As an amateur investor I’m often torn between the different worlds of research-supported strategies. On the one hand, I’m fascinating with capital efficiency and maximum diversification. However, I’m equally mesmerized by factor equity strategies that have the potential to deliver excess returns over vanilla MCW approaches. Today we’re fortunate because our guest doesn’t compromise! He does ’em both. Without further ado, let’s things over to Trending Value!

How I Invest: A Warm Welcome To Trending Value!

I am a DIY factor-focused investor with a high ability, need, and moderately high willingness to take on risk. My spouse has a job which brings in a steady paycheck and is bond-like though not riskless. I am an entrepreneur and would consider my human capital stock-like (generally, shouldn’t put too fine a point on the analogy). I chose my twitter handle, Trending Value, because A. It was available and B. Value, Momentum, and Trend Following either are or will be key holdings in my portfolio.

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

An Investing Journey: From Boglehead To AQR

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Dave Ramsey introduced me to the basics of personal finance (go YNAB!). From Dave Ramsey I found my way to “Simple Path To Wealth” by JL Collins and then to the Boglehead community – low cost index funds; don’t look for the needle, buy the haystack – and then from there to Frank Vazques at Risk Parity Radio. Uncle Frank, as he is known, opened my eyes to a whole new world of investing adventures. His podcast has a treasure-trove of information for the DIY investor. Risk Parity Radio led me to the incredible Rational Reminder podcast and then community. The Rational Reminder community led me to firms like Alpha Architect and AQR, and people like William Bernstein and Larry Swedroe. Plus, I can’t leave out our mutual friend “HML_Compounder” who has been instrumental in unpacking complexity and setting my head straight.

If I had to recommend a guide to getting started (in order) it would look something like:

- Simple Path to Wealth by JL Collins

- Rational Expectations: Asset Allocation for Investing Adults

- The Psychology of Money by Morgan Housel

- Your Complete Guide to Factor-Based Investing by Larry Swedroe

- DIY Investor by Wesley R. Gray, Jack R. Vogel, and David P. Foulke

Then for a deeper dive (in no particular order):

- The Incredible Shrinking Alpha by Larry Swedroe

- Black Swan by Larry Swedroe

- Quantitative Momentum Jack Vogel and Wesley Gray

- Quantitative Value Wesley Gray and Tobias Carlisle

- Adaptive Markets by Andrew Lo

- Lifecycle Investing by Barry Nalebuff and Ian Ayres

- Blogs/Paper: Alpha Architect, Optimized Portfolio, AQR, PWL, Resolve

- Podcasts: Rational Reminder, Risk Parity Radio, Excess Returns, Resolve’s Gestalt U

I Learnt The Hard Way How To Manage Risk As An Entrepreneur

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

My investment personality was shaped by the passing of my father when I was a child and my decision—or perhaps compulsion—to become an artist/entrepreneur. Since my father essentially served as the CFO of our family, my mother was left with the dual challenge of managing a complex financial situation while caring for two small children. Thankfully, she had friends who stepped in to provide guidance. This family experience inspired me to deepen my own financial knowledge, in hopes of preventing similar circumstances in my own life. In addition, as an artist/entrepreneur, I’ve come to value the balance between risk and stability, as well as creativity and pragmatism, which significantly influences my approach to investment decisions.

As an entrepreneur with variable income, I learnt the hard way how to manage risk and make sure my needs were met over the long term. Since I take more risk in my career, we take less risk than might be recommended for a couple with our needs and abilities. For instance, we don’t lever up our all equity portfolio 2X even though a Lifecycle Investing strategy may be reasonable and even superior for some.

At the end of the day, DIY investing is not for everybody. It fits my personality; I have no problem diving into hours of podcasts, books, and white papers without structure. Investing is usually less complicated in the accumulation phase and so I do plan to work with an advisor in the future. My recommendation to people who are not interested in the space is to find a financial advisor from the start, but know that finding a high quality financial advisor may be just as challenging as deciding on an investment allocation. So, it’s worthwhile to read a few books and listen to a few Rational Reminder episodes before making any decisions.

The Best Portfolio Is The One You Can Stick With

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Move slowly. The worst time to shift allocation is when you are excited to shift the allocation. Only shift investment allocations once you’ve learned so much that you find the topic or asset boring. Also, and it’s a borderline cliché but remains true: the best portfolio is the one you can stick with. Investing is part science, part art.

I Am All In On Factor Investing: 2 Portfolios Designed For 2 Specific Goals

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

I have two portfolios designed for two specific goals.

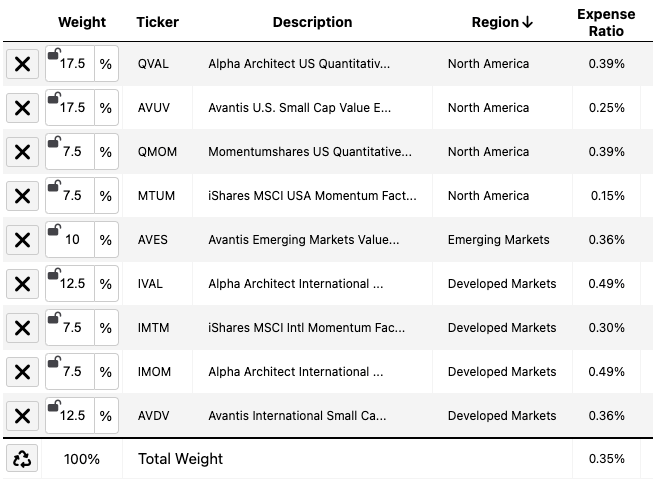

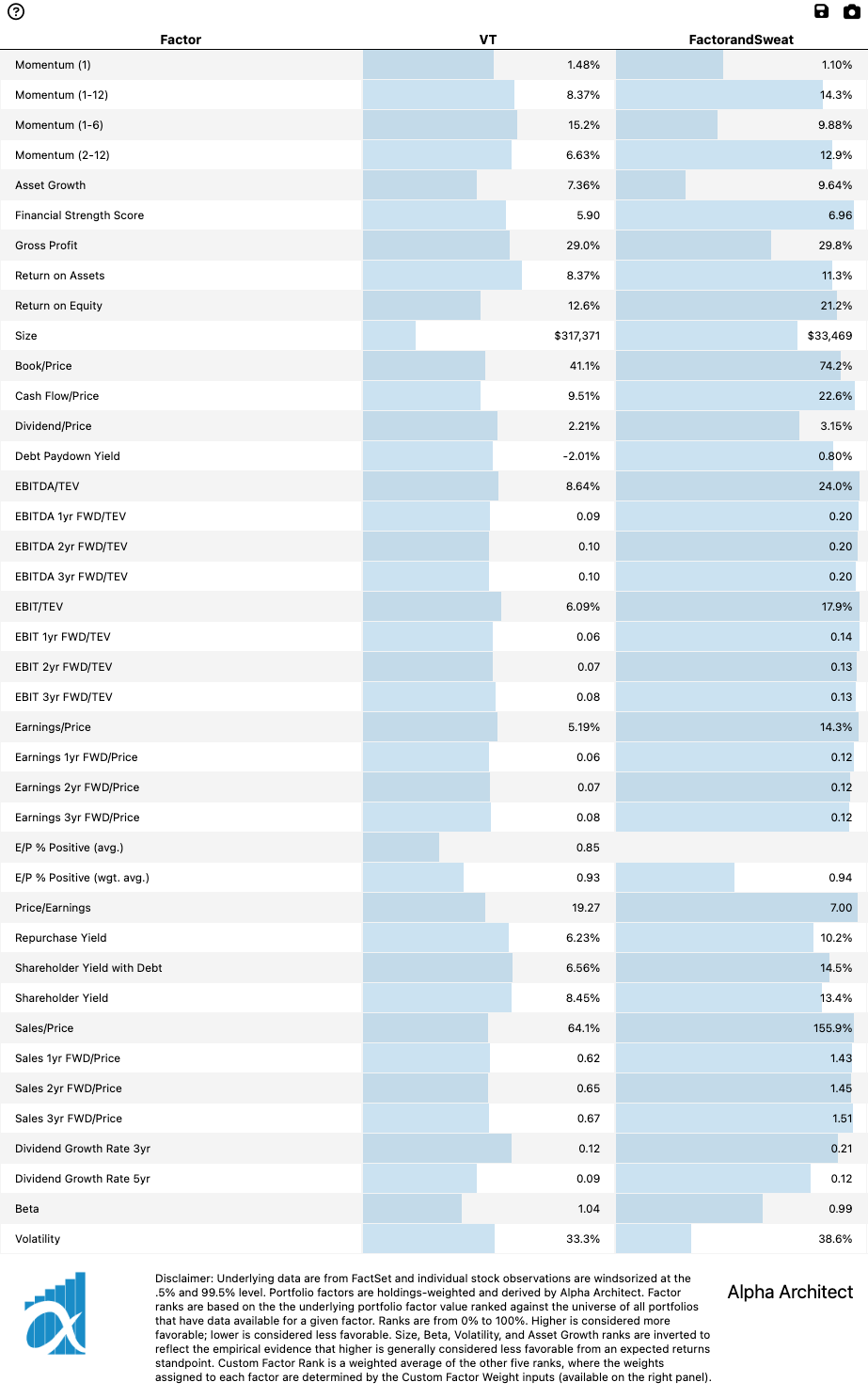

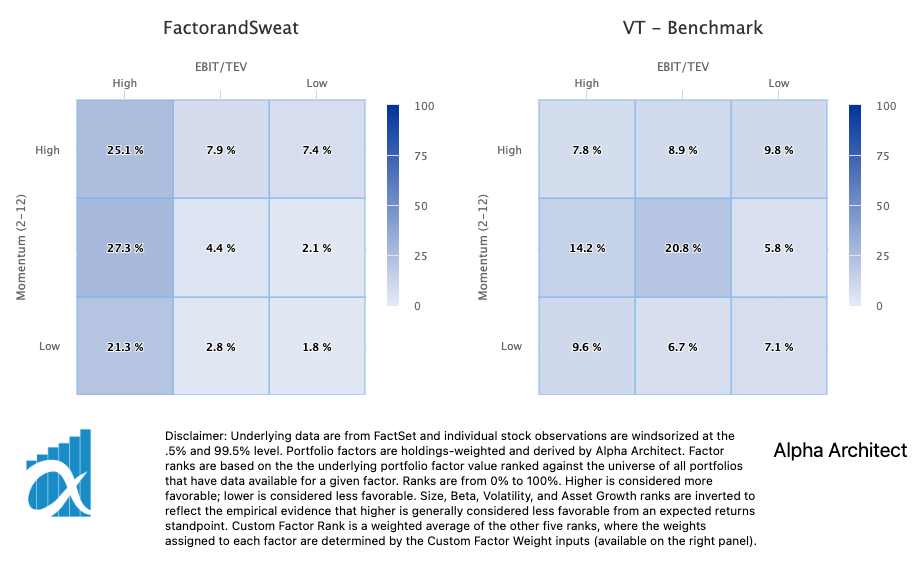

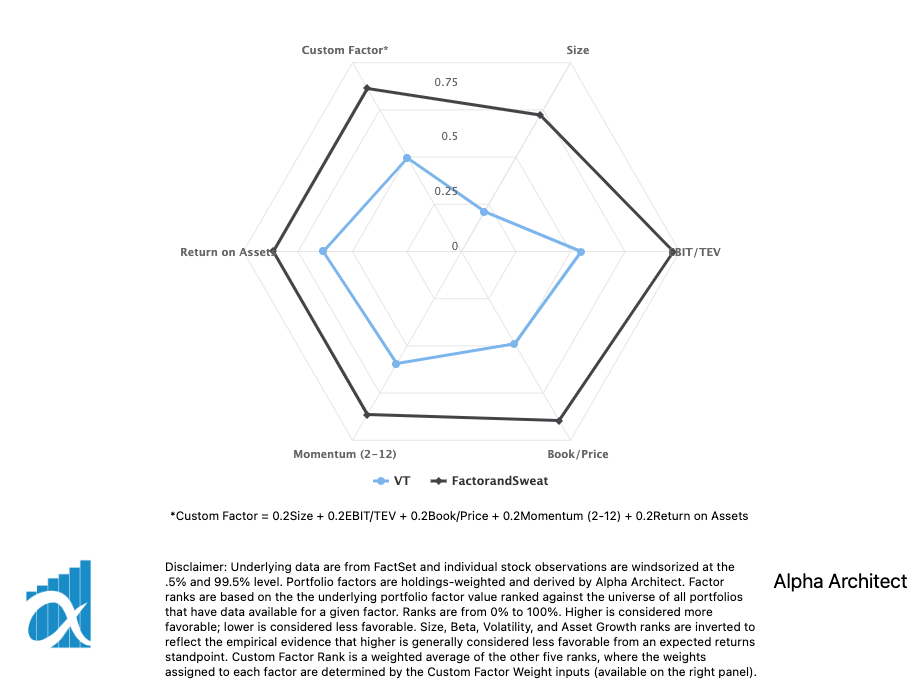

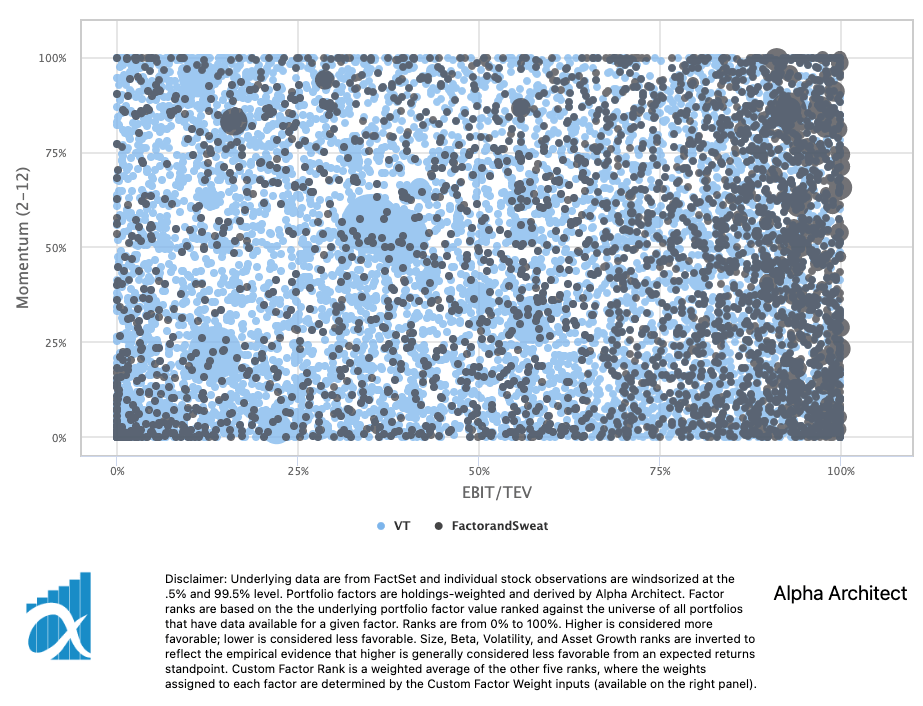

The “Factor & Sweat” portfolio (a distant cousin of the Boglehead famous ‘VTI And Chill”). It’s a retirement portfolio designed for a 30+ year investing horizon.

It’s 100% equities:

70 Value / 30 Momentum (I’m sinning a little given the current value spread).

50 US / 50 International.

I am all in on factor investing. I like to get a bargain, avoid junk, and ride a small wave of momentum on the side.

Antti Ilmanen and Jared Kizer found that factor investing helps reduce portfolio volatility and market directionality more than asset class diversification.

I overweight value due to the premium having strong risk and behavioral-based explanations whereas momentum has some risk-based explanations but primarily gets credit for exploiting bad behavior.

It should be noted that some say momentum will survive trading costs and taxes and some say it won’t.

Value and momentum are negatively correlated so their risk premiums tend to show up at different times.

I combine value and momentum in separate sleeves as opposed to using multifactor ETFs which blend them together. Behaviorally, it helps me to see how each piece is performing.

I hold an ensemble of funds in order to help navigate Rebalance Timing Luck – Newfound Research (thinknewfound.com). It likely means the portfolio won’t be the worst (if one of the value/momentum strategies underperform) but won’t be the best (by putting all my eggs in one strategy that shoots to the moon).

There will likely be long periods of time where this portfolio underperforms the market (the dreaded tracking error!). No pain no gain. But, it should also increase the expected returns and reliability of outcomes.

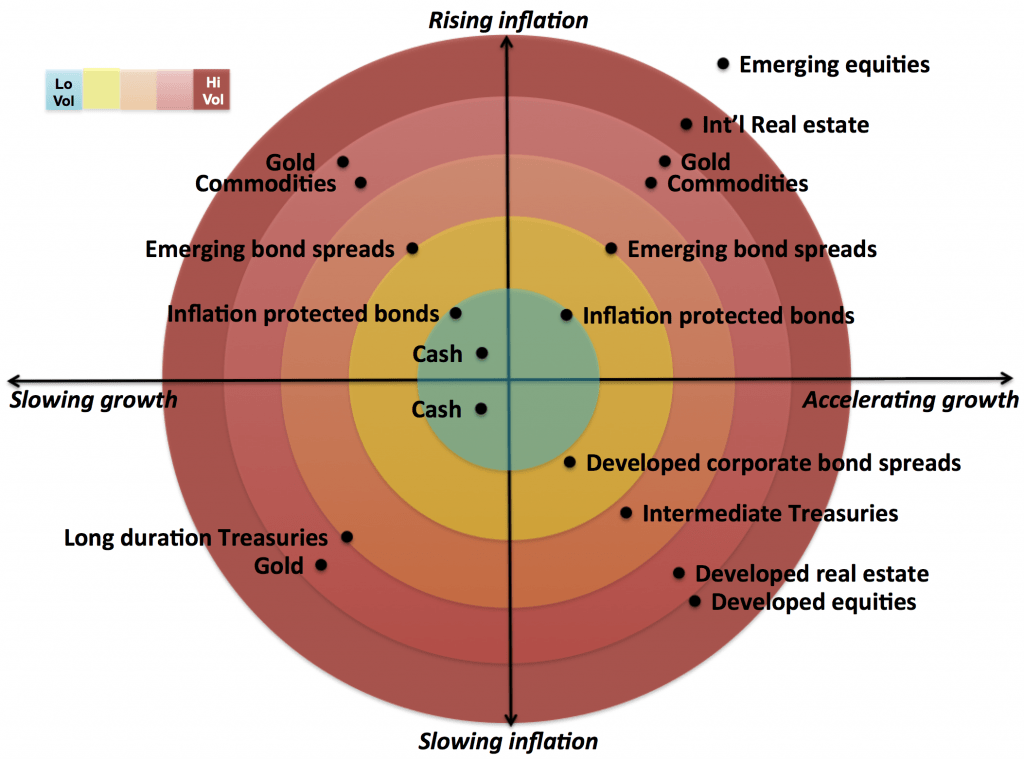

My second portfolio is based on Frank Vasquez’ Golden Ratio Portfolio and is designed for intermediate-term investing (3-5 years). We’re using it to save for a down payment on a house. Since we don’t know when or even if we’ll buy a house, this portfolio is designed to be moderately conservative while not significantly reducing long-term returns. Big ERN over at Early Retirement Now has a nice primer on the topic.

The portfolio consists of:

50% Equities (60% Global Small Cap Value / 40% Global Large Cap Momentum)

25% Long Treasuries

15% Managed Futures (KMLM, RSBT, QMHIX*)

10% Gold

*QMHIX is not displayed in photos as the Alpha Architect tool does not include mutual funds

It has diversified equities for rising growth/falling inflation, long treasuries for falling growth/falling inflation, gold to help in all environments except rising growth/falling inflation, and trend following on managed futures to agnostically go wherever the trends are (going long/short hundreds of markets – including commodities – and adding support to the positions that are already found in the portfolio). Since there is wide dispersion in the space, I attempt to capture the ‘beta’ of trend following managed futures by allocating to multiple funds. And because I have so many funds in this portfolio, I’ve limited the equities to MTUM/IMTM and AVUV/AVDV. Plus, there has been some analysis that large cap momentum is a better diversifier to small cap value than non large-cap momentum. In this portfolio, diversification reigns supreme and I have included alternative assets to stocks and bonds.

It should be noted that some say alternative assets are worthwhile and some say they aren’t.

No Investing Strategy Works If You Capitulate At The Wrong Time

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

You need extreme self-knowledge! Investing is personal. You have to be able to stick to a strategy over the long term. Larry Swedroe taught us that these strategies are pervasive, persistent, investable and implementable. But they won’t work if you capitulate at the wrong time. To riff on the law of conservation of energy: risk cannot be destroyed only transformed or transferred– even holding cash is a risk when inflation rears its ugly head! So at the end of the day, there are trade-offs everywhere you look. Pick the ones you can manage and be patient.

Also, it’s an exciting time to be a DIY investor! Costs are decreasing and we have access to more tools than ever before. I believe it’s important to leave dogma at the door and stay open to new ideas in the space. But, as Cliff Asness and others have said, “Keep an open mind, but not so open your brain falls out!”

Factor & Sweat Portfolio: Toned Down + More Aggressive Versions

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

A toned down version of the Factor & Sweat portfolio would be a one fund solution like AVGE. A more aggressive version of the Factor & Sweat portfolio would lever up 3X.

I Can See Both Sides Of An Argument

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

My greatest strength is my ability to see both sides of an argument. But, that can also present a big challenge when it comes time to make a decision. One of the ways I’ve found to move forward is to choose “both”. My ensemble approach is an example: should I have a concentrated value strategy or a diversified value strategy? They both have strong evidence in their favor. So, instead of choosing one over the other, I chose both. I’ve also been encouraged by research that shows naivete can be just as efficient as more sophisticated approaches.

Both Value and Momentum Are Reasonable Strategies To Pursue

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

I believe that both value and momentum are reasonable strategies to pursue directly but many find themselves in one camp or the other. My view of the debate between fundamental and technical analysts is similar to my view of the debate between theists and atheists about the existence of God. Right now, no one can say with certainty whether factors will continue to provide premiums and by the time we do find out, we’ll likely be long gone. Like everything in life, we’ll have to take a leap of faith.

On the other hand, many investors believe there is such a thing as a truly passive index fund and that investments are either active or passive. It’s a sliding scale. For instance, the S&P 500 could be seen as a low-resolution momentum machine (active!). People forget that market cap weighting was an active decision at some point. It’s active turtles all the way down.

Mild Obsession With The Idea Of Market Timing

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I’m diving into the world of levered risk parity more thoroughly. There is a strong case to be made that it is better to not hold 100% equities and instead lever up a diversified portfolio of stocks, bonds, commodities, and other alternative investments.

Since leverage adds complexity and there are many ways to construct leveraged risk parity portfolios, jury’s out on whether it’s worth the brain damage.

Don’t Hold One Small Cap Growth Stock Unless You Like To Go To The Lottery

What would be the ultimate anti-Trending Value portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Holding one small cap growth stock. There is nothing appealing about this portfolio. Unless you like to go to the lottery. Maybe you’ll hit the jackpot!

ADDENDUM:

In the original interview, I discussed the concept of “Levered Risk Parity” as a progression in portfolio optimization. While I wasn’t unfamiliar with the concept of “Levered Risk Parity,” I remained skeptical about its utility and feasibility for DIY investors in the accumulation phase, especially considering the available products. However, as of 2023, I believe it to be both a prudent and feasible strategy.

Given this newfound perspective, we’ve made adjustments:

Updated Retirement Portfolio (Factor & Sweat):

– 40% Long Only Value (AVUV/AVDV/AVES)

– 24% RSST (100% Large Cap US Equities + 100% Trend Following)

– 20% QLEIX (AQR Long-Short Equity)

– 16% TYA (~2.5x Intermediate Term Treasuries)

Portfolio Breakdown:

– 74% Equities (Beta + Long Only Factors)

– 24% Trend Following Managed Futures

– 20% Market Neutral Multifactor Equities

– 40% Intermediate Term (7-10 Yr) Treasuries

Overall Leverage: ~1.58x

On a side note, we transitioned from our intermediate term portfolio to cash, as we now plan to become homeowners in the next 1-2 years.

I anticipate this retirement portfolio to exhibit around 100% equity risk but with diminished volatility and drawdowns. As the landscape evolves, 2023 offers DIY investors a refreshing chance to craft more diversified portfolios, moving beyond the sole reliance on equities.

That being said, the equity risk premium remains one of the most reliable sources of excess returns and considering our bond-like human capital, we’re inclined to overweight it in our strategy. Of course, this portfolio isn’t strictly adhering to risk parity principles. Nevertheless, it signifies a meaningful stride towards diversification across both asset classes and strategies.

For a comprehensive overview on the topic of risk parity and hyper-diversification, Larry Swedroe has written several insightful articles. Additionally, there’s a wealth of knowledge from AQR, Resolve, Newfound as well as Antti Ilmanen’s new book “Investing Amid Low Expected Returns” and Larry Swedroe’s “Reducing The Risk of Black Swans.” And, of course, I have to give another shout out to the Risk Parity Radio podcast and anything by the father of “risk parity,” Ray Dalio.

Connect With Trending Value

Twitter: @TrendingValue

Nomadic Samuel Final Thoughts

I want to personally thank Trending Value for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.