No other investing strategy has enjoyed a greater moment in the sun quite like Managed Futures in 2022.

Traditional long-only asset classes have struggled mightily in a year where stocks, bonds and gold have all been down at the same time.

Thus, portfolios committed to static only allocations to conservative asset classes have felt the full brunt of the scorched earth economic regime of high inflation combined with aggressive interest rate hikes.

As investors we’ve been spoiled with over a decade of growth and deflationary economic environments.

Hence, the need for adaptive portfolio solutions hasn’t been a high priority for most investors.

That’s all changed this year.

Long-Only Traditional Asset Classes Have Struggled Mightily In 2022

During previous bear markets such as the Great Financial Crisis of 2008 and the early 2000s Dot Com Bubble traditional asset classes such as bonds and gold saved the day for investors savvy enough to diversify their portfolio beyond merely equities.

Investors inspired by the Harry Browne Permanent Portfolio or Ray Dalio All-Weather Portfolio likely sailed through that challenging decade without missing a beat whereas all equity and 60/40 enthusiasts struggled mightily.

However, 2022 has been a historically rough patch for even the most diversified long-only portfolios that feature an alternative sleeve, fixed income and reduced equity exposure.

Therefore, it has been a coming out party for Managed Futures investing strategies due to the fact that it’s one of the only games in town that has conspired to help reduce the overall carnage.

In fact, Managed Futures have shined brightly.

Managed Futures = Saved The Day?

A fund such as KMLM ETF has returned an impressive 33.96% YTD.

DBMF ETF has fortified portfolios with 27.34% in 2022.

More recently minted CTA ETF has posted 20.35% since inception.

Yet, despite the impressive results few investing strategies are more misunderstood than Managed Futures.

Some investors believe that Managed Futures only perform well during tumultuous market conditions that require “crisis alpha”.

Others fail to understand that “trend following” is not the only Managed Futures game in town.

What we’ll attempt to unpack in this article is 10 specific things investors need to know about Managed Futures investing strategies in order to make more informed decisions.

Without further ado let’s hop right in.

Managed Futures Investment Strategy: 10 Things Investors Need To Know About Managed Futures!

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

source: CME Group youtube

Uncorrelated with Long-Only Equities and Bonds

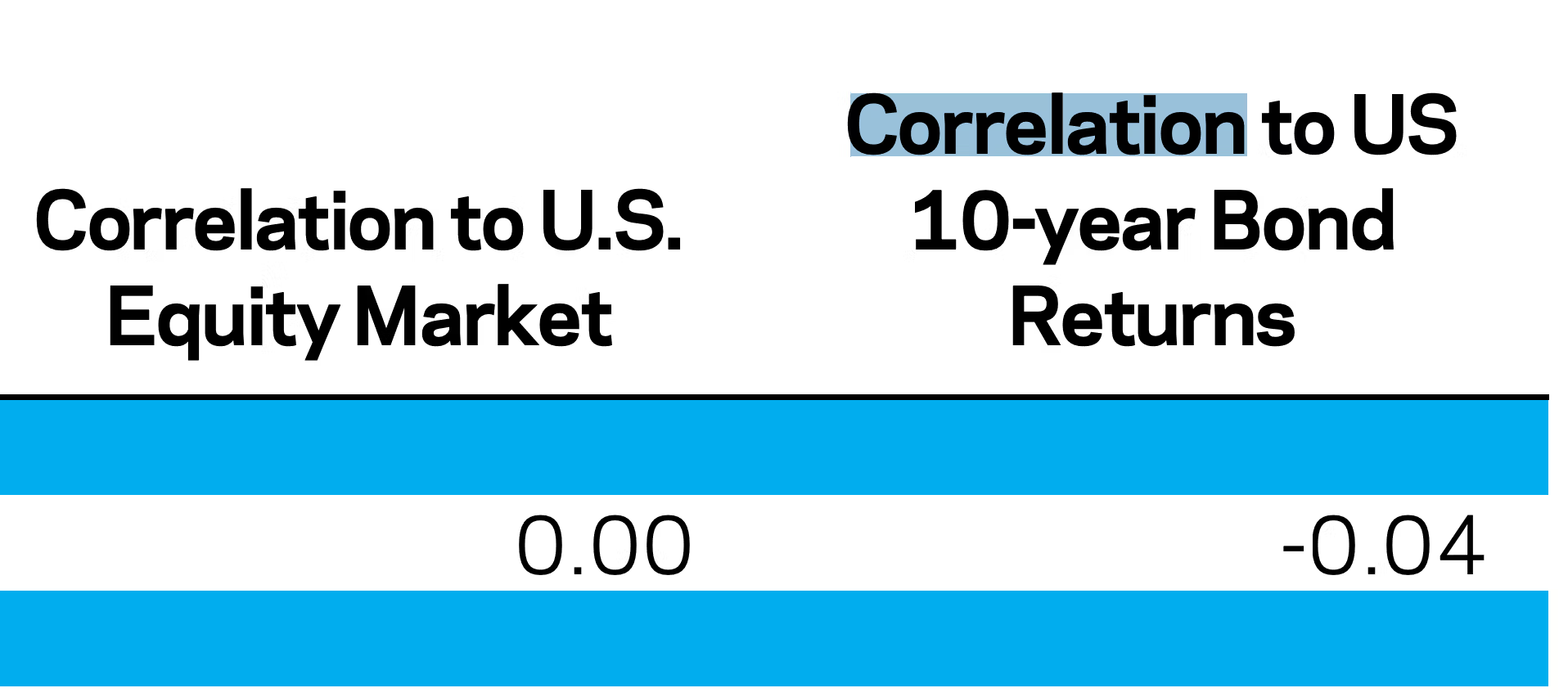

Without a shadow of a doubt the most important thing investors need to know about managed futures investment strategies is that they’ve historically been uncorrelated with BOTH equity and fixed income allocations.

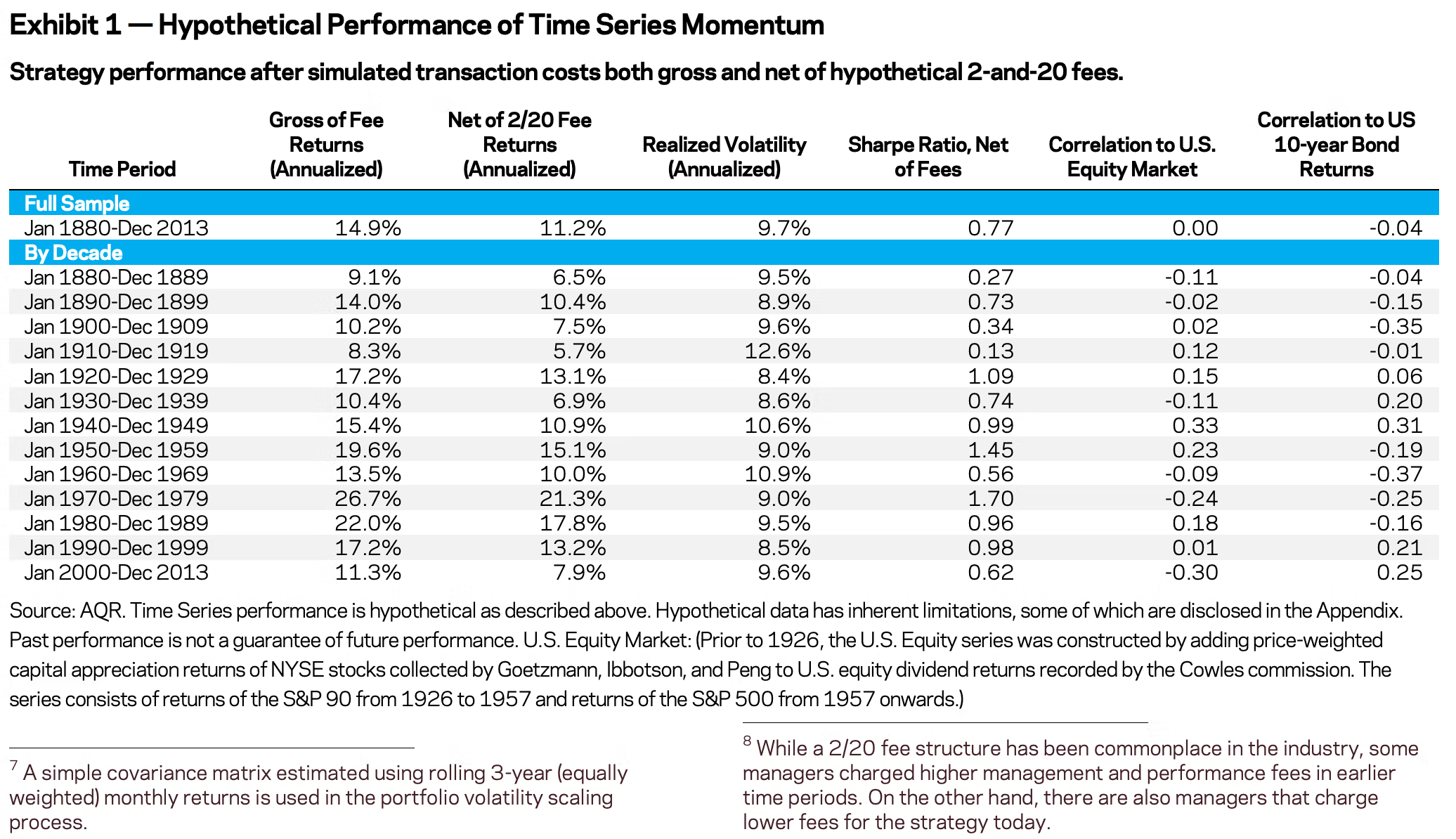

AQR’s seminal must-read “A Century Of Evidence Of Trend Following Investing” back-tested the hypothetical performance of time series momentum from January 1880 until December 2013.

The results are as follows:

Trend-Following Correlation to U.S. Equity Market: 0.00

Trend-Following Correlation to US 10-year Bond Returns: -0.04

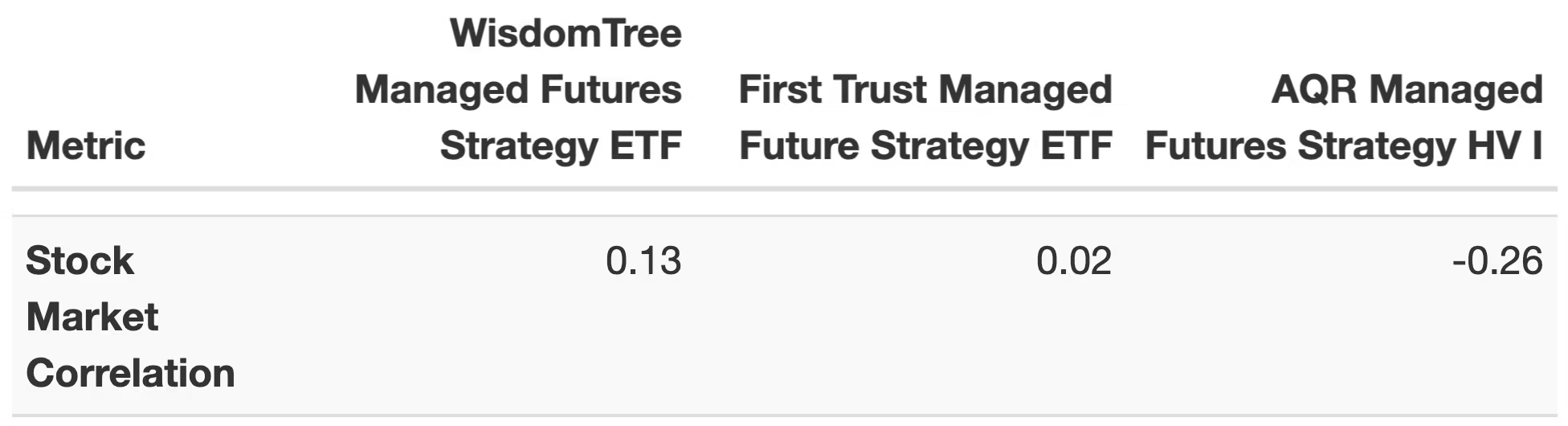

We can further confirm more recent correlation levels (this paper was published in 2013) with ETF and mutual fund managed futures products that have been in existence for close to a decade.

Since January 2014 until October 2022 these are the stock market correlation results versus the three different funds:

WisdomTree Managed Futures Strategy ETF Stock Market Correlation: 0.13

First Trust Managed Futures Strategy ETF Stock Market Correlation: 0.02

AQR Managed Futures Strategy HV l Stock Market Correlation: -0.26

What does all of this mean for investors?

The ability to add an “uncorrelated” asset class and/or strategy to your portfolio from a diversification benefit standpoint is huge.

We’ll unpack this in more detail later on in the article but for the time being the capacity for managed futures investing strategies to form the alternative “third leg” of your portfolio warrants serious consideration.

Historically Consistent Crisis Alpha

Having a return stream that doesn’t serpentine in unison alongside the likes of stocks and bonds is indeed intriguing.

However, the more important question is does managed futures perform well (aka providing “crisis alpha”) when you need it the most?

In a word – YES!

Historically speaking trend-following managed futures investment strategies have come to the rescue consistently with ample force when shit has hit the fan across markets.

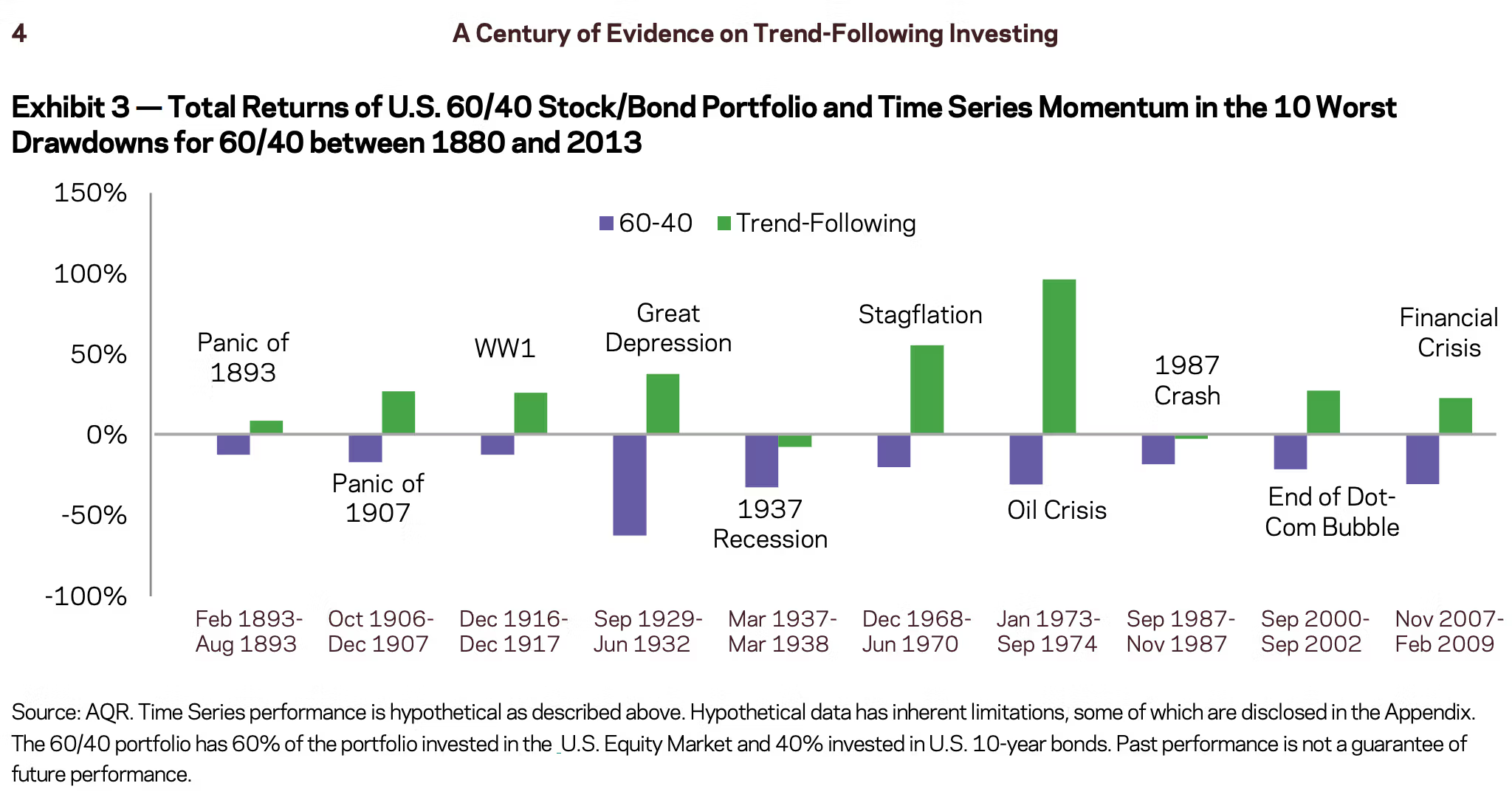

We’ll once again consult the brilliant white paper from AQR to examine the 10 worst drawdowns for a 60/40 portfolio to examine if/when “trend-following strategies” tossed a life-vest.

A Century of Evidence on Trend-Following Investing

80% of the time trend-following MF strategies provided “above water” returns when drawdowns were beating the tar out of the 60/40 portfolio.

100% of the time “trend-following” strategies provided “relative outperformance” versus the 60/40 portfolio.

For instance, during the 1987 Crash and 1937 Recession “trend-following” wasn’t above water but it wasn’t blowing up either.

Moreover, the strategy hypothetically thrived during periods such as the 20s/30s Great Depression, 70s Stagflation, and Oil Crisis and early 2000s Dot Com Bubble and Great Financial Crisis.

How about in 2022 when both equities and bonds are being eaten alive like Jabba the Hut wolfing down frogs?

source: feedher2 YouTube

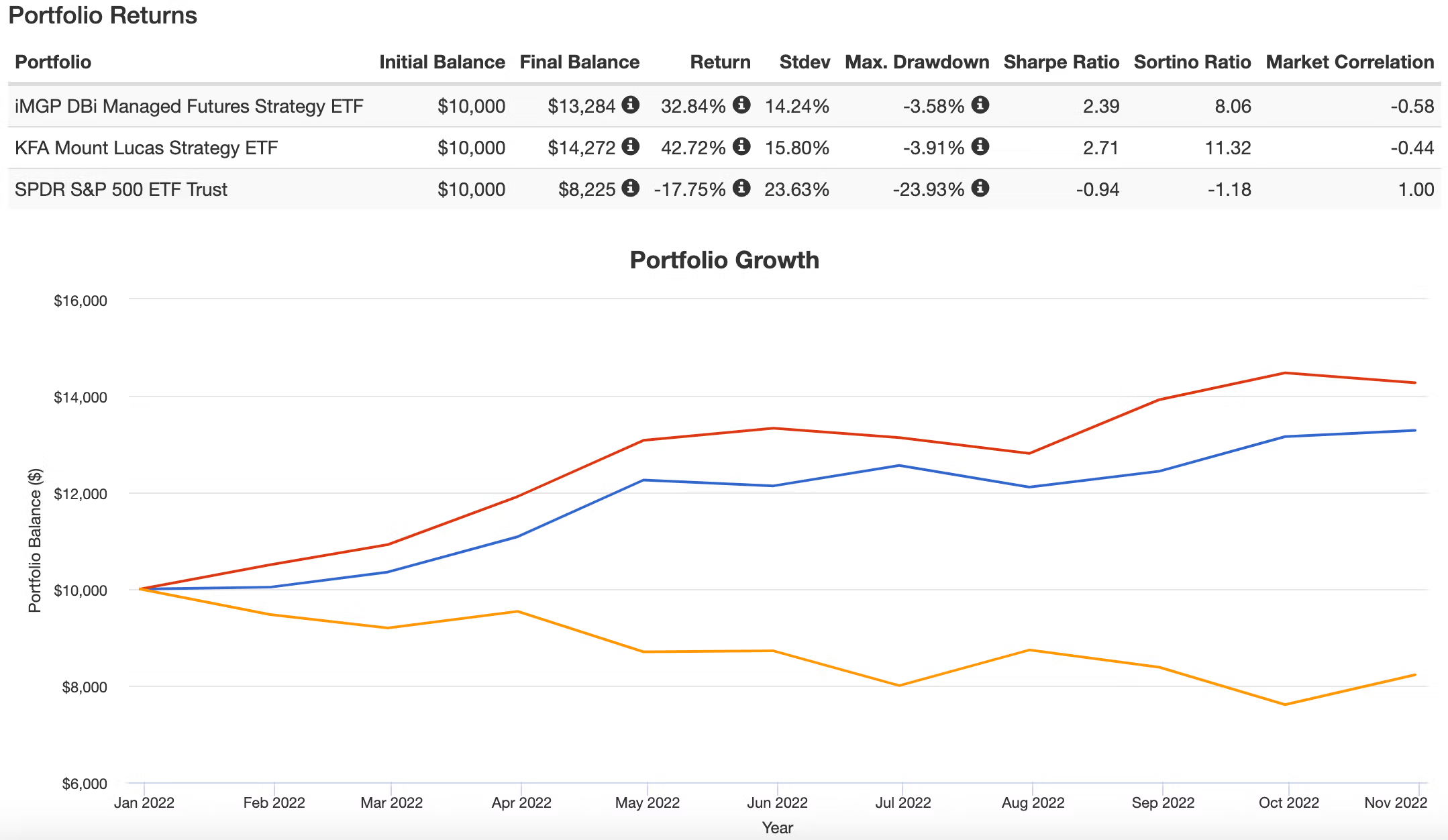

To find out let’s compare KMLM ETF and DBMF ETF with SPY ETF.

To say certain managed futures strategies such as the ones deployed by DBMF ETF and KMLM ETF have delivered “crisis alpha” in 2022 is the understatement of the year.

Relative to the S&P 500, which has been down -17.75% YTD, DBMF ETF has boasted 32.84% returns whereas KMLM ETF has triumphed supreme rocking 42.72%.

If we look at market correlations we find both MF ETFs negatively correlated to markets at -0.58 and -0.44.

It’s safe to say that MF investing strategies are indeed a historically reliable ally when markets are hopping on the shish-kebab.

Managed Futures Struggle Just Like Any Other Investing Strategy

Managed Futures strategies struggle mightily at times just like any other asset class.

As investors, we keep an industry-wide double standard where we’re keen to forgive the S&P 500 and QQQ for a lost 2000s but we’ll bring out the pitchforks and torches when Managed Futures strategies have a challenging 2010s often pronouncing it “dead”.

If you’re to think of MF as a line-item in your portfolio you’re going to be disappointed time and again when the strategy inevitably experiences tracking error versus equities.

However, if you take the long-term approach of viewing Managed Futures as an uncorrelated “alternative sleeve” diversification juggernaut you’ll likely be thrilled with the results if you can stay the course for decade upon decades.

Eric Crittenden, over at Standpoint Funds, made an excellent video highlighting the “line item” versus “combined asset classes” argument many investors struggle with.

source: Standpoint on YouTube

Potential To Perform Well During Good Economic Times Too

One of the biggest misconceptions about Managed Futures is that they ONLY perform well when markets are down.

Although it is TRUE that that it is often a “strength” of trend-following strategies to provide reliable “crisis alpha” when it is needed the most it is FALSE that the strategy will be a drag on portfolio returns during other economic regimes.

In fact, Managed Futures have positive expected returns long-term and have historically provided “equity-like” returns with only half of the volatility when you consider results net of fees.

The full sample period of hypothetical trend following managed futures returns from January 1880 until December 2013 is 11.2% net of fees.

Something that should immediately “excite investors” is that the 2/20 fee structure is quickly becoming a thing of the past with more cost conscious products hitting the market in recent years.

With annual realized volatility of 9.7% risk management is another feather in its cap.

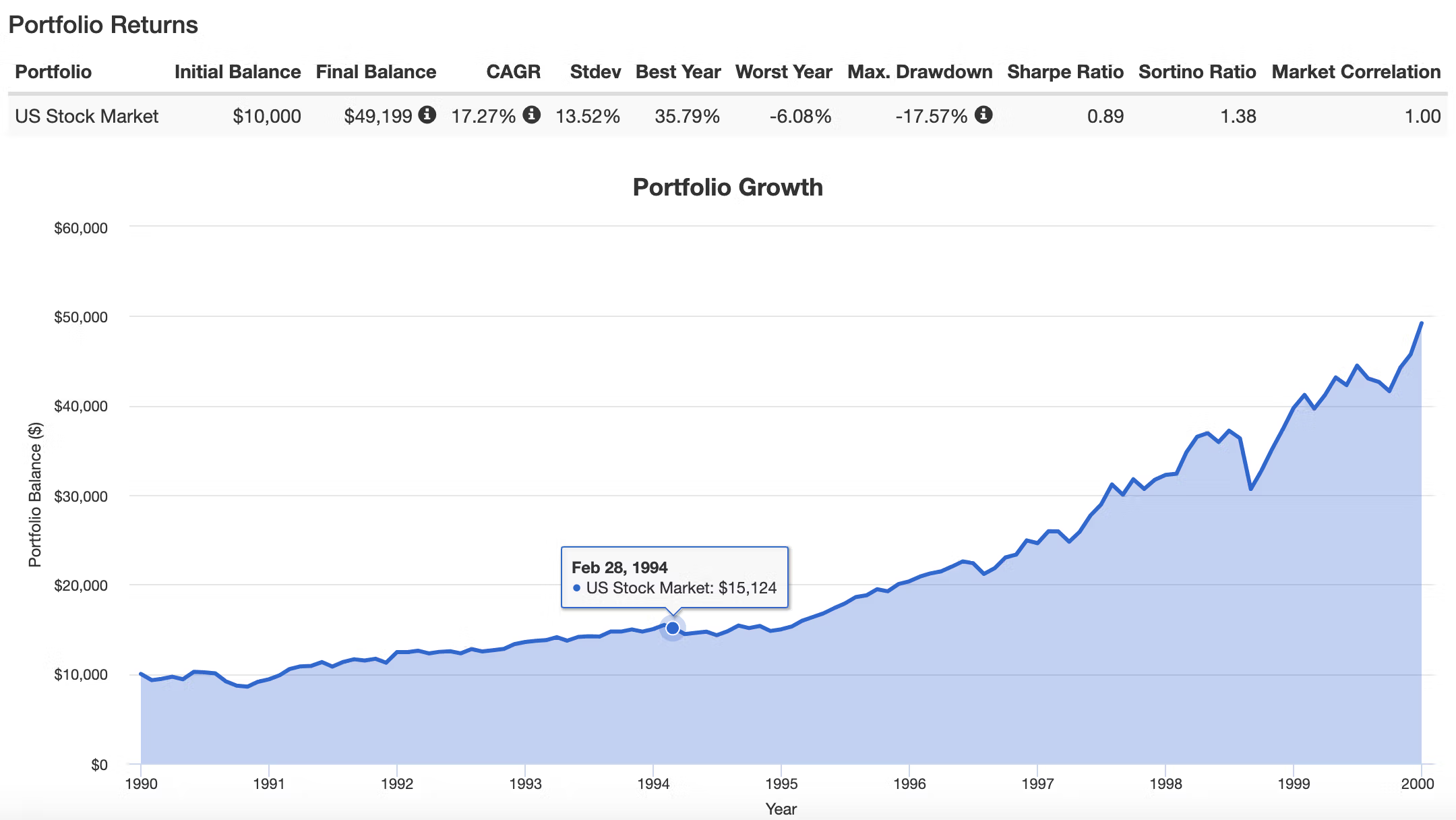

Getting back on track by considering the 90s as a classic example of trend following AND equities providing rip roaring returns at the same time.

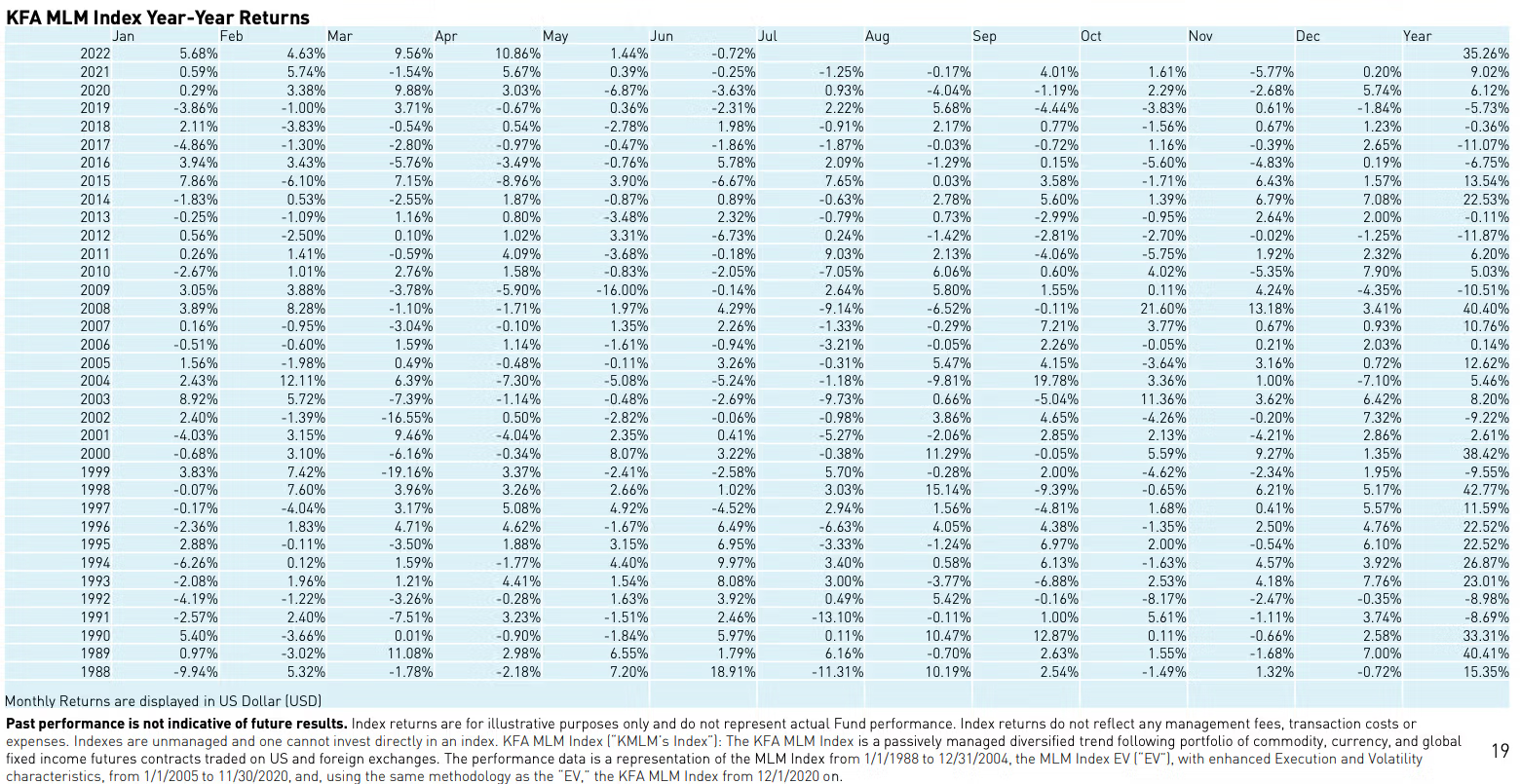

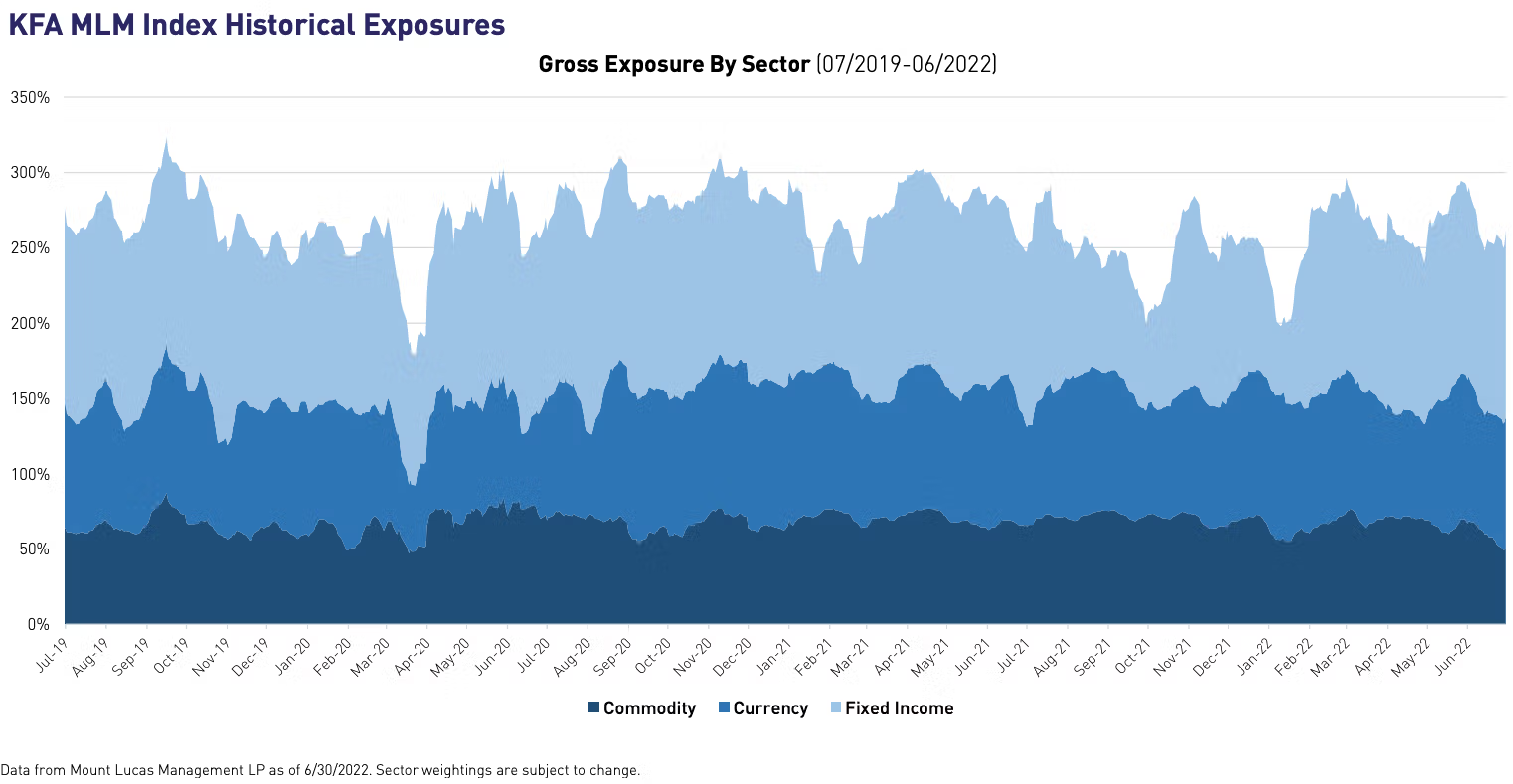

We can further confirm this by checking out the returns of KFA MLM Index Year-Year Returns.

Here you’ll notice the index KMLM ETF follows has tracked its performance dating back to 1988.

Notice the robust double digit positive returns from 1990 until 1999 for seven years (90, 93, 94, 95, 96, 97, 98).

Above you’ll notice US Equity Large Cap returns for the 1990s.

The takeaway message for investors is that it isn’t always Equities OR Trend-Following performing well while the other struggles.

It can be Equities AND Trend-Following Managed Futures driving phenomenal returns at the SAME time too.

source: Financial Wisdom YouTube

Trend-Following Is the Predominant Managed Futures Strategy

We’ve shone the spotlight upon mostly “trend following” as the managed futures strategy we’ve focused upon more than any other.

Why?

Because it is hands down the most predominant strategy in the managed futures universe.

Let’s unpack it a bit more.

Trend Following is an investment strategy that has the ability to go long/short across a broad equity, fixed income, commodities, currency and metals futures indexes.

It’s a strategy that is adaptive rather than just being positioned long only.

What do I mean by that specifically?

If you’re an equity investor with long positions in an S&P 500 index you only benefit when markets are going up.

You’re screwed when they’re down.

With trend following you’re able to adapt your position based on the current trend.

When lean hogs are trending up you’re long.

When they’re trend down you’re short.

The systematic approach to trend-following systems ensures no human emotion or judgement influences these decisions.

It just follows the moving average of its short, medium and long-term signals of the trading system.

That sounds great and all but what is the catch?

The catch is that when trends ARE NOT strong it’ll likely get whipsawed.

I like to use the analogy of a cruise ship to describe this.

If the ship pulls into port but then gets called to another location (changes position from long to short or vice versa) it’ll feel pain as it repositions.

Without adequate time to dock (ride the trend) it gets beat up in the ocean by choppy waves going from one place to the next.

Basically, when trends are not strong (or they’re back and forth) the strategy struggles.

It does its best when trends are strong and continuous such as in 2022.

Other Managed Futures Strategies

Trend Following is not the only Managed Futures game in town.

We’ve also got carry, value, defensive, mean reversion and risk-off just to name a few.

Since this isn’t an article “diving deep” into all of theses different strategies we’ll just briefly highlight one of them.

For instance, carry is a managed futures strategy where you’re long “high yielding” assets and short “lower yielding” assets.

This type of strategy is typically executed in currency/bond markets where you borrow and pay interest in order to buy something that has higher interest.

What’s important to remember is that not all managed futures funds are “trend-only” products and that many include a multi-strategy approach to further diversify and potentially better manage overall risk.

When you’re thinking of buying a Managed Futures ETF/Mutual Fund it is important to read the tear sheets and manager commentary pdfs to find out what strategies are being pursued by the given product in question versus what exposures/strategies you’re seeking as an investor.

Managed Futures Hybrid and Asset Allocation Products

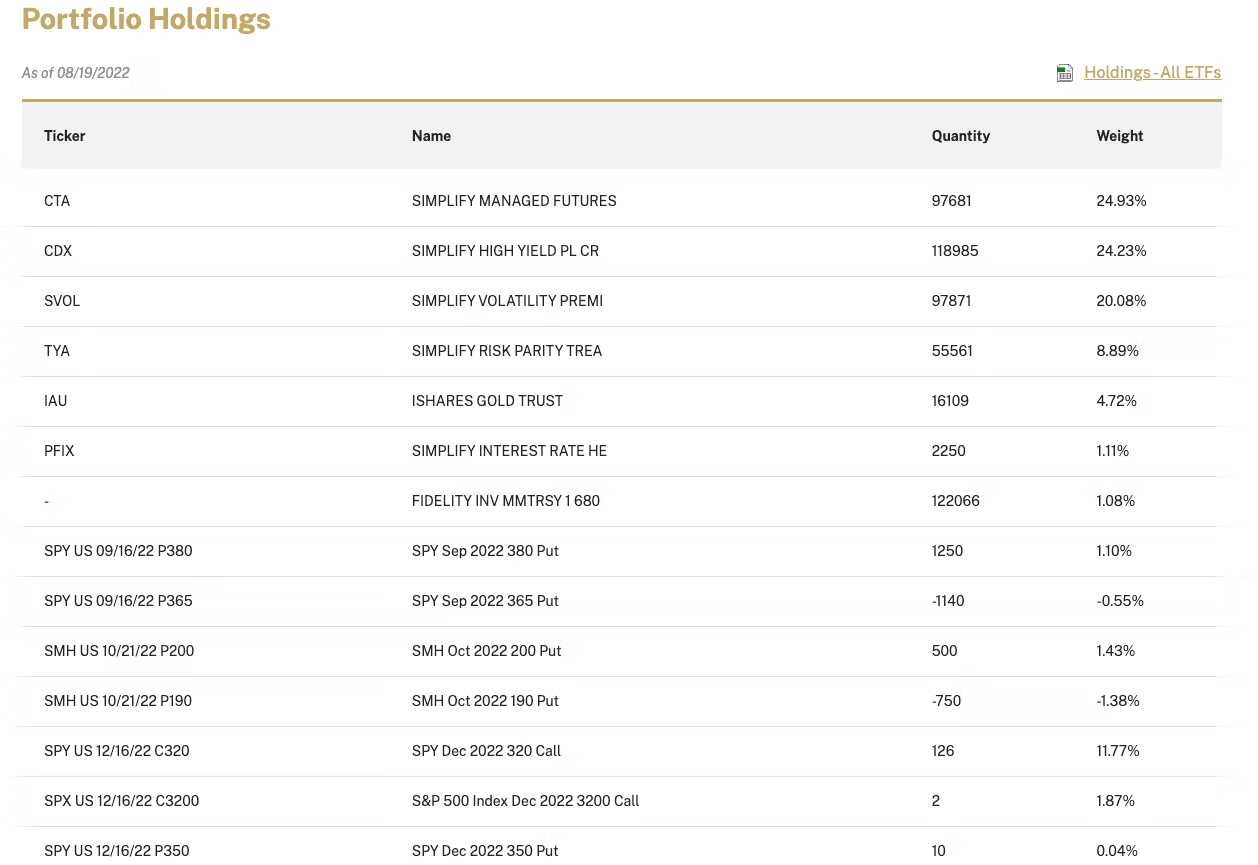

Investors need to be aware that managed futures products are often part of a hybrid strategy where they’re paired with “something else” or they’re a smaller slice of the pie in an asset allocation fund.

Two funds I’ve already reviewed on this site perfectly highlight these two examples.

Standpoint Multi-Asset Fund is an expanded canvas portfolio product which is long 50% global equities with a 100% trend-following managed futures sleeve.

Simplify Macro Strategy ETF is a fund of funds asset allocation ETF where managed futures ticker CTA ETF currently takes up a slice of the pie (24.93%) with a plethora of other strategies (I counted 10) also included in the mix.

Hence, you have the option of going for an expanded canvas hybrid or asset allocation approach alongside the opportunity to purchase a fund that is exclusively managed futures.

Exposures, Leverage and Volatility Targeting Matter

Not all Managed Futures ETFs and Mutual Funds are created equal.

Some have strict volatility targets (standard deviation) whereas others really let their horses run wild (winners win).

Other funds have gross leverage caps where long/short combinations are not able to exceed certain leverage thresholds such as 150%, 200% or 300% as an example.

Certain funds trade equities, fixed income, currencies, metals and commodities across a broad range of diversified global markets.

Whereas it’s also common to find products that will key in on a more narrow range of focus (currency and fixed income only in North American markets) with niche expertise.

You’ll discover that certain ETFs or Mutual Funds are “trend-following” only whereas others bring a diverse mix of managed futures strategies under one hood forming a multi-strategy approach.

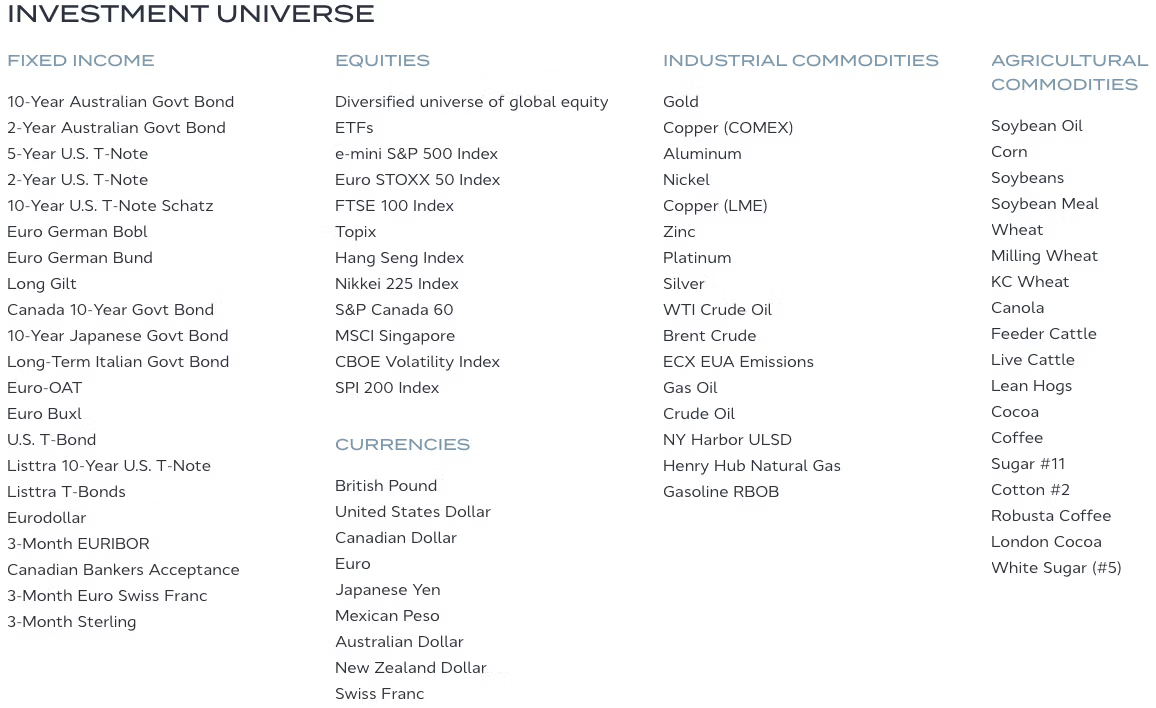

Managed Futures Covers A Diverse Range Of Asset Classes

No other investing strategy that I’m aware of provides access to as diverse a range of asset classes as Managed Futures.

Standpoint Funds has an awesome Investment Universe list of global fixed income, equities, currencies, industrial commodities and agricultural commodities that it tracks.

Fixed Income

10 Year Australian Government Bond

2 Year Australian Government Bond

5 Year US T-Note

2 Year US T-Note

10 Year US T-Note

Euro German Boble

Euro German Bund

Long Gilt

Canada 10 Year Government Bond

10 Year Japanese Government Bond

Long Term Italian Government Bond

Euro OAT

Euro Buxl

US T-Bond

Listtra 10 Year US T-Note

Listtra T-Bonds

Eurodollar

3-Month EURIBOR

Canadian Bankers Acceptance

3-Month Euro Swiss Franc

3-Month Sterling

Equities

e-mini S&P 500 Index

Euro STOXX 50 Index

FTSE 100 Index

Topix

Hang Seng Index

Nikkei 225 Index

S&P Canada 60

MSCI Singapore

CBOE Volatility Index

SPI 200 Index

Currencies

British Pound

United States Dollar

Canadian Dollar

Euro

Japanese Yen

Mexican Peso

Australian Dollar

New Zealand Dollar

Swiss Franc

Industrial Commodities

Gold

Copper

Aluminum

Nickel

Zinc

Platinum

Silver

WTI Crude Oil

Brent Crude

ECX EUA Emissions

Gas Oil

Crude Oil

NY Harbor ULSD

Henry Hub Natural Gas

Gasoline RBOB

Agricultural Commodities

Soybean Oil

Corn

Soybeans

Soybean Meal

Wheat

Milling Wheat

KC Wheat

Canola

Feeder Cattle

Live Cattle

Lean Hogs

Cocoa

Coffee

Sugar

Cotton

Robusta Coffee

London Cocoa

White Sugar

For shits and giggles I have infinite amounts of fun pretending I’m having an oddball dinner by combining various combinations in one sentence.

Tonight for supper we’ll be having Lean Hogs sprinkled with London Cocoa and Robusta Coffee purchased entirely with Swiss Francs.

Managed Futures Offer A Long-Term Diversification Benefit

Maybe the most crucial thing to understand as an investor is that managed futures offer a tremendous long-term diversification benefit for those who understand, commit and ultimately stick with the strategy as a permanent alternative sleeve within their portfolio.

Being able to combine an asset class and/or strategy that is uncorrelated to both stocks and bonds has the potential to enhance returns while lowering overall portfolio volatility.

Moreover, you get the added bonus of having a more palatable sequence of returns.

I found that portfolios that featured an “alternative sleeve” performed much better while also managing risk in the Battle of the Leverage Portfolios series.

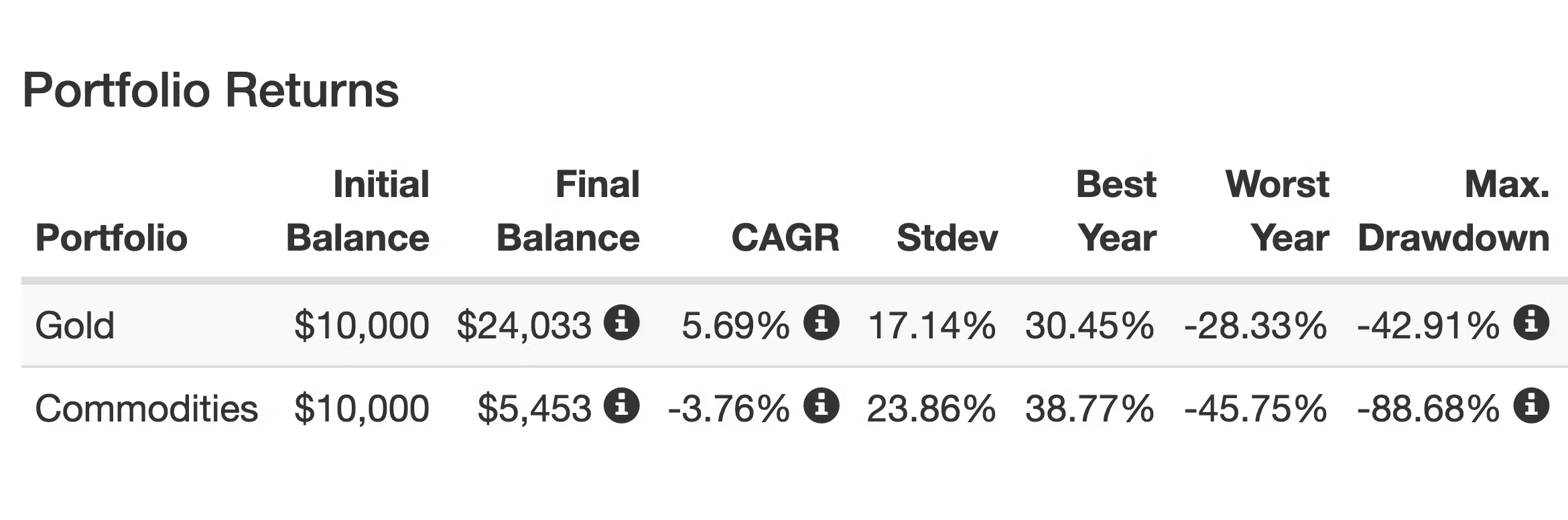

Heck, even back-testing the results of US Equities and Gold (oddly considered an “alternative investment“) revealed the benefits of combining uncorrelated asset classes that extend beyond equities/fixed income.

What Managed Futures strategies offer that long-only exposure to Gold and Commodity lacks is the ability to adapt by going long/short.

Since 2000, consider that Gold has had a worst year of -28.33% performance in 2013 and Commodities got hammered in 2008 with -45.75% returns.

More shocking is the maximum drawdown for Gold at -42.91% and Commodities at -88.68%.

How many investors have a chin worthy of receiving such vicious uppercuts?

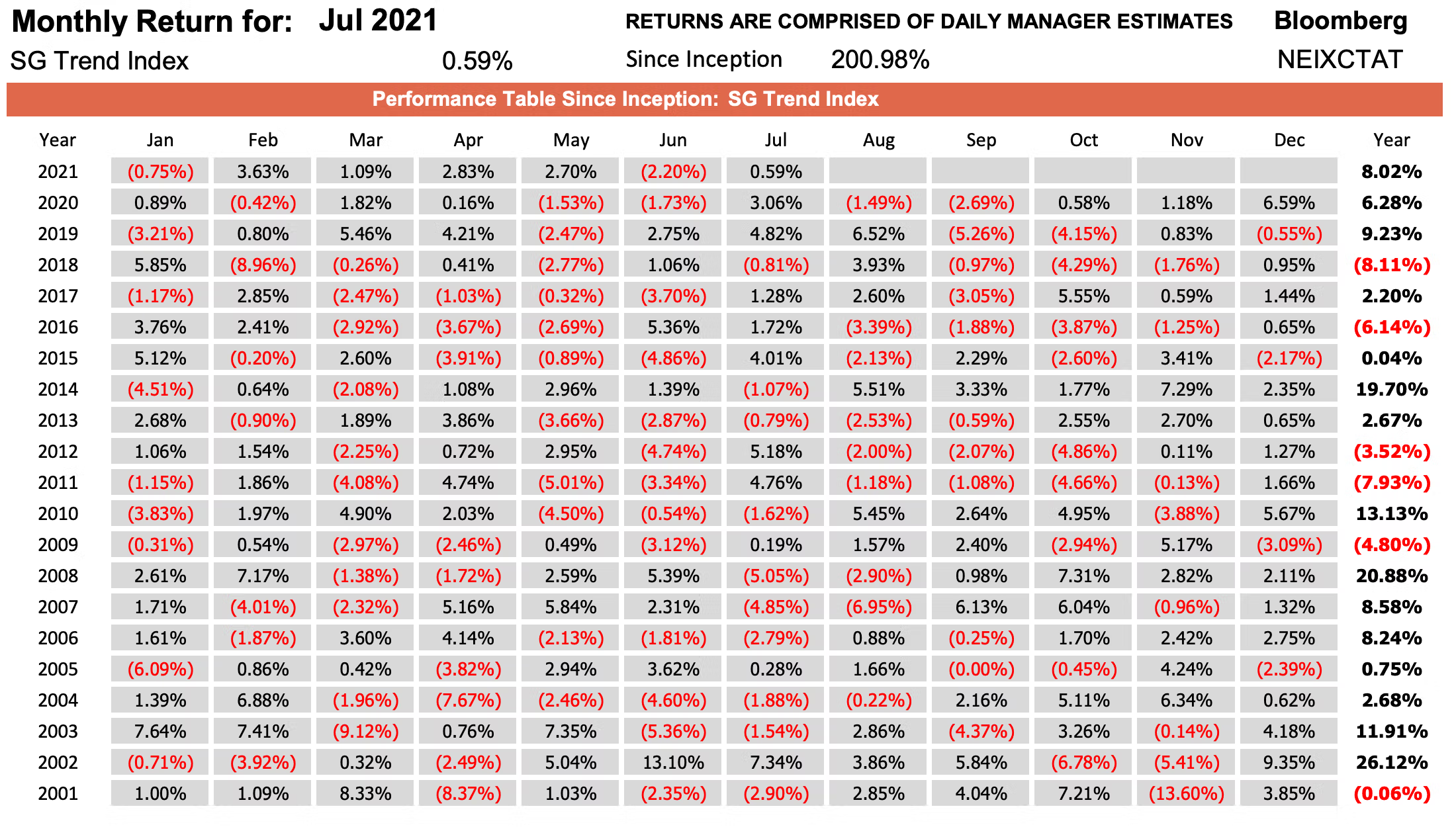

Now consider the SG Trend Index since 2001.

A far more palatable worst year of -8.11% in 2018.

What happens when you stick with Managed Futures investing strategies over an extended period of time?

Higher returns.

Lower Volatility.

As far as I’m concerned that’s the name of the game when it comes to portfolio construction.

As investors we should be seeking the ultimate scenario where returns and risk management collide.

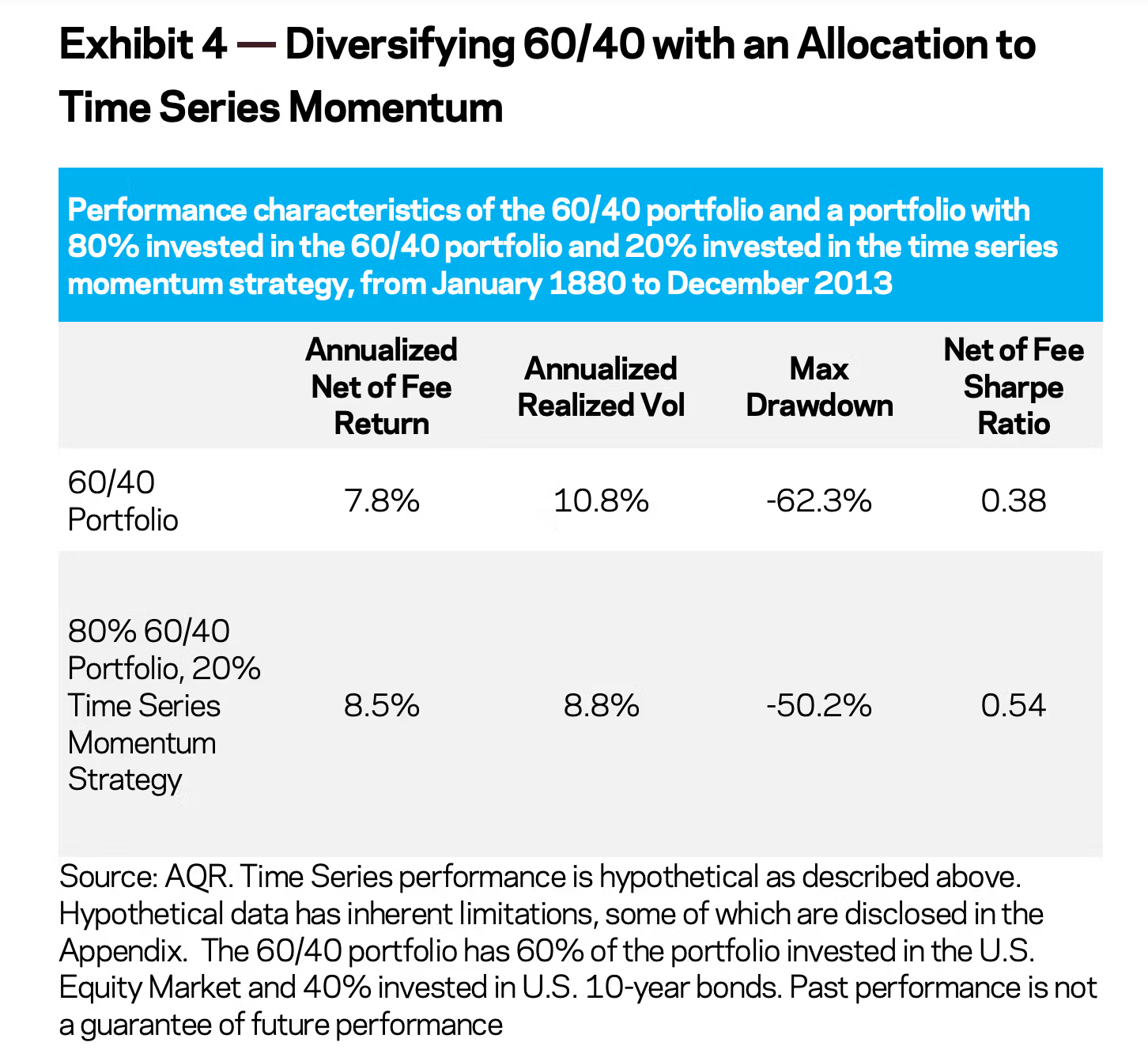

Let’s once again consult with AQR’s research to compare the results of a 60/40 portfolio versus a 50/30/20 portfolio where the classic portfolio gives way for a 20% alternative sleeve commitment to “trend following” as a permanent allocation.

60/40 Portfolio Returns: 7.8%

60/40 Portfolio Volatility: 10.8%

60/40 Portfolio Sharpe: 0.38

50/30/20 Portfolio Returns: 8.5%

50/30/20 Portfolio Returns: 8.8%

50/30/20 Portfolio Returns: 0.53

Back-testing long-term hypothetical results from January 1888 until December 2013 reveals a 70 basis points increase in returns with a 200 basis points improvement in volatility management.

A slice of 10% Managed Futures to a classic strategy likely moves the needle whereas 20% really makes a difference over long time horizons.

Bonus: 10 People Worth Following To Learn More About Managed Futures

My intention with this article was for it to be an introduction to managed futures investment strategies for investors who are “new” to this from the perspective of a curious amateur.

However, for those seeking to take a deeper dive and learn more about the subject I’d highly recommend following these 10 fine folks in no particular order:

- Andrew Beer

- Jason C. Buck

- Adam Butler

- Jerry Parker

- Rodrigo Gordillo

- Jeff Malec

- Richard Brennan

- Charles McGarraugh

- Michael Covel

- Tom Basso

From tweets and podcasts to books and articles to white papers and videos these guys have you covered across the board.

Super Bonus: 10 Managed Futures Funds To Consider

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Since we’ve already hit a bonus round let’s up the ante by going “super” by highlighting a few funds worth your consideration.

We’ll break things up into two categories: Managed Futures (trend + multi-strategy) and Asset Allocation Funds that include MF in no particular order.

Managed Futures ETFs/Mutual Funds (Trend + Multi-Strategy)

- DBMF – iMGP DBi Managed Futures Strategy ETF

- KMLM – KFA Mount Lucas Managed Futures ETF

- CTA – Simplify Managed Futures Strategy ETF

- RDMIX – Rational/ReSolve Adaptive Asset Allocation Fund Mutual Fund

- AQMIX – AQR Managed Futures Strategy Fund Mutual Fund

- EQCHX – AXS Chesapeake Strategy Fund Mutual Fund

Asset Allocation Funds (including Managed Futures allocations)

- FIG – Simplify Macro Strategy ETF

- TRTY – Cambria Trinity ETF

- BLNDX / REMIX – Standpoint Multi-Asset Fund Mutual Fund

- The Cockroach Portfolio by Mutiny Funds

Canadian Investors

- HRAA.TO – Horizons Resolve Adaptive Asset Allocation ETF

- NALT.TO – NBI Liquid Alternatives ETF

- AHP 1110 – WaveFront Global Diversified Investment Class

- Auspice One Fund by Auspice Capital

Managed Futures FAQ: 12 Essential Answers for Diversified, All-Weather Portfolios

1) What are managed futures in plain English?

They’re rules-based strategies that trade futures across many markets—stocks, bonds, currencies, commodities—able to go long or short. The goal is to capture broad trends and provide returns that don’t move in lockstep with traditional stock/bond portfolios.

2) Why did managed futures stand out in 2022?

Because both stocks and bonds fell together, the “third leg” many investors were missing was an uncorrelated return stream. Trend-following CTAs (a core flavor of managed futures) often profited from persistent moves (e.g., rising rates, strong commodity trends), delivering “crisis alpha” when diversification mattered most.

3) Are managed futures only for bear markets?

No. While they’re famous for cushioning crashes, they can also do well when strong trends exist in any direction—up or down—across rates, currencies, and commodities. They tend to struggle in choppy, trendless markets.

4) What’s the difference between managed futures and “trend following”?

“Managed futures” is the umbrella. Trend following (time-series momentum) is the most common approach under it. Other managed futures styles include carry, value, defensive, mean-reversion, and risk-off tactics, and some funds blend multiple styles.

5) How do they diversify a 60/40 portfolio?

Historically, managed futures show low to negative correlation to both stocks and bonds. Adding a 10–20% sleeve has, in long backtests, raised returns and lowered volatility versus plain 60/40, improving the overall sequence of returns.

6) What do “long” and “short” actually mean here?

Going long a futures contract benefits if prices rise; going short benefits if prices fall. The ability to profit either way is a key reason managed futures can help in inflationary spikes or bond bear markets.

7) Why do some funds use “volatility targets” and leverage?

Futures are capital-efficient. Managers often scale positions to a volatility target (e.g., ~10% annualized) for consistency. Leverage is typically gross exposure from offsetting longs/shorts—risk controls (position sizing, diversification, risk limits) are central to design.

8) What markets do managed futures actually trade?

A very broad universe: global government bonds and rates, equity index futures, major currencies, and commodities (energy, metals, grains, softs, livestock). Breadth increases the chance of finding trends somewhere.

9) Why do these strategies sometimes “whipsaw”?

When markets reverse quickly or chop sideways, breakout/momentum signals flip, and the system takes small losses while repositioning. That “whipsaw” is the known cost of being available to participate in the next sustained trend.

10) How do hybrid or “expanded canvas” funds use managed futures?

Some products pair a core equity sleeve with a managed futures sleeve (e.g., ~50% stocks + ~100% trend exposure), or include managed futures as one piece inside a multi-strategy allocation. Read holdings/tearsheets to understand role and weight.

11) What should I look for when evaluating funds?

Focus on:

Process & style (trend-only vs multi-strategy)

Market breadth (global, multi-asset)

Risk controls (vol targeting, drawdown management)

Costs & taxes (expense ratio, K-1 vs 1099)

Fit in your portfolio (allocation size, rebalancing plan)

12) Is this financial advice?

No. This is education/entertainment only and doesn’t consider your situation. Do your own research and consult a licensed advisor before investing.

Nomadic Samuel Final Thoughts

I honestly couldn’t imagine my portfolio without a permanent allocation to a myriad of managed futures strategies.

My goal as an investor is to build the most robust, resilient and capital efficient portfolio possible where I seek maximum risk management alongside rip roaring returns.

Managed Futures strategies are an integral part of this process as they provide massive diversification benefits alongside my equity and bond sleeves.

Yet, I’m fully aware they’re not a magic bullet.

They’ll struggle at times just like any equity factor strategy, market cap weighted index or aggregate bond allocation.

I’m fully prepared for that.

A 2010s scenario of a challenging stretch for Managed Futures investing strategies is just as possible as a lost decade was for MCW US equities in the 2000s.

Investors with “weak hands” and a “soft chin” will abandon Managed Futures strategies as being “dead” when they’re relatively underperforming for a prolonged period of time.

More sophisticated and patient investors will understand this is just part of the overall investing journey.

Hopefully this article has helped unpack Managed Futures strategies in a more digestible manner.

As a more esoteric investing strategy than long-only stocks and fixed income it takes some digging and effort to unravel the potential benefits.

Yet the effort is well worth it in my opinion.

Now over to you.

What do you think of Managed Futures investing strategies?

Are they a flash-in-the-pan one-hit-wonder of 2022?

Or are they a permanent part of your overall portfolio?

I’m curious to find out!

Please let me know in the comments below.

That’s all I’ve got.

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Can we get a review of TFPN? THANKS!