Out of all of the optimized equity factors that can potentially drive performance none may be as potent as quantitative momentum.

Yet no other equity factor is more misunderstood than momentum.

Value is a cinch to explain.

Cheap. Undervalued. Bargains.

Kind of like buying high quality grocery items on sale.

How about minimum volatility?

That’s ever easier.

Companies that are stable.

Lower highs and lower lows.

Less volatility. Less Risk. Steady. A gentle wave.

And momentum?

Well, isn’t that just basically growth?

No.

It’s the tendency for recently winning stocks to continue performing well into the near-term future.

And who better to join us for a “living legends’ interview than Ryan Patrick Kirlin of Alpha Architect to help demystify momentum investing.

As the Head Of Capital Markets and Sales for Alpha Architect, we could dive deep into various topics and territories with Ryan but we’ll instead focus specifically on momentum investing.

Alpha Architect is renowned for its factor based momentum and value strategies (and prolific evidence-based research capabilities) where they frequently publish new blog posts and white papers.

Moreover, Ryan specifically, has been one of the most generous ‘Investing Legends‘ on Twitter in terms of interacting with DIY investors (like myself and others) to help inform and educate on a myriad of different topics.

But, as always, I’ve rambled on long enough.

Let’s hear from Ryan Patrick Kirlin!

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Quantitative Momentum Investing Strategy

Momentum vs Growth Investing

Thanks for joining us Ryan! We could talk about value, momentum and/or trend-following with you all-day long but we’ll focus specifically on momentum investing given it’s maybe the most underrated yet misunderstood equity optimization factor.

Firstly, let’s define momentum as clearly as possible in terms of an equity strategy and more importantly let’s distinguish it from growth investing which it often gets mistaken for.

Momentum investing is buying things that are going up faster than other things (or, potentially, going down less than others) over some defined period (i.e. the last 1 year).

Said shorter, it’s buying whatever is strongest.

You can then apply that on a specific universe (the largest 1500 US stocks, as we do) or even higher level with multiple different asset classes (bonds, stocks, commodities, etc) and buy the strongest asset classes.

This is different from growth investing.

Growth investing is defined by academics as having a high stock price relative to the stocks’ fundamentals (such as their revenue).

Momentum is what you should buy when you want to buy growth.

By the time you know a sector or stock is hot, that’s likely because it’s gone up a lot over the last year.

Momentum will systematically buy that for you, and then get you out when the price begins to slow (or moves down).

Dynamic!

If you buy a growth strategy to own “the hot stocks” there’s no strategy to get out of those growth stocks when those stocks begin to go down.

Not dynamic!

Historically, with growth you would have underperformed the market over the long term.

And historically, with momentum, you would have outperformed the market.

And for one quick side tangent, a big misunderstanding of value is that they’re slow growth companies.

Which is not true.

Value stocks can be fast growing too.

They’re just generating good earnings and at a fair price.

But that’s enough of my side tangent.

Back to momentum!!

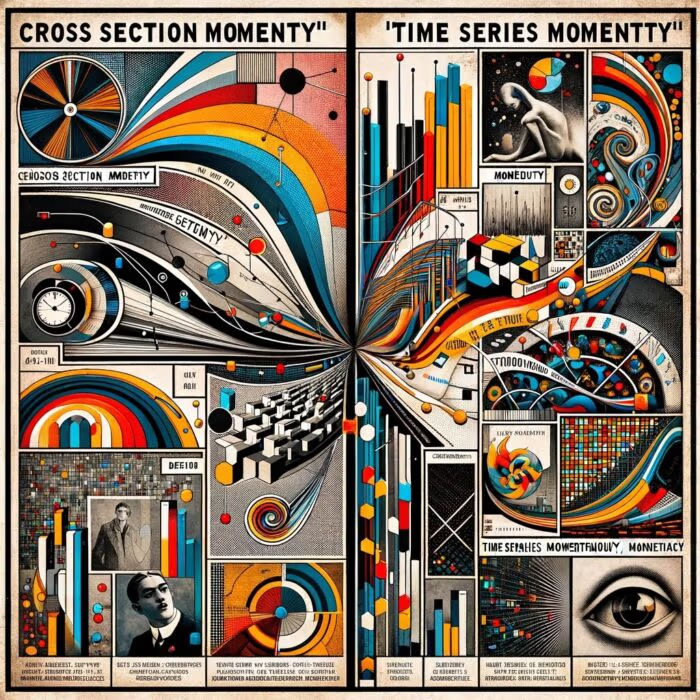

Cross-Sectional Momentum vs Time-Series Momentum

If we could continue with a bit of “geek speak” what is the difference between cross-sectional momentum versus time-series momentum strategies?

As a follow-up, do you have a preference between one over the other or do you see both as equally important?

Academics are really good at using complicated wording that makes it harder to understand things.

This is one of those examples! [ducks]

And it’s also made more complicated because a lot of these academic terms are based on long/short strategies.

But very few investors apply long/short investing in the real world.

Long/short is good for academics to reach conclusions.

Since most investors don’t do that though, I’ll try and keep the conversation to long only investing.

Cross sectional momentum: Let’s call that relative momentum.

Time Series Momentum: Let’s call that absolute momentum.

Relative momentum is what I described earlier.

You’re buying whatever stocks are strongest.

Maybe you’re buying stocks that “only” went down 10% when the rest of the market is down 30%, or maybe you’re buying stocks that are up 100% when the market is up 30%.

Either way, you’re buying whatever stocks are strongest relative to the others.

Absolute momentum is when you buy things that are going up and don’t buy things that are going down.

In that previous example then, you’d buy stocks whether they had a 30% return or a 100% return, but you wouldn’t buy the stocks that had a negative 10% or negative 30% return.

Most of the better known investment strategies use relative momentum for long only strategies, though there certainly is a niche of absolute momentum strategies investors can access.

Source: Alpha Architect on YouTube

Momentum as a “Persistence” Equity Factor

Momentum is unique and on its very own island, given that compared to the five other equity factors it is the only one categorized as a “persistence” factor.

Minimum volatility, Yield and Quality are “defensive” factors.

Value and Size are “pro-cyclical” factors.

What makes momentum unique in this regard (having its own category) and when can we expect it to perform well versus struggle given its distinct characteristics in a full market cycle.

Academics hate questions like this.

It’s not precise.

But you’re in luck because I’m not an academic.

I’m going to give you a not 100% precise answer, but that is fairly practical from my experience.

When momentum does well and when it does poorly: When things are going on big runs.

The longer things run, the crazier they get, the harder it is to ignore your FOMO (fear of missing out) and eventually people concede and buy in to the hot thing…which sends the prices higher.

This is why I say momentum is what you should buy when you want to buy growth.

I used to have to give examples from the past of that.

I’d talk about how in 2000 *if* our momentum strategy was around you’d be buying the booming tech stocks.

And then *if* our strategy was live in 2001 you’d switch and own utilities stocks and whatever other “boring” stocks were now going up the most.

But I don’t have to give hypothetical, backtested, answers anymore.

We just lived our very own growth stock mania!

Around August 2020 we owned the “stay at home” stocks like Zoom, Peloton, Tesla, etc.

We even owned Microstrategy: the company that used a combination of debt and equity to buy bitcoin and hold it on its balance sheet.

It’s a terrible business model, no matter what your views on bitcoin are.

I’d say the same thing if you were leveraging up a publicly company to buy gold.

You’re supposed to be an operating company.

Earning money for doing something.

If I want to buy a commodity, I’ll buy it right?

Anyway…we bought that stock in BACK TO BACK quarters!

I wanted to puke the second time seeing us buy it AGAIN.

You are confident it’s not going to end well for owners of the stock.

Fortunately, we aren’t long term owners with our momentum strategy (dynamic!) and we actually made money for our investors in owning it.

And another benefit, we gave our investors help on the behavioral side of things by buying into the mania for them, and having a strategy to get them out when the mania stopped.

Over the next few quarters as the mania started to die, we rode down a lot of those stocks too.

There’s no magic there.

Momentum is going to take it on the chin right along with the growth stocks when the slide starts.

BUT…over the next couple quarters, we were able to rotate out into the new strongest stocks (energy and financials), while growth stock strategies continued to own the egregiously overvalued growth stocks.

In short then, it does good when it’s riding a strong trend (2000 tech bubble/ 2020-2021 stay at home bubble).

It does poorly when those bubbles pop.

BUT…for our clients who owned through the whole cycle, it was a great ride because it really helped behaviorally, and got you out of the growth stocks and into energy before you fully rode the growth stocks down.

Turnover is key with momentum strategies.

Barbell Strategy: Momentum + Value

Momentum, as an equity factor, is considered to be by some a perfect building block for a barbell strategy that can be paired with uncorrelated factors such as value and/or minimum volatility.

Can you explain what makes momentum such an attractive factor from this standpoint?

Smoothing out of returns?

Potential rebalancing alpha?

Momentum, historically, has higher expected returns than the stock market at large.

That’s the first thing that makes it attractive.

Momentum also has fairly uncorrelated returns (for a long-only strategy) to value stocks.

More uncorrelated + higher historical returns than seemingly any other major factor make it the ideal partner (in my opinion) to value investing.

Value and momentum are the varsity factors.

Everything else is on the JV team and can be good for refining once you’re already doing value and momentum.

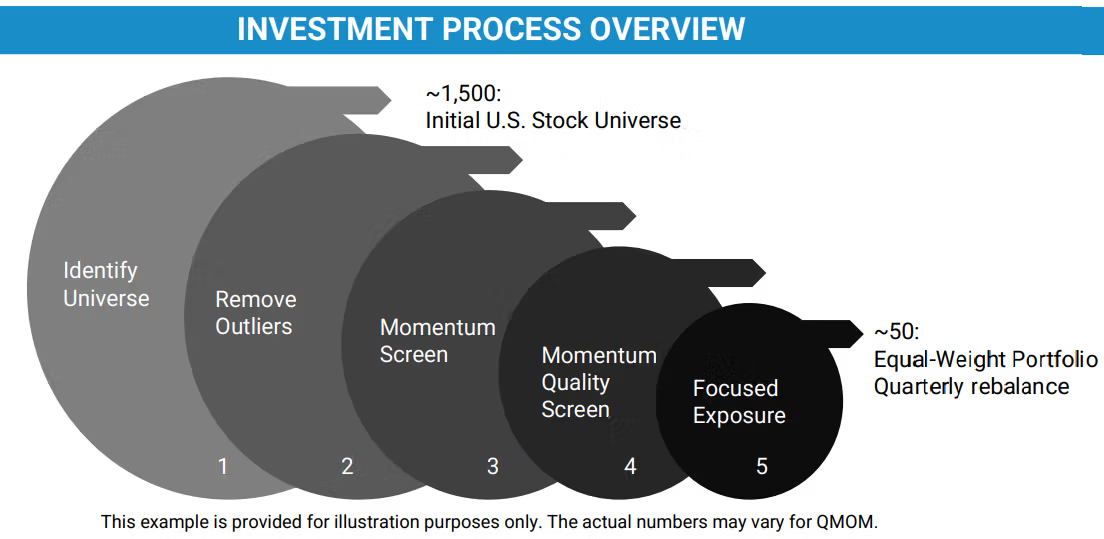

Alpha Architect 5 Step Momentum Screening Process

Over at Alpha Architect, you’re renowned for your rigorous 5-step process of starting from Identifying a Universe to a Focussed Exposure of 50 positions.

Can you describe this process in detail and also identify what you mean by “frog in the pan” differentiated momentum exposure and your decision to key in on concentrated exposure.

Additionally, what is it about your high conviction strategy of 50 positions that you’re most excited about versus say 100, 250 or 500?

Yes, you can read about the 5 step process for our momentum strategy here.

In short though, step 1 with any strategy is deciding what universe of stocks you’re going to be targeting.

In our case, we choose the top 1500 stocks in the US or International Developed (depending on the strategy).

That is a range of small, medium, and large market cap stocks.

We want access to as many stocks as possible to run through our screens so we can pick the stocks with the best characteristics and not be limited by their market cap (such as picking from small cap universe only).

This is because we feel what matters most is the momentum characteristics of stocks before their size by market cap.

We exclude any that are too illiquid because we want our clients to be able to get in and out with less friction and to keep our trading costs as low as possible.

Step 2: We implement negative screens here to remove stocks that have very bad characteristics, regardless of what their 2-12 momentum is.

We kick out high beta stocks.

And we get out stocks in the 5% worst 6 and 9 month momentum scores.

Stocks can every now and then have good 2-12 momentum and bad 6 or 9 month momentum.

We don’t want those.

The market knows something!

Step 3: Now we get to the primary screen.

We screen the remaining stocks on their 2-12 momentum.

We remove the most recent month because there seems to be a “dead cat bounce” effect for stocks that have gone down a lot where they “bounce” up for 1 month.

We take the top 100 stocks on 2-12 momentum then.

Step 4: From the highest 100 momentum stocks, we then apply the “Frog in the Pan” screen to them.

Said simply, we want to own the lower volatility momentum stocks.

We want to own the hypothetical sneaker company that’s gone up a little bit each day for the last year, as opposed to the hypothetical biotech company that just discovered some new drug and went up 400% the day before we run our screens.

We then select, from the 100 highest momentum stocks, the 50 with the lowest volatility.

Step 5: Finally, we take those 50 stocks and equal weight.

We are systematic investors attempting to own a basket of stocks with the best characteristics we can find.

We don’t care much for each stock on its own, so we don’t want to overweight or underweight any of them.

Then we rebalance our strategies quarterly.

A frequent rebalance is very important for running a momentum strategy.

The ETF wrapper is even more important then for running an ETF strategy as it allows us to kick out little, if any, capital gains distributions when we rebalance.

This matters because if you tried to run a high turnover momentum strategy in another wrapper (mutual fund or owning single stocks) you would likely generate high capital gains distributions OR make the choice of not turning over the strategy as much as the research guides you to do so.

Either way, doing momentum in anything but an ETF forces you to make suboptimal decisions.

ETFs really are a better technology!

Some firms are slow to accept this (or have other motivations to intentionally be slow on the uptake).

But not your readers.

Now they know!

QMOM and IMOM = Mid-Cap Equity Exposure

When I examine your US and International Developed Quantitative Momentum ETFs (Tickers: QMOM and IMOM), with a third-party screener, I’m noticing a strong mid-cap exposure, low P/E and very high historical earnings percentage relative to its category average.

What are some of the advantages of focussing on these specific characteristics versus other momentum funds which tend to be more large-cap centric and higher P/E in nature?

The advantage is that we believe Momentum (and Value) are where you should start when screening for stocks to own to generate the highest, sustainable, compounded returns.

We start there then, as opposed to starting with the market cap of the stocks (as most firms do for reasons of either trying to build more scale into their funds, to be able to offer more funds to sell, or a combination of both).

That leads to our starting universe being large, mid, and small caps.

We then equal weight because our goal as systematic factor investors is to own a basket of stocks, not to take heavier bets on single stocks (which you would be doing by market cap weighting).

An outcome of equal weighting large, mid, and small stocks is it causes our average weight to be mid cap.

Which makes sense!

But it also leaves us open to going where the strongest momentum is.

To use an extreme example to make the point, say next year all small caps had a return of zero percent for a year, and large caps had a return of 100%.

Then we could go own only the large caps and not be dictated by market cap.

We’ll go where the strongest momentum is!

And our low P/E is created by the dynamic-ness of our momentum strategies (frequent rebalance).

Right now, the strongest stocks are energy stocks.

Next quarter it could be tech stocks again.

We’ll go wherever the strength is.

Source: Flirting with Models on YouTube

Why Does Momentum Outperform and Generate Excess Returns?

Momentum is one of the least understood factors in terms of a clear explanation as to why it outperforms and generates excess returns.

One camp suggests investors are compensated for bearing higher risk; while others are of the opinion it’s due to market inefficiencies produced by delayed price relations.

Where do you stand in terms of explaining the secret sauce of “momentum” in terms of the reason it is one of (if not) the strongest equity factors?

I grew up in the practitioner world.

I like the behavioral based explanation as “humans are gonna human”.

Momentum seemingly works just about everywhere you look.

All these different data sets from all different asset classes it seemingly works.

Researchers got their hands on Imperial Russia stock market data from the 19th century.

It was great because it was untouched data (out of sample in geek terms).

And what do they find?

2-12 momentum does great.

It’s also sometimes easier for me to think about this another way.

Rather than worrying about whether it’s a risk-based explanation or a behavioral based explanation, I say to anyone who doesn’t believe it works, “you’re betting that just about every piece of data we can get our hands on from human history is wrong.”

I don’t like those odds.

They could be right!

But I don’t like that game.

The one thing investors must keep in mind is a firm saying their doing momentum, doesn’t make it so.

We, at Alpha Architect, attempt to adhere as closely as we can (balancing real world costs) to the academic research this whole discussion is based on.

Most strategies that have momentum in their name do not do that.

Why Is Momentum Investing Not More Popular?

Momentum strategy mutual funds and etfs, from various providers, generally don’t attract as much AUM as value strategies.

What are some of the “best ideas” you have over at Alpha Architect to help inform, educate and promote momentum as a factor strategy worth potentially including in portfolios?

As a follow-up, are you aware of momentum based investing groups or clubs?

It seems value investing has all of this and more but I’m woefully unaware of something similar for momentum strategies.

Momentum is just newer.

It hasn’t had the same amount of time to get the mindshare that value investing has.

Even more importantly though, the ETF wrapper is really what makes momentum investing possible for taxable investors (as I described earlier in this piece).

Put those two “new” things together, and that’s what it doesn’t have the mind share.

Little by little word is getting out though!

Financial Twitter or the Rational Reminder community are areas where momentum is vigorously debated and accepted by some.

Source: Cboe Global Markets on YouTube

VMOT = My Favourite Alpha Architect Fund

My favourite fund you offer at Alpha Architect, Value Momentum Trend (Ticker: VMOT), is listed as an “alternative” sleeve offering.

It has all four of your main equity strategies under the hood (US + International Value/Momentum ETFs) plus a trend-following market-cap

beta hedge (full-partial-none).

What are you hoping to achieve with this strategy?

How does combining momentum and trend-following hedges enhance potential returns while mitigating risk?

Our long only strategies (QVAL, IVAL, QMOM, and IMOM) are going to be heavily dependent on the beta of the stock market.

If the stock market is generally going up, these are generally going to be going up.

If the stock market is generally going down, these are going to be generally going down (as is the case for just about any long only strategy).

That’s good.

Because with all of this talk on factors it’s good to remind everyone that beta is likely the biggest factor.

Though even beta can suffer long time periods of zero returns though (as in the 2000’s).

Our VMOT ETF, owns those four long only ETFs, but has the ability to go short SPY and EFA against them if the beta of the stock market is trending poorly.

The goal there is to hopefully remove the big draw downs (25%+) while still giving you a good bit of upside from the beta, value, and momentum factors.

We also recently added a relative momentum screen in there.

VMOT will own in rank order our ETFs by their relative momentum.

If value is doing well, and US stocks are doing well, that likely means QVAL will have the highest weighting.

If momentum is doing well, and international stocks are doing well, that could mean IMOM has the highest weighting.

Bucket-List Travel Activity

Thanks so much Ryan!

Let’s end things off with something a little bit light.

As a travel media specialist, I love finding out the ultimate dream destination and bucket-list activity of guests on this blog.

Where would you love to go and what would you do if you had an all-expenses paid trip (on someone else’s dime) dangling in front of you right now?

The trip I’d love to make is to the 2023 Ryder Cup (Golf event) in Rome, Italy.

My wife is Italian and has never been to Italy. I like golf and activities (as opposed to sitting on a beach all day).

That trip would be a great compromise for the both of us!

Quantitative Momentum Investing Strategy with Ryan Patrick Kirlin — 12-Question FAQ

1) What is momentum investing (and how is it different from growth)?

Momentum is the tendency for recent winners to keep winning over the near term. In practice, you buy what’s been strongest over a defined lookback (e.g., last 12 months, skipping the most recent month) and rotate away when strength fades. Growth, by contrast, is about expensive fundamentals (high price relative to earnings/sales). Momentum is price-based and dynamic; growth is character-based and static.

2) What’s the difference between cross-sectional and time-series momentum?

Cross-sectional (“relative”) momentum ranks a universe and buys the strongest vs. peers. Time-series (“absolute”) momentum buys assets whose own trend is positive and avoids those trending down. Long-only equity momentum funds most commonly use relative momentum; absolute momentum is more common in multi-asset/trend approaches.

3) When does momentum tend to shine or struggle?

Momentum excels during extended trends and manias (it systematically owns what’s working) and then suffers in sharp regime changes/whipsaws as leadership flips. Over full cycles, the ability to rotate from fading leaders into new strength is the durable edge.

4) Why pair momentum with value in a “barbell”?

Long-only momentum and value have complementary, low correlations and both have shown historically elevated expected returns. Together they can smooth the ride (diversification) and create rebalancing opportunities—value buys what’s cheap, momentum rides what’s strong.

5) How does Alpha Architect’s 5-step momentum process work?

Define the universe (top ~1,500 US or ex-US developed; remove illiquid names).

Quality/behavioral negatives: drop high-beta names and the worst 6/9-month performers.

Primary rank: 2-to-12-month return (skip month 1) → top 100.

“Frog-in-the-Pan” filter: prefer smoother, steadier momentum and avoid one-day rockets → select 50.

Equal-weight & quarterly rebalance (ETF wrapper helps with tax efficiency despite turnover).

6) What is “Frog-in-the-Pan” momentum?

It prioritizes consistently compounding winners (many small up days) over lottery-like spikes (one huge jump). The aim is a cleaner, lower-volatility expression of momentum.

7) Why concentrate in ~50 positions instead of 100–500?

Momentum’s edge comes from owning the strongest signals. A 50-stock, equal-weighted sleeve targets higher factor purity and avoids diluting exposure with middling names, while still diversifying idiosyncratic risk.

8) Why do QMOM/IMOM often look mid-cap with lower P/Es?

Starting from signals first (not a market-cap bucket) plus equal-weighting naturally tilts average exposure toward mid-caps. Frequent rebalances into current leadership (recently, energy/financials) can also lower portfolio P/E vs. growth-heavy momentum variants.

9) Why does momentum earn excess returns?

Two main lenses:

Behavioral: investors under-react/over-react and chase late; trends persist before eventually reversing (“humans gonna human”).

Risk-based: momentum may bear distinct risks (e.g., crash risk in reversals).

Empirically, momentum shows up across eras and markets, supporting a durable effect.

10) If momentum “works,” why isn’t it more popular?

It’s newer in mindshare vs. value, and its turnover/tax profile historically made it hard to run outside ETFs. Even now, many “momentum” products water down the signal. Education and better wrappers are improving adoption.

11) What is VMOT (Value-Momentum-Trend) trying to achieve?

VMOT combines AA’s four long-only factor sleeves (US/Intl value + momentum) and overlays a trend-based beta hedge (can short broad US/international equity beta when trends deteriorate). Goal: keep the factor upside while mitigating big equity drawdowns; weights tilt toward the sleeves with stronger relative momentum.

12) What practical considerations should investors know?

Momentum requires discipline with regular rebalancing, acceptance of higher turnover, and tolerance for regime-shift pain. The ETF wrapper helps with trading and tax efficiency, but success still depends on sticking to process through inevitable rough patches.

Connect with Ryan on Social Media

Finally, how can people connect with you online across all of your various social media platforms?

You can follow me on twitter @RyanPKirlin or visit our site at alphaarchitect.com.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.