It’s time for another long-short equity fund to be featured as part of the “Strategy Behind The Fund” series!

This time we’ll be focusing our attention upon a unique alpha extension / active extensions / enhanced version.

It’s a higher conviction outperformance mandate.

Instead of having a NET exposure of less than 100 you receive an entire scoop of beta with a long-short overlay added on top.

Most strategies max out at 130/30 but we’ll be reviewing a 150/50 mandate today!

The fund has a unique fee/yield structure as well.

Enter the room ATSX ETF.

It’s better known as Accelerate Enhanced Canadian Benchmark Alternative Fund.

Without further ado, let’s turn things over to Julian Klymochko to find out more!

Meet Julian Klymochko of Accelerate

I hail from the city of Winnipeg, Manitoba, Canada. Unlike Warren Buffett, I did not embark on the journey of stock purchasing at the tender age of 11. It was not until my tenure at university that I developed a fervent interest in the realms of business and investing. I am a dual degree holder, possessing expertise in both engineering and finance—a combination that may seem atypical to many. Following my academic pursuits, I joined the ranks of BMO Capital Markets in their investment banking division, where I honed my skills in the intricate world of mergers and acquisitions.

Subsequent to my tenure in investment banking, I transitioned into the hedge fund sector in 2009, forging my path as a professional investor and adept arbitrageur. I initially sharpened my skills in closed-end fund arbitrage, merger arbitrage, and convertible arbitrage. As time progressed, my portfolio management evolved to include more sophisticated strategies like volatility arbitrage, SPAC arbitrage, and multifactor long-short investing. My proficiency in this field was recognized in 2015 when I received the distinguished honor of leading Canada’s #1 hedge fund, as awarded by the Canadian Hedge Fund Awards.

Currently, I am at the helm of Accelerate, serving as the founder, CEO, and Chief Investment Officer. Accelerate stands as a paragon in the industry of alternative investment solutions, assisting investment advisors, institutions, and individual investors in diversifying their portfolios, optimizing risk management, and augmenting their risk-adjusted returns.

Furthermore, I am a proud bearer of the CFA charter and actively contribute to the financial community as a board member of the CFA Society Calgary.

Reviewing The Strategy Behind ATSX ETF (Accelerate Enhanced Canadian Benchmark Alternative Fund)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of ATSX ETF?

For those who aren’t necessarily familiar with a “enhanced benchmark or active extensions” style of investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

An “enhanced benchmark or active extension” refers to an investment strategy that seeks to outperform a specific benchmark or index by taking positions that deviate from the benchmark’s composition.

The goal of an enhanced benchmark or active extension is to outperform the underlying benchmark, either through additional return or reduced risk, via the extension portion of the strategy.

A common alpha extension strategy is to add a long-short overlay to an underlying benchmark. For example, an S&P 500 extension could provide 100% exposure to the underlying equity index, plus a 50% long / 50% short overlay.

The overlay would weigh certain factors long and short, providing a 150 long / 50 short total exposure. Typical overlay factors include quality, value, and momentum.

Therefore, the 150/50 strategy would provide exposure to the S&P 500 index, while overweighting desired factors (high quality, attractive valuation, positive momentum) and underweighting undesired factors (low quality, unattractive valuation, negative momentum).

Over time, this strategy would be expected to outperform because quality, value, and momentum are proven drivers of returns.

Unique Features Of Accelerate Enhanced Canadian Benchmark Alternative Fund ATSX ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

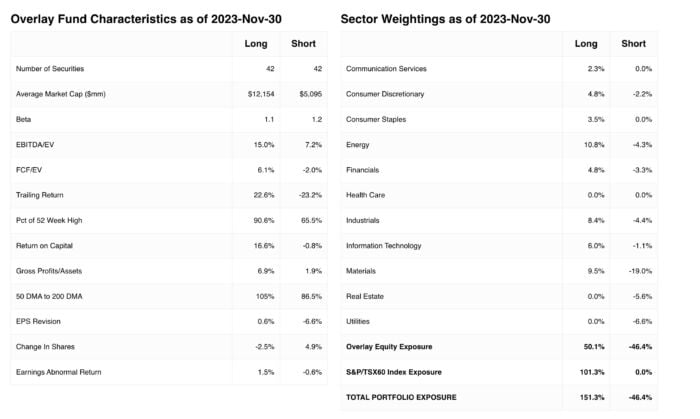

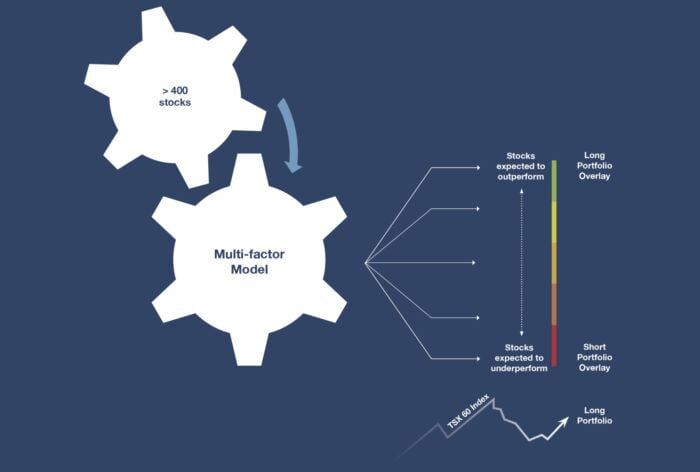

The Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX) combines exposure to the S&P/TSX 60 plus a long-short Canadian equity overlay designed to add incremental performance above the broad Canadian equity index.

ATSX provides a 100% exposure to the S&P/TSX 60 plus a 50% long / 50% short overlay. It is a leveraged strategy, given it is 150 long / 50 short, however, its exposure is 100% net long and the Fund’s beta is typically less than 1.0.

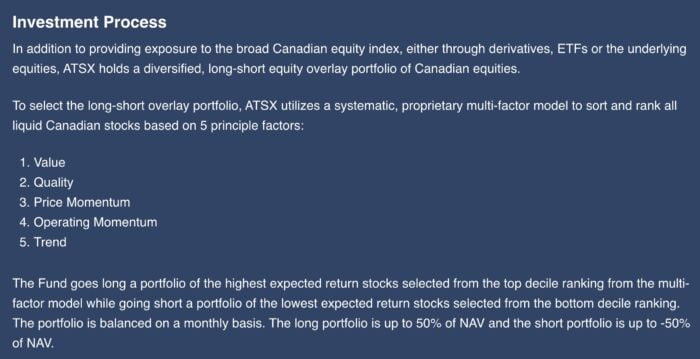

The ATSX 50 long / 50 short overlay portfolio is rebalanced on a monthly basis. Each month, Accelerate sorts and ranks all 400 liquid equities on the Canadian stock market by five main factors, or drivers of return:

- Value

- Quality

- Price momentum

- Operating momentum

- Trend

Empirical evidence, supported both academically and internally at Accelerate, indicates that these five factors have predictive power to forecast future returns. For example, an undervalued, high-quality stock with positive price momentum, solid operating momentum, and a good share price trend is expected to outperform while an overvalued, low-quality stock with negative price momentum, poor operating momentum, and a bad share price trend is expected to underperform.

Each stock in the Fund’s universe is given a composite score given how it ranks in the predictive model. From the top-ranked stocks, the model selects the long portfolio of stocks expected to outperform, and from the bottom-ranked stocks, the model selects the short portfolio of stocks expected to underperform.

It is an active, rules-based systematic strategy that provinces index exposure while overweighting proven drivers of return and underweighting proven detractors of return.

ATSX has a 0% management and charges a performance fee of half the alpha only if the Fund outperforms the underlying benchmark index.

What Sets ATSX ETF Apart From Other Alternative Equity Funds?

How does your fund set itself apart from other “alternative equity” funds being offered in what is already a crowded marketplace? What makes it unique?

ATSX is a 150/50, institutional-caliber, long-short equity ETF. Typically, these strategies are only available to accredited investors such as pensions, endowments, and family offices. We launched ATSX as a TSX-listed ETF, and therefore it is available to all investors with a brokerage account with no minimum investment.

In addition, ATSX is rare in that it has a 0% management fee and a pay-for-performance model that makes it unique.

Also, ATSX pays a 7% yield to its investors.

What Else Was Considered For ATSX ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

We considered a 130/30 fund, however, we determined that 150/50 was better positioned to add value to investor portfolios.

When Will ATSX ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

ATSX tends to outperform the benchmark during down markets. It outperforms when the index declines because the junk stocks in the Fund’s overlay portfolio tend to fall far more than the market in this scenario, while the high-quality securities in the Fund’s overlay tend to hold up.

The Fund tends to underperform in a speculative market, when ATSX’s junk short stock overlay rallies. When money-losing, low quality, overvalued companies are outperforming in the market, ATSX tends to underperform.

Why Should Investors Consider Accelerate Enhanced Canadian Benchmark Alternative Fund ATSX ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

ATSX provides low cost beta exposure with an alpha overlay. It is designed for investors seeking an “index plus” solution, meaning a strategy that will generally track the index but aim to generate some incremental outperformance.

While it has a 0% management fee, investors only pay a performance fee if the Fund outperforms the benchmark.

How Does ATSX ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

ATSX is used by Canadian investors as a compliment to their Canadian equity exposure. Investors may use ATSX for their entire Canadian equity exposure (core), or may use it to augment their existing Canadian equity exposure (satellite).

Personally, I use it for my entire equity sleeve within my portfolio.

The Cons of ATSX ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Canadians love to pick stocks, but will allocate to managed funds in other asset classes. For equities, alpha-extension strategies still have not caught on yet in Canada. It is more difficult to understand than the underlying equity index. The “index plus” nature of ATSX refers to the knowledge required to use it as well, so it requires additional work for enterprising investors.

The vast majority of active equity funds underperform. I believe that enhanced benchmark strategies structurally provide the highest probability of outperforming.

The Pros of ATSX ETF

On the other hand, what have others praised about your fund?

Given the ATSX long-short overlay portfolio, investors like how it provides some downside protection in bear markets. Historically, it has outperformed in challenging markets and kept up in bull markets.

It also pays out a 7% yield for those seeking income and is supported by the Fund’s total return.

Learn More About ATSX ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

I think we’ve covered all the basics behind the Accelerate Enhanced Canadian Benchmark Alternative Fund and the enhanced benchmark / active extension strategy.

Accelerate’s goal is to be the preeminent provider of institutional-caliber hedge fund ETFs that investors use to diversify their portfolios.

Remember, diversification is the only free lunch in investing!

source: Rob Tetrault on YouTube

Connect With Julian Klymochko of Accelerate

Follow me on Twitter @JulianKlymochko for news!

We are always trying to innovate in the alternative investment space and look forward to helping investors diversify their portfolios.

Visit AccelerateShares.com for more information and research. Sign up to our distribution to get value-added content delivered to your inbox.

source: The RO Show on YouTube

Nomadic Samuel Final Thoughts

I want to personally thank Julian for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

Julian has already stopped by to discuss three other alternative funds that he offers: ARB ETF: Review Of The Strategy Behind Accelerate Arbitrage Fund, ONEC ETF: Review Of The Strategy Behind Accelerate OneChoice Alternative Portfolio Fund and HDGE ETF: Review Of The Strategy Behind Accelerate Absolute Return Hedge Fund.

Julian was also a guest for the “Investing Legends” series (Merger Arbitrage And Long-Short Equity Investing With Julian Klymochko) which I recommend checking out.

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.