As an investor who craves capital efficient exposure and maximum diversification, I’ve often pondered my dream fund.

I’d want balanced traditional asset exposure to long-only global stocks and bonds with a significant slice of gold thrown in for good measure.

I have a strong preference for breaking the link between market cap weighted equities with research supported equity optimization strategies that are a less crowded trade.

Here I’ve fulfilled all of my static asset allocation cravings.

And then it’s on to alternatives.

Specifically, I’m seeking exposure to a wide spectrum of asset classes that have the capacity to adaptively take long and short positions across various market regimes.

My conviction in adaptively protective strategies has grown stronger in recent months.

Unlike the 2010s, when it was mostly smooth sailing, we’re facing a new decade that appears to have a lot more in common with the 2000s and 70s.

2022 was a sobering reminder that long-only asset allocation has a clearly defined Achilles’ Heel.

Correlations between historically uncorrelated asset classes can change when the perfect storm of pesky and persistent inflation rears its ugly head.

Hence, the necessity of creating space in your portfolio for trend-following managed futures strategies becomes paramount.

And the more the better.

Especially when you’re not having to shave down your traditional asset class exposure to make room for it.

So what does this dream portfolio look like when all is said and done?

Auspice One Fund – “Equity Replacement”

Well, my friends it looks an awful lot like Auspice One Fund Trust.

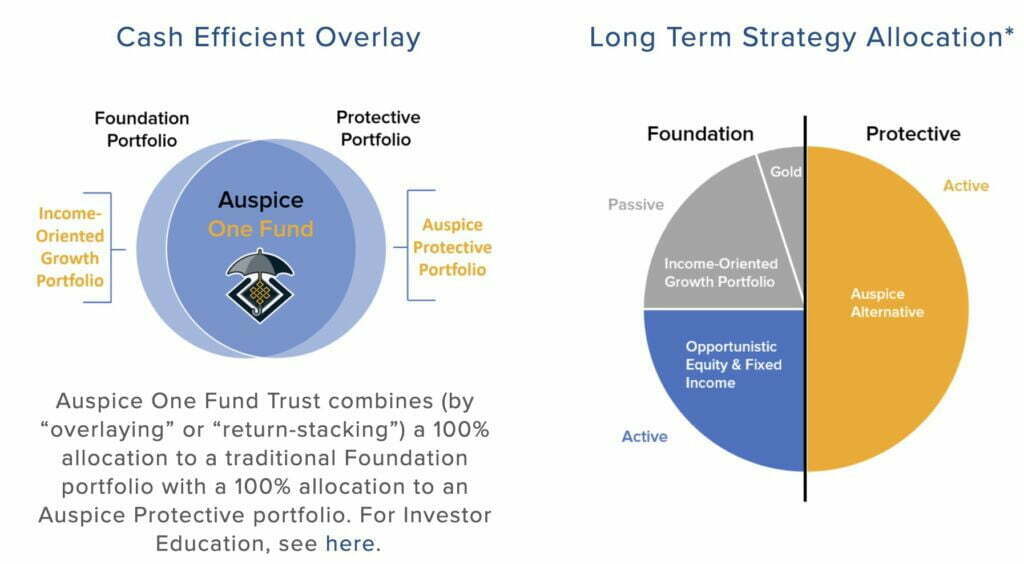

It’s an expanded canvas portfolio of 100% traditional asset class exposure to global stocks, bonds and gold with a 100% diversifying layer of managed futures keying in mostly on commodities.

What was once only available to accredited and institutional investors is now accessible to the retail masses.

Hallelujah!

source: Auspice Capital on YouTube

This is especially a welcome development in the Canadian marketplace!

Until recently I was mostly reaching south of the border to grab stellar capital efficient funds such as the WisdomTree trifecta of NTSI, NTSE and GDE.

Now we’re starting to see the Canadian marketplace wake up to possibilities of this particular genre of asset allocation.

Now let’s explore how a 200% expanded canvas multi-strategy fund simulates versus traditional long-only equity and balanced funds.

Performance: Auspice One Fund Trust (AOFT Mutual Fund)

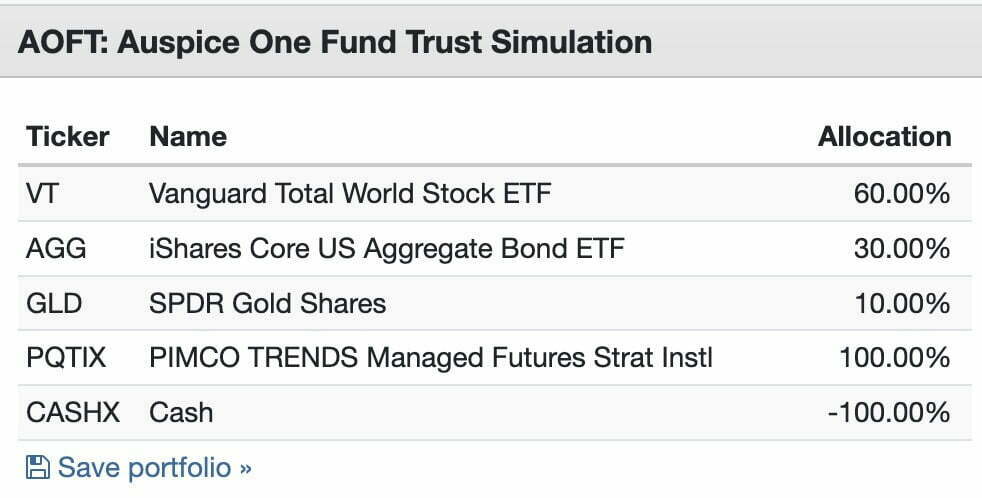

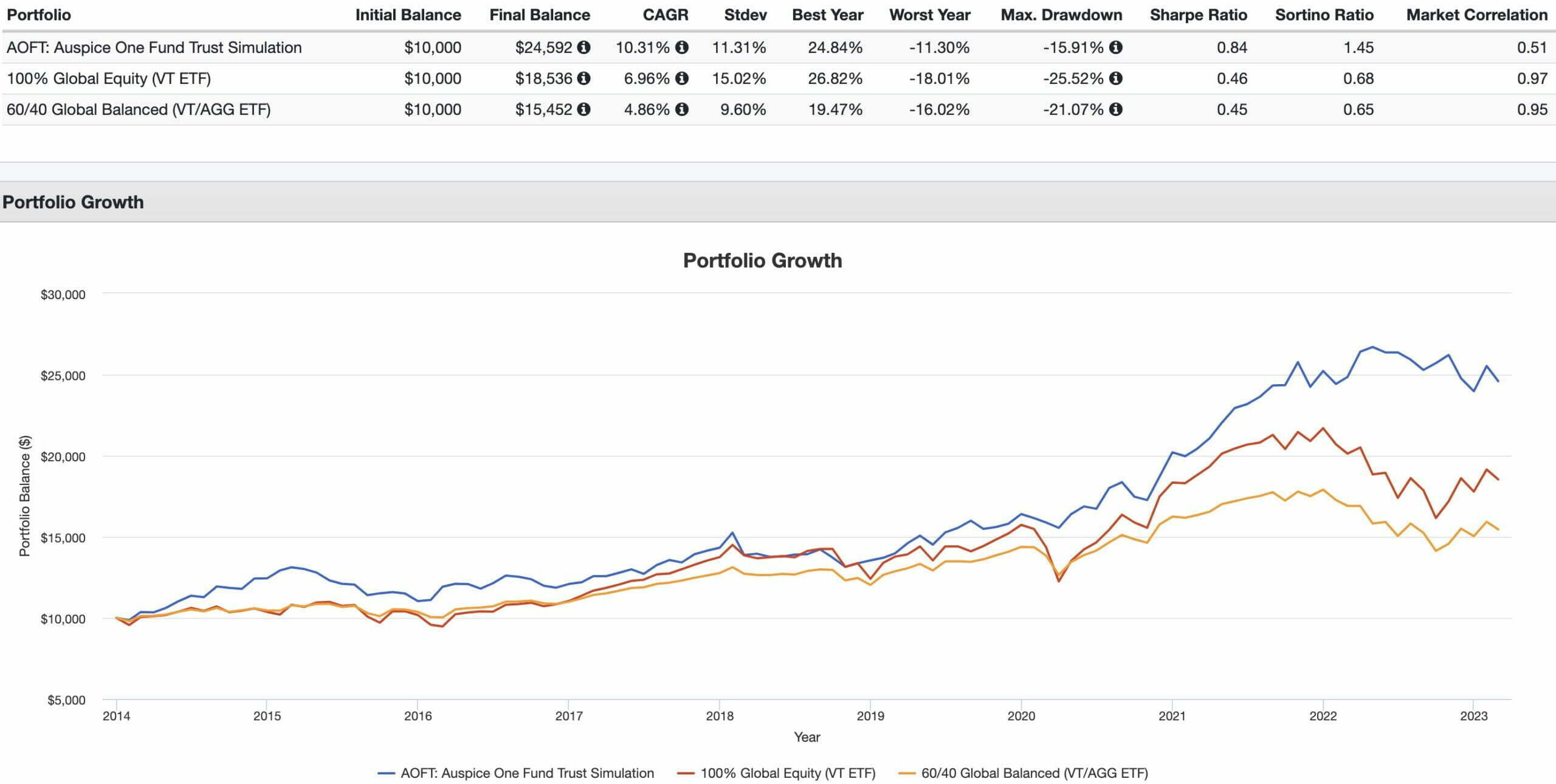

We’ll compare AOFT (with a simulation of various funds) directly with a globally diversified industry standard 60/40 balanced and 100% equity portfolio as best represented by VT ETF and AGG ETF.

This is far from a perfect representation of the fund but we’re able to get a taste of what a globally diversified stocks, bonds and gold portfolio handcuffed to an adaptive managed futures strategy looks like with the following arrangement.

60% VT ETF

30% AGG ETF

10% GLD ETF

100% PQTIX Mutual Fund

-100% CASHX

Now let’s see how that does against the industry standard milquetoast duo of 100% equity and 60/40 configurations.

AOFT vs 100% VT ETF vs 60% VT ETF & 40% ETF AGG Performance Summary

CAGR: 10.31% vs 6.96% vs 4.86%

RISK: 11.31% vs 15.02% vs 9.60%

BEST YEAR: 24.84% vs 26.82% vs 19.47%

WORST YEAR: -11.30% vs -18.01% vs -16.02%

MAX DRAWDOWN: -15.91% vs -25.52% vs -21.07%

SHARPE RATIO: 0.84 vs 0.46 vs 0.45

SORTINO RATIO: 1.45 vs 0.68 vs 0.65

MARKET CORRELATION: 0.51 vs 0.97 vs 0.95

Wowzers!

If the first thing that comes to mind is that everything is better with the AOFT simulation versus a 60/40 and 100% equity portfolio your first impressions are indeed astute.

It slaughters both portfolios especially in terms of overall returns, worst year, Sortino ratio, max drawdown and overall market correlation.

If you look closer you’ll notice it outperforms during overall favourable market conditions (2010s) and kicks things into savage mode during turbulent times (2020s).

The power of maximum diversification, uncorrelated asset classes/strategies and capital efficiency is on full display here.

AOFT: Auspice One Fund Trust

Unfortunately, portfolio visualizer does not accept Canadian mutual funds for backtest purposes.

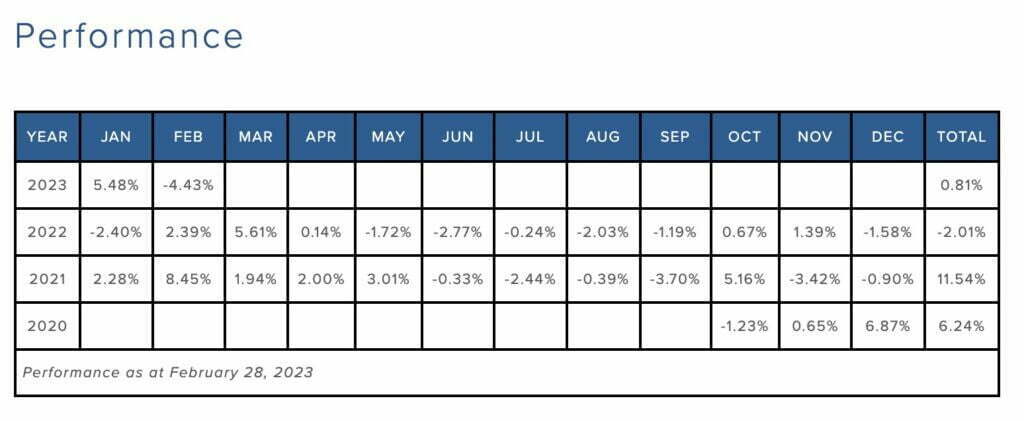

However, we’re able to see how the fund has performed since its inception (Oct 2020).

Noteworthy is that the fund has only become available to retail investors just recently.

Its performance in 2022 is worth zooming in on as the fund clearly handled the economic curveballs thrown its way better than a 60/40 portfolio.

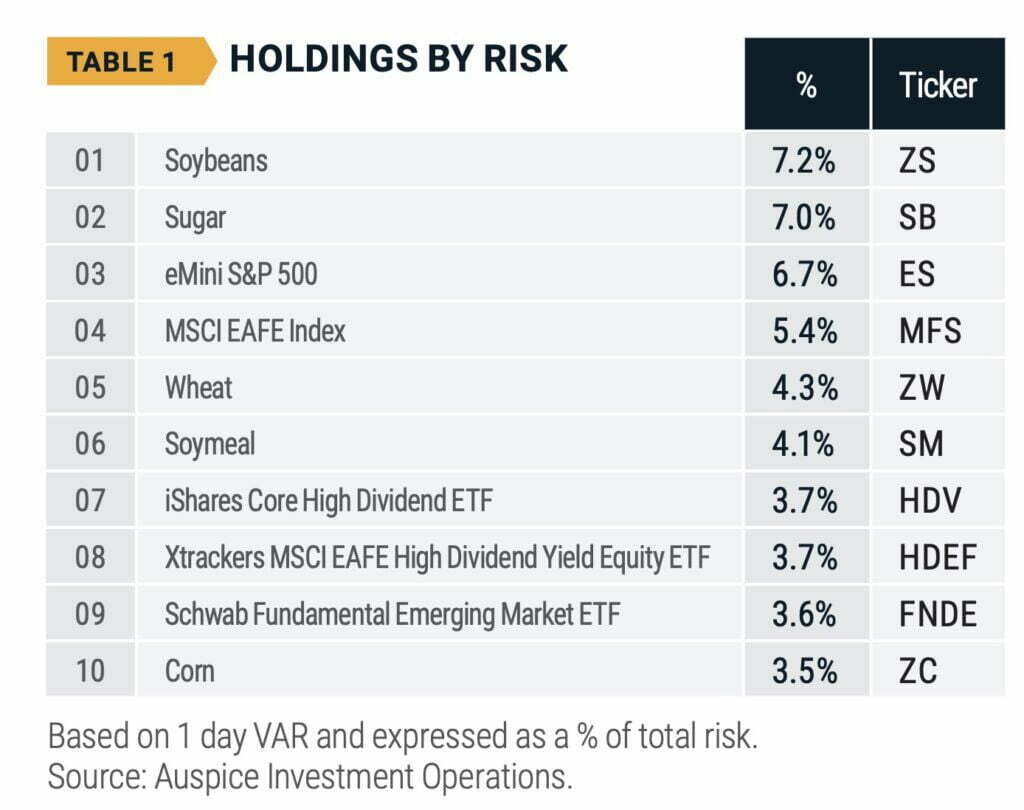

Here we’re able to view the fund holdings where high dividend and fundamental indexes pair alongside traditional market cap weighted exposures.

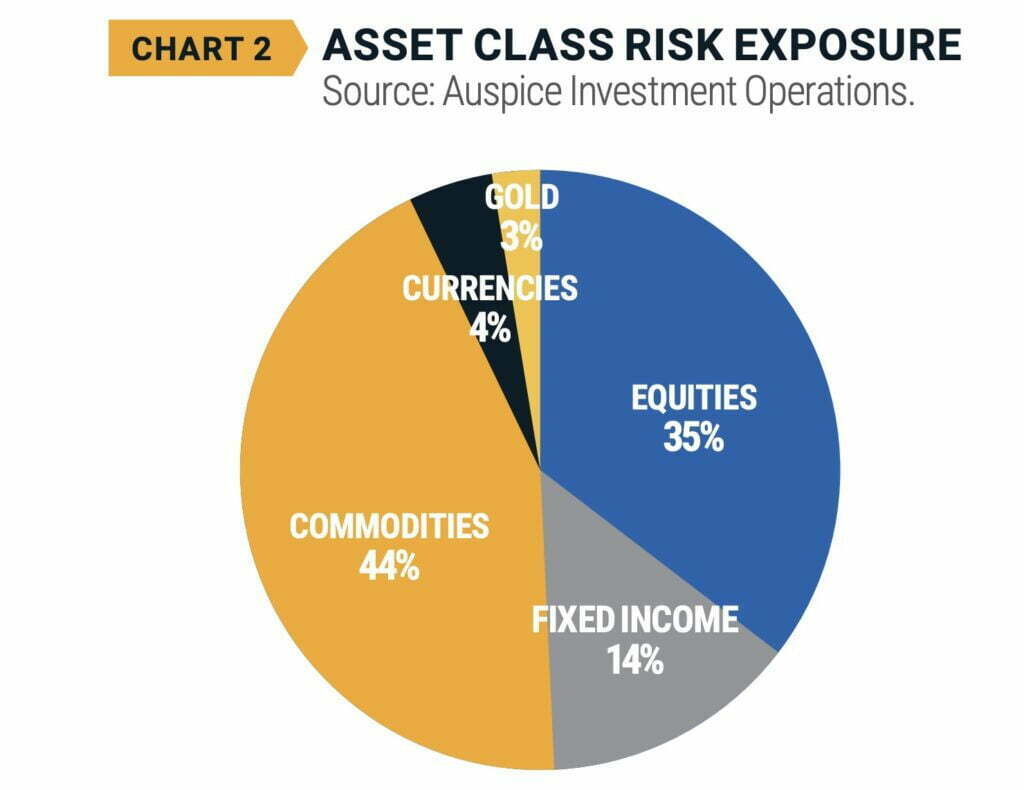

Here we’re able to see the balanced asset class exposure of the fund:

44% Commodities

35% Equities

14% Fixed Income

4% Currencies

3% Gold

We’ll double things up to see how that appears in a 200% canvas configuration:

88% Commodities

70% Equities

28% Fixed Income

8% Currencies

6% Gold

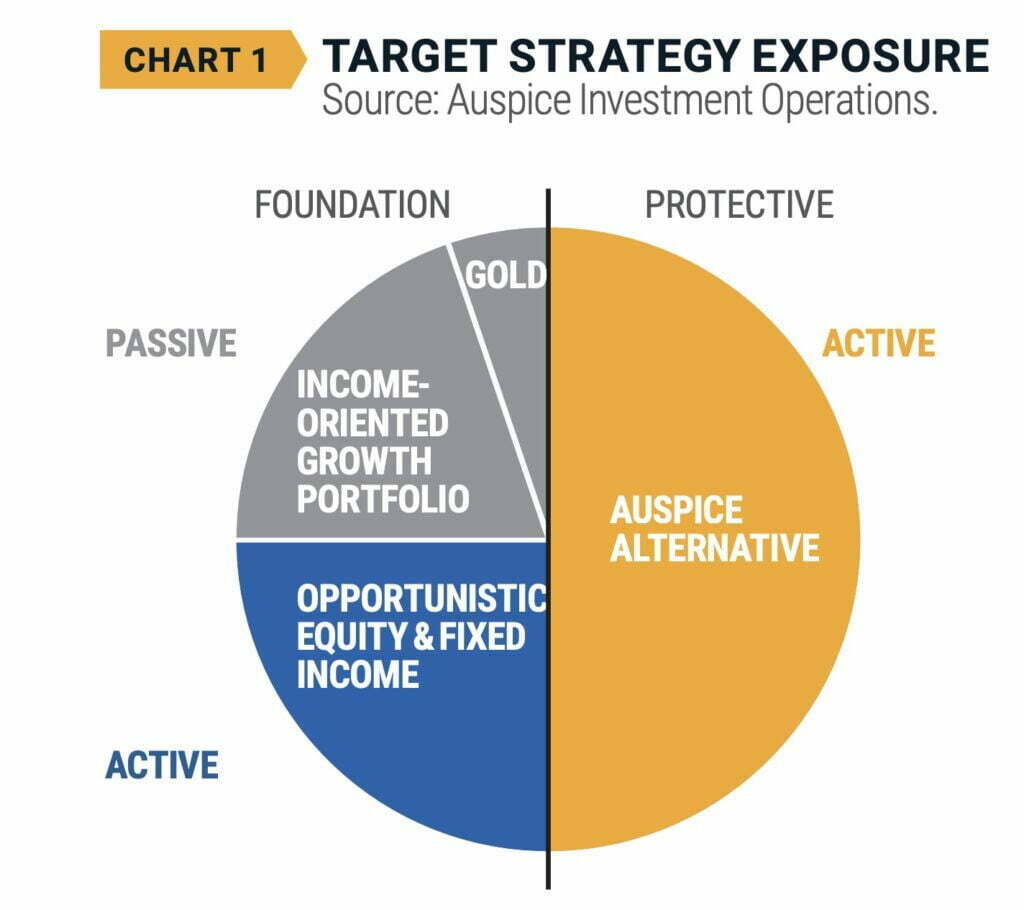

Finally we have the target strategy exposure above.

Auspice One Fund Trust Review | 100% Traditional Assets + 100% Adaptive CTA Allocation

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Auspice Capital: Canada’s Commodity Fund Manager

Auspice Capital is best known as Canada’s commodity fund manager!

They’ve run a number of successful award winning mandates over the years.

US investors may be aware of COM ETF!

Here is the complete roster of strategies they run:

- Diversified Fund

- Broad Commodity

- Short Term

- Auspice One Fund

- Managed Futures

- Canadian Crude Index

- Canadian Natural Gas Index

Auspice One Fund Trust Overview, Holdings and Info

The investment case for “Auspice One Fund Trust” has been laid out succinctly by the folks over at Auspice Capital: (source: fund landing page)

Upside Opportunity, Downside Protection, Income-Oriented, in One Fund.

100% allocation to a commodity tilted CTA overlayed on top of a 100% allocation to traditional investments.

High Sharpe, cash efficient institutional solution in a retail fund that is unique in Canada.

INVESTMENT OBJECTIVE:

The investment objective of the Fund is to seek to achieve superior absolute and risk-adjusted returns as compared to balanced fund approaches, or a long-only equity fund, with the added benefits of protection and performance during sustained downward trends while earning a yield.

INVESTMENT STRATEGY:

Auspice One Fund Trust (“One Fund”) maintains traditional exposure while markets move higher yet always protecting capital, tactically adjusting to reduce inevitable corrections while maintaining the non-correlated opportunities at all times.

One Fund uses global futures contracts to efficiently generate the core protective exposures (commodities, interest rates, currencies, equity indices) while the remaining assets are invested in traditional equity and fixed income ETFs and/or mutual funds along with Gold.

RULES BASED AND INCOME ORIENTED:

One Fund benefits from a rules-based active management core. It combines the long-term track record of Auspice with tactical active and passive income-oriented global growth equity and fixed income ETFs.

Auspice One Fund Trust: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve highlighted what I feel are the most salient parts and summarized the key points at the very bottom. (source: summary prospectus)

Investment Objective:

“The Fund seeks to achieve superior absolute and risk-adjusted returns as compared to balanced fund approaches, or a long-only equity fund, with the added benefits of protection and performance during sustained downward trends while earning a yield.

This will be achieved by combining traditional assets with the Manager’s protective strategies on a near equal basis, which allows the Fund to benefit from the non-correlation of equity, fixed income and divergent alternative investments.”

Investment Strategies:

“The Fund maintains traditional exposure while markets move higher yet also protects capital, tactically adjusting to reduce inevitable corrections while maintaining the non-correlated opportunities at all times.

The Fund uses global futures contracts to efficiently generate the Manager’s core exposures (commodities, interest rates, currencies, equity indices) while the remaining assets are invested in traditional equity, fixed income, credit, cash, gold, and other instruments including exchange traded funds (each an ETF), exchange traded notes (each an ETN) and/or futures.

The Fund benefits from a rules-based active management core.

It combines the long-term track record of Auspice Diversified core strategies with tactical active and passive global equity and fixed income instruments (e.g., ETFs, ETNs and/or futures).

The Fund may use leverage through the use of cash borrowings, short sales and derivatives.

If used, the fund will manage its risk in such a manner as to keep the absolute VaR under 20% of its net asset value.”

Targeted Yield:

“The Fund is targeting to pay a yield on a quarterly basis depending on market conditions.

This return is not guaranteed.

Unitholders of the Fund can elect to reinvest such distributions for stronger growth oriented goals.”

Foundation Portfolio: Equity & Fixed Income

“Auspice uses liquid low-cost ETFs, ETNs, and futures in the foundation portfolio.

The portfolio is tilted towards equity and fixed income, but not exclusive to these asset classes: alongside, gold and other diversifying exposures may be added with the goal of creating a portfolio of assets that is more diversified with better risk-adjusted returns than a traditional 60/40 equity/fixed income portfolio.

Active futures strategies used successfully in Auspice’s other funds to tactically increase exposure, or reduce exposure in extreme volatility, are also employed.”

Active Alternative Strategies:

Auspice’s rules-based approach is rooted in trend following over global exchange traded commodity and financial markets.

Trends are determined by quantitative parameters but the concept is simple: participate in trends agnostic to direction or market.

Risk management is the backbone producing non-correlated returns to the equity market with lower volatility and drawdowns.

Auspice has a long history of outperforming in periods of volatility and stress when diversification is most valuable.”

Cash Management:

“As much of the portfolio achieves a high cash efficiency through the use of futures exposures, the fund tends to have a large cash position.

Cash is invested in a number of income producing instruments, ETFs, and ETNs inorder to achieve an attractive yield while always maintaining liquidity and other risk considerations.”

Result: One Fund Combination

A multi-strategy approach that combines the best of rules-based active and passive investing across traditional and alternative assets to generate alpha and efficiently capture equity gains while protecting and benefitting on the downside.

The combination is powerful and demonstrates the synergy from combining non-correlated strategies together resulting in low correlation to equity markets.

The Fund may enter into securities lending, repurchase and reverse repurchase transactions to earn additional returns, subject, in each case, to limits at least as stringent as those required by Canadian securities regulatory authorities.

As the Fund is considered an “alternative mutual fund” within the meaning of NI 81-102, as noted, it may use strategies generally prohibited to be used by conventional mutual funds, such as the ability to invest more than 10% of its NAV in securities of a single issuer, the ability to invest in physical commodities or specified derivatives, to borrow cash, to short sell beyond the limits prescribed for conventional mutual funds and to generally employ leverage.

The Fund may depart temporarily from its investment strategies in the event of adverse market, economic, political or other considerations.”

Auspice One Fund Trust Investment Strategy Key Points

- Fund Objectives: Seeks superior absolute and risk adjusted returns in comparison to a traditional balanced portfolio or long only equity portfolio

- Protection And Performance: Ability to generate positive returns in downward trends while earning a yield

- Investing Universe: Combination of traditional assets (equity, fixed income, credit, cash, gold via ETFs/ETNs) and Futures (commodities, interest rates, currencies, equity indices)

- Active Management: Rules-based Auspice Diversified core strategies with active tactical and passive global equity and fixed income

- Risk Management: Keep the absolute VaR under 20% of its net asset value

- Targeted Yield: Pay a yield on a quarterly basis

- Foundation Portfolio (Equity & Fixed Income): Tilted towards equity and fixed income with gold exposure via low-cost ETFs/ETNs

- Active Alternative Strategies: Rules based Trend-Following over global exchange traded commodity and financial markets

- Cash Management: Cash is invested in income producing instruments, ETFs and ETNs to achieve an attractive yield

- One Fund Combination: 100% rules based active/passive traditional assets plus 100% alternative trend-following assets

- One Fund Goal: Multi-strategy approach of combining non-correlated strategies to generate alpha, offer downside protection and have low correlation with equity markets

Auspice One Fund Trust Info

Ticker: ACA301A (A), ACA303I (I), ACA305T (T)

Adjusted Expense Ratio: 1.00 + 10% or 15% Performance Fee

AUM: $15,659,251.75 (Series A) / $17,988,243.89 Million (Series I) / N/A (Series T)

Inception: October/2020

Auspice One Fund Trust Pros and Cons

Let’s move on to examine the potential pros and cons of Auspice One Fund Trust.

Auspice One Fund Trust Pros

- Capital Efficient exposure to traditional global asset classes (stocks, bonds, gold) and non-correlated alternatives (managed futures trend-following)

- 200% Expanded canvas portfolio that is evenly prepared for prosperity and economic turbulence with its multi-strategy approach

- The potential to seriously outperform long-only balanced and equity portfolios with higher absolute and risk adjusted returns

- A total portfolio all-in-one expanded canvas solution as opposed to being just a capital efficient puzzle piece

- Underlying ETFs that deviate from merely MCW equity exposure

- The capacity to generate positive returns during all economic environments with an adaptive alternative sleeve

- A hybrid approach of rules based active, passive and adaptive management strategies

- A unique fund in the Canadian marketplace offering capital efficient strategies that used to only be available to institutions

- Novel fee structure for a diverse multi-strategy approach with a 1% management fee OR a 10/15% performance incentive (not both)

- Chance to support an innovative boutique fund provider with an excellent long-term track record and award winning performance

Auspice One Fund Trust Cons

- Sometimes the alternative “diversification” will be a drag on performance and investors need to be prepared for tracking error

- Management fee that is higher than what low cost indexers are used to paying

Auspice One Fund Trust Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

We’re able to assemble a diversification masterpiece by utilizing Auspice One Fund Trust as the backbone of our portfolio while adding diversifying strategies in 10% and 5% slices.

50% AOFT – Auspice One Fund Trust Mutual Fund (Fund Code: ACA301A)

10% ONEC.TO – Accelerate OneChoice Alternative Portfolio ETF

10% HRAA.TO – Horizons ReSolve Adaptive Asset Allocation ETF

10% JFS.UN.TO – JFT Strategies Fund ETF

10% PFAE.TO – Picton Mahoney Fortified Active Extension Alternative Fund ETF

5% PFMN.TO – Picton Mahoney Fortified Market Neutral Alternative Fund ETF

5% ARB.TO – Accelerate Arbitrage Fund ETF

We’ve got Auspice One Fund Trust mutual fund taking up the bulk of the portfolio real-estate at 50% providing a hybrid of traditional asset class exposure (global stocks, bonds and gold) along with an equal parts adaptive alternative sleeve.

Accelerate OneChoice Alternative Portfolio brings a unique 10-1 alternative strategy where we gain diversified exposure to long-short equity, bitcoin and arbitrage to name just a few.

Horizons ReSolve Adaptive Asset Allocation brings a unique blend of global systematic managed futures strategies such as carry and seasonality (as opposed to just trend) across a wide variety of asset classes.

JFT Strategies Fund is a unique absolute return fund that has provided investors superior returns and low market correlation versus a static 60/40 portfolios.

Picton Mahoney Fortified Active Extensions Alternative Fund is a 140-40 long-short equity fund that packs a big punch and since its inception has crushed its benchmark of the TSX.

Picton Mahoney Fortified Market Neutral Alternative Fund brings a defensive equity approach to the table with an incredible track record of above water returns since its inception.

Accelerate Arbitrage Fund offers unique exposure to arbitrage as a diversify alternative strategy to add to the overall mix.

Overall we have exposure to the following 10 strategies with our uniquely Canadian expanded canvas portfolio:

- Equities

- Bonds

- Gold

- Managed Futures (Trend):

- Global Systematic Macro (Carry, Seasonality, etc)

- Long-Short Equity

- Market-Neutral

- Arbitrage

- Bitcoin

- Other Alt Strategies (REITS/MBS/ETC)

This is definitely a portfolio I could roll with long-term.

Auspice One Fund Trust Review: 12 Essential FAQs for Canadian Investors

What is the Auspice One Fund Trust (AOFT)?

The Auspice One Fund Trust is a Canadian alternative mutual fund designed to provide 100 % exposure to traditional asset classes—global equities, bonds, and gold—plus 100 % exposure to managed futures strategies. It uses futures to “stack” adaptive alternative strategies on top of a traditional core, aiming for superior risk-adjusted returns and downside protection compared to standard 60/40 or long-only equity portfolios.

How is Auspice One Fund Trust different from a typical 60/40 balanced fund?

Unlike a traditional 60/40 that splits allocations between stocks and bonds, AOFT overlays trend-following managed futures on top of a fully allocated traditional base. This creates a 200 % expanded canvas portfolio—100 % traditional exposure plus 100 % alternatives—without forcing investors to cut their equity or bond exposure to make room for alternatives.

What asset classes does AOFT target?

AOFT strategically invests across equities, fixed income, gold, commodities, and currencies. Roughly 44 % of the base allocation is commodities, 35 % equities, 14 % fixed income, 4 % currencies, and 3 % gold, which is then doubled for a 200 % notional exposure using futures.

How has the AOFT simulation performed compared to 60/40 and 100 % equity portfolios?

Using backtested allocations that mimic the fund’s structure, AOFT produced a CAGR of 10.31 % versus 6.96 % for global equity (VT) and 4.86 % for a 60/40 mix. It also had shallower drawdowns (-15.91 % vs. -25.52 % and -21.07 %), a higher Sharpe ratio (0.84 vs. 0.46 and 0.45), and lower market correlation (0.51 vs. 0.97 and 0.95).

What makes AOFT capital efficient?

The fund uses futures to gain exposure to managed futures strategies without reducing traditional exposure, effectively return stacking two diversified portfolios in one fund. This allows investors to maintain a full traditional allocation while adding alternatives that historically improve risk/return characteristics.

What are the fund’s key objectives?

The fund seeks superior absolute and risk-adjusted returns compared to balanced funds or long-only equity portfolios. It aims to participate in bull markets through its traditional sleeve while protecting capital and performing during sustained drawdowns using managed futures.

How is AOFT managed?

AOFT follows a rules-based active management approach, rooted in Auspice’s trend-following strategies over global commodity and financial markets. Futures are used to gain exposure to commodities, interest rates, currencies, and equity indices, while ETFs and mutual funds provide traditional equity and fixed-income exposure.

Who manages AOFT?

AOFT is managed by Auspice Capital, a Canadian commodity and alternative strategy specialist known for its long-standing track record with trend-following mandates. They’re also the managers behind COM ETF in the U.S. market.

What are the fund’s fees?

The fund has a 1 % management fee plus a 10 % or 15 % performance fee, depending on the series. This fee structure reflects the active, multi-strategy approach and differs from typical low-cost index ETFs.

Is AOFT available to retail investors?

Yes. Although AOFT strategies were historically only available to accredited or institutional investors, the fund has recently become available to Canadian retail investors, marking a major development in the capital-efficient investing landscape in Canada.

What are the potential drawbacks of investing in AOFT?

While AOFT offers diversification benefits, its alternative sleeve may drag on performance during strong equity bull markets. Its fees are higher than standard index funds, and investors must be comfortable with tracking error versus traditional benchmarks.

How might AOFT fit into a broader portfolio?

AOFT can serve as a core holding for investors seeking maximum diversification and return stacking in a single product. It may also be complemented by other alternative strategies, such as arbitrage or long-short equity funds, to create a uniquely Canadian expanded canvas portfolio.

Nomadic Samuel Final Thoughts

Auspice Capital has dropped a game changer capital efficient bomb into the Canadian marketplace.

Not only is it on my radar but it’s completely obliterated the way I plan on constructing my portfolio.

And by “bomb” and “obliterate” I mean as terms of endearment in case that wasn’t quite clear…LOL

I’ve now got a new centrepiece fund to build around.

That means everything else in my portfolio is going to be playing a reduced role and/or second fiddle from now on.

I’m quite honestly still figuring things out.

But at this point in the review I’m more interested in what you’ve got to say.

What do you think of AOFT: Auspice One Fund Trust?

Is it on your radar?

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Great fund. My only gripes are the heavy exposure to corporate bonds, financials, and energy sectors. I think it’s a fantastic building block for modern portfolios if you find some diversification away from those.

If it didn’t have the corporate bonds I think my dream portfolio would be:

50% AOFT

20% PFAA

10% AVUV

10% AVDV

10% Cortland Credit Strategy

Wouldn’t bother with private credit and corporates.