As investors we’re often hyper focused on what is transpiring during regular trading hours.

But what if we were to consider what happens at night?

Today we’re joined by Bruce Lavine of NightShares to discuss how investors can potentially capture the “Night Effect“.

We’ll explore the “Night Effect” by zeroing in on the period between market close and market open as we continue our the “Strategy Behind The Fund” series.

Specifically, we’ll cover NSPY ETF.

It’s better known as NightShares 500 ETF.

And we’ll also highlight NSPL ETF: NightShares 500 1x/1.5x ETF.

It’s a 2-1 special.

With this in mind, let’s turn things over to Bruce to find out more!

Meet Bruce Lavine of NightShares

Bruce is the CEO of NightShares, a new ETF company offering ETFs designed to capture the Night Effect.

Bruce was one of the founders of the iShares business in 1999 where he acted as CFO and ran product development in the U.S. and then ran the European iShares business from 2003-2006.

Bruce then became the President & COO of WisdomTree as it launched and spent 16 years there as an operator and Board Member.

He is responsible for launching some of the most widely used ETFs including DVY, LQD, TLT, SHY, EFA,EEM & DXJ.

Bruce grew up in Manhattan and now resides outside San Francisco.

He spent 6 years at the University of Virginia getting both his undergraduate degree and his MBA.

He is a Chartered Financial Analyst (CFA).

Reviewing The Strategy Behind NSPY ETF (NightShares 500 ETF) with its creator Bruce Lavine

Hey guys! Here is the part where I mention I’m a travel content creator! This the “Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of NSPY ETF?

For those who aren’t necessarily familiar with a “NightShares style” of investing which seeks the performance of the S&P 500 at night while avoiding daytime trading exposure, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

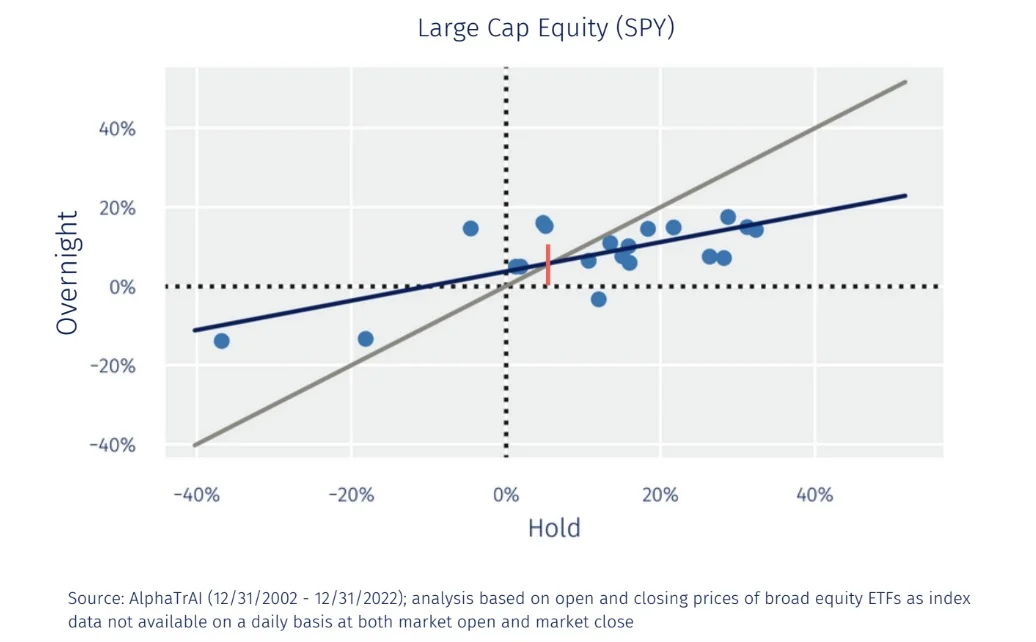

NightShares are designed to capture the Night Effect, an academically well-documented tendency for overnight markets to outperform daytime markets.

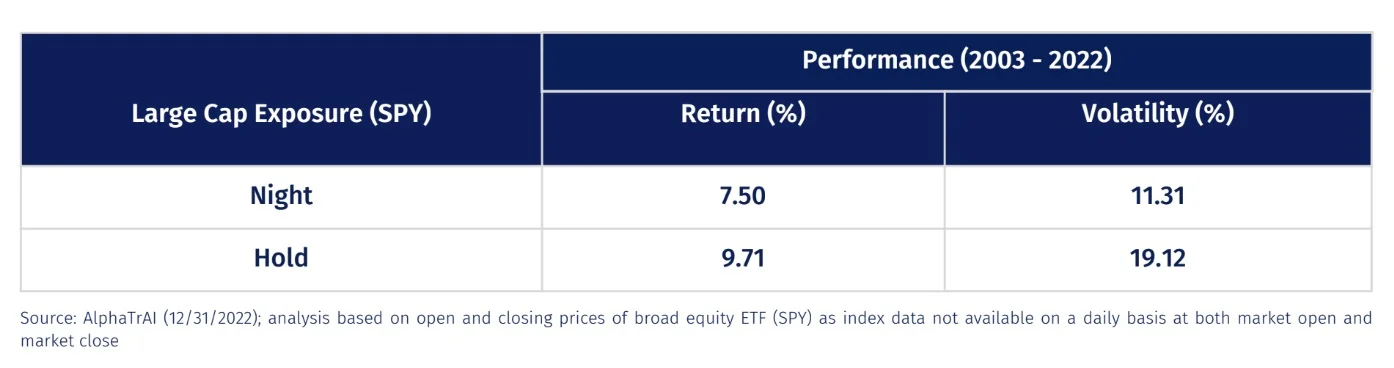

Simply buying at the close and selling the next morning at the open captures much of the return in markets with substantially less volatility.

Over the last twenty years, our research found that approximately 75% of the return of the S&P 500 and over 100% of the return of the Russell 2000 came in the night session.

And in both cases, the volatility of owning the night only was about 55-60% of owning the full 24 hour period.

The NightShares funds’ overweight the night as compared to the day.

Two of them (NSPY, NIWM) only are invested at night and sit in cash/treasuries only during the day.

The third fund, NSPL, is 100% during the day and 150% at night.

BONUS: What’s The Strategy Of NSPL ETF

There are two things that differentiate NSPL from NSPY, and these relate to the market sessions.

During the daytime session, NSPL provides 100% exposure to 500 U.S. large cap stocks via a holding in a low cost S&P 500 focused ETF whereas NSPY holds cash.

Overnight, NSPL provides 150% exposure to the large cap equity market while NSPY provides 100% exposure.

Unique Features Of NightShares 500 NSPY ETF

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

NightShares are transparent, systematic active ETFs that make the same trade every day.

In the case of NSPY and NIWM, the funds hold cash and treasuries and then buy index futures at the close and sell them the next morning, giving equity exposure only to the overnight session.

The third fund, NSPL employs 50% leverage in the historically lower volatility overnight session in addition to its 100% core exposure.

NSPY and NIWM have a 55 bp expense ratio and NSPL is 67 bps.

What Sets NSPY ETF Apart From Other Strategic Equity Funds?

How does your fund set itself apart from other strategic equity funds being offered in what is already a crowded marketplace?

What makes it unique?

We are the only funds designed to capture the night effect.

The night effect historically is a factor or a risk premia that has benefits in reduced volatility, diversification of approach and low correlation between the day and night sessions.

What Else Was Considered For NSPY ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

The night effect works in a more pronounced way in certain individual stocks and more concentrated ETFs.

However, we wanted to keep transaction costs manageable and scalable so we have focused initially on areas of the market that have highly liquid futures contracts.

This allows our portfolio management to be highly efficient.

When Will NSPY ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

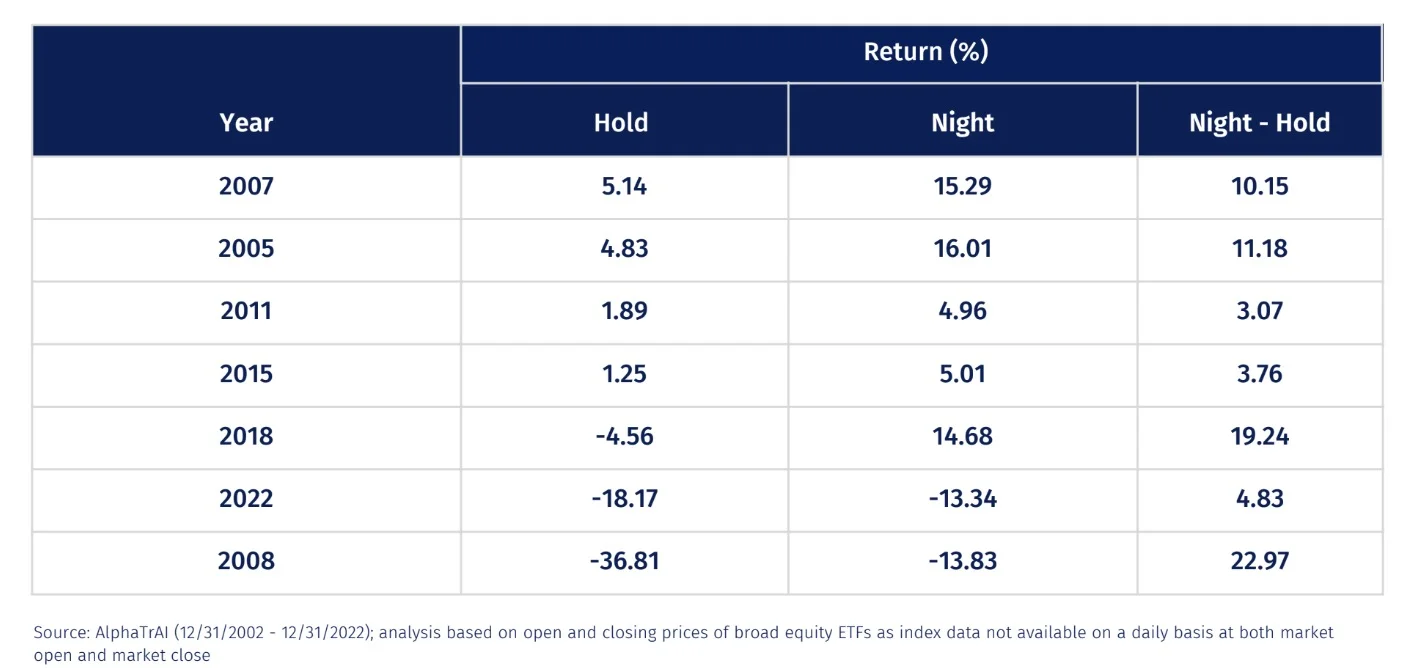

One of the challenges of the night effect is that it works over time but not all the time.

Historically, a night focused strategy has worked well on a relative basis when markets are modestly up or down.

In such cases, the day session was more volatile and with negative/low returns and thus avoiding it was beneficial.

In environments where the market is up strongly, it can be beneficial to have daytime exposure in addition to night exposure.

I am attaching a recent paper on the subject.

Bonus: When Will NSPL ETF Perform At Its Best/Worst?

NSPL will do well across a wide range of markets relative to hold so long as the night time session is positive.

With NSPY, this Night Effect strategy will struggle from a pure returns perspective when day is positive.

Given NSPL invests in both the day and night sessions, it will not face the same potential headwinds that NSPY faces when equity markets are up double digits.

Why Should Investors Consider NightShares 500 NSPY ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

NightShares are designed to offer better risk-adjusted returns than passively holding traditional benchmark focused investments, say in a 60/40 portfolio.

As noted earlier, NightShares have historically beat hold when markets are modestly up or down – therefore investors would have benefited by staying clear of the day in those market environments.

In addition, for investors focused on unit of return per unit of risk in their equity portfolios (i.e those focused on Sharpe ratios), NightShares help investors by avoiding the highly volatile and therefore poorly rewarded day session.

source: WealthManagement Informa on YouTube

How Does NSPY ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

A large cap approach that leverages the night by 50% has historically outperformed a buy and hold approach with a modest uptick in volatility (because the leverage is only employed in the lower volatility night session).

Such a strategy can be a straight substitute for a traditional large cap equity holding.

The night session also interestingly has limited correlation to the hold session (with a historical correlation of around 0.63).

Therefore, it can operate like a liquid alternative in the portfolio, providing diversification benefits, reduced volatility and exposure to a unique factor.

In Small Caps, the night effect historically added value in both increased returns and reduced volatility and could be used as a substitute for a core indexed small cap position.

With over 100% of the return in small cap historically coming at night, and with day being highly volatile, it unclear as to why a long term inventor would want the day session as part of her portfolio.

The Cons of NSPY ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

The biggest criticism has been fund returns since inception.

Like with almost everything in the capital markets the Night Effect does not work every day year in and year out and night has not outperformed hold in both large and small caps since we launched the first two funds on June 28th.

Bonus: The Cons of NSPL ETF

The biggest issue we’ve encountered is related to “how much to allocate”.

The case for NSPL is strong given it has both day and overnight exposure, but it tilts to the better rewarded night session and investors seem to be figuring out how much to tilt into the night.

The second issue we’ve faced is simply one of tenure of the fund.

Having launched on October 5th, we don’t yet have a full quarter of performance to show and many investors would like to see a longer period of performance.

The Pros of NSPY ETF

On the other hand, what have others praised about your fund?

We hear two things consistently.

The first is that people are really intrigued by the Night Effect itself.

People have either never heard of the Night Effect or know about it at a very high level but they’ve never seen the data and/or all the compelling academic research about it.

So they give us credit for exposing something that has been “hiding in plain sight”.

The second thing we hear is about how straight forward our solution is to capturing the Night Effect.

Recognizing this is an industry that often prides itself on complexity, the notion of holding cash during the day (or simply 100% exposure during the day by holding a low cost broad based ETF) and then using futures to gain targeted exposure to the overnight session is easy to understand and helps further frame the “when to invest” discussion.

Two Things That Drive Us: Data and Transparency

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

There are two things that drive us: data and transparency.

To that end, we’ve created two online tools that we would invite people to use to better understand the Night Effect.

The first is a tool on our website called NightVision.

NightVision allows investors to better understand the historical risk and return characteristics of the U.S. equity markets over multiple time periods.

The second tool is NightWatch, which is a downloadable mobile app that allows investors to track the Night Effect daily and in real time.

For those interested in seeing the Night Effect at market open and throughout the course of the day, NightWatch provides a simple way to better understand the capital markets.

Connect With Bruce Lavine of NightShares

Website: NightShares

Funds: NightShares ETFs

Twitter: @NightShares

Nomadic Samuel Final Thoughts

I want to personally thank Bruce for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.