It’s time for the clash of the Titans!

We’re comparing the two most famous long-only asset class portfolios known for their balance, risk management and overall diversification levels that put them miles ahead of an industry standard 60/40 portfolio.

If you haven’t guessed it already, we’re comparing the Ray Dalio All Weather Portfolio versus the Harry Browne Permanent Portfolio.

Many consider these two classic portfolio configurations to be the most all-season, resilient and robust long-only portfolios.

I’m honestly hard pressed to think of two portfolios that have had a bigger influence on investors of all backgrounds, experience levels and pedigrees.

And you’ve got hardcore fans on both sides!

Some will go to the ends of the earth to toot the horn for Ray whereas others are staunch admirers of Harry.

It’s quite honestly fascinating.

One of the most popular tweets from my @NomadicSamuel twitter account (which I’ve lost control over – @nomadicsammy is what I’m using for the time being) was a poll I did asking investors which portfolio they liked better.

Here are the results:

I'm writing an article I'm excited about:

— Nomadic Samuel (@NomadicSamuel) November 26, 2022

"Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio"

Many consider these 2 classic configurations to be the most all-season, resilient & robust long-only portfolios.

My question to you is which one do you like more?

So how exactly are we going to compare the strengths and weaknesses of the Ray Dalio All Weather Portfolio versus the Harry Browne Permanent Portfolio head to head?

I thought we’d zero in on the following 6 categories:

1) Overall Strategy

2) Portfolio Design

3) Branding

4) Long-Term Performance

5) Risk Management

6) Adaptability For Modifications

We’ve got a lot to cover so let’s get crackin’!

Comparing the Ray Dalio All Weather Portfolio Versus the Harry Browne Permanent Portfolio Head To Head

Hey guys! Here is the part where I mention I’m a travel content creator as my day job! This investing opinion blog post is entirely for entertainment purposes only. Most investors should not use leverage in any way, shape or form. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Overall Strategy: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

Firstly, before we can compare the two portfolios head to head we need to lay the cards down on the table.

Let’s examine the two portfolios in their full configurations.

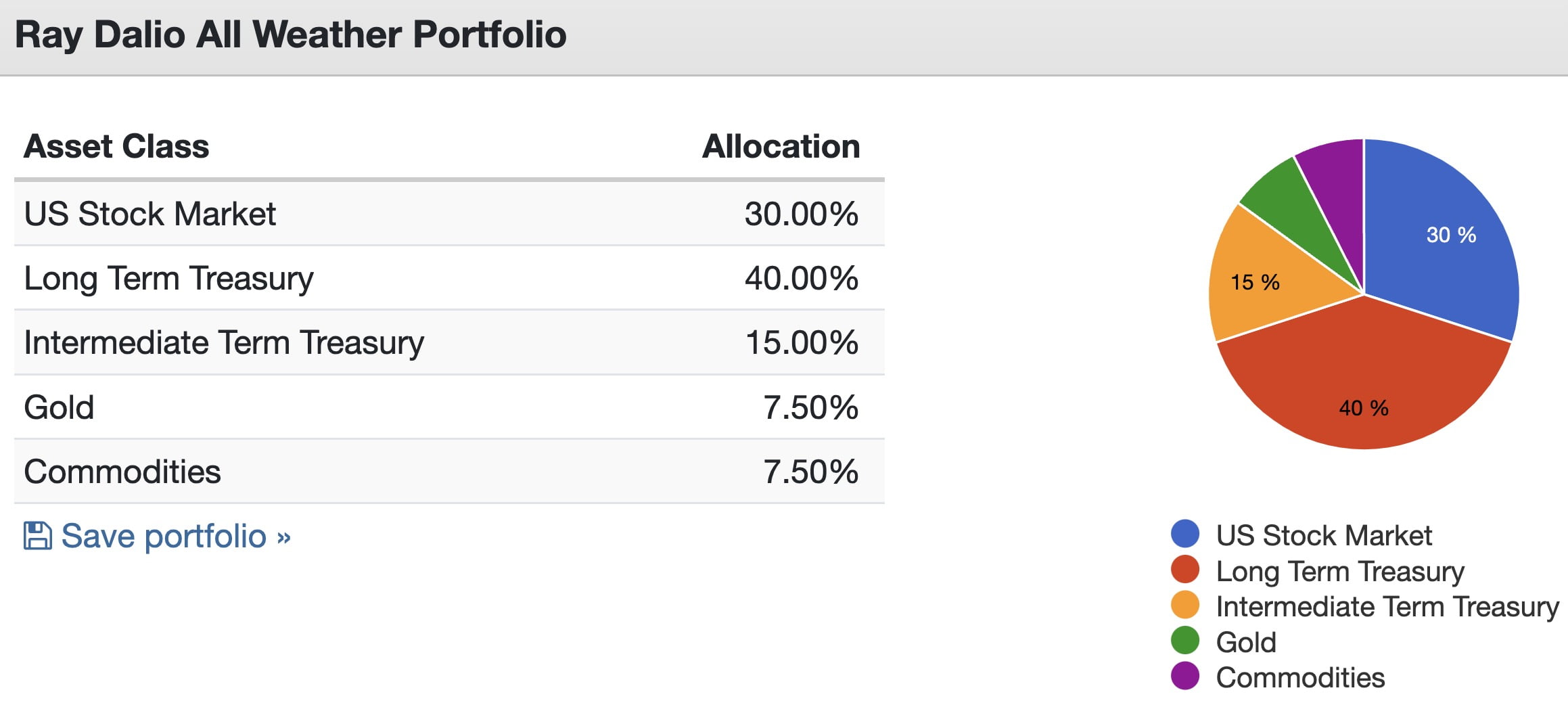

We’ll start with the Ray Dalio All Weather Portfolio:

Ray Dalio All Weather Portfolio Asset Allocation

30% US Total Stock Market

40% Long-Term Treasury

15% Intermediate-Term Treasury

7.5% Gold

7.5% Commodities

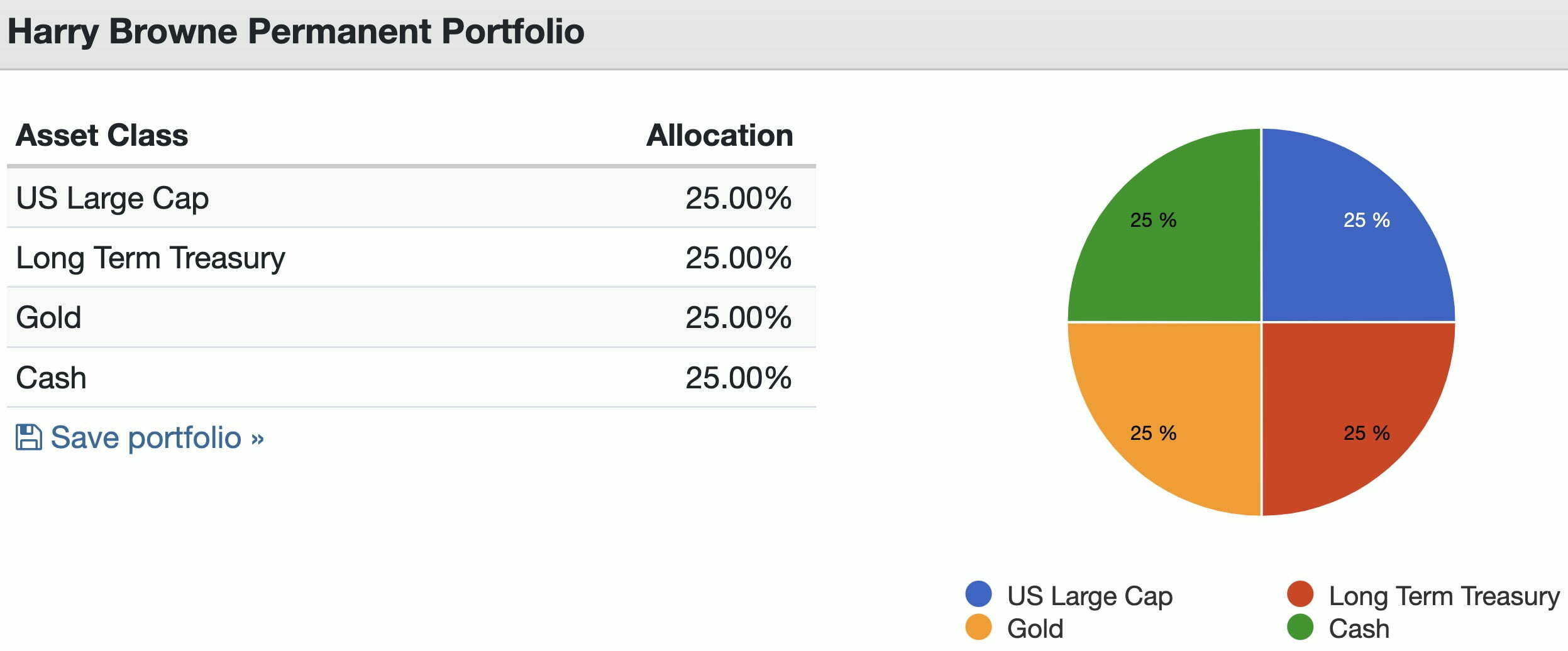

And now let’s move on to the Harry Browne Permanent Portfolio:

Harry Browne Permanent Portfolio

25% US Stocks

25% Long-Term Treasury

25% Gold

25% Cash

In many regards they’re both diversification masterpieces!

Here are four ways they rank ahead of the industry standard 60/40 portfolio from a diversification and risk management standpoint:

- Reduced Equity Exposure (30% and 25% respectively versus 60%)

- Equal Or Greater Parts Allocation To Bonds

- Alternative Sleeve (Gold for both, Commodities for Ray Dalio and Cash for Harry Browne)

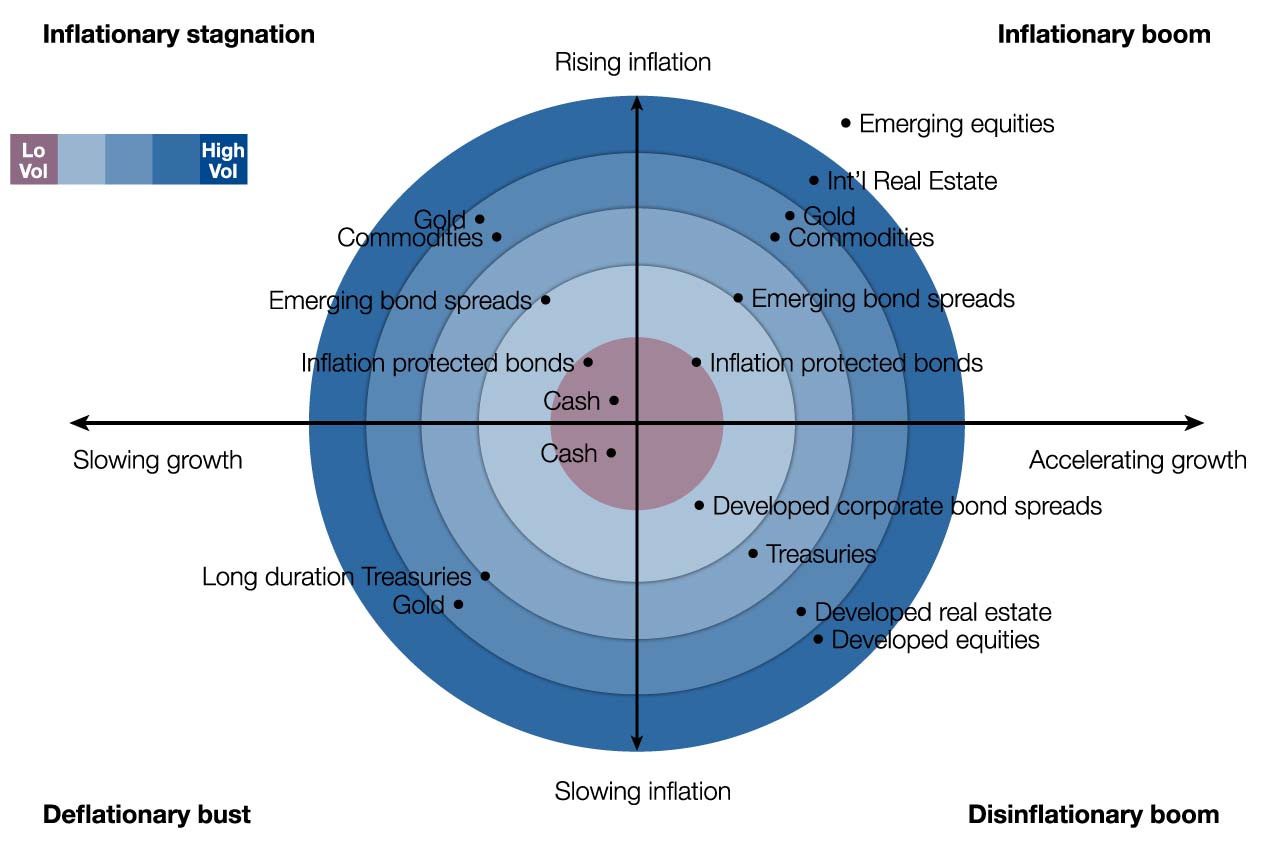

The idea here is that the two classic long-only portfolios are prepared for all economic regimes whereas the 60/40 is mostly designed for growth and deflationary environments.

Here are the possible four economic environments:

- High Growth / High Inflation = Inflationary Boom

- Low Growth / High Inflation = Inflationary Stagnation

- High Growth / Low Inflation = Disinflationary Boom

- Low Growth / Low Inflation = Deflationary Bust

The fine folks over at Invest ReSolve have designed the best chart to explain the four economic outcomes and asset classes that thrive during each of those given regimes.

It’s painstakingly obvious to see how a 60/40 portfolio isn’t prepared for inflationary stagnation and deflationary bust.

The Ray Dalio All Weather Portfolio and Harry Browne Permanent Portfolio are well equipped for such environments.

In a head to head battle between the two portfolios it’s hard to come up with a winner here.

You’ve got zero ego balance of the Harry Browne Permanent Portfolio with its equal slices versus the more bond-centric Ray Dalio All Weather Portfolio.

Both portfolios tame the equity sleeve and therefore reduce the overall risk of the portfolio.

Both have Gold as a diversifier.

And then it’s cash versus commodities.

It’s such a close call here that I’m going to call this a tie.

Both portfolios have been constructed with risk management and overall economic regime readiness as primary goals.

And both are excellent in this regard.

So this is a tie.

Winner: Tie Between the Ray Dalio All Weather Portfolio and Harry Browne Permanent Portfolio

Portfolio Design: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

When it comes to portfolio design it’s a no-brainer who wins this round!

Can you guess?

It’s the Harry Browne Permanent Portfolio by a landslide and then some.

It’s beautifully designed with its 25% slices that provide an ego free allocation to four distinctly different asset classes that are easy enough to remember.

25% Stocks

25% Bonds

25% Gold

25% Cash

You could explain this portfolio to a pedestrian on the street who would rather visit the doctor or dentist than talk about investing strategy.

And within minutes they’d likely understand what is going on.

Cash and Gold are pretty self explanatory.

Next you’d just have to inform them that stocks are a small sliver of ownership in a company and bonds are basically loans.

Boom.

You’re done.

Remember those 4 things and you’re good to go with a balanced portfolio.

On the other hand, the Ray Dalio All Weather Portfolio consists of awkward 7.5% slices amongst other things.

30% US Equities

40% Long Term Treasury

15% Intermediate Term Treasury

7.5% Gold

7.5% Commodities

Instantly, I’m craving to tidy this up a little bit.

And I’m quite honestly a messy person who is known for having an uncanny ability to turn a hotel room into a pigsty in no time flat!

30% Equities

30% Long Term Treasury

20% Intermediate Term Treasury

10% Gold

10% Commodities

Now that’s a lot cleaner and still keeps with the spirit in my humble opinion.

Regardless, when it comes to design it’s Harry Browne all day every day.

Winner: Harry Browne Permanent Portfolio

Branding: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

When we compare the Ray Dalio All Weather Portfolio versus the Harry Browne Permanent Portfolio from a branding perspective things really get interesting.

The “All Weather” monicker has permeated the consciousness of the investing industry in a manner that is totally unrivalled.

Those who specialize in constructing risk parity portfolios almost inevitably refer to their approach by dropping in “all weather” at some point in the conversation whether they’re consciously aware of it or not.

It’s branding that signifies strength, durability and preparedness.

It’s been adapted and coopted by certain funds seeking to convey a robust product offering either in a direct or indirect manner:

- HGER ETF – Harbor Commodity All-Weather Strategy ETF (HGER)

- Waypoint All Weather Alternative Fund

- Standpoint Multi-Asset Fund: “A mutual fund for U.S. investors seeking an all-weather investment solution.”

On the other hand the “permanent portfolio” is quite clever too from a branding point of view.

Having the capacity to be “over and done with” when it comes to asset allocation is certainly appealing.

Permanently allocating to your four core strategies with neat 25% slices and then moving on with your life offers a stress-free form of portfolio construction.

However, it hasn’t penetrated quite the way “all-weather” has and for that reason I’m of the opinion “all-weather” is superior branding.

Winner: Ray Dalio All Weather Portfolio

Long-Term Performance: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

So we’ve discussed a number of topics related to these two classic portfolios but we’ve yet to discuss performance.

Let’s examine that now.

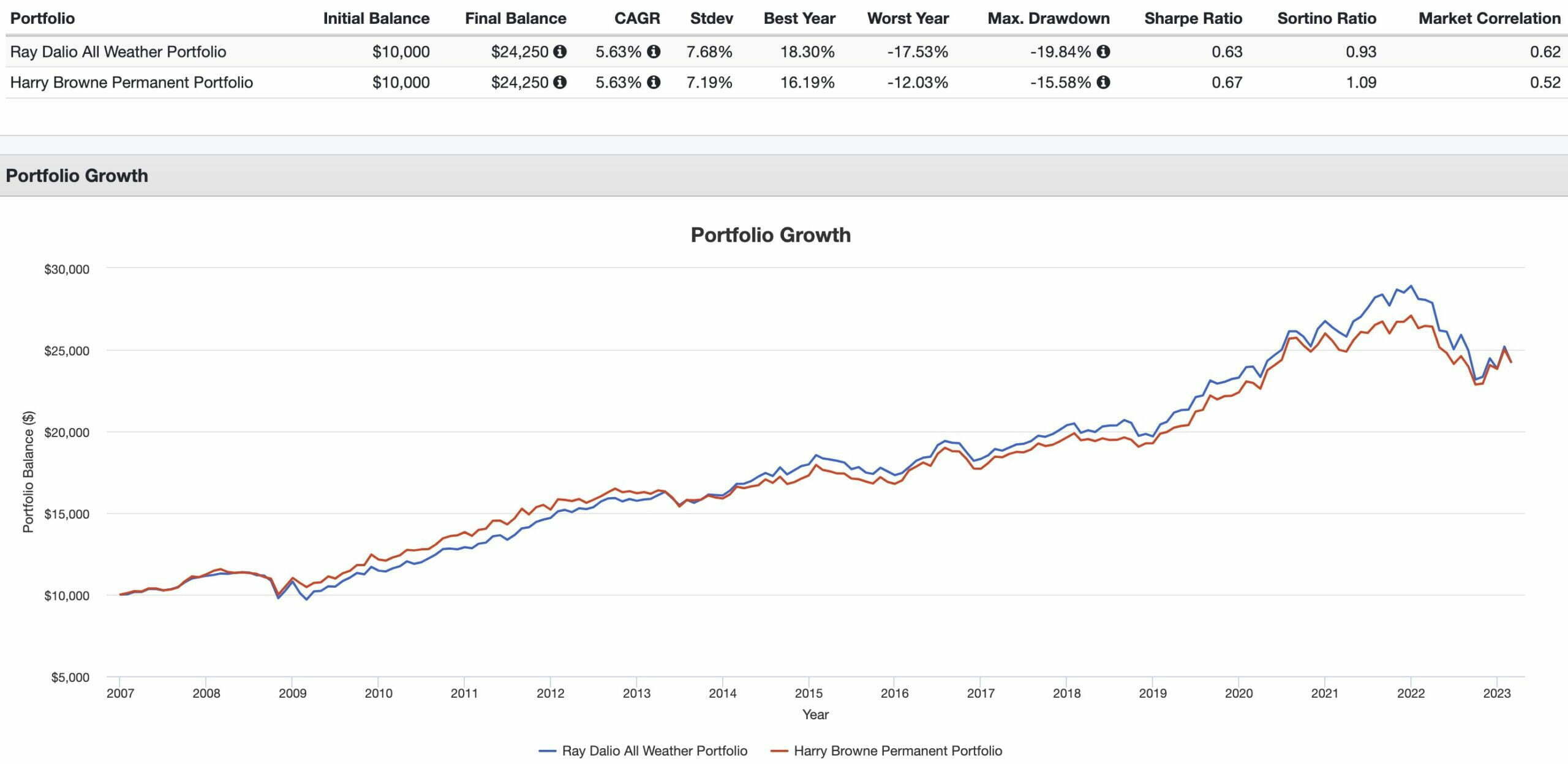

Ray Dalio All Weather Portfolio versus Harry Browne Permanent Portfolio Performance Summary

CAGR: 5.63% vs 5.63%

RISK: 7.68% vs 7.19%

BEST YEAR: 18.30% vs 16.19%

WORST YEAR: -17.53% vs -12.03%

MAX DRAWDOWN: -19.84% vs -15.58%

SHARPE RATIO: 0.63 vs 0.67

SORTINO RATIO: 0.93 vs 1.09

MARKET CORRELATION: 0.62 vs 0.52

LOL!

Quite honestly I couldn’t have imagined a scenario where both the Ray Dalio All Weather Portfolio and the Harry Browne Permanent Portfolio have the exact same CAGR (5.63%) as far back as we can rewind the clock!

What trips us up from going all the way back to 1978 is commodities.

It’s noteworthy that the Ray Dalio All Weather Portfolio was outperforming the Harry Browne Permanent Portfolio up until 2022.

A catastrophic year for bonds evened the score and also ensured that these two classic portfolios (previously only had single digit worst annual years) experienced their worst year in the past 50 years.

If we’re talking about a two to three decade horserace I’d have the Ray Dalio All Weather Portfolio coming ahead for two specific reasons:

- 5% More Equity Exposure (30% vs 25%)

- Bonds having the potential for greater long-term returns than Cash

Thus, I’m going to have the Ray Dalio All Weather Portfolio squeaking out an ever so tight win long-term here.

Winner: Ray Dalio All Weather Portfolio

Risk Management: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

So we’ve zeroed in on performance between the Ray Dalio All Weather Portfolio versus the Harry Browne Permanent Portfolio.

Let’s move on to risk management.

Both portfolios boast of being more regime ready than a 60/40 portfolio with diversifying assets such as gold, commodities, cash and a reduced equity position.

Let’s examine things a bit closer here:

RISK: 7.68% vs 7.19%

WORST YEAR: -17.53% vs -12.03%

MAX DRAWDOWN: -19.84% vs -15.58%

SHARPE RATIO: 0.63 vs 0.67

SORTINO RATIO:0.93 vs 1.09

MARKET CORRELATION: 0.62 vs 0.52

When it comes to managing risk and risk adjusted rates of returns, the Harry Browne Permanent Portfolio is superior.

And that totally makes sense.

It’s less dialled up when it comes to its bond exposure and takes a slightly reduced equity position at 25% versus 30%.

Cash as an extra diversifier is considerably less volatile than commodities.

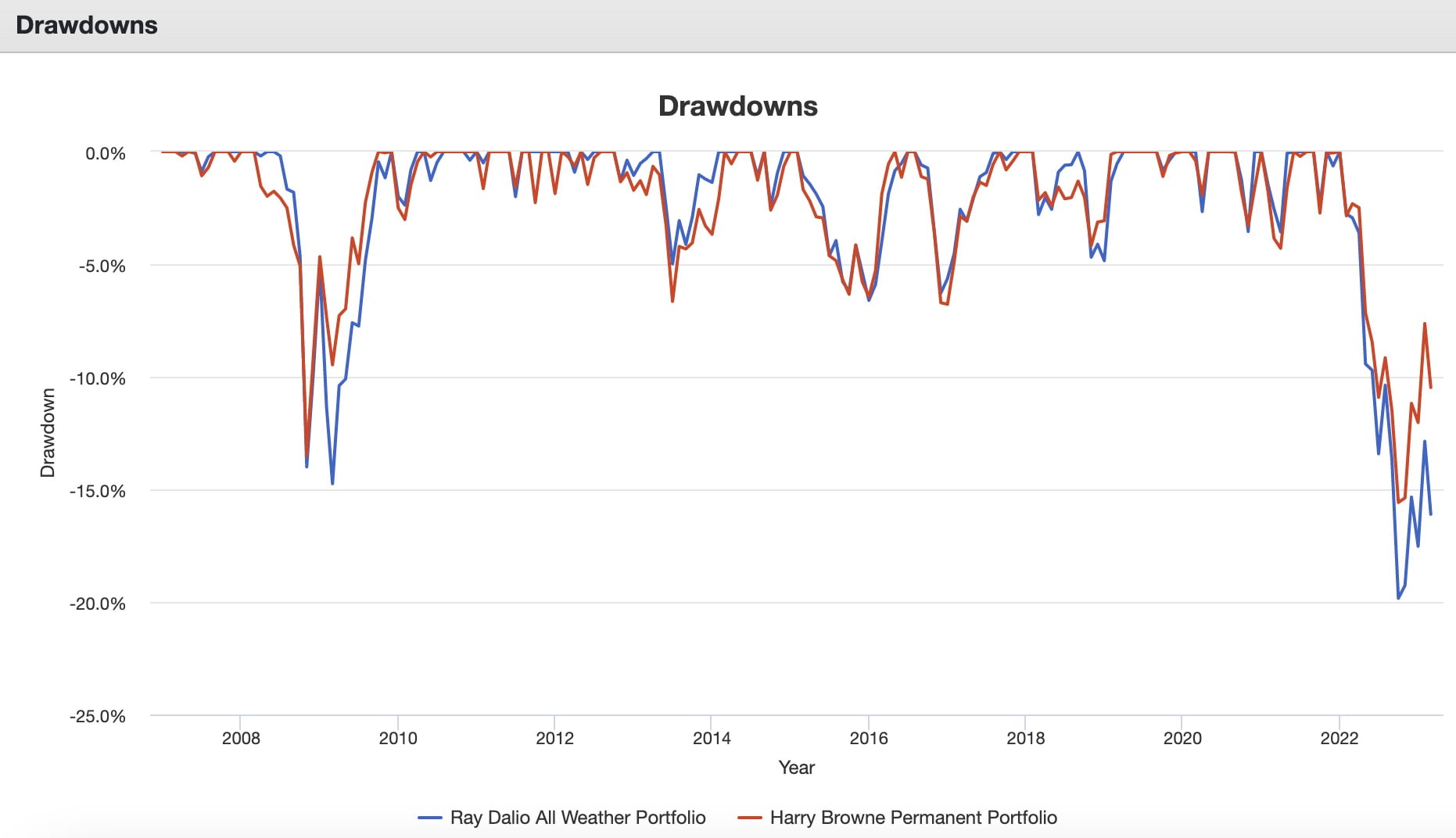

Drawdowns For The Ray Dalio All Weather Portfolio Compared With The Harry Browne Permanent Portfolio

Here we’re able to clearly see that the Harry Browne Permanent Portfolio was better equipped to handle the onslaught of a challenging 2022 year better than the Ray Dalio All Weather Portfolio.

It’s pretty darn close though between the two.

Hence, it’s an ever so slight win for the Harry Browne Permanent Portfolio.

Winner: Harry Browne Permanent Portfolio

Adaptability For Modifications: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

When it comes to adapting the Ray Dalio All Weather Portfolio and the Harry Browne Permanent Portfolio one clearly offers an easier template to modify.

The awkward 7.5% slices and 55% overall bond allocation of the Ray Dalio All Weather Portfolio provides obstacles for investors looking to create a clean reinterpretation of the portfolio.

That’s not to say it isn’t possible though!

I’ve written two articles on the subject matter just recently:

- How To Create A More Defensive Ray Dalio All Weather Portfolio

- Expanded Canvas Ray Dalio All Weather Portfolio: A Capital Efficient Maximum Diversification Masterpiece?

But when you compare it with the balance, harmony and tidy structure of the Harry Browne Permanent Portfolio it’s not even close to being in the same league.

What exactly do I mean by that?

Well, let’s consider some reinterpretations of it.

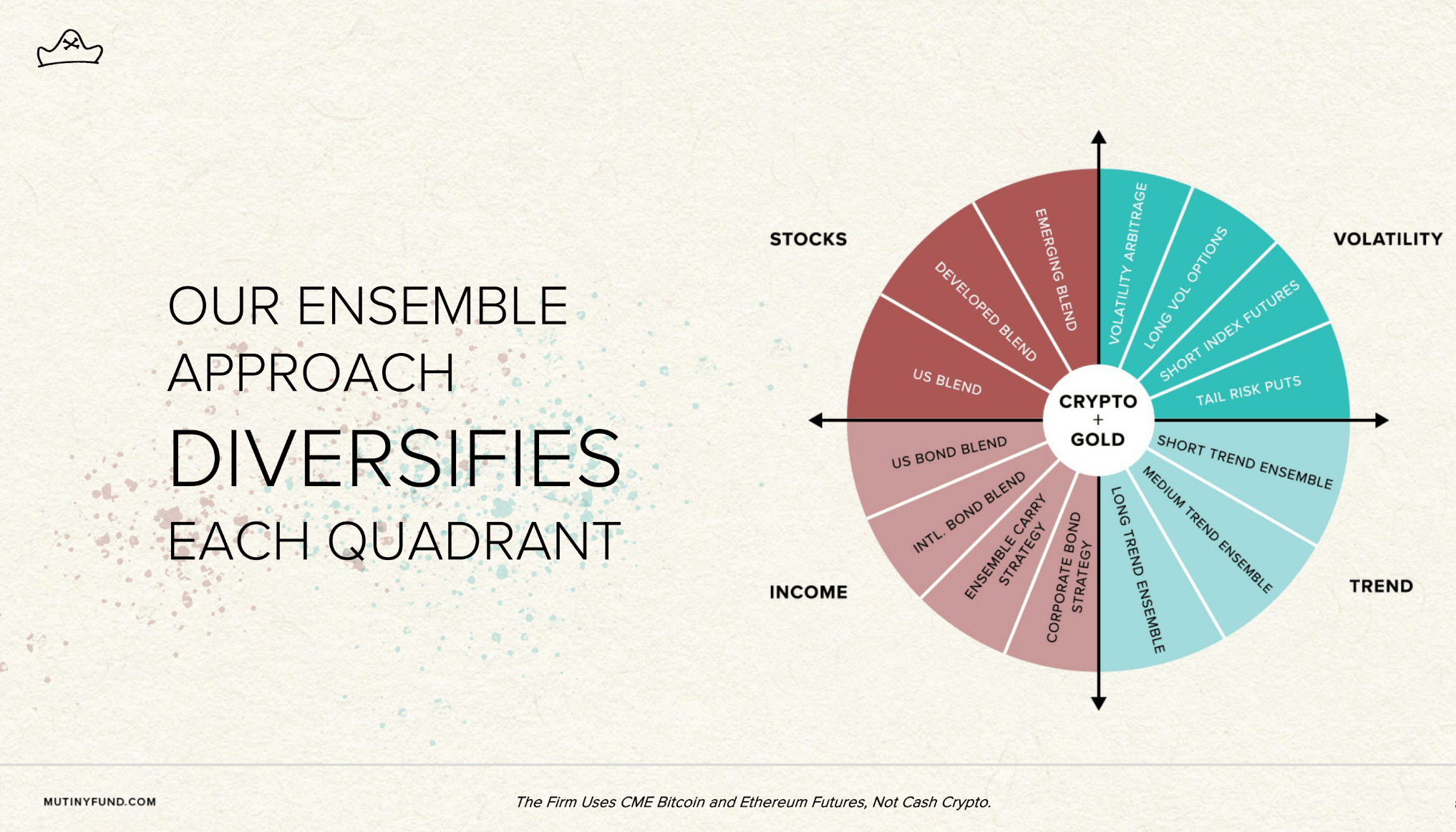

The Cockroach Portfolio is a perfect example of a “modern take” that was influenced and inspired by the Harry Browne Permanent Portfolio.

It adheres to the overall balance of the 25% equal partitions.

However, the Cockroach Portfolio brings forth an adaptive managed futures strategy and an ensemble long-volatility strategy as opposed to the significant slabs carved out just for gold and cash.

It’s a combination of classic long-only asset allocation and adaptive strategies that provides a unique offensive and defensive approach.

The Cockroach Portfolio attempts to be the “least shitty portfolio” by taking a balanced, harmonious and ego free approach to asset allocation with a refreshingly humble viewpoint that “we’re not able to know the future” and thus we ought to prepare for all potential outcomes.

It’s should be abundantly clear at this point that it’s easier to work with the framework of the Harry Browne Permanent Portfolio when it comes to adaptations and potential enhancements.

Winner: Harry Browne Permanent Portfolio

Overall Winner: Ray Dalio All Weather Portfolio vs Harry Browne Permanent Portfolio

Overall, this was a close race between the two classic risk balanced portfolios.

Both the Ray Dalio All Weather Portfolio and the Harry Browne Permanent Portfolio have some clear pros and cons when compared on a head to head basis.

You’d be hard pressed to find two other portfolios that have had a greater influence on investors.

However, if push came to shove I’m going to have to give the edge to the Harry Browne Permanent Portfolio.

Its design is superior and easier to adapt.

For instance, if I had to work with the framework of 25% sleeves I’d likely do something along these lines:

- 25% Global Equities (Min Vol and Factor Focused)

- 25% Global Bonds (Diverse Range of Durations and TIPs)

- 25% Managed Futures (Trend-Following plus other Strategies)

- 25% Alternative Other (Gold + Arbitrage + L/S Equity + Market Neutral + Options)

Nomadic Samuel Final Thoughts

Both the Ray Dalio All Weather and Harry Browne Permanent Portfolio have had a profound impact on investors of all backgrounds and experience levels.

I firmly believe they’ll continue to inspire generations well into the future.

However, that doesn’t mean they’re perfect or can’t potentially be improved or enhanced.

They provide an excellent framework for modern portfolio construction if you take the best of their features from a long-asset class perspective and combine them with more adaptive strategies such as managed futures.

But at this point in the article I’m more curious about what you have to say.

Are you a fan of the Ray Dalio All Weather Portfolio and/or the Harry Browne Permanent Portfolio?

Which Portfolio (these two or others) has inspired you the most on your investing journey?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.

very kind of you to share so much relevant information, but I still feel lost the content is deep for me.

I am not a fan of either of the portfolios. They are both ridiculous. Using 2007 as a starting point, S&P 500 beats both with respect to CAGR. Note that by starting in 2008, the mortgage meltdown is included in the comparison. Even so, 100% equity beat those two stupid concoctions.

Weather: 6.06%, Permanent: 6.18%, S&P 500 9.48%

Now… change the comparison start date to 2009 and the difference is even more profound.

Weather: 5.99%, Permanent: 6.16%, S&P 500: 13.87%

It never ceases to amaze me that people give diversified portfolios any credence at all. S&P 500 beats all diversified portfolios.

All data comes from Portfolio Visualizer.

Sure – if you’re willing to accept short-to-medium term volatility and have enough lifespan left to ride out the lows. Not so good if your elderly and may need to liquidate your assets at a loss to pay for say care home fees. Incidentally, there is evidence that holding a 10-25% position in bonds with the rest in equities will slightly outperform a 100% share portfolio. So I wouldn’t dismiss these portfolios as ‘stupid’ or ‘ridiculous’…