Today we’ll be reviewing one of the OG value ETFs from Vanguard that has received 5-star distinction from Morningstar.

Vanguard Value ETF.

Ticker: VTV

Vanguard Value ETF launched in 01/26/2004 at a time when Mutual Funds dominated the investing landscape and ETFs were very much still in their infancy.

Now closing in on its 20th birthday, VTV ETF has amassed an otherworldly 104.4 Billion AUM as the “King of All Value Funds” with only SPY, IVV, VOO, VTI and QQQ ahead of it.

Hence, we’re fortunate compared to other ETFs to have a large sample size of data to analyze.

Consequently, for investors seeking to shake the shackles of US market cap weighted indexes such as the S&P 500, VTV ETF offers exposure to 342 stocks in the large to mid-cap range.

VTV ETF Product Summary

Here is a product summary directly from Vanguard:

- “Seeks to track the performance of the CRSP US Large Cap Value Index, which measures the investment return of large-capitalization value stocks.”

- “Provides a convenient way to match the performance of many of the nation’s largest value stocks.”

- “Follows a passively managed, full-replication approach.”

Hence, we can define Vanguard Value ETF as a product offering investors exposure to hundreds of US Large Cap Value stocks.

As one of the most liquid passive ETFs out there in the marketplace it’s also one of the most affordable from a cost perspective featuring an expense ratio of just 0.04.

Undoubtedly, that’s enough to put a feather in the cap for low cost aficionado investors out there.

But a fund with as many positions at VTV ETF and targeting just one geography (US) can often suffer from having “watered down value exposure” compared to other value funds that are more concentrated.

Moreover, another potential issue at hand is that many value investors prefer to hang-out in small-cap value territory where historically returns have been higher than in the large-cap landscape.

Hence, we’ll attempt to unpack whether or not you get significant “value factor exposure” with Vanguard Value ETF and how hanging out in large-cap value territory compares to both mid-cap and small-cap value dating back to 1972.

Let’s get cracking over here!

VTV ETF Review | Is Vanguard Value ETF The Best US Large Cap Value Fund?

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

The Case For US Large Cap Value Investing?

What’s the case for US Large Cap investing?

Isn’t just owning the S&P 500 enough for most investors?

Let’s examine the historical results with a backtest.

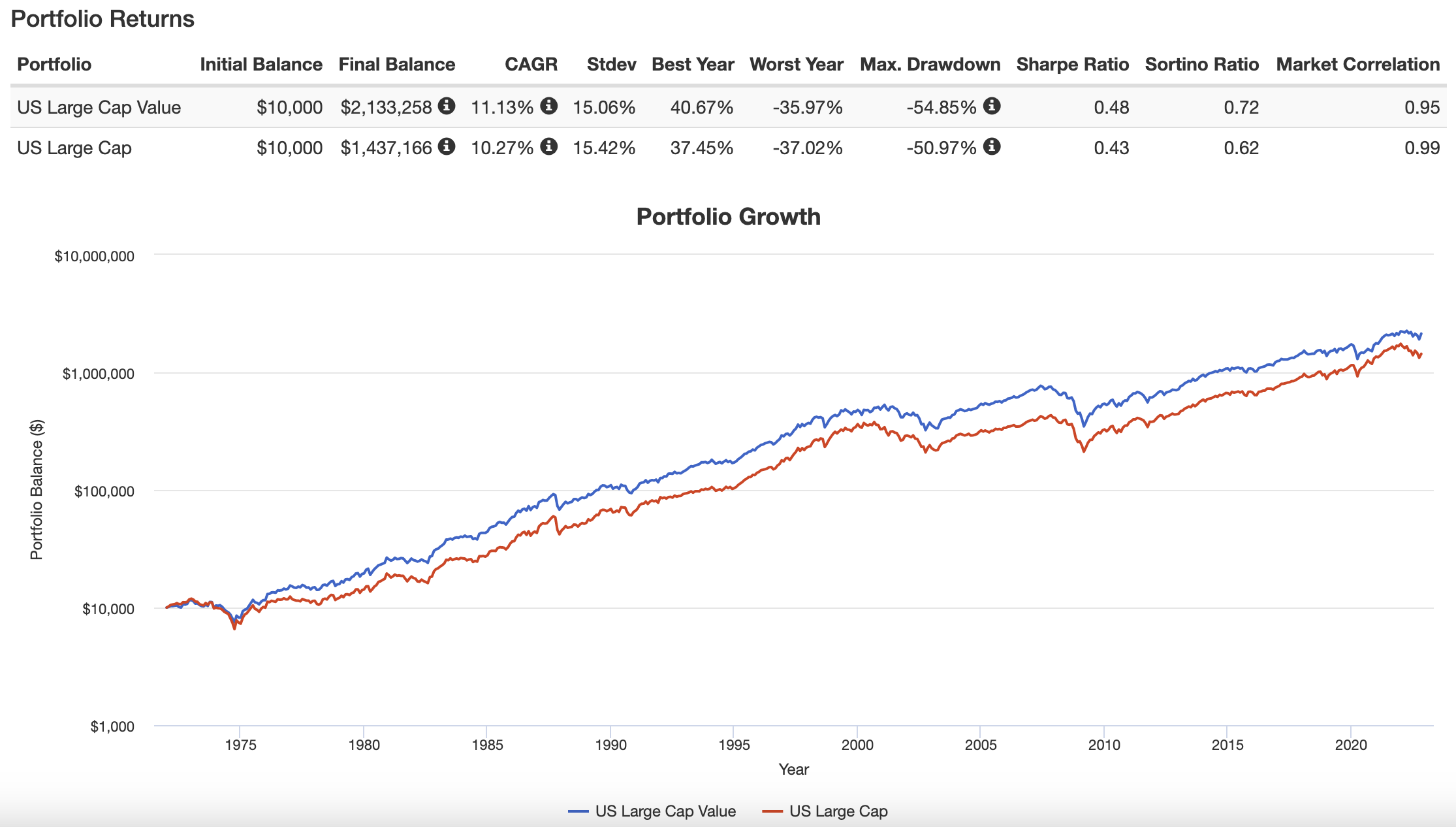

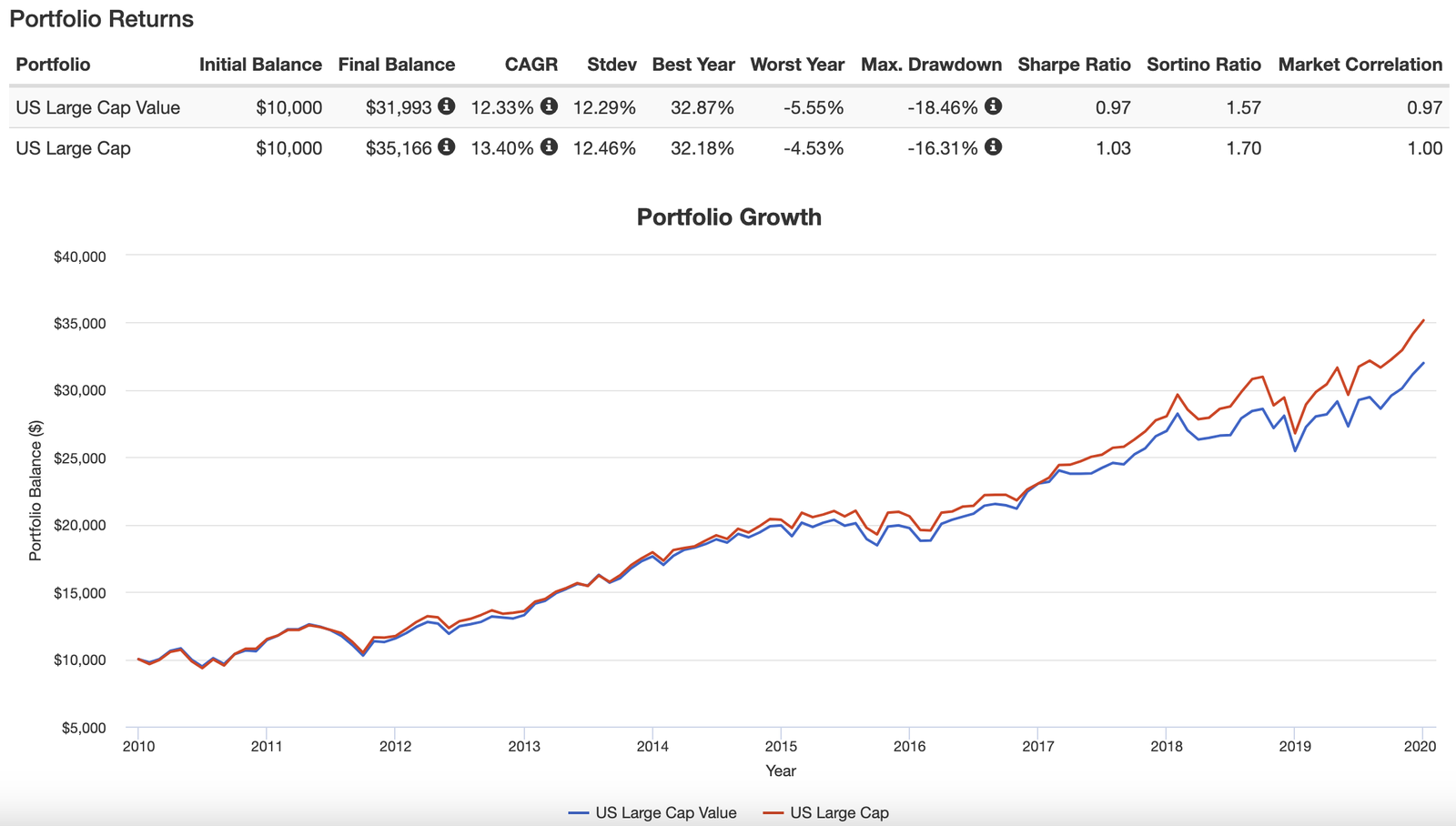

US Large Cap Value vs US Large Cap 1972 until 2022

CAGR: 11.13% vs 10.27%

RISK: 15.06% vs 15.42%

SHARPE: 0.48 vs 0.43

SORTINTO: 0.72 vs 0.62

It’s easy to see why investors would seriously consider allocating to US large cap value strategies versus more generic US large cap blend funds.

Not only are returns higher for US Large Cap Value (86 basis points of outperformance) but risk management is also a nice cherry on top (36 basis points more defensive coverage).

Sharpe Ratio and Sortino Ratio complete the sweep as value clearly triumphs over blend.

US Large Cap Value vs US Large Cap 1972 until 1979

Worth considering seriously is that US Large Value strategies provided “relative stability” during the two most challenging periods of time for the S&P 500.

In the 1970s when US Large Cap stocks had a CAGR of 4.55% (well below inflation) it was US Large Cap Value stocks saving the day with 8.71% CAGR.

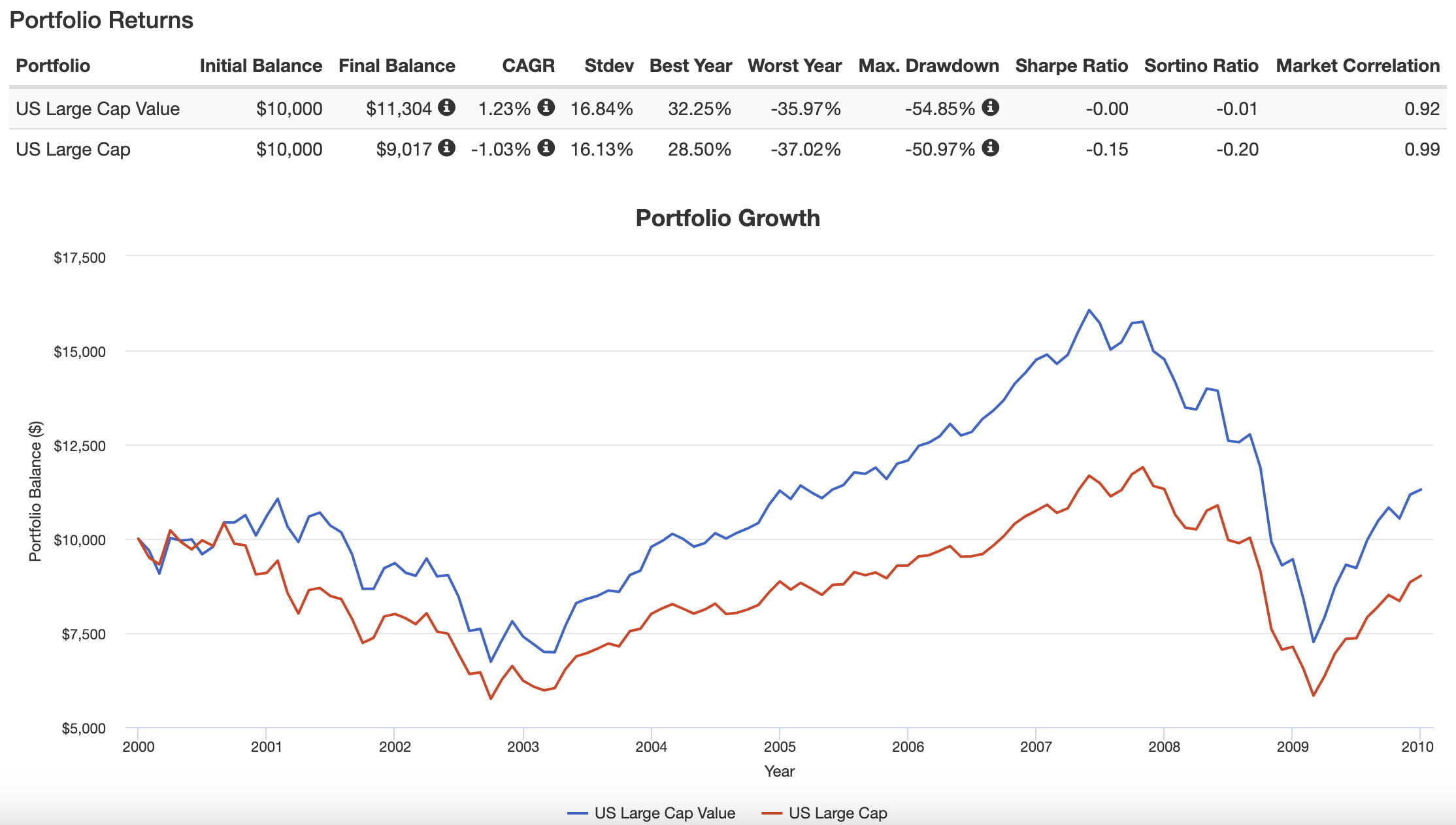

US Large Cap Value vs US Large Cap 2000s

During the “lost decade” for the S&P 500 in the 2000s, US Large Cap Value offered a slight reprieve from the carnage by at least being above water at 1.23% CAGR versus -1.03%.

Of course, value strategies can relatively struggle versus blend; no period of time better exemplifies that than the 2010s.

US Large Cap Value vs US Large Cap 2010s

Here you’ll notice US Large Cap Value trailing the S&P 500 for the decade by over 100+ basis points.

It’s not always easy being a value investor.

Putting up with and persevering during times of tracking error when value strategies are riding the coattails of market cap weighted indexing is a part of the long-term journey.

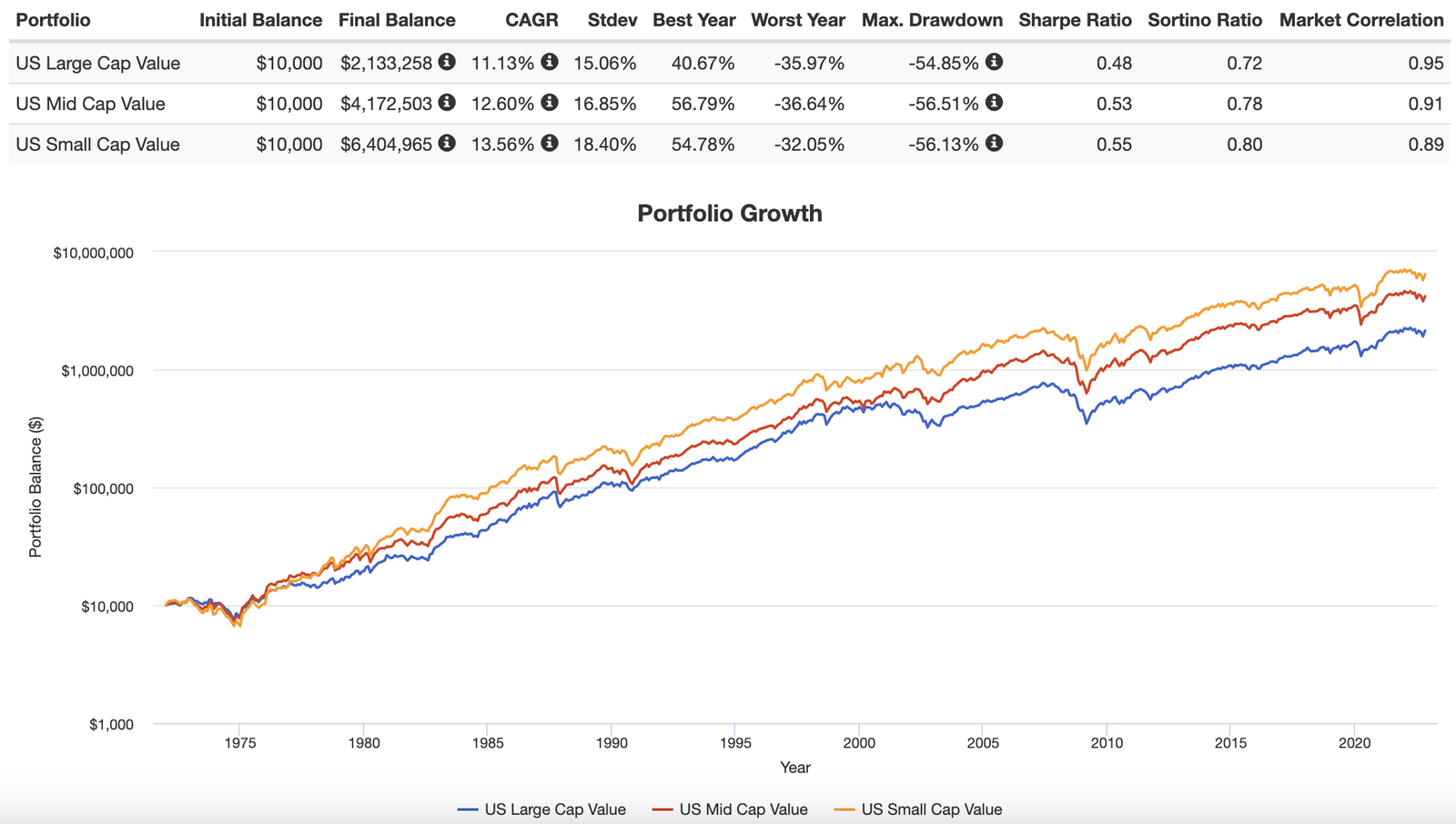

US Large Cap Value vs US Mid Cap Value vs US Small Cap Value

Here is where things get really interesting.

For investors seeking across the board coverage of US value strategies it is worth considering Mid Cap Value and Small Cap Value as well.

CAGR: 11.13% vs 12.60% vs 13.56%

RISK: 15.06% vs 16.85% vs 18.40%

SHARPE: 0.48 vs 0.53 vs 0.55

SORTINO: 0.72 vs 0.78 vs 0.80

US Small Cap Value reigns supreme from a returns standpoint but is also the most volatile.

US Mid Cap offers a nice middle-ground when it comes to CAGR and RISK.

US Large Cap trails in terms of returns but is the most stable of them all from a standard deviation perspective.

VTV ETF Overview, Holdings and Info

Let’s get into the nitty gritty by seeing exactly what Vanguard Value ETF has to offer investors.

It’s time to pop open the hood of VTV ETF!

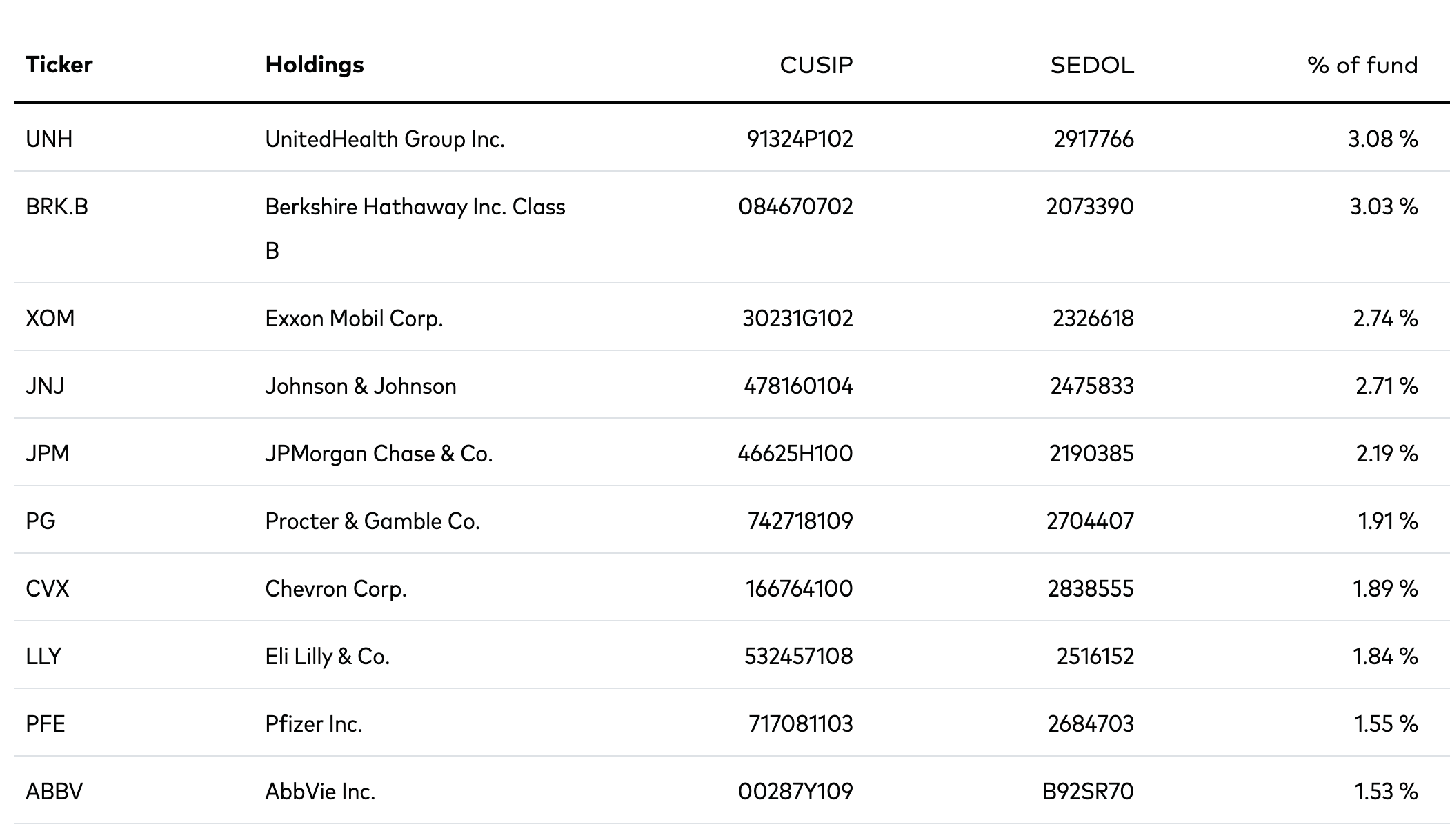

VTV ETF Top 10 Holdings

As mentioned previously, VTV ETF has 342 positions overall with its top 10 positions ranging from 3.08% to 1.53%.

There are a lot of companies folks likely recognize including Berkshire Hathaway, Exxon Mobile, Johnson and Johnson, Chevron and Pfizer to name just a few.

Notice the complete absence of FOMO FANGMA stocks (Facebook, Apple, Netflix, Google, Microsoft and Apple).

VTV Info

Ticker: VTV

Number of Stocks: 342

Net Expense Ratio: 0.04

Distributions: Quarterly

AUM: 102.1. Billion

Inception: 01/26/2004

VTV ETF offers a 1-2 knock-out combination of affordability (0.04 expense ratio) and liquidity (102.1 Billion AUM).

It’s been in the ETF game since 2004 which makes it relatively old in the tooth but certainly stable.

For investors seeking income, Vanguard Value ETF will provide quarterly distributions.

Vanguard Value ETF: Principal Investment Strategy and Principal Risk

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund employs an indexing investment approach designed to track the performance of the CRSP US Large Cap Value Index, a broadly diversified index predominantly made up of value stocks of large U.S. companies.

The Fund attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the Index, holding each stock in approximately the same proportion as its weighting in the Index.

Principal Risks

An investment in the Fund could lose money over short or long periods of time.

You should expect the Fund’s share price and total return to fluctuate within a wide range.

The Fund is subject to the following risks, which could affect the Fund’s performance:

• Stock market risk, which is the chance that stock prices overall will decline.

Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

The Fund’s target index tracks a subset of the U.S. stock market, which could cause the Fund to perform differently from the overall stock market.

In addition, the Fund’s target index may, at times, become focused in stocks of a particular market sector, which would subject the Fund to proportionately higher exposure to the risks of that sector.

• Investment style risk, which is the chance that returns from large-capitalization value stocks will trail returns from the overall stock market.

Large-cap stocks tend to go through cycles of doing better—or worse—than other segments of the stock market or the stock market in general.

These periods have, in the past, lasted for as long as several years. 2 Because ETF Shares are traded on an exchange, they are subject to additional risks:

• The Fund’s ETF Shares are listed for trading on NYSE Arca and are bought and sold on the secondary market at market prices.

Although it is expected that the market price of an ETF Share typically will approximate its net asset value (NAV), there may be times when the market price and the NAV differ significantly.

Thus, you may pay more or less than NAV when you buy ETF Shares on the secondary market, and you may receive more or less than NAV when you sell those shares.

• Although the Fund’s ETF Shares are listed for trading on NYSE Arca, it is possible that an active trading market may not be maintained.

• Trading of the Fund’s ETF Shares may be halted by the activation of individual or marketwide trading halts (which halt trading for a specific period of time when the price of a particular security or overall market prices decline by a specified percentage).

Trading of the Fund’s ETF Shares may also be halted if (1) the shares are delisted from NYSE Arca without first being listed on another exchange or (2) NYSE Arca officials determine that such action is appropriate in the interest of a fair and orderly market or for the protection of investors.

VTV ETF – Sector Exposure

Vanguard Value ETF offers 20%+ sector exposure to both Healthcare and Financial Services.

It is relatively underweight Technology, Communication Services and Consumer Cyclical.

It is slightly overweight Industrials and Consumer Defensive.

Overall, if you’re looking to avoid “technology clogging” blend strategies you’ll be impressed to see VTV ETF only has a 7.83% allocation.

VTV ETF – Style Measures

When it comes to measures VTV ETF is relatively more expensive than category averages with a P/E of 13.60 vs 12.40.

It deviates most in terms of Cash-Flow Growth % and Historical Earnings %.

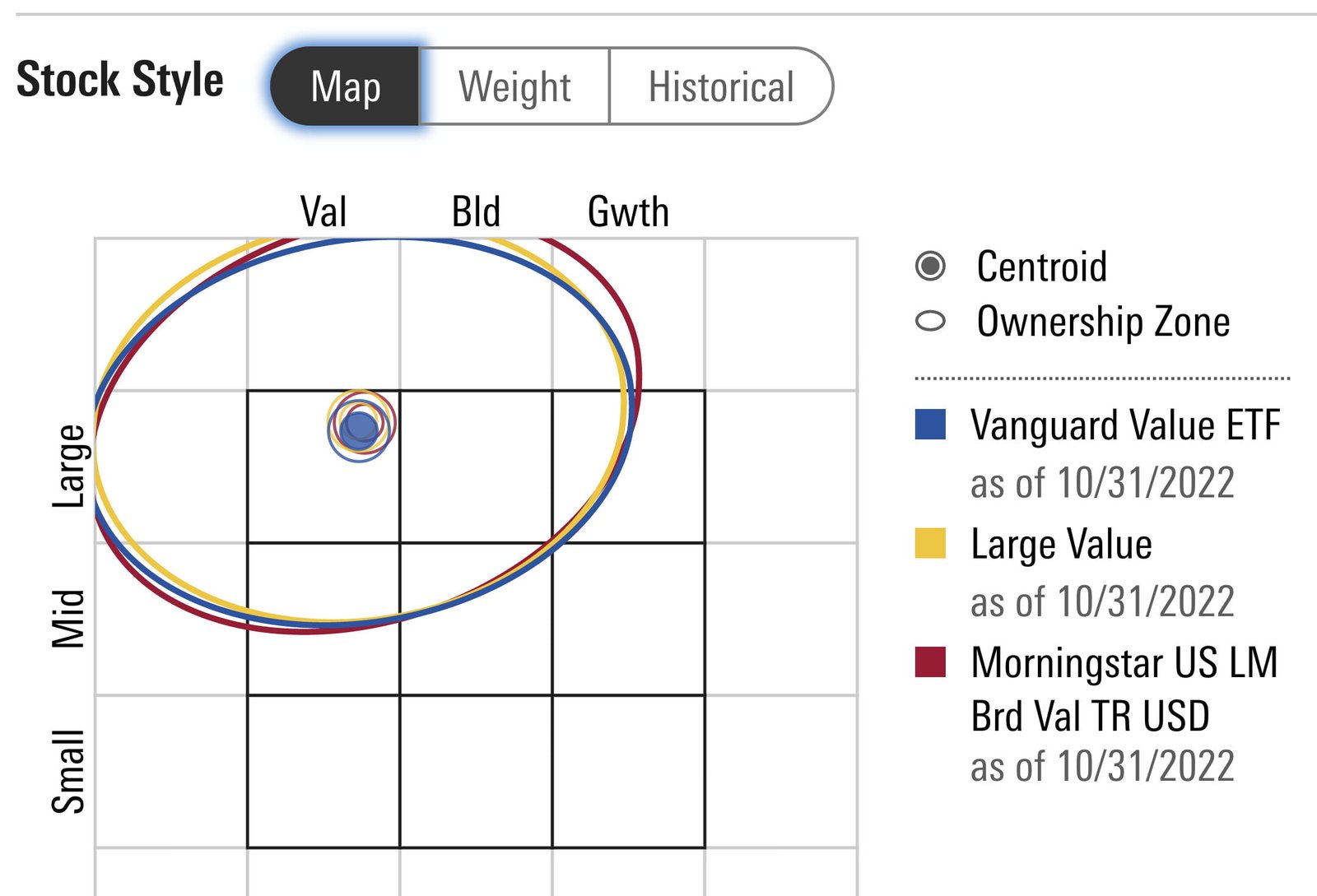

VTV ETF – Stock Style

As might be expected Vanguard Value ETF nails its large cap value mandate with a clean bullseye in the upper left hand corner of the style box.

Overall, VTV ETF gives you significant large cap value exposure.

However, it is noteworthy that “blend” takes up 54% of the fund.

Given it is a fund with a large number of positions it is not surprising to see a lack of value concentration.

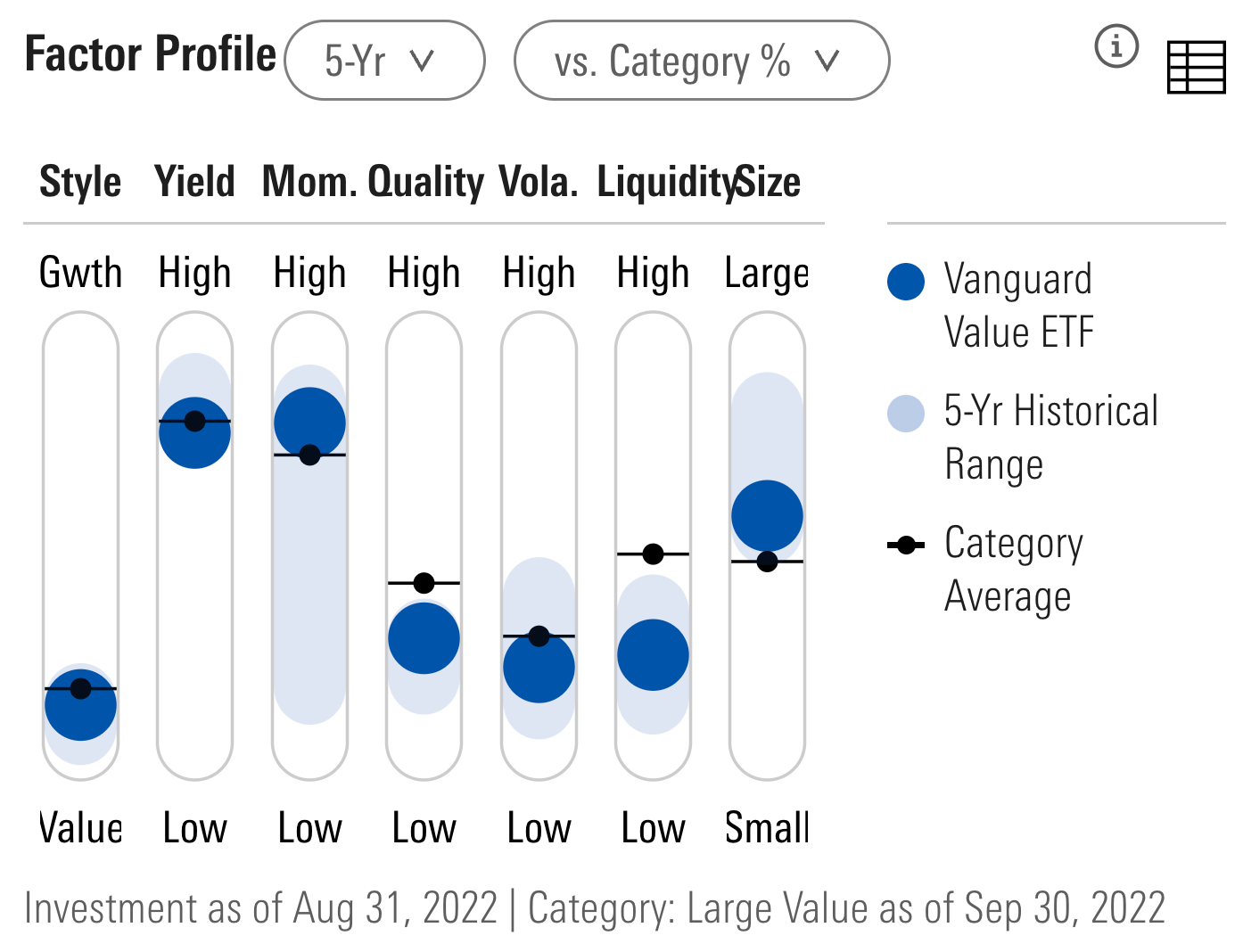

VTV ETF – Factor Profile

VTV ETF currently offers factor thirsty investors impressive hard-lever pulls in terms of its value-momentum, low volatility and yield exposure.

Noteworthy is that quality is rather low.

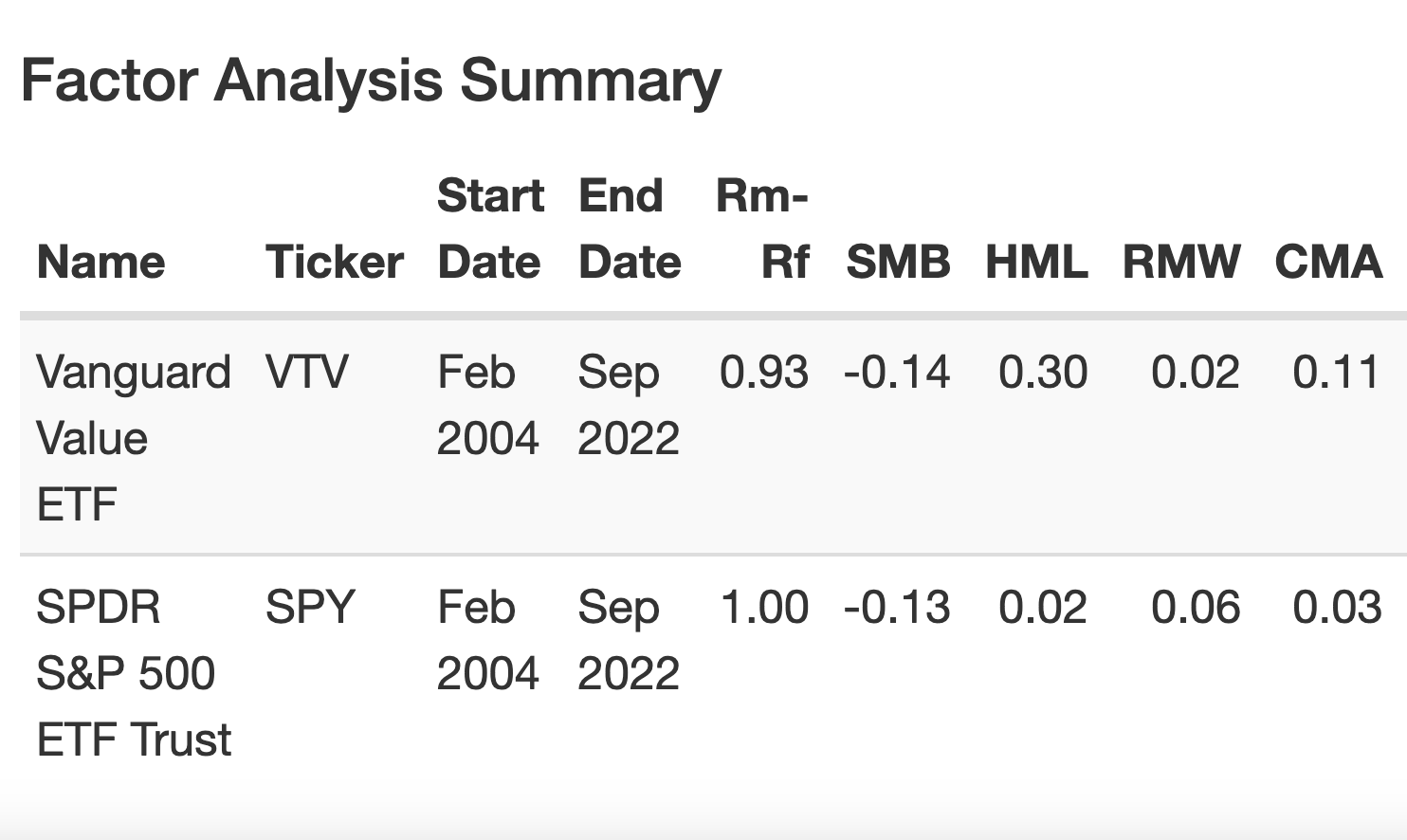

VTV ETF – Fama-French 5-Factor Model

To close out our factor analysis it is noteworthy that Vanguard Value ETF posts strong HML (high minus low) to capture the value factor but doesn’t offer anything significant aside from that.

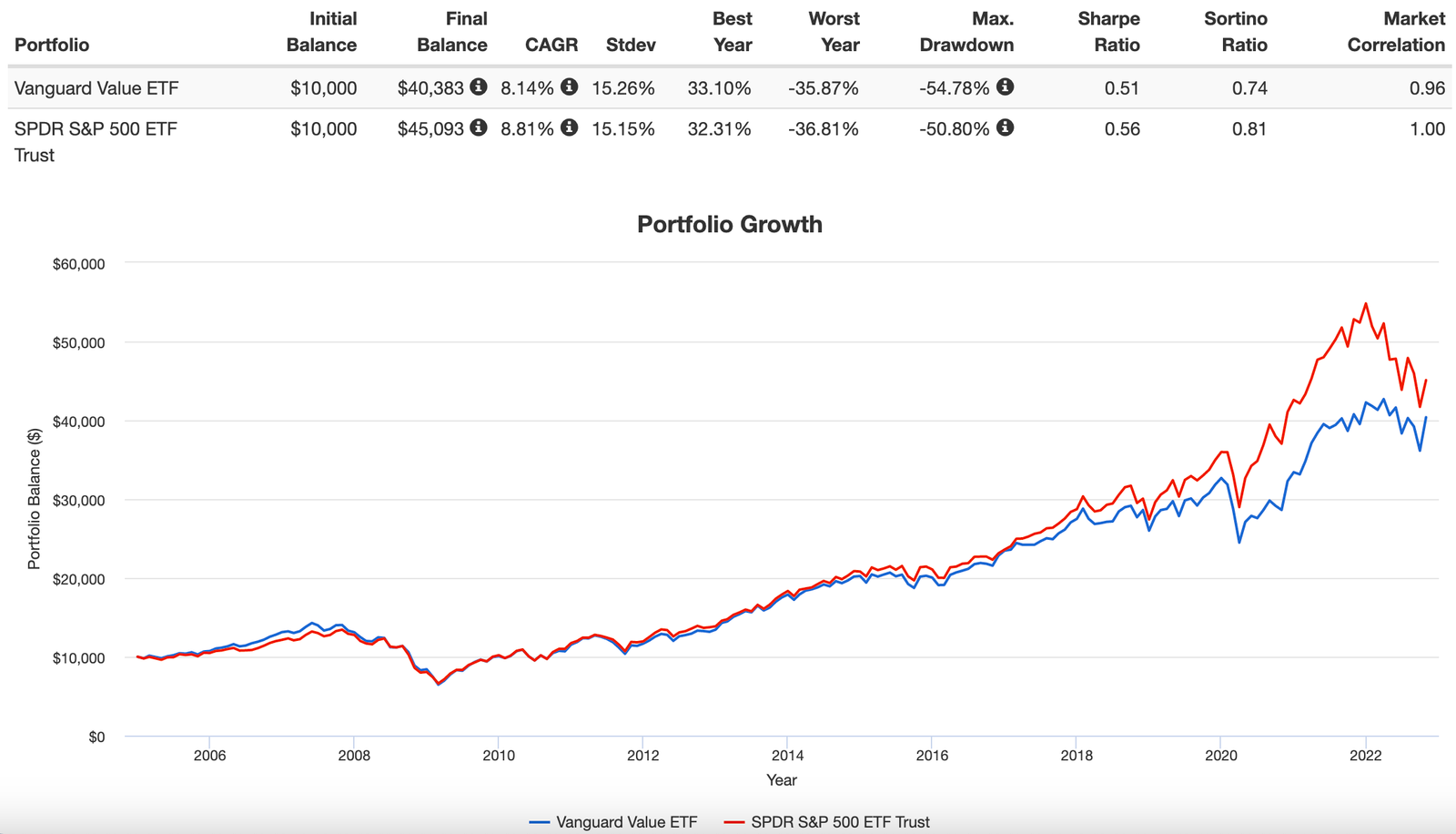

Vanguard Value ETF Performance

If we look at a recent performance VTV ETF has outperformed the S&P 500 over the last couple of years offering a CAGR of 10.90% versus 3.18%.

However, if we look at the bigger picture it has underperformed the S&P 500 since its inception.

It’ll be interesting to see if the tables turn given that VTV ETF has mostly existed in what has generally been referred to as a “growth” period for US stocks.

VTV ETF Pros and Cons

Let’s examine the pros and cons of Vanguard Value ETF.

VTV Pros

- Offers investors exposure to US Large Cap Value companies as a way to diversify away from blend vanilla MCW products

- Has a rock-bottom all in expense ratio of 0.04

- Because it is “large cap” companies it offers more “brand name stocks” that investors are familiar with in real life

- Hits the upper left hand bullseye of large-cap value on the Morningstar style box fulfilling its mandate

- Has offered relative outperformance over the past couple of years versus US Large Cap blend strategies

- Offers factor exposure to momentum, yield and low volatility aside from just value

VTV Cons

- Doesn’t offer more concentrated value exposure with a fund that has 342 positions

- Doesn’t cover the full spectrum of mid-cap and small-cap exposure meaning investors seeking that will have to find separate funds

VTV Potential Portfolio Solutions

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Now that we’ve taken a thorough look at VTV ETF let’s see how it can potentially fit into a portfolio at large.

100% ALL Equity Portfolio

Is it possible to just purchase Vanguard Value ETF and be done with it?

Well, that entirely depends on your investing goals.

If you’re an equity-only value investor that is “okay” with having “home country bias” while preferring to hang-out in large cap territory (with stocks that are well known from a brand perspective) then VTV and done is a possibility.

100% VTV ETF.

US Value 60/40 Portfolio

If you’re committed to US value investing but want across the board coverage for large, mid and small cap stocks you might consider the following portfolio.

20% VTV ETF – Vanguard Value ETF

20% ROE ETF – Vanguard Mid-Cap Value ETF

20% VBR ETF – Vanguard Small-Cap Value ETF

40% BND ETF – Vanguard Total Bond Market ETF

Here you’ve got equal slices of Vanguard value (large-cap, mid-cap and small-cap) funds for a high conviction US value strategy.

You’ll round out your portfolio by dropping in 40% of BND ETF for your US Aggregate bond exposure.

This portfolio offers more mid-cap and small-cap exposure than a typical SPY/AGG 60/40 portfolio.

US Value + Blend 60/40 Portfolio

Finally, for investors who want a blend of value and vanilla combined nicely in a 60/40 wrapper we have the following suggestion:

30% VOO ETF

30% VTV ETF

40% BND ETF

Here you’ve got a 50/50 split between the S&P 500 and Vanguard Value ETF along with US aggregate bonds.

What Others Have To Say About VTV ETF

Now that we’ve covered a few different portfolio solutions let’s see what others have to say about the fund for those who prefer video format.

source: Firefighters Financial Toolbox YouTube

source: 401k and Beyond! YouTube

source: MindWealth YouTube

source: Joshua Talks Money on YouTube

source: Heritage Wealth Planning on YouTube

Vanguard Value ETF Review | Is VTV ETF The Best US Large Cap Value Fund? — 12-Question FAQ

What is VTV in one sentence?

Vanguard Value ETF (ticker: VTV) is a low-cost, passive fund that tracks the CRSP US Large Cap Value Index, giving broad exposure to hundreds of U.S. large-cap value stocks.

How old and how large is the fund?

Launched in 2004, VTV is one of the oldest and largest value ETFs, with AUM well over $100B—making it the category heavyweight for U.S. large-cap value exposure.

What does VTV actually hold?

About 300–350 U.S. large- and mid-cap value names (recently ~342), with familiar “blue chips” like Berkshire Hathaway, Exxon Mobil, Johnson & Johnson, Chevron, and Pfizer—no FANG-style growth heavyweights dominating the top.

How much does it cost?

Just 0.04% in annual expenses—rock-bottom pricing that’s hard to beat for broad, rules-based value exposure.

What index does it track and how?

VTV fully replicates the CRSP US Large Cap Value Index, owning (substantially) all constituents at index weights to match the performance of large-cap value stocks.

Where are the sector tilts today?

Historically overweight Health Care and Financials, underweight Technology, Communication Services, and Consumer Cyclical—useful if you want less tech concentration than broad market blends.

How “valuey” is VTV—does it give deep value?

It delivers clear value exposure (strong HML loading) but, with 300+ holdings and a large-cap universe, the tilt is diversified rather than “deep”—expect diluted value intensity versus more concentrated value ETFs.

How has large-cap value fared versus large-cap blend historically?

Since the early 1970s, U.S. large-cap value has outpaced large-cap blend with slightly lower volatility, and it showed relative resilience in tough decades like the 1970s and 2000s (though lagged in the growth-led 2010s).

How does large-cap value compare to mid- and small-cap value?

Long-run returns have generally stepped up moving from large- to mid- to small-cap value—along with higher volatility; VTV gives the most stability of the three but the lowest expected return.

What are the main pros of VTV?

Ultra-low fee, massive liquidity, clean large-cap value bullseye, recognizable holdings, and a style tilt that has historically improved risk-adjusted returns versus plain large-cap blend.

And the key trade-offs/cons?

Value intensity is watered down versus concentrated or multi-factor value funds; it omits mid/small value, and its style can trail the market for multi-year stretches during growth-led cycles.

How could I use VTV in a portfolio?

As a core U.S. value sleeve, a 50/50 blend with an S&P 500 fund, or paired with mid-cap value (VOE/ROE) and small-cap value (VBR) for full-spectrum U.S. value; add bonds or diversifiers to fit your risk profile.

Nomadic Samuel Final Thoughts

As a factor investor I’m perpetually seeking funds that disentangle me from market-cap weighted index investing.

VTV ETF represents a US Large Cap Value solution that offers the benefit of “market-cap weighted” low cost fees while providing value factor exposure.

This in and of itself makes the product appealing for investors who are cost conscious but seeking “evidence based” advanced portfolio solutions.

However, it’s not a slam-dunk decision to select a fund such as Vanguard Value ETF.

Fund providers such as Avantis and Alpha Architect offer “deeper value” products with funds featuring less positions and more concentrated value exposure.

Moreover, these other value ETFs aren’t exclusively hanging out in large-cap value territory with significant mid-cap and small-cap style box exposure.

Historically, small-cap value and mid-cap value have provided investors with higher returns in both the 20th and 21st century.

That should give investors some food for thought.

Hence, it is important as an investor to create a hierarchy of needs/preferences in order to make the most informed decision.

Thus, if US large cap value at the lowest cost is what you’re seeking VTV ETF is likely a slam-dunk consideration.

However, if you prefer to hang-out in small-cap and mid-cap territory (and prefer deeper and more concentrated exposure) you’ll likely be looking elsewhere as you continue to shop for value funds.

Now over to you.

Are you a value investor?

Is VTV ETF on your radar?

Let me know in the comments below.

That’s all I’ve got.

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.