Most investors are mesmerized by large cap equity strategies with familiar and famous companies making up the bulk of the indexes.

However, it’s clear that hanging out in mid-cap and small-cap territory is where you historically find better long-term returns.

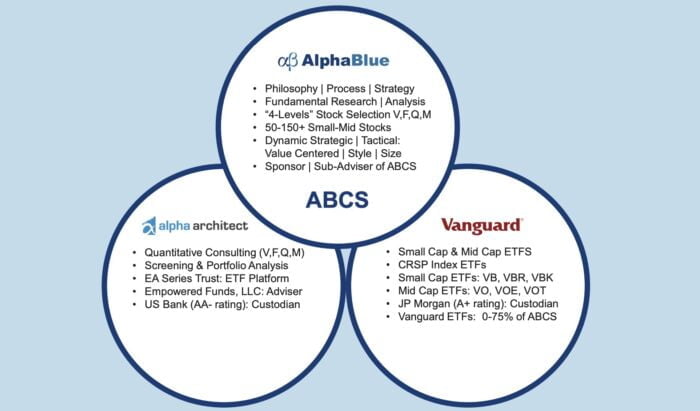

With that in mind, I’m thrilled to welcome David Dabora of Alpha Blue Capital to discuss his new US Small-Mid Cap strategy.

It’s better known as Alpha Blue Capital US Small-Mid Cap ETF.

Ticker ABCS.

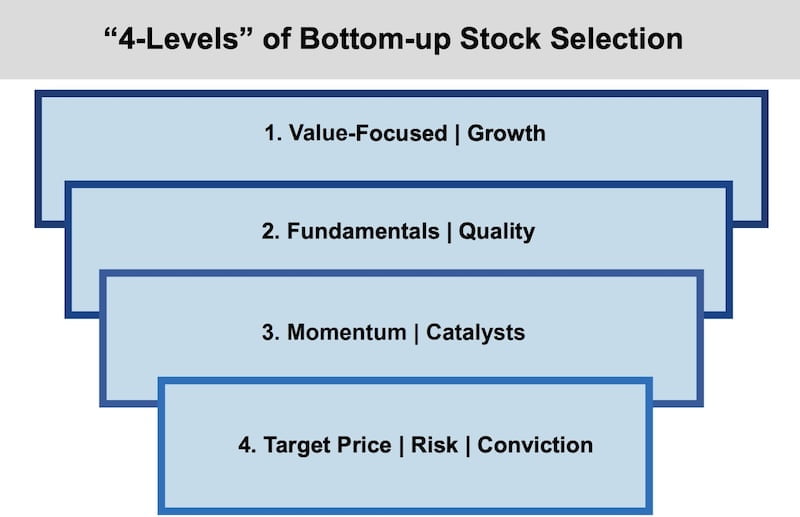

It’s unique approach targets VFQM (value, fundaments, quality and momentum) equities in a manner that attempts to capture the best of value and growth at reasonable price strategies.

Without further ado, let’s turn things over to David.

Meet David Dabora of Alpha Blue Capital

Over 30+ years of successful investing experience. Founder, Managing Partner & Portfolio Manager of Alpha Blue, LLC | Alpha Blue Capital L.P. | Alpha Blue Capital Management LP providing Fundamental Research & Value-Focused Investment Management since inception in 2010. Located in the San Francisco Bay Area City of Greenbrae in Marin County, California. Portfolio Manager & Architect of the ABCS-Alpha Blue Capital US Small-Mid Cap Dynamic ETF Strategy and the Alpha Blue Alternative Equity Hedge Fund Strategy.

Reviewing The Strategy Behind ABCS ETF (Alpha Blue Capital US Small-Mid Cap Dynamic) with its creator David Dabora

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of ABCS ETF?

For those who aren’t necessarily familiar with a “US Small to Mid-Cap dynamic strategy with targeted annualized alpha & investment performance of 1%-3% in excess of the Bloomberg US 2500” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

ABCS is a pioneering Active Dynamic Small-Mid Cap ETF that integrates a repeatable fundamental bottom-up security selection investment process practiced for 30+ years with the flexibility of investing in Vanguard Small & Mid Cap Passive CRSP Equity Index ETFs all in one ETF. The portfolio of individual stocks have attractive Value, sound Fundamentals, Quality & positive business Momentum (V,F,Q,M). The strategy focuses on the less efficient, bottom 30% of stocks by market weight of the US stock market. At launch there were 100 stocks and 4 Vanguard Small & Mid Cap ETFs representing approximately 65% and 35% of the holdings, respectively.

The strategy begins with its Investment Philosophy:

1. Value Investing spanning to growth & quality at a reasonable price.

2. Fundamental Bottom-up security selection.

3. Prudent and Consistent equity risk taking.

4. Disciplined Risk Management & Broad Diversification.

Unique Features Of Alpha Blue Capital US Small-Mid Cap Dynamic ABCS ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

The ABCS ETF has broad exposure to the bottom 30% of the US market by market weight with individual stocks greater than $500 million to up to the largest market cap in the Vanguard Mid Cap CRSP Index ETF of approximately $55 billion. The ETF is very much Dynamic and definitely active but allows for investing in the 6 Vanguard Small & Mid Cap Passive ETFs: Mid Blend (VO), Mid Value (VOE), Mid Growth (VOT), Small Blend (VB), Small Value (VBR), Small Growth (VBK).

The ETF does not use any leverage and is not rules based. The strategy utilizes a proven Investment process dependent on a fundamental / analytical edge and judgment.

The Fee structure is as follows: 40 bps plus the 2bps for fees related to the current Vanguard ETFs for a total of 42 bps. There is a fee waiver through 12/31/24 bringing down the expense ratio to 27 bps.

What Sets ABCS ETF Apart From Other Funds?

How does your fund set itself apart from other “equity factor and/or equity optimization” funds being offered in what is already a crowded marketplace? What makes it unique?

Having the flexibility to invest in the Vanguard Small & Mid Cap CRSP Index ETFs definitely makes it unique. In addition, the ability to dynamically tilt the portfolio to the best opportunities in both size and style with the individual stocks and ETFs in the Small-Mid Cap space and the goal of achieving 1%-3% Alpha over the Bloomberg US 2500 Index.

What Else Was Considered For ABCS ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

The ABCS ETF is a comprehensive strategy that allows for flexibility to manage it effectively and has a very good probability of achieving its investment objectives. There was nothing more to possibly add to the strategy. It is inclusive of the whole design.

When Will ABCS ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

The ABCS ETF strategy is new and there were no specific back tests. The process has been practiced for over 30 years and other similar active stock selection strategies have performed well and outperformed the benchmarks. Additionally, The Vanguard Small & Mid Cap CRSP Index ETFs have performed well in the past and are considered by many to be best in class.

The strategy will generally be Value-focused and centered so when the market is driven more by Value stocks, it is anticipated to outperform. Conversely, in speculative or low quality driven markets, it is possible the ETF may underperform. Generally, in down or negative return markets, the ETF could outperform but also be down too.

Why Should Investors Consider Alpha Blue Capital US Small-Mid Cap Dynamic ABCS ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

I would suggest that the ABCS ETF does have a low cost, that can invest in even lower cost Vanguard Small & Mid Cap Passive ETFs with the goal and ability to add Alpha.

ABCs has the potential to provide the best of both worlds of Active and Passive Investing in the less efficient, bottom 30% of the US market by market cap with the potential or opportunity to outperform the larger Cap broad US market returns.

How Does ABCS ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

ABCS ETF wouldn’t be considered a total portfolio solution but could be a core holding or satellite diversifier. Based on its market cap range and broad diversification, it could be as much as a 30-50% of a US Public Equity allocation.

Some other Investment applications of the ABCS ETF:

1. Stand Alone basis for Active/Passive Small-Mid Cap exposure.

2. Part of a US Small-Mid Cap Multi Manager mandate (active and/or passive).

3. Passive Equity Investors in the S&P 500 and/or Total US Market.

4. Private Equity and/or Private Business Owners.

5. Part of a Global Equity Mandate.

The Cons of ABCS ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

I wouldn’t call it criticism but many I have shared the strategy with are curious about the ultimate reaction of potential investors of the Dynamic Active strategy that integrates Vanguard Small & Mid Cap Passive CRSP Equity Index ETFs.

The Pros of ABCS ETF

On the other hand, what have others praised about your fund?

The comprehensive nature of the Strategy and a great opportunity for outperformance of the benchmark and larger cap passive and active strategies. And the pioneering implementation of investing in passive ETFs in an active strategy.

Learn More About ABCS ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

I would add that I have over 30+ year track record with very successful investment performance and I am very excited about the strategy and optimistic that investors will ultimately embrace it. I am funding the initial Capital in ABCS and am committed to a $1-$5+ million investment in the ETF.

Nomadic Samuel Final Thoughts

I want to personally thank David for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.