When it comes to creating a portfolio that is prepared for all economic regimes, is it possible that investors can improve upon the Ray Dalio All Weather Portfolio?

Hmmm.

An even better umbrella to handle the rain in an all-weather scenario?

Now that would be a tall order.

In many ways the Ray Dalio All Weather Portfolio is the pinnacle of diversification – especially when compared to the classic 60/40 portfolio.

Firstly, it isn’t nearly as risky as the balanced 60/40 portfolio given that its equity allocation is shaved down.

Secondly, it allocates a greater percentage of its portfolio to bonds in order to provide stability.

Thirdly, it has an alternative sleeve of gold and commodities protecting the portfolio from stagflation.

We’re witnessing in real-time the Achilles heel of the 60/40 portfolio in 2022.

When stocks and bonds are no longer correlated the so-called Titanic suddenly starts sinking.

But beating the tar out of the milquetoast 60/40 folio is kind of low-hanging fruit, isn’t it?

Indeed.

Let’s get back on track here.

Can we improve upon the Ray Dalio All Weather Portfolio, in such a manner, that we can enhance returns and stabilize overall risk management and diversification?

I think so.

Here are 10 ways we’re going to attempt it.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

10 Ways to Improve the Ray Dalio All Weather Portfolio

All Weather Portfolio Introduction

Before we look at improving the Ray Dalio All Weather Portfolio let’s first examine what it is in its original form.

The Ray Dalio All Weather Portfolio is a portfolio that moves beyond merely stocks and bonds with the addition of gold and commodities as an alternative sleeve.

The purpose of the portfolio is to perform in all economic environments as opposed to just inflationary boom and disinflationary boom regimes.

Relative to a 60/40, the all weather portfolio reduces its exposure to equities, increases its exposure to bonds and adds both commodities and gold in an attempt to balance its risk/reward profile in such a manner that it offers investors protection during inflationary stagnation and deflationary bust economic regimes.

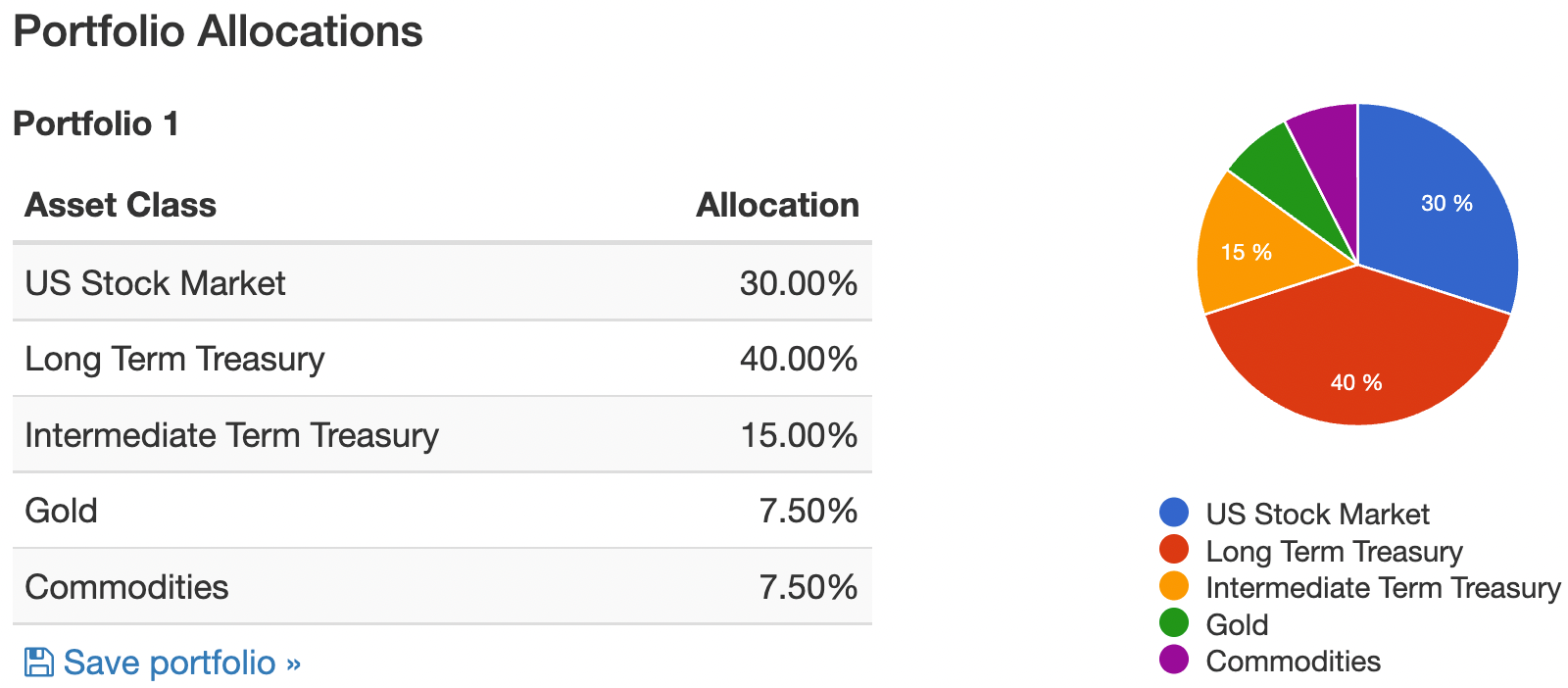

Ray Dalio All Weather Portfolio Allocations

US Stock Market = 30%

Long Term Treasury = 40%

Intermediate Term Treasury = 15%

Gold = 7.5%

Commodities = 7.5%

With equities limited to just 30% and bonds making up 55% of the portfolio, the all-weather allocation is instantly more conservative than most other portfolios that are more aggressive with equities.

Uncorrelated asset classes of gold/commodities round out the portfolio with 7.5% slices each.

In my opinion, this all-weather portfolio is a diversification masterpiece, (relatively speaking) compared to what 90% of most investors have going for them.

The results of this portfolio in the picture perfect portfolio challenge (leveraged portfolios battle) at the 1X. 2X, 3X and 4X level speaks for itself.

It dominated.

This is a robust regime ready portfolio that can handle all economic conditions in addition to high amounts of leverage as well.

But that doesn’t mean it can’t be enhanced.

And so let’s explore that now.

Source: YouTube on Investopedia Channel

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

1) Add Global Equities To The All-Weather Portfolio

Maybe the most obvious place to start would be going from a US only equity allocation to diversifying globally.

In the past decade, investors who have gone global (as opposed to being US-centric), have by and large been frustrated with the results.

However, when considered through the lens of the early 2000s, diversification was the key ingredient that kept your equity sleeve above water.

The idea here isn’t to pick which region of the world is going to be the winner over the coming years/decades but rather have it spread out so broadly as to not guess at all.

One of the most informative self-education moments throughout my journey as a DIY investor, has been to pick up vintage investing books that weren’t recently published.

Open up an investing book published in the mid 90s and you’ll likely find information on how investing abroad in the 70s would have prevented a lost decade.

If diversification is your only free lunch as an investor then avoiding to succumb to home country bias should be an absolute no brainer of an upgrade.

This is low hanging fruit my friends.

I’ll gladly accept this “easy upgrade” by going from US centric equities to a globally diversified portfolio featuring both significant EAFE and Emerging market exposure.

2) Minimum Volatility Equities Upgrade To The All-Weather Portfolio

Can we further optimize our equity sleeve of our Ray Dalio inspired all-weather portfolio?

I believe so.

Let’s explore factor optimization.

Given our mandate of creating an enhanced Ray Dalio All-Weather portfolio, we’re specifically looking for ways to drive performance while smoothing out the ride.

What can help make the equity investing journey a little less bumpy?

Factors.

Specifically, defensive factors.

Yield.

Quality.

Minimum Volatility.

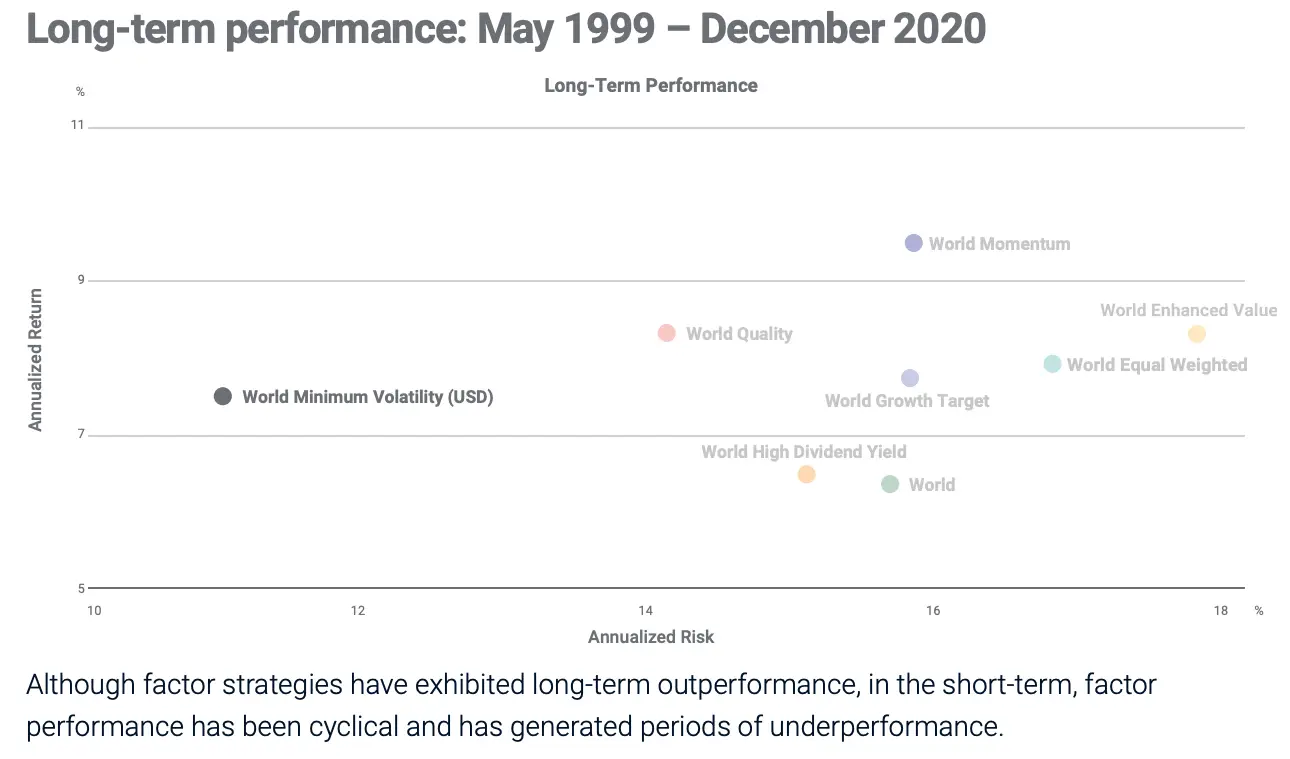

Amongst the three mentioned above, the most defensive of them all is minimum volatility.

From the time period of 1999 to 2020, Global market cap weighted equities had a standard deviation of 16, Yield scored 15, Quality hovered around 14 and World Minimum Volatility was a defensive stalwart coming in at 11.

Given our mandate of making the Ray Dalio All Weather Portfolio an enhanced version of itself, we’ll take the 5 standard deviation points of risk improvement and say thank you very much.

Thus, at this point, we’ve now moved away from “home country bias” US only equities to global and we’ve upgraded from market-cap weighted to minimum volatility to bolster our defence.

Yummy.

So far.

Source: YouTube on Investopedia Channel

3) Expand The Canvas Of The All-Weather Portfolio

Now that we’ve optimized our equites in two different ways, it’s time to turn our attention to the rest of the portfolio.

What does an artist need to paint a beautiful picture?

A canvas.

Our canvas has been confined to 100%.

Let’s change that right now.

We’ll expand it to 200%.

But with the explicit caveat of not adding more of what we’ve already got in the portfolio.

No scooping extra mashed potatoes on top of the previous pile.

Instead we’re going to use this extra space to add additional diversifying elements to the portfolio.

But before we do this let’s examine why it’s even a potentially good idea (or not) to add leverage to the Ray Dalio All Weather portfolio.

For that we’ll need to jump over to the Battle of the Leverage Portfolios (Picture Perfect Portfolio Challenge) to see how the Ray Dalio All Weather Portfolio performed at each level:

- Ray Dalio All Weather Portfolio in the Battle of the 2X Leverage Portfolios

- 3X Leverage portfolio performance for the Ray Dalio All Weather Folio (coming soon)

- Wacky Ray Dalio All Weather in the 400% Leveraged Portfolio competition (coming soon)

Just as a heads up, the results are with GOLD taking up 100% of the COMMODITY sleeve given back-test data constraints from portfolio visualizer only going back to the mid 2000s with commodities.

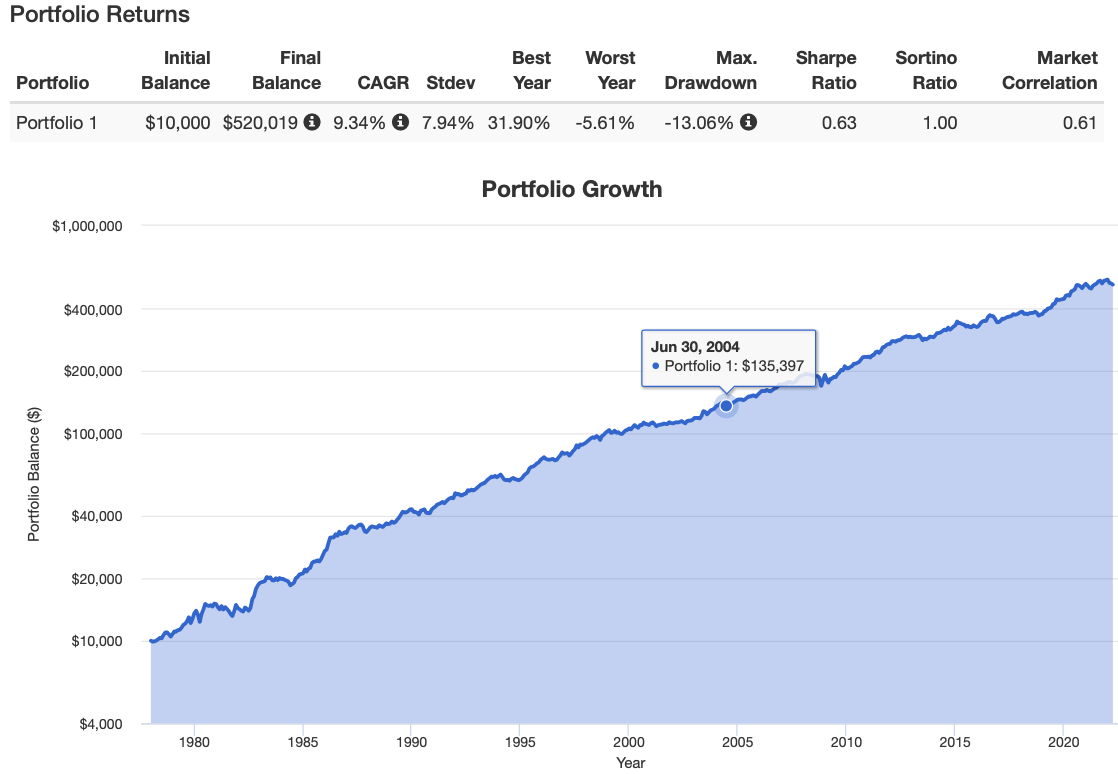

Ray Dalio All-Weather Portfolio Performance 100%

Initial Balance: $10,000

Final Balance: $520,019

CAGR: 9.34%

RISK: 7.94%

Worst Year: -5.61%

Sharpe Ratio: 0.63

Sortino Ratio: 1.00

From 1978 until 2022 (March) a hypothetical $10,000 investment in the Ray Dalio All Weather Portfolio would have grown to $520,000.

With a CAGR of 9.34% it delivered an impressive 140 basis points outperformance over RISK at 7.94%.

Its worst year comes in at only -5.61% with a Sharpe Ratio of 0.63 and Sortino Ratio of 1.00.

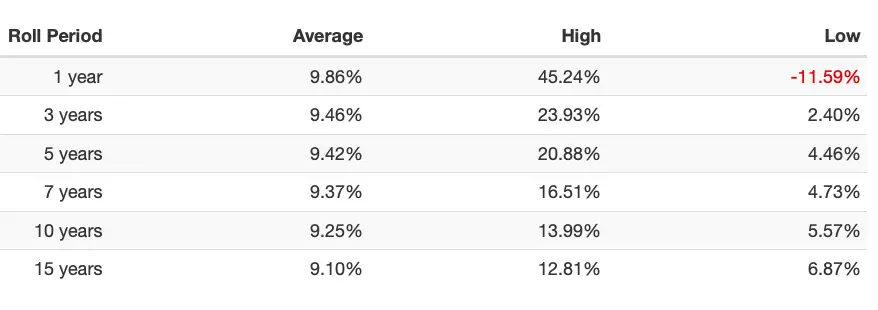

Ray Dalio All-Weather Roll Period 100%

When we check out the Roll Period it is even more impressive.

The Ray Dalio All Weather Portfolio had only a low of 1 year at -11.59% with all sequence of returns being positive at a 3 year, 5 year, 7 year, 10 year and 15 year periods.

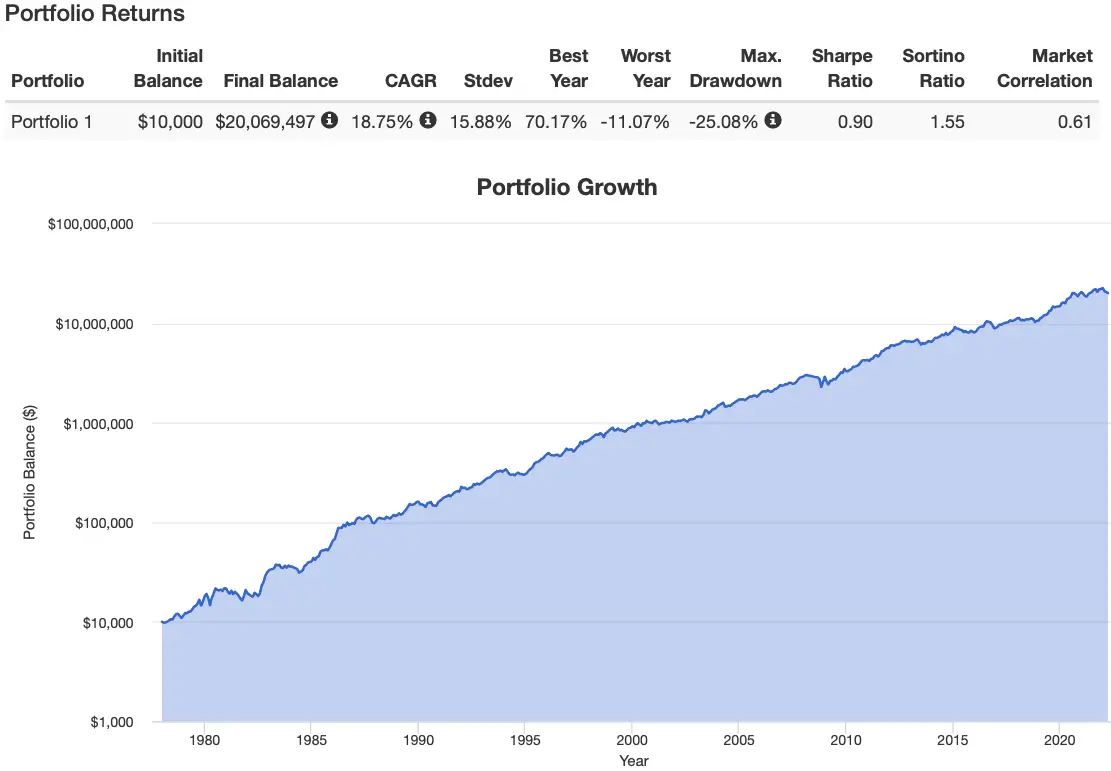

2X Ray Dalio All-Weather Portfolio Performance 200%

Initial Balance: $10,000

Final Balance: $20,069,497

CAGR: 18.75%

RISK: 15.88%

Worst Year: -11.07%

Sharpe Ratio: 0.90

Sortino Ratio: 1.55

What happens when we expand the Ray Dalio All Weather Portfolio from 100% to 200%?

In a word….

Magic.

The 2X Ray Dalio All-Weather portfolio really comes alive when a modest amount of leverage is applied.

Consider how a hypothetical backtest of $10,000 grows now to $20,069,497.

$520,000 at 1X canvas vs $20,069,497 at 2X.

Wowzers!

Moreover, the CAGR shoots up to 18.75% with a 287 basis points of outperformance versus RISK at 15.88%.

You’d think with double the leverage the Ray Dalio portfolio might fall apart a little in terms of its worst year performance.

Nope.

Just -11.07%.

Finally, it’s Sharpe Ratio of 0.90 and Sortino Ratio of 1.55 are massive improvements over the 100% canvas level as well.

This is a portfolio that is Taylor-made for leverage.

It’s time to lever up buttercup.

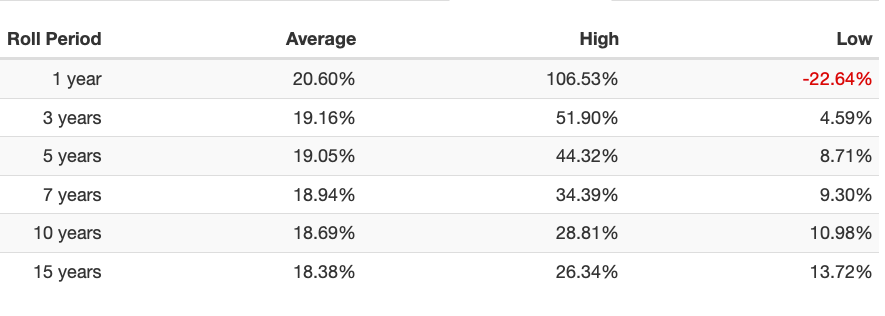

2X Ray Dalio All-Weather Roll Period 200%

4) Adding Uncorrelated Assets To The All Weather Portfolio

So we’ve decided to expand the canvas of the Ray Dalio All-Weather portfolio but what is it that we’re going to add if we’re not just doubling up its already existing asset classes?

Well, if we’re beating the drum of diversification is your only free lunch we’re going to run a marathon with that.

But the Ray Dalio All-Weather portfolio is already a diversification masterpiece, is it not?

Yes.

In many ways it is.

But we’ve still got various asset classes and multi-strategy enhancement opportunities.

Off the table is the following:

- Global Minimum Volatility Equities

- Long-Term Treasury

- Intermediate Treasury

- Gold

- Commodities

So what could we add?

TIPs.

Managed Futures.

Merger Arbitrage.

These all come to mind.

Let’s explore them individually.

5) TIPs Strategy To The All-Weather Portfolio

Let’s first explore adding to the fixed income/bond sleeve of the Ray Dalio All Weather portfolio.

Since we’ve already got long-term and intermediate treasury securities we’ll turn our attention towards something that is more prepared to safeguard our portfolio from inflation.

Enter the room TIPs.

In a nutshell, TIPs are treasury inflation protected securities, issued by the US government, that are designed to shield investors from declines in purchasing power by being indexed to inflation.

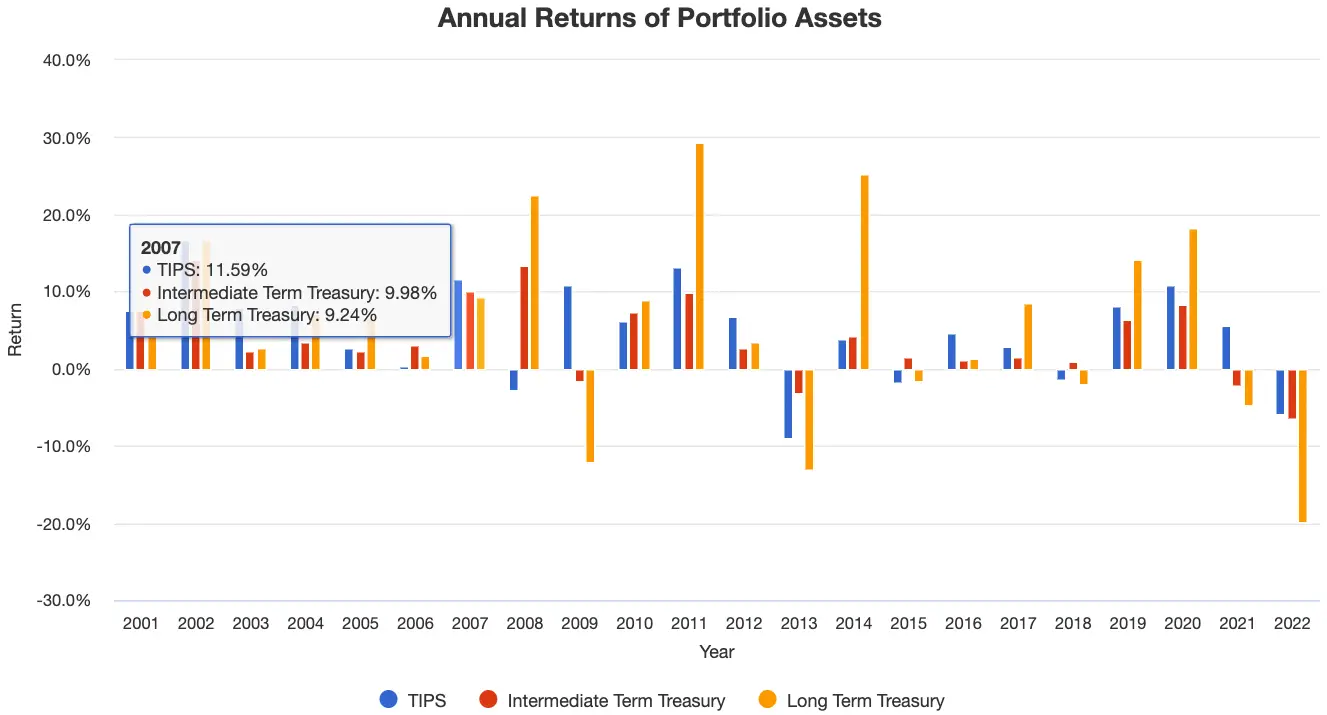

What jumps out to me immediately from an annual performance standpoint, when I compare TIPS with Intermediate Term Treasury and Long Term Treasury, are the years 2008 & 2009 and 2021 & 2022.

You’ll notice uncorrelated performance in 2008 when TIPS were less defensive and much stronger recovery in 2009.

In more recent times, when inflation has been persistent and pesky, TIPS have done their job by being above water in 2021 and more relatively defensive in 2022.

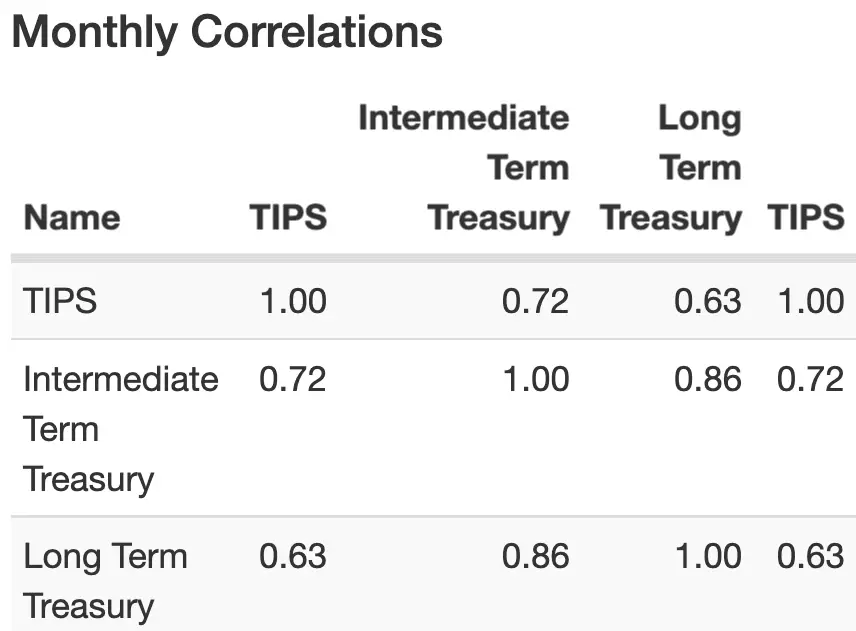

While Long Term Treasury and Intermediate Treasury have a correlation of 0.86 adding TIPS to the mix provides an immediately clear diversification benefit.

TIPS correlation with Long Term Treasury is 0.63 and with Intermediate Term Treasury is 0.72.

This in my opinion is a considerable diversification upgrade in the fixed income sleeve of the portfolio.

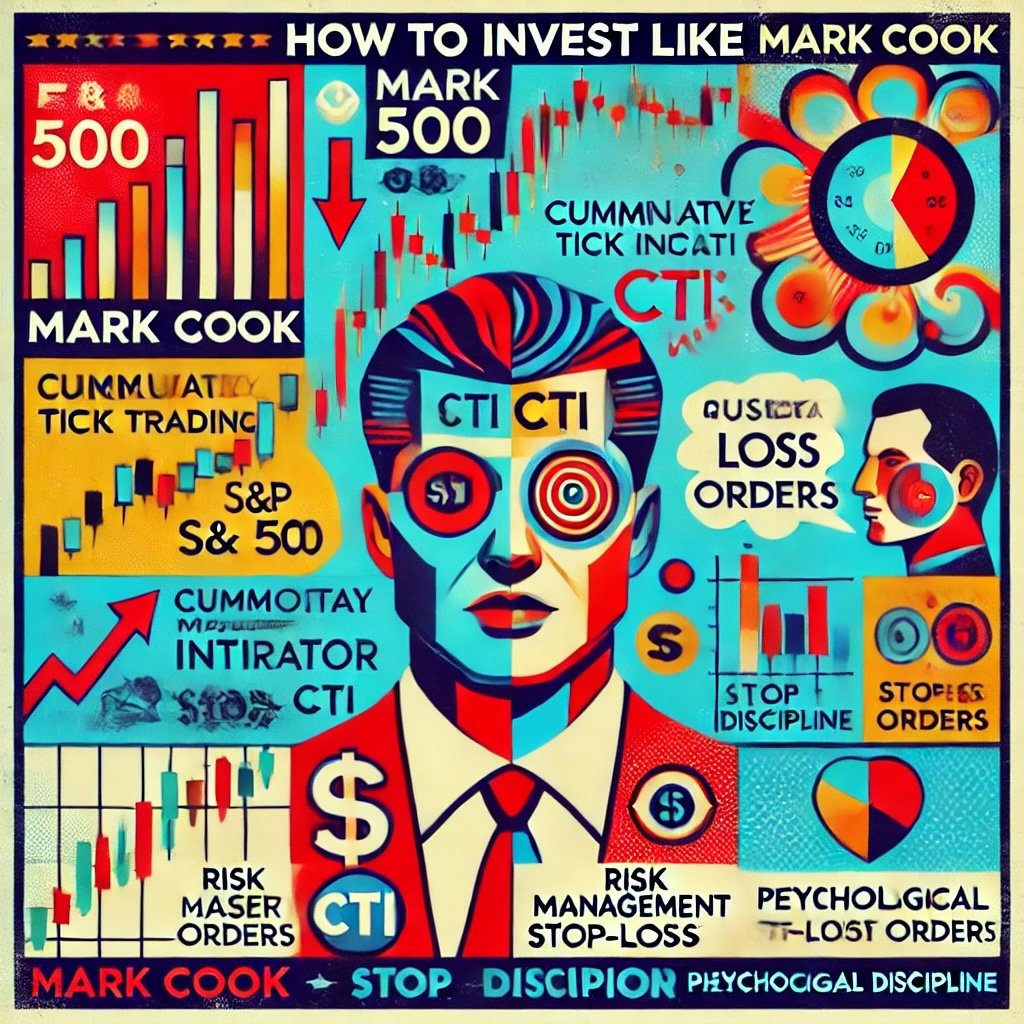

6) Trend-Following To The All-Weather Portfolio

One of the most most glaring omissions from the Ray Dalio All-Weather portfolio is a total lack of managed futures exposure.

I wrote a detailed post about the benefits of trend-following and why it is not a more popular investing strategy.

Basically, being able to go both long/short commodities, currencies, equities and bonds from a broad range of global markets adds massive diversification to the portfolio given it is an uncorrelated strategy to both stocks and bonds.

Consider 2022 for example.

When both equities and bond markets from across the globe (have by and large) been down for the year, trend-following strategies have been thriving.

Why?

Because they adapt like a chameleon to whatever is going on in the markets in terms of short-term, medium-term and long-term signals.

When equity markets are down they say “yes” to that by shorting exposure.

When bonds are down they also say “yes” to that by shorting exposure.

One other clear benefit is that this strategy isn’t nearly as volatile as Gold and Commodities allocations.

You don’t have the at times annual -20% to -40% years of volatile drawdowns.

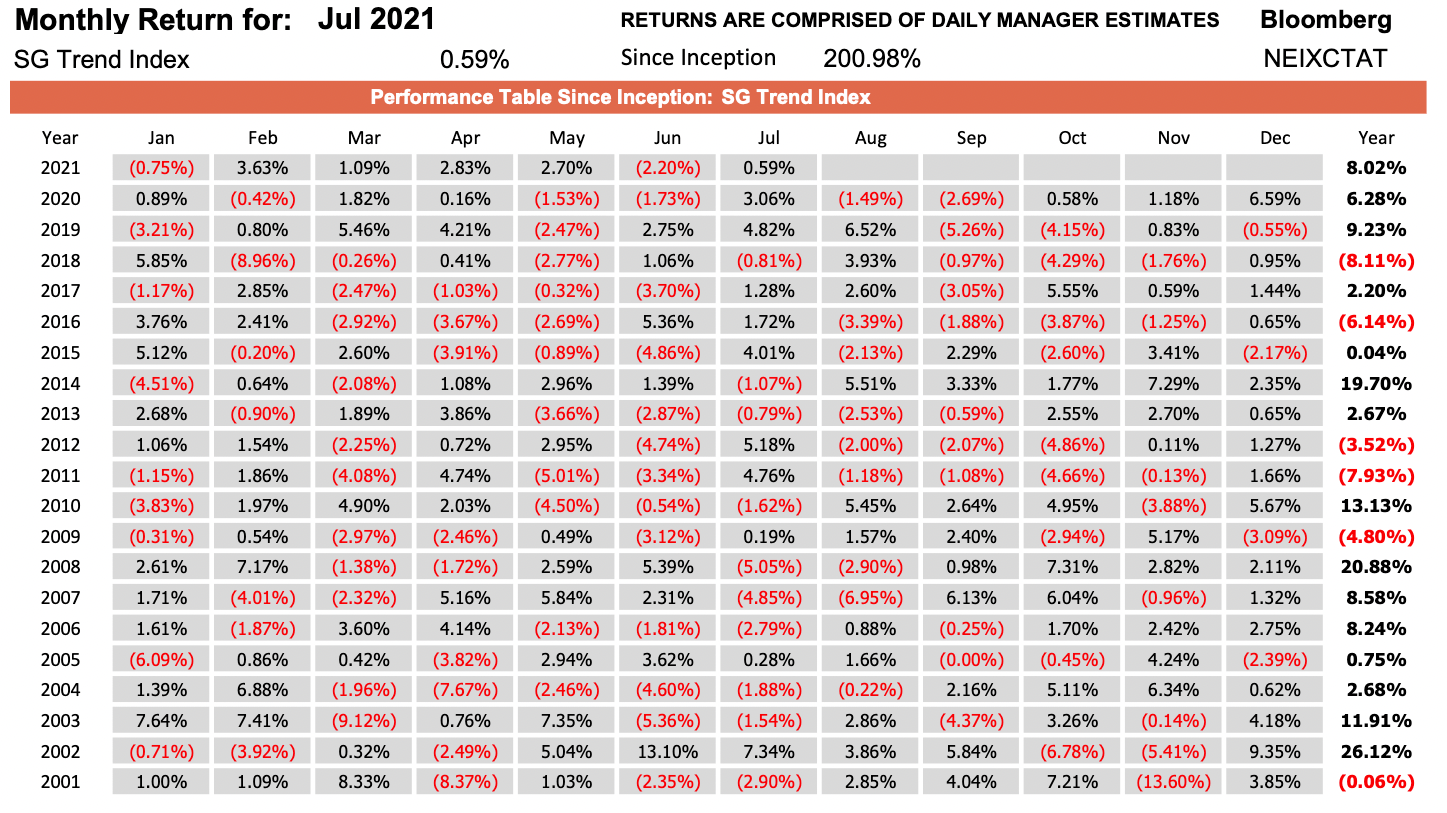

When I examine annualized data from SG Trend index I’m noticing a worst year of only -8.11% in 2018.

SG Trend Index Returns

What I’m most impressed with is the performance of this strategy during the early 2000s and 2008 in particular.

When equities are struggling (such as in 2022) trend-following provides significant fortification to the portfolio in terms of historical backtests.

Hence, adding a managed futures trend-following strategy to our enhanced Ray Dalio All-Weather Portfolio is quite honestly a no-brainer.

7) Market Neutral Investing Strategy To The All Weather Portfolio

A market neutral investing strategy is the most conservative of all the long-short equity strategies.

Its NET exposure is often far less than its long-short brother and active extensions sister.

It seeks to select stocks it thinks will relatively outperform while shorting those that it feels are either relatively overvalued or will potentially underperform.

Managers of a market neutral strategy are seeking to profit from both increasing and decreasing prices in the marketplace.

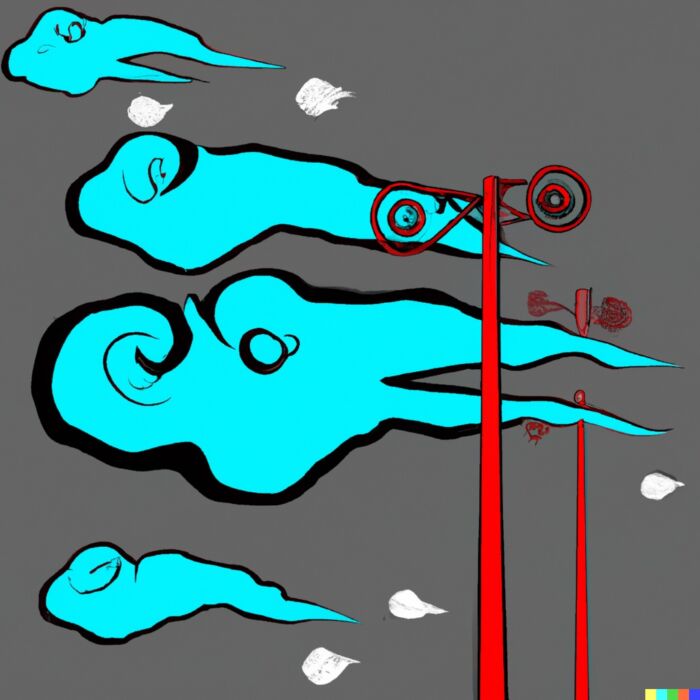

Consider the performance of Picton Mahoney, a Canadian alternative fund provider, with its long-short market neutral mandate.

A much higher sharpe ratio than its TSX benchmark (0.81 vs 0.40) and standard deviation of 4.71% versus 17.05%.

More importantly notice the difference in terms of annual returns.

Above water in 2008 at 2.12% when equities were down -33% and again in 2015 and 2018 when equities were below water.

Adding a market-neutral strategy to the portfolio should very well improve its overall diversification.

8) Merger Arbitrage Addition To The All Weather Portfolio

Let’s add a merger arbitrage strategy to the portfolio.

I just finished interviewing Julian from Accelerate about merger arbitrage as an alternative investment strategy.

Please check it out.

Briefly, merger arbitrage is an event driven hedge fund strategy that purchases stocks of merging companies attempting to take advantage of market inefficiencies before (and/or after) a merger/acquisition.

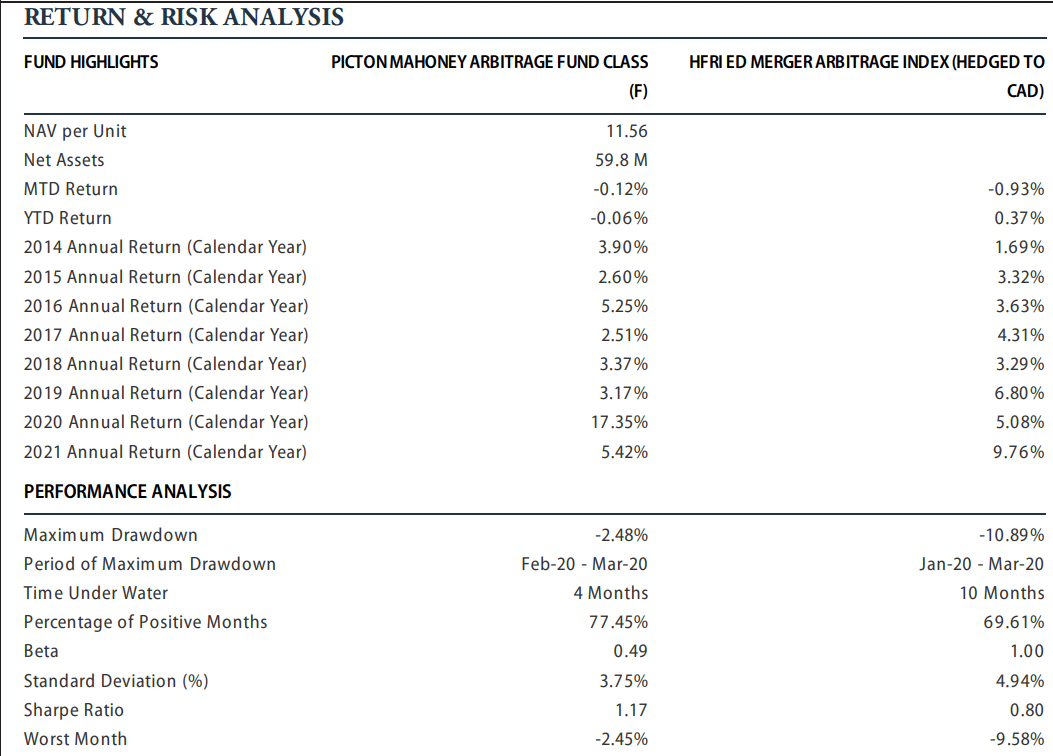

Let’s once again consult with Picton Mahoney as they’ve been delivering results from a merger arbitrage mandate for several years.

Check out that Sharpe Ratio of 1.17!

No negative years.

A 77.45% positive months success rate.

A standard deviation = 3.75%.

We’re adding more stability/defensiveness to the portfolio with this unique strategy.

9) Mystery Asset Allocation To The All-Weather Portfolio

Here is the fun part.

I’m carving out a dedicated portion of the portfolio for you to add whatever you want.

That’s right.

It’s entirely a choose your own adventure sleeve.

When it comes to all of the potential options to consider for this totally flexible “mystery asset allocation” sleeve here are a few options that come to mind:

- Private Equity

- Managed Futures (Global Systematic strategies other than trend-following)

- Crypto Currency

- Active Extension Equities 130/30

- NFTs

- Art, Wine, Collectibles

- REITs

- Real Assets

- Private Debt

- Factor Optimized Equities (Value, Momentum, Quality, Size, Yield)

- Reinsurance

Personally, I’d probably choose a few of these at 2-3% slices but that’s just me.

Whatever you’d do with this 10% is entirely subjective.

I believe investing should also be “fun” and not just a boring procedure, so this 10% might seem trivial but I’m hoping it provides a creative outlet for those who are curious about certain asset classes/strategies but never pursued them before.

Have a little bit of fun.

Life is short.

10) All Weather Tail Protection Addition

Let’s slap a little insurance on this portfolio for those rare black swan events.

How can we do this?

By adding tail protection.

Tail risk arises when the portfolio (typically equities) moves three standard deviations from the mean.

It’s a rare event.

But let’s be prepared for it.

One of the easiest ways we can add insurance to the portfolio is by purchasing put options at various strike prices that trigger if/when a severe equity drawdown takes place.

Think 2008 levels.

We’ve got other elements in our portfolio that will be conspiring to keep our portfolio above water in this type of scenario but adding tail risk protection is just another way we can “diversify our diversifiers” as some folks in this industry love to say.

Enhanced Ray Dalio All Weather Portfolio

Now that we’ve made 10 different adjustments to potentially improve the Ray Dalio All Weather Portfolio what do we have as the final asset allocation?

New Ray Dalio All Weather Portfolio

30% Global Minimum Minimum Volatility Equities

40% Long Term Treasury Bonds

15% Intermediate Term Treasury Bonds

7.5% Gold

7.5% Commodities

40% Managed Futures (Trend-Following)

20% TIPS (Treasury Inflation Protected Securities)

15% Market Neutral Equities

10% Merger Arbitrage Strategy

10% Wildcard (Crypto, NFTs, Reinsurance, Factor Equities, ETC. Whatever you want!)

5% Tail Protection Strategy

That’s quite a few enhancements!

To recap briefly the only thing we tinkered with in terms of the original Ray Dalio All Weather portfolio was ultimately going global with equities and choosing minimum volatility as our factor as opposed to market-cap weighting.

The rest of the “classic configuration” stays the same with 40% Long Term Treasury, 15% Intermediate Term Treasury, 7.5% Gold and 7.5% Commodities.

For the additional 100% layer we’ve added 40% Managed futures, 20% TIPS, 15% Market-Neutral Equities, 10% Merger Arbitrage, 10% Whatever You Want and 5% Tail Protection.

The primary goal of the expanded canvas was to add uniquely uncorrelated (or less correlated) multi-asset class strategies as additional layers of return streams while boosting overall portfolio diversification.

I’m happy with what we’ve been able to accomplish here.

In fact, it is quite similar to the All Weather Picture Perfect Portfolio I’ve designed.

I could easily ride this portfolio off into the sunset as I believe it’ll provide a beautiful intersection of returns meets risk management.

But that’s just my opinion.

I’m interested in yours.

Do you think this is an improvement over the original Ray Dalio All Weather Portfolio or would you have just left things the same?

Please let me know in the comment section below.

If you enjoyed this article I think you might also like “10 Ways Investors Can Improve A 60/40 Portfolio | Ultimate Enhanced 60/40 Portfolio With ETFs” where we expand the canvas to add alternative sources of returns in addition to what is classically provided with equities and bonds.

12-Question FAQ — 10 Ways Investors Can Improve the Ray Dalio All Weather Portfolio

1) What is the classic Ray Dalio All Weather Portfolio?

A rules-driven allocation aimed to work across economic regimes: 30% US stocks, 40% long-term Treasuries, 15% intermediate Treasuries, 7.5% gold, 7.5% commodities—tilting conservative vs. a 60/40 while adding inflation hedges.

2) Why try to “improve” an All Weather portfolio?

To maintain the all-regime intent while pursuing higher risk-adjusted returns and shallower drawdowns by expanding beyond long-only stocks/bonds/commodities and adding uncorrelated strategies.

3) What’s the first upgrade—global vs. US-only equities?

Swap the US-only sleeve for global equities to reduce home-country bias and capture diversification across EAFE and emerging markets without having to pick regional winners.

4) Why use Minimum Volatility (MinVol) for the equity sleeve?

MinVol historically delivers smoother rides (lower stdev) and better downside capture than market-cap weighting—aligned with All Weather’s goal of defensive resilience.

5) What does “expand the canvas” mean here?

Move from 100% to ~200% total exposure (return stacking/leverage)—not to double stocks/bonds, but to add new, uncorrelated return streams on top of the core without crowding out the base.

6) Which bond enhancement belongs first?

TIPS (Treasury Inflation-Protected Securities) complement long/intermediate Treasuries by directly indexing principal to inflation—helpful when inflation is persistent or surprise-positive.

7) Why add Managed Futures (trend-following)?

Managed futures can go long/short across commodities, rates, currencies, and equities; they’ve tended to zig when stocks/bonds zag, offering crisis alpha and regime adaptability.

8) What’s the role of Market-Neutral equity?

Market-neutral seeks stock-selection alpha with near-zero net market exposure, targeting low volatility and low correlation—an additional return stream that doesn’t rely on market beta.

9) How does Merger Arbitrage help?

Event-driven merger arb harvests deal spreads with historically low volatility and low equity beta, adding another differentiated source of return and drawdown buffer.

10) What’s the “Wildcard” sleeve for?

A ~10% sandbox to personalize the portfolio—e.g., crypto, reinsurance, real assets, private debt/equity, factor sleeves—kept small to preserve the portfolio’s core risk profile while letting investors express views.

11) Why include tail-risk protection?

Systematic put options/tail hedges can help during multi-sigma selloffs, complementing trend and diversifiers to further cap left-tail outcomes (with an expected carry cost in calm markets).

12) What does the enhanced allocation look like at a glance?

Core stays recognizable (now global MinVol equities + Treasuries + gold/commodities). The added 100% layer introduces managed futures, TIPS, market-neutral, merger arb, a wildcard sleeve, and tail hedging—all aimed at more diversification without over-relying on equities.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Happy thanksgiving!! Could you recommend which minimum volatility etf and which arbitrage funds you would recommend? Did you use leveraged etfs for the original all weather portion?

Hi, how was the portfolio rebalanced in your all weather portfolio performance charts?

Very informative post! Thanks for sharing.

Your allocations don’t add up to 100% …..but I good read nevertheless.

How you get the 2x portfolio ?

ALLW