Emerging Markets have been shunned by many investors from a performance, strategic and political standpoint in recent decades; however, what if there was an alternative to investing in countries such as China and Russia that instead valued personal and economic freedom metrics?

Enter Freedom 100 Emerging Markets ETF (Ticker: FRDM).

This Emerging Markets fund, created by Perth Tolle, has recently celebrated its third birthday as an ETF and has also attracted impressive AUM flows of late.

Given that investors are now increasingly seeking non-financial factors such as Environmental, Social and Governance within their portfolios, an Emerging Markets ETF that keys in on personal and economic freedom, is very much a welcome addition to the marketplace.

But how does a fund that shuns certain countries fit into a portfolio from purely a financial/returns perspective?

Our review of the Freedom 100 Emerging Markets ETF will examine things from both sides of the coin (social vs strategic) to determine whether it has a potential place in your portfolio.

Freedom 100 Emerging Markets ETF Review

Hey guys! Here is the part where I mention I’m merely a travel vlogger! This ETF review is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

FRDM ETF Review

Travel And Living in Emerging Markets

One advantage I have, from entirely a subjective point of view, is that I have lived and/or travelled to every single one of the top 10 country holdings of the FRDM ETF.

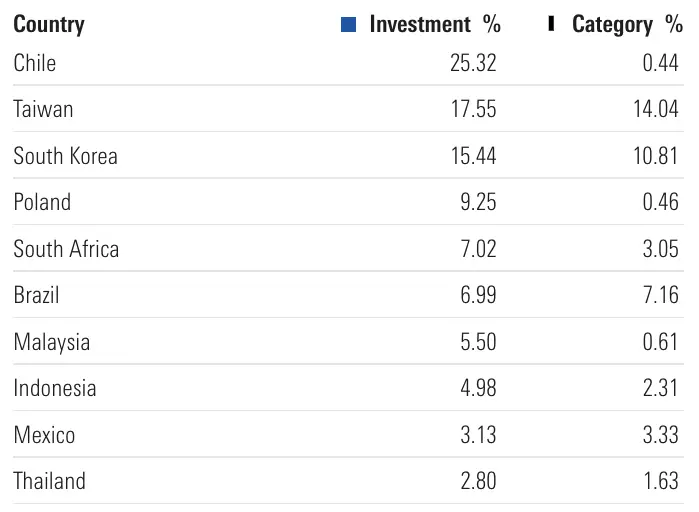

As of May 2022 here are the top 10 country holdings:

Top 10 Country Holdings FRDM Index

1) Chile at 20.87%

2) Taiwan at 17.99%

3) South Korea at 15.92%

4) Poland at 10.99%

5) South Africa at 7.98%

6) Brazil at 7.34%

7) Malaysia at 5.54%

8) Indonesia at 4.79%

9) Mexico at 3.08%

10) Thailand at 2.63%

I’ve been to Chile twice. You won’t find a more majestic place to hike than Torres del Paine National Park.

Taiwan is where I’ve tasted the most fascinating street food, at night markets, including but not limited to stinky tofu.

I spent several years teaching English in South Korea and it’s also where I met my wife Audrey.

Poland is where you can easily gain 10 pounds in less than a month devouring pierogi while visiting underrated cities such as Wroclaw.

South Africa is one country I’m most interested in revisiting again in the near future. World-class safari. Underrated wine regions. Coastal areas that rival Ireland.

Brazil is a destination where we have relatives located in Rio. And pão de queijo to keep my waistline ever expanding.

Malaysia might be the most underrated country to visit in SE Asia from a sightseeing and cuisine standpoint. I’m craving Laksa just thinking about it.

Most visitors gravitate towards Bali but I feel exploring other islands in Indonesia really rewards curious travellers.

We’ve only experienced “resort-land” once in Mexico, so we’re itching to see more of the country.

Thailand is the land of smiles for good reason. Chiang Mai was our favourite digital nomad base of all-time.

Thanks for the personal touch and all but what does any of this have to do with investing?

Well, a lot.

I believe strongly in the economic future of all the countries listed here.

Furthermore, this list looks very different than a typical market-cap weighted Emerging Market fund.

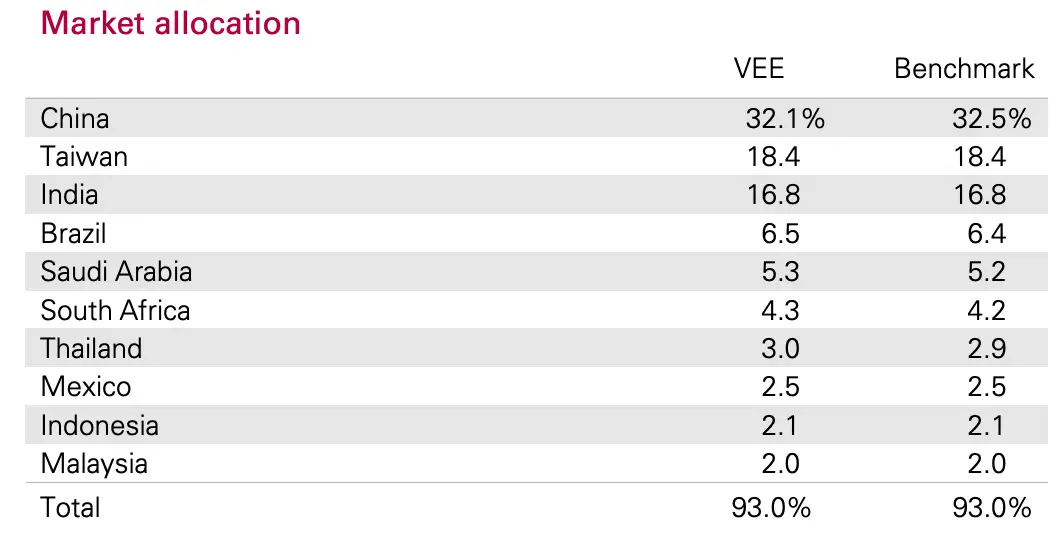

Top 10 Country Holdings FTSE Index

1) China at 32.1%

2) Taiwan at 18.4%

3) India at 16.8%

4) Brazil at 6.5%

5) Saudi Arabia at 5.3%

6) South Africa at 4.3%

7) Thailand at 3.0%

8) Mexico at 2.5%

9) Indonesia at 2.1%

10) Malaysia at 2.0%

With China, India and Saudi Arabia accounting for 54.2% of a typical Emerging Markets index fund, one of the clear immediate benefits FRDM ETF offers is a diversified set of countries excluding these ones.

This is an advantage for investors seeking exposure to Emerging markets outside of especially China, India and Russia.

Freedom 100 Emerging Markets ETF Fund Overview, Holdings and Info

The investment case for “Freedom 100 Emerging Markets ETF” has been laid out succinctly by the folks over at Freedom ETFs: (source: fund landing page)

- “Provides an alternative option with freer country exposures for investors who believe in the long-term benefits of freedom and want to express those preferences in their EM allocations.

- Allocates higher weights to freer markets with potential for more sustainable growth, more innovation and adaptability to market trends, and more efficient use of capital and labor.

- Rewards markets that promote and protect personal and economic freedoms, while excluding markets with the worst human rights records which may have over-concentrations in other commonly used EM strategies.”

Freedom 100 Emerging Markets ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund uses a “passive management” (or indexing) approach to seek to track the total return performance, before fees and expenses, of the Index. The Life + Liberty Freedom 100 Emerging Markets Index is a freedom-weighted emerging markets equity index.

Life + Liberty Freedom 100 Emerging Markets Index

The Index is designed to track the performance of a portfolio of approximately 100 equity securities listed in emerging market countries. Thereafter, country inclusion and weights are determined based on quantified data covering 79 personal and economic freedom factors.

Factors are categorized into three main types of freedoms: the rights to life (such as absence of terrorism, human trafficking, torture, and political detentions), liberty (such as rule of law, due process, freedom of the press, freedom of religion, freedom of assembly), and property (such as marginal tax rates, access to international trade, business regulations, established monetary and fiscal institutions, and size of government).

A quantitative model is used to weigh the countries based on human and economic freedom metrics as described below.

Securities within countries are then selected based upon market capitalization (“market cap”) and liquidity metrics (90-day average daily volume of shares traded on a public exchange or “Market Liquidity”) and are subsequently market cap-weighted.

The Index excludes state owned enterprises (“SOE”) from the security selection process.

The Index was developed in 2017 by Life + Liberty Investments, LLC, the Fund’s index provider (the “Index Provider”).

The Index Universe

Construction of the Index begins with the universe of common and preferred stocks (or their depositary receipts) of emerging markets countries, (collectively, the “Eligible Emerging Markets”).

Market Capitalization Screens

The Index Provider determines the emerging markets eligible to be included in the Index at the time of each annual reconstitution of the Index based primarily on the market capitalization of each emerging market relative to the aggregate world market capitalization.

Eligible Emerging Markets with a market capitalization of at least 0.15% of current global market capitalization plus an average market capitalization of at least 0.15% for the prior three years are included in the Index.

After inclusion, an Eligible Emerging Market is retained in the Index so long as its Freedom Score (defined below) does not fall below a disqualifying level.

Country Selection and Weighting

The Index methodology continues its rules-based process by further screening each Eligible Emerging Market by its composite freedom score (“Freedom Score”).

This score determines each Eligible Emerging Market’s inclusion and weight in the index.

The Freedom Score is derived using a combination of 79 quantified personal and economic freedom factors compiled by [ ], a leading independent global think-tank.

The Freedom Score is translated by the Index Provider into a relative weight for each Eligible Emerging Market which can be positive or negative. Eligible Emerging Market countries with positive weights are included in the Index.

Based on the Index rules, the higher a given Eligible Emerging Market’s Freedom Score, the higher its relative weighting in the Index.

The lower a given Eligible Emerging Market’s Freedom Score, the lower its relative weight in the Index. As of February 14, 2019, ten Eligible Emerging Markets were included in the Index (each, an “Index Market”). At the conclusion of this step, the country weights are established.

Component Selection and Weighting:

The index securities’ universe includes all companies, other than SOEs, that are domiciled in each of the selected emerging market countries. The third-party index calculation agent (Solactive AG or “the “Calculation Agent”) determines the country of domicile for each security included in the index securities universe.

The top ten securities within each Eligible Emerging Market are identified, based on market capitalization and Market Liquidity.

All securities must meet a minimum trading volume on a public exchange and market capitalization requirement, otherwise they will be excluded.

Either local shares or depositary receipts can be used in the Index depending on which is more liquid and whether the country of domicile has restrictive foreign ownership requirements.

The Index Components are then individually weighted within each country based on their market capitalization. SOEs are defined by the Index Provider as companies with 20% or more government ownership and are excluded from the Index.

The Index may include small-, mid-, and large-capitalization companies; however, the rules of the Index will naturally favor large-capitalization companies with Market Liquidity.

At the conclusion of this step, the individual security weights within each country will be established.

Portfolio Construction:

The Index is assessed annually in January of each year at which time the Index is reconstituted and rebalanced by the Index Provider.

Component changes are made after the market close on the third Friday of January and become effective at the market open on the next trading day.

The Fund’s Investment Strategy:

Under normal circumstances, at least 80% of the Fund’s total assets (exclusive of collateral held from securities lending) will be invested in the component securities of the Index or in depositary receipts representing such component securities.

The Adviser expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better.

The Fund will generally use a “replication” strategy to seek to achieve its investment objective, meaning the Fund will invest in all of the component securities of the Index in the same approximate proportions as in the Index, but may, when the Adviser believes it is in the best interests of the Fund, use a “representative sampling” strategy, meaning the Fund may invest in a sample of the securities in the Index whose risk, return and other characteristics closely resemble the risk, return and other characteristics of the Index as a whole.

The Fund may also invest up to 20% of its assets in cash and cash equivalents, other investment companies, as well as securities and other instruments not included in the Index but which the Adviser believes will help the Fund track the Index.

For example, the Fund may invest in securities that are not components of the Index to reflect various corporate actions and other changes to the Index (such as reconstitutions, additions and deletions).

The Fund will be considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund.”

Life + Liberty Freedom 100 Emerging Market Index

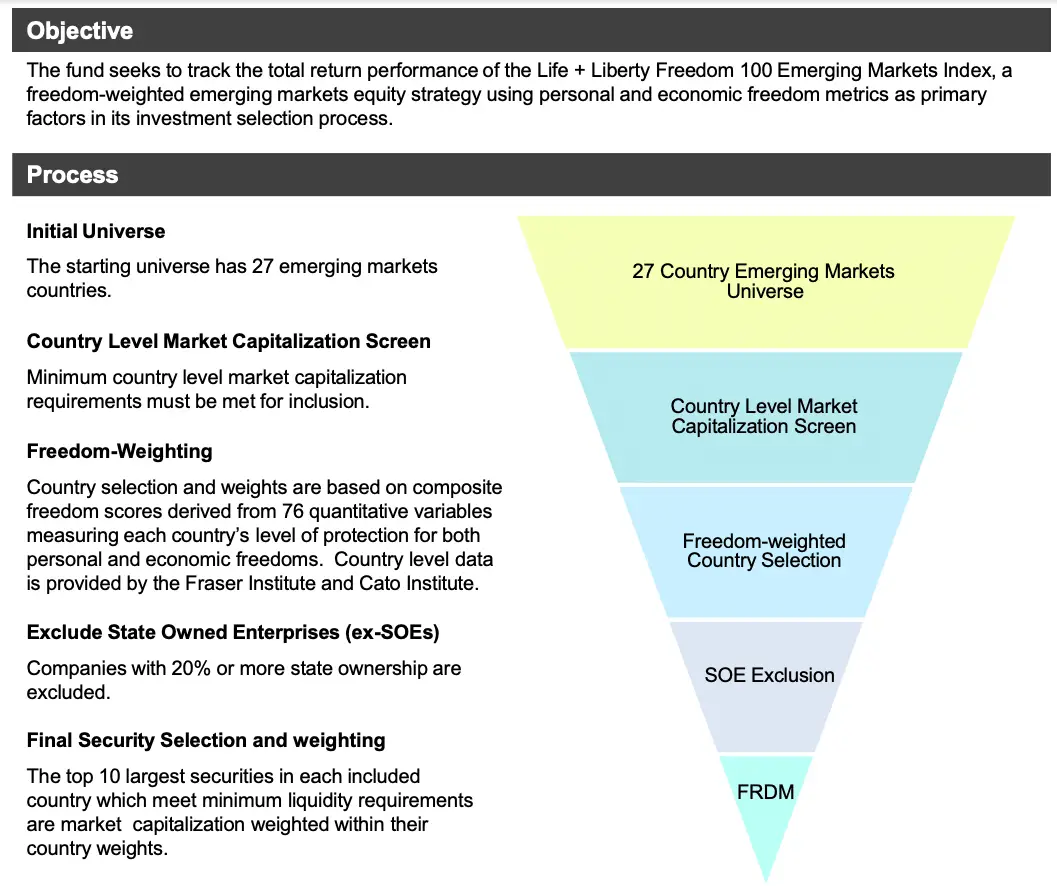

The clear objective and transparency process of FRDM is definitely one of its strengths as a fund.

As an index it weights based on freedom and economic metrics.

It scans from a 27 country market universe and ensures a minimum level market capitalization requirement is met.

It then utilizes a freedom weighting index derived from 76 quantitate variables measuring personal and economic freedoms for each given country while excluding companies with more than 20% state ownership.

The top 10 securities from each included country are then market capitalization weighted.

Top 10 Security Holdings

1) Samsung Electronics at 7.08%

2) Taiwan Semiconductor Mfg Company Ltd at 6.65%

3) Sociedad Química y Minera de Chile S.A. at 6.23%

4) Vale S.A. at 3.62%

5) Sudamericana Vapor at 3.12%

6) Falabella Sa at 3.08%

7) Bk Central Asia at 2.90%

8) Bank Pekao Sa at 2.73%

9) Mediatek Inc at 2.55%

10) Hon Hai Precision at 2.47%

When I add up the 10 positions of this fund I notice it takes up 40.43% out of 112 positions.

In other words, the other 102 securities account for the remaining 59.57% of FRDM ETF.

The fate of its performance is very much tied to its concentrated top 10 holdings – especially its top 3 positions.

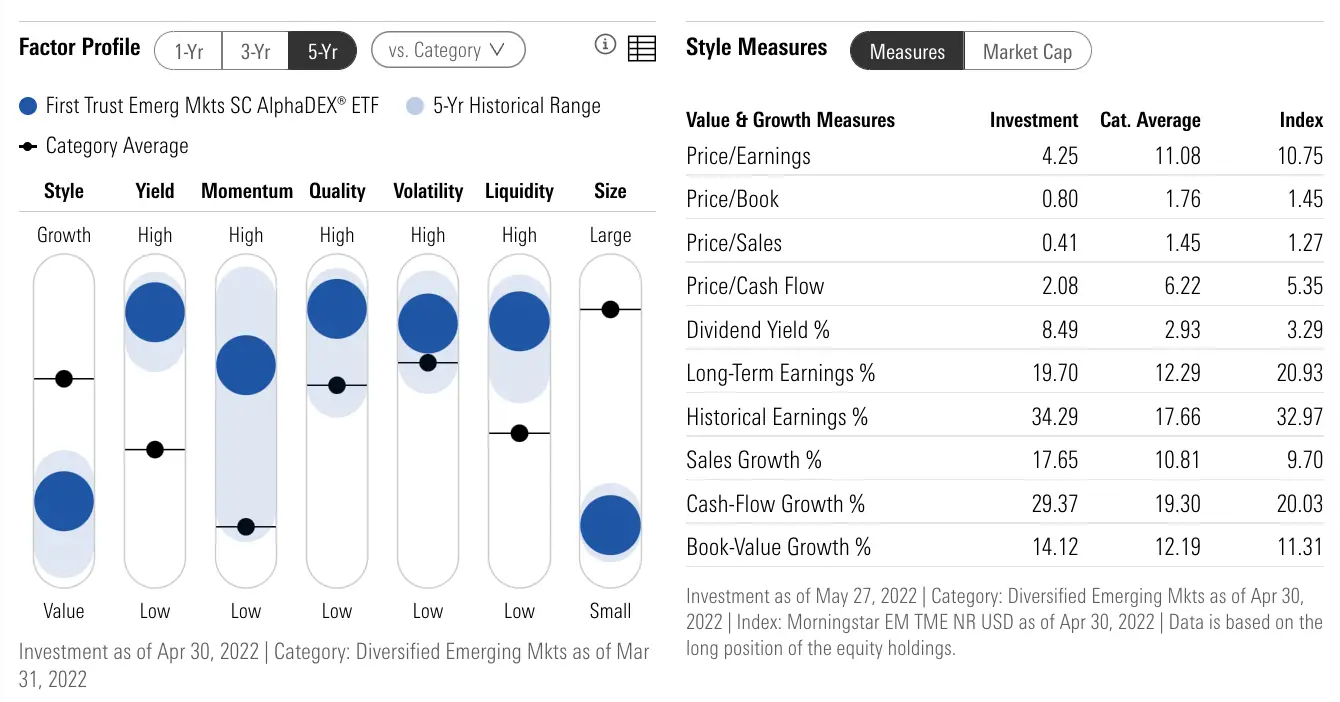

FRDM Factor Exposure

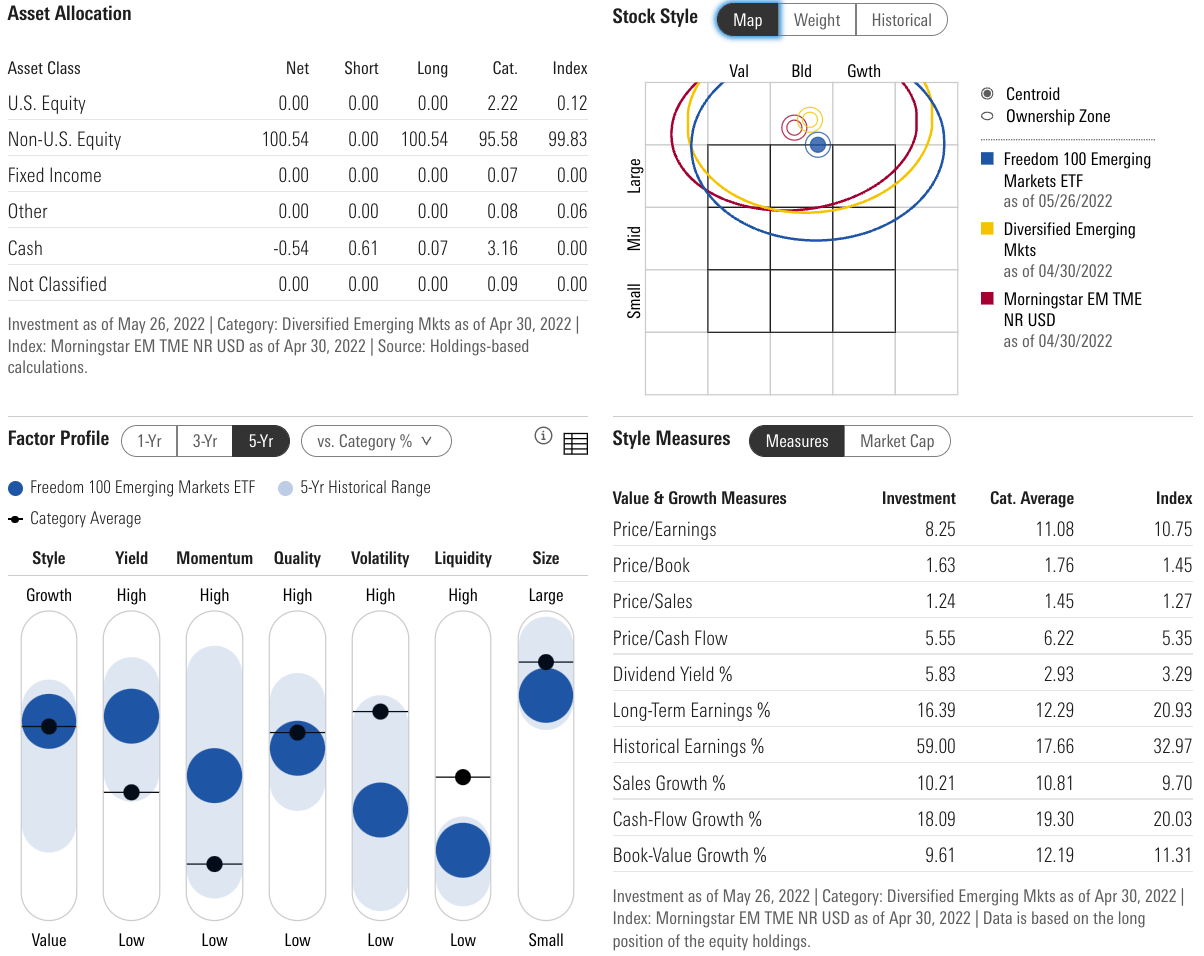

Given this is an equity only review let’s check out the stock style, factor profile and style measures of this fund as screened by Morningstar under the hood.

Freedom 100 Emerging Markets ETF is very much a mega/large cap centric fund with a bullseye landing in the blend column with a slight growth tilt.

In terms of Style measures the fund offers a highly attractive P/E of 8.25 versus its category average of 11.08

Its dividend yield of 5.83% and Historical Earnings of 59% also really jump out versus its category benchmark.

In terms of FRDM ETF’s factor profile it has decent exposure to both yield and low volatility which are attractive defensive equity factors.

For those seeking multi-factor exposure to “historic return drivers” of size, momentum, quality and value FRDM ETF falls short in that regard.

If FRDM offered a further screening process for factors, in addition to market-cap weighting, it would instantly become more attractive to me as a factor thirsty investor.

However, for those comfortable with more vanilla market-cap weighting factor profiles this may not be as much of an issue.

I do love that FRDM offers large-cap established companies with defensive low volatility and yield characteristics given that Emerging Markets (and especially more concentrated funds) tend to be more volatile than developed markets equities.

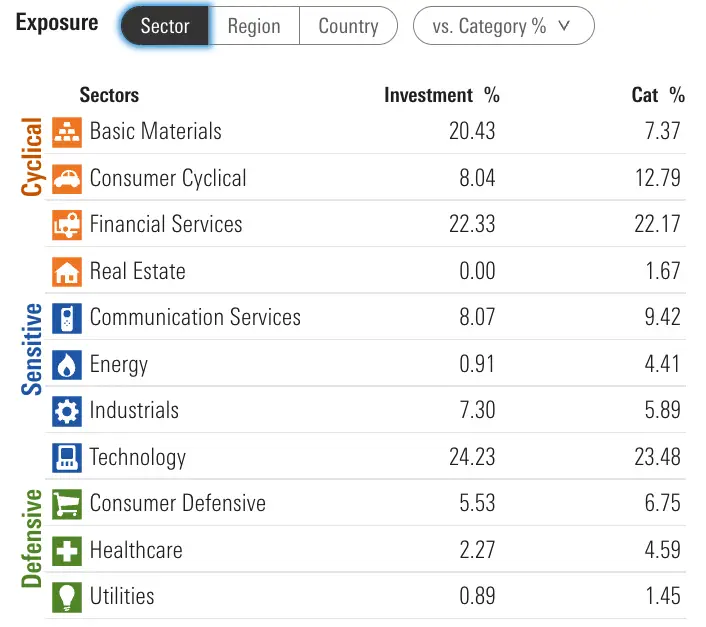

FRDM Sector and Country Exposure

Let’s check out sector exposure and country exposure for Freedom 100 Emerging Markets ETF.

In terms of sector exposure FRDM spreads out nicely and is quite compositionally similar to its EM benchmark standard.

One noticeable exception is in terms of Basic Materials which is approximately 20.43% of the fund versus its benchmark of 7.37% with less consumer cyclical, consumer defensive and real estate exposure.

I’ve covered the funds country exposure earlier in the article but I’d like to briefly touch upon its outsized exposure to Chile (25% vs 0.44%) and Poland (9.25% vs 0.46%) in particular while also highlighting that countries such as Mexico, Brazil and Taiwan are nearly identical in weightings to classic EM configurations.

You’re definitely getting something different with this Emerging market fund, in terms of its country weightings, whether you view that as a pro or con.

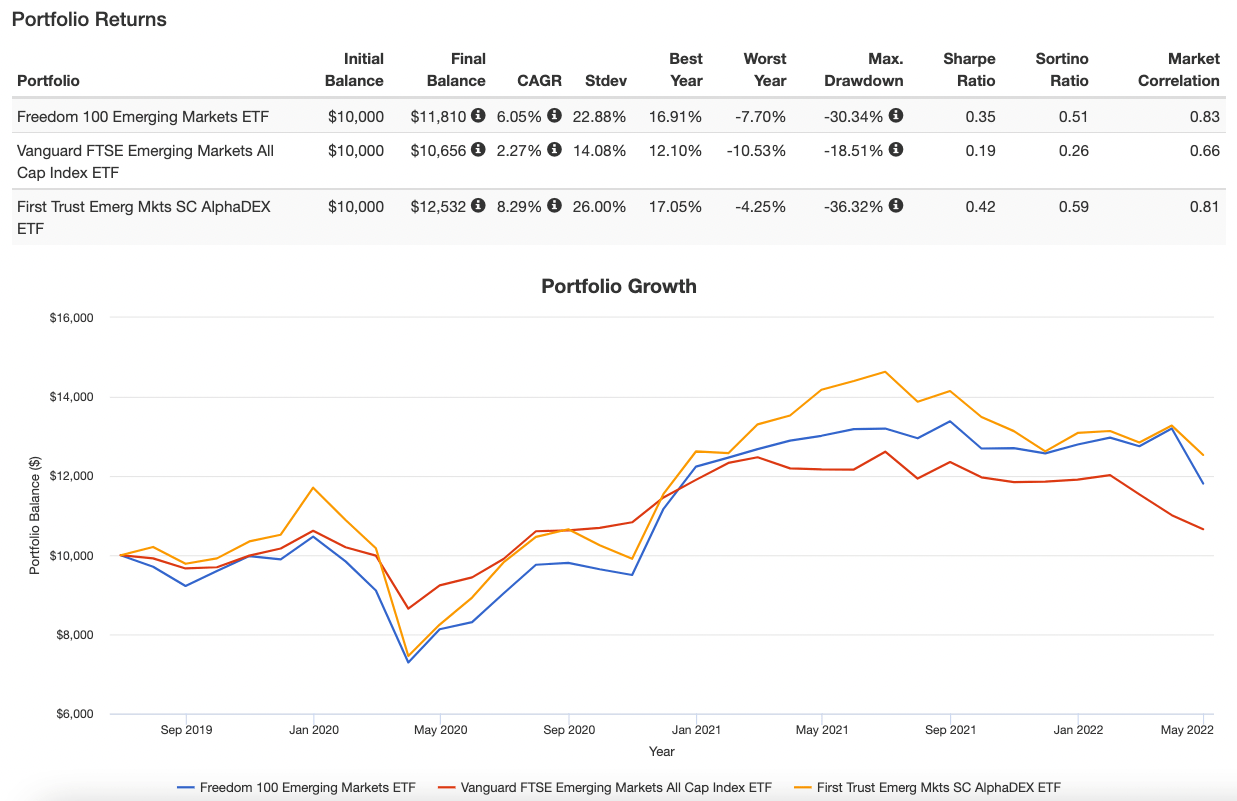

FRDM ETF Performance

Since I’ve mentioned both Emerging Markets market-cap weighted FTSE index and concentrated factor-focused FEMS, I thought I’d compare FRDM with them directly.

Keep in mind FRDM is only 3 years old so this backtest is limited in terms of a long-term direct comparison.

What immediately jumps out as a feather in Freedom 100 Emerging Markets ETF’s cap is that it has clearly outperformed its benchmark since inception.

With a 6.05% CAGR it is confidently ahead of Vanguard FTSE Emerging Markets All Cap Index which returned 2.27% CAGR.

However, against multi-factor stalwart FEMS it hasn’t performed as well against its 8.29% CAGR.

Keep in mind for both of the concentrated funds (FRDM and FEMS) have considerably more frightening drawdowns of more than -30% versus all country EM FTSE which was -18%.

Concentrated funds are more of a rollercoaster ride, both in terms of highs and lows, and savvy investors in these types of funds need to be mentally prepared for that.

FRDM ETF Pros and Cons

FRDM ETF Pros

- Tremendous branding stroke of genius with personal and economic freedom metrics as the backbone of the fund

- An opportunity to support and add diversification to your portfolio with Emerging markets exposure while not supporting current “freedom inhibiting” regimes such as China and Russia

- Outsized exposure to countries such as Chile and Poland which are typically afterthoughts in a market-cap weighted portfolio

- Factor exposure to low-volatility and yield which are defensive in nature and help manage volatility in a more concentrated fund such as FRDM

- Attracting investors to Emerging Markets that have been idealistically opposed to investing in certain countries for a variety of personal/political reasons

- A very reasonable and attractive 0.49% MER

- Opportunity to support boutique level ideas and creativity rather than merely hand over money freely to the Goliaths of the industry

FRDM ETF Cons

- Its top 10 positions take up over 40% of the fund meaning its fate is pretty much directly tied to these concentrated bets

- Outsized exposure to countries such as Chile and Poland which indirectly give “elsewhere home country” bias outside of “your home country” (assuming you’re a US investor)

Source: YouTube from Value After Hours Channel

FRDM ETF Core Holding Idea

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Could FRDM ETF be your total Emerging Markets portfolio solution in that part of your equity sleeve?

Possibly.

In order to justify the Freedom 100 Emerging Markets ETF as your sole EM fund in your portfolio, it requires a large degree of faith in your conviction of wanting to support countries with higher relative economic and personal freedoms.

Strategically speaking, with 40%+ of the fund being concentrated in only 10 positions, you’re likely in for a bumpy ride in emerging markets that are more volatile historically than developed countries.

For those with a strong conviction towards global investing and EM exposure a potential core holding for FRDM in a 60/40 portfolio might look like this:

60/40 Portfolio

30% US Equities

20% Int-Dev Equities (ex-USA)

10% FRDM (Emerging Market)

40% Aggregate Bond Index

FRDM ETF Partial Portfolio Idea

I think FRDM, as an Emerging Market ETF, really thrives as a partial portfolio solution for those investing in Emerging Markets as part of a globally diversified portfolio.

Given that FRDM ETF is providing market-cap weighted exposure I’ll suggest two other funds with quant strategies to help drive returns.

10% Emerging Markets Sleeve

3.33% FRDM

3.33% FEM

3.33% FEMS

The combination of these funds provides market-cap weighted strategies with a growth tilt in tandem with multi-factor tilted EM funds that provide exposure to size, value, momentum, quality and yield.

Nomadic Samuel Final Thoughts

Freedom 100 Emerging Markets ETF represents one of the most interesting funds in the marketplace today.

As a fund that has attracted over 217.58 million AUM there is definitely a desire from investors for personal and economic freedom ETFs.

That’s terrific.

Moreover, it’s amazing to see boutique level creativity thrive given that giants in the industry such as the Vanguards and iShares gobble up most of assets under management.

Thus, I have a lot of respect for Perth Tolle for coming up with such an important product in terms of its potential impact beyond just finance and investment strategy.

I’m a big believer in Emerging Markets from a personal point of view (travel and living in these countries) and I also confidently invest globally as part of a diversified investing strategy.

What do you think?

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.