We continue the “How I Invest” series with Stefan Schumacher who reveals his globally diversified risk on risk off portfolio comprised of 55% stocks, 20% bonds and 25% alternatives.

The portfolio is a fascinating combination of different equity strategies (including individual stocks, global market cap weighted indexes and factor funds), alternatives (gold/silver, trend-following, tail risk, reits and market neutral strategies) and fixed income (treasury and bond exposure via asset allocation funds).

This, quite frankly, is one of the most diversified amateur portfolios I’ve ever encountered and I’m excited to turn things over to Stefan for further explanation.

How I Invest with a Globally Diversified Risk On Risk Off Portfolio Strategy

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Stefan’s Investing Influences

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

Until I was in my late 20s (I’m in my early 40s now), I literally didn’t know a stock from a bond.

I had very little understanding of personal finance or investing beyond a checking or a savings account.

I was reading stuff like Kiplinger and SmartMoney magazine, picking some random stocks and mutual funds.

I had no real sense of an allocation or a strategy.

I started to get a bit more grounding by reading those Little Book series.

In particular:

- The Little Book of Common Sense Investing by Jack Bogle

- The Little Book That Beats the Market by Joel Greenblatt

- The Little Book of Market Myths by Ken Fisher.

Honestly, they’re great resources.

Easy to read and understand, a wealth of knowledge, excellent foundation.

My favorite book about investing, though, that doesn’t often get mentioned amongst the typical classics is actually a novel – The Financier by Theodore Dreiser.

It’s about a young upstart investor post-Civil War who rises and falls and rises again throughout market panics, personal scandal, and government corruption.

It’s market history, market psychology and business rolled into a great story.

There’s a great quote from the book that has stuck with me and I think of it any time there is craziness in the market, because it matches my overall philosophy: “Anything can make or break a market … from the failure of a bank to the rumor that your second cousin’s grandmother has a cold. It’s a most unusual world … No man can explain it. I’ve seen breaks in stocks that you could never explain at all – no one could … My God, the rumors of the stock exchange! They beat the devil.”

It makes for great conversation, but we don’t truly know what has or will move markets.

Another big influence was The Meb Faber podcast – that’s what really got me into having a global market allocation and gave me a better understanding of market history, the role of different asset classes, the risks and limitations of various strategies.

He’s got excellent knowledge and humility, really puts the broader investing spectrum into perspective.

I also love pretty much everything from the Ritholtz crew – I love watching What Are Your Thoughts and The Compound and Friends on YouTube. Josh Brown, Michael Batnick, Ben Carlson and Barry Ritholtz provide such entertaining and educational commentary with their various blogs and podcasts.

And it may sound boring, but Morningstar does a lot of very level-headed stuff and they have great data on funds.

In terms of my personal evolution, I think it’s really a case of going from stock picker to allocator, from discretionary to systematic.

Not entirely, but that’s how I lean.

Events The Shaped Stefan’s Investing Viewpoint

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I started investing for the first time towards the end of 2007.

Right at the peak of the housing bubble, the doorstep of The Great Financial Crisis.

It would be insane to think the events that followed didn’t have a huge influence on my views as investor.

It was fairly conventional wisdom at that time – and maybe it still is – that buying a house was the primary way to build wealth.

Cause housing only goes one way – up.

But since then, I don’t look at a primary residence as an investment.

That stretch from 2008-09 was a great lesson in how far markets can fall and how much they can recover.

To my detriment, though, I think it left me always looking for the next big crash, which has caused me to be far too conservative and risk-averse during the last decade.

Conversation With Your Younger Self

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

The obvious thing to say given the past decade would be just keep buying US stocks, but performance notwithstanding, I think I would have said buy the global stock market with as few funds as possible, and don’t add anything else until you have a very well thought out thesis as to how it will optimize your portfolio.

I have way too many funds and stocks in my portfolio.

In the past, I’ve bought things without enough conviction or with too big a position size, and then sold too soon or too late.

I would’ve told myself to start as broad and as simple as possible before delving into more strategies.

Stefan’s Risk On Risk Off Portfolio

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

In the broad sense, my portfolio is essentially 55% risk, 45% risk off.

My risk assets are essentially 50% US, 25% international developed and 25% emerging markets.

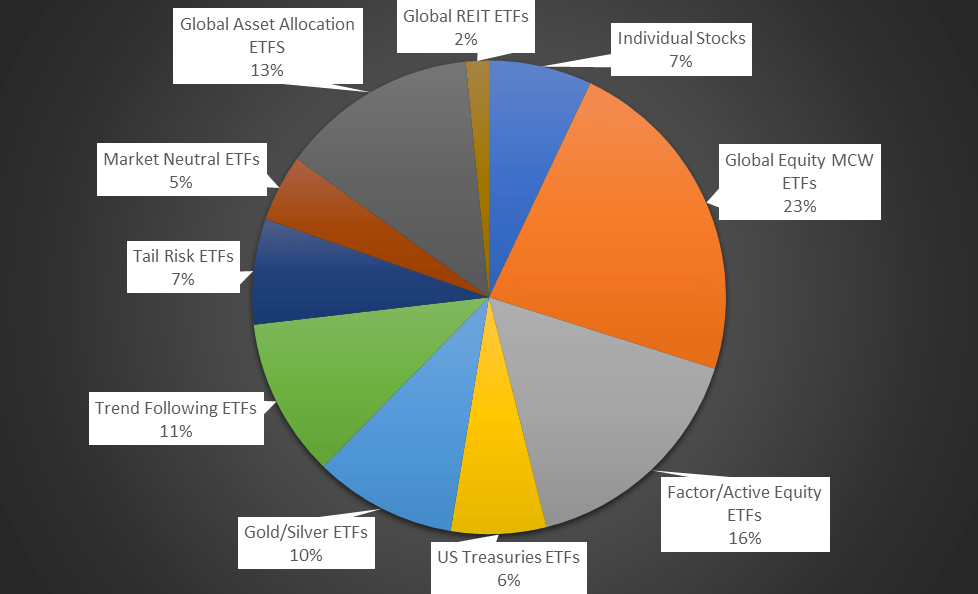

In terms of your standard asset classes, it’s 55% stocks, 20% bonds and 25% alternatives.

However, I’ve complicated this basic mix into about a million components – individual stocks, asset allocation ETFs, vanilla index funds, active or factor equity funds, trend ETFs, tail risk, market neutral.

My general feeling being that risk assets tend to perform well most of the time, so I want to be slightly overweight them, however they could also be subject to long periods of poor performance or steep drawdowns.

What if I need the money? It would be easy if I could guarantee that I wouldn’t be touching any of this until I’m 65, but in the real world people lose jobs, kitchens need remodeled, homes need down payments.

I don’t necessarily want to be all in stocks and then have to pull money out when stocks are down 50%.

So here’s the breakdown by investment type:

Risk On Risk Off Portfolio

Honestly, I’m not sure if this is a strategy or a pinwheel.

But much like Nomadic Samuel, I’m fascinated by different strategies.

I also like to test drive different ETFs and pick individual stocks.

I believe there are many good strategies that will work over time and also that anything could happen.

What’s worked the last 100 years may not work the next 50 years.

Without going through all of them, I’ll mention some of my favorite ETFs:

Favorite ETFs

- Cambria’s global asset allocation strategies – GAA (the global market portfolio), TRTY (the global market portfolio with a tactical trend sleeve mixed in), and GMOM (global momentum trend following). They’re balanced and thoughtfully designed.

- Van Eck’s series of ETFs based on Morningstar’s equity research – MOAT ETF being the biggest of them. It picks the cheapest valued 50 wide moat stocks. It beat the S&P over the last 10 years. There’s also an international and global version.

- Vanguard’s US multifactor – VFMF is very cheap at 18 basis points, it ranks something like 500 stocks based on value, momentum and quality, and its holdings are very evenly distributed by company size, so you’re getting significant exposure to small, mid and micro caps, as well as large caps.

- Cambria’s tail risk and AGFIQ US market neutral anti-beta strategies – TAIL and BTAL are what I would call my “when all else fails” bucket. BTAL has done very well in 2022 and TAIL did phenomenal during the COVID crash. In some respect, it’s a nice psychological boost to see something going up when everything is getting crushed.

Of course, I also own the cheap beta products from Vanguard, Schwab and iShares and they’re great products.

I think there’s an extremely valid case to be made for owning nothing but these type of products – they make up about 40% of my portfolio – SCHB (US market), IDEV (international developed), IEMG (emerging markets), IAU (gold), GOVT (US treasuries).

And then in regard to individual stocks, my top five holdings are:

Favorite Stocks

- Chipotle (CMG)

- Elevance Health (ELV) – used to be Anthem

- Apple (AAPL)

- ETSY (ESTY)

- Target (TGT)

I own about 50 individual stocks.

Is it necessary? No.

Is it wise? Maybe not.

But it’s a learning experience and I do get some sense of pride having a tiny piece of direct ownership in individual businesses.

My expectation is that my portfolio will perform well when the global stock market does well, and that this mix of diversifiers will buoy it when the global stock market does poorly.

Of course, then 2022 happens.

Managing Risk and Reward As An Investor

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

I have a very moderate risk tolerance – and probably a bearish instinct.

My style of investing embraces the idea that anything could happen even if it hasn’t happened for a long time (international stocks outperforming the US, for example).

With this kind of investment approach, you also have to be ok with underperforming when the stock market is soaring.

Pockets of my portfolio may outperform, but overall there will always be something doing better.

Hopefully, that also means I’m not overly exposed when certain asset classes are going bad.

If I had an iron stomach, or I was certain I wouldn’t be touching the money for 30 years, or I had an endless source of additional capital to deploy, by all means, I would take on more risk.

More Aggressive and Conservative Portfolio

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

The toned down version of my portfolio would be to just put everything in a global asset allocation fund or a robo advisor.

I think there’s a very good chance that a systematic fund or computer model – that does everything on automatic with no emotion – is going to better than a person.

Even if that model is suboptimal in some way, the fact that it’s driven by rules rather than discretion is a great quality.

The aggressive version would be a global stock portfolio only.

Just buy VT and call it a day.

That would give you plenty of diversification while still being aggressive, and you’d do quite well over time.

The question is what do when stocks are in a 50% drawdown, you’ve just been laid off, and you have a baby on the way?

Leaves you in a tough spot.

Stefan’s Greatest Strengths/Weaknesses As An Investor

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

I think just being an investor, period – who doesn’t panic sell or chase wild speculation – is a great foundation.

My greatest strength is probably understanding my own risk tolerance, and also just not selling out at the bottom.

I didn’t panic during the GFC or the Covid crash.

My biggest weakness is being overly involved.

I like to learn about new strategies and tweak my portfolio.

I try to mitigate that by staying within the confines of my balanced risk parameters.

I might mix up the spices in the soup, but it’s still a soup.

What Stefan Agrees and Disagrees With

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

I’ve come to this realization recently, but the biggest belief I have that goes against conventional wisdom is that dividends are essentially a distraction.

There is so much dogma around dividends and dividend payments, but they’re just part of your overall return.

They’re not some kind of a bonus check.

There’s just so many products built around these distributions, but they’re bad for you from a tax perspective and they almost trick you into thinking you’re making money when you’re not.

The phrase “I’m getting paid to wait” is nonsense.

If you invest in something that has a negative return over whatever time period, it doesn’t matter what the dividend payment was during that time.

Sure, dividend paying companies often can be good investments, but it’s not the dividend that makes them good investments.

The return can come in a dividend or in price appreciation, but the return is the return.

The overweighting of US stocks in US investors’ portfolios is something that I think is risky, whereas it’s seen as being conservative.

It was only 20 years ago that US stocks spent a decade doing nothing.

I believe in spreading my investments across the globe, even though that hasn’t been the best thing to do recently.

Learning More About Market History

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I’d like to read more about market history.

You hear a lot about the Great Depression and some of the big bubbles, but I’d like to know more about what drove returns during different periods.

Maybe it gives me a better sense of what strategies stand the test of time.

It’s easy to get caught up in what’s happening now.

Avoiding Real Estate As An Investment

What would be the ultimate anti-Stefan portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Anything involving physical real estate – flipping houses, renting out apartments, buying property.

I don’t want to be getting calls in the middle of the night that someone’s refrigerator is leaking.

It stresses me out enough just owning my own house.

There are just so many costs and headaches involved, and you’re using huge leverage.

I know a lot of people see it as the roach to riches, but the inconvenience and the amount of management involved would be a nightmare for me.

I think people like it because it’s tangible, the checks are literally coming in every month and it’s something you feel like you can control.

But I don’t know that you can.

Risk On Risk Off Portfolio Investing Strategy with Stefan Schumacher: 12 Essential Questions Answered

What is a “risk on / risk off” portfolio strategy?

A risk on / risk off strategy dynamically balances growth-oriented assets (like equities) with defensive assets (like bonds and alternatives) depending on market conditions. The goal is to participate in upside during favorable environments while having ballast to reduce drawdowns during volatile or bearish periods.

How is Stefan Schumacher’s portfolio structured?

Stefan’s allocation consists of 55% stocks, 20% bonds, and 25% alternatives, blending individual equities, global index funds, factor ETFs, gold, trend-following strategies, tail risk hedges, REITs, and market-neutral funds. This diversified structure reflects his globally oriented “risk on / risk off” mindset.

What makes this portfolio globally diversified?

Rather than focusing solely on U.S. equities, Stefan allocates across U.S., international developed, and emerging markets, plus gold and global tactical ETFs. This broad exposure aims to capture opportunities outside the U.S. and mitigate home-country bias.

What role do alternatives play in Stefan’s portfolio?

Alternatives make up a full quarter of the portfolio. They include gold and silver for crisis hedging, trend-following strategies for adaptive risk management, tail risk funds to profit in crashes, market neutral strategies for diversification, and REITs for real-asset exposure. These diversifiers are designed to perform differently from traditional stocks and bonds.

Which ETFs does Stefan favor most?

Stefan’s favorite ETFs include Cambria’s GAA, TRTY, and GMOM for global allocation and momentum, VanEck’s MOAT for wide-moat value exposure, Vanguard VFMF for multifactor U.S. equity exposure, and TAIL / BTAL for tail risk and market neutral positioning. He also uses broad beta ETFs like SCHB, IDEV, IEMG, IAU, and GOVT.

Does Stefan invest in individual stocks?

Yes. He holds roughly 50 individual stocks, with his top five positions being Chipotle, Elevance Health, Apple, Etsy, and Target. While he acknowledges it may not be strictly necessary, he views stock-picking as a learning tool and enjoys owning pieces of businesses directly.

How does Stefan manage risk in his portfolio?

He acknowledges his moderate risk tolerance and bearish instincts, accepting that he may underperform in raging bull markets but will likely avoid severe damage in downturns. By maintaining a balanced allocation, he seeks to weather a wide range of market environments without panic selling.

What influenced Stefan’s investment philosophy the most?

Key influences include Jack Bogle’s and Joel Greenblatt’s “Little Book” series, The Meb Faber Podcast, Ritholtz Wealth content, Morningstar research, and historical market lessons from the 2008 Financial Crisis. These shaped his evolution from a stock picker to a globally diversified allocator.

How has Stefan’s personal experience shaped his investing style?

Starting to invest in 2007 during the housing bubble, living through the Global Financial Crisis, and being naturally conservative led Stefan to value diversification, systematic approaches, and risk management. He has become more allocation-focused and less discretionary over time.

What are Stefan’s biggest strengths and weaknesses as an investor?

His greatest strength is knowing his risk tolerance and not panic selling during crises. His weakness is being overly involved—tinkering too much with new strategies. He manages this by staying within broad risk parameters even as he experiments at the margins.

How does Stefan view dividends and U.S. stock dominance?

He considers dividends overrated, noting that they’re just part of total return and often tax-inefficient. He also believes U.S. stock overweighting is risky, advocating for broader global diversification despite recent U.S. outperformance.

What kind of portfolio would Stefan avoid entirely?

Anything heavily dependent on physical real estate. He dislikes the leverage, maintenance, and stress involved. While he acknowledges why others find it appealing, it doesn’t suit his temperament or desired level of involvement.

How You Can Follow Stefan

Thanks so much for taking part in the “How I Invest” series! How can others connect with you on social media and other platforms that you run?

Follow me on Twitter @DeathStripMall.

Nomadic Samuel Final Thoughts

I want to personally thank Stefan for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to take part in the “How I Invest” interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.