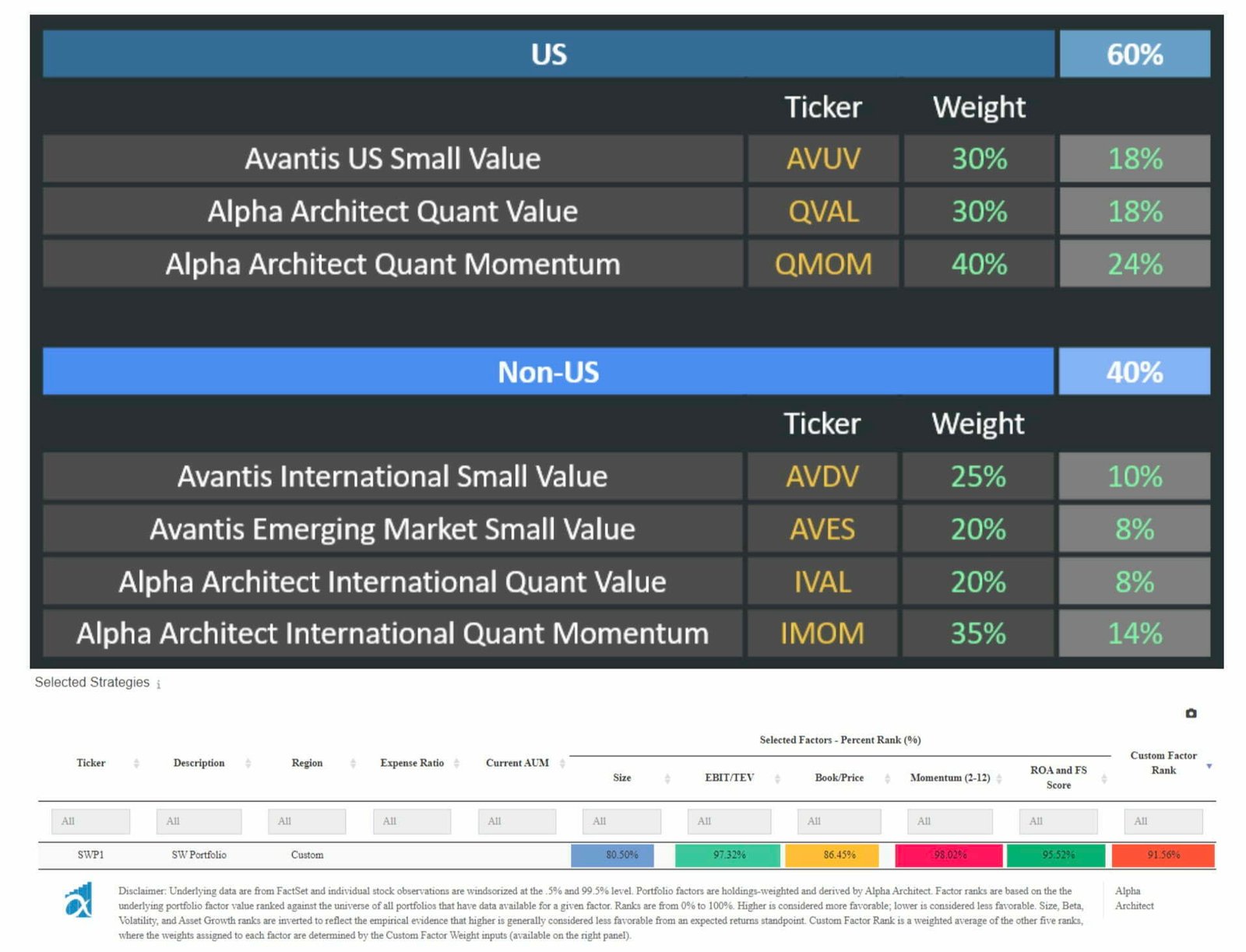

I’m basically 60/40 between US and international.

I own no bonds or alt strategies.

All my equity portfolio is in high tilt factor ETFs from managers I know and understand; Avantis & Alpha Architect.

I am a big believer in adding momentum to a value driven portfolio.

Momentum is capture-able net of costs and especially so net of tax given that we can do it in an ETF like QMOM / MTUM etc…

I try to equally weight all 3 main factors (Value, momentum, profit/quality) and every ETF I use to do this tends to tilt into mid-cap and small caps so if the size premium is robust and real, I’ve got some tilt into that as well.

It’s kind of a core + satellite approach except my core is still strongly tilted into value and profit.

I hold no individual stocks and if I were to ever make a play on an individual stock, I would probably use leverage via options to do it.

No margin or leverage to own any of my ETFs.

Avantis + Alpha Architect ETF Portfolio

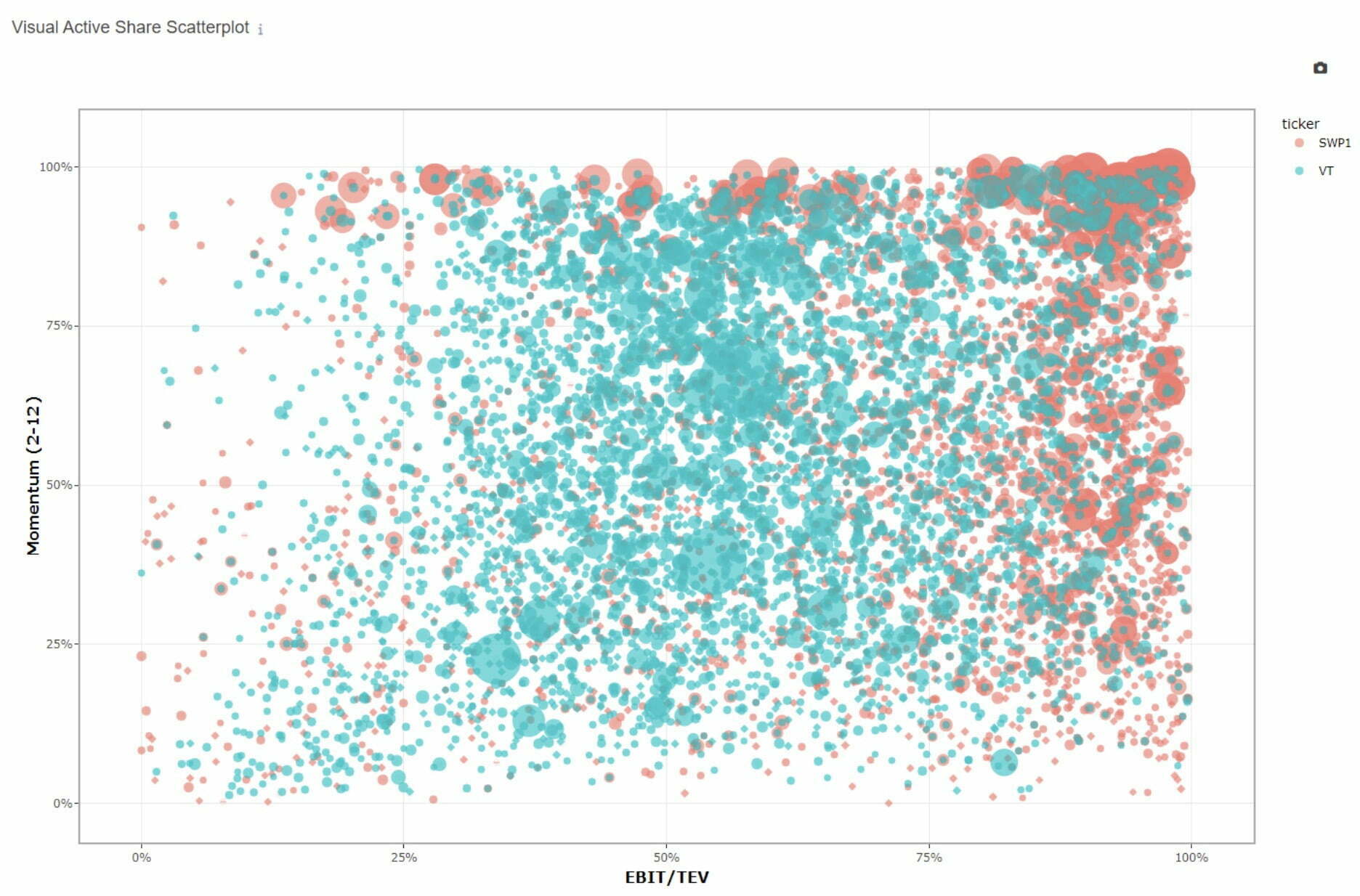

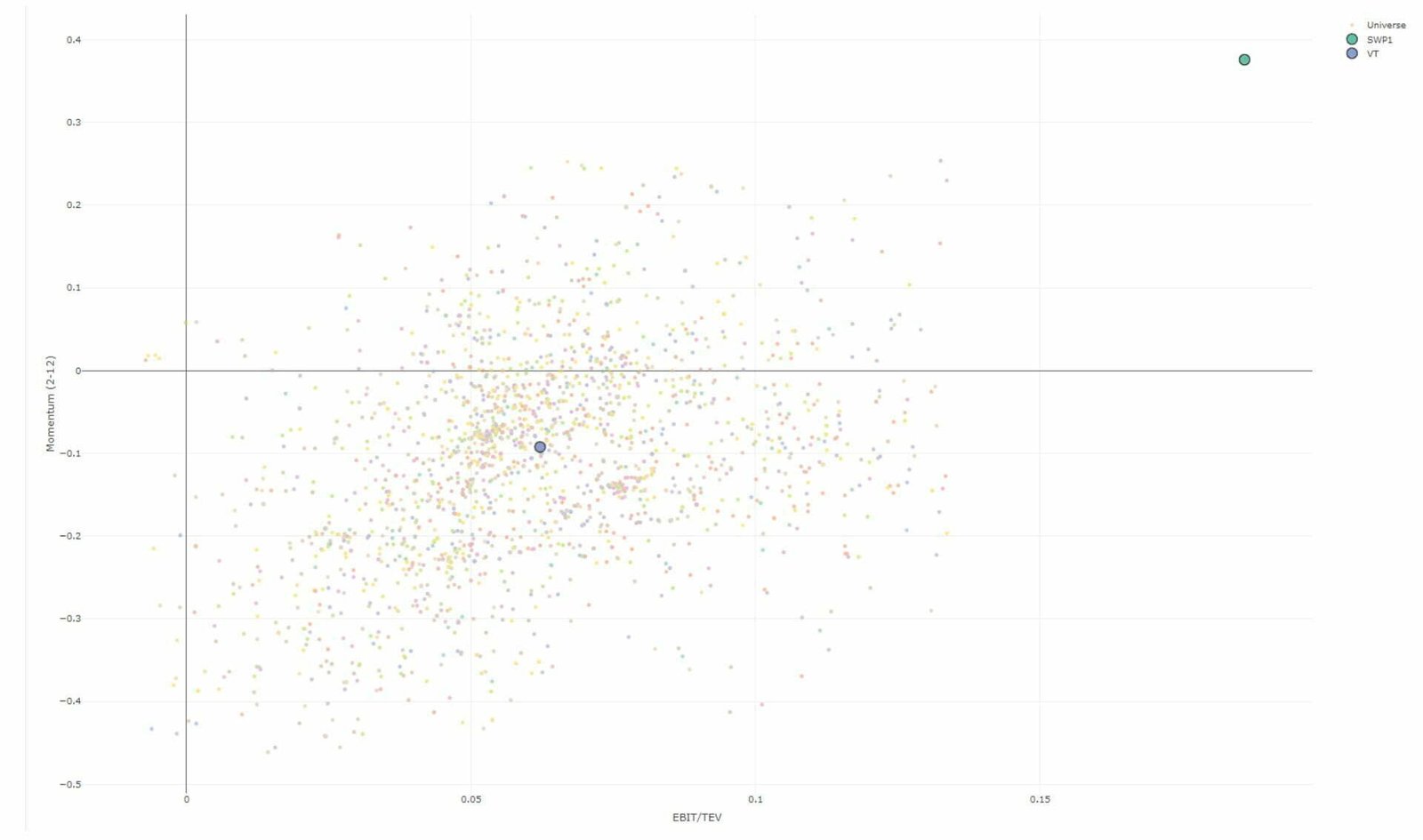

Visual Active Share Scatterplot: Momentum + EBIT/TEV

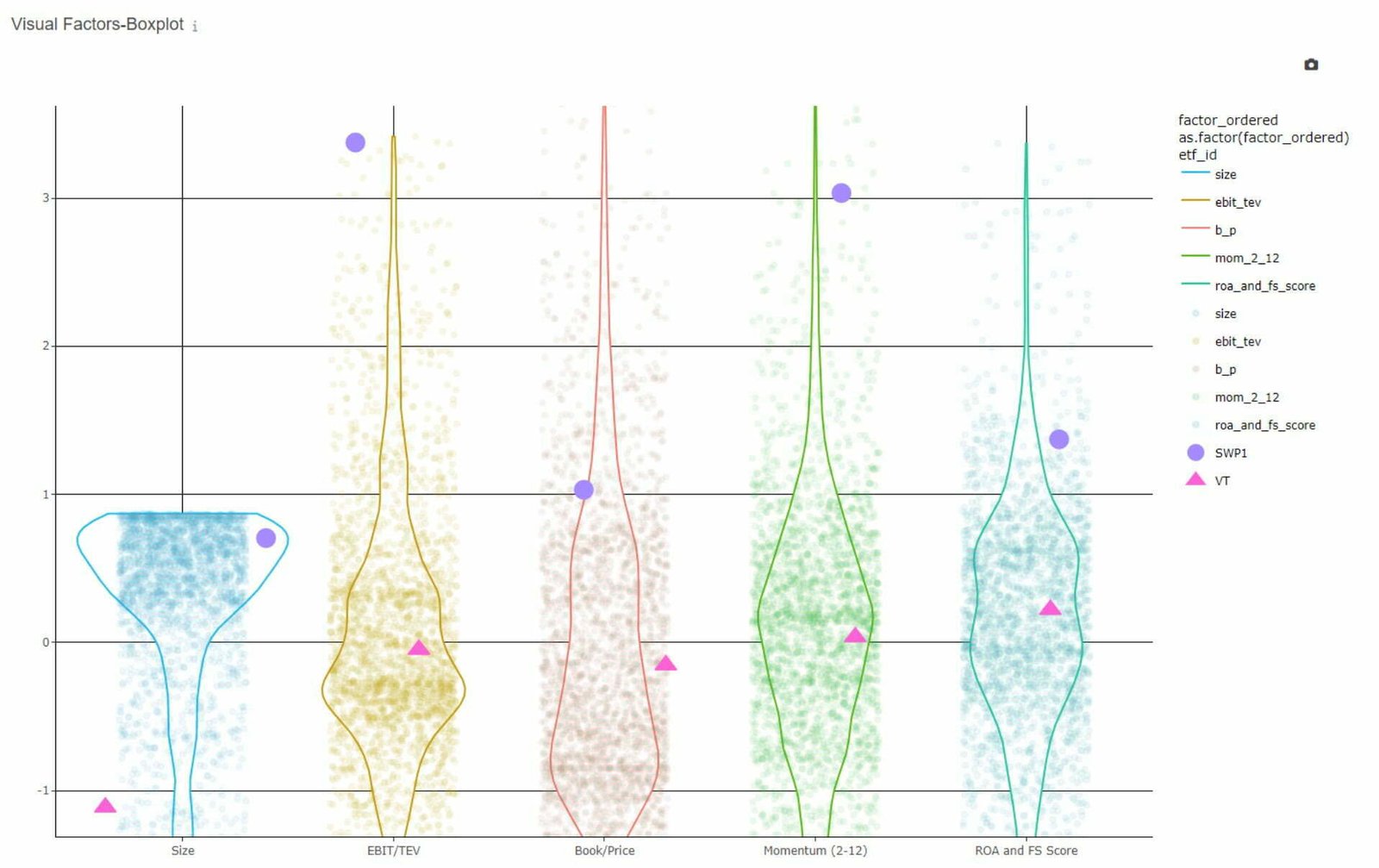

Visual Factors Boxplot: Size + EBIT/TEV + B/P + Momentum + ROA

Momentum (2-12) + EBIT/TEV

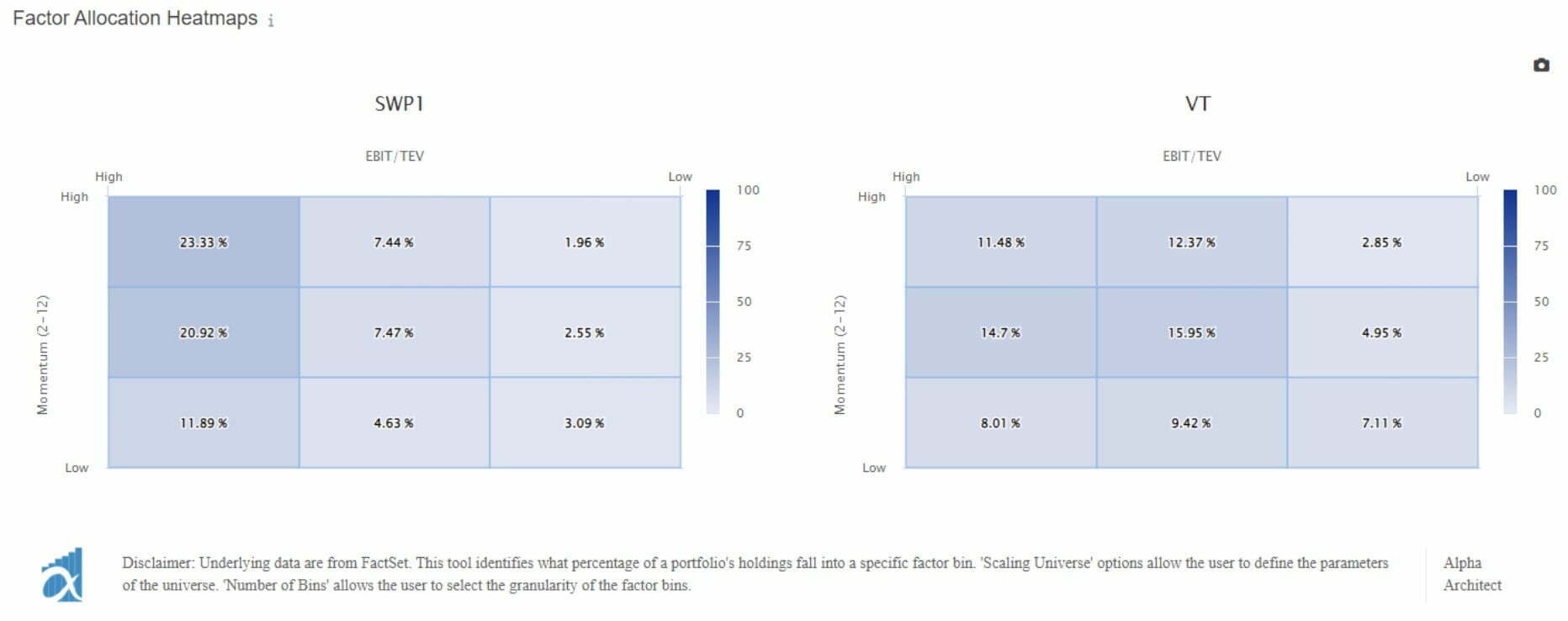

Momentum Factor Allocation

I like using the Portfolio Architect tool from Alpha Architect.

It lets me really see how aggressive I’m tilting into these factors and deviating from the common market benchmarks.

If I had to sum up what I own in my portfolio:

“I like to own companies that are cheap relative to their peers…..make a lot of money via operating profit and earnings…..and are trending in the right direction price wise.”

Since I tilt heavy into value and momentum, I expect to have some significant tracking error at times, but momentum tends to help value when expensive assets are getting more expensive and momentum doubles down on value when those spreads tighten.

I feel that factor premiums can exist because of both behavioral issues and systematic risks.

I’d say value may be more systematic risk while momentum is behavioral but who knows for sure.

Regardless, I would expect a heavy value tilt to struggle in economic shocks and downturns and for my portfolio to really excel when the market is on fire.

source: Raise Your Average on YouTube

Patience Is Necessary With Factor Investing Strategies

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

You absolutely must commit to the strategies.

If you don’t read the evidence and the research behind the academic factors, then I doubt many people can hold onto them all long-term.

Most investors will chase back and forth between value and growth or even other factors without realizing it.

Patience is probably the biggest trait that would allow you to stick with it.

Value just went through a 10-year underperformance against growth so you really had to stick with it to get the benefit.

Just look at how much AUM is flowing into value funds this year.

Investors and advisors are once again chasing after value and they’re late to the party; how late?

I have no idea but I hope there is still a lot of partying ahead for us value folks!

AVGE ETF To Water Down | Alpha Architect ETFs To Ramp Up

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

AVGE lol.

That is an easy answer.

I haven’t really found many other factor strategies that are more high tilt than what Alpha Architect is doing.

One could always apply a bit of leverage I guess and borrow money to purchase the funds.

I have always wondered about buying a strategy like AQR Style Premia (QSPIX) on leverage.

The fund has short positions to strip out market beta and it would be interesting to own the fund with modest leverage.

Perhaps a bit of risk parity in levering it up to the same vol as a market index but then again margin rates would eat my lunch.

I’ll let Cliff and company apply the leverage for me.

I Could Care Less What People Around Me Are Doing With Their Portfolios

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

I’m remarkably patient and I absolutely could care less what people around me are doing with their portfolios.

A lot of investors get caught up trying to keep up with the Jones’.

They hear about their neighbor or co-worker who hit it big in Tesla or crypto and then they go home and invest cash that should be in savings and lever it up and boom, its gone and they panic and purchase a dip hoping it goes back up.

Probably a reason for the momentum premium lol.

Greatest weakness would be to dismiss other strategies too easily.

Anyone can find evidence to support their strategies given the right time period or metrics.

You can even cherry pick academic articles to support your claims.

I am pretty good at asking myself why something should work.

Or why it wont work going forward.

Value has entered my mind given some of the well-known academic metrics may not be the best given how accounting rules have changed and economies have evolved over time.

I also think it’s important to diversify your sources of information.

“I never allow myself to hold an opinion on anything that I don’t know the other side’s argument better than they do” ― Charlie Munger

If you call yourself a value investor, you better be able to explain why people believe in growth investing.

I actually hate that term “growth”.

I’m not against growth, I’m against paying insane prices for a growth company.

I love me some growth stocks if they’re cheap!

Same with crypto recently.

I know very little about crypto and it all seems crazy to me, but I can’t write it off as dismissible.

It will take me a while to understand the other side to it but I’m ok taking my time even if I miss a boatload of returns.

I get rubbed the wrong way when investment professionals say their way of doing it is the only way.

I guess we all have to sell ourselves as doing the best we can. I think there’s 5-10 firms out there doing a great job for investors and they all cook up their funds a little different.

There are some well-respected quant shops that say momentum cannot be harvested in a long-only and net of tax portfolio.

Then there are other quant shops who literally show how this is wrong.

The funny thing is that both firms have employees who have degrees from the same schools and use the same data analysis.

Everyone has an angle they’re pitching, try to look at their competitors and see who has the better defence.

The Markets Can Be Both Efficient And Inefficient At The Same Time

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

That markets can be both efficient and inefficient at the same time.

To steal Lasse Pedersen’s title “Efficiently Inefficient”.

I feel that far too many investors put themselves into one camp or another.

Either black or white and most of the world is gray.

Markets can never truly be perfectly efficient but that doesn’t mean I can go pick stocks or time markets.

The investor who can sit in both camps is probably going to fair the best over the coming years.

There is a large chunk of the investment world that is waking up to Wall Street’s active management game and just buying indexes and that’s awesome.

I get annoyed when these indexers simply state that there is no alpha out there and the only way to go is to buy an index fund at a super low cost.

The idea that markets are perfectly efficient, and no alpha can be had is laughable.

Not all stocks have the same expected returns going forward so I don’t know why someone would want to own all stocks in the market according to their market cap.

Market cap alone is questionable to weight portfolios.

No investor is passive; even the decision to go passive is an active choice.

Private Investments + Interval Funds + Alternative Investment Strategies

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

Private investments.

There are some interval funds that are interesting from the outside, but I can’t figure out how they do it.

Cliffwater Enhanced Lending is one of them.

I guess I’m just nervous that things could freeze up and clients / investors may not be able to get all their capital out.

I trust firms like AQR and the MAN Group but it is hard to really see what they’re holding and how their portfolios are structured.

Sometimes these strategies sound too good to be true and then when they perform like they have in 2022, I wonder if they’re destined for another 10-year period like the one we just had.

AQR Multi Strategy fund is interesting to me at a 5.5-7% annual return with 6-8% volatility.

Sounds almost too good to be true.

I’d be completely fine allocating 30% of my parent’s retirement accounts into QDSIX and holding short-term cash in t-bills or DFSD and then using Avantis or DFA for the remainder.

I’m a big fan of true alternative strategies as being a 3rd bucket of returns.

I still hold all equities at this point in my investing life but once I hit 50 or so, I may begin to add alternative investment strategies like these to my portfolio.

I’m also eager to learn more about recent research on market inelasticities and research on sentiment driven investment returns.

Ralph Koijen at UChicago has been doing a lot of work on this.

I was actually on an email chain with him and Jack Vogel from Alpha Architect.

That email chain alone made me realize how far behind I was in knowledge compared to PhDs discussing quant finance lol.

No Thanks To Expensive Stocks With An ESG Tilt

What would be the ultimate anti-Scott Wimmer portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

My anti-portfolio would probably be heavily weighted into really expensive stocks that make little if any money and have an ESG tilt or screen to them.

I love the environment and social issues but come on….this was just a Wall Street marketing tactic to grab AUM at a higher fee.

The craziness of the 2018-2020 timeframe will be burnt in my memory forever.

I’m still amazed at how there are major companies listed on exchanges that are spending billions on marketing, advertising and management payroll and yet make little if any profit.

It’s as if shareholders like giving their capital to the companies so they can enrich their own employees at the shareholders expense.

Amazing really but I can’t time when these companies fail so I don’t know how to profit from it.

I’d buy puts but I know how expensive theta is.

95% of hedge funds and private equity investments also would really make me sick to hold.

Whenever I hear an investment professional state a return in IRR (internal Rate of Return) I have a hard time not laughing out loud.

Also love how private investments always have insane Sharpe ratios; must be nice to pick and choose when you value your holdings.

Steel Man It: I could see a defense of this style of investing if done correctly and applied with a systematic approach.

Kai Wu (ITAN) has created a unique ETF that targets intangible value or “innovation at a fair price” and that really does interest me.

I’m not against innovation, that is the driver for capitalism and markets themselves.

I am just against paying an insane price to own it.

One could always say that it is fairly priced or even cheap given the capabilities of these new companies.

It is true, modern tech firms can achieve insane rapid growth with little capital invested and need for future expenditures.

I mentioned some of the interval funds above.

There are great firms like AQR and MAN Group that are truly offering 0 beta and non-correlated asset and return exposures at a fair price.

There are also private equity firms that can generate value but sadly, they wont take my money.

Connect With Scott Wimmer

Twitter: @wimms5987

Linkedin: https://www.linkedin.com/in/scott-wimmer-58a762200

Website: www.meredithwealth.com

Nomadic Samuel Final Thoughts

I want to personally thank Scott for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.