“It’s good to be king, if just for a while.

It’s good to be king and have your own way.

It’s good to be king and have your own world.”

Whoops!

This is an investing blog and not a lyric sheet for a Tom Petty song.

My bad!

With an ETF marketplace full of vanilla and milquetoast offerings painstakingly positioned to be nothing more than average, it’s refreshing to find funds that are taking a different approach.

Enter the room KNGS ETF.

Better known as Upholdings Compound Kings ETF.

Today we’re fortunate enough to have the fund’s creator, Robert Cantwell of Upholdings, join us as part of the “Strategy Behind The Fund” series to discuss his strategy that seeks to generate high returns on investment.

With this in mind, let’s turn things over to Robert!

Meet Robert Cantwell of Upholdings

- Private equity investor turned start-up CFO turned public market portfolio manager. 4 year track record available at kngsetf.com

Reviewing The Strategy Behind KNGS ETF (Upholdings Compound Kings ETF) with its creator Robert Cantwell

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of KNGS ETF?

For those who aren’t necessarily familiar with a “compound kings” of investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Compound Kings generate high returns on investment.

For example, a company that can hire a new employee for $250,000, and can then quickly generate an additional $750,000 gross profit.

The hard part is identifying companies with the features that would enable such a return: their market position, size of industry, opportunities for reinvestment, and risks that can come up along the way.

Example:

Verisign owns every .com domain in the world, but their pricing is regulated to ~$9 per domain per year. (When you ‘buy’ a site through GoDaddy, you’re actually just leasing it from Verisign.)

This extreme market position enables Verisign to coerce government entities to allow them to negotiate higher prices over time.

Thus, the company can grow gross profit year-in and year-out without having to invest in any additional headcount or capital expenditures.

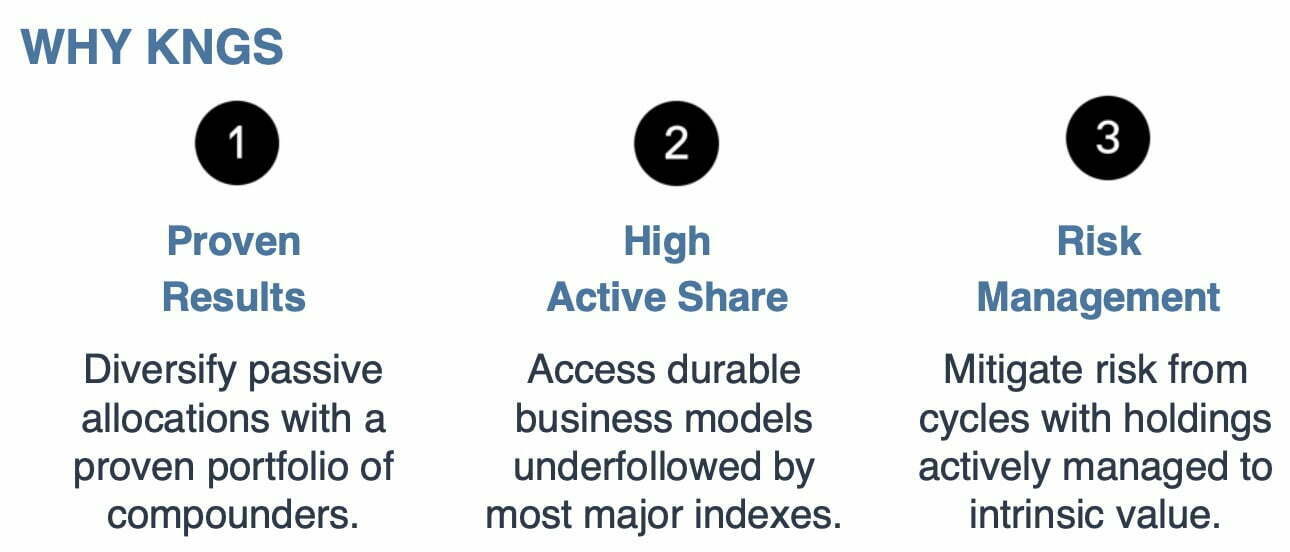

Unique Features Of Upholdings Compound Kings ETF KNGS

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The KNGS ETF is actively managed by a fund manager with a 4+ year track record of outperforming the S&P 500.

How many ETFs can say that?

We seek out the world’s greatest businesses, and acquire shares at or below intrinsic value.

Because our standards are so high, there is relatively low turnover in our fund, and many of the stocks in the portfolio will be there for years.

We leverage the tax efficient feature of ETFs to avoid capital gains distributions.

We charge 60 bps.

source: The Meb Faber Show on YouTube

What Sets KNGS ETF Apart From Other Equity Funds?

How does your fund set itself apart from other “optimized equity funds” being offered in what is already a crowded marketplace?

What makes it unique?

Research.

We spend everyday getting to know our companies and their competitors better.

You can count on one hand the number of other ETFs that are doing this amount of real company diligence.

For about half of our stocks, the KNGS ETF has higher concentration than any other ETF in the entire market.

This is only possible because of our research.

What Else Was Considered For KNGS ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

Leverage.

We believe part of our job is to stay invested.

But there are moments every few years when the market offers truly remarkable prices.

We’ve considered employing leverage to acquire more shares during these moments.

But we have so far refrained.

We believe in leaving leverage decisions up to individual investors, instead of forcing all of our investors along at once.

source: Opto CMC on YouTube

When Will KNGS ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

In our four year history, we’ve done really well when interest rates are flat, or declining. 2022 was our worst year on record, when interest rates jumped the fastest.

The long term nature of our companies means they’ll generate more cash in the future than they’ve generated in the past, making them more sensitive discount rates than more short term oriented business strategy.

Why Should Investors Consider Upholdings Compound Kings ETF KNGS?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Low cost beta exposure is an outstanding strategy.

But the best you can do is match market averages.

Market returns are like inflation — you lose purchasing power over time if you don’t keep up with inflation.

Similarly, we lose wealth power if we don’t keep up with market returns.

So you could simply state that our goal is to increase wealth power.

I don’t know of many other funds with the track record and/or stated intention of doing that.

source: ReSolve Asset Management on YouTube

How Does KNGS ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

Personally, I’m 100% invested in KNGS.

Across our 500 investors, they range from a 0.1% to 100% allocation to KNGS depending on how much they each personally align with our investment approach.

The Cons of Upholdings Compound Kings ETF KNGS

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Some investors find our concentration levels daunting.

We believe in the importance of high active share, personal investment in the fund, and always doing more research.

Those features enable us to run at higher concentration levels than other funds.

The Pros of Upholdings Compound Kings ETF KNGS

On the other hand, what have others praised about your fund?

Investors have been pleased with our performance and our communication.

We speak with investors through modern channels: email, social media, TV appearances.

Being able to share our holdings across these venues creates a lot of trust.

source: Excess Returns on YouTube

Inflation Protection Via Credit Card Volumes

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

Did you know that credit card volumes have grown dollar for dollar with M2 Money Supply over the last two decades?

Talk about inflation protection.

Connect With Robert Cantwell of Upholdings Investments

- Follow @upholdings on Twitter

- Sign up for quarterly letters at upholdings.com

Nomadic Samuel Final Thoughts

I want to personally thank Robert for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.