A few months ago when I wrote the article “ETF Wishlist for DIY Investors” (as a collaboration with friends from #FinTwit) one of the most repeated suggestions was for a fund that offered global core equity and factor tilts (especially value) in one neat package.

Basically, an all-in-one global fund that offered the best of both worlds – core equity and factor exposure.

Being able to fulfill “all of your equity desires” in one fund has remained elusive for most sophisticated DIY investors and savvy advisors who have had to cobble together several funds in order to tick-off all of the boxes.

For instance, imagining a scenario where you wanted a global market-cap weighted strategy plus value funds to represent all of the major markets including US, International and Emerging.

You’d likely be looking at solutions such as VT ETF (Vanguard Total World Stock Index Fund ETF) for your market-cap weighted exposure and then three separate value funds (US/Int-Dev/EM) to round out your factor focused mandate.

Jeez Louise, wouldn’t it sure be nice to have one fund that could do all of that?

Enter the room Avantis All Equity Markets ETF (ticker: AVGE).

Freshly minted AVGE ETF is the first global fund that I’m aware of that attempts to bring everything together under one hood that balances the demands for both “core equity” and “multi-factor” mandates as a total package solution.

As a fund of funds it manages to squeeze 10 of its equity ETF ingredients into a super-sandwich.

Why a Super Fund of Funds?

Why do all of this?

The folks over at Avantis give four distinct reasons:

- “This strategy is designed to provide exposure to a broadly diversified set of companies, sectors and countries while emphasizing securities with higher expected returns. The strategy pursues its objective through investing in a series of other Avantis exchange-traded funds (ETFs).”

- It pursues the benefits associated with indexing (diversification, low turnover, transparency of exposures) but with the ability to add value by making investment decisions using information in current prices.

- “Efficient portfolio management and trading process that are designed to enhance returns while seeking to reduce unnecessary risks and transaction costs.”

- “This strategy is built to provide an investor with an effective total-market equity allocation.”

What immediately comes to mind is that if you can solve all of your equity needs with one fund it allows you to focus more on the “other sleeves” of your portfolio such as fixed income and alternatives.

However, there are at least three potential problems that could arise from an all in-one fund that tries to do it all.

- Does it have strong enough factor tilts (especially towards value) to satisfy staunch value investing enthusiasts?

- Does it provide enough “core exposure” for those leaning more towards indexing solutions?

- Does it satisfy the global asset allocation of US, International Developed and Emerging Markets in a manner that is palatable for most investors?

We’ll do our best to examine and unpack these concerns in this ETF review.

AVGE ETF Review | Avantis All Equity Markets ETF Fund Review

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

source: New York Stock Exchange YouTube

Avantis ETFs: The Top Value Funds For Investors?

In little over 3 years Avantis Investors has managed to jockey for a position as one of (if not the best) value investing firms for DIY investors.

From an entirely subjective experience on social media I’m hard-pressed to think of “value ETFs” that are more recommended than the likes of AVUV (Avantis U.S. Small Cap Value ETF), AVDV (Avantis International Small Cap Value ETF) and AVES (Avantis Emerging Markets Value ETF).

Objectively, this reality is confirmed by several of those funds amassing Billions of dollars in AUM.

AVUV ETF = 3.2 Billion

AVDV ETF = 2.0 Billion

Thus, the table has been set for a newly minted fund such as AVGE ETF to succeed.

However, investors historically have oddly been less keen to adopt “global” products.

This baffles my mind.

AVGE ETF Overview, Holdings and Info

As mentioned previously, AVGE ETF is a super fund of funds in the sense that it packs 10 underlying ETFs in its suitcase.

Hence, it’s a 10-1 fund.

Let’s pop the hood to examine all of the goodies we’ve got inside.

AVGE Exposures Sorted By Geography

| COMPANY | TICKER | CUSIP | ISIN | SECTOR | MARKET VALUE ($) | WEIGHT |

|---|---|---|---|---|---|---|

| Avantis Emerging Markets Equity ETF | AVEM | 025072604 | US0250726041 | Diversified | 2,377,287.22 | 5.67% |

| Avantis Emerging Markets Value ETF | AVES | 025072372 | US0250723725 | Diversified | 1,598,858.64 | 3.81% |

| Avantis International Equity ETF | AVDE | 025072703 | US0250727031 | Diversified | 4,265,279.20 | 10.17% |

| Avantis International Large Cap Value ETF | AVIV | 025072364 | US0250723642 | Diversified | 2,165,792.20 | 5.16% |

| Avantis International Small Cap Value ETF | AVDV | 025072802 | US0250728021 | Diversified | 857,055.04 | 2.04% |

| Avantis Real Estate ETF | AVRE | 025072356 | US0250723568 | Real Estate | 1,195,288.92 | 2.85% |

| Avantis U.S. Small Cap Value ETF | AVUV | 025072877 | US0250728773 | Diversified | 2,190,733.38 | 5.22% |

| Avantis US Equity ETF | AVUS | 025072885 | US0250728856 | Diversified | 18,718,224.00 | 44.61% |

| Avantis US Large Cap Value ETF | AVLV | 025072349 | US0250723493 | Diversified | 6,492,731.70 | 15.47% |

| Avantis US Small Cap Equity ETF | AVSC | 025072323 | US0250723238 | Diversified | 2,120,141.40 | 5.05% |

Directly from the AVGE ETF Prospectus we’re able to notice the following: “target weight” vs “target range”

AVGE Target Weight

US Equity = 70%

International Developed = 17%

Emerging Markets = 10%

Sector Equity = 3%

AVGE Target Range

US Equity = 63 to 77%

International Developed = 10-24%

Emerging Markets = 3-17%

Sector Equity = 1-6%

Now here is where we cannot please all investors.

Some will seek “greater exposure” to International Developed and Emerging Markets!

They’d likely prefer a 50/35/15 split between US, International and Emerging Markets.

On the other hand, you’ll find those investors that don’t feel the “slight home country bias” is enough!

They’d prefer 80/15/5.

And then you’ll find those who are “super contrarian” and want all three markers split evenly.

33/33/33 or 40/30/30.

This is clearly where going “global” will not tickle the subjective fancy of all.

And this is the primary reason why many investors prefer splitting up US, International and Emerging markets exposure into separate funds in order to allocate to personal taste.

I’m of the opinion the allocations (especially the target range) are acceptable but I’d be leaning more towards greater exposure to Int-Dev and EM versus US markets.

It’s by no means a deal-breaker though.

AVGE ETF Info

Ticker: AVGE

Net Expense Ratio: 0.23

Distributions: Semi-Annual

AUM: 37.9 Million

Inception: 09/27/2022

Considering the fund is less than 2 months old, I’m impressed by the AUM it has been able to accumulate.

Although it’s not over the threshold of 50 Million (that seems to keep a fund safe from the executioner) it is well on its way.

The management fee of an all-in-cost of 0.23 is very reasonable in my opinion for a 10-1 fund.

Militant low-cost indexers will likely disagree but those who aren’t trying to shave the cat to the bone are probably “just fine” with it.

Avantis All Equity Markets ETF Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

The underlying funds represent a broadly diversified basket of equity securities that seek to overweight securities that are expected to have higher returns or better risk characteristics than a passive, market-cap weighted index.

The following table indicates the fund’s target weight and range for allocation among the fund’s major asset classes and shows the underlying funds that comprise each asset class.This information is as of the date of this prospectus.

| Target Weight | Target Range | |||||||

U.S. Equity | 70% | 63% to 77% | ||||||

Avantis U.S. Equity ETF | ||||||||

Avantis U.S. Small Cap Equity ETF | ||||||||

Avantis U.S. Large Cap Value ETF | ||||||||

Avantis U.S. Small Cap Value ETF | ||||||||

| Target Weight | Target Range | |||||||

Non-U.S. Developed Markets | 17% | 10% to 24% | ||||||

| Avantis International Equity ETF | ||||||||

| Avantis International Large Cap Value ETF | ||||||||

| Avantis International Small Cap Value ETF | ||||||||

| Emerging Markets | 10% | 3% to 17% | ||||||

Avantis Emerging Markets Equity ETF | ||||||||

Avantis Emerging Markets Value ETF | ||||||||

Sector Equity | 3% | 1% to 6% | ||||||

Avantis Real Estate ETF | ||||||||

Under normal market conditions, the fund will invest at least 80% of its assets in equity ETFs.

The managers will strategically allocate to the underlying funds across geographies and investment styles to achieve the desired allocation.

The U.S. vs. non-U.S. allocations across geographies will be predicated on each region’s relative market capitalization with a home bias toward the U.S. The portfolio managers regularly review the fund’s allocations to determine whether rebalancing is appropriate.

To better balance risks in changing market environments and control costs and tax realizations, the portfolio managers may allocate within the target range in light of prevailing market conditions and relative performance.

We reserve the right to modify the target ranges and underlying funds from time to time should circumstances warrant a change.

The fund is an actively managed exchange-traded fund (ETF) that does not seek to replicate the performance of a specified index.The portfolio managers continually analyze market and financial data to make buy, sell, and hold decisions.”

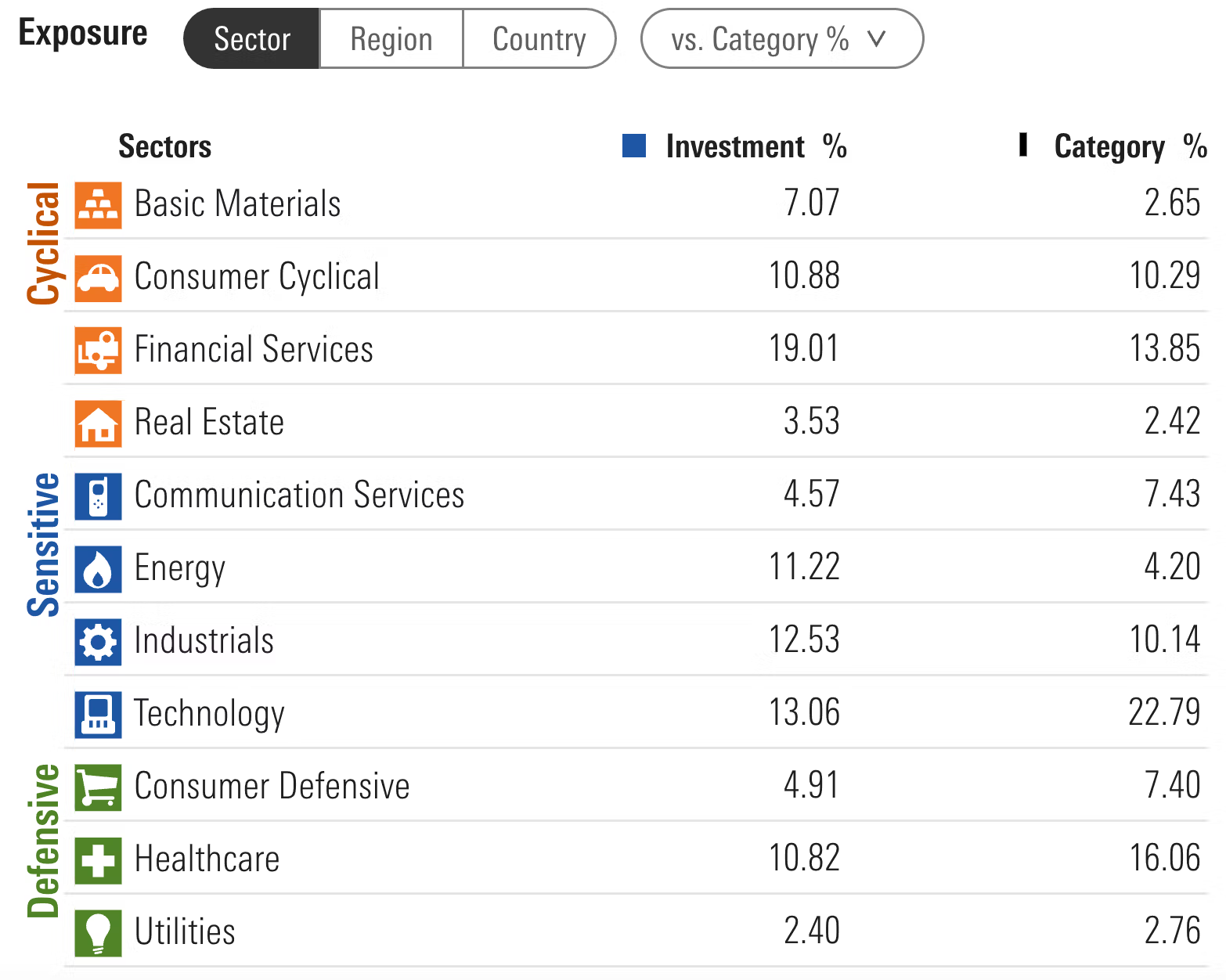

AVGE ETF – Sector Exposure

What’s immediately apparent about Avantis All Equity Markets Equity ETF is that it spreads out nicely from a sector exposure perspective.

I love that no sector reaches 20%!

You’ll notice AVGE ETF is overweight energy, industrials, real estate, basic materials and financial services.

On the other hand, it’s underweight healthcare, technology, consumer defensive and communication services.

Overall, I’m impressed with the sector exposure the fund offers with across the board coverage to everything.

AVGE ETF – Style Measures

Here is where AVGE shines relative to typical Market-Cap Weighted indexes from the perspective of value and growth measures.

It has a huge advantage in Price/Earnings with 10.51 versus the Category Average of 17.21.

It offers across the board more attractive measures for P/B, P/S and P/Cash Flow (where lower is better) and Dividend Yield (where higher is better).

Noteworthy, is the funds relatively impressive Cash-Flow Growth % where it reigns supreme versus typical market-cap weighted index.

Overall, AVGE ETF looks mighty impressive across the board for a core meets factor fund.

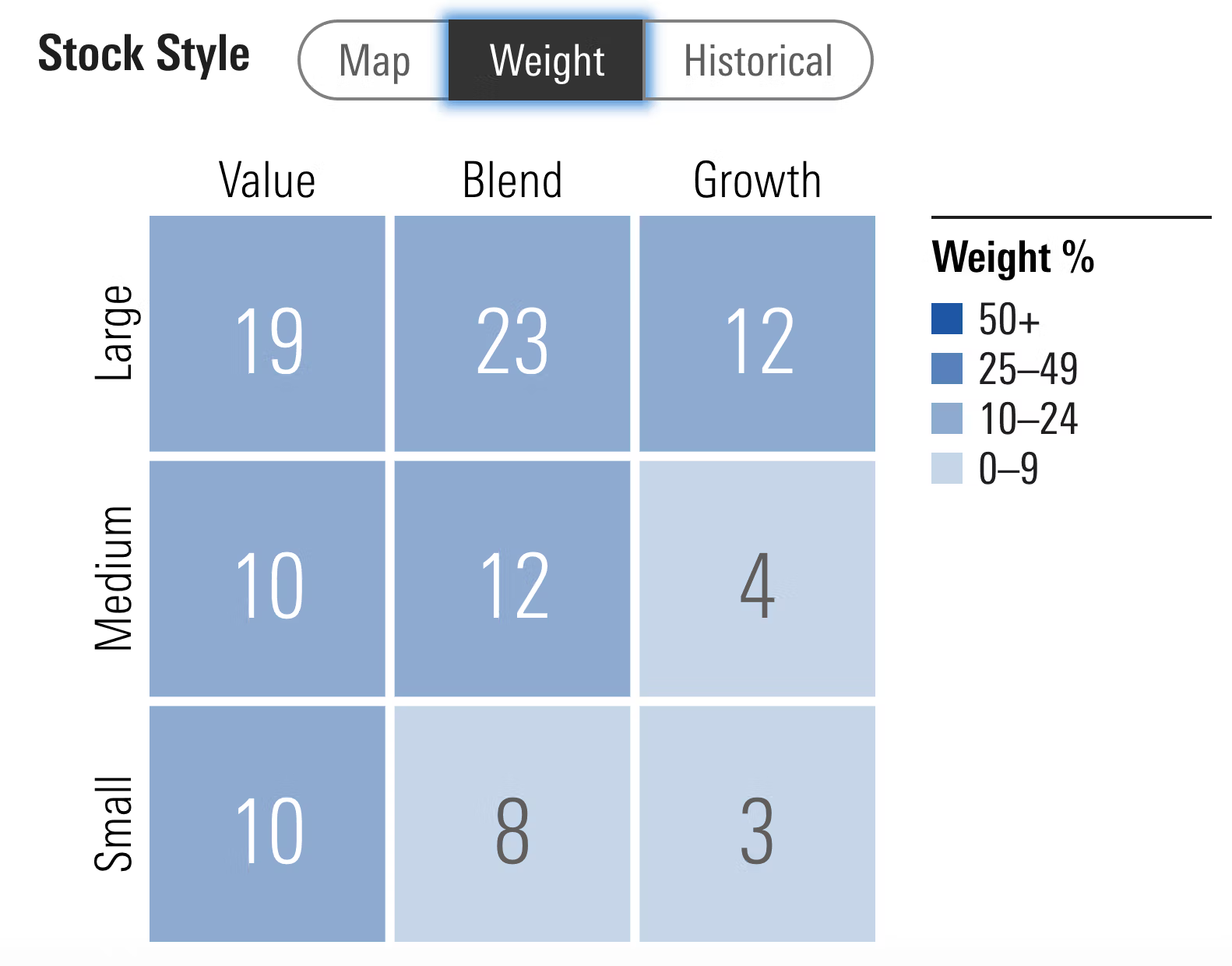

AVGE ETF – Stock Style

An immediate feather in the cap of AVGE ETF is that it offers considerably more small-cap and mid-cap exposure than typical market-cap weighted products that tend to be top heavy.

Overall, it tilts towards value with 49% versus 19% allocated to growth.

Its spreads out nicely with 21% small-cap, 26% mid-cap and 54% large-cap.

As with geographical allocations, AVGE ETF isn’t going to please all investors with its stock style configurations.

For instance, small-cap investors likely won’t bite.

However, I think the fund strikes a nice balance by covering all of its bases.

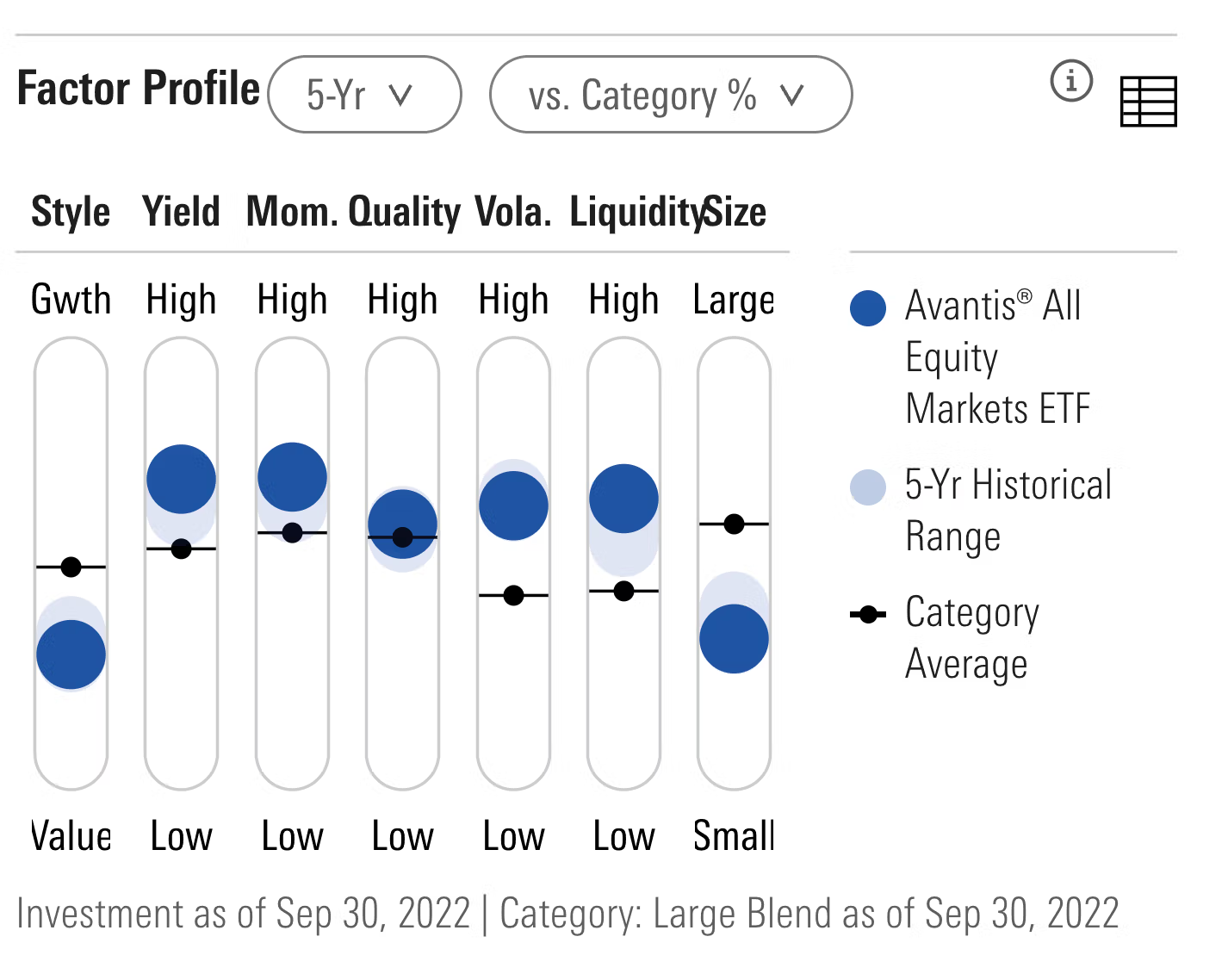

AVGE ETF – Factor Profile

AVGE offers solid across the board multi-factor exposure to value, size, momentum and yield versus category averages.

Often the biggest criticism of “vanilla market cap weighted funds” is that they don’t offer any significant factor exposure.

Yet Avantis All Equity Markets ETF is able to buck the trend.

AVGE ETF Alpha Architect Screening

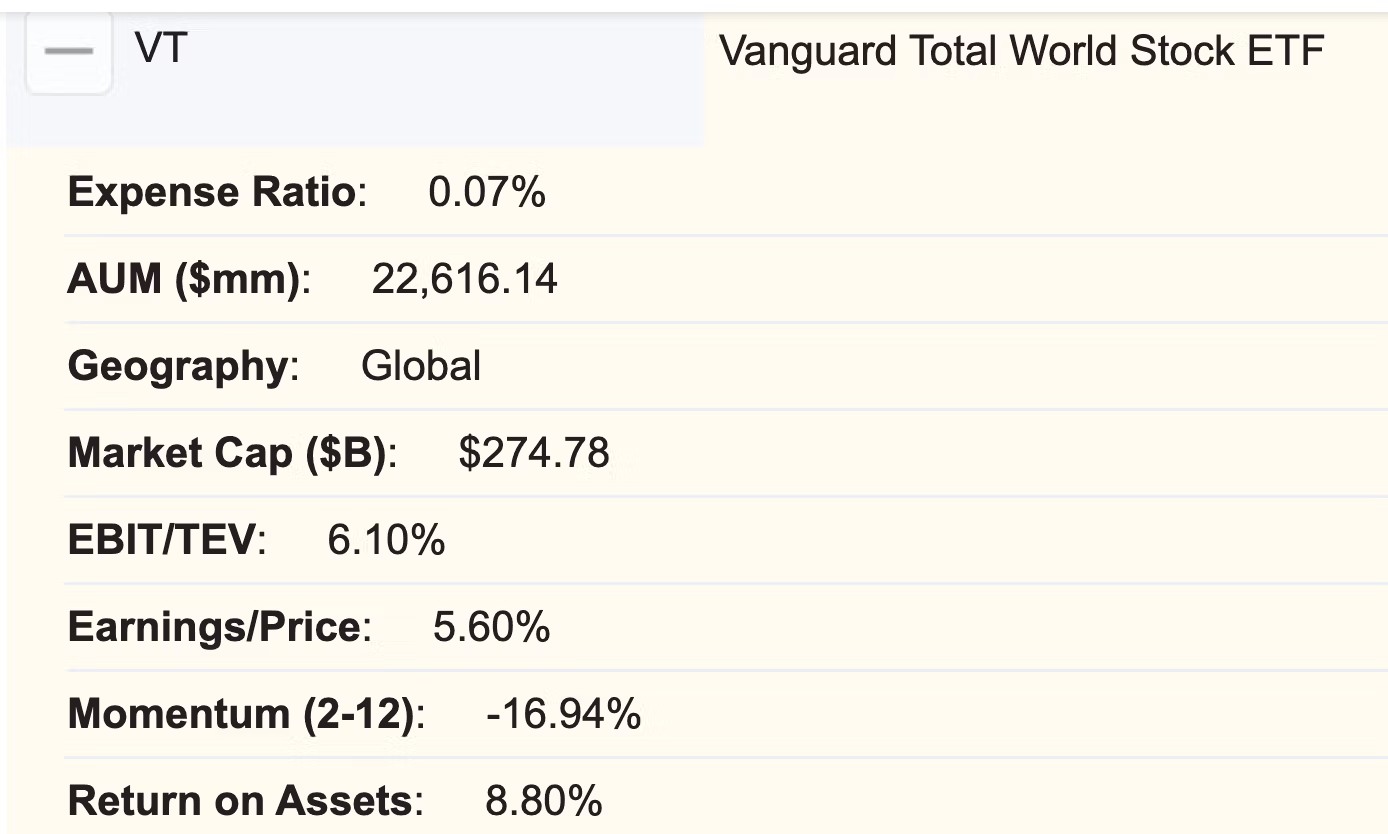

Finally let’s consult the invaluable Alpha Architect Fund Screener for a comparison of AVGE ETF vs VT ETF.

EBIT/TEV: 9.93% vs 6.10%

Earnings/Price: 8.42% vs 5.60%

Momentum (2-12): -8.96% vs -16.94%

Returns on Assets: 9.63% vs 8.80%

It’s an impressive win across the board for AVGE ETF versus VT ETF.

Avantis All Equity Markets ETF Performance

This fund was just released so its performance has to be taken with a grain of salt.

However, it has offered investors more than 200+ basis points of higher returns relative to VT since its inception.

I’ll update the article at a future date to better reflect its performance over time.

AVGE ETF Pros and Cons

Let’s examine the pros and cons of Avantis All Equity Markets ETF.

AVGE ETF Pros

- 10 in 1 fund providing a truly global equity solution for investors seeking a core fund with multi-factor tilts (especially value)

- The possibility for this fund to be a one fund solution for your equity exposure allowing you to focus upon other areas of your portfolio

- Significant mid-cap and small-cap exposure versus other “vanilla” market-cap weighted products

- Exposure to International and Emerging Markets to avoid “home country bias”

- Very reasonable net expense ratio of 0.23

- Potentially tax-efficient for US based investors (I’m Canadian so this is not an area of expertise)

- Adaptability to shift exposures geographically (could be considered a con by some)

AVGE ETF Cons

- Maybe not enough “global diversification” to satisfy certain investors that want 50-60% or less US equity exposure

- Potentially “too watered down” by its core equity allocations and not enough small-cap exposure to appease value investors

What Others Have To Say About AVGE ETF

Prior to completing this article I asked friends on Twitter to express their thoughts on Avantis All Equity Markets ETF with some great responses.

“I like the expense ratio, global diversification, tax efficiency, simplicity, and factor tilts. I like a little deeper tilts myself, but can’t complain!” – @MarkTMeredith

“Well said. It is an amazing fund and in my view, the best one-fund solution out there. Rumor is that the fund-of-funds structure gives US investors the benefit of foreign tax credits, something that even the competition in $VT doesn’t do.” – @HML_Compounder

“Love: The cost:benefit as @MarkTMeredith discussed already. The systematic, quantitative approach Dislike: The lack of clarification regarding the shifting weights (as far as I know this hasn’t been clarified). Emerging Markets exposure for at-best similar returns to S&P.”

– @DominantPort

“Waiting for UCITS version of the fund 🙏” – @MaciejWasek

AVGE Potential Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Now that we’ve taken a thorough look at AVGE let’s see how it can potentially fit into a portfolio at large.

100% ALL Equity Portfolio

Are you an all-equity investor?

Seeking a one-click solution for you portfolio?

Boom!

AVGE ETF and out.

100% AVGE.

Diversified Quant Portfolio

Here is a portfolio idea for the diversified quant:

60% AVGE ETF

20% KMLM ETF

10% LBAY ETF

10% TYA ETF

Here you’ve got your global equity solution covered with AVGE and you’ve introduced efficient treasury coverage with TYA (3X exposure) allowing you to also add trend-following managed futures (KMLM ETF) and a long-short equity strategy (LBAY ETF) to your portfolio.

Market-Cap Weighted Portfolio

If you’re committed to a market-cap weighted portfolio but want to dip your toes into the factor pond you might consider this allocation:

40% VT

20% AVGE

40% AGG

You’ve still got your 60/40 Portfolio with a small slice of factor exposure.

12-Question FAQ: Avantis All Equity Markets ETF (AVGE)

What is AVGE in one sentence?

A globally diversified, fund-of-funds equity ETF that blends broad “core” exposure with multi-factor tilts (notably value, size, quality, momentum) using underlying Avantis ETFs.

What’s inside AVGE?

Roughly ten underlying Avantis equity ETFs spanning U.S., international developed, emerging markets, plus a small sector sleeve (real estate).

How are the target weights set?

Prospectus targets (with ranges): U.S. 70% (63–77%), Int’l Developed 17% (10–24%), Emerging 10% (3–17%), Sector 3% (1–6%). Managers can position within ranges to balance risks, costs, and taxes.

How does AVGE deliver factor tilts?

By allocating across Avantis “core” and “value/small” ETFs; the combined basket overweights cheaper, smaller, higher-profitability names versus a pure market-cap index while retaining broad market coverage.

Does AVGE still hold growth and large caps?

Yes. It remains a total-market equity solution; factor sleeves increase value/size exposure but the fund keeps diversified large/mid/small and value/blend/growth representation.

How global is the exposure?

It’s a U.S.-tilted global portfolio (home bias) with material allocations to developed ex-U.S. and emerging markets via AVDE/AVIV/AVDV and AVEM/AVES.

What about sector diversification?

AVGE spreads across sectors (no single sector near 20% in recent snapshots) and includes a small real estate sleeve (AVRE) within the 1–6% sector range.

Fees, distributions, and structure?

Net expense ratio ~0.23%, semi-annual distributions. It’s an actively managed fund-of-funds (not an index replicator) that invests in other Avantis ETFs.

Who is AVGE for?

Investors wanting a single-ticket global equity holding that bakes in sensible factor tilts—simplifying implementation while avoiding a multi-ETF “Franken-portfolio.”

When might AVGE shine vs. a cap-weighted world fund (e.g., VT)?

When value/size and non-U.S. exposures outperform mega-cap U.S. growth, and when quality/profitability tilts help during fundamentals-driven markets.

When might AVGE lag?

During stretches of narrow, mega-cap U.S. growth leadership or when value/small underperform broad cap-weighted benchmarks.

Is this financial advice?

No. Educational only. Check the latest prospectus and consult a qualified advisor for your goals, taxes, and risk tolerance.

Nomadic Samuel Final Thoughts

There is a lot to love about Avantis All Equity Markets ETF!

Its one of the first ETFs to take a crack at being a truly global fund that blends core and factor (value) strategies together while offering significant small-cap and mid-cap exposure.

Yet, does it have enough “global exposure” to lure investors committed to avoiding home country bias?

Are the value tilts enough to lure in hardcore value investors?

Only time will tell.

But I do applaud Avantis for taking a stab at this kind of product as there definitely appears to be enough of a demand for it.

Overall, I’m impressed.

Now over to you.

What do you think of Avantis All Equity Markets ETF?

Is it on your radar?

Please let me know in the comments below.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

No thanks, but so appreciate the review. I already have plenty VT that I will never move from. My SCV is a 33% AVUV/AVDV/AVES. What I really want is a single global SCV only fund but that doesn’t exist…

You might be happy to learn that avantis is going to release Just that in July I believe . Stay tuned !

DGLIX – is a small global small cap blend from a company that tilts value. Via Morningstar, I do not see a true global scv.

I think its great. I like the concept of set it and forget it but always thought some of the broadly diversified funds had too much junk in them. For instance, 2022 saw VTI have a bigger drawdown than VOO. Mainly because there are quality screens in VOO that VTI doesn’t have. I guess time will tell if AVGE works out.

Unless someone is super picky, there’s very little to complain about in my view. It’s my understanding simplicity and diversification are most important to investing success.I think this fund is just about perfect for US investors. A total global market fund with moderate factors tilts and what seems like an appropriate amount of US home country bias, all in one fund.

My portfolio is this fund (AVGE) and Vanguard Total World Bond Fund (BNDW). With just these two funds I feel like I’m thoroughly well diversified in both stocks and bonds. Simplicity and diversification. What more could I want?

If you like more of a value tilt, consider AVGV – Avantis All Equity Markets Value.