In the pantheon of legendary investors, two figures hold a special place – Warren Buffett and Charlie Munger. Both are synonymous with extraordinary wisdom, prescient investing, and sustained success over decades.

Warren Buffett, the “Oracle of Omaha,” is a name familiar to even the most casual observers of the investment world. Born in Omaha, Nebraska, in 1930, Buffett demonstrated an early aptitude for numbers and business. From operating a pinball machine business as a teenager to running one of the world’s most successful investment conglomerates, Buffett’s journey is the stuff of legends.

Charlie Munger, on the other hand, while not as instantly recognizable as Buffett, is equally respected within the investing community for his intellectual rigor and breadth of knowledge. Born in Omaha in 1924, Munger trained as a lawyer before transitioning into real estate and eventually, investment management. His vast wisdom extends beyond the realm of finance, drawing from multiple disciplines – a trait that has deeply influenced Buffett’s investing approach.

Professional Relationship and Collaboration at Berkshire Hathaway

Buffett and Munger’s professional relationship is an extraordinary story of collaboration and mutual respect. Their paths first crossed in 1959 through a mutual acquaintance, and they quickly discovered shared principles and a mutual admiration that laid the foundation for a lifelong partnership.

In 1978, Munger officially joined Buffett at Berkshire Hathaway, the investment conglomerate that Buffett had been leading since 1965. As Vice Chairman, Munger became Buffett’s right-hand man, trusted sounding board, and intellectual sparring partner. Despite Buffett’s name often taking the spotlight, Munger’s influence has been pivotal in shaping the investment philosophy and decision-making process at Berkshire Hathaway.

Over the decades, Buffett and Munger transformed Berkshire Hathaway from a struggling textile company into a behemoth of the investing world, with a diverse portfolio of businesses and investments. Their investment strategy, a fusion of both their ideas, has consistently beaten the market, making them among the most successful investors in history.

Together, Warren Buffett and Charlie Munger represent an unparalleled synergy of two great investing minds. As we delve deeper into their partnership, we’ll see how Munger’s influence helped refine and evolve Buffett’s investing approach, further cementing their legacy in the annals of investment history.

The Early Years: Buffett meets Munger

The story of how Warren Buffett and Charlie Munger first met carries a touch of serendipity, yet also, a sense of inevitability. It was in the late 1950s, and both men were already making a name for themselves in the investing world. The stage was set for their paths to cross at a dinner party in Omaha, arranged by a mutual acquaintance who believed they’d have a lot to talk about.

Their friend was right. What unfolded at that dinner was akin to intellectual fireworks. Both Buffett and Munger found in each other a mirror reflecting their own uncommon appetite for investing, their affinity for clear thinking, and their shared belief in the power of compounded returns.

Mutual Admiration and Early Influence on Each Other’s Thinking

From their first meeting, Buffett and Munger developed a mutual admiration that was almost instant. Buffett was impressed by Munger’s expansive knowledge, razor-sharp wit, and his approach to investing that sought wisdom from various disciplines. Munger, for his part, admired Buffett’s intuitive grasp of investing, his relentless focus, and his knack for identifying undervalued companies.

This meeting of minds didn’t just end in admiration; it sparked a transformation in their thinking. Buffett, who had hitherto been a disciple of Benjamin Graham’s ‘cigar-butt’ investing style – buying cheap, sub-par companies for a quick profit – started to see the merits of Munger’s approach. Munger believed in buying quality companies, even if they were not the cheapest, and holding them for the long term.

Similarly, Munger saw in Buffett a master of practical implementation of investment theories, someone who could bring his ideas to life with remarkable success. Buffett’s focus on understanding the businesses he was investing in and his extraordinary patience resonated with Munger, and he saw how their ideas could combine to create a potent investment strategy.

Thus, their meeting was more than just a get-together of two brilliant minds; it was the beginning of an influential partnership that would leave an indelible mark on the investing world. As we peel back the layers of their collaboration, we’ll see just how deep Munger’s influence runs in Buffett’s approach to investing, and how their partnership became a hallmark of successful collaboration.

source: YAPSS on YouTube

The Impact of Munger on Buffett’s Investment Philosophy

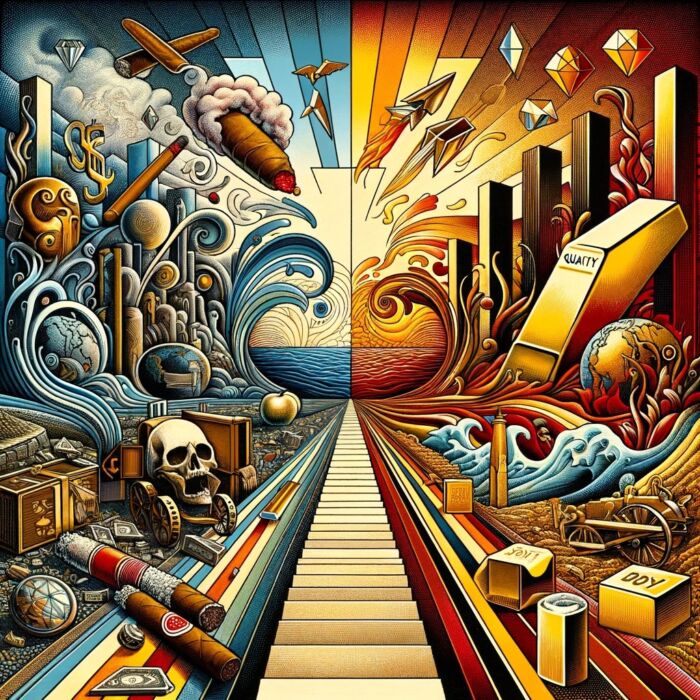

One of the most significant shifts in Buffett’s investing philosophy under Munger’s influence was the transition from “Cigar Butt” investing to focusing on quality businesses.

Transition from “Cigar Butt” Investing to “Quality” Investing

The “Cigar Butt” strategy, named so because it’s like picking up a discarded cigar butt with a few puffs left in it, involves investing in companies that are cheap, often due to poor business quality or prospects.

Munger, however, presented a different perspective, emphasizing the value of investing in quality businesses that can deliver sustained earnings over the long term, even if they come at a higher price. He likened this approach to buying a stake in a profitable toll bridge. Once you own it, you simply “sit back and collect money.”

Under Munger’s influence, Buffett began to appreciate this wisdom. He started focusing more on businesses’ underlying quality and their ability to generate consistent earnings over time. This shift is reflected in some of Berkshire Hathaway’s most successful investments, such as Coca-Cola and See’s Candies, which have been veritable cash machines for the company.

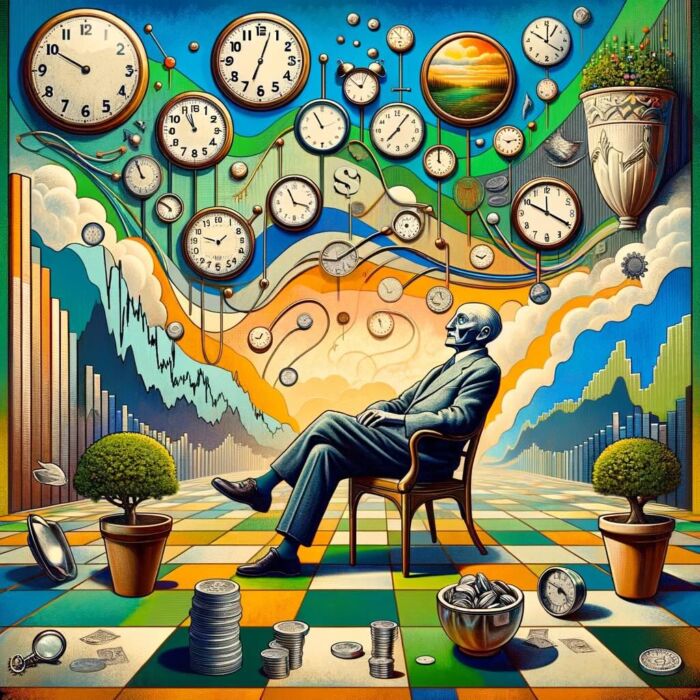

Influence of Munger’s “Sit on Your Ass” Investing Approach on Buffett

Another notable Munger-ism that shaped Buffett’s investing approach is the principle of “sit on your ass” investing. This phrase encapsulates Munger’s belief in the power of patience and long-term investing. The idea is simple yet profound – find a high-quality business, buy it at a reasonable price, and then do nothing. Just sit on your ass and let the business and its compounding returns do the work.

Buffett, who already had an innate grasp of the power of compounding, embraced this approach with gusto. His famous quote, “Our favorite holding period is forever,” reflects the influence of Munger’s philosophy. This long-term outlook enables them to reap the full benefits of compounding and allows the businesses they invest in to weather short-term storms and grow their intrinsic value over time.

Munger’s Push for Broader Diversification Beyond What’s Traditionally Considered

In the classic sense, diversification means spreading investments across various sectors, asset classes, or geographies to manage risk. While Buffett was not opposed to this idea, his focus was typically on understanding businesses thoroughly before investing, which sometimes led to a more concentrated portfolio.

Munger, on the other hand, argued for a broader interpretation of diversification. He advocated for diversifying across different types of business models and quality companies, regardless of the industry. This, he argued, could offer more robust protection against potential downturns in any single sector or business model.

Influenced by Munger, Buffett started diversifying Berkshire Hathaway’s portfolio across various high-quality businesses, irrespective of the sector. This broader diversification strategy has helped the company withstand various economic downturns and market cycles.

From a shift in investing philosophy to a more patient and broader diversification approach, Charlie Munger’s influence on Warren Buffett’s investing style is unmistakable. The fingerprints of their collaborative wisdom are evident in the investing giant that Berkshire Hathaway is today.

source: We Study Billionaires on YouTube

The Incorporation of Munger’s Mental Models

Charlie Munger is famously a proponent of the concept of ‘Mental Models,’ a principle that borrows from multiple disciplines, such as psychology, economics, mathematics, and physics, to name a few.

Munger’s Concept of Mental Models

The idea is straightforward yet remarkably powerful: to make better decisions, one must have numerous ‘models’ in the mind, and these models should span a wide array of disciplines.

Munger believes that one can’t make consistently good decisions by sticking to a single worldview or discipline. Instead, he argues that a multidisciplinary approach allows for a more nuanced understanding of situations, as each mental model offers a different lens through which to view and interpret the world. This approach requires an appetite for continuous learning, an attribute both Munger and Buffett share in abundance.

How Munger’s Mental Models Influenced Buffett’s Decision-Making Process

Buffett, although a voracious reader and learner himself, initially focused primarily on economic and financial factors in his investment decision-making. Munger’s influence broadened this scope, encouraging Buffett to incorporate principles from other disciplines into his analysis.

Munger’s advocacy for mental models nudged Buffett to integrate insights from areas such as psychology, business strategy, and competitive advantage into his investment decisions. This multidisciplinary approach has not only enriched Buffett’s understanding of the businesses he invests in but has also helped him avoid numerous pitfalls that a single-discipline approach might have missed.

Examples of Specific Mental Models Used by Buffett in His Investment Decisions

Several of Munger’s mental models have found their way into Buffett’s investment decisions. One prominent example is the model of ‘Margin of Safety,’ a principle borrowed from engineering, which Buffett now applies to investing. It refers to investing at a price significantly below the estimated intrinsic value to allow for potential errors, bad luck, or unforeseen events. This concept has become one of the cornerstones of Buffett’s investment philosophy.

Another key mental model is ‘Mr. Market,’ borrowed from Buffett’s mentor Benjamin Graham, which personifies the stock market as a manic-depressive character who offers business deals every day. This model helps Buffett to remember that price fluctuations are opportunities, not mandates, and that he should focus on the real value of businesses, not the mood swings of Mr. Market.

The concept of ‘Circle of Competence,’ as we discussed earlier, is another mental model which Buffett has incorporated into his strategy, recognizing that one should invest in areas they understand well while continually striving to expand their knowledge.

The interplay of these and many other mental models, encouraged by Munger, has deepened and diversified Buffett’s investing acumen, contributing to his extraordinary track record. These models have given him a richer toolkit for making decisions and understanding the complex dynamics of business and investment landscapes.

The Value of Long-term Partnerships

Warren Buffett and Charlie Munger’s partnership is not just a partnership; it’s a testament to the power of collaboration in creating extraordinary value.

The Importance of Their Partnership in the Success of Berkshire Hathaway

Their shared journey at the helm of Berkshire Hathaway is a story of synergy, where the combined result is greater than the sum of its parts.

The success of Berkshire Hathaway cannot be attributed to Buffett alone, nor solely to Munger. Instead, it’s the blend of their skills, knowledge, wisdom, and shared values that has propelled the company to its enviable heights. They’ve navigated the ebbs and flows of the economic landscape, making investment decisions that have consistently yielded high returns over the long term.

How Their Contrasting Strengths and Perspectives Create a Balanced Approach to Investing

Despite their shared philosophy, Buffett and Munger are not clones of each other. Each brings a unique set of strengths and perspectives that balance and enrich their investing approach.

Buffett, with his intuitive understanding of businesses and their valuations, brings a sharp focus to the details of investing. Munger, with his multidisciplinary approach and incisive wit, broadens that focus to encompass a wide range of influences and factors that could impact their investments. Buffett is often more optimistic, while Munger provides a counterbalance with his clear-eyed pragmatism.

This complementary dynamic allows for a more robust investing strategy, blending detailed analysis with broad wisdom, optimism with caution, and a focus on the present with a view to the long-term potential.

The Value of Humility and Learning in Their Partnership

If there’s one thread that consistently runs through the partnership of Buffett and Munger, it’s their shared humility and relentless pursuit of learning. Despite their success and acclaim, they never consider their knowledge complete or their learning finished.

Munger’s wisdom has had a profound influence on Buffett, but the reverse is also true. This mutual respect and willingness to learn from each other is a powerful testament to their humility. It’s not uncommon to hear Buffett credit Munger for the success of their investments or vice versa.

Their lifelong learning mindset, coupled with their humility, has enabled them to continually refine their investment approach, adapt to changing market conditions, and drive the sustained success of Berkshire Hathaway.

The Buffett-Munger collaboration underscores the value of long-term partnerships in investing. Their partnership exemplifies how differing strengths can come together to create a potent strategy, how humility and learning can fuel sustained success, and how shared values and respect can drive a synergistic collaboration. Their partnership offers invaluable lessons not just for investing, but for any form of collaboration or teamwork.

Case Studies: Munger’s Influence on Buffett’s Key Investments

- See’s Candies: The investment in See’s Candies in 1972 stands as a shining example of Munger’s influence on Buffett’s shift from the “cigar butt” to “quality” investing approach. When Berkshire Hathaway acquired See’s Candies, it wasn’t the cheapest deal. The price was, in fact, higher than what the then Ben Graham-inspired Buffett would have typically considered.

However, Munger saw the intrinsic value in the company’s strong brand and loyal customer base, which would allow it to increase prices over time and thus improve profitability. Buffett eventually agreed, and the acquisition turned out to be a stellar investment, consistently providing high returns and teaching the duo the value of brand power and pricing power in a business.

- Coca-Cola: The decision to invest in Coca-Cola in 1988 also bore the mark of Munger’s philosophy. Here was a global brand with an immense moat and an evergreen product. It wasn’t a bargain in the Grahamian sense, but it was a quality business with a durable competitive advantage, fitting right into the Munger quality-over-quantity framework. The Coca-Cola investment, needless to say, has been one of Berkshire Hathaway’s most lucrative, validating Munger’s insistence on the quality aspect of investing.

Lessons Learned from Their Collaborative Decisions

Both See’s Candies and Coca-Cola investments demonstrated the potency of Buffett and Munger’s collaborative wisdom. These decisions underscored several important lessons:

- The Value of Quality: These investments highlighted that buying quality businesses at a fair price could lead to superior long-term returns than buying average businesses at a cheap price. This represented a major shift from Buffett’s early investment style and became a key tenet of Berkshire Hathaway’s investment philosophy.

- The Power of Brands: See’s Candies and Coca-Cola showed the immense value of a strong brand and loyal customer base, factors that could sustain businesses through economic downturns and allow them to consistently increase profits over the long term.

- The Importance of Moats: These companies had durable competitive advantages or ‘moats’ that allowed them to fend off competition and maintain their market-leading positions. Munger’s multidisciplinary mental models helped identify these moats, reinforcing their importance in investment decisions.

- The Efficacy of Long-term Investing: Finally, the extraordinary returns that these investments have generated over the decades are a testament to the ‘sit on your ass’ investing approach. They illustrate the power of patience and the compounding of returns in wealth creation.

These case studies illustrate how Munger’s influence has shaped not only Buffett’s investing philosophy but also specific investment decisions, leading to some of Berkshire Hathaway’s most successful and iconic investments.

source: We Study Billionaires on YouTube

Challenges and Limitations of the Munger Influence

Even within the harmonious collaboration of Buffett and Munger, there have been instances of divergent views. One notable example is their differing opinions on technology stocks. For a long time, Buffett famously avoided tech stocks, citing his lack of understanding of the tech sector and his adherence to his “Circle of Competence.” Munger, on the other hand, was more open to the idea of investing in tech companies.

This divergence came to the fore when Munger, through his investment in Daily Journal Corporation, bought shares in companies like Microsoft and Alibaba. While these investments have so far proven profitable, it’s interesting to note that Berkshire Hathaway, under Buffett, only recently warmed up to tech stocks with its significant investment in Apple.

Analysis of Whether Munger’s Influence Always Led to Positive Results

The impact of Munger’s influence on Buffett has been largely positive, as evidenced by their phenomenal track record at Berkshire Hathaway. However, not all decisions influenced by Munger have had uniformly positive outcomes.

For instance, Berkshire’s investment in Dexter Shoe in 1993 was based on the quality-over-quantity philosophy championed by Munger. Unfortunately, increased global competition led to Dexter Shoe’s decline, and Berkshire eventually had to write off the investment. Buffett famously called this his worst investment mistake.

Exploring Potential Overreliance on a Single Influence in Decision Making

While Munger’s influence has undoubtedly been significant in shaping Buffett’s investing approach, an overreliance on any single influence in decision-making can create blind spots. Even Munger himself advocates for a diverse set of mental models to avoid the man-with-a-hammer syndrome, where every problem looks like a nail.

However, the strength of the Buffett-Munger partnership lies in their shared commitment to continuous learning and intellectual curiosity. They constantly challenge their assumptions, adapt to new information, and refine their mental models. This commitment reduces the risk of overreliance on a single influence or viewpoint.

While Munger’s influence has undeniably been critical in Buffett’s success, it’s equally important to recognize the potential limitations and challenges of this influence. The key lies in maintaining a balanced approach, continually seeking diverse perspectives, and staying open to learning and adaptation. This is a principle that both Buffett and Munger have exemplified throughout their illustrious careers.

12-Question FAQ: The Impact of Charlie Munger on Warren Buffett’s Investing Approach

How did Charlie Munger change Buffett’s core strategy?

Munger nudged Buffett away from Ben Graham’s “cigar-butt” bargains toward paying a fair price for exceptional businesses. Quality, durable moats, and long runways replaced mere statistical cheapness.

What is the simplest summary of Munger’s influence?

“Wonderful business at a fair price” > “fair business at a wonderful price.” That single inversion reoriented Berkshire toward brand power, pricing power, and compounding machines.

Which investments best showcase this shift?

See’s Candies and Coca-Cola. Both offered brand strength, customer loyalty, and enduring economics—case studies in paying up (within reason) for quality and letting compounding work.

How did Munger’s mental-models approach broaden Buffett’s analysis?

Munger pushed a multidisciplinary latticework—psychology (biases), microeconomics (moats, switching costs), game theory (incentives), and basic engineering (margin of safety)—to avoid narrow, single-lens decisions.

What role did “opportunity cost” start playing?

Munger elevated opportunity cost as a first-class filter: every dollar in a merely “good” idea can’t be in a great one. This sharpened Berkshire’s selectivity and sizing.

Did Munger change Buffett’s views on portfolio concentration?

Yes—toward focused ownership of a few outstanding businesses held for very long periods, provided durability and reinvestment capacity were high.

How did Munger affect Buffett’s patience and activity level?

He reinforced “sit-on-your-ass” investing: act rarely, but decisively; then mostly do nothing while fundamentals compound. Low turnover became a feature, not a bug.

What process upgrades came from Munger’s thinking?

Checklist discipline and “anti-models”: seek disconfirming evidence, study failure modes, and write the bear case yourself before buying.

How did Munger shape Buffett’s view of moats?

He emphasized real competitive advantages—network effects, cost advantages, brands, culture, switching costs—over accounting metrics alone. Moat durability trumped one-off cheapness.

Did their perspectives ever diverge?

At times—especially around technology. Munger was more open-minded sooner, while Buffett stayed closer to the Circle of Competence until Apple (framed as a consumer-ecosystem moat) met his bar.

What cultural impact did Munger have at Berkshire?

A bias for candor, rationality, and incentive alignment. Their partnership institutionalized intellectual humility: change your mind fast when the facts change.

What’s the enduring takeaway for investors?

Think in mental models, prize quality and incentives, keep a strict circle of competence, and be patient. Most alpha comes from avoiding unforced errors and letting compounding do the heavy lifting.

Conclusion: Charlie Munger’s impact on Warren Buffett’s investing approach

The narrative of Warren Buffett’s legendary investing career is incomplete without acknowledging the profound impact of his partner and friend, Charlie Munger. Munger’s influence reshaped Buffett’s investment philosophy, ushering in a shift from the “cigar butt” style of investing to a focus on quality businesses with strong brands, loyal customer bases, and sustainable competitive advantages.

Munger’s concept of ‘Mental Models’ offered Buffett a multidimensional lens to view potential investments, extending beyond the traditional economic and financial factors to incorporate insights from diverse disciplines. This has resulted in a richer, more nuanced approach to investment decisions.

Enduring Value of Their Professional Partnership

The Buffett-Munger partnership has become a gold standard in the world of investing. Their collaborative efforts have driven the spectacular success of Berkshire Hathaway, making it one of the most admired companies globally. Their partnership demonstrates the power of combining complementary skills, perspectives, and strengths in a spirit of mutual respect, learning, and humility. It is a testament to the extraordinary value that long-term partnerships can generate.

Applying the Lessons from Their Collaboration to One’s Own Investing Approach

The lessons from the Buffett-Munger collaboration extend beyond investing. Their shared journey embodies principles applicable in all spheres of life: the importance of lifelong learning, the value of humility, the benefits of a multidisciplinary approach, and the power of enduring partnerships.

In the realm of investing, their approach is a reminder to focus on quality, to stay within your Circle of Competence while continuously striving to expand it, to think long-term, and to remain patient and disciplined. They show us the value of a strong ethical compass and the significance of sticking to your principles, even when the market or popular opinion swings the other way.

The Buffett-Munger partnership illuminates the path not just to investing success but to a richer understanding of decision-making, collaboration, and value creation. As we forge our own paths in the world of investing, we can turn to their journey for guidance, inspiration, and, above all, the wisdom to think for ourselves.

Remember, as Charlie Munger often says, “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” So, here’s to being consistently not stupid in our investing journey.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

formation

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized reproduction, republication, or commercial use of this content without express written permission is strictly prohibited.

8. Governing Law, Arbitration & Severability BINDING ARBITRATION:

Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.