I’ve connected online with mostly value investors and even though I’m a diversified factor investor, if push came to shove, I identify far more on the left side of the equity style box than I do the right.

Yet that doesn’t mean I’m not intrigued by growth investing.

However, I do have the usual objections that most non-growth investors have towards being on the right hand side of the style box.

Typically high valuations.

FANGMA.

The awareness that growth investing is often prone to significant boom and bust cycles.

Narrative based investing.

Many of the stocks you’ll find in growth funds are companies that are more prone to investor exuberance.

Taking a quick glance at Vanguard Growth ETF it is Apple, Microsoft, Amazon, Tesla and Google holding the top current positions.

Now contrast that with a Minimum Volatility strategy such as USMV ETF with two of its top 10 positions being Waste Management Inc and Waste Connections Inc.

But what about a growth strategy that avoids higher P/E equities with stretched valuations?

AKA GARP.

Well, that’s the exact growth investing strategy what we’ll be reviewing today here on Picture Perfect Portfolios.

Invesco S&P 500 GARP ETF.

Ticker SPGP ETF.

It’s a fund that operates in the S&P 500 universe of large cap companies that selects 75 positions out of a potential 500 candidates that best fulfill its growth at a reasonable price mandate.

The fund has a considerably lower P/E than both the S&P 500 and especially Vanguard Growth ETF.

And you won’t find any FANGMA in its top 10 positions either.

Regeneron Pharmaceuticals Inc, Cigna Corp and Everest Re Group Ltd are its current top 3 holdings.

Let’s find out what makes this fund an alternative to typical growth investing strategies and if it has a potential place in a diversified factor focused portfolio.

Invesco S&P 500 GARP ETF Review (Growth at a Reasonable Price) | SPGP ETF Review

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Invesco ETFs: Greater Possibilities Together

Invesco is a fund provider I’m quite familiar with.

They’re obviously more well known for US listed ETFs (especially QQQ ETF) but they have a strong presence in Canada as well.

In fact, they offer two of my favourite funds north of the border.

PLV.TO – Invest Low Volatility Portfolio ETF

PWZ.TO – Invesco FTSE RAFI Global Small-Mid ETF

PLV offers investors a globally diversified asset allocation fund with a fund of funds approach to low volatility strategies.

PWZ packs globally diversified small and mid cap exposure with a RAFI fundamental index strategy.

However, one of the key differences I’ve noticed between the Canadian roster of ETFs and those in the US is the amount of S&P 500 products on offer.

Invesco offers a bonanza buffet of options for investors who are not satisfied with merely a S&P 500 market cap weighted straight shooter approach.

And the fund we’re reviewing today (SPGP ETF) is part of its impressive overall roster of S&P 500 Universe ETFs.

Invesco S&P 500 Fund List

RSPE ETF – Invesco ESG S&P 500 Equal Weight ETF

EQWL ETF – Invesco S&P 100 Equal Weight ETF

SPGP ETF – Invesco S&P 500 GARP ETF

SPMV ETF – Invesco S&P 500 Minimum Variance ETF

QVML ETF – Invesco S&P 500 QVM Multi-factor ETF

RWL ETF – Invesco S&P 500 Revenue ETF

SPVM ETF – Invesco S&P 500 Value with Momentum ETF

SPVU ETF – Invesco S&P 500® Enhanced Value ETF

RSP ETF – Invesco S&P 500® Equal Weight ETF

SPHB ETF – Invesco S&P 500® High Beta ETF

SPHD ETF – Invesco S&P 500® High Dividend Low Volatility ETF

SPLV ETF – Invesco S&P 500® Low Volatility ETF

SPMO ETF – Invesco S&P 500® Momentum ETF

RPG ETF – Invesco S&P 500® Pure Growth ETF

RPV ETF – Invesco S&P 500® Pure Value ETF

SPHQ ETF – Invesco S&P 500® Quality ETF

XLG ETF – Invesco S&P 500® Top 50 ETF

XRLV ETF – Invesco S&P 500® ex-Rate Sensitive Low Volatility ETF

Holy Mother of Molly!

I think the only thing missing is a S&P 500 fund where a monkey spins a wheel to select 50 random holdings at 2% position sizes.

SPIN ETF.

Terrible jokes aside, I’ll interject my personal bias by saying I’d probably go with just about any of these funds over the market cap weighted S&P 500.

Let’s get back on track here.

The Case For Growth At A Reasonable Price

We already covered three of the main reasons why someone might consider GARP (Growth At A Reasonable Price) vs a typical Growth Strategy.

GARP Avoids These 3 Things

- High P/E Companies

- High Valuations/Volatility and Low Yield/Quality

- Narrative / FOMO Based Investing

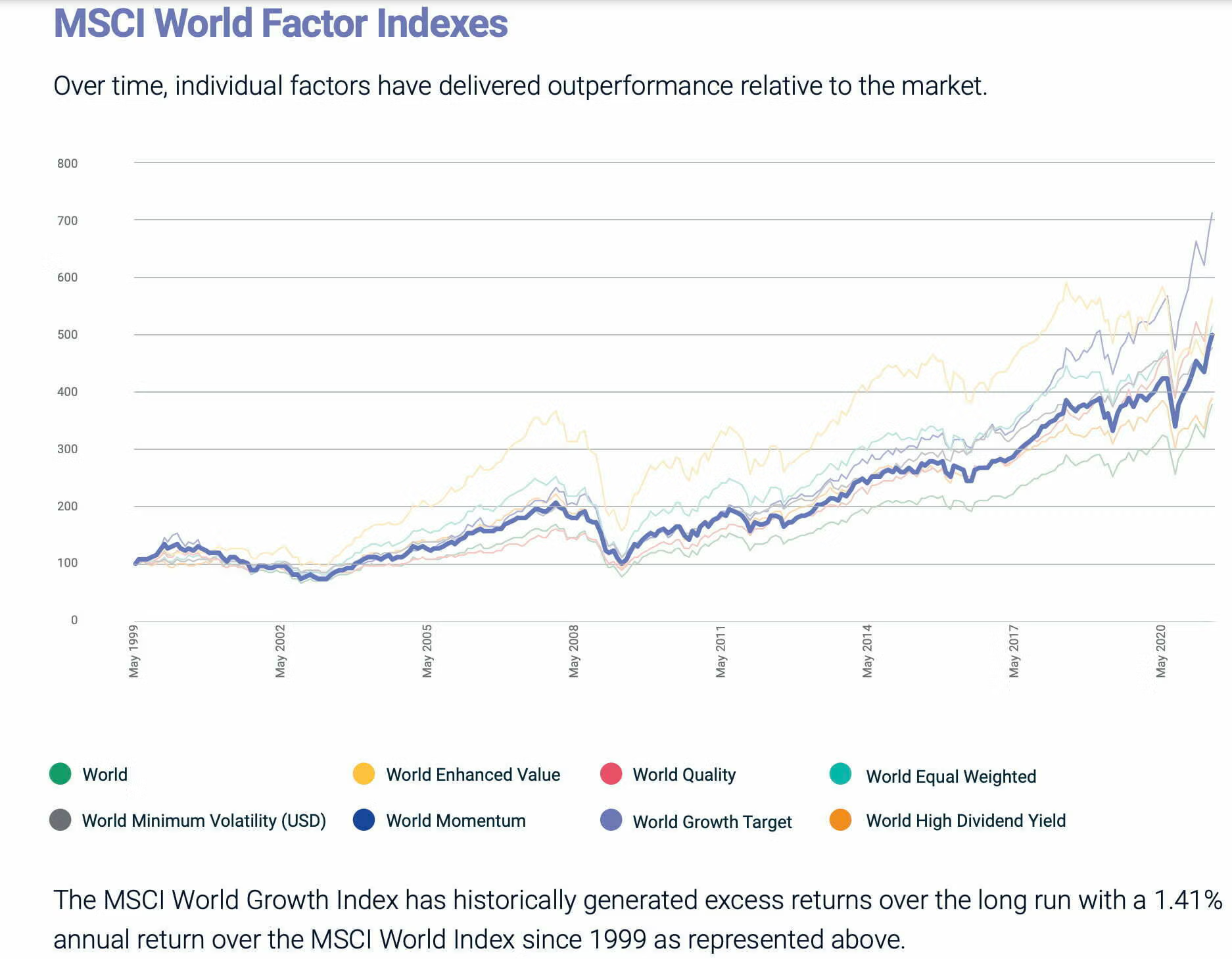

MSCI “Growth” Factor in Focus does a great job highlighting these concerns.

“One challenge capturing growth through simple selection models can be the impact of unintended exposure, which demonstrate that assets with high growth may also have high valuations, high volatility, low yield and low quality, which may negatively affect the performance of a portfolio.

MSCI’s growth target index controls for unintended risks and exposures and extends the concept of growth at a reasonable price (GARP) to seek a reasonable level of volatility, yield and quality.

Growth at a reasonable price (GARP), a concept long employed by growth investors, seeks to avoid paying too much for the potential growth of a stock.

The GARP concept can be extended by controlling the level of value exposure—ensuring the long-term premium for growth is not eroded by the unintended and incidental impact of securities with high valuations— i.e. negative exposure to the value factor.”

Why Investors Consider Growth Strategies

They then go on to give a great explanation as to why investors have used growth strategies:

Growth is a recognized investment strategy and has a high explanatory power in risk forecasting, as shown in risk models.

The pure growth factor, independent of exposure to other style or industry factors, has shown an attractive longterm return compared to MSCI ACWI Index as well as low or negative correlation with other factors which may help diversify a multi-factor portfolio by reducing short-term cyclicality.”

A lot of investors may be surprised to see that “Global Growth” has outperformed its “Global Market Cap Weighted” parent index.

However, I’m most interested in comparing the results of GARP vs PURE GROWTH.

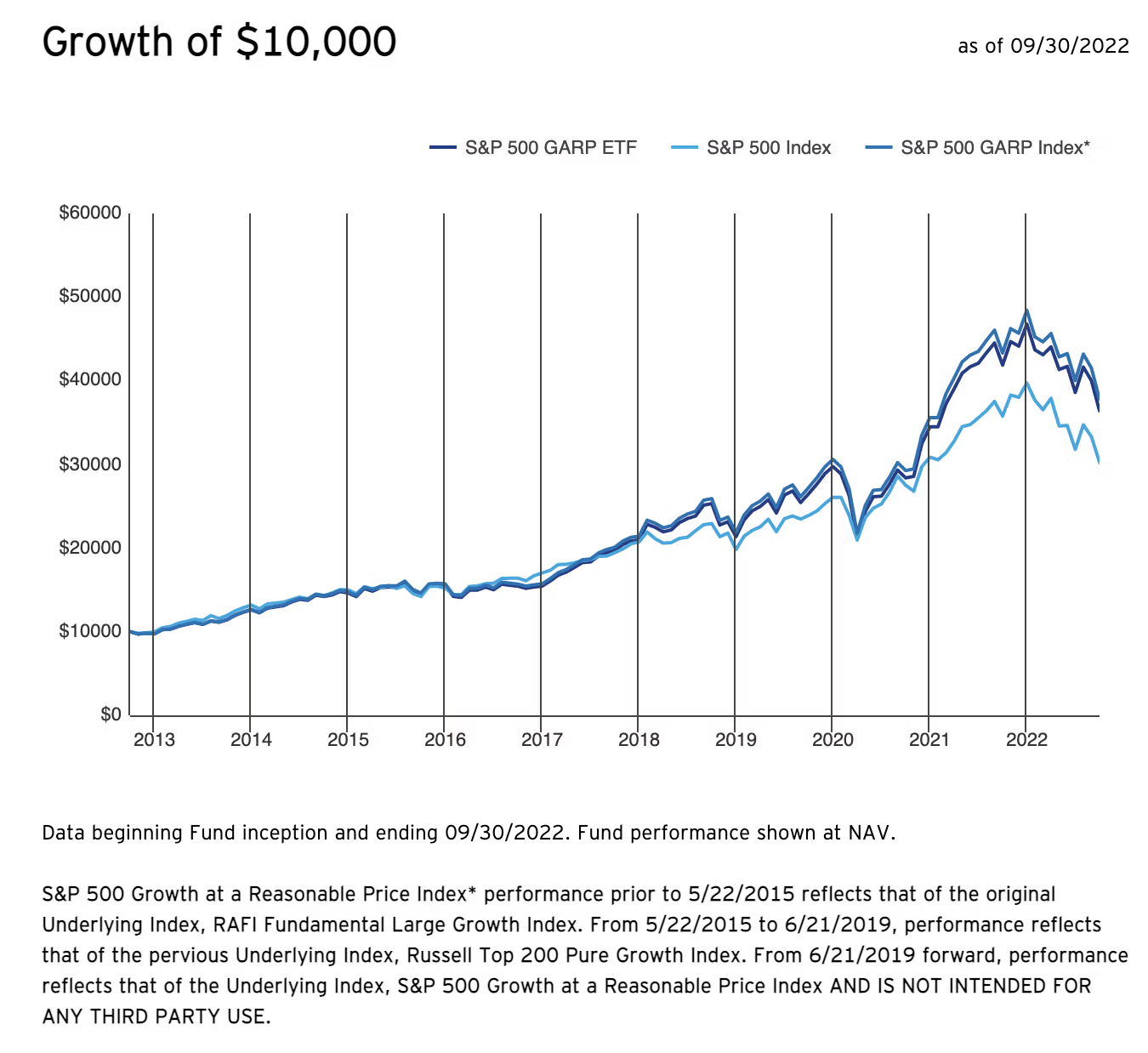

Noteworthy is that ticker SPGP has changed its index/strategy three times since inception.

It is only from 6/21/2019 that it has been using the S&P 500 GARP strategy as previously it was Russell Top 200 Pure Growth and before that RAFI Fundamental Large Growth (notice the fine print on the graph below).

With this in mind we’ll only look at data from September 2019 onwards.

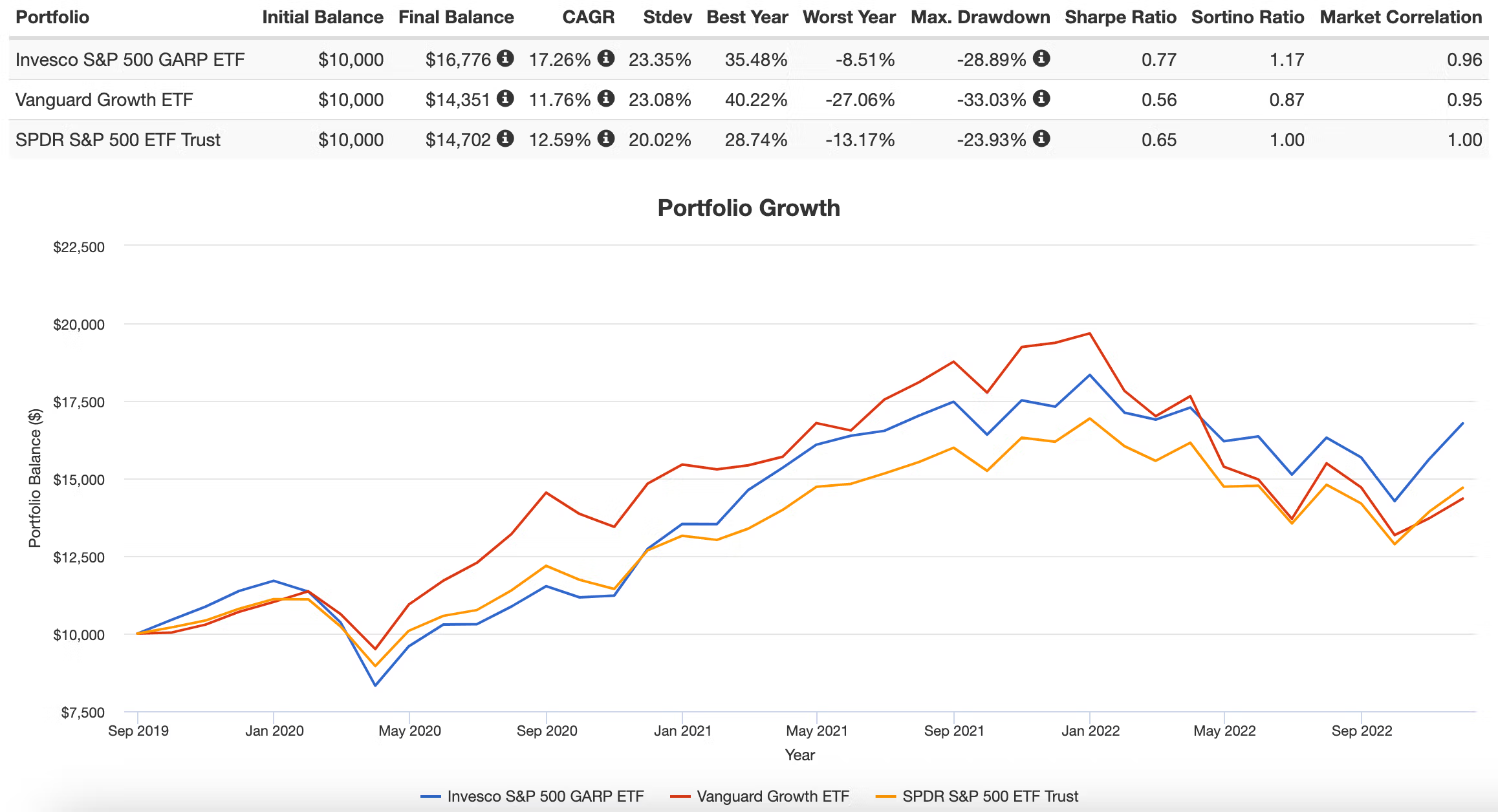

SPGP vs VUG vs SPY Long-Term Performance

Invesco S&P 500 GARP ETF has considerably outperformed Vanguard Growth ETF and SPY ETF since inception.

It has had a CAGR of 17.26% vs 11.76% (VUG) vs 12.59% (SPY).

Its outperformance can mostly be explained by what it has been able to accomplish in 2022.

Let’s zoom in to take a closer look.

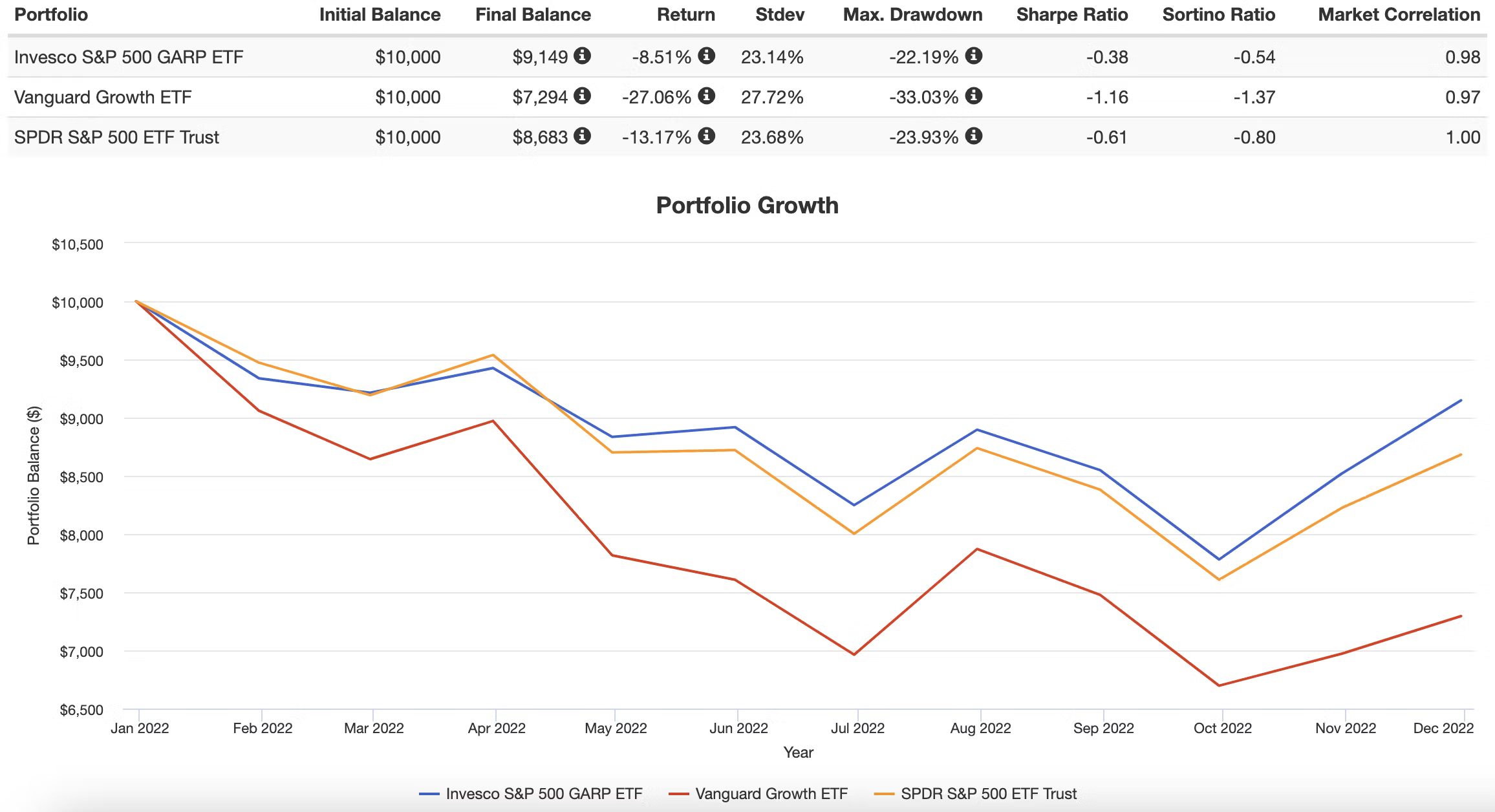

SPGP vs VUG vs SPY 2022 Performance

Indeed, Invesco S&P 500 Growth At A Reasonable Price ETF has been the most defensive in 2022.

Why?

It may have a lot to do with the fund having generally lower P/E and other valuations compared to the other two funds.

More on that later.

SPGP ETF Overview, Holdings and Info

The investment case for the “Invesco S&P 500 GARP ETF ” has been laid out succinctly by the folks over at Invesco ETFs: (fund landing page)

“The Invesco S&P 500 GARP ETF (Fund) is based on the S&P 500 Growth at a Reasonable Price Index (Index).

The Fund will invest at least 90% of its total assets in the component securities that comprise the Index.

The Index is composed of approximately 75 securities in the S&P 500® Index that have been identified as having the highest “growth scores” and “quality and value composite scores,” calculated pursuant to the index methodology.

The Index constituents are weighted based on their growth scores. The Fund and the Index are rebalanced and reconstituted semi-annually.”

We’re able to see clearly that the fund will select 75 securities from the S&P 500 universe with the highest “growth scores” and “quality and value composite scores” rebalanced semi-annually.

Let’s dig in a bit deeper to find out more about its growth, quality and value scoring process via the fund’s prospectus:

Growth, Quality and Value Scores

“A stock’s growth score is the average of its: (i) three-year earnings per share (“EPS”) growth, calculated as a company’s three-year EPS compound annual growth rate and (ii) three-year sales per share (“SPS”) growth, calculated as a company’s three-year SPS compound annual growth rate.

Stocks are ranked by growth score and the top 150 stocks remain eligible for inclusion in the Underlying Index.

The Index Provider then calculates a quality/value (“QV”) composite score for each of the remaining 150 stocks.

A stock’s QV composite score is the average of its: (i) financial leverage ratio, calculated as a company’s latest total debt divided by its book value; (ii) return on equity, calculated as a company’s trailing 12-month EPS divided by its latest book value per share; and (iii) earnings-to-price ratio, calculated as a company’s trailing 12-month EPS divided by its price.

In accordance with the Underlying Index methodology, the remaining 150 stocks are ranked by QV composite score and the top 75 stocks are selected and form the Underlying Index.”

Let’s boil that down to the basics.

- Growth Score: EPS + SPS (3 year earnings per share + 3 year sales per share)

- QV Score: Financial Leverage Ratio (Debt / Book Value) + Return On Equity (12-month EPS / Book Value Per Share + Earnings To Price Ratio (12 month EPS / Price)

To summarize the fund screens specifically for earnings per share, sales per share, financial leverage, return on equity and earnings to price ratio.

Invesco S&P 500 GARP ETF: Principal Investment Strategy

To better understand the process of how the fund operates, let’s turn our attention towards the prospectus where I’ve summarized the key points at the very bottom (source: summary prospectus).

Principal Investment Strategies of the Fund

“The Fund generally will invest at least 90% of its total assets in securities that comprise the Underlying Index.

Strictly in accordance with its guidelines and mandated procedures, S&P Dow Jones Indices LLC (“S&P DJI” or the “Index Provider”) compiles, maintains and calculates the Underlying Index, which is designed to track the performance of approximately 75 growth stocks in the S&P 500 ® Index with relatively high quality and value composite scores, which are computed as described below.

In selecting constituent securities for the Underlying Index, the Index Provider first identifies stocks that exhibit growth characteristics by

calculating the growth score for each stock in the S&P 500 ® Index.

A stock’s growth score is the average of its: (i) three-year earnings per share (“EPS”) growth, calculated as a company’s three-year EPS compound annual growth rate and (ii) three-year sales per share (“SPS”) growth, calculated as a company’s three-year SPS compound annual growth rate.

Stocks are ranked by growth score and the top 150 stocks remain eligible for inclusion in the Underlying Index.

The Index Provider then calculates a quality/value (“QV”) composite score for each of the remaining 150 stocks. A stock’s QV composite score is the average of its: (i) financial leverage ratio, calculated as a company’s latest total debt divided by its book value; (ii) return on equity, calculated as a company’s trailing 12-month EPS divided by its latest book value per share; and (iii) earnings-to-price ratio, calculated as a company’s trailing 12-month EPS divided by its price.

In accordance with the Underlying Index methodology, the remaining 150 stocks are ranked by QV composite score and the top 75 stocks are selected and form the Underlying Index.

The Underlying Index components are weighted by growth score and no security will have a weight below 0.05% or above 5%.

Additionally, each sector, as defined according to the Global Industry Classification Standard (“GICS”),will be subject to a maximum weight of 40%.

As of June 30, 2022, the Underlying Index was comprised of 75 constituents with market capitalizations ranging from $ 7.7 billion to $2.12

trillion.

The Fund employs a “full replication” methodology in seeking to track the Underlying Index, meaning that the Fund generally invests in all of the securities comprising the Underlying Index in proportion to their weightings in the Underlying Index.

The Fund is “diversified” under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund may become “non-diversified”

solely as a result of a change in relative market capitalization or index weighting of one or more constituents of the Underlying Index.

Should the Fund become “non-diversified,” it will no longer be required to meet certain diversification requirements under the 1940 Act.

Shareholder approval will not be sought when the Fund crosses from diversified to non-diversified status under such circumstances.

Concentration Policy.

The Fund will concentrate its investments (i.e., invest more than 25% of the value of its net assets) in securities of issuers in any one industry or group of industries only to the extent that the Underlying Index reflects a concentration in that industry or group of industries.

The Fund will not otherwise concentrate its investments in securities of issuers in any one industry or group of industries.

As of April 30, 2022, the Fund had significant exposure to the health care sector.

The Fund’s portfolio holdings, and the extent to which it concentrates its investments, are likely to change over time.”

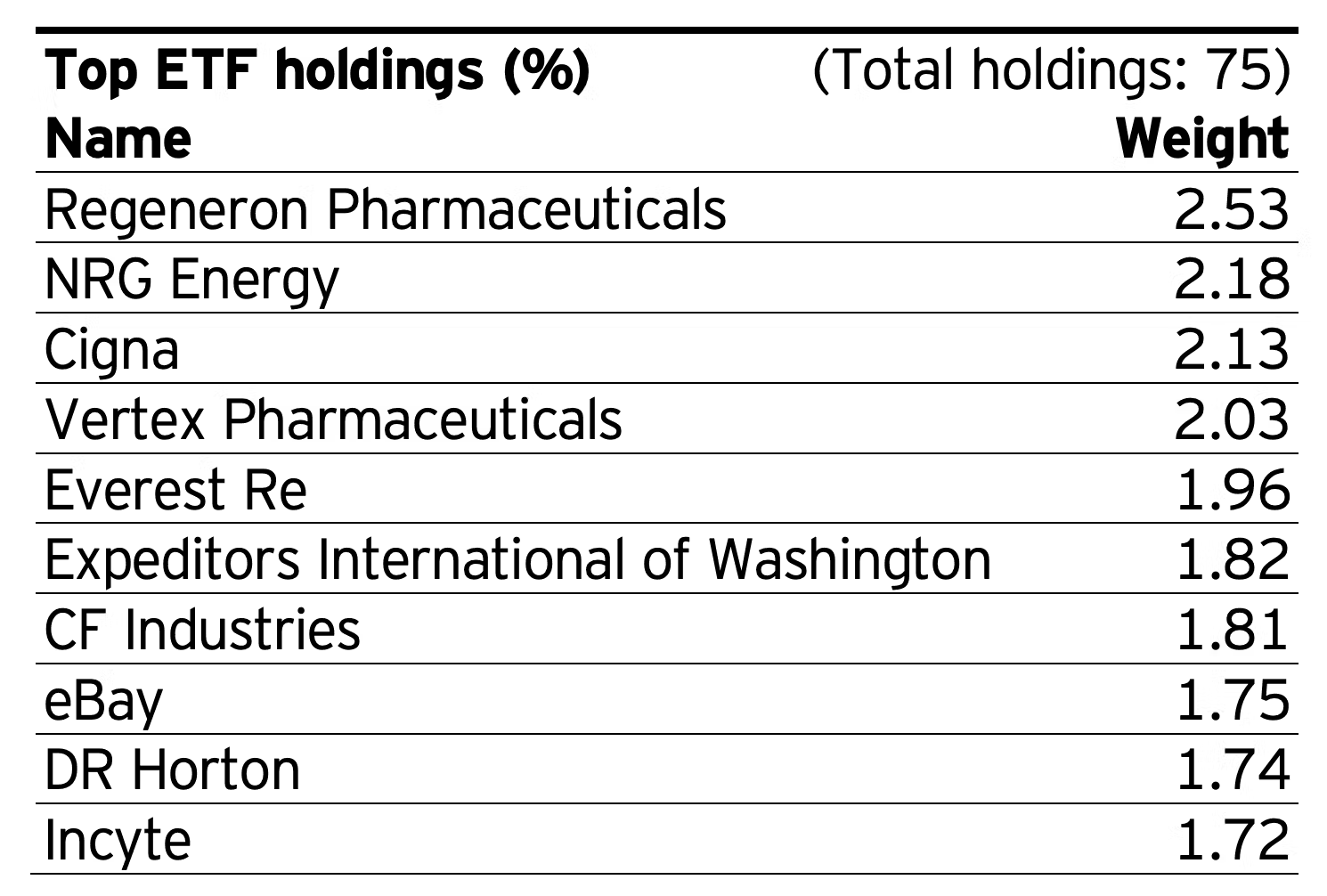

SPGP ETF: Holdings

The Top 10 Holdings in SPGP ETF range from Regeneron Pharmaceuticals at 2.53% at the top position with Incyte at 1.72% as the 10th position.

A couple of immediate observations come to mind!

Firstly, no FANGMA!

At all!

Secondly, I like how the top position has been capped at 2% meaning that the portfolio spreads out nicely amongst its 75 positions.

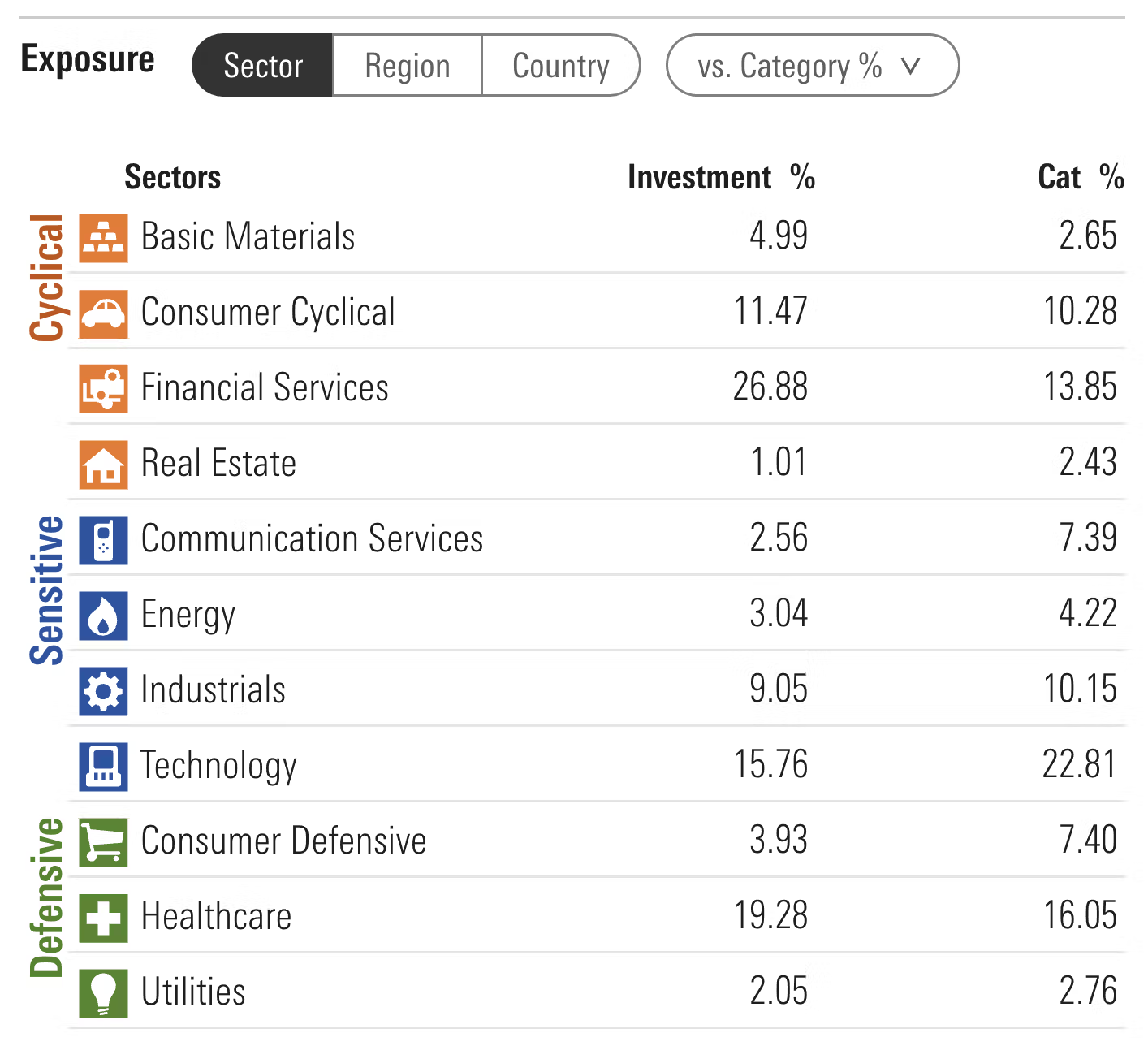

SPGP ETF: Sector Exposure

What immediately jumps out is that SPGP ETF is considerably overweight financial services while being underweight technology.

Healthcare is slightly above category average whereas Consumer Defensive is slightly below.

SPGP ETF Info

Ticker: SPGP

Net Expense Ratio: 0.33

AUM: 1.8 Billion

Inception: 06/16/2011

SPGP ETF – Style Measures

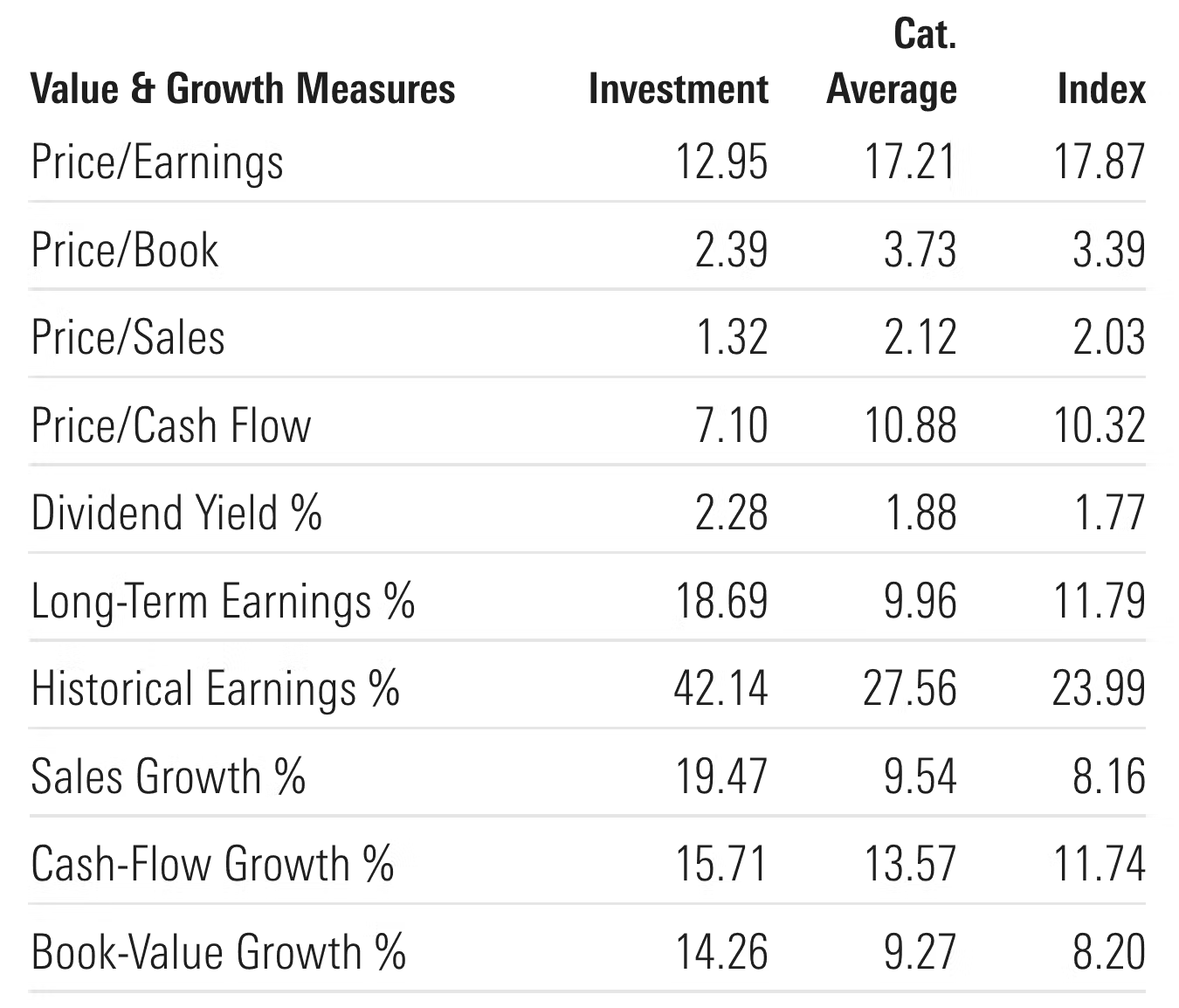

SPGP ETF has favourable measures from a Price/Earnings, Price/Book, Price/Sales and Price/Cash Flow versus its category average where lower is better.

Furthermore, it ranks relatively well from a Dividend Yield %, Long-Term Earnings %, Historical Earnings %, Sales Growth %, Cash-Flow Growth % and Book-Value Growth % where higher is better.

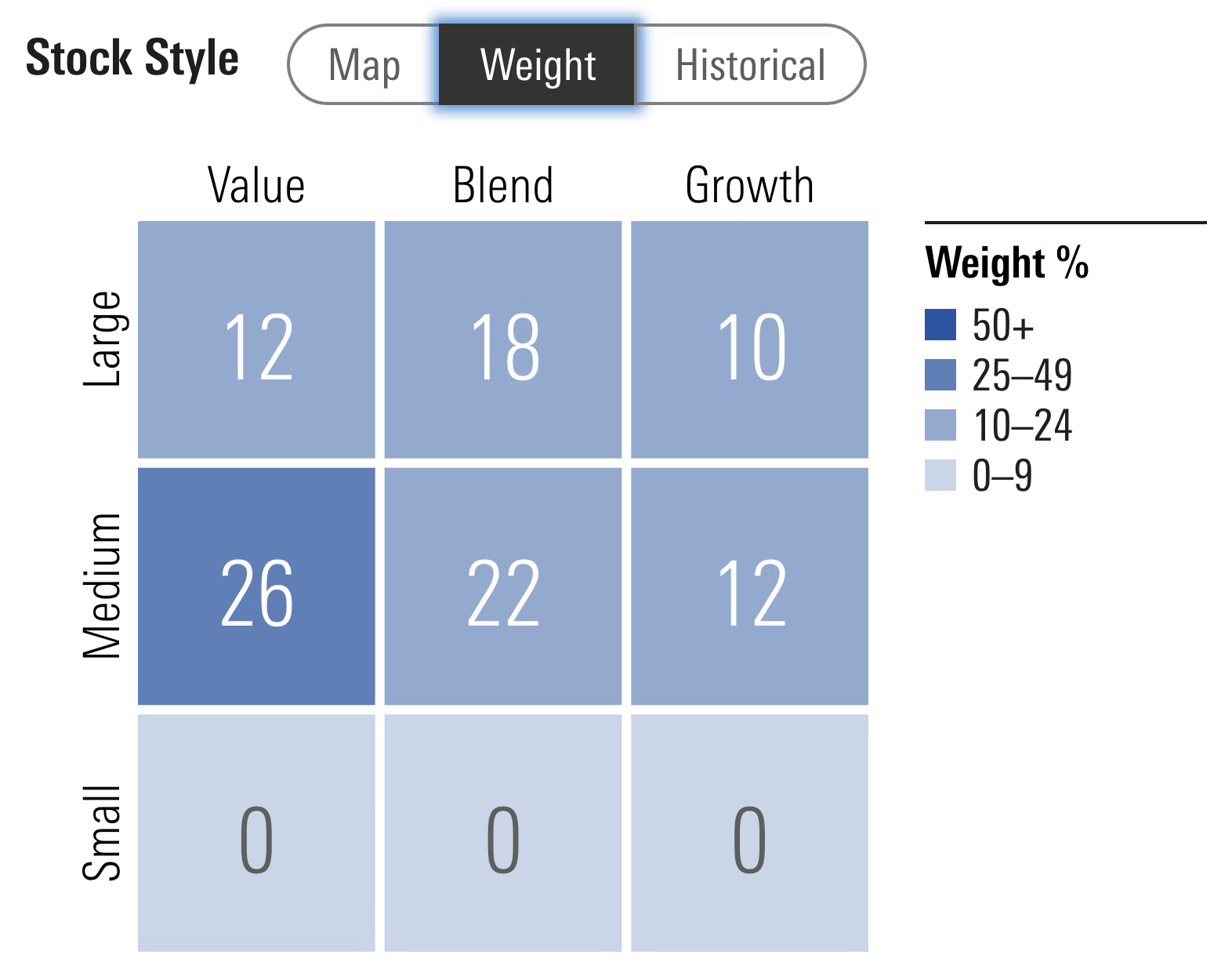

SPGP ETF – Stock Style

Here is where your jaw probably just dropped!

SPGP ETF currently leans more towards value than growth!

36% Value.

40% Blend.

22% Growth.

It hangs out mostly in mid-cap territory (60%) vs large-cap (40%).

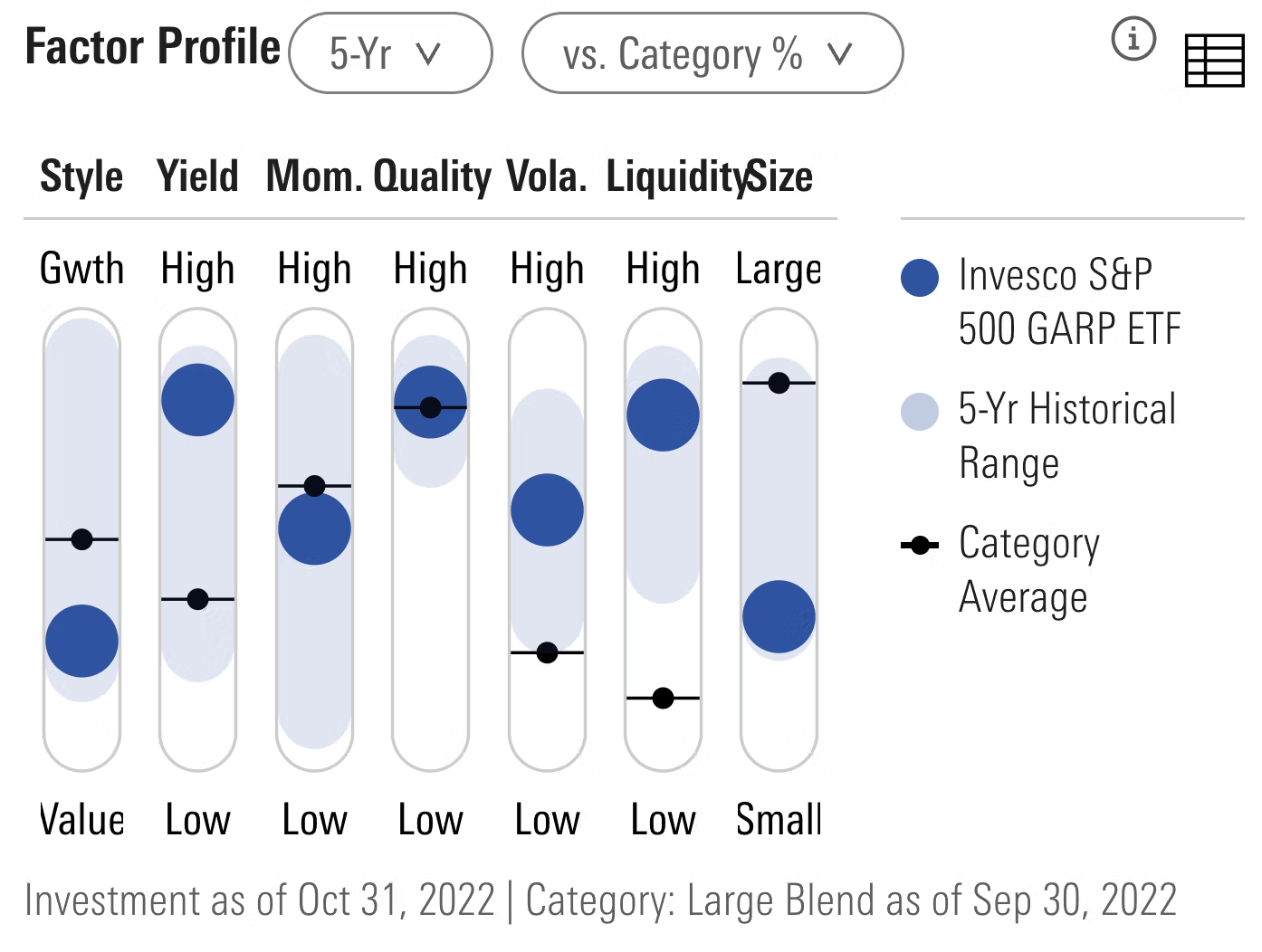

SPGP ETF – Factor Profile

SPGP ETF has an attractive factor profile offering multi-factor exposure to value, size, yield and quality especially!

A growth fund leaning more towards value???

Interesting!

SPGP ETF Pros and Cons

SPGP Pros

- Growth At A Reasonable Price addresses the main flaws of pure growth strategies such as high P/E, stretched valuations and narrative based security selection (no FANGMA)

- Clear outperformance versus VUG ETF and SPY ETF

- A reasonable expense ratio of 0.33

- A potential “growth” replacement strategy or something to stand alongside another growth strategy in the portfolio

- Plenty of mid-cap exposure versus more large-cap centric funds

- Strong multi-factor exposure to quality, yield, size and value

- A higher conviction 75 position strategy with no stock taking up more than 2%

SPGP Cons

- A Growth strategy that currently tilts more towards Value will certainly raise some eyebrows as to whether or not the strategy should be renamed or rebranded

- An expense ratio that is higher than owning market-cap weighted SPY (not a deal-breaker for me but it might be for others)

SPGP Potential Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Let’s explore a potential portfolio for Invesco S&P 500 GARP ETF.

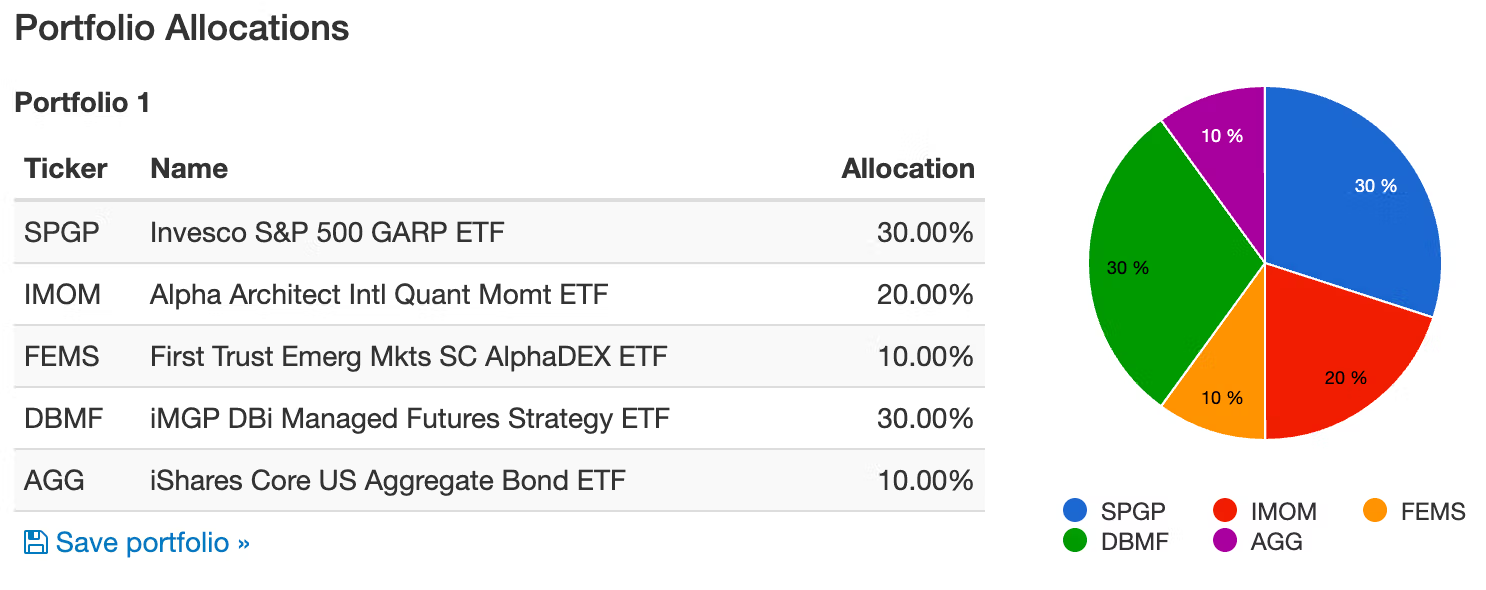

30% SPGP

20% IMOM

10% FEMS

30% DBMF

10% TYA

How about a factor focused portfolio where we’re pursuing a different strategy in each geographical region?

Here we have our US exposure represented by a GARP strategy.

International Developed is covered by Momentum and Emerging Markets with a multi-factor approach.

We’ll add in some managed futures and capital efficient treasuries to round things out.

TYA trips up our backtest from rewinding the clock so I’ve just replaced it with AGG for the time being.

Overall, our SPGP ETF and Friends Portfolio clearly defeats a 60/40 portfolio based upon a small sample size.

What Others Have To Say About SPGP ETF

Now that we’ve covered a few different portfolio solutions let’s see what others have to say about the fund for those who prefer video format.

source: StayTheCourse on YouTube

SPGP ETF — 12-Question FAQ (Invesco S&P 500 GARP ETF)

1) What is SPGP and what does it aim to do?

SPGP tracks the S&P 500 Growth at a Reasonable Price (GARP) Index, holding ~75 S&P 500 stocks that combine growth with quality and reasonable valuation constraints.

2) How does the GARP methodology select stocks?

It first ranks S&P 500 stocks by a Growth Score (3-yr EPS CAGR and 3-yr Sales-per-Share CAGR). The top 150 by growth then get a Quality/Value (QV) composite (low financial leverage, high ROE, high earnings-to-price). The top 75 by QV make the index.

3) How are constituents weighted and how often does it rebalance?

Constituents are weighted by Growth Score, with 0.05%–5% single-name caps and 40% sector caps. The index rebalances and reconstitutes semi-annually.

4) What are SPGP’s basic fund facts?

Ticker: SPGP | Expense ratio: 0.33% | AUM: ~$1.8B | Inception: 2011-06-16 (GARP index since 2019-06-21) | Holdings: ~75.

5) What does “Growth at a Reasonable Price” (GARP) try to solve?

GARP seeks growth without overpaying—aiming to avoid high-P/E, high-volatility, low-quality names common in pure growth screens, and to temper narrative/FOMO risk.

6) How does SPGP differ from a typical pure-growth ETF (e.g., VUG/RPG)?

Unlike pure-growth screens that often tilt to mega-cap tech and higher valuations, SPGP requires quality + value checks and caps positions/sectors, often producing more balanced sector/style exposure and lower multiples.

7) Why are there no FANGMA names in the current top holdings?

Because the QV overlay and weight caps can exclude or down-weight high-valuation mega-caps if they score poorly on earnings-to-price, leverage, or ROE, or breach 5% single-name/sector constraints.

8) What does the current style and factor profile look like?

Though labeled “growth,” the methodology can result in a value/blend lean at times, with meaningful mid-cap exposure and multi-factor tilts to quality, yield, value, and size alongside growth.

9) How has SPGP performed vs VUG and SPY since adopting GARP?

Since mid-2019, SPGP has outpaced both VUG and SPY in CAGR, aided by defensiveness in 2022 stemming from lower valuation exposure and QV constraints.

10) What are the main pros of SPGP?

Disciplined GARP screen (growth + quality + reasonable valuation)

High-conviction ~75-stock portfolio with 5% cap per name

Outperformance vs VUG/SPY since GARP adoption (small sample caveat)

Reasonable fee (0.33%) for a rules-based smart-beta screen

11) What are the key cons or risks?

Can tilt toward value/blend, which may confuse “growth” purists

Tracking error vs market-cap benchmarks; may lag in mega-cap growth surges

Semi-annual rebalance means signals adjust on a schedule, not continuously

12) How might investors use SPGP in a portfolio?

As a GARP core or satellite in U.S. large caps, or paired with momentum, minimum volatility, managed futures, or treasuries to pursue higher risk-adjusted returns and drawdown control.

Nomadic Samuel Final Thoughts

I’m always thrilled when an alternative to the S&P 500 is beating its market cap weighted index.

However, I’m a bit perplexed by SPGP ETF overall.

A GARP ETF that leans more towards value?

Now that wasn’t something I was expecting to be honest.

It’s left me with mixed feelings about the fund from a brand/naming convention perspective.

But I’m impressed with its high conviction 75 position strategy and screening process.

Hence, I do like the fund.

But I’m more interested in what you have to say about it.

Is SPGP an ETF you’d consider for your portfolio?

Please let me know in the comments below.

That’s all I’ve got.

Ciao for now.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.