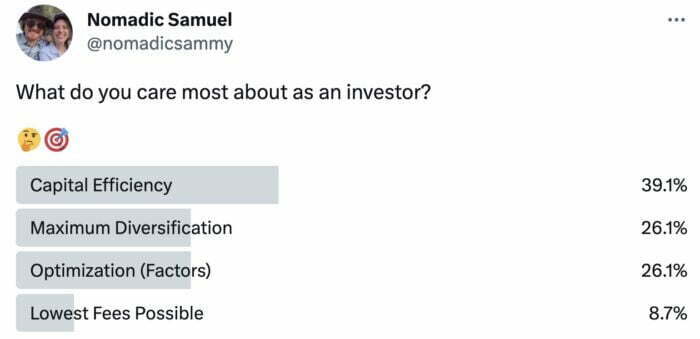

What do you care about most as an investor?

For me it’s a slam dunk no brainer.

It’s all about capital efficiency, baby!

Let me explain.

Imagine a hypothetical buffet that’s been created and customized just for you!

This hypothetical buffet has a memory like an elephant.

It never forgets.

It remembers all of the wonderful baked goods your Grandma made for you as a child to tickle the desire of your premature tastebuds.

Those double fudge brownies you used to pig-out on to the point of nearly drifting off into a diabetic coma.

They’re stacked up and waiting for you to grab at liberty.

It also recalls the hole-in-the-wall cafe you meandered into by accident in Hanoi, Vietnam.

You know, the one where you parked your arse down on a plastic chair and slurped Pho with locals as the only gringo in sight?

Yeah, that one – it only cost $1.

But that’s the best Pho you’ve ever had!

This buffet has it all.

Stuff you loved and wolfed down as a kid.

Things that your more mature tastebuds appreciate as an adult.

East meets West.

North and South.

Local and International flavours.

Savoury, sweet, sour, salty, zesty, pungent, putrid, pickled and everything else in between!

It’s all there for the taking.

But there’s a catch.

You only get one plate and one serving.

Expanding The Canvas: Can I Please Get A Bigger Plate?

You’re in total disbelief.

Firstly, you’re shocked that all of your favourite foods that you’ve ever sampled are right in front of your nose and available all at once.

Secondly, you’re equally perplexed about only having one regular sized plate with not enough room to fit it all.

Immediately you start making concessions and compromises.

Well, if I only grab one slice of pizza maybe I’ll still have a bit of room for the sushi, tandoori chicken and laksa?

But then I may not have enough space to grab a decadent dessert.

You’re a tortured soul having to utilize addition by subtraction methods to figure out what to do.

But what if there was another option?

Could you ask for a bigger plate?

Hmmm…

You hadn’t thought of that one until just now!

A bigger plate!

More space.

You could grab a bit more of everything without having to shave down something else.

“Is it possible! Can you give me a bigger plate!”

You belt out with glee.

The waiter nods his head and brings you something twice the size of what you’re currently holding in your hands.

Without having to make compromises you line up to grab a bit of everything being offered at the buffet.

There’s just enough room on your expanded canvas plate to cover it all.

It’s the best meal of you life.

Capital Efficiency Is What I Care The Most About As An Investor

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Capital Efficiency: Creating An Expanded Canvas Portfolio

Capital efficiency for me is like being at this customized buffet where all of my favourite foods are available.

I’m excited about the prospects but I need the extra space to enjoy everything!

How do I create that?

Well, in the example above I grabbed a bigger plate.

In an investing scenario I can “grab a bigger plate” by utilizing capital efficient ETFs and Mutual Funds to create this extra space in my portfolio.

I don’t have to play within the confines of a 100% sandbox or small dinner plate.

I can move the boundaries to create a bigger sandbox or I can grab a bigger dinner plate.

For $1 spent on merely a bond only ETF I can spend that same $1 and grab a product like Return Stacked Bonds and Managed Futures ETF where I get $1 worth of bonds and 1$ worth of managed futures.

So instead of shaving down bonds to make space for managed futures I can nod my head and just take equal amounts of both.

Now one can get greedy and just go hog wild on a couple of different items.

Consider the buffet example from earlier in the article.

Imagine if I used that large dinner plate to load up only on pizza (stocks) and grandma’s double fudge brownies (bonds).

Don’t get my wrong, that’s a stellar combo!

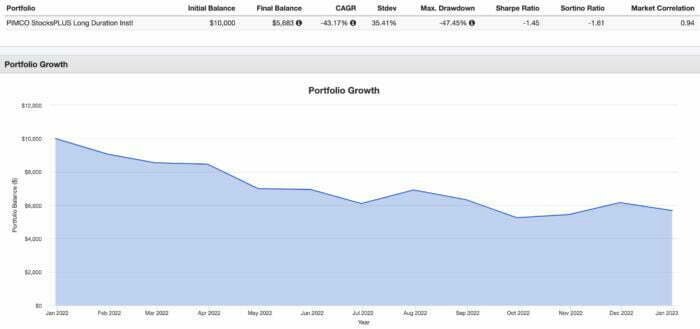

I could do a 100% portfolio of a fund like PSLDX to achieve just that!

100% stocks (pizza) and 100% bonds (grandma’s double fudge brownies).

Mmmm….that sounds pretty darn good!

But it might leave me with a tummy ache or severe indigestion from time to time (2022 for example with PSLDX being down -43.17%!!!).

I don’t really want that.

Is there a better way to proceed?

I think there is!

Capital Efficiency Reigns Supreme So That I Can Maximally Diversify

Capital efficiency reigns supreme so that I can maximally diversify my portfolio!

Pizza (stocks) and Grandma’s double fudge brownies (bonds) are no doubt a winning combo!

And I want plenty of those on my plate (portfolio) but I want to create space for other things I love as well.

I want to have ramen, bibimbap and braai as well!

These are different flavours (uncorrelated asset classes and strategies) that’ll diversify my plate from merely pizza and brownies (stocks and bonds).

This is a buffet after-all!

The primary reason I want to diversify my portfolio is so that I can create an all-weather juggernaut that can compound with the likes (or better) than an all equity portfolio but with considerably less risk.

I want my portfolio to feature all of the different flavours and tastes.

Just sweet (stocks) and salty (bonds)?

That’s not enough for me.

I want sweet, sour, salty, bitter, and umami!

A plate prepared for every craving under the sun!

A portfolio prepared for every season: sunny (prosperity), overcast (deflation), rain (inflation) and storms (recession)

Something that can handle every economic curveball thrown its way!

I’m able to stretch the canvas of my portfolio or update the size of my plate to include the necessary ingredients to make all of this happen.

Instead of just stocks and bonds I can also add the following:

- Managed Futures (Trend-Following)

- Gold

- Market Neutral

- Options (Calls/Puts)

- Bitcoin

- Global Systematic Macro (other MF strategies aside from trend)

- Inverse Vix

- Arbitrage

- Long-Short Equity

- Style Premia

These are just a few of the ingredients I can add to my expanded canvas plate.

I’ve got the space (real-estate) to make it happen.

It’s just a matter of how I assemble things together.

Capital Efficient Puzzle Pieces: All Of The Dishes At The Buffet!

What would say a 150% or 200% expanded canvas portfolio allow you to do as an investor seeking a capitally efficient plus maximally diversified portfolio?

Could you use this extra space wisely to load up with all of your favourite dishes at the buffet of your wildest dreams?

Yes.

These days you can.

Here are some of the most fascinating building blocks out there today.

This is our buffet menu!

source: Optimized Portfolio on YouTube

Stocks And Bonds

Let’s start with pizza and Grandma’s double fudge brownies!

We’ve got the classic stocks and bond combinations that are capital efficient.

100/100 Equities/Bonds

PSLDX – PIMCO StockPlus Long Duration Fund

DSEEX – DoubleLine Shiller Enhanced CAPE

DSEUX – DoubleLine Shiller Enhanced Intl CAPE

90/60 Equities/Bonds

RSSB – Return Stacked Global Stocks And Bonds

NTSX – WisdomTree U.S Efficient Core Fund

NTSI – WisdomTree International Efficient Core Fund

NTSE – WisdomTree Emerging Markets Efficient Core Fund

70/90 Equities/Bonds

SWAN – Amplify BlackSwan Growth & Treasury Core ETF

ISWN – Amplify BlackSwan ISWN ETF (International)

QSWN – Amplify BlackSwan Tech & Treasury ETF

Stocks And Managed Futures

These funds are 50% Equities / 100% Managed Futures strategies.

BLNDX – Standpoint Multi-Asset Fund

MAFIX – Abbey Capital Multi Asset Fund

MBXIX – Catalyst/Millburn Hedge Strategy Fund

Other Interesting Combinations

Two of my personal favourites over here!

We’ve got a 90/90 US equities plus gold fund and a 100% Aggregate Bonds plus 100% Managed Futures ETF.

RSBT – Return Stacked Bonds & Managed Futures ETF

GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund

Multi-Strategy Asset Allocation Funds

Here are multi-asset class plus multi-strategy asset allocation funds.

FIG – Simplify Macro Strategy ETF

UPAR – Ultra Risk Parity ETF

RPAR – Risk Parity ETF

RDMIX – Rational/ReSolve Adaptive Asset Allocation Fund

NFDIX – Newfound Risk Managed U.S. Growth Fund

Diversifying Strategies

These are various diversifying alternative strategies.

ARB – AltShares Merger Arbitrage ETF

BTAL – AGF US Market Neutral Anti Beta Fund

LBAY – Leatherback Long/Short Alternative Yield ETF

VMOT – Alpha Architect Value Momentum Trend ETF

QLEIX – AQR Long-Short Equity Fund

QDSIX – AQR Diversifying Strategies Fund

TAIL – Cambria Tail Risk ETF

PFIX – Simplify Interest Rate Hedge ETF

BITO – ProShares Bitcoin Strategy ETF

SVOL – Simplify Volatility Premium ETF

FLSP – Franklin Systematic Style Premia ETF

FSMSX – FS Multi-Strategy Alternatives Fund

Capital Efficient Portfolio Ideas: Maximum Diversification Model Portfolios

Now let’s move on to the fun part!

We’ve got all the of buffet dishes at our disposal.

How are we going to assemble our plates?

Let’s explore a few different capital efficient model portfolio ideas ranging from 2, 3, 4, 5 and 8 fund combos!

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

2 Fund – Multi-Strategy Portfolio

50% UPAR – Ultra Risk Parity ETF

50% FIG – Simplify Macro Strategy ETF

It’s hard to believe that combining two asset allocation funds 50/50 could offer exposure to the following strategies:

- Global Equities – UPAR / FIG

- Commodity Producing Equities – UPAR

- TIPS – UPAR

- Capital Efficient Bonds – UPAR / FIG

- Gold – UPAR / FIG

- L/S Equity – FIG

- Options (Calls/Puts) – FIG

- Managed Futures – FIG

- Inverse VIX – FIG

- High Yield Credit – FIG

Both are capital efficient as well!

Eat that 60/40 that only brings stocks and bonds to the table.

3 Fund – 5 Strategy Portfolio

50% $GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund

45% $RSBT – Return Stacked Bonds & Managed Futures ETF

5% $BTAL – AGF US Market Neutral Anti Beta Fund

With just three funds we’ve assembled a five strategy portfolio that is more diversified than a 60/40 portfolio.

We’ve got the following exposures:

45% US Equities

45% Gold

45% Aggregate Bonds

45% Managed Futures Trend

5% Anti-Beta Market Neutral

Canvas: 185% Expanded Canvas Portfolio

This equal parts portfolio is reminiscent of the Harry Browne Permanent Portfolio.

The only difference is that it punts out cash for the more adaptive strategy of managed futures.

And it has one last diversifier and return smoother in BTAL.

CountDown Portfolio – 4, 3, 2, 1

40% $RSSB – Return Stacked Global Stocks And Bonds

30% $RSBT – Return Stacked Bonds & Managed Futures ETF

20% $GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund

10% $BTAL – AGF US Market Neutral Anti Beta Fund

The countdown portfolio is a four fund portfolio that includes many of the same ingredients as the 3 fund portfolio we covered above.

However, it isn’t an equal parts portfolio.

The countdown portfolio prioritizes 4, 3, 2, 1 between 40%, 30%, 20% and 10% slots.

Overall, we have these exact exposures:

54% Global Equities

54% Bonds

30% Managed Futures

18% Gold

10% Anti-Beta Market Neutral

Canvas: 166% Expanded Canvas Portfolio

Our portfolio is balanced between Stocks (54%), Bonds (54%) and Alternatives (58%)

Mutual Fund Portfolio – 5 Funds

20% $PSLDX – PIMCO StockPlus Long Duration Fund

20% $DSEUX – DoubleLine Shiller Enhanced Intl CAPE

30% $BLNDX – Standpoint Multi-Asset Fund

10% $QLEIX – AQR Long-Short Equity Fund

20% $QDSIX – AQR Diversifying Strategies Fund

This five ticker mutual fund portfolio brings loads of diversification to the dinner table.

We’ve got the following strategies

- Global Equities

- Bonds

- Managed Futures

- Long-Short Equity

- Arbitrage

- Market Neutral

- Style Premia

- Global Macro

- Currencies

- Commodities

Maximum Diversification Portfolio – 8 Funds

25% $RSSB – Return Stacked Global Stocks And Bonds

25% $RSBT – Return Stacked Bonds & Managed Futures ETF

25% $FIG – Simplify Macro Strategy ETF

5% $ARB – AltShares Merger Arbitrage ETF

5% $BTAL – AGF US Market Neutral Anti Beta Fund

5% $GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund

5% $FLSP – Franklin Systematic Style Premia ETF

5% $VMOT – Alpha Architect Value Momentum Trend ETF

This is the most complicated portfolio hands down.

But with it we’ve assembled the most diversified portfolio of them all:

- Global Equities

- Bonds

- Managed Futures

- Arbitrage

- Gold

- Market Neutral

- Style Premia

- Long-Short Equity

- High Yield Credit

- Options (Calls/Puts)

- Inverse VIX

Nomadic Samuel Final Thoughts

Capital Efficiency reigns supreme in my portfolio!

It is my number one priority.

I use it to stretch the canvas of my portfolio to paint a more detailed picture.

I upgrade my dinner plate in the buffet line to capture more dishes being served.

It’s interesting because I recently created a poll on Twitter to ask others the following question:

“What do you care most about as an investor?”

- Capital Efficiency

- Maximum Diversification

- Optimization (Factors)

- Lowest Fees Possible

It’s fascinating because this is my list of priorities ranked in order of importance.

Firstly, I care most about capital efficiency as it allows me to create space in my portfolio.

Secondly, I’m thrilled about maximum diversification because I can utilize that extra space to stuff as many uncorrelated strategies into the mix as possible.

Thirdly, I love to optimize (factor strategies) whenever possible but I mostly capture this with L/S equity funds as opposed to long-only.

Finally, I’m just like everybody else on the planet when it comes to fees – I’d love to pay less!

But at this point in the article I’m more curious about what you have to say.

What do you think about building capital efficient portfolios?

Is it something you’re doing or considering?

Please let me know in the comments below.

That’s all I’ve got for today!

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.