Stock picking is an investment strategy that intrigues me unlike any other.

Those of you who have been following this blog closely will know that I’ve been slightly obsessed with long-short equity strategies of late.

Being able to identify attractive stocks to hold long is a form of active management that has the potential to crush popular equity indexes.

Or it can fall flat on its face.

That’s why I’m thrilled to welcome Tony of Systematic Microcap Investor to the “How I Invest” series where he will detail his systematic multi-factor approach to selecting an equal weighted concentrated portfolio of stocks.

There is a lot to discover about this particular stock picking strategy, so let’s just jump right into it!

How I Invest With A Multi-Factor Stock Picking Investment Strategy | Systematic Microcap Investor

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Tony Of Systematic Microcap Investor

I was born in 1992 and raised in a village in the middle of Saxony, Eastern Germany.

I come from a working class family and my parents always did their best to balance expenses on the house, saving and providing for my older brother and me.

I had a joyful simple youth in the countryside and tried out a lot of hobbies including skating, snowboarding, windsurfing, volleyball, football, playing the guitar, drawing, chess, poker, gaming… but none of them really stuck.

This might already say a lot about me.

I love to learn and try out new stuff but lose interest fast.

I am not very competitive and I am not very detail-oriented.

Nonetheless, I was a good student.

After high school, I worked for the German Red Cross for one year to earn some money and get a break to think about what to do next.

2011, I started my studies in Material Sciences and specialized in Refractory Ceramic Materials.

2016, I started a job as a research associate at my institute and worked with different steelmaking companies on refractory materials used in steel casting processes.

2022, I graduated but for now I continue work at my institute as a post-doc.

My investment journey started in high school (2008ish) and it was a steady learning experience since then.

However, it of course became an order of magnitude more serious since 2016, when I started my first job and got my first real salary.

2019, I decided to become a DIY quant equity investor.

Influenced By Quant Researchers And Investors

Who were your greatest influences as an investor when you first started to get passionate about the subject?

My journey started with a simple paper trading game in school.

Until then, I never heard or cared about the stock market.

But I was immediately hooked.

From there, I first stumbled upon the usual suspects of course: Warren Buffett, Charlie Munger, Peter Lynch, George Soros, amongst others.

From those, I admired Warren Buffett for his wisdom but I was more hooked by Peter Lynch at first.

Later I discovered Youtube Channels and Podcasts like “The Investors Podcasts” which opened the door to whole new world for me.

They made investing 100x more accessible for (non-US) retail investors like me.

There I learned also about James O’Shaughnessy, which most likely had the largest influence on my investing.

Since then there are many quant researchers and investors which I follow closely, mainly via their Podcasts, Blogs, Papers and Audiobooks.

Just to name a few: Rob Arnott, Cliff Asness, Wes Gray, Tobias Carlisle, Corey Hoffstein, Matthias Hanauer, and many more.

The Need To Automatize My Decision Making

How have your views evolved over the years to where you currently stand?

At first I was a pure contrarian deep value investor, or least I thought so.

I quickly learned that this path requires a unique mindset and personality and that I am not patient enough to pull that off.

I then became more of a discretionary Peter Lynch style investor.

I looked at names individually at the intersection of business model, growth, valuation and current trends.

I was more or less successful with this but I noticed that this discretionary style caused mild anxiety in me.

If a stock moved up or down or new in information came in, I always asked myself:

“Should I buy? Should I sell?

Does this change my investment thesis?

What is the opportunity cost?

What else is out there?

I have this other stock on the watchlist, should I switch my current holding for this one?

Will I regret doing so? Will I regret not doing so?”

In other words, I needed a way to outsource or automatize my decision making, although I didn’t know yet how.

Jim O’Shaughnessy’s book “What Works On Wall Street” gave me a way to do it.

From then on I read everything about factors and risk premia, I can get my hands on.

It also solved my problems with contrarian thinking since the data finally showed me that pro-cyclical and countercyclical ideas can coexist.

It just depends on the time frame you are looking at.

Investors (me included) often make the mistake to be contrarian investors on a momentum time frame and vice versa.

Compared to my early years, implementation of momentum in my process was one of the main changes for me.

Investing Resources

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Investing Books

“What Works On Wall Street” by Jim O’Shaughnessy

“The Psychology of Money” by Morgan Housel

“Big Mistakes” by Michael Batnick

“Thinking Fast and Slow” by Daniel Kahneman

“Richer, Wiser, Happier” by William Green

Equity Factor Data Library

https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

https://www.interactinganomalies.com

Investing Blogs

https://alphaarchitect.com/blog/

https://www.aqr.com/Insights/Research

https://blog.thinknewfound.com

https://www.researchaffiliates.com/insights/publications

https://www.osam.com/commentary

Investing Podcasts

Value: After Hours

Animal Spirits

The Meb Faber Show

Excess Returns

The Market Huddle

The Curious Investor

Happy To Have Had Expensive Lessons Early On As An Investor

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I am a gambler at heart and I lost a lot of money unnecessarily because of that.

My first “investment” was a row of knockout certificates in beaten down value stocks which of course got knocked out.

My largest “permanent” loss was when I blew an account by shorting the market in 2019 and 2020.

These “bumps in the road” were expensive lessons but I am truly happy that I had them this early.

In total, these experiments costed me only 1 yearly savings pile from my current salary.

So you could say, I went on a one-year unpaid internship where I learned risk management.

I don’t even blame leverage or shorting for this.

Like a knife, they are just tools, which can be useful but deadly if handled incorrectly.

I now learned to frequently monitor my risk exposure.

Furthermore, my job as an engineer and research associate gave me the necessary tools to understand statistics and to code my own R scripts for my screens and quant research projects.

This cross-fertilization between my day job and my investing really boosted my productivity in both ways.

Everything I learned in this regard, I owe to a handful of close friends and colleagues.

A recent event which changed my view on the world was the invasion of Ukraine.

I held a few Chinese and a Russian stocks until then since I am a global investor.

The closing of the Russian market for foreign investors made me rethink my investing universe.

I stopped investing in non-democratic countries with low degrees of freedom.

Learn By Trying, Failing And Standing Up Again

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

In hindsight, I would be really careful about what to tell him.

I am a learning-by-doing type.

Every major mistake I’ve made, could have been avoidable by theoretical knowledge I already had 7 years ago before I earned my first real money.

I seem to only learn by “try, fail, stand up, try again”.

Giving my younger self too much knowledge would make him overconfident and do more harm than good.

I would maybe just give him directions:

“Read everything you can about equity factor investing.

That’s our thing in the future.

Start with this book and this podcast.

You will find the way from there.

Try some stuff on the side but only with small money.

And learn to code now, it’s not that hard.

Everything will be alright.

There will be some bumps in the road but you’ll do fine.”

Stock Picking By Multi-Factor Rank

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

My current process is as follows:

1. I download the data for (almost) every stock listed on European exchanges with revenues > $1M via gurufocus.com (I tried adding a US subscription once but it doesn’t add much value for the extra cost for me as most stocks are also listed in EU; might add it in the future).

2. I read, clean and manipulate the data using a R script to generate the ratios and metrics I need. I then rank each stock based on the single metrics including P/E, Buybacks, Debt/Cashflow, etc. in comparison to the whole stock universe.

3. I then regroup the single metric ranks into 3 major categories:

a. Valuation (P/E, P/S, EV/EBIT, P/FCF, …)

b. Momentum (12-1-Month Performance, 6-1-Month Performance, …)

c. Quality (Net Stock Issuance, Asset Growth, Debt/Cashflow, 3-Month Volatility, …)

4. The ranks in each group are summed up and re-ranked to form a Valuation Rank, a Momentum Rank and a Quality Rank.

5. To form the final Multifactor Rank, the three Category Ranks are again summed up and ranked.

6. I then buy stocks with the highest Multifactor Rank. I aim for 20-30 holding, equally weighted.

I try to always be fully invested (although right now is one of the rare times I am not) I screen once a week to check my holdings.

If a stock falls below a Multifactor Rank of 0.8 (meaning the stock is not anymore in the top 20%), I sell it and replace it.

Of course this can (depending on market environment) result in high turnover.

Thus, I have to be careful that the stocks aren’t too illiquid.

Nonetheless, my preferred hunting ground is the realm of small and micro caps.

Although factor investing also works in mid and large caps, the obtainable returns are usually lower in these since price discovery is more efficient here.

In fact, I recently implemented a gradual penalty for the 50% largest stocks by market cap in my screen.

Additionally, I dabbled on trend following and treasuries this year (with mixed success).

This is why I am currently in a restructuring phase.

Due to the selling of my last large caps and the reduced exposure following my trend following experiment, I currently am not fully invested.

To get a feeling for a typical portfolio in my system, see here my current holdings:

Current Holdings: Systematic Microcap Investor Portfolio

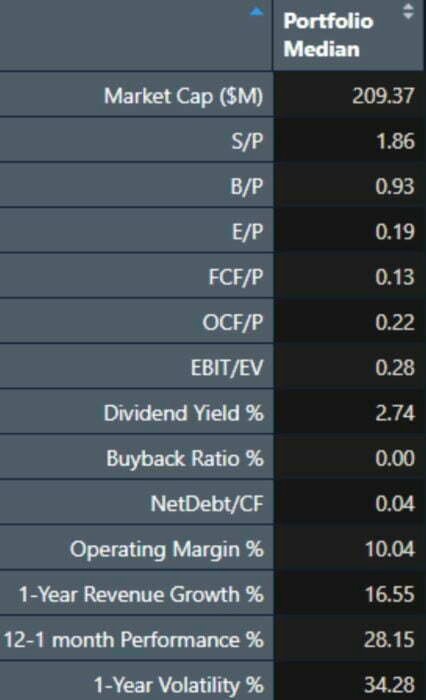

The following table shows some median stats for current holdings in my portfolio:

So you can describe it as global small deep value with momentum and a certain threshold quality.

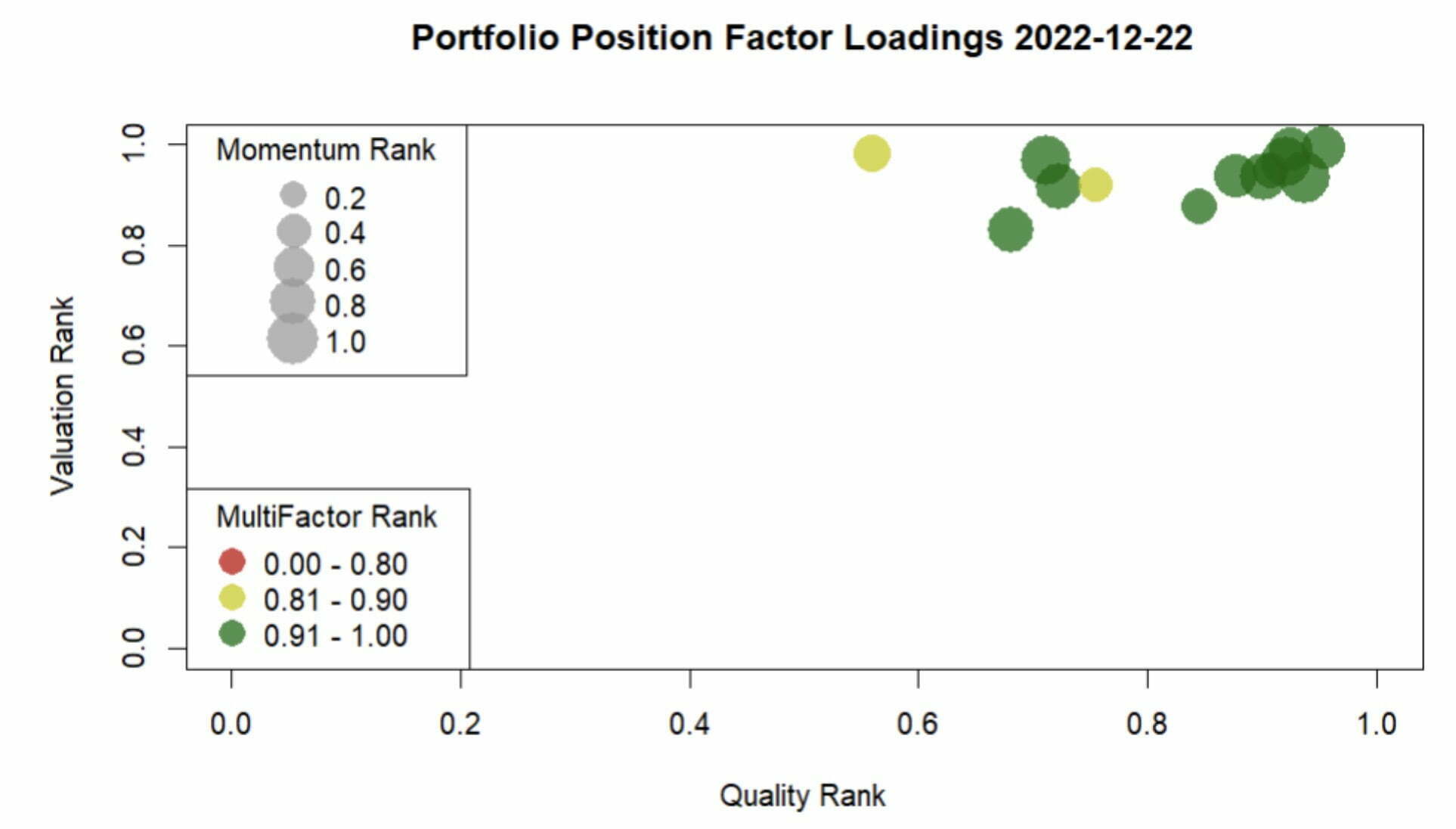

I also like to visualize my holdings as follows:

Portfolio Position Factor Loadings

In this way, I see directly after screening if some of my holdings are entering the danger zone.

I started my system in April 2019. Since then I was able to beat the S&P, MSCI World and Europe Small Cap indexes (all in Euro), despite the broad underperformance of Value, International and Smallcaps.

This makes me confident that my strategy can work well in the future.

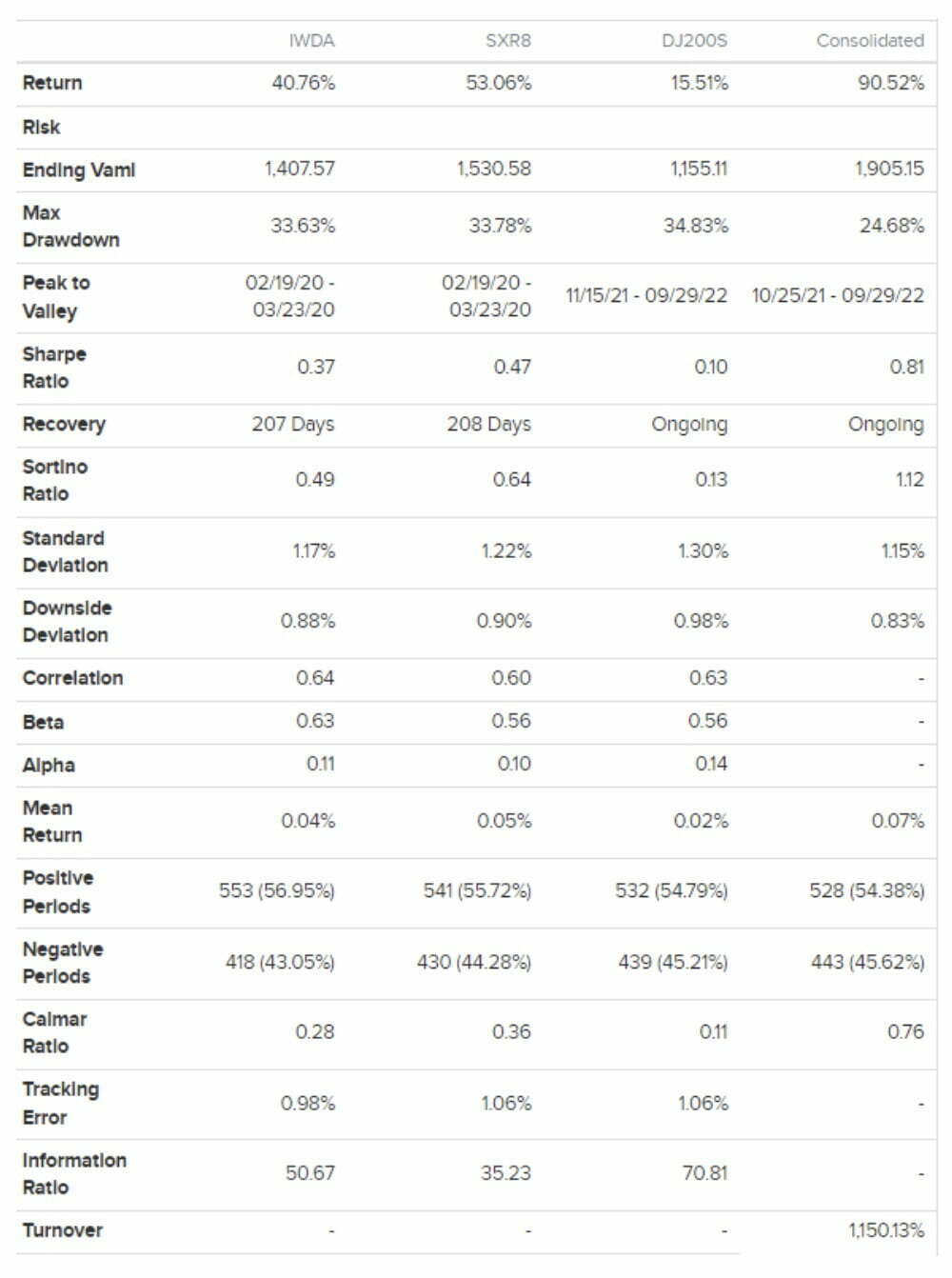

Systematic Microcap Investor Portfolio Performance

(time-weighted performance since 2019/04)

Stats since 2019/04:

Systematic Microcap Investor Portfolio Complete Stats

Of course it’s not all return without risk.

The major risk to my portfolio is idiosyncratic risk of single names with rather high weighting.

A 20-stock portfolio can have higher exposure to hidden risk.

E.g. this year I owned a Russian mining stock which basically a -100% after the Ukraine invasion and a Norwegian Salmon Stock with was cut in half when Norway proposed a new tax on fish farming.

Also due to the small cap international nature of the portfolio, a global crash or recession will hit my portfolio way harder and I have to be prepared for larger drawdowns.

Furthermore, I am confident that the Value winter is over but there is no guarantee for that.

Factor investing can and will go through lost decades.

The approach seems to do best in a broad reflation after a recession like we saw it in 2020/21 and tries to rotate intelligently.

The momentum components breaks when trends become more volatile and unclear and general market breadth deteriorates.

There are many more examples and pitfalls.

The key is to understand the underlying dynamics and trust the system.

I experimented a lot over the past years, e.g. with trend following.

But I never did a hard style shift in my main book and also I don’t intend to do so, even if we get a bad 5-10 years.

When You’ve Found Your Style You’ll Know It

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

Coding helps and is a nice tool.

You should also be a numbers / big-picture guy instead of a detail- oriented narrative / deep-dive guy.

You have to be wired in the right way to use this approach.

You have to acquire as much knowledge as you can about the topic, select the factors which fit your personality and chose your preferred way to implement it (what I do is called an integrated approach, meaning I throw all factors in a mixer and by the “best” stocks at the intersection.

There is also a sleeve approach, where you look at Value, Momentum and Quality separately and buy e.g. the 10 Highest-Value stocks, the 10 Highest-Mom Stocks and the 10 Highest-Quality-Stocks)

After that, you just have to trust.

Nobody can teach trust.

It has to come from the alignment of the investment style with your personality, your values and your philosophy.

It is hard to explain it but when you truly found your style, you’ll know it.

Research And Then Trust: That’s The Art

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

A watered down version would be using either one of the many US ETFs I have no access to as a German investor (QVAL, QMOM, XSVM, …) or you could just go to a screener like TIKR, and boil it down to inputs that should get you like 80% of the way there like:

- Market cap < $5B

- 12-month performance > S&P500 12-month performance

- Stock Issuance <=0

- Operating Cashflow > 0

- Buy a basket, cheapest by EV/EBIT or EV/FCF

Sounds too easy?

Well, try buying and holding those names without severe doubts.

Research and then trust.

That’s the art.

A more sophisticated version of my system would be to go Long-Short and lever the long side with the proceeds of the short leg.

E.g. a 125/25 approach. If I had the data, I could also add e.g. analyst revisions or other more sophisticated factors.

Evidence-Based Nature Of Quant Investing

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

My laziness and lack of interest for detail is my main weakness in my day job and my discretionary investing endeavours.

It simultaneously seems to be a key strength for quant investing though.

I intuitively was convinced by the automation aspects of quant investing.

The evidence-based nature of the style also deals with my anxious paranoia regarding my biases since it takes decision-making off my hands.

I only have to deal with the big picture and the system itself.

Even when I look at my single holdings, of course I feel anger if a single stock falls 30% in a day or I feel joy when a single stock jumps 30% in a day but I quickly learned that single positions and trades are meaningless compared to the overall portfolio, especially in the long run.

Practice and routine made me more resilient.

In short, I did not actively try to work on my weaknesses and build on my strengths, I simply chose an investment style which complements my personality and interests in the best possible way.

Many people try to change themselves to become like Warren Buffett.

In my opinion that is a dangerous path.

There is a perfect investment style for every personality, you just have to find it.

I Disagree Whenever I Hear Factor Investing Is Dead

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

Most investing beliefs I disagree with boil down to confusion of target audience and people talking past each other as a consequence.

In factor research, the common target audience are big institutional investors with high market impact.

Thus, the whole discussion is often limited to large and megacaps or cap-weighted construction instead of equal-weighted.

Market impact, scale and career risk have much higher importance in the public discourse than for a retail investor like me.

I can buy a concentrated micro-cap portfolio without problem.

A big fund with $20B AUM can’t.

Same goes for discussions about certain vehicles like boutique ETFs or derivatives.

As a German retail investor, buying futures is a tax nightmare and most US strategic ETFs are not available in the EU.

Of course whenever I hear: Factor investing is dead, I also disagree.

Appeal Of Capital Efficient Asset Allocation

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I love to learn more about trend following, multi-asset allocation and return stacking.

I love the appeal of using capital as efficiently as possible, also by using leverage, shorting, alternative asset classes etc.

Due to my limited and/or inefficient access to many of the corresponding assets, I would not implement it though.

A Boring Value Portfolio Won’t Make You New Friends At A Cocktail Party

What would be the ultimate anti-Systematic Microcap Investor portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Currently, ARKK seems to be ultimate example.

It is as if you take the worst multi-factor short portfolio and buy it for the long run.

Expensive, now low-momentum, highly diluting through share and debt issuance, pure narrative.

Every statistic speaks against these stocks, especially now that momentum broke.

Nonetheless, it performed well for a long time.

The narrative around innovation and technology is also what makes it appealing.

Many value investors (including me) asked themselves: “What if this time is indeed different”.

The Base rates speak against it but also the internet is a clear outlier in human history.

Companies like Tesla boosted the global EV transformation.

Many SAAS products helped millions of people during the pandemic to continue teaching, working, communicating.

These kind of enterprises tend to truly change the world (hopefully for the better) and no one wants to miss it.

A boring dinosaur value portfolio which is as non-ESG as possible, won’t get you any new friends at the cocktail party.

Connect With Systematic Microcap Investor

Twitter: @systvest

Blog: https://systvest.substack.com/

Nomadic Samuel Final Thoughts

I want to personally thank Tony of Systematic Microcap Investor for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.