When it comes to staying the course with your investment portfolio the biggest enemy is staring right back at you when you look into the mirror.

That’s right.

It’s you.

Nah.

That can’t be possible.

Actually it entirely is.

But it’s not your fault.

The skillset required to be a good investor is just not built naturally into our DNA.

When your house is burning down you grab the fire extinguisher.

Being chased by a lion. Run like heck!

If you’re sputtering out of control with bad habits and behaviours you take the necessary steps to modify things.

In other words, you take action.

But when it comes to investing the ability to not take action is far more crucial.

Inaction vs action.

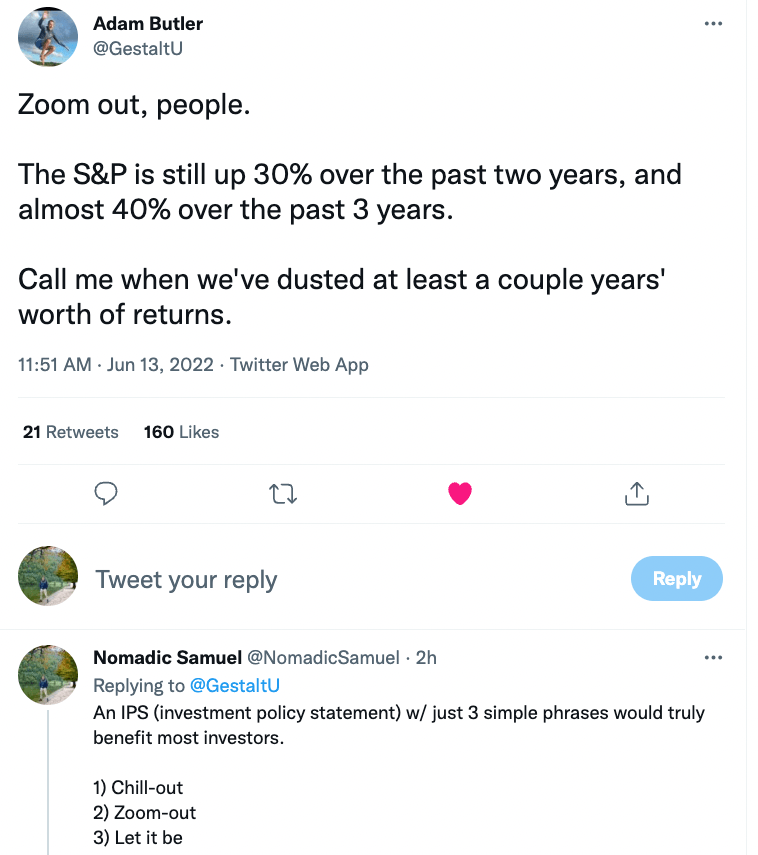

Sometimes a #FinTwit tweet inspires a blog post.

This is once again the case.

I have both Adam Butler, who has been a guest on “investing legends” interview series and Dominant Portfolio to thank for getting the ball rolling over here.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Investment Statement Policy

A personal investment statement and action plan is needed in order to protect you from yourself.

A contract that stipulates how you’re going to behave when markets are inevitably volatile, your portfolio is experiencing drawdowns and your patience is running thin.

Who ya gonna call?

Not Ghostbusters.

You’re going to refer to your ISP.

Oh, I’ve clearly outlined what I’m supposed to do when event X, Y and Z is happening.

Okay.

Whew.

But before you can write such a plan you first need to prepare a portfolio that suits your investment goals, provides adequate diversification and prevents you from taking on too much risk.

This is a highly subjective matter.

No one shoe fits each investor the same.

And before you can assess whether or not you’ve got the right strategy you need to educate yourself on investor psychology and also be aware of your natural impulses and tendencies.

This is no easy task.

Self awareness is tricky.

It has to be acquired either through knowledge and/or a system that prevents you from making irrational short-term decisions based on narrative, recent macro events and normal levels of volatility experienced in the markets.

Certain people have the personality, disposition and self-awareness through enough experience and education to become disciplined investors.

Others, no matter how many books they read on behavioural finance, podcasts discussing the subject, and/or exposure to enough infamous Warren Buffet and Charlie Munger quotes cannot overcome the temptation to muck about a perfectly sensible investing plan and well thought out portfolio.

I’ve been meaning to write on this very subject since starting the blog but I’ve been admittedly sidetracked by pursuing the picture perfect portfolio.

My bad.

Which, by the way, is merely the icing on the cake when it comes to transforming into a successful investor.

No sensible investment plan survives the cockpit eject button.

Even the best of the best portfolios, from a returns meets risk meets diversification standpoint, require a full commitment to the strategy over decades to bear its intended fruits.

Yet most investors think in terms of days, weeks, months and maybe a year or two at best as opposed to three, five, ten, twenty year time horizons.

Short-term thinking is pervasive.

Long-term thinking is what is required.

So let’s get back on track here with a Personal Investment Statement.

I’ve been preparing a comprehensive one for a while now, that reads more like a white paper, so you’ll want to grab a coffee and a snack or a large bowl of popcorn and a soda because this is going to take a little while to read and digest.

Here it is.

Zoom Out. Chill Out. Let It Be.

Zoom out.

Chill out.

Let it be.

Oh, that’s a clever title.

How about the body?

One more time here.

Zoom out.

Chill out.

Let it be.

What the heck?!?!?!

Yeah, that’s the full plan.

At least from the a behavioural and psychological standpoint.

Once you’ve dialled in a portfolio from an asset allocation perspective, decided on a rebalancing strategy, figured out what to do when it comes to contributions/distributions the only thing left is the following:

Zoom out.

Chill out.

Let it be.

That’s overly simplistic, no?

Amateur, even?

Maybe.

But what doesn’t it cover?

Let’s unpack that a little bit.

Zoom Out Investment Statement Policy

What does it mean to zoom out as an investor?

It’s the ability to see the big picture.

You see as investors we’re constantly being bombarded by negative news stories, doomsday scenario macro events and quite often drawdowns within our portfolio.

It’s easy to get caught up in the moment and think that recent events are going to continue in perpetuity.

But they’re not.

They never have and they never will.

Booms lead to busts.

Busts lead to booms.

Bears follow raging bull markets.

Bull markets are borne out of the Bear market’s despair.

But how do you learn to zoom out as an investor?

You have to be willing to see the big picture.

I’ve found personally zooming out with various scenarios, which you can construct on portfolio visualizer, really helps in this given area.

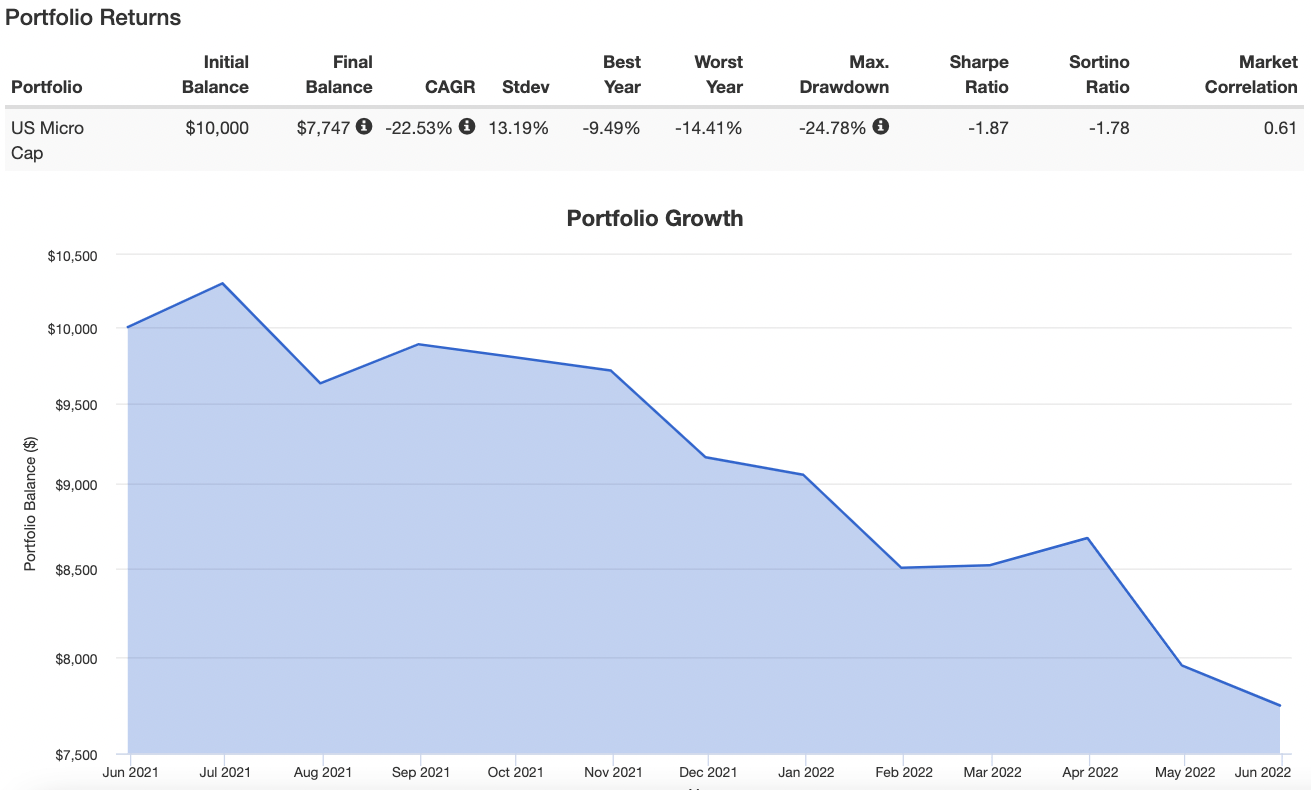

Let’s use US Micro-Caps as an example.

They’re one of the most volatile style box equity classes you’ll find with higher historical returns and associated higher levels of risk (standard deviation).

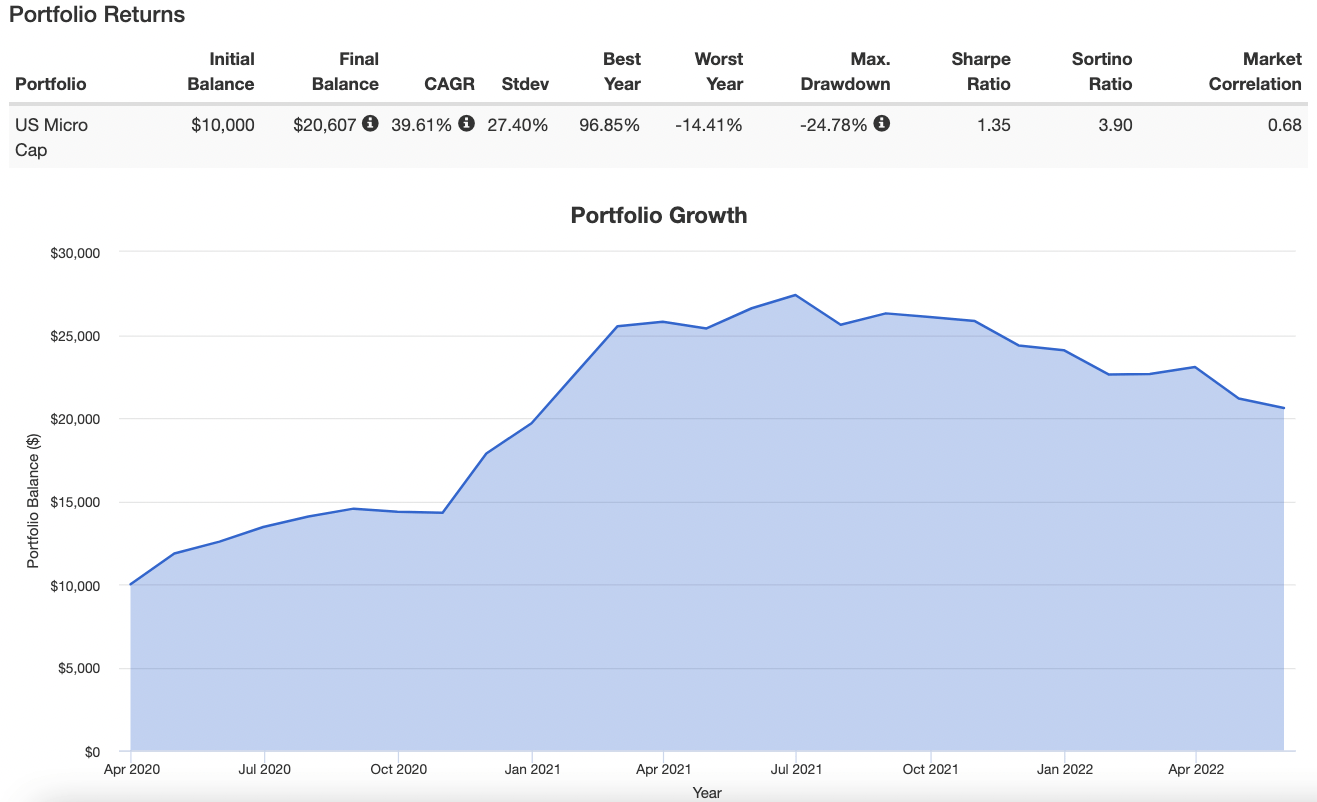

Let’s zoom in!

Yikes!

The sky is falling!

You’ve committed to a US micro-cap strategy last June and it has been nothing but a pain game ever since.

Down freakin’ -22.53%.

Ah man, I’m an idiot.

Clearly I bought at the top.

No.

Even worse.

This strategy simply doesn’t work anymore.

What was I thinking investing in micro-caps?

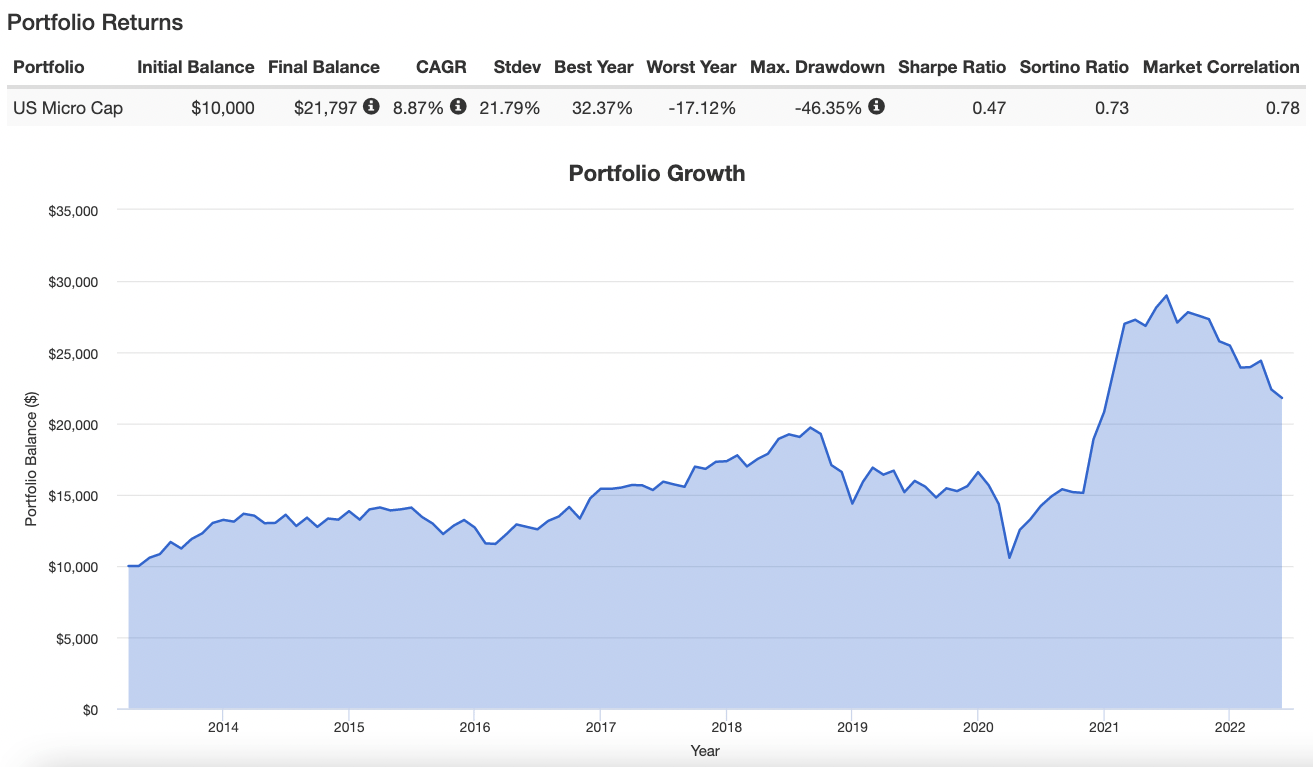

Let’s zoom out – just a tad!

Oh my!

This looks a little more encouraging.

From the perspective of two years worth of returns I’m not such a fool after-all.

Check out the 39.61% CAGR!

Fool!

Ha!

In fact, I’m a genius.

Now we’ll zoom out even further!

How about the 10 year returns from this asset class?

Not too shabby at all.

A solid 8.87 CAGR.

Jeez Eloise, this seems to be not too bad of an equity strategy now that I think about it.

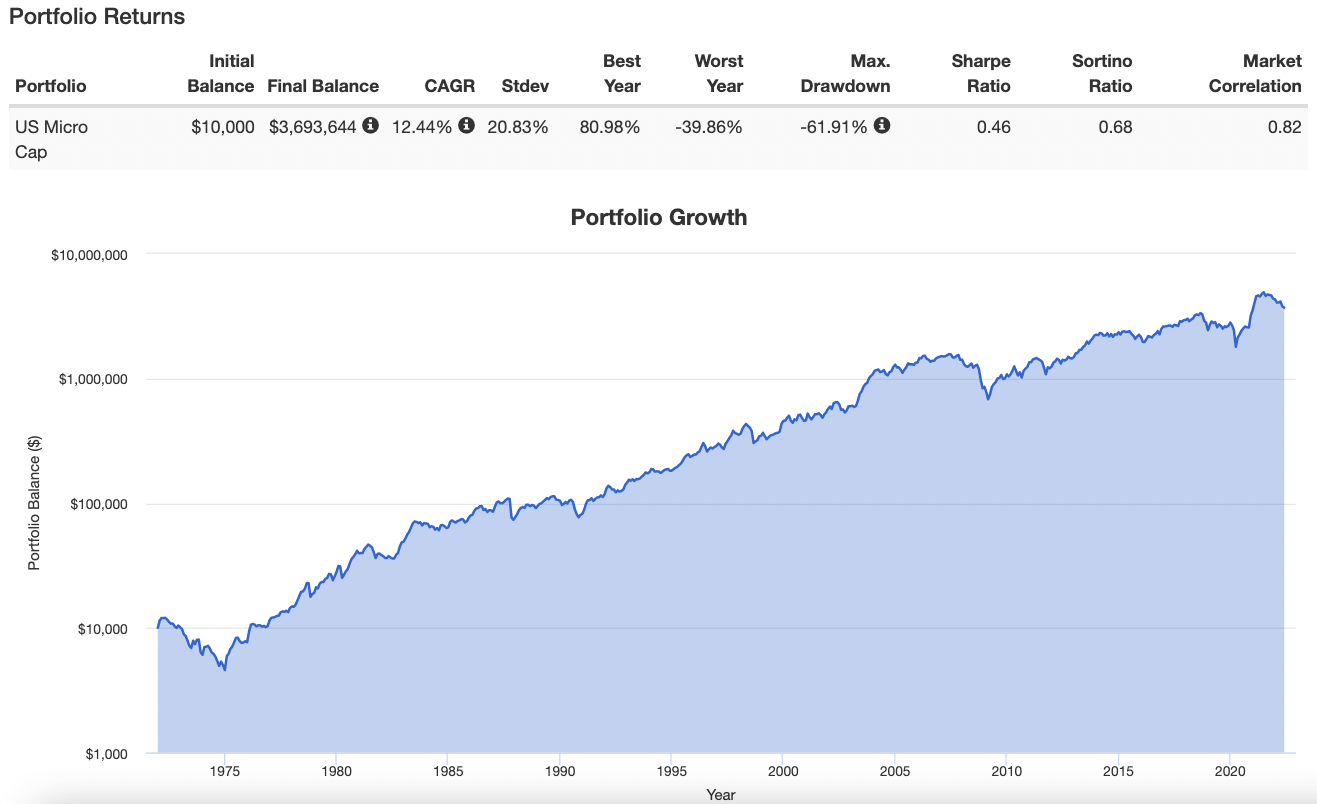

Zooming out entirely for the big picture!

Well, check this out.

Holding on for over 50 years would mean a 12.44% CAGR.

$10,000 hypothetical dollars would have turned into $3,693,644 (before fees and taxes).

Zooming out and seeing the big picture is crucial as an investor.

Short-term results are volatile.

Long-term results are not.

The great advance rewards investors who can just zoom out and get out of the way.

Just hold on and get out of the way with your sensible strategy, turns out to be, the best thing an investor can do.

Chill Out Investment Statement Policy

Bringing emotions into the arena of investment decisions is a recipe for disaster.

Consider what Charlie Munger had to say on the subject:

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century … you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

Let’s define equanimity: “Mental calmness, composure, and evenness of temper, especially in a difficult situation.” (Source: Oxford Dictionary)

Sounds like a clever way of describing “chilling out” don’t ya think?

What does Warren Buffet have to say on the subject of being able to “chill out” when it comes to your investment’s recent performance?

“The stock market is a transfer of wealth from the patient to the impatient.”

Oh, that one cuts like a knife.

No beating around the bush from Mr. Buffet when it comes to clear and concise advice.

Yet, most investors ignore the greats like Munger and Buffet and instead indulge the four Horsemen of the Apocalypse of staying the course:

- Recency bias

- Loss aversion

- Narrative based investing and suffer from

- FOMO (fear of missing out)

Yeah, those four things will screw up any investment plan.

How does one avoid not succumbing to all of these tempting ways to muck things up?

Basically, by just chilling out.

How do you increase your chances of chilling out?

Here are three suggestions:

- Not checking your portfolio very often

- Avoiding the news (especially when it is related to day to day market performance)

- Realizing that even the best portfolios, from a maximum diversification standpoint, only have a success ratio of 80 to 90%

Thus, you’ve got to be prepared as an investor for negative years.

That’s even with a Risk Parity Portfolio or Ray Dalio All Weather Portfolio.

Chilling out means also being able to integrate the “Zooming Out” into the equation.

If you see the big picture the odds are on your side.

Chill out.

Be more like Spock and less like Captain Kirk.

Think of a Sloth as your spirit animal.

Sloths aren’t lazy – their slowness is a survival skill.

Your portfolio also survives quite nicely by being more sloth-like, eh?

Let It Be Investment Policy Statement

It was great to see that a friend on Twitter, Dominant Portfolio, was thinking the same thing I was.

There is no better song to represent not mucking up or screwing up a portfolio than the Beatles classic: “Let It Be”

When I find myself in times of trouble

Mother Mary comes to me

Speaking words of wisdom

Let it be

And in my hour of darkness

She is standing right in front of me

Speaking words of wisdom

Let it be

Let is be, let it be

Let it be, let it be

Whisper words of wisdom

Let it be

So when is your darkest hour when it comes to investing?

Likely when kaka is hitting the fan.

So what should we do in that situation?

Let it be.

Let your portfolio be as it is.

You see loss aversion is twice as powerful of an emotion than when things are working out well for you as an investor.

We’re naturally, as humans trying to survive in a complex world, more attuned to what is going wrong than what is going right.

Yet, capitulation and selling your assets or abandoning a well thought out plan when things aren’t working out is exactly the wrong thing to do.

Why?

Because we’d be turning hypothetical losses into real ones.

If you don’t sell 1000 units of fund $XYZ then you still own 1000 units of $XYZ even while it’s experiencing a drawdown.

So long as you don’t sell it and allow it to recover you’ve lost nothing.

It’s only when you panic, and you don’t let it be, that you turn a hypothetical loss into a real one.

One of the ways as investors, we can better prepare for drawdowns, is to own a portfolio of diversified strategies and uncorrelated asset classes.

A 1-2-3 approach to investing where we own stocks, bonds and alternatives.

Portfolios such as the Risk Parity Portfolio, the Ray Dalio All Weather Portfolio, the Adaptive Asset Allocation Portfolio, the Cockroach Portfolio, Return Stacked 60/40 Portfolio and the Picture Perfect Portfolio are prepared for all economic outcomes.

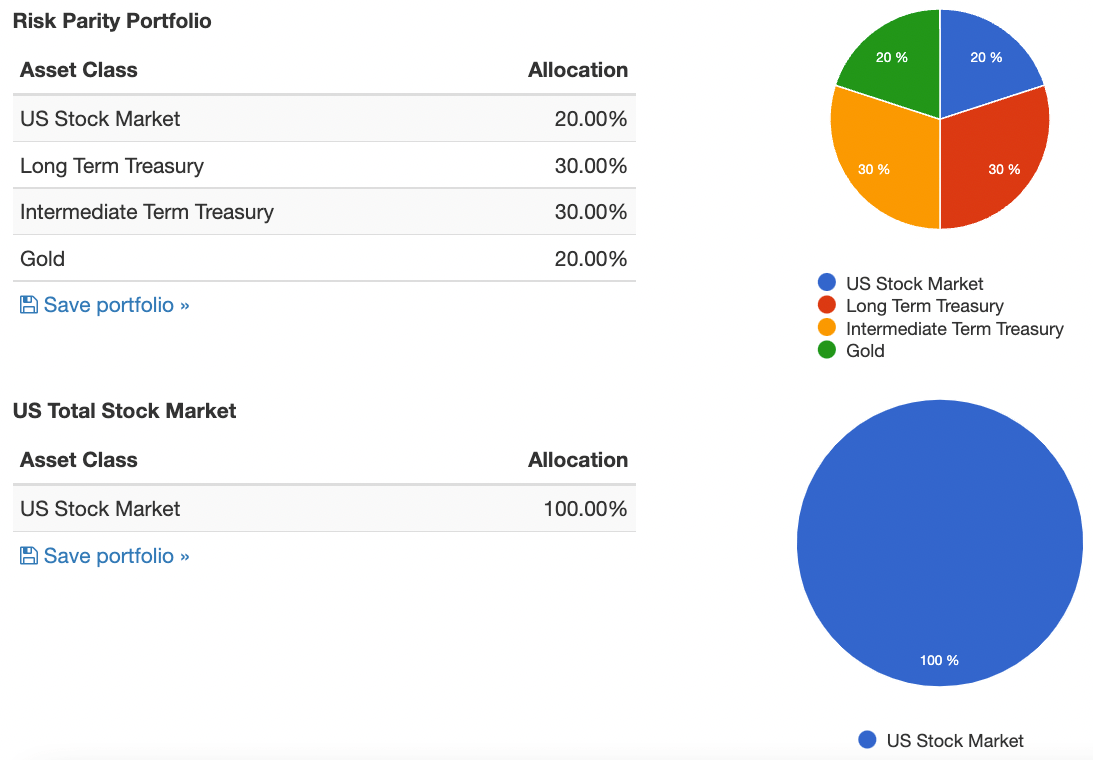

Let’s consider the following as a quick example.

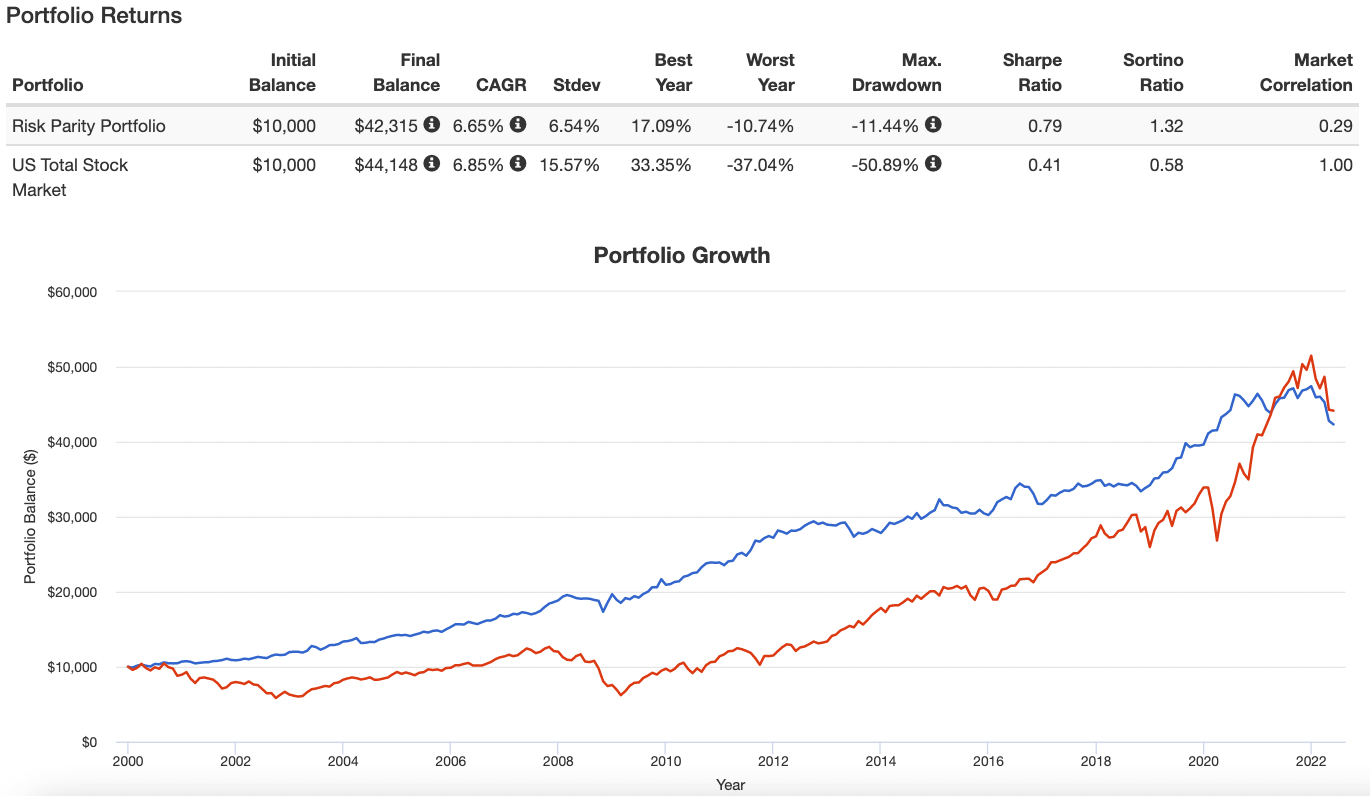

The Risk Parity Portfolio vs a US Total Stock Market only Portfolio.

20% US TOTAL STOCK MARKET

30% LONG-TERM TREASURY

30% INTERMEDIATE-TERM TREASURY

20% GOLD

100% US TOTAL STOCK MARKET

What we notice is that the Risk Parity Portfolio and the US Total Stock Market Portfolio get roughly the same results long-term but what a difference in the ride!

One is smooth and steady.

The other is a rollercoaster.

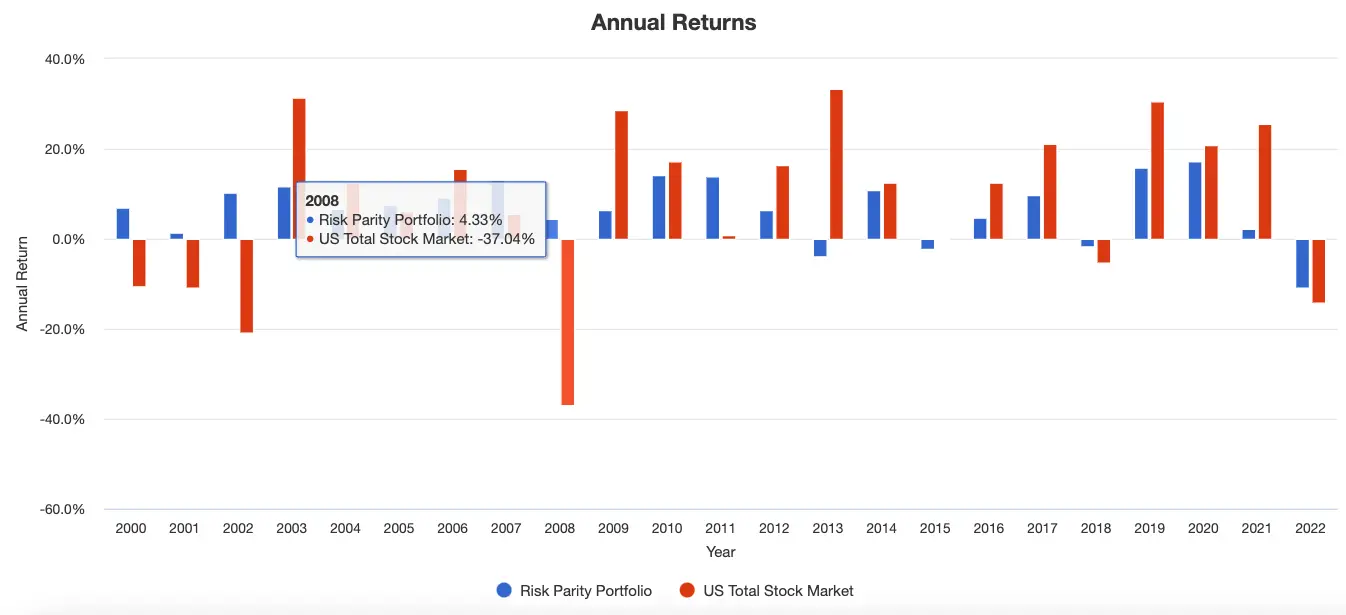

The annual returns paints a more vivid picture.

The Risk Parity Portfolio is up more often than it is down. And when it is down it is not down by much.

The US Total Stock Market has much wilder lows and highs including rough patches in the early 2000s, 2008 and 2022.

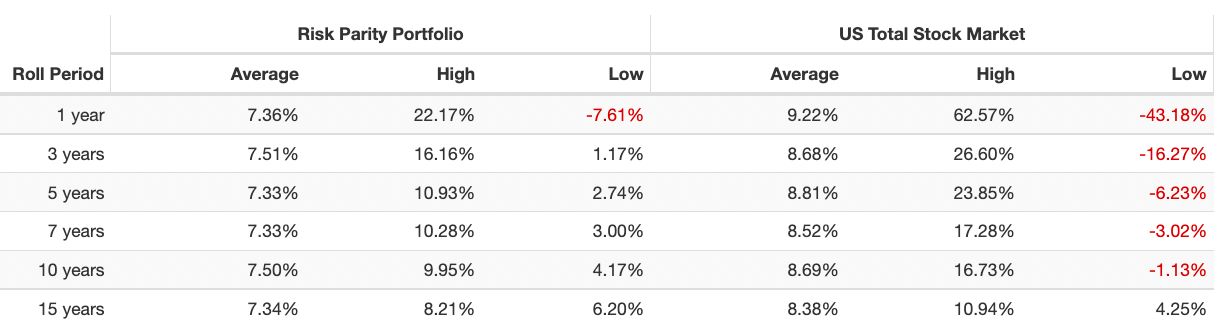

And from a sequence of returns risk Roll Period, it’s much easier to “Let it Be” when your worst case scenario is a 1 year low versus a 10 year low!

Thus, careful portfolio construction from an asset allocation standpoint is one of the key components of enhancing your odds of “Letting it be” through the thick and thin of it all.

Investment Statement Policy Example — “Chill Out • Zoom Out • Let It Be” (12-Question FAQ)

1) What is an Investment Policy Statement (IPS) and why do I need one?

An IPS is a one-page contract with yourself that defines goals, portfolio, risk limits, rebalancing rules, contribution/withdrawal plans, and what you’ll do in drawdowns. Its job is to pre-commit you to sensible behavior when emotions run hot.

2) What does “Zoom Out” mean in practice?

Judge results on long windows (5–10+ years), not weeks or quarters. Use rolling-return charts, not recent headlines. Keep a simple dashboard: 10-year goal progress, current allocation vs. target, cash runway months. Everything else is noise.

3) What does “Chill Out” look like day-to-day?

Reduce triggers that spark reaction: check accounts monthly (not daily), mute push alerts, cap “market news” to a set window (e.g., 20 minutes on Fridays). Pre-write your drawdown script: “If portfolio −20/−30%, I… (rebalance / add cash / do nothing).”

4) What does “Let It Be” mean for portfolio changes?

Default to no changes unless a pre-defined rule is hit (e.g., target drift >5 percentage points, tax-aware TLH window, life event). You’re promised the strategy, not short-term results; sticking power is the edge.

5) How should I set goals in my IPS?

State time-bound, money-weighted goals (e.g., “Retire at 60 with $X real; college fund $Y by 2038”). Add funding rates (monthly contributions), expected real return bands, and a minimum cash buffer (e.g., 6–12 months expenses).

6) What portfolio fits a “Chill-Zoom-Let” mindset?

One you can hold: globally diversified stocks + high-quality bonds + a sleeve of diversifiers (e.g., TIPS/real assets/managed futures) sized so you can live through a 25–35% drawdown without capitulation.

7) What are simple rebalancing rules?

Pick one and enshrine it:

• Calendar: quarterly/semiannual.

• Bands: rebalance when an asset is ±20% of its target or ±5 percentage points, whichever first.

• Cash-flow first: use contributions/distributions to nudge back before selling.

8) How do I handle contributions and withdrawals?

Automate contributions on payday. In retirement, use a “guardrail” rule (e.g., raise/lower withdrawals 10% when portfolio breaches upper/lower bands) and refill cash buckets opportunistically after rallies.

9) When is it okay to change the plan?

Only for you-changes, not market-changes: new goals, horizon, income, tax bracket, dependents, or a proven, documented process upgrade you’re willing to hold through a full cycle. Require a 30-day cooling-off period before implementing.

10) How do I pre-commit to behavior in crashes?

Add a drawdown table to your IPS: at −10% (do nothing), −20% (rebalance), −30% (deploy reserve cash X%), −40% (review spending 5–10%). Sign it. Share it with an accountability partner.

11) What’s my information diet?

Write it in: “I read statements monthly, rebalance semiannually, annual deep review each January. I do not act on intraday news. I track only: savings rate, allocation drift, fees, taxes.”

12) What does a one-page ISP template look like?

Purpose & Goals: (bulleted, dated, $ real)

Portfolio Targets: (e.g., 55% global stocks / 30% bonds / 15% diversifiers) with ±5 pp bands

Rebalancing: (method + cadence)

Cash & Liquidity: (X months expenses; funding order)

Contrib/Withdraw Rules: (auto dates; guardrails)

Risk Limits: (max expected drawdown; behavior table)

Change Policy: (cool-off 30 days; reasons allowed)

Info Diet & Checkpoints: (monthly/annual)

Sign & Date

Nomadic Samuel Final Thoughts

So we’ve hit over 2000 words!

Quite a lengthy post for such a short IPS (Investment Policy Statement).

One more time:

Zoom Out.

Chill Out.

Let It Be.

Do you agree?

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.