Ray Dalio, Harry Browne and a Mystery Quant all walk into a bar and within four hours have to agree on a defensive portfolio mandate.

The first hour they spend drinking profusely, insulting one another and wasting time.

The last three hours are focused on trying to hammer out a sensible equity plan, classic asset allocation and an alternative esoteric sleeve.

The goal is to find something that has performed better than the Ray Dalio All-Weather Portfolio, Harry Browne Permanent Portfolio and 60/40 Portfolio roughly over the past decade.

And it had darn well better be more defensive too!

Each of them has a “Veto Card” which they can pull out to make sure they’re getting at least something that they want in this portfolio.

They’ll all have to all compromise at the end of the day.

It’s, no doubt, a tall order.

They’ve only got 4 hours.

Let’s see if they can figure it out in time.

Hey guys! Here is the part where I mention I’m a travel content creator! This article is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

The First Hour At The Bar

Dalio: “Harry, what the heck are you doing here? Didn’t you croak a while back?”

Browne: “You never mind mind that! I’ve got a bone to pick with you over your so-called All-Weather Portfolio. You basically…”

Mystery Quant: “Hey, what’s up guys? I’m new in town!”

Dalio: “Who the heck are you?”

Mystery Quant: “I know of Corey Hoffstein, Rodrigo Gordillo and Jason Buck.”

Browne: “You didn’t answer the question, Whippersnapper. Who the heck are you?”

Dalio: “Hey, are you that freakin’ amateur, Nomadic Samuel?”

Browne: “Nomadic Samuel. Who the “fill-in-the-blank” is that?”

Dalio: “I only know of that guy because he wrote some bogus ‘How To Improve The Ray Dalio Portfolio‘ and ‘How To Build A More Defensive Ray Dalio Portfolio‘. What a buncha BS that was. The Ray Dalio AW Portfolio can’t be improved!”

Mystery Quant: “Ray, do you always refer to yourself in the third person?”

Dalio: “You simmer down over there, you wet-behind-the-ears no good cocky lil quant!”

Browne: “Wait a minute. Isn’t that Nomadic Samuel – the guy who tags everyone in tweet storms? I heard about that on the most recent episode of Pirates Of Finance.”

Mystery Quant: “Nah. I’m not below the level of pond scum. I wouldn’t try an outdated growth hack like that.”

Browne: “Ha! The heck you wouldn’t! You’re such a…”

Dalio: “Enough about Nomadic Samuel. I’m walking outta here if you mention that amateur’s name again.”

Browne: “How original, Ray!”

Mystery Quant: “Yeah, Ray. Ya got somethin’ better to do? Got some bonds to lever back home?”

Dalio: “Fine. I’ll stick around a ‘lil while yet. Don’t you dare diss my levered bonds that way ever again!”

Hammering Out The Equity Sleeve

Mystery Quant: “OK. So, we’ve pissed away the first hour exchanging barbs and pleasantries. Time’s a tickin’. We gotta hammer out our equity sleeve. I’m thinking 55% multi-factor long momentum, value, quality, size whilst short…”

Dalio: “Hold it right there. You ain’t stretching the equity sleeve beyond 30%.”

Browne: “You better believe it! I’m thinking more along the lines of 25%.”

Mystery Quant: “Are you kidding me? We’ve gotta factor optimize and at least allocate…”

Dalio: “No way!”

Mystery Quant: “I’m pulling out my veto card right here and now! If you’re gonna throttle my equity optimization strategies, I’m at least going to return stack some managed futures and…

Browne: “Return stack? What the flying furnace is that all about?”

Mystery Quant: “‘Return stacking’ is a term coined by Rodrigo Gordillo and Corey Hoffstein where you “stack” uncorrelated asset classes/strategies with the intention of enhancing risk management and potentially boosting returns.”

Dalio: “Come up with your own darn ideas!”

Browne: “That’s rich, coming from you!”

Mystery Quant: “Fine. We’re expanding the canvas of our portfolio. Otherwise, I’m just going to invest everything in the Cockroach Portfolio.”

Dalio: “The $fdud, did you just say?”

Browne: “I think he said the Cockroach Portfolio. You buggin’ out over there?”

Mystery Quant: “Nah, it’s a more modern and sophisticated take on merely the long-only asset allocation portfolios you guys are known for. It plays both offence and defence and isn’t just long GDP with its sophisticated approach to…”

Dalio: “Cool your engines! You get your “return stacking” but we’re throttling the equity sleeve at 30%. What do you think, Harry?”

Browne: “Yeah. Good enough for me. And none of that multi-factor non-sense either. It’s US equities or go take a hike!”

Mystery Quant: “Fine. It’s return stacked managed futures and market neutral or I’m meandering on out of here.

Gold-ilocks & Cash Is Trash

Mystery Quant: “Ray, your portfolio is a cluster-schmuck for the ages. Awkward 7.5% slices of this, 40% of that, 15%…”

Dalio: “Keep your mouth shut! What have you, accomplished? You nobody quant!”

Browne: “Symmetry, Ray. 4 quadrants. I’ll repeat it again. 4 equal slices….”

Dalio: “Ha! Gold-ilocks! Who on earth allocates 25% to gold? And don’t even get me started with your cash is trash…”

Mystery Quant: “LOL! Cash? Gold? What are you guys some kinda throwbacks from the 20th century? Ya’ll cavemen! Modern day asset allocation doesn’t afford any space…”

Browne: “You hold it right there cocky ‘lil quant! I’m pulling out my veto card. No cash? No gold? And I’ll go back to being…”

Dalio: “I agree with a bit of gold! But 25% is a damn crime!”

Mystery Quant: You’re both making me sick over here. But we’ve only got 2 hours left to figure out this defensive portfolio. Harry, are you cool with 10% cash and 10% gold?

Browne: It’s not nearly enough but I’ll take it.

Dalio: Deal.

Dalio’s Dastardly Deed: Levered Bonds

Dalio: Boyz, I’m pre-emptively pulling out my veto card. It’s levered…”

Mystery Quant: “Ray, we get it.”

Browne: “Yup.”

Dalio: “But I want at least 55%…”

Mystery Quant: “No freakin’ way!”

Browne: “We’re cutting you off at 50%. It’s double what I’d personally…”

Dalio: “Argh!”

Mystery Quant: “You’ve got your levered bonds? What more could you want?

Dalio: “55%!”

Browne: “You’re not getting that!”

Mystery Quant: “We’ve only got 15 minutes to submit our portfolio proposal! Quick, let’s figure this all out.”

Dalio: “Wait. What’s that non-sense I see you’ve got loaded up on your phone? Why do you have Twitter open? You’ve tagged at least 20 people! What the “fill-in-the-blank” is wrong with you?”

Browne: “Ah-hah! Only one kind of loser would do such a thing! It is Nomadic Samuel! You sneaky lil…”

Dalio: “Ha, you epic fool! @choffstein is going to unfollow you for sure!”

Mystery Quant (revealed as Nomadic Samuel): “No! Please, @choffstein just give me one more chance! I can change. I can turn things around. I promise. I’m really not that kinda…”

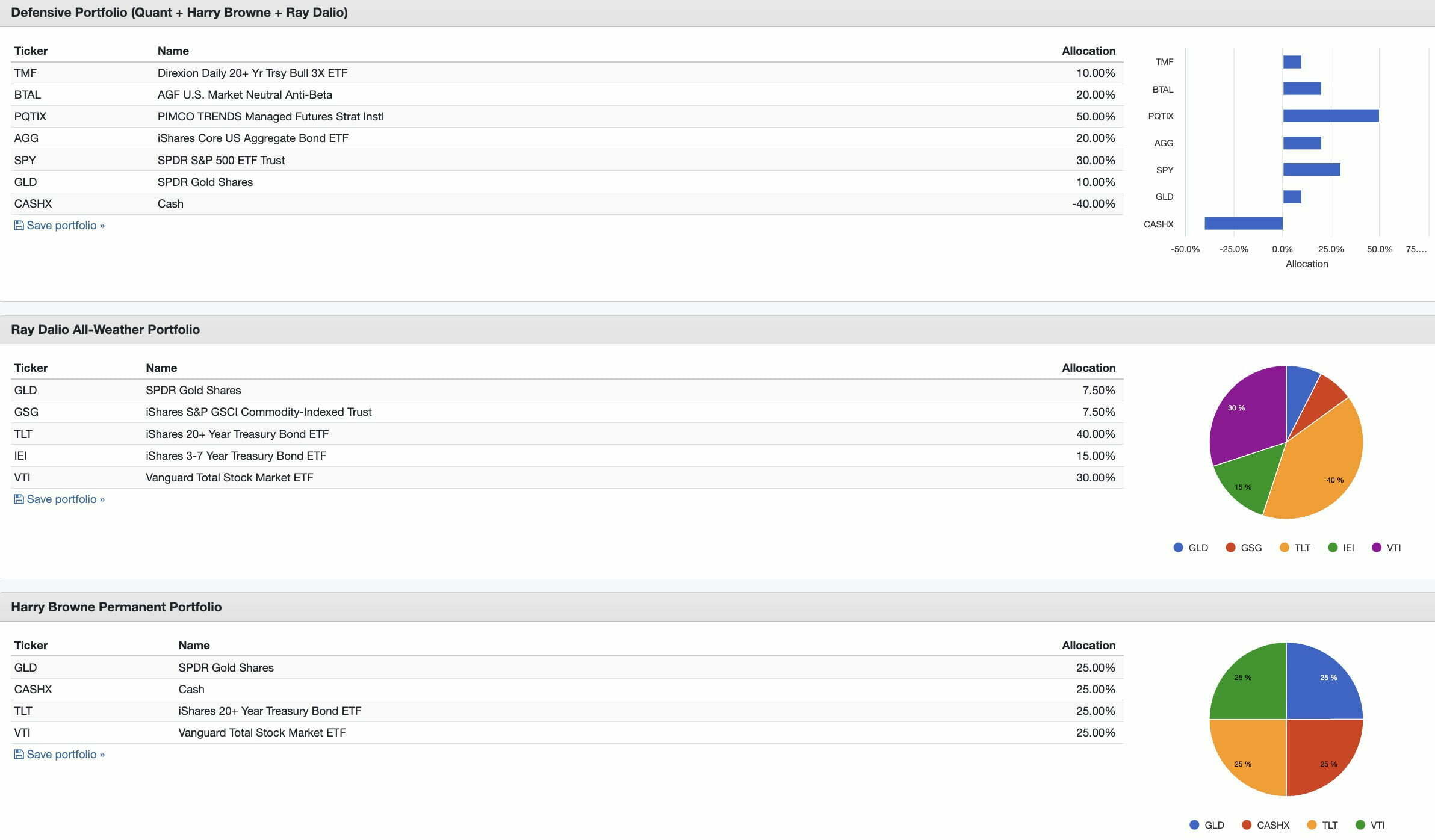

Ray Dalio All Weather + Harry Browne Permanent Portfolio + Quant Strategies = Defensive Portfolio?

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Well, hopefully that ridiculous attempt at some light-hearted humour didn’t just melt your brain.

Let’s see what an “everybody has to compromise” Ray Dalio plus Harry Browne plus Quant Strategies so-called “Defensive Portfolio” might look like.

Fortunately, we’ve got some great building blocks to work with in order to fulfil the following mandate:

- 30% US Equities (Dalio & Browne)

- 10% Gold + 10% Cash (Browne)

- 50% Bonds (Dalio)

- Expanded Canvas with Managed Futures + Market Neutral (Quant)

Let’s toss the ingredients into the blender:

- 30% Return Stacked US Equities and Managed Futures (100/100)

- 20% Return Stacked Bonds and Managed Futures (100/100)

- 10% Levered Long-Term Treasury (3X)

- 10% Gold

- 10% Cash

- 20% Market Neutral Anti-Beta

What does exactly does that look like?

- 30% RSST??? (ticker TBD & fund launching later this year)

- 20% RSBT

- 10% TMF

- 10% GLD

- 10% CASHX

- 20% BTAL

Overall, we’d have the following exposures:

- 30% US Equities

- 50% Bonds (20% AGG + 3X LT Treasury)

- 50% Managed Futures

- 10% Gold

- 10% Cash

- 20% Market Neutral Anti-Beta

How Does The “Compromise” Defensive Portfolio Perform?

Ya’ll know what time it is!

It’s time for a freakin’ back-test!

Let’s see how this mishmash defensive portfolio does against the classic ones.

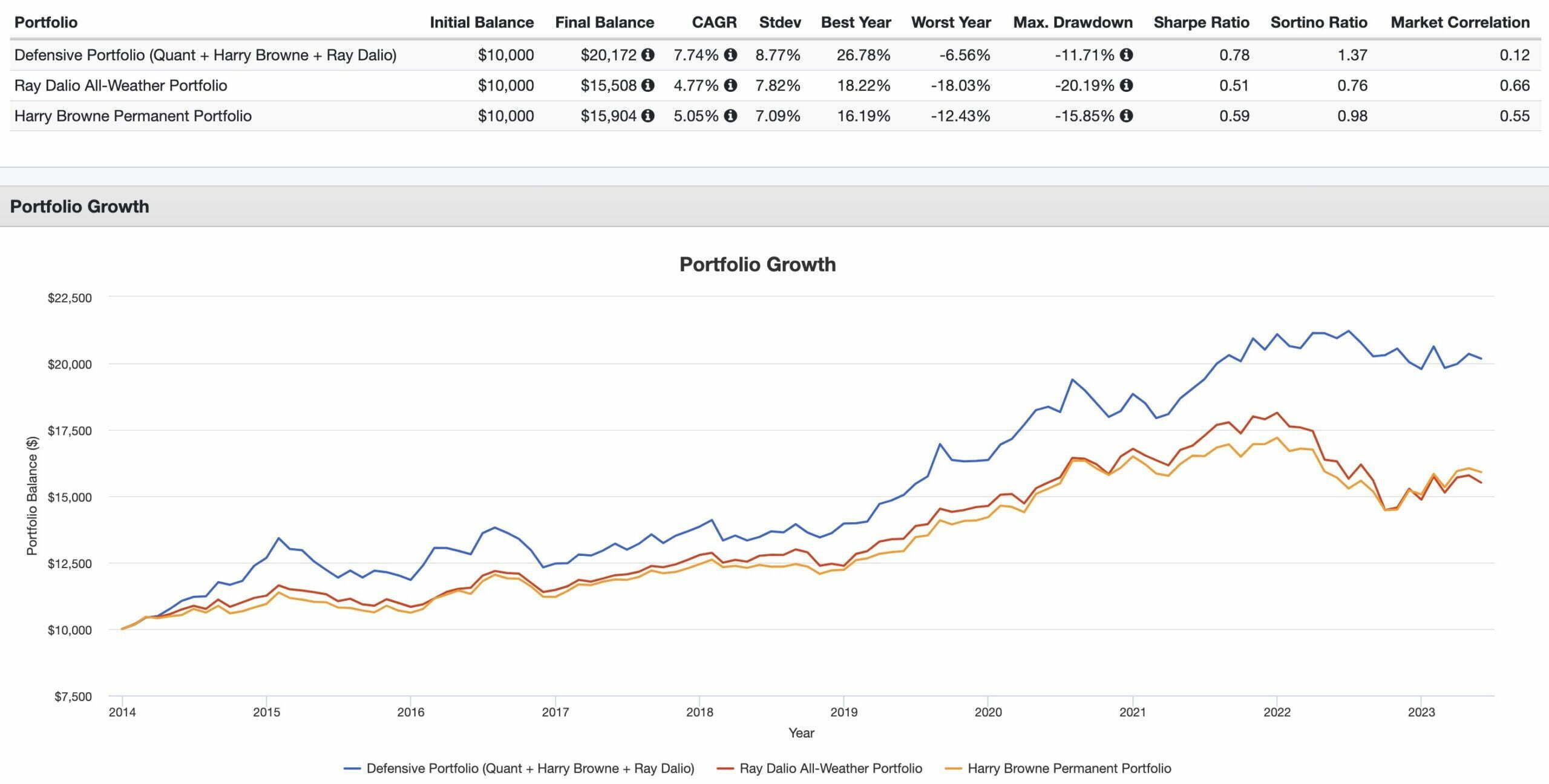

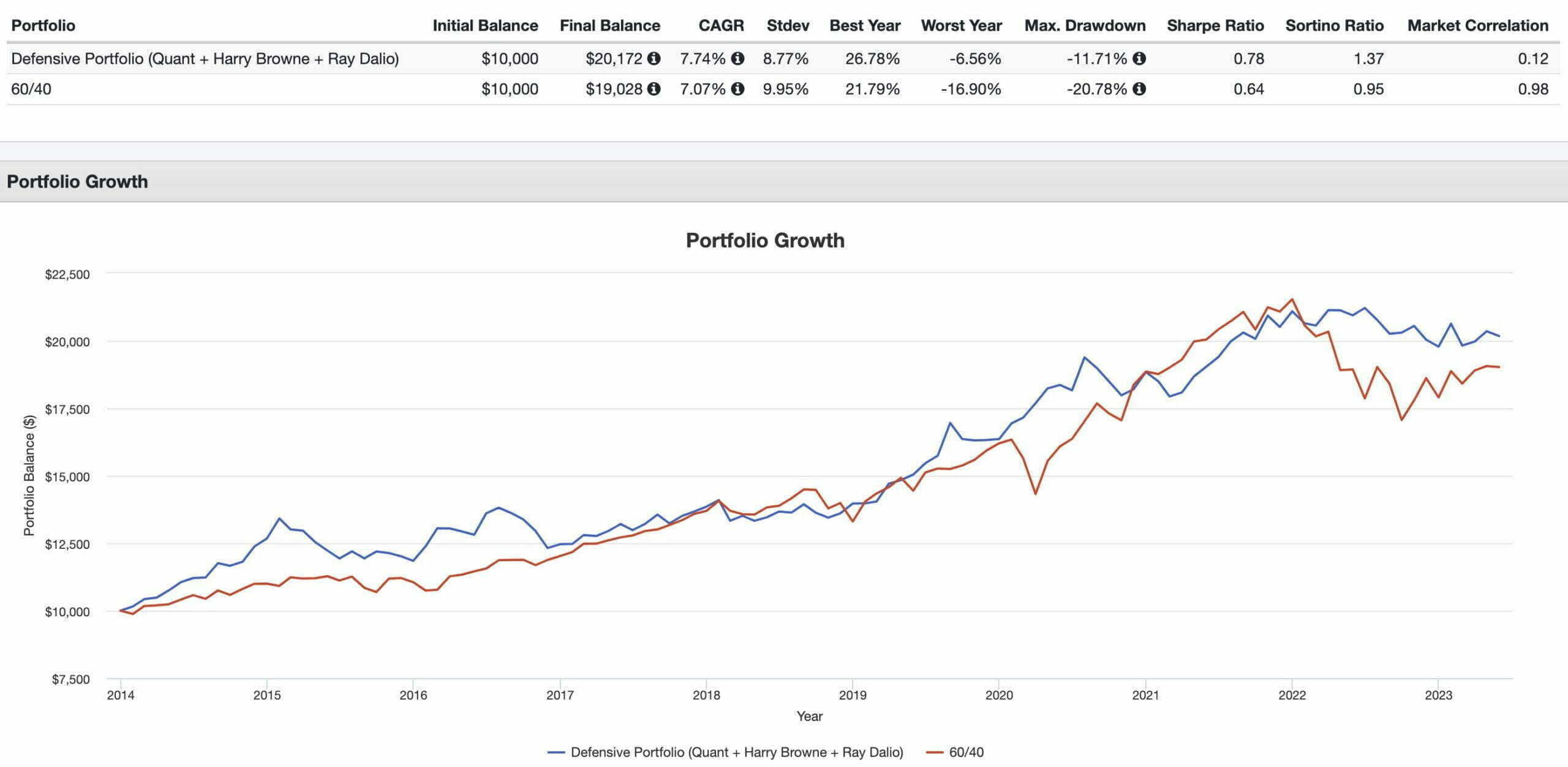

We’re going to compare it head to head versus the Ray Dalio All-Weather Portfolio and Harry Browne Permanent Portfolio as far back as we can go.

If you’re not familiar with those two portfolios let’s check them out quickly:

Ray Dalio All-Weather Portfolio

- 30% US Equities

- 40% Long-Term Treasury

- 15% Intermediate-Term Treasury

- 7.5% Gold

- 7.5% Commodities

Harry Browne Permanent Portfolio

- 25% US Equities

- 25% Long-Term Treasury

- 25% Gold

- 25% Cash

Defensive vs Harry Browne vs Ray Dalio Performance Summary

CAGR: 7.74% vs 4.77% vs 5.05%

RISK: 8.77% vs 7.82% vs 7.09%

WORST YEAR: -6.56% vs -18.03% vs -12.43%

MAX DD: -11.71% vs -20.19% vs -15.85%

SHARPE: 0.78 vs 0.51 vs 0.59

SORTINO: 1.37 vs 0.76 0.98

CORRELATION: 0.12 vs 0.66 vs 0.55

The results are impressive across the board for the hybrid quant + traditional defensive portfolio.

It spends the entire time outperforming both the Ray Dalio All-Weather and Harry Browne Permanent Portfolio.

If you feast your eyes upon the results (2022) you’ll notice the adaptive managed futures plus market neutral strategies really helped weather the storm whereas the classic long-only portfolios had their worst year on record this century.

It’s once again capital efficiency and maximum diversification for the win.

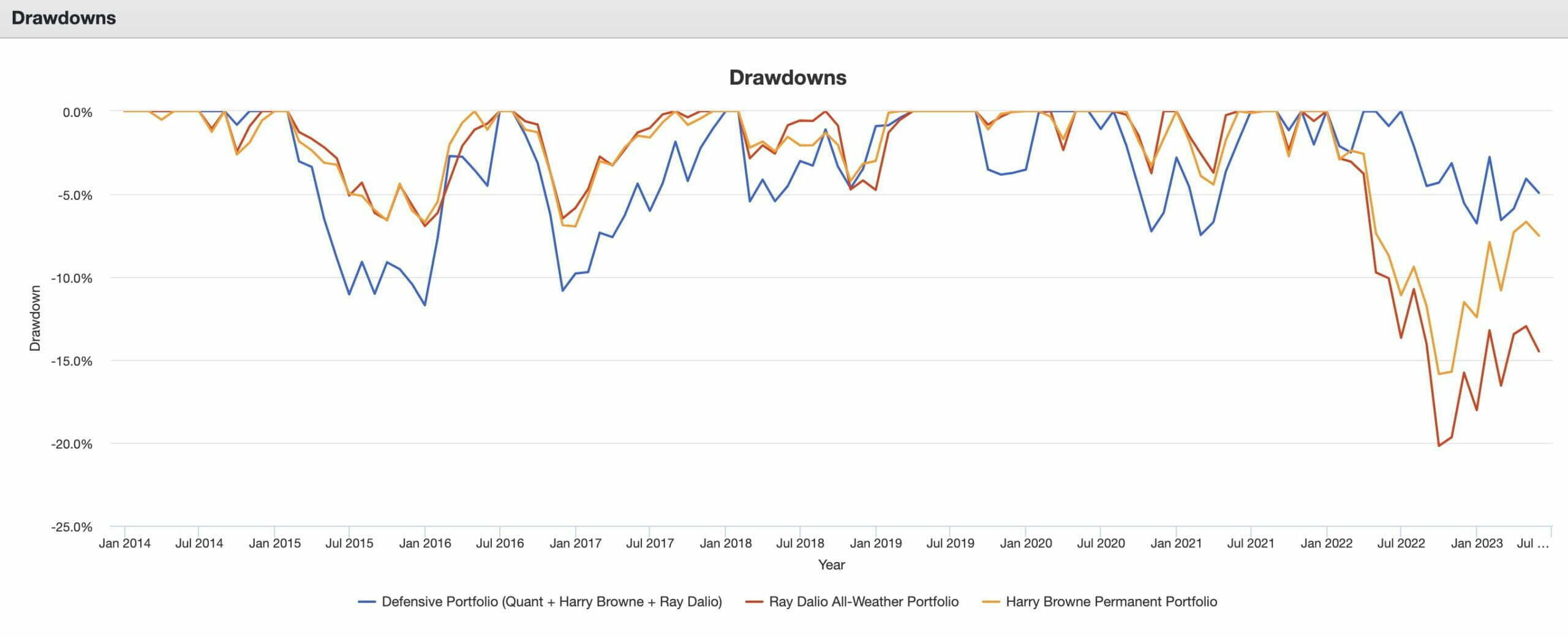

But how does this compare with the classic 60/40?

Defensive vs 60/40 Portfolio

CAGR: 7.74% vs 7.07%

RISK: 8.77% vs 9.95%

WORST YEAR: -6.56% vs -16.90%

MAX DD: -11.71% vs -20.78%

SHARPE: 0.78 vs 0.64

SORTINO: 1.37 vs 0.95

CORRELATION: 0.12 vs 0.98

So we’ve also outperformed a 60/40!

Hooray!

But it’s not clear outperformance though.

With a portfolio that has only 0.12 market correlation there is massive tracking error and you’ll notice the 60/40 pulling ahead in 2021.

That’s something you’ve got to live with if you’re assembling a portfolio that is massively diversified and different from the classic mainstream configurations.

Leverage To Build A More Defensive Portfolio?

The point I want to hammer home with this article is that leverage can be utilized to build a more defensive portfolio.

Most amateur investors (myself included) are enamoured exploring more aggressive configurations.

But you can turn your attention towards constructing a more defensive mandate as well.

It’s not one over the other.

It’s the correct shoe (portfolio mandate) to fit the specific foot of the given investor.

If you’ve got low risk tolerance you can expand the canvas of your portfolio to create space for defensive asset classes and strategies.

Here is a brief checklist of what aids you in this process:

- Shave Your Equities Down Below 60% + Increase Your Bond Allocation (equal to or greater than your equities)

- Add Adaptive Strategies With The Potential For Crisis Alpha (Managed Futures)

- Hedge Against Severe Market Drawdowns (M/N Anti-Beta or TAIL [OTM PUT] strategies)

- Don’t forget about the OG Diversifiers (Gold and Cash)

Nomadic Samuel Final Thoughts

I want to extend a special thanks to some of the fine gentlemen mentioned in this article.

Firstly, Harry Browne and Ray Dalio have contributed immensely to opening the eyes of investors (both amateurs and pros) to the benefits of diversification and thinking outside of the box.

Secondly, I’ve learned a great deal from Corey Hoffstein, Jason Buck and Rodrigo Gordillo!

You can follow them all on Twitter (by clicking on their names above) where they frequently share podcasts, papers and other resources for investors of all backgrounds.

And that’s all I’ve got for today.

Hope all of you had a great weekend!

Ciao for now.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.