At the heart of any thriving economic system lies the complex interplay between optimism, speculation, caution, and fear. Periodically, this delicate balance is destabilized, giving rise to phenomena that have become all too familiar yet remain deeply perplexing: market bubbles and their inevitable counterpart, crashes.

A market bubble occurs when the prices of assets, often stocks, real estate, or commodities, increase at an exponential rate, far exceeding their intrinsic value. This rapid, unchecked appreciation is usually not backed by corresponding growth in the fundamentals of the asset but is driven more by irrational exuberance, speculation, and the illusion that the asset’s price will continue to rise indefinitely.

Brief Overview of Market Bubbles and Crashes

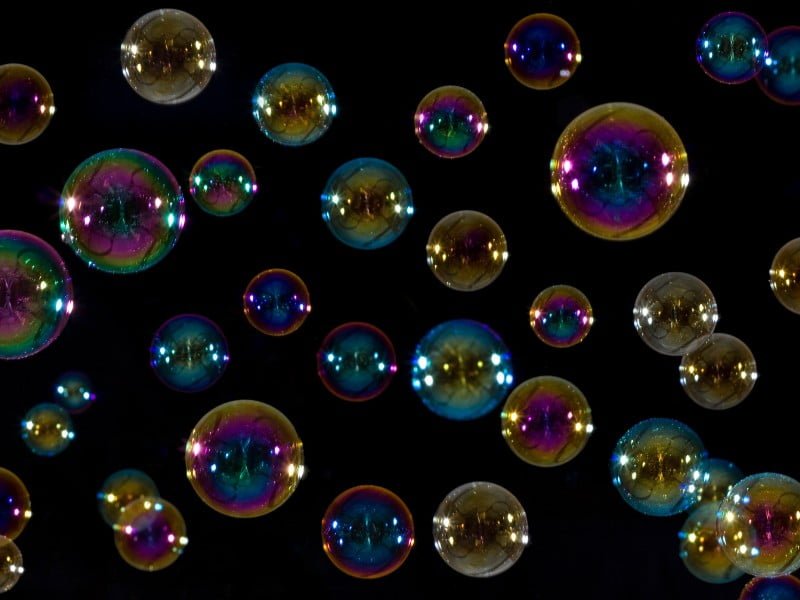

However, like all mirages, this illusion cannot last forever. Eventually, there’s a tipping point—a moment of collective realization that these inflated prices are unsustainable. When this moment arrives, the bubble bursts, leading to a sharp decline in prices, often more precipitous and damaging than their initial ascent. This resultant downward spiral is referred to as a market crash.

Understanding the mechanics of bubbles and crashes—how they form, escalate, and dissipate—is not merely an intellectual exercise. It holds profound implications for businesses, policymakers, investors, and even the ordinary man on the street. At the core of these phenomena is not just economic theory, but a deep-rooted human psychology that drives collective behavior.

Importance of Understanding their Psychological Underpinnings

Economists and market observers have frequently found traditional financial models lacking when trying to explain the formation and bursting of bubbles. These models, which often presume rationality in investor behavior, come up short in accounting for the wild swings of optimism and pessimism that characterize these events. This has led many to look to psychology to fill in the gaps.

By understanding the psychological triggers and responses at play, we can better anticipate potential market disruptions, mitigate their adverse effects, and implement strategies to prevent their occurrence. Moreover, grasping the emotional and cognitive factors that fuel these market events can aid in developing educational and policy interventions aimed at fostering more stable and resilient markets.

At the individual level, this knowledge empowers investors and stakeholders to make more informed decisions, avoiding the pitfalls of herd mentality, and navigating the market landscape with a clearer, more objective lens. In essence, a deep dive into the psychological aspects of market bubbles and crashes offers us tools to transform our approach to investment, risk assessment, and wealth preservation.

In the subsequent sections, we shall embark on a journey to uncover the intricate psychological tapestry that underpins market bubbles and crashes. We will explore the cognitive biases that lead to irrational decision-making, the social dynamics that magnify collective euphoria or panic, and the emotional triggers that can send markets soaring or plummeting. Through this exploration, we aim to shed light on the enigmatic nature of these phenomena and provide guidance on how we might better navigate the unpredictable waters of the financial world.

What is a Market Bubble?

A market bubble, in its simplest form, refers to a situation where the price of an asset or a group of assets rises far above what is justified by its fundamentals, leading to an unsustainable and often inflated market situation. However, it’s much more than just a mispricing; it’s a complex phenomenon, characterized by a mix of tangible market indicators and intangible human behaviors.

Key Characteristics of a Market Bubble include:

- Irrational Exuberance: Coined by Alan Greenspan, this term refers to the undue and sometimes baseless optimism that investors exhibit during the inflation of a bubble. Investors buy assets based more on the hope and expectation of future price increases rather than the inherent value of the asset.

- High Trading Volumes: During a bubble, there’s a significant increase in the trading volume of the inflated asset, driven primarily by speculation.

- Supply and Demand Imbalance: As optimism takes over, demand for the asset skyrockets, often outstripping supply, leading to soaring prices.

- Leverage Increase: Investors tend to borrow more money to invest in the booming market, confident that they can repay the debt with the expected higher returns.

- Disconnect from Fundamentals: One of the hallmark signs of a bubble is that asset prices are no longer reflective of their fundamental values. Instead, they’re driven by speculation, investor sentiment, and sometimes even sheer greed.

- Widespread Media Coverage and Public Involvement: Bubbles often capture widespread public attention. Media amplifies the optimism, drawing even novice investors into the market, hoping to capitalize on the boom.

- FOMO (Fear of Missing Out): This social anxiety fuels the bubble further. Seeing others make seemingly easy profits, more and more investors jump in, fearing they might miss out on the opportunity.

Historical Examples

- Tulip Mania (1630s):Often cited as the first recorded speculative bubble, Tulip Mania took place in the Dutch Golden Age when prices for some tulip bulbs soared to extraordinarily high levels. At its peak, some single tulip bulbs sold for more than 10 times the annual income of a skilled craftsman. The bubble burst in February 1637, causing prices to drastically drop. The causes of this phenomenon are debated, but it serves as an early example of the irrationality that can grip markets.

- South Sea Bubble (1720):Founded in 1711, the South Sea Company was a British joint-stock company with a monopoly on trade in the South Seas. In the early 1720s, the company’s stock began to rise as investors were promised future profits from the company’s trade monopolies. Stories of unimaginable wealth from overseas territories fueled the speculation. The company’s directors engaged in insider trading and propagated false claims about the profitability of their ventures. The bubble burst in 1720, ruining many investors and leading to significant financial reforms in Britain.

- Dotcom Bubble (Late 1990s – Early 2000s):As the internet began to take off in the 1990s, there was massive speculation around the potential profitability of internet-based companies. This led to a rush of investments in tech startups, many of which had no clear business model or even revenue. Driven by the allure of the digital age, stock prices of many tech companies soared, leading to the NASDAQ index peaking in March 2000. However, by 2002, the bubble had burst, leading to significant financial losses and the collapse of many internet companies. This era was marked by a combination of speculative investing, easy capital, and the uncharted territory of the internet frontier.

Each of these bubbles, while unique in their context and cause, showcases the common threads of unwarranted optimism, speculation, and the eventual painful correction. They serve as powerful reminders of the human tendencies that, when unchecked, can lead markets astray, resulting in significant economic consequences.

source: Crush The Street on YouTube

The Psychological Forces Behind Bubbles

Unveiling the psychological architecture that underlies market bubbles offers a tantalizing glimpse into the human psyche. Our emotions, beliefs, biases, and social interactions converge, often leading us down a path of collective irrationality. Two primary psychological forces stand out as perennial contributors to the formation of bubbles: overconfidence and overoptimism.

Overconfidence

Overconfidence is a well-documented cognitive bias in which an individual’s subjective confidence in their judgments is systematically greater than the objective accuracy of those judgments. This distortion in self-perception becomes particularly pronounced in the realm of financial markets, and its manifestations during the formation of bubbles can be dissected as follows:

- Illusion of Knowledge: Investors often believe they have access to unique information or possess superior analytical skills, thinking they can outsmart the market. This illusion leads them to make more trades than might be rationally justified, pushing prices further away from intrinsic values.

- Self-attribution Bias: Successes in the market are often attributed to one’s skill or insight, while failures are dismissed as bad luck or external factors. This creates a feedback loop; as prices rise and early investments bear fruit, investors increasingly believe in their own prowess, further stoking their confidence.

- Dunning-Kruger Effect: Less competent investors are more likely to overestimate their abilities, while the more competent ones might be more cautious. In a bubbling market, the former group can significantly outnumber and out-voice the latter, leading to an environment where overconfidence prevails.

Overoptimism

While overconfidence revolves around one’s belief in their abilities, overoptimism is more about a general positive expectation of the future. Even when confronted with data suggesting otherwise, individuals tend to remain buoyant about outcomes. This inherent optimism bias can have severe repercussions in financial markets:

- Belief that Prices Will Keep Rising Indefinitely: One of the hallmarks of a bubble is the widespread belief that the upward trajectory of prices is the new norm. Historical data, fundamental valuations, or even glaring red flags are brushed aside. The narrative focuses on potential gains, with stories of overnight millionaires feeding the optimism frenzy. Anecdotal success stories hold more sway than hard data, and the collective belief becomes that the sky’s the limit.

- Projection Bias: Investors, buoyed by recent gains and the prevailing euphoria, project current positive trends far into the future without considering potential reversals or market corrections.

- Underestimation of Risks: In an overoptimistic environment, potential risks are either blatantly ignored or severely downplayed. Warning signs, dissenting voices, or cautionary tales are dismissed as outliers. There’s a collective belief that “this time is different,” and past crashes or bubbles are seen as irrelevant to the current situation.

- Herding Behavior: Optimism can be contagious. When individuals see others investing and making profits, they are more inclined to follow suit, believing that the majority can’t be wrong. This herd mentality can rapidly inflate asset prices as more and more investors jump on the bandwagon, further feeding the bubble.

The tandem forces of overconfidence and overoptimism, combined with various other cognitive biases and social dynamics, create a fertile ground for market bubbles. These psychological underpinnings, deeply rooted in our evolutionary history and social fabric, challenge the traditional economic view of the rational investor. Understanding them not only demystifies the seemingly irrational behavior during bubbles but also provides insights into strategies that can be employed to mitigate their effects.

source: Big Think on YouTube

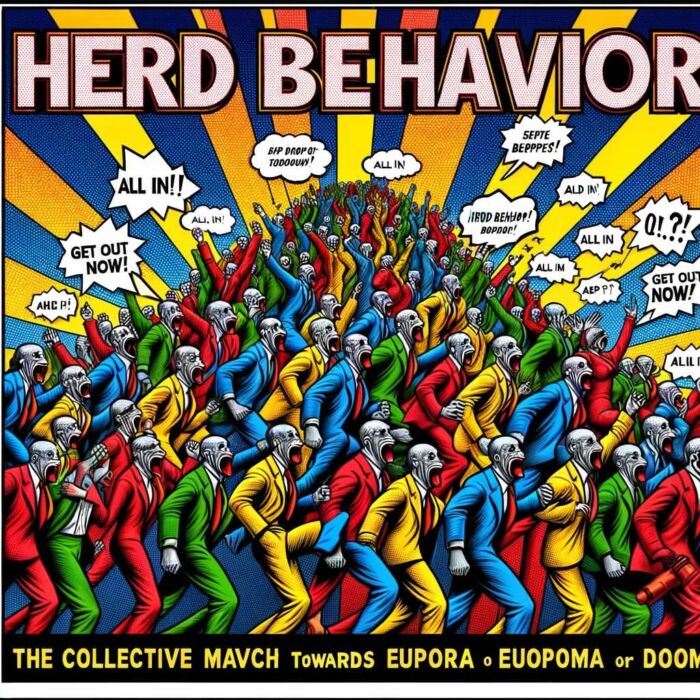

Herd Behavior: The Collective March Towards Euphoria or Doom

When exploring the dynamics of market bubbles, we cannot sidestep the compelling influence of herd behavior. This sociopsychological phenomenon, rooted deeply within both our evolutionary past and the intricacies of human interaction, often serves as the catalyst that accelerates the inflation of bubbles and exacerbates their eventual burst.

Herd Behavior Defined

Herd behavior in financial markets refers to the propensity of investors to follow and mimic the financial behaviors of a majority, or a herd, either leading to exuberant rallies or panicked sell-offs. This collective action often arises not from individual analysis, but from the innate human inclination towards social conformity.

Why Herding Happens: A Dive into Human Psychology

- Evolutionary Roots: Historically, for our ancestors, there was safety in numbers. Sticking with the group often meant protection from predators, more efficient hunting, and shared resources. Over time, this group-oriented survival mechanism has become deeply ingrained, manifesting in modern times as a tendency to follow the crowd, even in financial decisions.

- Informational Cascades: In situations of uncertainty, individuals often look to the decisions of others as a source of information. If a significant number of investors are buying a particular asset, it might be perceived by others as a signal that the asset is valuable, leading them to also buy, regardless of their own private information or analysis.

- Reputation and Professional Pressures: For professional fund managers and investors, there’s a reputational risk associated with deviating significantly from the market consensus. If they make unconventional decisions that lead to losses, they might be viewed as incompetent. However, if they follow the herd and the market crashes, they can defend their actions by saying they were doing what everyone else was doing.

- Cognitive Ease and Mental Shortcuts: Analyzing market information and making independent investment decisions requires cognitive effort. It’s often easier and more comforting for investors to simply emulate what others are doing, relying on the presumption that the majority must be informed and correct.

FOMO (Fear of Missing Out)

Intertwined with herd behavior is the contemporary phenomenon of FOMO. It’s the pervasive apprehension that others might be having rewarding experiences from which one is absent, leading to a desire to stay continually connected with what others are doing.

- The Amplification of Gains: In the context of financial markets, FOMO manifests as a fear of missing out on potential profits. As stories of individuals making substantial gains circulate, others rush to invest, worried about being left behind.

- Social Validation: In the age of social media, successes are often broadcasted widely, creating an environment where one’s financial decisions are not just private choices but social statements. FOMO is amplified when investors see peers celebrating their gains, leading to a fear not just of lost profits but also of lost social validation.

- The Feedback Loop: The more people act under the influence of FOMO, the more asset prices rise, which in turn attracts more attention and draws more people into the market. This feedback loop can rapidly inflate asset prices, further intensifying the bubble.

In essence, herd behavior and FOMO, while seemingly irrational from a pure economic viewpoint, are deeply rooted in our psychological makeup. They serve as powerful reminders that markets are not just cold, calculating entities, but vibrant ecosystems influenced by the raw, often unpredictable nature of human emotion and behavior. Recognizing and understanding these tendencies is crucial for both individual investors and market regulators to navigate and stabilize the financial landscape.

Greed and the Illusion of Wealth: The Sirens of Speculation

In the intricate tapestry of human emotions, greed stands out as one of the most potent drivers, especially in the context of financial markets. While it has often been vilified, greed, at its core, represents an intense desire for wealth and the power and comforts it brings. In market bubbles, this instinct is not merely present; it is amplified, drawing investors into a vortex of speculation, fueled by the tantalizing mirage of easy wealth.

The Anatomy of Greed

- Evolutionary Origins: Like many other emotions, greed has evolutionary underpinnings. In times of scarcity, accumulating resources (like food or tools) often meant the difference between life and death. Those who sought more than their immediate share were more likely to survive and pass on their genes. In modern times, this manifests as an insatiable desire for more—more money, more status, more possessions.

- The Dopaminergic Reward System: From a neuroscientific perspective, the accumulation of wealth or the prospect of gains stimulates the brain’s reward system, releasing dopamine, a neurotransmitter associated with pleasure and reinforcement. This biochemical reward reinforces the desire to continue pursuing wealth, creating a positive feedback loop.

- Social Conditioning: In many societies, wealth is equated with success, power, and prestige. The accumulation of wealth is not just about comfort but is also tied to social status and validation. This societal framework further feeds the flames of greed.

Rapid Price Increases and the Illusion of Easy Money

- Exponential Gains: One of the hallmark signs of a bubble is the rapid, often exponential increase in asset prices. These swift gains create a narrative of easy money, where investors believe they can achieve significant returns with minimal effort or time investment.

- Reinforcement through Success Stories: Every bubble has its poster children—individuals or entities who have made astronomical gains in a short period. These stories, often amplified by media and word of mouth, serve as powerful testimonials to the promise of easy wealth. They perpetuate the belief that anyone can strike it rich if they just get in at the right time.

- Speculative Overdrive: As prices soar and tales of overnight millionaires proliferate, the market sees a surge in speculative investments. Investors buy assets not for their inherent value or long-term potential but solely in anticipation of selling them at a higher price. The focus shifts from investment to pure speculation.

- Overleveraging: Lured by the prospect of magnified gains, many investors borrow heavily to invest in the bubbling asset, believing that the returns will far outstrip the borrowing costs. This overleveraging further inflates the bubble and makes the eventual crash even more devastating.

- Dismissal of Risks: In the euphoric environment, where the illusion of easy money reigns supreme, potential risks and red flags are often downplayed or outright ignored. Any cautionary voices or dissenting opinions are drowned out by the overwhelming chorus of optimism.

The Fragility of Illusionary Wealth

The wealth accumulated during a bubble, while tangible on paper, is often illusionary. When the bubble bursts, asset prices can plummet rapidly, erasing vast amounts of wealth in a short span. The very factors that fueled the rise—speculation, overleveraging, and the dismissal of risks—become the harbingers of the fall.

In conclusion, greed and the illusion of easy wealth are formidable forces during market bubbles. They highlight the vulnerabilities of human psychology, ensnaring investors in a web of optimism and desire. Understanding these dynamics is vital, not just for individual investors seeking to navigate treacherous financial waters, but for societies and economies aiming to mitigate the repercussions of bursting bubbles.

source: Sprouts on YouTube

Cognitive Dissonance: The Mind’s Dance of Denial and Justification

The human mind is a marvel of cognition, creativity, and consciousness. Yet, it is also a labyrinth of biases, contradictions, and mechanisms to protect one’s sense of self and worldviews. One of the most compelling and pervasive of these psychological phenomena is cognitive dissonance, a term coined by social psychologist Leon Festinger in the 1950s. Within the theater of financial markets and bubbles, this phenomenon takes center stage, influencing investors’ behaviors in profound and often detrimental ways.

Understanding Cognitive Dissonance

Cognitive dissonance refers to the mental discomfort or psychological stress experienced by an individual who holds two or more contradictory beliefs, values, or attitudes simultaneously, or is confronted by new information that conflicts with existing beliefs, values, or attitudes.

- Desire for Consistency: The human psyche craves consistency. Our beliefs, attitudes, and actions ideally align in a harmonious state. When they don’t, a state of imbalance or tension arises, prompting the individual to resolve this inconsistency and restore equilibrium.

- Manifestations: Dissonance can manifest in various ways, from simple feelings of unease or discomfort to profound crises of belief or identity. The severity often depends on the significance of the beliefs in question and the degree of their conflict.

Cognitive Dissonance in Financial Markets

- Investment Choices and Ego: For many, investment decisions are not just financial maneuvers but extensions of one’s identity, intellect, and abilities. When these investments underperform or when market data suggests they were ill-advised, it poses a direct challenge to one’s self-perception.

- Ignoring Contrary Evidence: One of the primary ways individuals reduce dissonance is by downplaying or outright ignoring evidence that contradicts their beliefs. In the context of a bubble, an investor might dismiss negative reports about an overvalued asset or overlook historical data suggesting an imminent crash.

- Rationalization: Another tactic to alleviate dissonance is through rationalization. An investor might justify holding onto a plummeting asset by attributing its decline to temporary market anomalies or external factors beyond their control. They might also convince themselves that the market will soon correct, and their initial investment thesis will ultimately prove accurate.

- Seeking Confirmatory Information: Confirmation bias, closely related to cognitive dissonance, is the tendency to seek, interpret, and remember information in a way that confirms one’s preexisting beliefs. In a bubble, investors might gravitate towards optimistic news sources, analysts, or peers who reinforce their bullish stance, while sidelining or criticizing bearish perspectives.

- Doubling Down: Sometimes, to reduce the tension created by dissonance, individuals might double down on their initial stance. For instance, if an investor bought an asset expecting its price to rise, and it starts to fall, they might purchase more of it, believing they’re getting a bargain, rather than re-evaluating their initial decision.

The Costs of Dissonance-Driven Decisions

Decisions made in the throes of cognitive dissonance can be costly, both financially and psychologically:

- Financial Losses: Stubbornly adhering to an investment thesis, despite contrary evidence, can lead to significant financial losses when the market corrects.

- Emotional and Mental Strain: Wrestling with dissonance can lead to stress, anxiety, and even depression. The mental gymnastics required to reconcile conflicting beliefs can be exhausting and emotionally draining.

- Loss of Trust: Persistently denying reality in the face of clear evidence can erode an investor’s credibility and trustworthiness in professional and social circles.

Cognitive dissonance, while a natural mechanism to maintain mental harmony, can be a treacherous force in the domain of financial decision-making. Recognizing its influence and developing strategies to objectively evaluate evidence and revise beliefs is pivotal for investors aiming to navigate the tumultuous waters of financial markets successfully.

Feedback Loops: The Echo Chambers of Financial Euphoria and Despair

Feedback loops, though a concept rooted in systems theory and often discussed in fields like ecology, engineering, and biology, are profoundly influential in the realm of economics and finance. They play a pivotal role in amplifying market trends, both upwards and downwards, and are often at the heart of asset bubbles and their subsequent crashes. To truly grasp the intricate dance of financial markets, one must first understand the mechanics and implications of these loops.

Dissecting Feedback Loops

A feedback loop in a system occurs when a certain portion of the system’s output is fed back into the system as an input. This can amplify (positive feedback) or dampen (negative feedback) the system’s behavior.

- Positive Feedback Loop: This is when the output of a system acts to increase the initial stimulus. In financial markets, a classic example is when rising asset prices attract more buyers, which in turn drives prices even higher.

- Negative Feedback Loop: Here, the output acts to decrease or counteract the initial stimulus. In financial contexts, this could manifest when rising prices deter new investors due to perceived overvaluation, stabilizing the asset’s price.

Positive Feedback and the Financial Markets

- Rising Prices and Increased Demand: One of the most evident manifestations of positive feedback in markets is the allure of rising prices. As an asset’s price increases, it garners attention, attracting new investors hoping to capitalize on its upward trajectory. This increased demand, fueled by both genuine interest and speculative fervor, further accelerates the price rise.

- Reinforcement of Successful Past Behavior: When investors experience success with certain strategies or in particular market conditions, they’re inclined to repeat those actions, anticipating similar outcomes. For instance, if buying a certain asset during its early upward trend yields profits, investors might continue purchasing it or similar assets during subsequent price rises, reinforcing the feedback loop.

- Media Amplification: The media plays an instrumental role in feedback loops. As assets surge in value, they attract media attention, which in turn brings them to the radar of even more potential investors. This media spotlight, especially in the age of digital communication, can exponentially amplify the feedback loop.

- Momentum Trading and Algorithmic Strategies: Many modern trading strategies are momentum-based, meaning they seek to capitalize on existing market trends. When these strategies detect a strong upward price movement, they often pile on, buying more of the asset, thereby exacerbating the positive feedback loop. Additionally, algorithmic trading systems can automatically buy or sell based on certain triggers, further intensifying the loop when multiple algorithms respond to the same market conditions.

The Perils of Positive Feedback

While positive feedback loops can create rapid wealth accumulation and market euphoria, they’re fraught with dangers:

- Detachment from Fundamental Value: As assets get caught in the whirlwind of positive feedback, their market prices can vastly outstrip their intrinsic or fundamental values. This creates a bubble, where the price is sustained primarily by investor enthusiasm rather than underlying value.

- Volatility and Fragility: Markets dominated by positive feedback loops can become highly volatile. A minor negative event or sentiment shift can halt the loop, leading to sharp price declines as investors rush to exit.

- Reversal of Feedback: When the sentiment does shift, the once positive feedback loop can swiftly invert. Falling prices deter new investments, leading to further price declines, creating a negative feedback loop of its own.

Feedback loops, while intrinsic to market dynamics, can be double-edged swords. They magnify gains during bullish phases but can equally amplify losses during downturns. For the discerning investor, understanding and identifying these loops is vital, both to capitalize on opportunities and to navigate potential pitfalls.

source: RealVision on YouTube

Signs of a Bubble: Detecting the Financial Storm Clouds

Market bubbles, with their intoxicating mix of rapid wealth accumulation and collective optimism, have dotted the financial landscape throughout history. However, while each bubble has its unique features, they often share common signs that hint at an overheated market. Recognizing these signs is crucial for investors and regulators to navigate the tumultuous waves of speculative frenzy and avoid being caught in the inevitable crash.

Unsustainable Price Increases

- Accelerated Growth Rates: One of the most blatant signs of a bubble is an asset’s price appreciating at a rate that far outstrips historical averages or its inherent value. This exponential growth often detaches from the asset’s fundamentals, being driven more by speculative interest than intrinsic worth.

- Comparative Asset Valuation: When the valuation of a particular asset class or sector significantly surpasses its peers without a clear and sustainable reason, it’s often a sign of speculative bubble dynamics.

- Historical Context: Examining an asset’s price relative to its historical averages, or a price-to-earnings ratio well above its long-term average, can provide indications of overvaluation.

Amplified Trading Volumes

- Surge in Transactions: An abrupt and disproportionate increase in trading volumes often accompanies the euphoric stages of a bubble. As more participants rush to capitalize on perceived opportunities, the frequency and size of transactions soar.

- Entry of Novice Investors: Bubbles tend to attract a surge of first-time or inexperienced investors, lured by stories of quick riches. When there’s a noticeable influx of such participants, it can be an indicator of a frothy market.

- Short-Term Focus: A shift in market sentiment towards short-term gains, with an increasing number of trades targeting quick turnarounds rather than long-term investments, can be indicative of speculative fervor.

Excessive Media Coverage and Public Excitement

- Media Hype: When financial news starts making regular headlines in mainstream media, it’s often a sign of heightened public interest. Overzealous media coverage can fan the flames of a bubble, drawing even more participants into the market.

- Anecdotal Evidence: Tales of individuals making significant wealth in short time frames, or stories of those who “missed out”, become commonplace. These narratives, often fueled by a Fear of Missing Out (FOMO), can be strong indicators of an overheated market.

- Tech and Innovation Hype: In many bubbles, especially those related to new technologies or innovations, there’s a pervasive belief that “this time is different.” Such sentiments, propagated by media and influencers, can justify soaring prices, obscuring the bubble’s presence.

Widening Credit and Excessive Borrowing

- Ease of Credit: Bubbles are often inflated by an abundance of credit in the system. When borrowing becomes especially easy, with low interest rates or lax lending standards, it can drive asset prices up as investors leverage themselves to buy more.

- Increasing Debt Levels: As optimism mounts, both institutions and individuals tend to take on disproportionate debt, believing that the returns from their investments will easily cover borrowing costs.

- Risky Financial Instruments: The emergence or popularity of complex financial products designed to amplify returns, often with increased risk, can be indicative of a bubble. These instruments can obfuscate true risk levels, drawing in unsuspecting investors.

- Mismatch of Loan Duration: When short-term borrowing is used to finance long-term assets, it can be a precarious sign. This mismatch can lead to liquidity crises if short-term lenders demand their money back before the long-term investments yield returns.

While bubbles might seem intoxicating and even rational during their inflation, their bursts are often devastating. Recognizing the signs of a bubble is not just an academic exercise but a practical tool to safeguard financial health. As the old adage goes, “Those who cannot remember the past are condemned to repeat it.” Understanding these markers can prevent history’s financial missteps from recurring in one’s own portfolio.

Market Crashes: The Thunderstorms After the Euphoria

Financial markets, with their intricate web of economic forces, investor psychologies, and geopolitical influences, are naturally predisposed to cyclical fluctuations. But while regular market downturns or corrections are par for the course, market crashes are cataclysmic events, causing significant financial distress and often altering economic landscapes for prolonged periods. Let’s dive deep into understanding these ominous occurrences.

Definition and Characteristics

- Definition: A market crash is a sudden, drastic, and typically unexpected drop in stock prices across a significant cross-section of the market, often accompanied by panic selling.

- Duration: Crashes are generally rapid, unfolding over days or weeks rather than the prolonged decline seen in bear markets.

- Intensity: The declines in a crash are extreme, often wiping out substantial portions of market capitalization.

- Panic Selling: An integral characteristic of crashes is the psychology of panic. Investors rush to liquidate holdings, fearing further losses, exacerbating the decline.

- Ripple Effects: The financial repercussions of market crashes often extend beyond the stock market, affecting economies at large, from business operations to job markets and consumer confidence.

Historical Examples

1. The 1929 Stock Market Crash

- Backdrop: Known as the Great Crash, it began in October 1929 and was the most devastating stock market crash in the history of the United States, given the full breadth and duration of its fallout. The roaring twenties had seen an unprecedented era of economic prosperity and stock market growth.

- Crash Dynamics: On October 24, 1929, a day dubbed “Black Thursday,” panic selling began, and the market plunged. Despite brief rallies, the decline continued till “Black Tuesday” on October 29, where the market suffered a massive blow.

- Aftermath: The crash signaled the beginning of the 10-year Great Depression that affected all Western industrialized countries. Unemployment soared, banks failed, and global trade collapsed.

2. Black Monday (1987)

- Backdrop: October 19, 1987, witnessed the largest one-day percentage decline in the Dow Jones Industrial Average. The 1980s had seen a strong bull market driven by computer technology and increased global trading.

- Crash Dynamics: While the exact causes remain debated, potential triggers include computerized trading, overvaluation, illiquidity, and market psychology. Automated trading systems began to sell positions in response to declines, triggering a feedback loop of selling.

- Aftermath: The crash prompted regulatory overhauls, leading to the implementation of “circuit breakers” in stock exchanges to prevent such precipitous declines in the future. Remarkably, markets rebounded relatively quickly, with the broader economy experiencing limited impacts.

3. 2008 Financial Crisis

- Backdrop: A culmination of years of risky lending practices, particularly in the U.S. housing market, and the proliferation of complex financial products tied to these loans, set the stage for the crisis.

- Crash Dynamics: As mortgage defaults began rising, the intricate web of financial instruments linked to these loans (like mortgage-backed securities) began to unravel. Major financial institutions, deeply tied to these securities, faced severe liquidity crises. Lehman Brothers’ bankruptcy in September 2008 accelerated the panic.

- Aftermath: The ripple effects were global. Stock markets worldwide crashed, credit markets froze, and many banks and financial institutions either collapsed or were bailed out. This led to a global recession, massive unemployment, and austerity measures in many economies. In response, there were sweeping regulatory changes in the financial industry and massive stimulus measures by central banks.

Market crashes, while distressing events, offer profound lessons in the delicate balance of risk and reward, the imperatives of due diligence, and the ever-present need for investor and institutional preparedness. History has shown that while markets do recover, the scars of such events shape financial practices, regulations, and investor psychologies for generations.

source: Financial Wisdom on YouTube

The Psychological Forces Behind Crashes: From Euphoria to Despair

Financial markets, as much as they are grounded in economic indicators and corporate fundamentals, are deeply intertwined with the collective psyche of their participants. The numerical fluctuations on stock tickers and trading screens are as much a reflection of investor sentiment as they are of profit margins or interest rates. When these psychological forces converge towards negativity, they create a potent storm that can lead to market crashes. The descent from market highs to lows isn’t just a downward slope; it’s often a precipitous drop, spurred by deep-seated human emotions and behaviors.

Panic Selling: When Fear Overshadows Reason

- The Nature of Panic: Panic, in essence, is an intense fear that can override logic, leading to hasty actions. In financial markets, this translates to investors rushing to sell assets, often irrespective of their intrinsic value, driven by a desire to prevent further losses.

- Loss Aversion: Psychological studies indicate that the pain of a loss is felt more acutely than the pleasure of an equivalent gain. This cognitive bias amplifies the dread during market downturns, pushing investors towards a selling frenzy.

- Information Asymmetry: In moments of crisis, there’s often a lack of clear, accurate information. This void can be filled with rumors, speculation, or misinformation, further fueling panic. Investors, unsure of the actual state of affairs, may choose to sell first and assess later.

- Liquidity Needs: Some selling during crashes isn’t just fueled by fear. Institutional investors, for instance, might need to liquidate holdings to meet redemption requests or margin calls, adding to the selling pressure.

Chain Reactions: The Domino Effect of Declines

- Contagion Effect: Just as enthusiasm and optimism can spread in a bull market, fear and pessimism can propagate in a downturn. When major players or markets start selling, it can induce others to follow suit, fearing similar repercussions. This mimetic behavior intensifies the crash.

- Automated Trading Systems: Modern financial markets operate with a significant influence from algorithmic trading systems. These algorithms can trigger large-scale sales when certain conditions or thresholds are met, leading to rapid declines. When multiple algorithms act concurrently, it can exacerbate the crash.

- Feedback Loops: Just as positive feedback loops amplify rising prices during bubbles, the converse is true during crashes. Falling prices can deter potential buyers, leading to even sharper price drops—a self-reinforcing negative feedback loop.

- Margin Calls and Leverage: Many investors use borrowed money (leverage) to amplify their returns. However, during downturns, if asset values fall below a certain level, brokers may issue margin calls, demanding investors deposit more money or sell assets to cover the deficit. This forced selling can significantly intensify declines.

- Interconnected Markets: In today’s globalized world, financial markets are deeply interconnected. A crash in one major market or asset class can have ripple effects across others. This interdependence means that panic or declines in one arena can quickly spread, making a localized issue a global concern.

The Speed of Declines: The Accelerated Descent

- Digital Era Amplification: With the advent of the internet and real-time communication, information (and misinformation) spreads faster than ever before. This means that reactions, including panic, are magnified in scale and speed.

- Globalized Trading Hours: With markets across the world operating in different time zones, there’s almost always a market open. This continuous trading means that negative sentiments can propagate around the globe without pause, amplifying declines.

- Lack of Circuit Breakers: While many major exchanges have implemented circuit breakers to halt trading during significant drops, not all markets or segments have such safeguards. In their absence, rapid declines can continue unchecked.

Loss Aversion: The Asymmetric Emotional Impact of Gains and Losses

Loss aversion, a cornerstone concept in the field of behavioral economics, posits that people tend to dislike losing more than they like winning. This seemingly simple observation carries profound implications for understanding human decision-making in economics, finance, and beyond. But why does the sting of loss surpass the joy of gain, and how does this inherent bias influence our choices?

The Roots of Loss Aversion

- Evolutionary Perspective: From a survival standpoint, early humans faced life-or-death decisions daily. Missing out on a food source (a loss) had more dire consequences than securing an extra one (a gain). Over time, this preference for avoiding loss became ingrained in our psyche as it increased our ancestors’ chances of survival.

- Neurological Responses: Studies employing neuroimaging have shown that losses activate regions of the brain associated with pain and distress more intensively than gains engage areas tied to pleasure. This suggests a hard-wired neurological basis for loss aversion.

- Cultural Conditioning: Many cultures emphasize caution, thriftiness, and risk aversion as virtues. This cultural reinforcement might amplify our inherent tendencies to be more sensitive to losses.

Manifestations of Loss Aversion

- Financial Decisions: Investors often hold onto losing stocks for longer than rational economic theory would predict, hoping they’ll rebound, while selling winning stocks quickly to “lock in” gains. This behavior is inconsistent with optimizing returns but aligns with the desire to avoid the pain of realizing a loss.

- Endowment Effect: People often assign a higher value to things they own than to identical items they don’t own. This cognitive bias, wherein individuals overvalue their possessions, can be traced back to the pain associated with giving up or ‘losing’ something they have.

- Status Quo Bias: Individuals have a proclivity to maintain the current state of affairs even if change might be beneficial. This inertia stems from the disproportionate weight given to potential losses from changing the status quo versus potential gains.

- Risk-taking Behavior: While loss aversion often makes people risk-averse, under certain conditions, it can lead to risk-seeking behavior. For example, if someone is faced with certain loss, they might take bigger risks to avoid that loss, even if the odds are unfavorable.

Implications and Applications

- Marketing and Pricing: Businesses understand the potency of loss aversion. Tactics such as “limited-time offers” or “while supplies last” create a fear of missing out (FOMO), compelling consumers to act quickly to avoid perceived loss.

- Policy and Public Programs: Governments and organizations can frame policies in ways that leverage loss aversion for positive outcomes. For example, framing energy conservation as a “loss” of resources can be more effective than framing it as a “gain” for the environment.

- Negotiations: In negotiations, framing concessions as losses rather than framing gains can have a significant impact on the perceived value of the offer. Understanding this can help negotiators strategize more effectively.

Overcoming Loss Aversion

While loss aversion is deeply rooted, awareness of this bias is the first step toward mitigating its effects. By:

- Reframing Decisions: Instead of viewing decisions in isolation, consider them as part of a broader portfolio or a longer timeline. This holistic view can help dilute the impact of potential losses.

- Seeking Objective Input: External perspectives, like financial advisors or trusted confidants, can provide more objective views, free from the emotional bias of loss aversion.

- Emphasizing Learning: Instead of fixating on potential losses, focusing on what can be learned from each decision—win or lose—can reorient our mindset.

Information Cascade: Following the Herd in Sequential Decision-making

An information cascade occurs when individuals, confronted with a decision, opt to disregard their personal information or signals and instead follow the actions or beliefs of others. This phenomenon becomes particularly interesting in the realm of sequential decision-making where earlier decisions influence those made later. Understanding the dynamics of information cascades offers insights into how opinions, behaviors, and trends can quickly gain momentum, even if they’re not grounded in robust evidence or sound logic.

Understanding the Basics

- Initial Assumptions: For the cascade to start, early decision-makers usually rely on their private information or signal, given the lack of prior public decisions to observe.

- Observing Others: As more people make decisions, later participants may opt to rely on the aggregate behavior of their predecessors rather than their own information. This can stem from the belief that the collective wisdom of the group outweighs personal data.

- The Threshold: A critical mass is reached where the accumulated public decisions strongly sway subsequent choices, triggering the cascade.

Causes and Mechanisms

- Rationality and Imitation: It might seem irrational for individuals to ignore their personal information, but in scenarios where they believe others have better or more accurate information, imitating others can seem rational.

- Ambiguity and Uncertainty: In situations where individual signals are ambiguous or when there’s significant uncertainty about the correct decision, individuals may lean more heavily on observed decisions.

- Social and Cultural Pressure: Beyond rational calculations, people might conform to perceived majorities due to a desire for social acceptance or fear of social sanctions.

- Reputation Concerns: Professionals, particularly in areas like finance or consultancy, may fear appearing deviant or uninformed. Thus, they might follow the crowd to safeguard their reputation, even if their private information suggests otherwise.

Examples and Manifestations

- Financial Markets: Perhaps the most cited example is in stock markets, where investors might buy or sell not based on intrinsic valuations but based on observed market trends or behaviors of other investors.

- Consumer Behavior: Product popularity, especially in the age of online reviews and ratings, can influence purchasing decisions. If many people are seen buying or endorsing a product, others might follow, assuming a collective wisdom.

- Social Media and Viral Trends: The rapid spread of memes, challenges, or narratives on platforms like TikTok or Twitter can be seen as information cascades. Users, seeing the popularity of content, engage with it, thereby amplifying its reach.

Implications and Concerns

- Strength and Fragility: While cascades can gather momentum quickly, they can also break easily. Introduction of strong contrary evidence or influential dissenting opinions can disrupt the cascade.

- Suboptimal Outcomes: Cascades can lead societies or markets toward suboptimal or incorrect conclusions. For instance, market bubbles, fueled by cascading investment behaviors, can burst when they drift too far from fundamental valuations.

- Manipulation and Exploitation: Recognizing the potential of cascades, certain actors might attempt to artificially initiate or steer them for personal, political, or economic gain.

Mitigating Information Cascades

- Promote Diversity: Encouraging diverse opinions and perspectives can act as a buffer against cascades, ensuring a broader array of information is considered.

- Education and Awareness: By educating individuals about the dynamics of cascades, they can become more discerning and less likely to follow the herd blindly.

- Transparency and Open Information: Ensuring open access to information and promoting transparent decision-making processes can reduce reliance on observing others’ actions.

Leverage and Margin Calls: The Double-Edged Sword of Financial Debt

In the world of finance, the use of borrowed money, or leverage, is a widely accepted strategy to amplify returns. However, with this potential for magnified gains comes the risk of magnified losses. One of the most feared consequences of leveraging investments is the dreaded ‘margin call.’ This topic dives deep into the mechanics of leverage, the causes and effects of margin calls, and the broader implications of forced selling due to debt.

Understanding Leverage

- Basic Definition: At its core, leverage involves using borrowed money to enhance the potential return of an investment. The more an individual or institution borrows to fund an investment, the higher the leverage.

- Benefits of Leverage: Properly used, leverage can significantly boost returns. If an investor anticipates a favorable move in an asset’s price, borrowing can allow them to invest more heavily and reap larger profits.

- Risks of Leverage: However, if the asset moves against the investor, losses can be magnified. The higher the leverage, the greater the potential swing in both profit and loss.

Margin in the Context of Leverage

- Trading on Margin: When an investor borrows money to buy securities, they are said to be trading “on margin.” This is facilitated by a margin account, distinct from a regular trading account.

- Initial and Maintenance Margins: Brokers typically require an initial margin, a minimum deposit, to begin trading on margin. Post this, a maintenance margin – a set minimum account balance – must be maintained.

- Margin Ratio: This is the total value of securities in the margin account divided by the loan amount from the broker. A higher ratio indicates less leverage and, hence, lower risk.

The Margin Call Mechanism

- Definition: A margin call occurs when the value of an investor’s margin account falls below the broker’s required maintenance margin. When this happens, the broker demands that the investor deposit additional money or securities to cover the deficit.

- Forced Selling: If the investor cannot meet the margin requirement, the broker has the right to sell the securities in the account at a possible loss to cover the margin loan.

- Accelerating Declines: Forced selling can exacerbate market declines. If many investors face margin calls simultaneously, it can lead to a cascade of selling, pushing asset prices down further.

Causes of Margin Calls

- Adverse Asset Movement: The most direct cause is an unfavorable move in asset prices. If leveraged assets drop in value, the equity in the margin account decreases, leading to potential margin calls.

- Excessive Leverage: Over-leveraging one’s investments can lead to a thin buffer, making margin calls more likely even with minor price fluctuations.

- Market Volatility: In highly volatile markets, rapid and significant price changes can trigger a wave of margin calls.

- Liquidity Concerns: In less liquid markets, even a few forced sales due to margin calls can lead to substantial price drops, triggering further calls.

Broader Implications of Forced Selling Due to Debt

- Market Instability: As mentioned, a series of margin calls can cascade, leading to sharp price declines, which can spook the broader market and lead to more extensive sell-offs.

- Impact on Individual Investors: Beyond financial losses, receiving a margin call can have psychological effects on investors, leading them to become more risk-averse in the future.

- Lender Caution: During times of market stress, lenders might tighten margin requirements, further exacerbating liquidity issues and leading to more forced selling.

- Historical Crises: Several financial crises have been exacerbated by high leverage and subsequent margin calls, notably the 2008 financial crisis. Here, excessive leveraging of complex financial instruments played a significant role in amplifying market shocks.

Mitigating the Risks of Margin Calls

- Prudent Leverage: Using leverage judiciously and maintaining a buffer above the maintenance margin can reduce the likelihood of margin calls.

- Diversification: Spreading investments across a range of assets can minimize the impact of adverse movements in any single asset.

- Regular Monitoring: Keeping a close eye on margin accounts, especially during volatile times, allows for timely adjustments.

- Understanding the Terms: Investors should be well-acquainted with their broker’s margin requirements and the terms of their margin agreement.

The Role of Institutional Factors in Market Dynamics

Institutional factors play a pivotal role in shaping and influencing the behavior of financial markets. While psychological factors drive individual and collective decisions, institutional elements set the stage on which these decisions play out. From regulatory lapses to the introduction of new financial products, and from central bank policies to global economic conditions, institutional dynamics can either stabilize or destabilize markets. Understanding these factors is crucial to gaining a comprehensive view of market functioning and forecasting potential pitfalls.

Regulatory Failures: The Pitfalls of Oversight

- Nature of Regulatory Failures: These refer to the absence, inefficacy, or inadequacy of supervisory mechanisms designed to ensure the stability, integrity, and transparency of financial markets.

- Consequences of Lax Oversight: Without rigorous oversight, financial institutions might adopt excessively risky behaviors, leading to systemic vulnerabilities. Examples include the subprime mortgage crisis where under-regulated lending practices led to widespread defaults.

- Shadow Banking and Regulatory Arbitrage: Financial institutions might exploit gaps or ambiguities in regulatory frameworks, leading to unchecked growth in sectors like shadow banking, which can be sources of financial instability.

- Lagging Behind Financial Innovations: Regulatory frameworks often struggle to keep up with the rapid pace of financial innovation, leading to areas of the financial system operating in regulatory grey zones.

Financial Innovations: The Double-Edged Sword

- Nature of Financial Innovations: These involve the creation of new financial instruments, technologies, or practices. Innovations can range from complex securities like collateralized debt obligations (CDOs) to new platforms for trading and investment.

- Potential Benefits: Financial innovations can enhance market efficiency, offer new investment opportunities, and foster economic growth. For instance, securitization, in its essence, can distribute risk and make credit more accessible.

- The Dark Side: However, when these innovations are poorly understood, they can become sources of systemic risk. The 2007-2008 financial crisis showcased how CDOs, initially seen as a way to distribute and manage risk, became significant pain points.

- The Need for Education: As new products emerge, there’s a pressing need for educating both professionals and the public to understand their workings and associated risks fully.

Macroeconomic Factors: The Larger Market Context

- Central Bank Policies: Central banks wield enormous influence over financial markets through their control over monetary policy. Their decisions on interest rates, for instance, can either encourage or deter borrowing, spending, and investment.

- The Interest Rate Influence: Low interest rates, while they can stimulate borrowing and investment, can also lead to asset bubbles as investors seek higher returns in riskier assets. Conversely, high rates can stifle growth but can also act as a check against runaway market speculation.

- Global Economic Conditions: The interconnectedness of today’s global economy means that economic conditions in one region can have ripple effects worldwide. For example, a slowdown in a major economy like China or the US can impact global trade, commodity prices, and investment flows.

- The Role of Speculation: In a globally connected world, speculators can act on economic news and policy changes almost instantaneously, leading to rapid market movements. This speculation can amplify the effects of macroeconomic factors.

Interplay of Institutional Factors

It’s important to understand that these institutional elements don’t operate in isolation. Regulatory decisions can shape financial innovations, which in turn can be influenced by macroeconomic conditions. For instance, in a low-interest-rate environment (a macroeconomic factor), financial institutions might innovate more aggressively to seek returns, and if regulatory oversight isn’t vigilant, this can lead to significant market vulnerabilities.

source: The Plain Bagel on YouTube

Lessons Learned and Measures to Prevent Bubbles and Crashes

Historically, financial markets have been cyclical, with periods of exuberance often followed by sharp downturns. While it’s arguable whether bubbles and crashes can be entirely prevented, understanding the underlying causes, especially from a behavioral finance perspective, can help in implementing measures to mitigate their severity and frequency.

The Importance of Behavioral Finance

Behavioral finance is a field that melds the principles of financial economics with cognitive psychology. It seeks to explain why market participants make irrational decisions that deviate from traditional financial theories, which assume rational behavior.

- Rational vs. Irrational Behavior: Traditional economic theories, like the Efficient Market Hypothesis, suggest that markets are efficient and that prices always incorporate and reflect all available information. Behavioral finance challenges this view by highlighting instances where market behavior is driven by irrational decisions based on cognitive biases.

- Relevance to Market Bubbles and Crashes: Cognitive biases can fuel the formation of bubbles (over-optimism, herd behavior) and exacerbate crashes (panic selling, loss aversion). By understanding these biases, measures can be taken to mitigate their impact.

Key Cognitive Biases and Their Influence on Market Behavior

- Overconfidence Bias: Investors often overestimate their knowledge, underestimating risks. This can lead them to take on excessive risk, believing that their analysis is superior.

- Confirmation Bias: This involves favoring information that confirms one’s preconceptions. In a rising market, an investor might only seek out and give weight to positive news, further inflating the bubble.

- Herd Behavior: This is the tendency for individuals to mimic the actions (rational or irrational) of a larger group. It can significantly amplify market movements, both upwards (bubble formation) and downwards (crashes).

- Loss Aversion: Studies suggest that the pain of a loss is felt more intensely than the pleasure of a similar gain. This can lead to panic selling during downturns, further exacerbating market declines.

Behavioral Finance Interventions

Given the profound influence of these biases on market dynamics, several interventions rooted in behavioral finance can be considered:

- Investor Education: A foundational step is to educate investors about these biases, making them aware of the psychological traps they might fall into. Through workshops, seminars, and online courses, investors can be better equipped to recognize and counteract their biases.

- Regulatory Mechanisms: Financial regulators can integrate insights from behavioral finance into their policies. For instance, implementing “cooling-off” periods for certain trades can prevent impulsive, emotion-driven decisions.

- Financial Advising: Financial advisors can play a pivotal role in checking their clients’ biases. By acting as a sounding board, they can challenge and temper their clients’ over-optimism or excessive pessimism.

- Robo-Advisors and Algorithmic Trading: These can be designed to operate devoid of emotional biases. By basing decisions on data-driven algorithms, they can potentially act as a stabilizing force, although they are not entirely immune to market dynamics.

- Transparent Reporting: Financial institutions can be encouraged or mandated to provide clearer, more transparent reporting. Simplified, straightforward financial statements can reduce the chances of misinterpretation or oversight due to cognitive biases.

- Limiting Leverage: Given that overconfidence can lead to excessive risk-taking, regulators might consider imposing stricter leverage ratios, ensuring that individuals and institutions don’t take on more debt than they can handle.

- Stress Testing and Scenario Analysis: Financial institutions can be mandated to conduct regular stress tests, simulating adverse market conditions to gauge their vulnerability. By visualizing potential losses in downturn scenarios, they can be better prepared to navigate them.

Financial Education: Promoting a Deeper Understanding of Markets and Risks

In an increasingly complex financial landscape, the importance of financial education cannot be overstated. Financial literacy goes beyond just understanding how to balance a checkbook or setting up a savings account. In the modern age, it encompasses a broader range of topics, from understanding investment strategies, analyzing market trends, to navigating the maze of financial products available. Here, we delve deep into the imperatives of financial education, its multifaceted benefits, and the means to promote it.

Why Financial Education Matters

- Empowering Decision Making: Informed financial decisions can impact everything from day-to-day spending habits to long-term financial stability. With adequate knowledge, individuals can make choices that align with their financial goals and risk tolerance.

- Mitigating Risks: An educated investor is better equipped to decipher the complexities of financial markets, identify potential pitfalls, and make decisions that mitigate risks.

- Promoting Economic Health: On a macro scale, financially educated populations contribute to economic stability and growth. They’re less likely to default on loans, more likely to invest wisely, and can better navigate economic downturns.

- Bridging the Knowledge Gap: The financial world, with its array of products and services, can be daunting. Financial education helps bridge this knowledge gap, demystifying concepts and providing clarity.

Core Components of Financial Education

- Budgeting and Savings: Understanding how to manage personal finances, track expenses, and save effectively sets the foundation for financial well-being.

- Investment Principles: Knowledge about stocks, bonds, mutual funds, and other investment avenues, including their associated risks and potential returns.

- Credit Management: Educating individuals about credit scores, the implications of taking on debt, and the intricacies of various credit products, from credit cards to mortgages.

- Taxation: Grasping the basics of taxation can help individuals optimize their financial decisions to minimize tax liabilities.

- Retirement Planning: This is crucial, given the long-term implications. Individuals must understand pension plans, 401(k)s, IRAs, and other retirement-related financial instruments.

- Risk Management: Beyond just investment risks, this covers insurance, hedging strategies, and understanding the concept of risk-reward trade-offs.

Improved Risk Management: Stress Tests and Risk-Assessment Tools

Risk management stands at the heart of modern financial systems, forming a protective shield against potential systemic failures and financial catastrophes. The emphasis on risk management has only grown following the 2008 financial crisis, prompting institutions and regulators to adopt more comprehensive tools and techniques. Among these, stress tests and advanced risk-assessment tools have emerged as pivotal instruments. This exploration focuses on the importance, mechanisms, and implications of these tools in shaping a robust financial environment.

Understanding the Need for Improved Risk Management

- Dynamic Financial Landscape: With globalization, rapid technological advances, and increasing interconnectivity of markets, the financial ecosystem has become more intricate and vulnerable to shocks.

- Past Failures: Historical crises have underlined the devastating impacts of poor risk management, pushing for more resilient systems.

- Stakeholder Confidence: For stakeholders, from shareholders to customers, confidence in a financial institution’s ability to manage risks is paramount. Effective risk management fosters this confidence.

Stress Testing: A Deep Dive

- What is Stress Testing? Stress testing involves simulating extreme but plausible adverse conditions to assess how institutions or financial systems would fare under those conditions. These scenarios might include a deep recession, a sharp fall in stock prices, or a significant rise in unemployment.

- Purpose and Benefits:

- Identifying Vulnerabilities: Stress tests help financial entities identify weaknesses in their operations that might not be apparent during normal conditions.

- Capital Adequacy Assessment: Institutions can determine if they hold enough capital to withstand adverse conditions.

- Guiding Policymaking: Regulators can use the results to formulate policies or mandate capital requirements.

- Challenges and Criticisms:

- Predictive Limitations: It’s challenging to anticipate and model all possible adverse scenarios.

- Over-reliance: Solely depending on stress tests can provide a false sense of security.

Advanced Risk-Assessment Tools

- Quantitative Models: These rely on historical data and statistical techniques to predict future risk. Examples include Value at Risk (VaR) and Conditional Value at Risk (CVaR).

- Qualitative Assessments: This involves expert judgments, where professionals analyze various factors to assess risk, often used when historical data is insufficient.

- Scenario Analysis: Unlike stress testing, which examines extreme conditions, scenario analysis evaluates more probable adverse conditions.

- Sensitivity Analysis: Determines how different values of an independent variable impact a particular dependent variable.

- Real-time Analytics: With advancements in technology, financial institutions can now use tools that provide real-time risk assessments, enabling swift decision-making.

Conclusion: The Cyclical Nature of Markets and Predicting Market Behavior

Throughout history, financial markets have consistently displayed a rhythmic pattern of booms and busts, expansions and contractions. Like the rise and fall of tides, this cyclical nature of markets is both predictable in its occurrence yet mystifying in its specifics. As society and technology progress, we might assume that our ability to comprehend, predict, and control these market cycles would increase. However, the reality is much more nuanced and intricate.

Embracing the Cycles

- Inherent to Human Nature: Market cycles aren’t just a product of numbers on a chart; they are deeply rooted in human psychology. Emotions such as greed, fear, optimism, and panic play a pivotal role in driving market behaviors, leading to periods of irrational exuberance followed by moments of undue pessimism.

- Economic Fundamentals: Beyond psychology, economic factors such as supply-demand imbalances, changes in interest rates, inflationary pressures, and technological disruptions also contribute to these cycles. Economic indicators and fundamentals have their own rhythms, which interact with the market, creating periods of growth and recession.

- External Shocks: Events such as wars, pandemics, and natural disasters can introduce unexpected variables into the equation, exacerbating or altering the expected trajectory of a cycle.

The Eternal Quest for Prediction

- Historical Patterns: One of the primary tools for understanding future market behavior is to study the past. Historical patterns, while not perfect predictors, provide insights into potential future outcomes.

- Technological Advancements: With the rise of big data analytics, artificial intelligence, and machine learning, our analytical capacity has reached unprecedented levels. These tools are increasingly being deployed to predict market trends, with varying degrees of success.

- Limitations of Prediction: Despite sophisticated models and algorithms, markets often defy expectations. This is due to their dynamic nature, with countless interdependent variables at play. Additionally, as these tools become widely adopted, they influence trader behaviors, thus altering the very patterns they’re designed to predict.

The Role of Preparedness

- Mitigation, Not Elimination: While we may not always accurately predict market turns, we can prepare for them. Building robust financial systems, fostering financial education, and adopting adaptive regulatory frameworks can help mitigate the adverse impacts of market downturns.

- Flexibility and Resilience: Rather than aiming for a rigid system that tries to prevent any downturn, the goal should be to create a resilient one that can withstand shocks and recover quickly.

The Future of Market Understanding

- Interdisciplinary Approaches: To truly understand markets, there’s a growing recognition of the need to merge insights from diverse fields – economics, psychology, sociology, technology, and even biology.

- Ethical Considerations: As we develop advanced tools to understand and manipulate markets, ethical considerations will come to the fore. The line between prediction and manipulation can become blurred, necessitating a renewed focus on market integrity.

The dance of markets, with its ebbs and flows, is a testament to the dynamic interplay of human behavior, economic principles, and external events. While we’ve made significant strides in our understanding, markets will always retain a degree of mystery, a reflection of their inherently human core. The challenge isn’t to eradicate the cyclical nature of markets, but to understand it better, predict its general course, and most importantly, be prepared for its inevitable turns. Our journey through the landscapes of bubbles and crashes underscores the value of humility, preparedness, and continuous learning in the face of the vast, intricate tapestry that is the financial market.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.