The concept of mutual funds, as a cornerstone of modern financial strategy, marks a significant milestone in the evolution of investment mechanisms. These vehicles have transformed the investment world, offering widespread access to various markets for individual investors. This comprehensive analysis aims to dissect the intricate history of mutual funds, tracing their origins and development, and ultimately uncovering the oldest mutual funds that are still operational today.

Mutual funds are fundamentally collective investment schemes where capital from numerous investors is pooled to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, these funds enable investors to access a diverse range of assets, democratizing investment opportunities across different economic segments.

Historical Roots: The Emergence of Mutual Funds

The inception of mutual funds dates back to Europe in the late 18th and early 19th centuries, with the Netherlands playing a pivotal role. One of the earliest examples was a closed-end fund established by Dutch merchant Adriaan van Ketwich in 1774, named “Eendragt Maakt Magt.” This initiative laid the foundation for modern collective investment schemes, offering diversified investment options to a group of investors.

source: InvestTalk on YouTube

The 19th and early 20th centuries witnessed the proliferation of mutual fund concepts in Europe and North America. A landmark development was the formation of the Massachusetts Investors Trust in 1924 in the U.S., recognized as the first modern mutual fund. This period also saw the establishment of regulatory frameworks like the Securities Act of 1933 and the Investment Company Act of 1940 in the U.S., which significantly bolstered investor confidence in mutual funds.

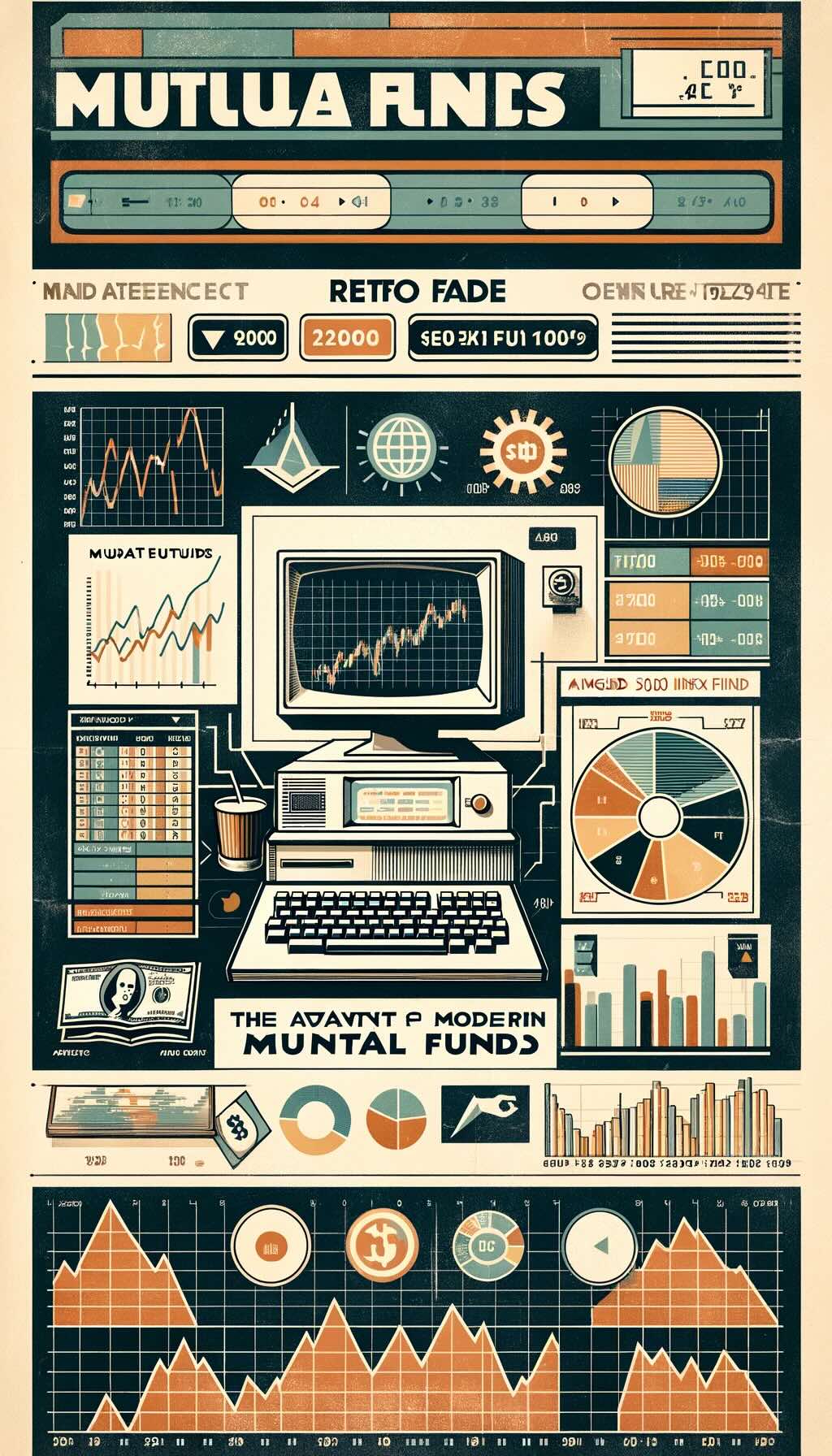

The Advent of Modern Mutual Funds: Late 20th Century Innovations

The latter half of the 20th century saw mutual funds gain widespread popularity, especially in the U.S. This era was marked by the introduction of various fund types, including the revolutionary index funds in the 1970s, with the Vanguard 500 Index Fund being a notable example. These developments represented a significant leap in the diversification and complexity of mutual fund offerings.

The Oldest Mutual Funds in Existence

Among the oldest mutual funds still in operation are some notable institutions. The Massachusetts Investors Trust, now known as MFS Investment Management, is one such fund, evidencing a long-standing history in the mutual fund sector. Another historic entity is the Wellington Fund, established in 1928, which is recognized for its early implementation of a balanced investment strategy.

The history of mutual funds is a narrative of financial innovation and the democratization of investment opportunities. From their early days to their present form, mutual funds have been pivotal in shaping the investment landscape. Understanding their history is not just an academic pursuit but a reflection on the evolution of investment strategies and the continued relevance of mutual funds in offering accessible investment avenues to a broad spectrum of the public.

The Dawn of Mutual Funds

At the cusp of modern financial history, the inception of mutual funds stands as a watershed moment, marking the confluence of economic innovation and societal evolution. This historical odyssey into the birth of mutual funds reveals not only the genesis of these investment vehicles but also the early objectives, structures, and the broader economic and social milieu in which they were conceived.

The Genesis of Collective Investment Ventures

The embryonic stage of mutual funds is rooted in the fertile grounds of 18th-century Europe, a period characterized by burgeoning economic theories and the nascent stages of industrial capitalism. The Dutch, known for their mercantile prowess and financial acumen, were pioneers in this realm. The creation of a closed-end fund by Adriaan van Ketwich in 1774, aptly named “Eendragt Maakt Magt” (Unity Creates Strength), is often cited as the progenitor of modern mutual funds. This early fund encapsulated the fundamental ethos of mutual funds: pooling resources from multiple investors to achieve diversification and mitigate individual investment risks.

Early Objectives and Structural Innovations

The primary objective of these early mutual funds was to provide a vehicle for investors, especially those of moderate means, to gain exposure to a broader range of investment opportunities, which were traditionally the purview of the wealthy. This democratization of investment was revolutionary, enabling wider participation in the burgeoning financial markets of the time. Structurally, these funds were typically closed-end, meaning they had a fixed number of shares. Investors bought into the fund at its inception, and the fund itself invested in a variety of securities, such as bonds and stocks, reflecting the investment landscape of the time.

Economic and Social Context of the Era

The birth of mutual funds cannot be extricated from the economic and social context of the era. The 18th and 19th centuries were periods of significant economic transformation, marked by the Industrial Revolution and the expansion of global trade networks. This era saw the rise of new wealth and a burgeoning middle class, both of which were eager to participate in the financial markets. Moreover, the economic landscape was becoming increasingly complex, with the emergence of new forms of securities and investment opportunities. This complexity underscored the need for diversified investment vehicles like mutual funds.

Additionally, the period was marked by a philosophical shift towards liberalism and individual economic empowerment, which dovetailed with the concept of mutual funds. The funds were seen as a means to level the economic playing field, allowing individuals from varied economic backgrounds to partake in investment opportunities that were once exclusive to the affluent.

The World’s Oldest Mutual Funds

In the annals of financial history, the chronicles of the world’s oldest mutual funds are not merely tales of enduring investment vehicles but also vivid testimonials to the evolution of the collective investment ethos. These venerated funds, having stood the test of time, offer a fascinating glimpse into the origins, foundational principles, and investment strategies that have shaped the mutual fund industry.

Massachusetts Investors Trust: The Progenitor of Modern Mutual Funds

At the vanguard of mutual fund history stands the Massachusetts Investors Trust (MIT), inaugurated in 1924. This open-end mutual fund, a pioneering force in the industry, fundamentally altered the investment landscape. Unlike its closed-end predecessors, MIT allowed investors to buy or sell shares at the fund’s net asset value, introducing unprecedented liquidity and accessibility. It was founded on the principle of making diversified investment strategies accessible to a broader demographic, not just the affluent elite. The fund’s inception was a harbinger of the democratization of the stock market, permitting average individuals to partake in the wealth of the burgeoning American economy.

source: Vanguard on YouTube

Wellington Fund: A Balanced Approach to Investing

Another paragon of longevity and innovation is the Wellington Fund, established in 1928. Its inception was marked by a novel investment philosophy that sought to blend both stocks and bonds in a single portfolio, an approach aimed at balancing growth with income generation and risk mitigation. This dual focus was relatively novel at the time and laid the groundwork for what is now known as a balanced or hybrid fund. The Wellington Fund’s pioneering strategy was a reflection of the economic uncertainties of the era, particularly the looming Great Depression, and an attempt to provide investors with a more stable and diversified investment avenue.

source: Heritage Wealth Planning on YouTube

George Putnam’s Balanced Fund: The Synergy of Conservatism and Growth

Founded in 1937 by George Putnam, the George Putnam Balanced Fund is another venerable entity in the mutual fund cosmos. This fund was established on the bedrock of conservative investment principles, aiming to provide long-term growth and income while preserving capital. The fund’s strategy was to invest in a mix of stocks for growth potential and bonds for income and stability, a blend that sought to weather the vicissitudes of economic cycles. The fund’s founding coincided with the aftermath of the Great Depression, an era marked by economic recovery yet plagued with uncertainty, making its conservative yet growth-oriented approach particularly appealing.

Evolution of the Oldest Mutual Funds

The venerable mutual funds that have withstood the relentless tide of time serve not merely as historical relics but as living chronicles of adaptability and resilience. Their evolution over the decades is a testament to the dynamism inherent in the financial world, reflecting changes in investment strategies, asset allocation, management styles, and responses to various economic cycles and market conditions.

Massachusetts Investors Trust: Embracing Change and Innovation

The Massachusetts Investors Trust (MIT), since its inception in 1924, has undergone profound transformations. Initially focused on a diversified portfolio of stocks, the fund has continuously adapted its investment strategy to align with the shifting economic landscape. In the wake of the Great Depression and subsequent market fluctuations, MIT embraced a more conservative approach, incorporating bonds to balance risk.

Over the years, the fund has progressively incorporated analytical and quantitative methods to guide its asset allocation, embracing technological advancements and modern portfolio management techniques. The management style, once predominantly discretionary, has evolved to integrate both active and passive strategies, ensuring the fund’s competitiveness in various market conditions.

Wellington Fund: Navigating Through Economic Eras

The Wellington Fund’s journey since 1928 epitomizes the balancing act between growth and stability. Originally a hybrid of stocks and bonds, the fund has continually recalibrated its asset mix in response to economic cycles. During periods of market exuberance, such as the post-World War II boom and the late 20th-century bull markets, the fund shifted towards a higher allocation in stocks to capture growth.

Conversely, in times of economic downturns and uncertainties, like the oil crises of the 1970s and the financial crisis of 2008, the fund increased its bond holdings, prioritizing capital preservation and income. The Wellington Fund’s management has been characterized by a blend of historical wisdom and a forward-looking approach, consistently adapting to the ever-evolving market dynamics.

George Putnam Balanced Fund: The Confluence of Tradition and Innovation

Since its foundation in 1937, the George Putnam Balanced Fund has upheld its core philosophy of conservative growth, yet its approach to achieving this goal has evolved. Initially focusing on a simple mix of blue-chip stocks and high-grade bonds, the fund has expanded its universe over the years, incorporating international equities, high-yield bonds, and even alternative investments to diversify and enhance returns.

The management of the fund has also transitioned from a primarily fundamental, research-driven approach to one that incorporates technical analysis and global economic trends. This evolution reflects the fund’s commitment to maintaining its foundational principles while adapting to the complexities of the modern financial world.

Notable Milestones and Achievements

The historical trajectory of the world’s oldest mutual funds is punctuated with notable milestones and achievements, each marking a significant chapter in their storied legacies. These venerable institutions have not only navigated through tumultuous market landscapes but have also contributed substantially to the financial industry, leaving an indelible impact on investors and the broader economic milieu.

Massachusetts Investors Trust: Pioneering and Progressing

A cornerstone in the annals of mutual funds, the Massachusetts Investors Trust (MIT), now MFS Investment Management, has several distinguished milestones. Its inception in 1924 as the first open-end mutual fund heralded a new era in investment accessibility. A significant achievement was the fund’s resilience and recovery during and after the Great Depression, showcasing its robust risk management and strategic agility. In the late 20th century, MIT was among the first to adopt global diversification, extending its reach beyond American borders, thus offering investors exposure to emerging and international markets. This strategic expansion was not only a milestone in the fund’s history but also a broader trendsetter in the mutual fund industry.

Wellington Fund: A Beacon of Balanced Investing

The Wellington Fund, established in 1928, is renowned for its introduction of the balanced fund concept, a mix of stocks and bonds in a single portfolio. This approach was groundbreaking, providing a template for what would become a ubiquitous investment strategy. Throughout its history, the fund has achieved consistent performance, even in the face of economic upheavals such as the 1929 stock market crash and subsequent depressions. Its ability to deliver stable returns over decades has been a testament to its sound investment strategy and adept management, cementing its status as a stalwart in the mutual fund industry.

George Putnam Balanced Fund: Conservative Growth and Stability

The George Putnam Balanced Fund, initiated in 1937, has been a paragon of conservative growth. Its major achievement lies in maintaining stability and delivering consistent returns across varying market conditions. The fund’s commitment to a conservative mix of stocks and bonds has been instrumental in protecting investor capital during market downturns, such as the tech bubble burst in the early 2000s and the 2008 financial crisis. Moreover, the fund’s gradual incorporation of international equities and alternative investments has showcased its ability to adapt without deviating from its core investment philosophy.

Historical Performance Highlights and Impact on Investors

The longevity and success of these funds are rooted in their historical performance, which has not only provided financial returns to investors but also fostered trust and credibility in the mutual fund industry. Their ability to navigate economic cycles, adjust strategies in response to market changes, and consistently pursue growth and stability has been central to their enduring appeal. This performance has had a profound impact on investors, providing a vehicle for wealth creation, retirement planning, and financial security for generations.

Lessons from the Longevity of These Funds

The enduring existence of the world’s oldest mutual funds is not merely a testament to their resilience but also a repository of valuable lessons for the contemporary investment world. Analyzing the factors that have contributed to their longevity and success unveils critical insights into effective fund management, investment philosophy, and the quintessence of adaptability in the ever-evolving financial landscape.

Stewardship and Sagacious Management

At the heart of these funds’ enduring success lies exceptional stewardship and management. The Massachusetts Investors Trust, Wellington Fund, and George Putnam Balanced Fund have all benefited from the acumen of astute fund managers who have adeptly navigated the tumultuous seas of the financial markets. These managers have demonstrated not just a proficiency in financial analysis and asset allocation but also a visionary approach, foreseeing market trends and preemptively adjusting strategies. Their management style is characterized by a harmonious blend of experience, insight, and innovation, ensuring that the funds remain relevant and robust across different market epochs.

Investment Philosophy: The Bedrock of Endurance

The investment philosophies underpinning these funds have been a critical factor in their longevity. For instance, the Massachusetts Investors Trust’s philosophy of broad market participation and the Wellington Fund’s balanced approach between stocks and bonds have been pivotal. Similarly, the George Putnam Balanced Fund’s conservative strategy focusing on long-term growth and capital preservation has stood the test of time. These philosophies are not static; they have evolved in response to market changes while maintaining their core principles. This steadfastness, coupled with the flexibility to adapt, has enabled these funds to endure market volatilities and economic cycles.

Adaptability: The Keystone of Survival

Adaptability is arguably the most vital attribute that has contributed to the longevity of these funds. They have demonstrated an extraordinary ability to evolve with changing market conditions, economic environments, and investor preferences. This adaptability extends beyond mere asset allocation; it encompasses embracing new investment methodologies, technologies, and global trends. For example, the incorporation of international assets and alternative investments reflects a response to globalization and the increasing complexity of financial markets.

Lessons for Modern Investment Strategies

The longevity of these funds offers invaluable lessons for modern investment strategies. Firstly, it underscores the importance of a solid investment philosophy as the foundation of enduring success. Secondly, it highlights the necessity of skilled and visionary management – individuals who can balance risk with opportunity and navigate through various market conditions. Thirdly, the significance of adaptability cannot be overstated; modern investment strategies must be flexible and responsive to changes in the economic landscape, investor needs, and technological advancements.

Comparison with Contemporary Mutual Funds

In the grand tapestry of the mutual fund industry, a juxtaposition of the oldest funds against their contemporary counterparts reveals both stark differences and underlying similarities, illustrating the evolutionary trajectory of mutual fund offerings and the diversity in today’s market. This comparison not only highlights the transformation in mutual fund strategies and structures but also provides insights into how the origins of this industry continue to influence its present and future course.

Contrasts in Strategy and Structure

The most salient difference between the oldest mutual funds and modern offerings lies in their structural and strategic evolution. Originally, mutual funds like the Massachusetts Investors Trust focused on a broad spectrum of stocks, reflecting the limited financial instruments available at the time. Contemporary funds, however, offer a more diverse range of assets, including international stocks, sector-specific investments, emerging market equities, and even complex derivatives.

Furthermore, while early mutual funds were primarily actively managed, today there is a significant presence of passively managed funds, notably index funds, which track specific market indices. This shift reflects a growing trend towards cost efficiency and the democratization of market access, catering to investors who prefer a more hands-off approach to investing.

Diversity and Specialization in Modern Offerings

Today’s mutual fund landscape is characterized by a remarkable diversity and specialization that were largely absent in the early days of the industry. Contemporary investors can choose from a plethora of funds specializing in various sectors, geographical regions, and investment themes, such as technology, healthcare, green energy, and even socially responsible investing. This contrasts with the more generalized investment approach of the oldest funds, which were limited by the scope of the markets and instruments of their time.

Evolution in Risk Management and Technological Integration

Another notable evolution is seen in risk management techniques and the integration of technology. Modern mutual funds employ sophisticated risk assessment tools, leveraging big data analytics, algorithmic trading, and artificial intelligence, capabilities that were inconceivable in the early 20th century. This technological advancement has allowed for more precise and dynamic portfolio management, a stark contrast to the more manual and intuitive methods employed by the earliest funds.

Similarities Rooted in Core Principles

Despite these differences, there are fundamental similarities that bind the oldest and newest funds. At their core, all mutual funds share the same basic principle of pooling resources from multiple investors to achieve diversification and reduce individual investment risks. Furthermore, the foundational goal of providing access to a broader range of investments remains a constant, echoing the democratizing ethos that gave birth to the mutual fund concept.

The Influence of Origins on the Modern Industry

The trajectory of mutual fund evolution and the current diversity in offerings are deeply influenced by the industry’s origins. Early funds set the stage for the principles of diversification and professional management, which remain central to today’s mutual funds. Additionally, the challenges and successes of these pioneering funds have informed the risk management strategies and structural innovations seen in contemporary funds.

The Role of the Oldest Mutual Funds in Modern Portfolios

In the contemporary investment panorama, the relevance of the oldest mutual funds transcends mere historical significance, positioning them as pivotal components in the crafting of diversified portfolios. The integration of these venerable funds into modern investment strategies demands a nuanced understanding of their unique attributes, balancing their historical legacy with contemporary financial objectives.

Enduring Relevance in Today’s Investment Landscape

The oldest mutual funds, with their decades-long track records, offer a unique proposition in the modern investment landscape. They provide not just a historical perspective but also a proven resilience in the face of diverse market conditions. Funds like the Massachusetts Investors Trust, Wellington Fund, and George Putnam Balanced Fund have weathered numerous economic cycles, including recessions, market crashes, and periods of high inflation, providing invaluable insights into long-term investment strategies. Their ability to adapt and evolve with changing market dynamics makes them relevant for today’s investors who seek stability and tested investment methodologies.

Strategic Inclusion in Diversified Portfolios

Incorporating these historic funds into a diversified portfolio warrants a strategic approach. These funds, with their established investment philosophies and management styles, can offer a stabilizing influence within a portfolio. For instance, a fund with a conservative approach, like the George Putnam Balanced Fund, can serve as a counterbalance to more aggressive or speculative investments. The inclusion of such funds should align with the investor’s risk tolerance, investment horizon, and overall financial goals. Their track record of stability and consistent performance can be particularly appealing for investors seeking long-term growth with managed risk exposure.

Balancing Historical Legacy with Modern Financial Objectives

While the historical legacy of these funds is undeniably attractive, investors must also consider their alignment with contemporary financial goals. It is essential to assess whether these funds continue to innovate and adapt to current market trends. For example, a fund’s approach to emerging markets, technology sectors, or ESG (Environmental, Social, and Governance) criteria can be indicative of its alignment with modern investment themes. Furthermore, the management’s ability to integrate advanced analytical tools and investment strategies is crucial for ensuring that the fund remains competitive in today’s fast-evolving financial landscape.

The Role of Active Management and Performance Metrics

The role of active management in these funds is another critical consideration. The historical success of these funds is often attributed to the skill and expertise of their management teams. Investors need to evaluate the current management’s capability to continue this legacy of active and effective fund management. Performance metrics such as fund returns, expense ratios, and volatility should be analyzed in the context of current market conditions to assess their suitability for inclusion in modern portfolios.

Challenges Faced and Overcome

The venerable mutual funds, which have steadfastly endured through the annals of time, are not just repositories of success but also chronicles of overcoming formidable challenges. Their journey through tumultuous market downturns and economic recessions offers a masterclass in resilience and strategic fortitude in the face of financial adversity.

Navigating Market Downturns and Economic Recessions

The oldest mutual funds have weathered a plethora of economic storms, each posing unique challenges. The Great Depression, stock market crashes, oil crises, the dot-com bubble burst, and the global financial crisis of 2008 are but a few of the monumental hurdles they have surmounted. Each crisis tested these funds’ resilience, forcing them to adapt and evolve.

For instance, the Massachusetts Investors Trust, now MFS Investment Management, encountered its first significant challenge during the Great Depression. The fund’s response was to diversify its holdings, shifting from a stock-heavy portfolio to a more balanced asset allocation, including bonds. This strategy not only helped the fund to survive the Depression but also laid the groundwork for a more conservative, risk-managed approach that would serve it well in future crises.

The Wellington Fund, with its balanced approach of combining stocks and bonds, faced a considerable test during the inflationary periods of the 1970s and the early 2000s’ market volatility. The fund’s response was to adjust its asset allocation dynamically, increasing its bond holdings during volatile periods to buffer against stock market fluctuations and preserve capital.

The George Putnam Balanced Fund, known for its conservative investment strategy, was put to the test during the 2008 financial crisis. The fund navigated this period by emphasizing high-quality bonds and dividend-paying stocks, which provided a degree of stability in a profoundly unsettled market.

Employing Strategic Adaptability and Innovation

A key element in these funds’ ability to overcome challenges has been their strategic adaptability. This adaptability is not just in terms of asset allocation but also in embracing innovation. For example, these funds have incorporated advanced analytical tools, quantitative methods, and global economic insights into their investment strategies. This evolution reflects a keen understanding that past strategies, while successful in their time, may need refinement to remain effective in a rapidly changing financial landscape.

Resilience in the Face of Adversity

The resilience of these funds is rooted in more than just strategic adaptability. It also lies in the strength of their foundational investment philosophies, which have provided a guiding compass through uncertain times. Whether it’s the balanced approach of the Wellington Fund or the conservative strategy of the George Putnam Balanced Fund, these philosophies have provided a consistent framework for decision-making, ensuring that the funds do not veer off course in the face of short-term market pressures.

The Future Outlook for the Oldest Mutual Funds

As we gaze into the financial horizon, the future outlook for the oldest mutual funds is a tapestry interwoven with both challenges and opportunities, set against an evolving financial landscape. These storied funds, carrying the legacy of decades, now stand at a critical juncture where their historical resilience must meet the demands of future market dynamics and evolving investor needs.

Projections and Expectations

The forward trajectory for funds like the Massachusetts Investors Trust, Wellington Fund, and George Putnam Balanced Fund is projected to be one of cautious optimism. Given their long-standing history of adaptability and prudent management, these funds are expected to continue their legacy, albeit with necessary adjustments to align with modern market realities. A key expectation is their continued commitment to balancing risk with growth, leveraging their deep-rooted understanding of market cycles and economic indicators.

Navigating Potential Challenges

The financial landscape of the future presents a multitude of challenges, ranging from heightened market volatility, geopolitical uncertainties, and the evolving nature of global economies. Additionally, the rise of disruptive technologies and digital currencies, coupled with increasing concerns about sustainability and climate change, are likely to redefine investment parameters. These oldest funds must navigate these complexities by further diversifying their portfolios, incorporating new asset classes, and enhancing their risk management frameworks.

The looming challenge of regulatory changes and increased competition from novel investment vehicles, such as exchange-traded funds (ETFs) and digital asset funds, also demands strategic responses. These funds may need to innovate in terms of product offerings and investor engagement strategies to remain competitive and relevant.

Seizing Emerging Opportunities

Despite these challenges, the future also presents a host of opportunities. One significant area is the growing emphasis on sustainable and responsible investing. These funds can capitalize on this trend by integrating environmental, social, and governance (ESG) criteria into their investment processes, appealing to a new generation of socially conscious investors.

Additionally, the increasing globalization of financial markets opens avenues for expanding into emerging markets and new sectors, offering growth potential beyond traditional markets. Embracing technological advancements in financial analytics and artificial intelligence for portfolio management and predictive modeling also presents a significant opportunity to enhance performance and investor experience.

Preparing for Future Market Dynamics and Investor Needs

Preparation for future market dynamics involves a multifaceted approach. Firstly, these funds are likely to continue evolving their investment strategies, integrating more global and thematic elements into their portfolios. This evolution will be supported by a robust analytical framework, leveraging data-driven insights for informed decision-making.

Secondly, in addressing investor needs, these funds are expected to focus on enhancing transparency, communication, and investor education. As investor profiles and preferences evolve, providing personalized investment experiences and responsive customer service will be crucial.

Lastly, operational agility and technological integration will be key. This entails not only adopting advanced technologies for investment management but also ensuring operational efficiency and cybersecurity in an increasingly digitalized financial world.

Conclusion

As we culminate our exploration of the oldest mutual funds, a reflective analysis unveils a series of profound insights about these enduring institutions. Their storied journey through the fluctuating tides of financial history not only offers a window into the evolution of investment vehicles but also imparts essential lessons that resonate with contemporary and future financial endeavors.

The oldest mutual funds, epitomized by institutions like the Massachusetts Investors Trust, Wellington Fund, and George Putnam Balanced Fund, stand as bastions of financial resilience and adaptability. These funds have traversed diverse economic landscapes, weathering market downturns and seizing growth opportunities with equanimity and strategic foresight. Their evolution from simple, broad-market investment vehicles to sophisticated, diverse portfolios reflects a profound understanding of market dynamics and investor needs.

These funds have demonstrated that enduring success in the mutual fund industry hinges on a delicate balance of steadfast adherence to core investment philosophies and the agility to adapt to changing market conditions. Their management strategies, characterized by prudent risk assessment, diversified asset allocation, and a forward-looking approach, have been instrumental in navigating financial upheavals and capitalizing on emerging market trends.

The Importance of History in Understanding Current Investment Vehicles

The historical trajectory of these funds is not merely an academic curiosity but a vital framework for understanding modern investment vehicles. Their history reveals the genesis of mutual fund concepts like diversification, professional management, and investor accessibility. These foundational principles, established by the earliest funds, continue to underpin the structure and operation of contemporary mutual funds. Furthermore, the resilience and adaptability demonstrated by these funds provide a blueprint for navigating the complexities of today’s global financial markets.

Reflection on the Legacy of the Oldest Mutual Funds

The legacy of the world’s oldest mutual funds is multifaceted. They are not only repositories of financial history but also active participants in shaping the mutual fund industry. Their enduring presence testifies to the viability and relevance of mutual funds as investment vehicles. They have democratized access to the financial markets, allowing individual investors to partake in a diversified portfolio that was once the domain of the wealthy.

Looking towards the future, these venerable funds are poised to continue their legacy, albeit in an ever-evolving financial landscape. Their future success will likely depend on their ability to integrate innovative investment strategies, respond to regulatory and market changes, and cater to the evolving preferences of a new generation of investors. As they navigate these challenges, their historical wisdom, coupled with an openness to innovation, will be crucial.

In conclusion, the journey of the world’s oldest mutual funds offers invaluable insights into the evolution of investment vehicles and the enduring principles of fund management. Their history is a testament to the resilience, adaptability, and visionary foresight necessary in the ever-changing world of finance. As these funds continue to evolve, their legacy serves as both a guiding light and a benchmark for the future of mutual funds, symbolizing a unique blend of historical continuity and progressive adaptation in the global financial landscape.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.