The Ray Dalio All Weather Portfolio is considered by many to be the cream of the crop when it comes to risk managed long-only asset allocation.

It’s designed specifically for all-weather conditions.

Unlike other portfolios that skew heavily towards equities, the all-weather approach is centred around diversification, balance, risk parity, correlations and overall economic regime readiness.

It’s not swinging for the fences with a home-run or strike-out as the most likely outcomes.

It’s more aligned towards having a disciplined eye willing to take a walk, lay down a bunt, slap a single past the third basemen or drive in a run with a sacrifice fly.

It’s a more versatile approach to asset allocation that has served investors well.

I’m of course referring to the simplified version of the Ray Dalio All Weather Portfolio that became popularized by a Tony Robbins book.

We’ve got the following allocations:

Ray Dalio All Weather Portfolio

30% US Total Stock Market

40% Long-Term Treasury

15% Intermediate Treasury

7.5% Gold

7.5% Commodities

What are some obvious benefits of the Ray Dalio All Weather approach versus a traditional 60/40?

- Less Aggressive Equity Position (30% vs 60%)

- Increased Fixed Income Exposure (Historically less volatile assets)

- An Uncorrelated Alternative Sleeve (Gold and Commodities which are lacking in a 60/40 portfolio)

Hence, the Ray Dalio All Weather Portfolio is focused first and foremost on managing risk and preparing itself for every economic outcome under the sun.

That’s the “All Weather” approach in a nutshell.

It’s a simple and super duper easy to assemble portfolio for amateur investors to consider.

However, it’s not the “Holy Grail” that Ray Dalio describes in a popular Investopedia video.

Please stop reading and watch this short video before we proceed further:

source: Investopedia on YouTube

How To Improve The Ray Dalio All Weather Portfolio With Capital Efficiency And Maximum Diversification For An Expanded Canvas Masterpiece!

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Ray Dalio’s Holy Grail Approach To Asset Allocation

So what did you think of the video?

Some of the key phrases and concepts presented pertain specifically to “returns relative to risk”, “the power of diversification” and “correlation of assets”.

But according to Ray the true magic is this one simple thing:

Find 15 or 20 ‘good’ uncorrelated return streams.

The name of the game is to assemble a portfolio with as many unique return drivers and uncorrelated asset classes/strategies as possible.

This creates an all-weather juggernaut where enhanced risk management and returns collide.

In order to accomplish this task we’re faced with a unique problem.

What do we shave down, reduce or eliminate in order to make room for these additional strategies?

Do I slice and dice my equities, shave down my bonds or hack gold down to create this extra space?

What if there was another option that didn’t involve addition by subtraction?

Expanding The Canvas: Maximum Diversification Via Capital Efficiency

Expanding the canvas is the solution to this problem.

Instead of deviating from the foundation of a sensible plan we’ll pack-mule a diversified stack of additional strategies on top of the backbone of the Ray Dalio All Weather Portfolio.

In other words, we’re committed to the foundational structure of the portfolio.

We’re going to ensure we’ve got exactly this:

30% US Total Stock Market

55% Fixed Income

7.5% Gold

7.5% Commodities

But we’re not going to make the classic mistake that trips up most amateur investors.

The temptation to dial things up 2 to 3X.

Instead, we’ll take the more sensible approach suggested by Ray Dalio.

We’ll seek a motley crew ensemble of alternative investment strategies that have low correlations amongst each other; and more importantly, ensure that they’re uncorrelated with the traditional asset classes we’ve already got in our all weather portfolio.

I’m not quite sure we’ll make it to 15!

Sorry, Ray!

But I’ll darn well try my amateur best to thumb my way across the finish line with at least 10.

Our Mission Statement: 10-15 Unique Return Sources

Let’s review our mission statement:

“We’ll attempt to build the Ray Dalio All-Weather Portfolio in its entirety utilizing capital efficient building blocks that expand the canvas to create additional space for diversifying uncorrelated strategies where we’re seeking at least 10 unique sources of returns for an overall enhanced version of the portfolio.”

Alrighty then!

We’ve got our work cut out for us but we’ll take a stab at it anyways.

Let’s get crackin’!

source: Investopedia on YouTube

Phase 1: Seeking The Most Capital Efficient Building Blocks

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

In order to create space in our portfolio to find unique sources of uncorrelated return streams we first need to expand the canvas.

So we’re specifically hunting for the most capital efficient products out there to give us the exposures we need to fulfill the requirements of the original Ray Dalio All Weather Portfolio.

We’ll first turn our attention towards PSLDX Mutual Fund.

It’s better known as PIMCO StocksPLUS Long Duration Fund.

For $1 spent here we’ll receive $1 worth of US Equities PLUS $1 exposure to long duration fixed income!

With a generous 30% allocation we’re filling up 30% each of the equites and fixed income buckets.

Our next capital efficient building block is RSBT ETF.

It’s more typically referred to as Return Stacked Bonds & Managed Futures ETF.

This is another 200% expanded canvas product that’ll give us a 2-1 special of aggregate bonds and managed futures.

With a 25% slice of the pie it’ll eat up our 55% fixed income requirement.

We’re now done with our two most important sleeves: 30% US Equities + 55% Bonds.

We’ve only used 55% of our portfolio real-estate to accomplish this goal and we’ve added a big ‘ole scoop of uncorrelated managed futures to the mix.

We’ll use one more capital efficient fund to round things out.

GDMN ETF at 8.5% provides us with 90% exposure to Gold Miners PLUS 90% Gold Futures meaning we get 7.65% towards each strategy.

It’s a nifty fund known as WisdomTree Efficient Gold Plus Gold Miners Strategy Fund.

Finally we’ve selected COM ETF to finish the task of completing all of the Ray Dalio All Weather sleeves.

It’s the only non-capital efficient fund we’re adding to the mix.

If you read the article entitled, “How To Create A More Defensive Ray Dalio All Weather Portfolio” you’ll find out why I chose Direxion Auspice Broad Commodity Strategy ETF with its long-flat strategy versus a long-only fund.

Let’s review what we’ve accomplished over here.

With 71% of the portfolio resources we’ve fulfilled the Ray Dalio All-Weather mandate and added a managed futures and gold miners to the mix.

We’ve still got 29% of our portfolio resources at our disposal to diversify to our heart’s content.

Phase 2: Diversifying Like There Is No Tomorrow!

So we’ve got a nice slice of empty canvas to paint our diversification masterpiece.

We’ve already added two unique return streams to the mix with managed futures and gold miners.

Shall we slice things up into 4%, 2% and 1% slots to add 8-10 more funds?

Let’s kick things off with a long-short equity strategy VMOT ETF that provides global factor focused exposure to value and momentum on the long-end with beta hedges on the short side during downward trends.

It’s full name is Alpha Architect Value Momentum Trend ETF.

We’ll add a market neutral anti-beta strategy with BTAL ETF which is long low volatility stocks and short high beta ones.

It’s better known as AGF US Market Neutral Anti Beta Fund.

IVOL ETF is a unique fund providing investors exposure to a generous slice of TIPs and also a OTC options strategy.

It’s called Quadratic Interest Rate Volatility and Inflation Hedge ETF.

Next we’ve got a multi-strategy FLSP ETF zeroing in on Quality, Value, Momentum and Carry mandate.

It’s full name is Franklin Systematic Style Premia ETF.

SVOL ETF gives you exposure to a hedged 0.2-0.3 Inverse VIX.

It’s better known as Simplify Volatility Premium ETF.

It’s probably no surprise that ARB ETF covers all of your merger-arbitrage needs.

It’s called AltShares Merger Arbitrage ETF.

And in term of covering your $TAIL you’ve got out of the money put options as portfolio insurance.

It’s full name is Cambria Tail Risk ETF.

With an OTC derivative strategy in PFIX ETF you’ve got a unique interest rate hedge for your portfolio.

It’s better known as Simplify Interest Rate Hedge ETF.

And why not dip our toes into the crypto market with just a 1% sliver with BITO ETF.

It’s called ProShares Bitcoin Strategy ETF.

Assembling The Maximum Diversification Ray Dalio All Weather Portfolio

Let’s take a peak at our expanded canvas Ray Dalio All Weather Portfolio.

Maximum Diversification Expanded Canvas Ray Dalio All Weather Portfolio

30% $PSLDX – PIMCO StocksPLUS® Long Duration Fund

25% $RSBT – Return Stacked Bonds & Managed Futures ETF

8.5% $GDMN – WisdomTree Efficient Gold Plus Gold Miners Strategy Fund

7.5% $COM – Direxion Auspice Broad Commodity Strategy ETF

4% $VMOT – Alpha Architect Value Momentum Trend ETF

4% $BTAL – AGF US Market Neutral Anti Beta Fund

4% $IVOL – Quadratic Interest Rate Volatility and Inflation Hedge ETF

4% $FLSP – Franklin Systematic Style Premia ETF

4% $SVOL – Simplify Volatility Premium ETF

4% $ARB – AltShares Merger Arbitrage ETF

2% $TAIL – Cambria Tail Risk ETF

2% $PFIX – Simplify Interest Rate Hedge ETF

1% $BITO – ProShares Bitcoin Strategy ETF

It’s not the most pleasing from a design point of view.

This is anything but the Harry Browne Permanent Portfolio with 25% equal slices as we’re a bit all over the place.

But ultimately I’m thrilled with how many strategies we’ve been able to add.

15 Distinct Investing Strategies Under The Hood

- US Stocks

- Fixed Income (Long-Term Treasury + Aggregate)

- Managed Futures (Trend-Following)

- Gold

- Gold Miners

- Commodities Long-Flat or Long-Short

- Long-Short Equities (Concentrated Value-Momentum Factor Focused)

- Anti-Beta Market Neutral

- TIPs

- Style Premia (Quality, Value, Momentum and Carry)

- Inverse VIX

- Arbitrage

- Tail Risk (Put Options)

- Interest Rate Hedge (OTC Derivatives)

- Bitcoin

Here is a full list of all the distinct strategies we’ve been able to assemble under one hood.

15 Distinct Investing Strategies Exposures Rank Ordered

- 55% Fixed Income (Long-Term Treasury + Aggregate)

- 30% US Equities

- 25% Managed Futures

- 7.65% Commodities (Long-Flat)

- 7.65% Gold Miners

- 7.5% Gold

- 4% Long-Short Equities (Focused Factors minus Beta)

- 4% Market-Neutral Anti-Beta

- 4% TIPs + Options (OTC)

- 4% Style Premia (Quality, Value, Momentum, Carry)

- 4% Inverse VIX (0.2-0.3 with hedge)

- 4% Merger Arbitrage

- 2% Tail Risk (Put Options)

- 2% Interest Rate Hedge (OTC Derivatives)

- 1% Bitcoin

Expanded Canvas Portfolio: 161.8%

And that’s our nifty little 161.8% expanded canvas portfolio!

Simulated Backtest and Correlations Between Strategies

The last thing for us to consider is a simulated backtest and to check out the correlations between all of the various funds and strategies we’ve assembled under the hood.

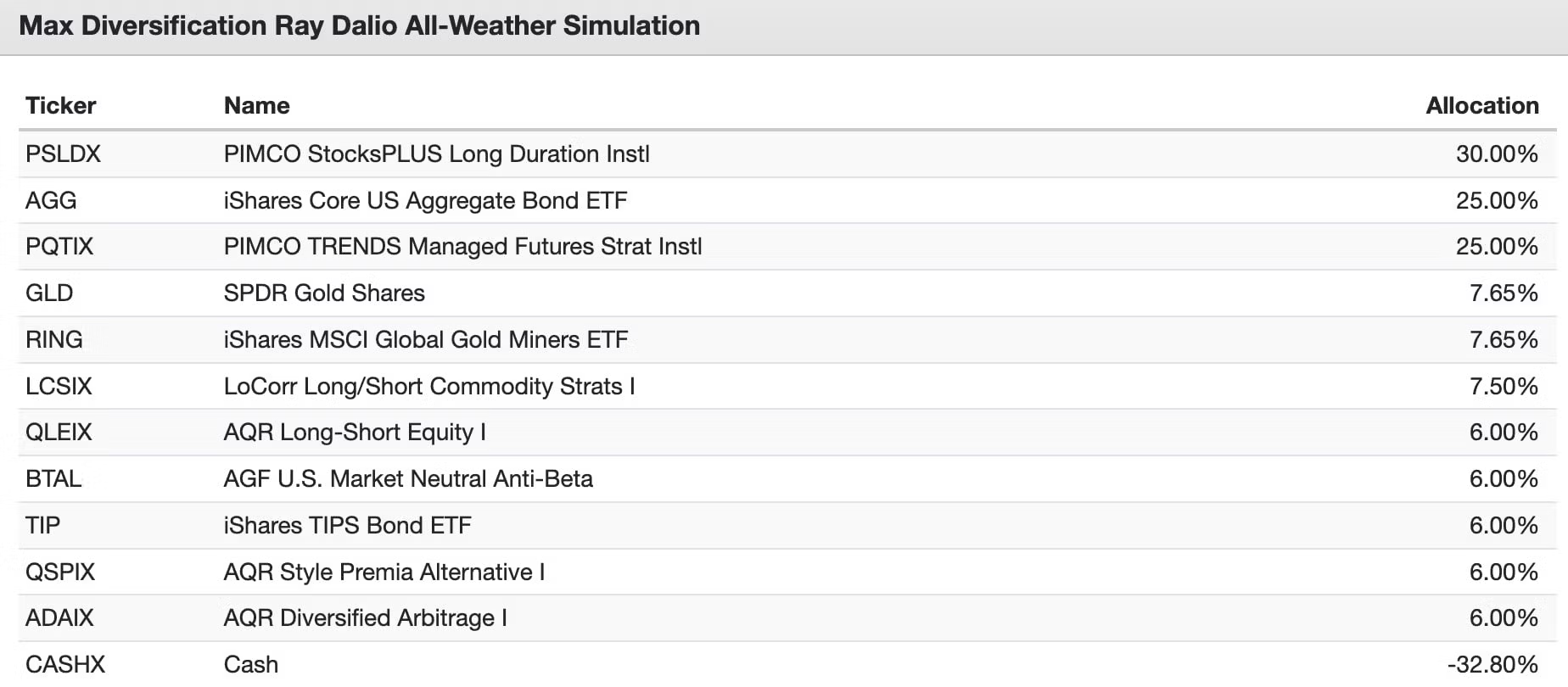

In order to rewind the clock back to 2014 for a long-range back-test I’ll have to trim some strategies and replace others with mutual funds.

So we won’t be able to backtest our Inverse VIX, Tail Risk, Interest Rate Hedge or Bitcoin funds.

That extra 9% space will be added to the five 4% funds at roughly 2% each.

30% PSLDX – PIMCO StocksPLUS Long Duration

25% AGG – iShares Core US Aggregate Bonds ETF

25% PQTIX – PIMCO TRENDS Managed Futures Strategy

7.65% GLD – SPDR Gold Shares

7.65% RING – iShares MSCI Global Gold Miners ETF

7.5% LCSIX – LoCorr Long/Short Commodity Strategy

6% QLEIX – AQR Long-Short Equity

6% BTAL – AGF U.S. Market Neutral Anti-Beta

6% TIP – iShares TIPS Bonds ETF

6% QSPIX – AQR Style Premia Alternative

6% ADAIX – AQR Diversified Arbitrage

-32.80% CASHX – Cash

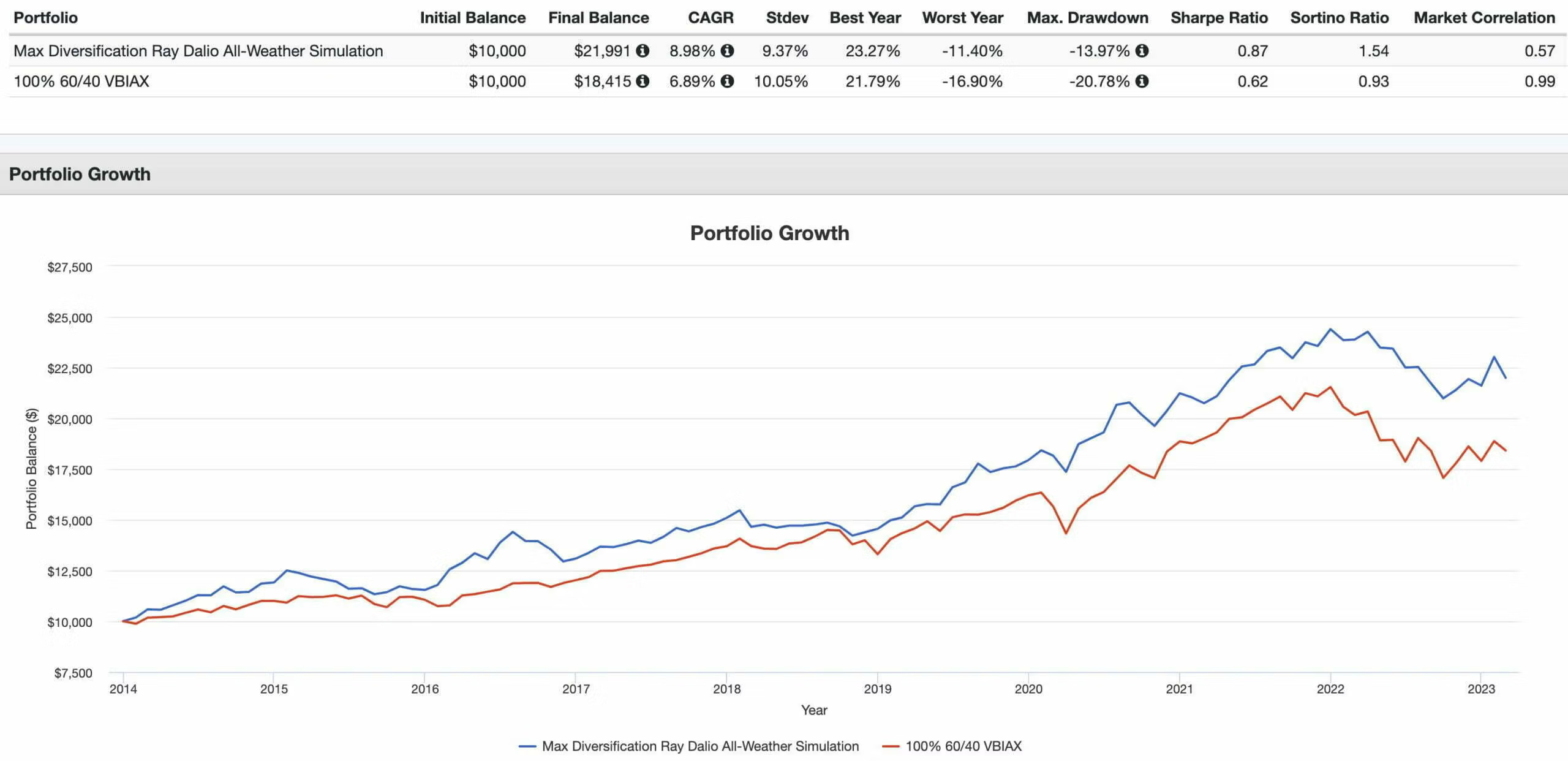

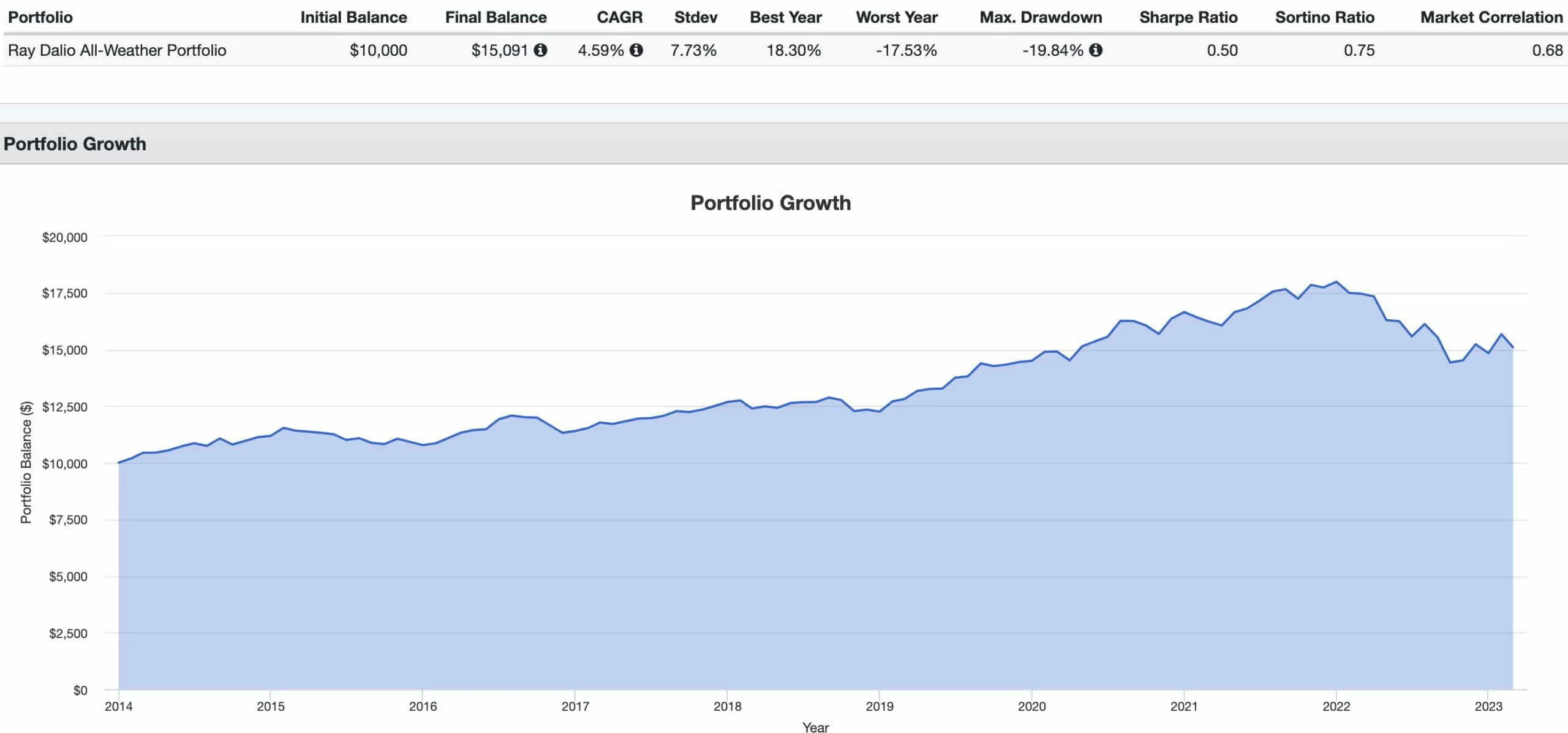

CAGR: 8.98% vs 6.89% vs 4.59%

RISK: 9.37% vs 10.05% vs 7.73%

BEST YEAR: 23.27% vs 21.79% vs 18.30%

WORST YEAR: -11.40% vs -16.90% vs -17.53%

MAX DRAWDOWN: -13.97% vs -20.78% vs -19.84%

SHARPE RATIO: 0.87 vs 0.62 vs 0.50

SORTINO RATIO: 1.54 vs 0.93 vs 0.75

MARKET CORRELATION: 0.57 vs 0.97 vs 0.68

We’re able to clearly see from an albeit imperfect back-test that the maximum diversification Ray Dalio All Weather Portfolio reigns supreme in comparison to the 60/40 Portfolio (VBIAX) and the traditional Ray Dalio All Weather Portfolio.

It clearly outpaces both portfolios in terms of performance, best year, worst year and maximum drawdown.

Moreover, it offers superior risk adjusted rates of returns as indicated by its Sharpe Ratio and Sortino Ratio.

Finally, it’s less correlated to markets than both portfolios.

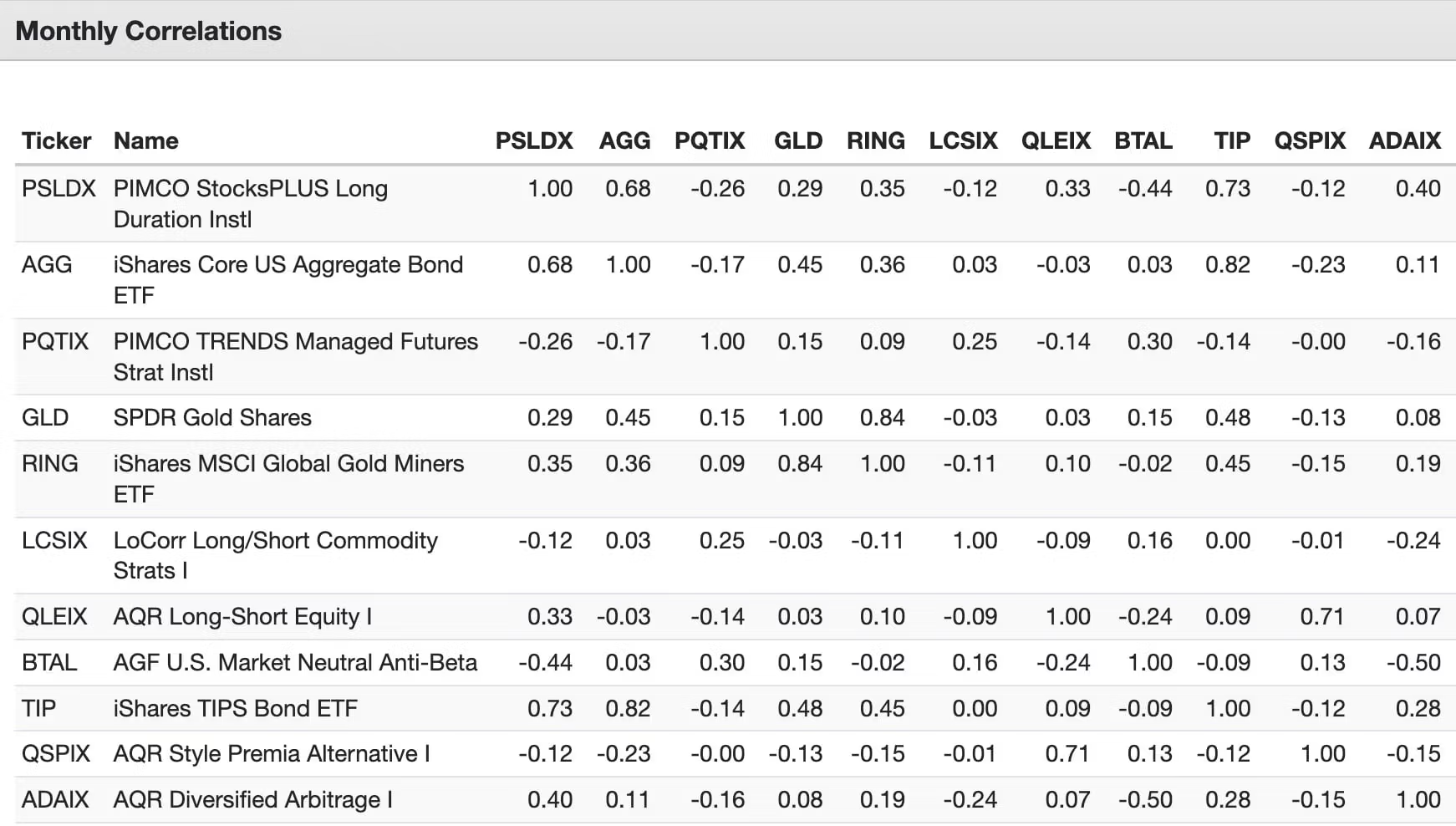

And now let’s check out the correlations between strategies which ranges from 2014 until 2023.

When comparing each fund with all of the others you get most low correlation results.

This is exactly what we’re seeking with our maximum diversification mandate.

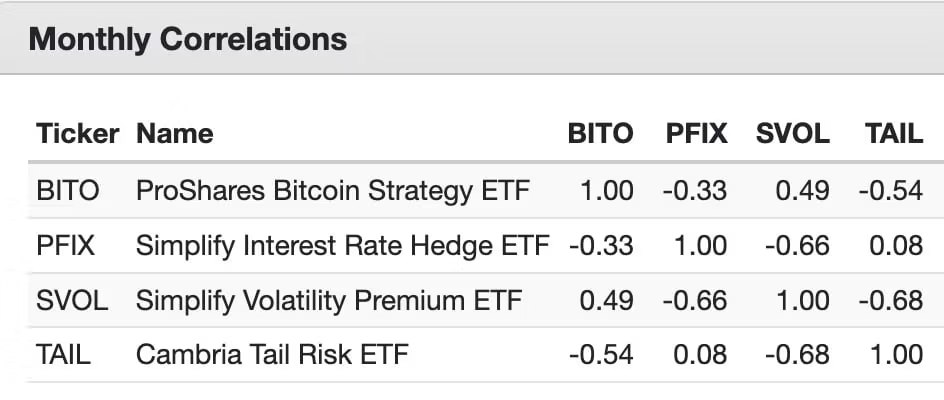

Finally, we’ll add back BITO, PFIX, TAIL and SVOL for a short sample size correlation examination.

Expanded Canvas Ray Dalio All Weather Portfolio — 12-Question FAQ

What is the “Expanded Canvas” All Weather Portfolio?

It’s a capital-efficient reinterpretation of the simplified Ray Dalio All Weather (AW) mix that preserves its core sleeves—stocks, bonds, gold, and commodities—then “stacks” additional, low-correlated strategies on top using futures/derivatives-based funds. The goal is more return streams, better diversification across economic regimes, and improved risk-adjusted outcomes without subtracting from the original AW foundation.

How does the classic Ray Dalio All Weather allocation look?

The well-known, simplified version is: 30% U.S. total stock market, 40% long-term Treasuries, 15% intermediate Treasuries, 7.5% gold, and 7.5% commodities. It’s designed to balance growth and inflation regimes with defensive ballast and an alternatives sleeve.

What does “expanding the canvas” (capital efficiency/return stacking) mean?

Instead of funding new sleeves by cutting core positions, capital-efficient funds overlay additional exposures (e.g., bond or gold futures) on top of equities or cash collateral. That lets you keep the full AW core while adding diversifiers like managed futures, long/short equity, market-neutral, or tail hedges within the same dollar.

Which building blocks can recreate the AW core efficiently?

One example set (illustrative, not advice): (1) PSLDX for U.S. equities + long duration bonds, (2) RSBT for aggregate bonds + managed futures, (3) GDMN for gold miners + gold futures, and (4) COM for a long-flat commodities sleeve. These pieces can fulfill ~30% equities, ~55% bonds, ~7.5% gold, and ~7.5% commodities—while also layering in managed futures and gold-miners beta.

What additional diversifiers can be stacked on top?

To move toward Dalio’s “15–20 good, uncorrelated return streams,” investors often consider: long/short factor equity (e.g., value/momentum with beta hedges), market-neutral anti-beta, TIPS + rates options overlays, style premia (value, quality, momentum, carry), merger arbitrage, volatility carry with hedges, explicit tail risk puts, interest-rate hedge overlays, and a small crypto sleeve.

Why seek 10–15+ distinct return sources?

Multiple independent drivers reduce reliance on any single macro outcome (growth up/down, inflation up/down). Low or negative correlations can dampen drawdowns, smooth the path of returns, and improve compounding via rebalancing between winners and losers over time.

How does the expanded version differ behaviorally from 60/40 or classic AW?

Expect more “tracking error” to common benchmarks. In some years the diversifiers (e.g., managed futures, long vol, merger-arb) may drive performance while stocks lag; other years equities dominate. Staying the course is essential—true diversification means something you own is almost always out of favor.

What are the main risks of an expanded, capital-efficient approach?

(1) Leverage/derivatives magnify both gains and losses during equity-bond selloffs. (2) Complexity and behavioral risk—more moving parts require discipline. (3) Basis/implementation risk—ETFs and mutual funds may not perfectly track intended sleeves. (4) Liquidity, roll, and counterparty exposures within futures/options. (5) Fees—multi-strategy overlays can increase all-in costs.

How would rebalancing work in practice?

A simple rule is periodic (e.g., quarterly or semiannual) rebalancing back to target weights with tolerance bands to limit turnover. Because many sleeves are low-correlated, rebalancing harvests relative performance dispersion—selling partial winners to add to laggards—supporting long-term risk-adjusted returns.

What if a fund isn’t available in my account or region?

You can substitute functionally similar exposures: equity + bond overlays (90/60-style funds) for core stacking; broad commodity funds (long-only or long-flat); managed-futures ETFs or mutual funds for trend; market-neutral/merger-arb for alt beta; TIPS and rate-hedge ETFs for inflation/curve risk. The principle—diverse, low-correlated return streams—matters more than brand.

Who is this approach for—and who should avoid it?

It fits investors who value robust, all-weather diversification, accept modest leverage, and can tolerate tracking error versus traditional benchmarks. It’s not ideal for those uncomfortable with derivatives overlays, multi-fund maintenance, or the patience required when certain sleeves inevitably lag.

What’s the big takeaway?

The classic All Weather is a great long-only risk-balanced starting point. Expanding the canvas preserves that backbone while adding multiple uncorrelated engines (e.g., managed futures, market-neutral, tail hedges) to pursue the “Holy Grail” of many independent return streams—aiming for steadier compounding across macro regimes.

Nomadic Samuel Final Thoughts

The Ray Dalio All Weather Portfolio is hands down one of the best long-only asset allocation model portfolios in terms of risk management, diversification and simplicity.

It’s easy to assemble and allows many investors to stay the course during more difficult economic regimes.

However, if we’re seeking what Ray Dalio refers to as “true magic” and the “one simple thing” we need something closer to 15-20 diversified return streams to direct our compasses towards “The Holy Grail”.

One of my biggest pet peeves in the industry is the general assumption that amateur investors aren’t capable of managing a portfolio of 10+ funds.

Imagine a spice rack consisting of only a few different ingredients.

All you’ve got is salt, pepper, garlic powder and oregano.

How boring!

Where’s the flavour enhancers and spices?

I’d be craving paprika in no time flat!

So if we can manage a cupboard full of diverse spices to create masterpiece meals why is it assumed we’ll crumble if managing a portfolio of more than 10 funds with an annual rebalance?

It quite honestly baffles my mind.

But let’s leave things on a more positive note.

What do you think of this maximally diversified capital efficient reinterpretation of the Ray Dalio All Weather Portfolio?

The expanded canvas version.

It is overly complex or just the right amount?

Can it be improved?

I’d be more than curious to hear your opinion.

Please let me know in the comments below.

That’s all I’ve got for today.

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Hi Samuel,

I like it a lot, though I would like it even better if there were more global equities involved. I realize that VMOT is a global etf, but what I’m thinking is a larger, capital efficient allocation along the lines of the PIMCO fund, or better yet an etf. Do you know if the Resolve guys are going to come out with a return stacked global equities/bond etf in addition to RSBT? That I believe would be even more interesting and expand Dalio’s idea further. Also, what about CYA (which already includes SVOL and PFIX and other strategies for tail risk); RRH for rising interest rates; BLOK for proxy crypto exposure with more of an emphasis on block chain tech and more global equities. I’m suggesting these in place of TAIL and BITCO. I’m also wondering about the virtue of gold miners. Perhaps just go long GLDM and call it a day? I wouldn’t add too much else; IMHO, once you get under say a 3 or 4% allocation I question it’s overall impact on the portfolio. Your thoughts?

Hello Samuel,

You’ve got a great site here. I’ve only recently discovered it, and I’ve enjoyed reading some of your back articles. I like what you’ve done here in applying return stacking to Dalio’s All Weather, and even more your additional uncorrelated assets. Thanks for including all the correlation data. One of the first things I do when comparing portfolio constructions, or investments is look at CAGR+MaxDD. It’s just a rule of thumb. Ideally, that sum should be positive. It’s usually negative. Here, what’s important is how your return stacked approach produces (8.98-13.97= -4.99). This is much better than the classic Ray Dalio All Weather (4.59 – 19.84 = -15.25).

After the disabusing nature of last year, I’m not excited about the All Weather, the Golden Butterfly or even plain old TIPS. All of these were supposed to be able to provide steady wealth protection, via low drawdowns, in unfavorable economic conditions. In return, you gave up some upside potential. In practice, it seems you gave up the upside and didn’t get anywhere near the downside protection one was led to expect. Maybe Cash and QQQ (55/45) which from 2014 to now would have given you a CAGR of 8.38 and MaxDD of -14.16. (so 8.38-14.16= -5.78), with maybe more upside and Sharpe and Sortino ratios close to what you have with 15 components, using only 2.

Bottom line though, getting 20% more performance with less risk is worth the effort of dealing with 15 funds.

Thanks

Where can I find your most up to date personal portfolio? I see recent changes but I am looking for an updated list that reflects your highest conviction portfolio.