One of the earliest memories I have of “fending for myself” was that time I made a super sandwich as a teenager.

Left alone to my own devices for lunch, I rummaged around the kitchen and found some leftover sourdough bread, turkey and bacon.

That alone toasted would have done the trick.

But I had to take it a step further.

So out came the strawberry jam, banana and peanut butter.

I know what you’re thinking.

That’s “___________” disgusting!

Hear me out.

Turkey and bacon are no doubt a winning combo?

Same with peanut butter and jam and peanut butter and banana?

Well, I’m telling you that all five of them together with melted butter on the sourdough toast sure tickled the fancy of my juvenile tastebuds.

It was an incredible 6-1 combination of unlikely ingredients that came together for the most ridiculously assembled super sandwich only a teenager could fully appreciate.

Well, the fund we’re going to review today is a super sandwich in the realm of alternative investments.

It takes six of AQR’s alternative funds and somehow gets all of the ingredients under one hood.

The super fund of funds, multi-asset class and multi-strategy fund I’m referring to is none other than AQR Diversifying Strategies Fund.

Ticker QDSIX.

I’ll attempt, as best my amateur eyes are capable of, to dissect what may be one of the best all-in-one alternative solutions for portfolios.

If you’re not still thinking about the ridiculous sandwich I mentioned, we can get started!

AQR Diversifying Strategies Fund: What’s Under The Hood?

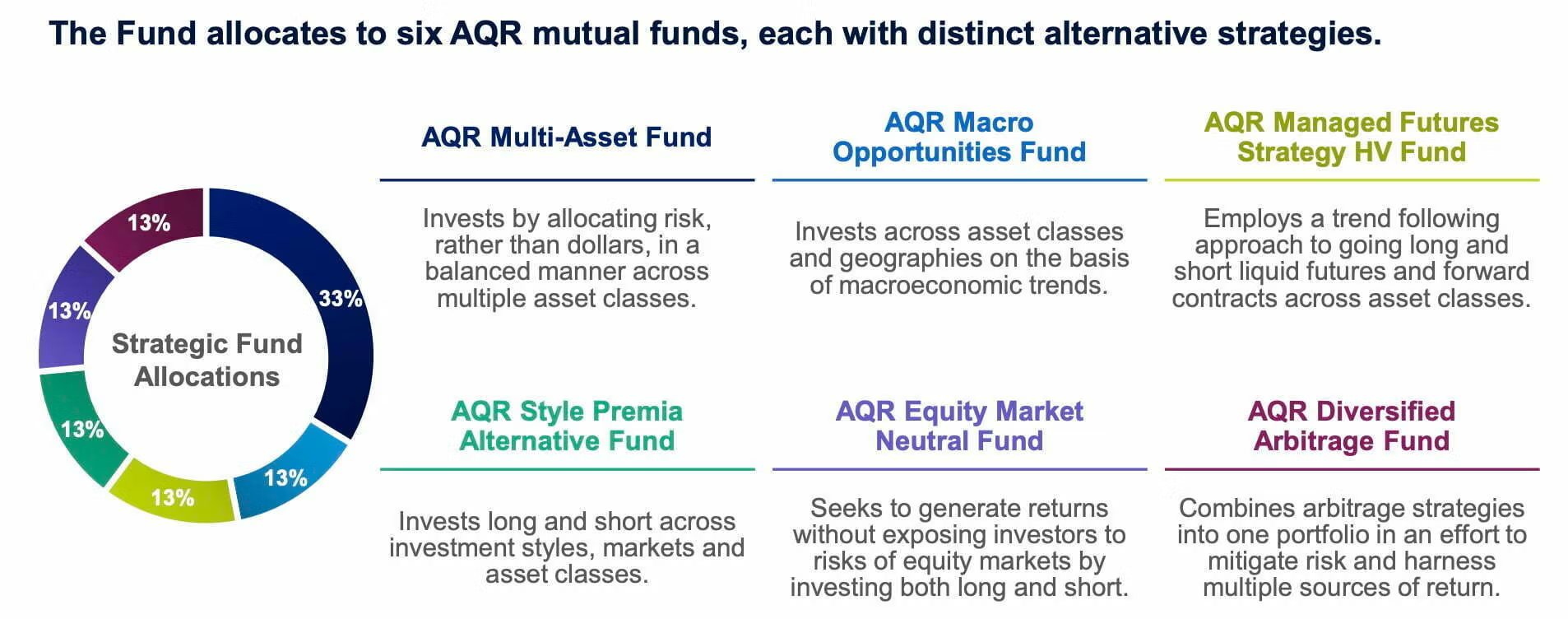

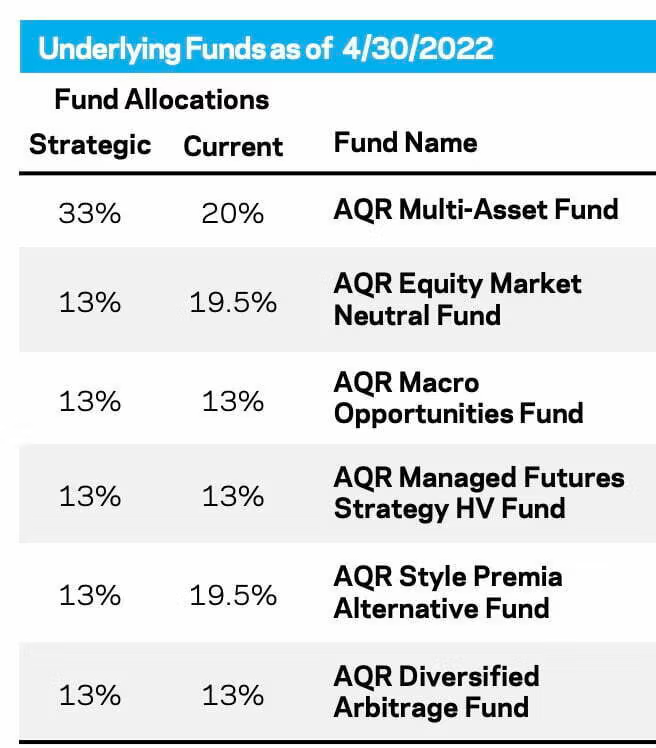

At this point you’re well aware this is a 6-1 super fund of funds but what exactly is under the hood of AQR Diversifying Strategies mutual fund?

- “AQR Multi-Asset Fund: Invests by allocating risk, rather than dollars, in a balanced manner across multiple asset classes.”

- “AQR Macro Opportunities Fund: Invests across asset classes and geographies on the basis of macroeconomic trends.”

- “AQR Managed Futures Strategy HV Fund: Employs a trend following approach to going long and short liquid futures and forward contracts across asset classes.”

- “AQR Style Premia Alternative Fund: Invests long and short across investment styles, markets and asset classes.”

- “AQR Equity Market Neutral Fund: Seeks to generate returns without exposing investors to risks of equity markets by investing both long and short.”

- “AQR Diversified Arbitrage Fund: Combines arbitrage strategies into one portfolio in an effort to mitigate risk and harness multiple sources of return.”

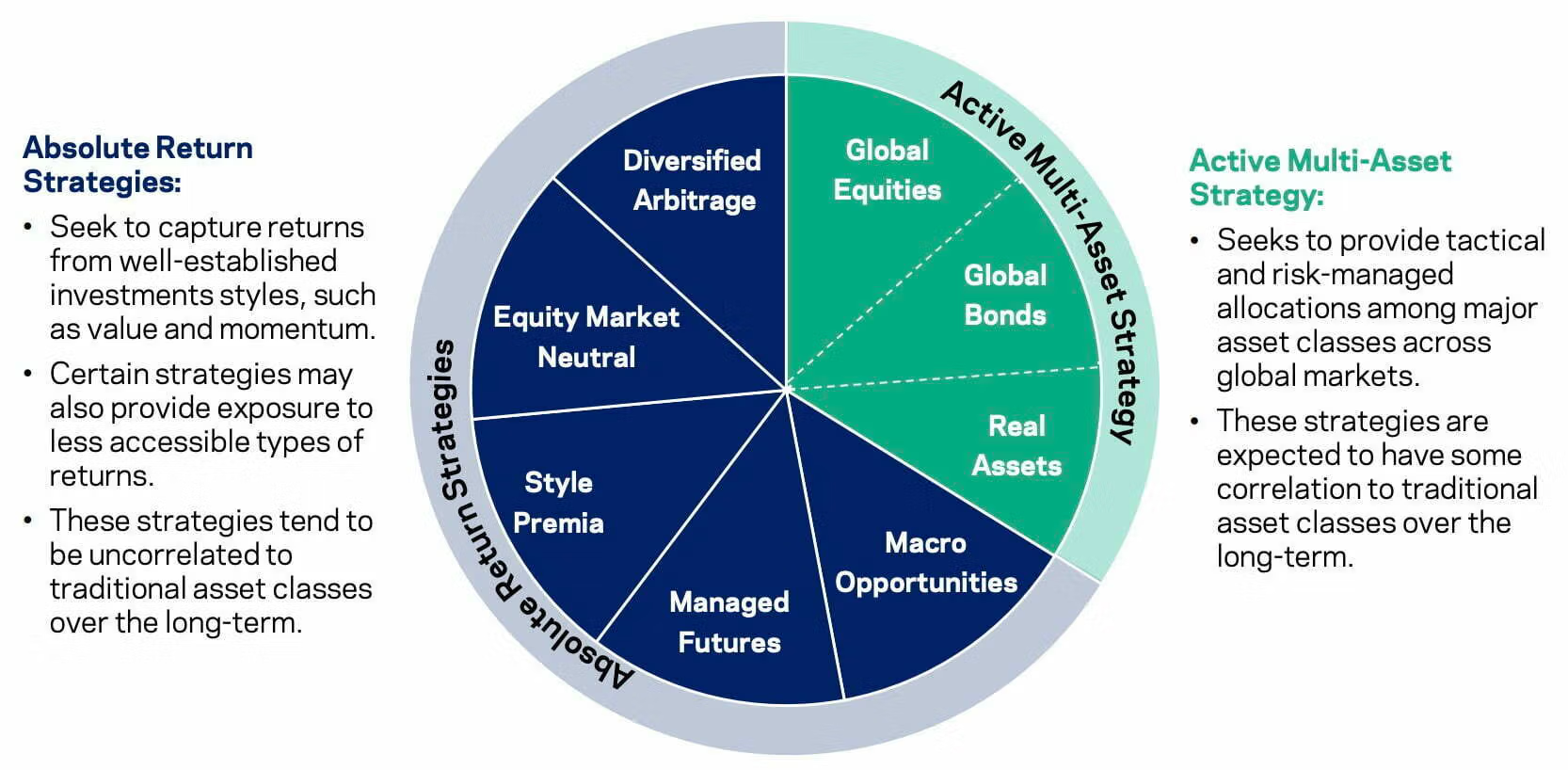

A better way of understanding the complex nature of this fund is to separate it into two categories.

The Active Multi-Asset Strategy (33% AQR Multi-Asset Fund) provides long-only tactical allocation to global equities, bonds and real assets.

This is what investors would be most familiar with in their traditional portfolios.

It’s a diversified mix of the global asset classes that make a long-only portfolio diversified.

The Absolute Return Strategies (5 Other alternative AQR funds each at 13% slices) are the long-short adaptive funds that deploy a myriad of different strategies.

I’d need to unpack each individual fund (with its own discreet review) to properly cover every strategy.

I actually plan on doing that!

But for the purposes of this article we’ll leave things to the brief strategy descriptions we highlighted above.

It’s also important to note a difference between the fund’s strategic and current holdings.

QDSIX utilizes a proprietary allocation methodology but with the discretion to modify based upon current market conditions.

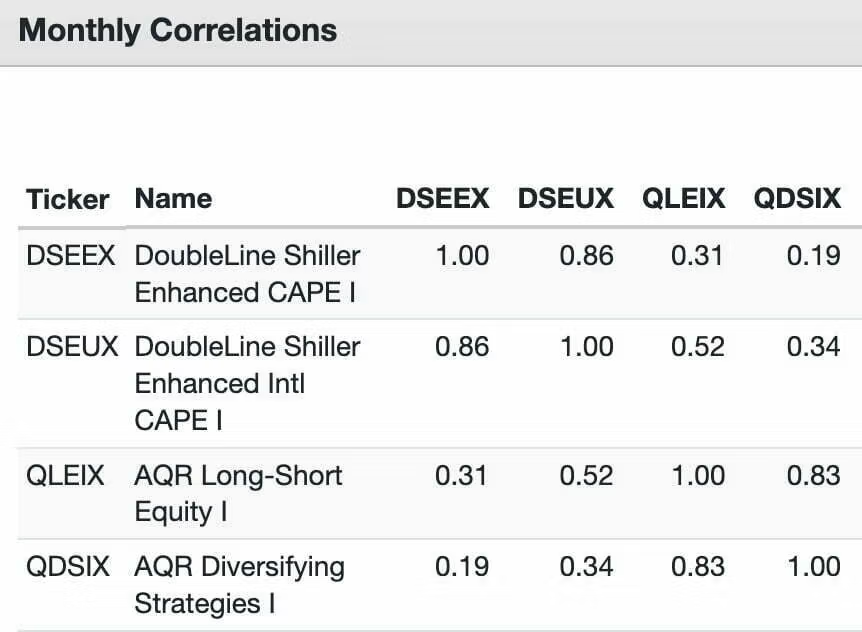

AQR Diversifying Strategies: Correlations Between Funds

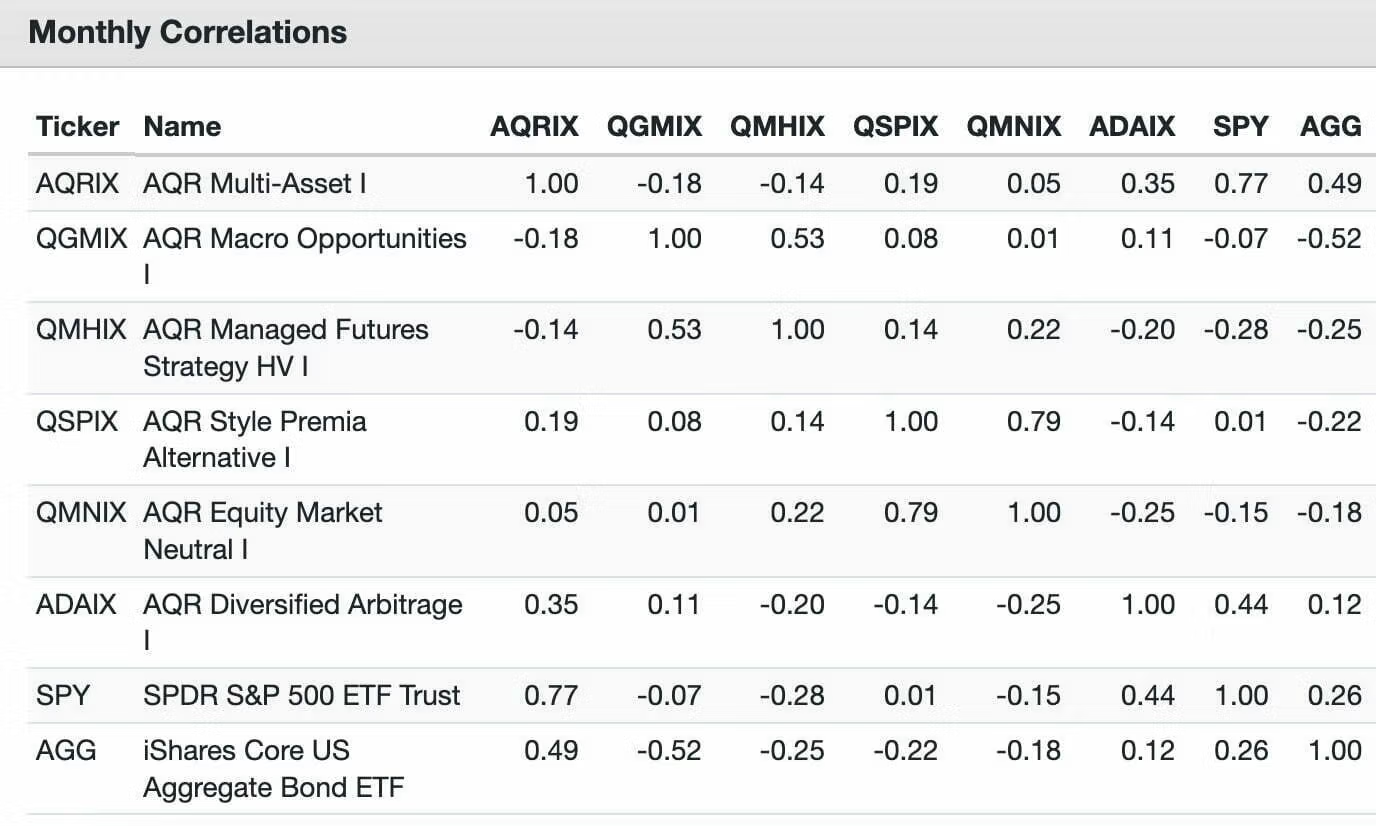

Here is where things get interesting.

We’re able to determine the monthly correlations between all AQR funds under the hood dating back to November 2014.

Just for good measure I’ve added SPY ETF and AGG ETF to the mix, so that investors can get a taste of correlations between the S&P 500 and Aggregate bond index.

Here is where you’re able to see a clear advantage of combining numerous alternative strategies together under one ticker.

Generally speaking, the alternative AQR strategies have low to negative correlations amongst each other.

Furthermore, they have low to negative correlations with SPY and AGG too.

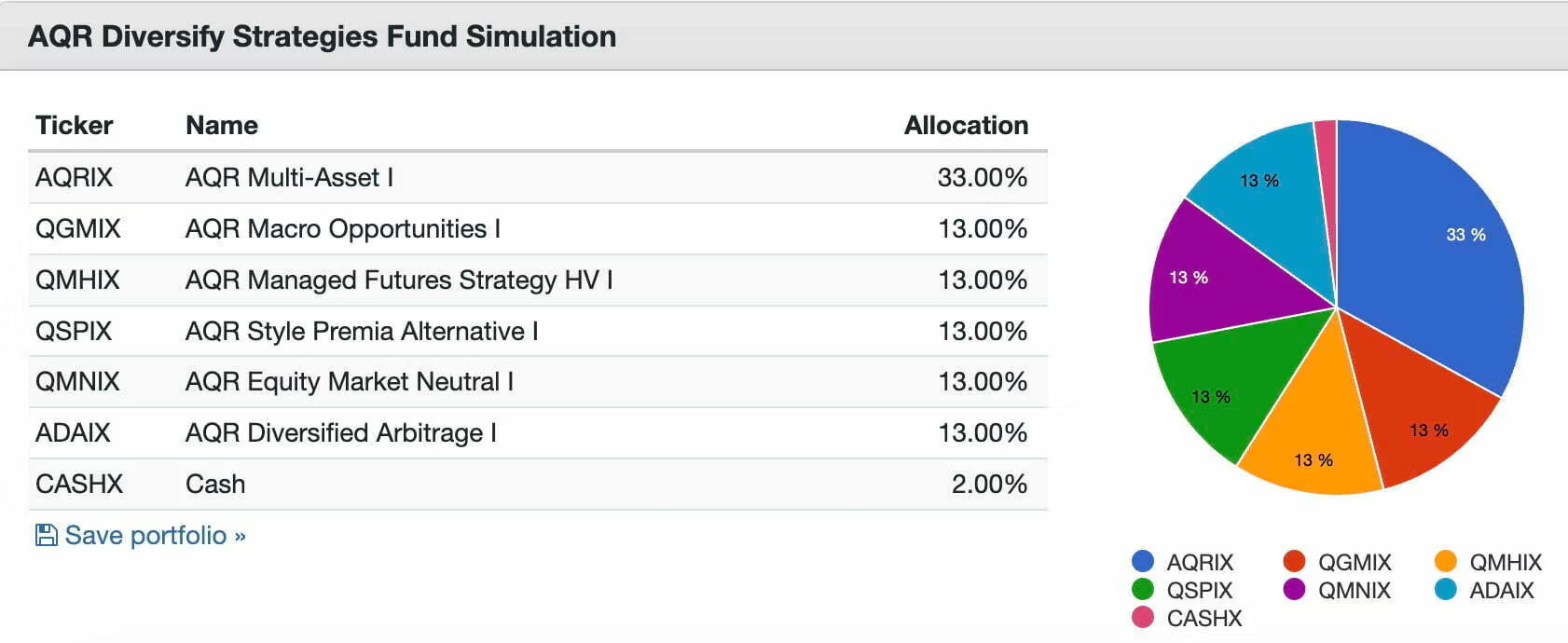

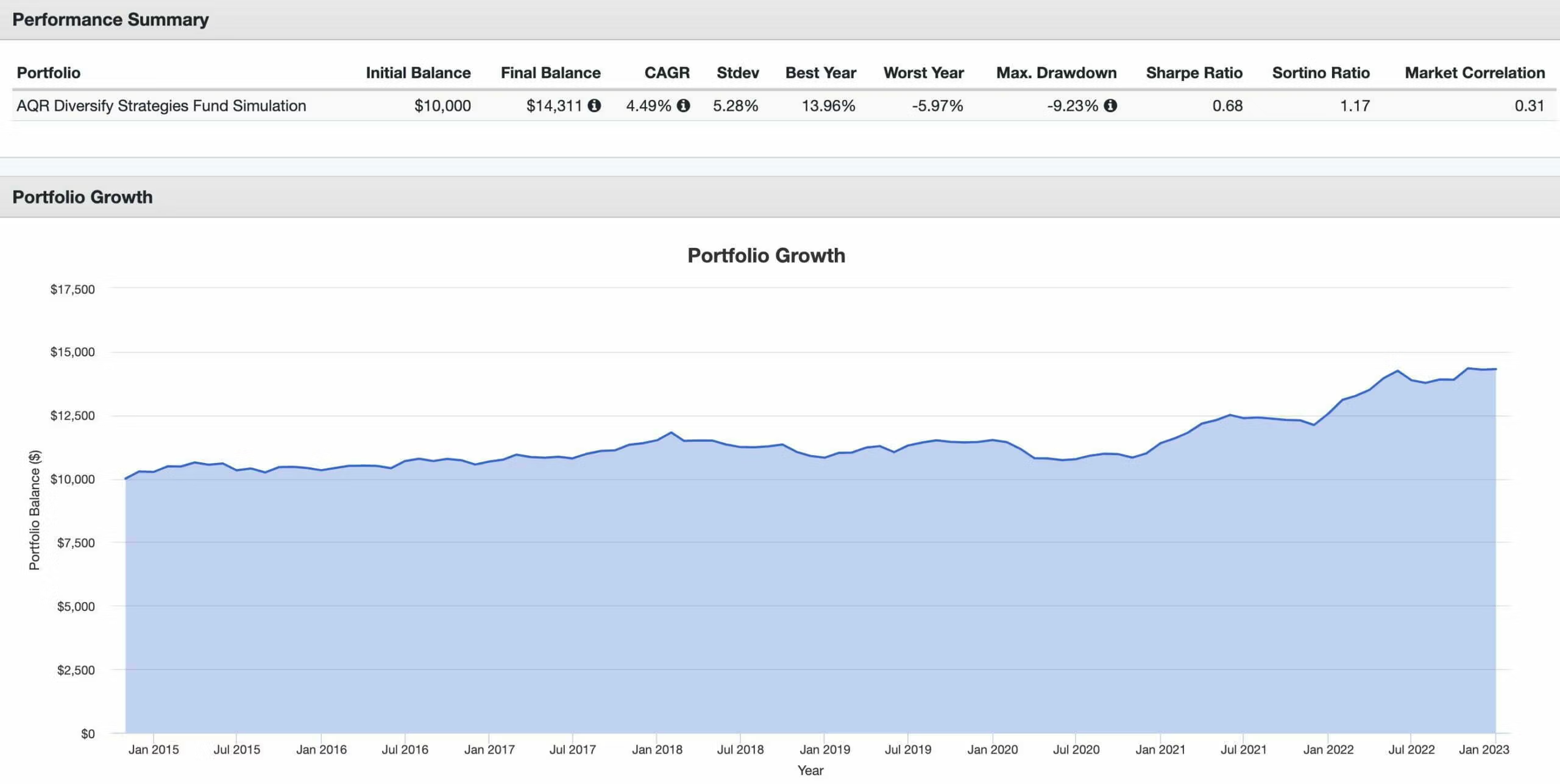

AQR Diversifying Strategies Simulation Performance

Let’s do a rough simulation of AQR Diversifying Strategies Fund by plugging in the strategic target allocations and rolling the clock back to November 2014.

CAGR: 4.49%

RISK: 5.28

BEST YEAR: 13.96%

WORST YEAR: -5.97%

MAX DRAWDOWN: -9.23%

SHARPE RATIO: 0.68

SORTINO RATIO: 1.17

MARKET CORRELATION: 0.31

In this backtest we’re able to clearly see that a simulated AQR Diversifying Strategies Fund at its target allocations provides decent returns and outstanding risk management.

With a maximum drawdown of only -9.23% and low market correlation of 0.31 it offers everything you’d want from an alternative fund in terms of a diversification meets risk management standpoint.

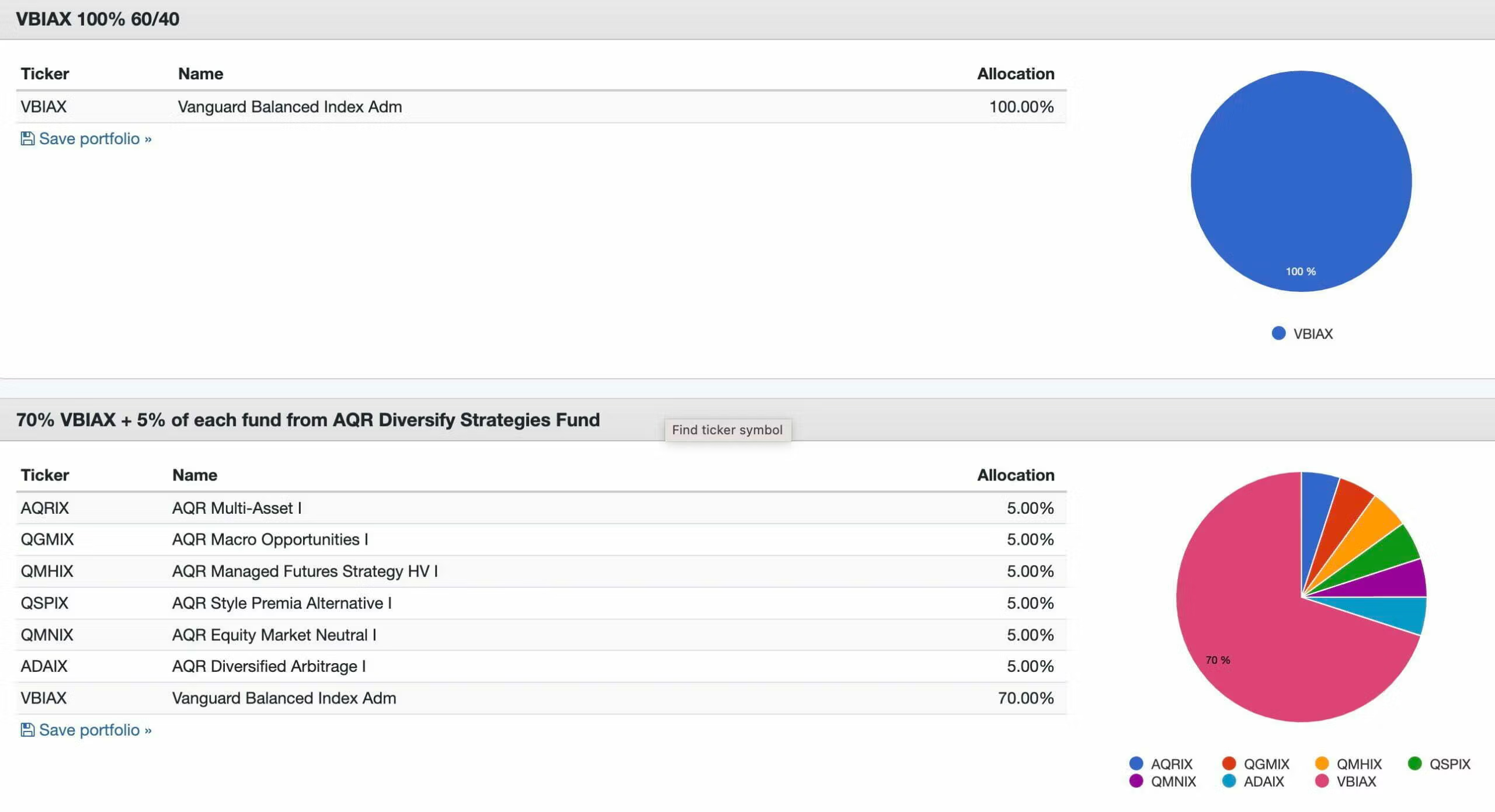

Just for fun let’s see what happens when we throw in 5% slices of all 6 of the underlying funds into a 60/40 portfolio.

Let’s view the difference in terms of performance versus risk management.

CAGR: 6.38% vs 6.12%

RISK: 10.30% vs 7.28%

BEST YEAR: 21.79% vs 16.09%

WORST YEAR: -16.90% vs -5.66%

MAX DRAWDOWN: -20.78% vs -9.96%

SHARPE RATIO: 0.56 vs 0.72

SORTINO RATIO: 0.82 vs 1.09

MARKET CORRELATION: 0.99 vs 0.97

What a difference in terms of risk adjusted returns when we add diversifying slices of AQR alternative funds to a milquetoast 60/40!

We give up 26 basis points of returns to receive 302 basis points of risk management in terms of enhanced standard deviation.

Our worst year and max drawdown become considerably more palatable.

And last but not least, we accept considerable upgrades in terms of our Sharpe Ratio and Sortino Ratio.

We’re able to clearly see the benefit of adding alternatives to the mix of a traditional portfolio.

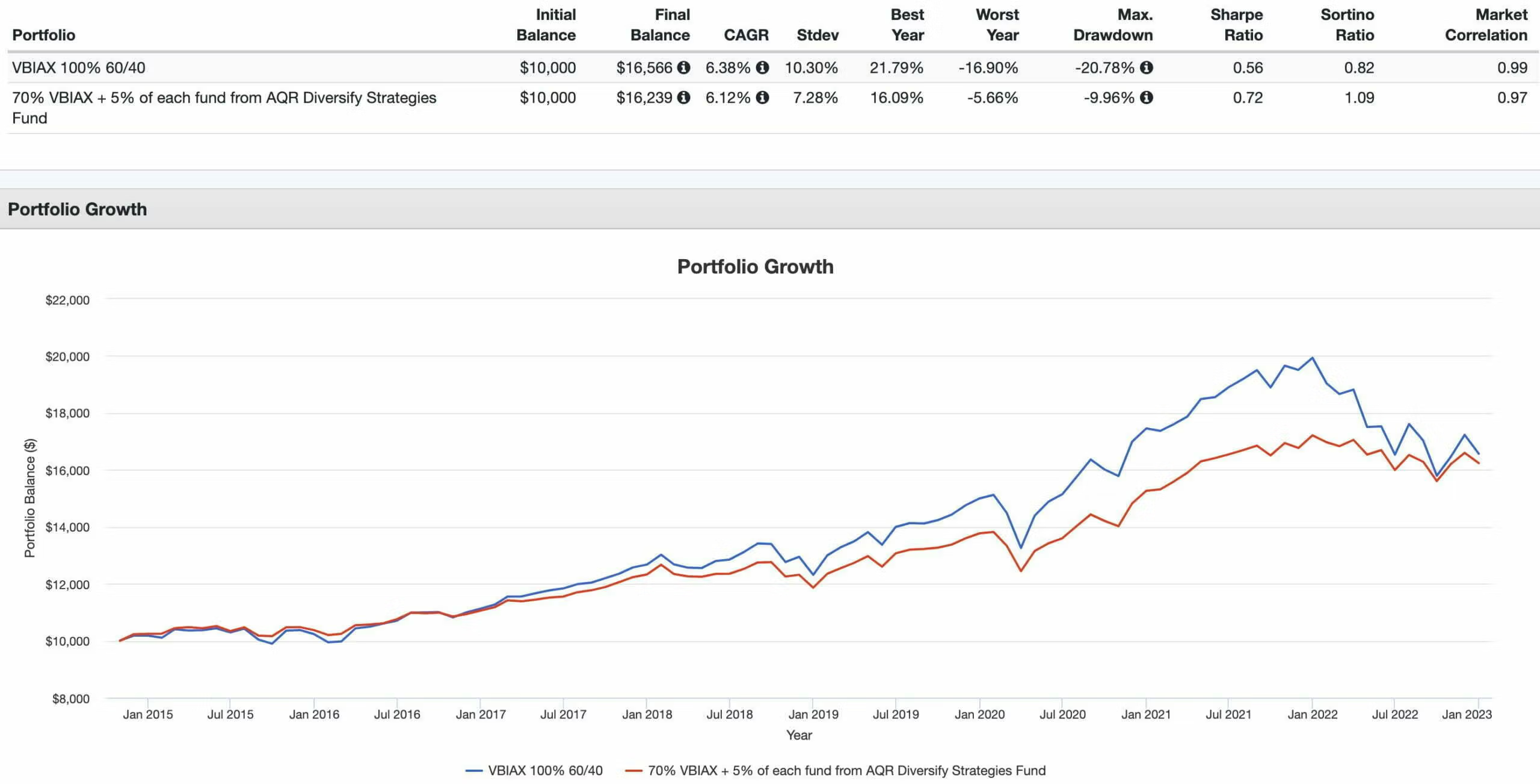

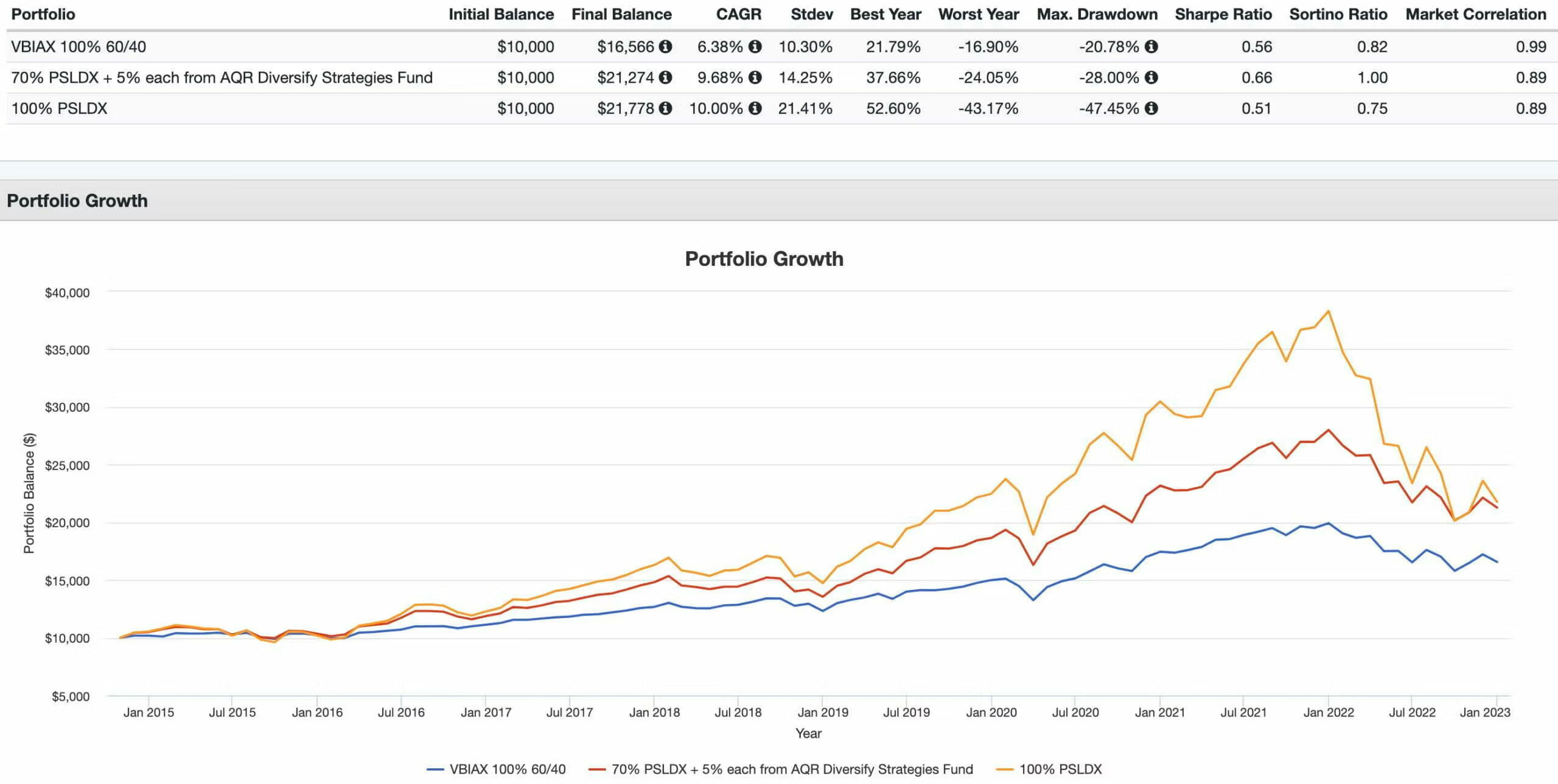

What about if we’re more capital efficient with our exposure to stocks and bonds?

To test that let’s compare the results of swapping out VBIAX with PSLDX versus a 100% VBIAX portfolio.

CAGR: 6.38% vs 9.68% vs 10.00%

RISK: 10.30% vs 14.25% vs 21.41%

BEST YEAR: 21.79% vs 37.66% vs 52.60%

WORST YEAR: -16.90% vs -24.05% vs -43.17%

MAX DRAWDOWN: -20.78% vs -28.00% vs -47.45%

SHARPE RATIO: 0.56 vs 0.66 vs 0.51

SORTINO RATIO: 0.82 vs 1.00 vs 0.75

MARKET CORRELATION: 0.99 vs 0.89 vs 0.89

When the AQR diversifying mix of alternative strategies is handcuffed to expanded canvas PSLDX it certainly helps tame its volatility.

The difference between standard deviation, worst year and maximum drawdown is jarring to say the least.

It’s pretty obvious at this point that an allocation to AQR Diversifying Strategies Fund offers investors a compelling puzzle piece whether they’re playing around in a 100% sandbox or with an expanded canvas.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

QDSIX Alternative Mutual Fund Review | AQR Diversifying Strategies Fund Review

AQR Capital Management: Alternative Investment Juggernaut

AQR Capital Management is an alternative investment juggernaut.

Few other fund providers offer such a wide ranging roster of funds for investors to consider.

Let’s check them out!

AQR Roster Of Funds

Single Strategy

AQR Diversified Arbitrage Fund – I: ADAIX / N: ADANX / R6: QDARX

AQR Equity Market Neutral Fund – I: QMNIX / N: QMNNX / R6: QMNRX

AQR Long-Short Equity Fund – I: QLEIX / N: QLENX / R6: QLERX

AQR Macro Opportunities Fund – I: QGMIX / N: QGMNX / R6: QGMRX

AQR Managed Futures Strategy Fund – I: AQMIX / N: AQMNX / R6: AQMRX

AQR Managed Futures Strategy HV Fund – I: QMHIX / N: QMHNX / R6: QMHRX

AQR Risk-Balanced Commodities Strategy Fund – I: ARCIX / N: ARCNX / R6: QRCRX

AQR Sustainable Long-Short Equity Carbon Aware Fund – I: QNZIX / N: QNZNX / R6: QNZRX

Multi-Strategy

AQR Alternative Risk Premia Fund – I: QRPIX / N: QRPNX / R6: QRPRX

AQR Diversifying Strategies Fund – I: QDSIX / N: QDSNX / R6: QDSRX

AQR Style Premia Alternative Fund – I: QSPIX / N: QSPNX / R6: QSPRX

AQR Multi-Asset Fund – I: AQRIX / N: AQRNX / R6: AQRRX

AQR Diversifying Strategies Fund Overview, Holdings and Info

The investment case for “AQR Diversifying Strategies Fund” has been laid out succinctly by the folks over at AQR: (source: fund landing page)

“Investment Objective:

Seeks capital appreciation.

A Diversified Approach to Alternative Investing:

The Fund seeks attractive long-term risk-adjusted returns through strategic allocations to AQR alternative mutual funds.

Investment Approach:

Leveraging AQR’s research and 20-year track record in alternative investing, the Fund is designed to complement an investor’s traditional stock and bond portfolio.

The Fund invests in a portfolio of AQR mutual funds, providing exposure to both Active Multi-Asset strategies and Absolute Return strategies:

Active Multi-Asset Strategies: seek to provide tactical and risk-managed allocations among major asset classes across global markets. These strategies are expected to have some correlation to traditional asset classes over the long-term.

Absolute Return Strategies: seek to capture returns from well-established investments styles, such as value and momentum. Certain strategies may also provide exposure to less accessible types of returns. These strategies tend to be uncorrelated to traditional asset classes over the long-term.

Why Invest in the Diversifying Strategies Fund?

A Core Alternative Allocation:

The Fund seeks to provide an all-in-one solution for investors seeking a strategic, long-term approach to alternatives.

Low Exposure to Traditional Markets:

The Fund seeks reduced sensitivity to stock and bond market movements, which can help improve portfolio resilience across various market environments.

Multiple Sources of Return:

The Fund offers diversified exposure to a range of alternative strategies and return sources.”

AQR Diversifying Strategies Fund: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve highlighted what I feel are the most salient parts and summarized the key points at the very bottom. (source: summary prospectus)

“Principal Investment Strategies of the Fund:

The Fund pursues its investment objective by investing in a portfolio of mutual funds that are each managed by the Adviser (the “Affiliated Funds”).

Through its investments in the Affiliated Funds, the Fund will have exposure across global markets, including developed and emerging markets, and across several asset classes, including equities, fixed-income, commodities and currencies.

The Affiliated Funds take long and short positions in a wide range of securities, derivatives and other instruments.

The Fund seeks to provide investors with:

1) reduced correlation to stock and bond market movements, and

2) multiple alternative return sources that are independent from traditional stock and bond markets.

Under normal circumstances, the Fund primarily invests its assets in the Affiliated Funds.

The Fund does not implement its principal investment strategy by investing directly in stocks, bonds, derivative instruments or other types of securities and instruments, but instead gains exposure to these types of investments through its investments in the Affiliated Funds.

The securities and other instruments in which the Affiliated Funds invest include equity securities, debt securities of any quality or maturity (including high-yield debt (e.g., below investment grade or “junk: debt) and inflation-protected securities, such as TIPS), convertible securities, options, swaps (including credit default swaps), futures contracts and forward contracts.

Investments in the Affiliated Funds.

Allocation to the Affiliated Funds is designed to provide exposure to two different categories of alternative strategies:

• Active Multi-Asset Strategies – these types of strategies seek to provide tactical and risk-managed allocations among major asset classes (e.g., equities, bonds, currencies) across global markets.

These strategies are expected to have some correlation to traditional asset classes over the long term.

• Absolute Return Strategies – these types of strategies seek to capture returns from both well-established investment styles (e.g., value and momentum) and certain strategies may also provide exposure to less accessible types of returns (e.g., merger and convertible arbitrage).

These strategies tend to be uncorrelated to traditional asset classes over the long term.

Absolute Return Strategies include exposure to:

○ Long/short strategies – taking long (and short) positions in investments deemed attractive (and unattractive) on a relative basis.

○ Directional strategies – taking long (or short) positions in investments deemed attractive (or unattractive) on an absolute basis.

○ Arbitrage strategies – these strategies include exposure to merger arbitrage, convertible arbitrage and other event-driven strategies.

The Adviser may allocate the Fund’s assets to individual Affiliated Funds at its discretion where the Adviser deems it appropriate and in accordance with the Fund’s investment objective.

Asset Allocation Investment Process.

The Adviser determines how the Fund allocates and reallocates its assets among the Affiliated Funds in accordance with its proprietary allocation methodology that is designed to provide the Fund with exposure to a diversified set of alternative strategies over time.

The Adviser will periodically review the investment strategies of the underlying Affiliated Funds and has discretion to modify these allocations, including adding or removing underlying.

Affiliated Funds, or rebalancing existing allocations, in accordance with a frequency it deems appropriate based upon current market conditions.

Additional Information

While the Fund does not target any particular level of volatility, the Adviser, on average, expects that, through its investments in the Affiliated Funds, the Fund will realize an annualized volatility level of between 4% and 8% over time; however, the actual realized volatility level of the Fund may differ from this expected range over certain periods of time.

Volatility is a statistical measurement of the dispersion of returns of a security or fund or index, as measured by the annualized standard deviation of its returns. Higher volatility generally indicates higher risk.

AQR Funds – Summary Prospectus

A portion of the Fund’s assets will be held in cash or cash equivalents including, but not limited to, money market instruments and/or U.S. treasury bills.”

AQR Diversify Strategies Fund Investment Strategy Key Points

- Fund Exposure: Global markets (developed and emerging markets) and Multiple Asset Classes (equities, fixed-income, commodities and currencies)

- Long and Short Positions: Across a wide range of securities, derivatives and other instruments

- Fund Goals:

A) Reduced correlation to stock and bond market movements, and

B) Multiple alternative return sources that are independent from traditional stock and bond markets. - Fund of Funds: Gains exposure to these types of investments and strategies through its own underlying alternative funds

- 2 Categories of Alternative Strategies:

A) Active Multi-Asset Strategies: Tactical and risk-managed allocations = some correlation to traditional asset classes

B) Absolute Return Strategies: Value, momentum, merger, convertible arbitrage = uncorrelated to traditional asset classes - 3 Types of Absolute Return Strategies:

A) Long/short strategies: Long (and short) positions in attractive investments (and unattractive) on a relative basis

B) Directional strategies: Taking long (or short) positions in attractive investments (or unattractive) on an absolute basis

C) Arbitrage strategies: Exposure to merger arbitrage, convertible arbitrage and other event-driven strategies - Asset Allocation Process: Proprietary methodology with the discretion to modify based upon current market conditions

- Target Volatility: No target but likely the fund will realize annualized volatility levels of between 4% and 8%

AQR Diversify Strategies Fund Info

Tickers: QDSIX (Class I) / QDSNX (Class N) / QDSRX (Class R6)

Adjusted Expense Ratio: 1.47 (Class I)

AUM: 224 Million

Inception: 06/08/2020

In terms of investment minimums, the fund is available for individual investors ($5 Million), Accounts offered by Financial Advisors (None) and Institutional Investors (None).

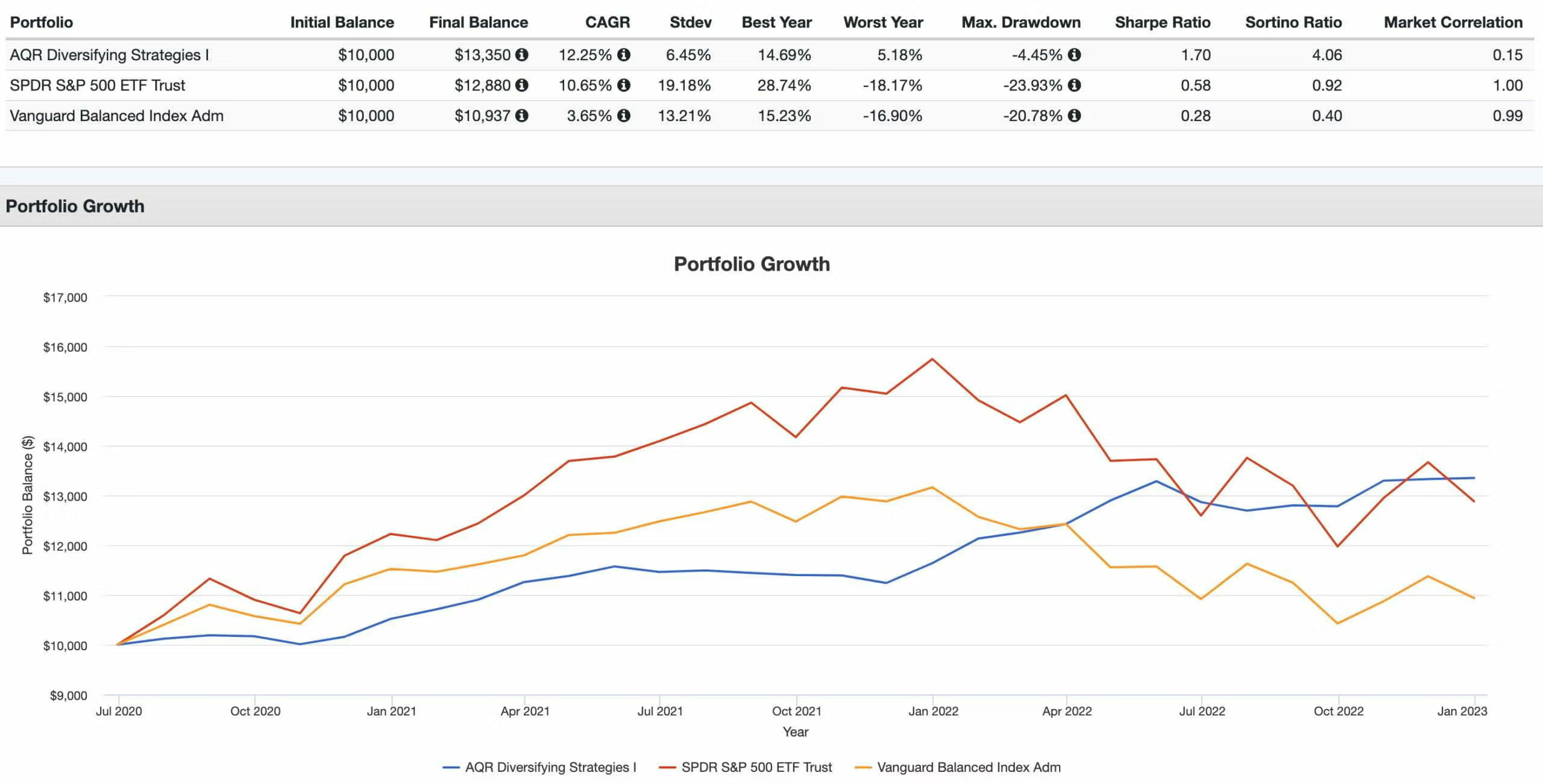

AQR Diversify Strategies Fund Performance

AQR Diversifying Strategies Fund couldn’t have picked a better time to be dropped into the sizzling frying pan.

Since its inception, it has handled the challenges the market has thrown its way with ease whereas the S&P 500 and 60/40 Portfolio have had their share of challenges to say the least.

CAGR: 12.25%

RISK: 6.45%

BEST YEAR: 14.69%

WORST YEAR: 5.18%

MAX DRAWDOWN: -4.45%

SHARPE RATIO: 1.70

SORTINO RATIO: 4.06

MARKET CORRELATION: 0.15

AQR Diversify Strategies Fund Pros and Cons

Let’s move on to examine the potential pros and cons of AQR Diversifying Strategies Fund.

QDSIX Pros

- Super fund of funds, multi-asset class, multi-strategy 6-1 single fund total alternative solution for your portfolio

- Low to negative correlations between the 6 alternative strategies offered in the fund

- Low to negative correlations between the 6 alternative strategies and major market fund such as SPY and AGG ETF

- The ability to plug into a traditional 60/40 portfolio and/or capital efficient portfolio to improve risk adjusted returns

- A strategy that has navigated the challenges of the 2020s with ease while traditional long-only asset classes have struggled

- The capacity to achieve superior absolute returns no matter what economic regime or curveball is thrown its way

- Instead of having to cobble together numerous alternative strategies you can just plug this all in one solution into your portfolio

- Eliminates the risk of one alternative strategy that is struggling from dragging the portfolio down by splitting up into 6 parts

- The expectation (but not target) of 4 to 8% volatility to smooth out overall portfolio returns

- Reasonable management fee for a fund of funds alternative investment strategy

QDSIX Cons

- Tracking error and prolonged periods of relative underperformance versus traditional asset classes tempts investors to bail on alternative strategies

- Could be a bit of a blackbox for investors not familiar with all of the alternative strategies that are part of the fund

AQR Diversify Strategies Fund Model Portfolio

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

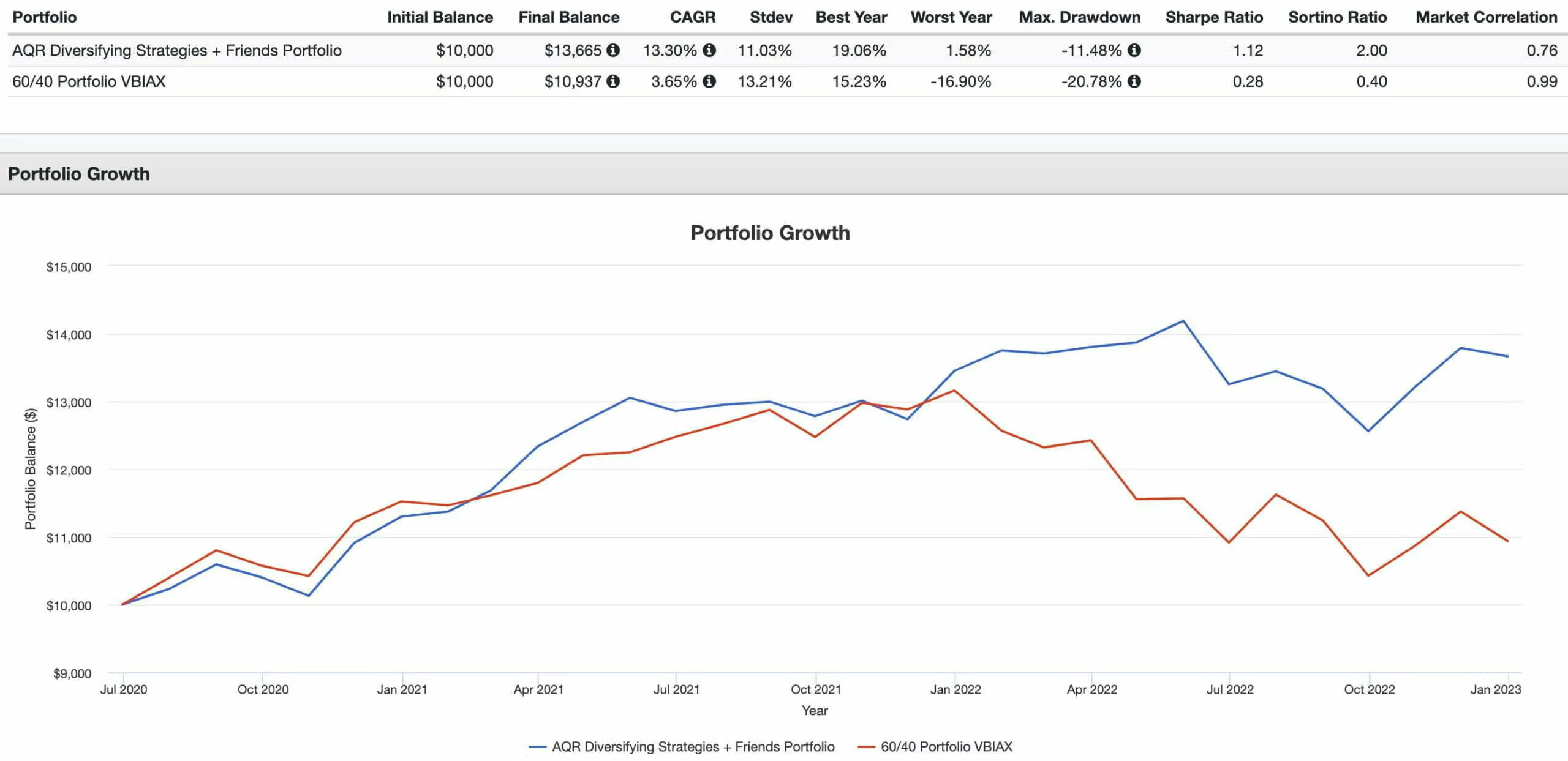

Let’s put together a globally diversified expanded canvas model portfolio where AQR Diversifying Strategies Fund has plenty of breathing room and space to shine.

20% DSEEX – DoubleLine Shiller Enhanced CAPE

20% DSEUX – DoubleLine Shiller Enhanced Intl CAPE

20% QLEIX – AQR Long-Short Equity

40% QDSIX – AQR Diversifying Strategies

The capital efficient 100/100 equities/fixed income DoubleLine funds allow us to reach 40/40 equities/bonds with a 40% allocation.

We’ll add 20% AQR Long-Short Equity to fulfill the exposure of a 60/40 portfolio with 40% of space leftover for QDSIX.

AQR Diversify Strategies Fund + Friends Portfolio vs 60/40 Portfolio (VBIAX)

CAGR: 13.30% vs 3.65%

RISK: 11.03% vs 13.21%

BEST YEAR: 19.06% vs 15.23%

WORST YEAR: 1.58% vs -16.90%

MAX DRAWDOWN: -11.48% vs -20.78%

SHARPE RATIO: 1.12 vs 0.28

SORTINO RATIO: 2.00 vs 0.40

MARKET CORRELATION: 0.76 vs 0.99

Here we’re able to see that an expanded canvas portfolio pursuing maximum diversification between strategies absolutely crushes a 60/40 portfolio in what is albeit a very small sample size.

It’s just an across the board triumph from a risk meets returns standpoint.

The monthly correlations between the four funds suggest that we’re well diversified for future battles.

Nomadic Samuel Final Thoughts

AQR has really created a masterpiece with its Diversifying Strategies super fund of funds.

Investors are able to drop a slab of the fund into their portfolios with six different alternative strategies conspiring to enhance risk adjusted returns.

It’s a no brainer, in my opinion, if you’re able to purchase it.

However, at this point in the review I’m more interested in what you’ve got to say.

What do you think of AQR Diversifying Strategies Fund?

Is it on your radar?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Given the multitude of asset classes, factors, trading strategies, etc. under the hood here, I’m wondering whether this could be similar to FIG as a standalone portfolio option even though AQR doesn’t seemingly market QDSIX in the same fashion.

Great content as always. Suggestions for an alternative fund with a longer track record for backtesting?

QLEIX and QDSNX are in the mix for me and have been stellar so far…

Thanks for shinning a light on these funds.