As the curtains rise on the stage of financial philosophy and lifestyle innovation, one concept has taken the spotlight – the FIRE movement. The acronym, crisp and sparking with promise, stands for “Financial Independence, Retire Early.” It is a clarion call to those who dream of releasing themselves from the shackles of traditional work, inviting a life where the yoke of mandatory employment is shed much earlier than conventional norms dictate.

FIRE is not just an investment strategy; it’s a philosophy, a lifestyle, a profound recalibration of one’s relationship with money and work. It questions the long-established blueprint of life that recommends working hard until one’s twilight years to enjoy the fruits of retirement. Instead, it propels you toward achieving a state of financial freedom so robust that working becomes a matter of choice rather than necessity, thus allowing the possibility of retiring far earlier than traditionally envisaged.

FIRE Movement and Its Increasing Popularity

Like the whispered beginnings of a ground-shaking revolution, the FIRE movement began quietly, tracing its roots to the 1992 classic, “Your Money or Your Life” by Vicki Robin and Joe Dominguez. Today, it echoes loudly in the chambers of personal finance forums and reverberates across cyberspace, its sound amplified by personal finance blogs and burgeoning online communities.

The allure of FIRE has proven irresistible, especially to millennials, who see in it an escape hatch from the numbing monotony of the traditional 9-to-5 grind. Its appeal extends beyond mere financial independence to promise an emancipation of time, offering a life less ordinary, one liberated from the tyranny of the alarm clock. It is more than just a financial trend; it’s an ideological shift, a counter-narrative to traditional notions of work and retirement.

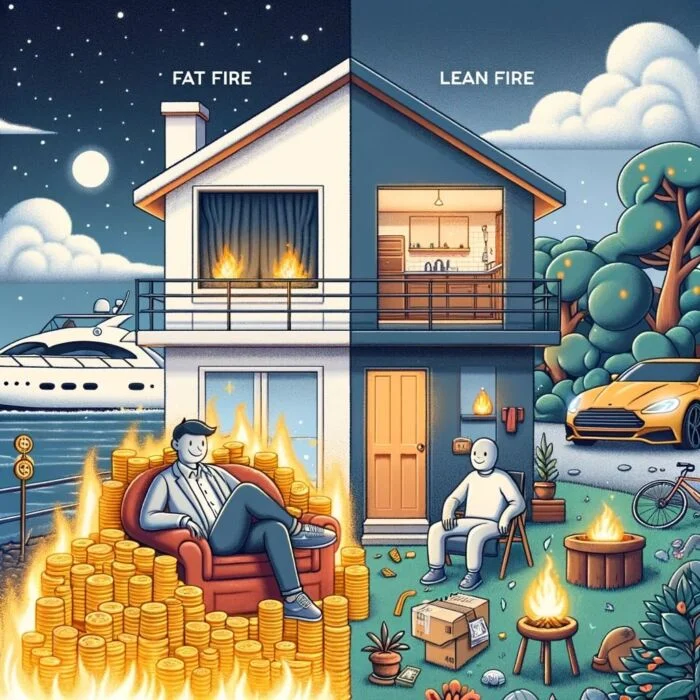

Two Main Types of FIRE: Fat FIRE and Lean FIRE

The FIRE movement, much like its followers, is not a monolith. Instead, it boasts a diverse array of interpretations, reflecting the variety of those it attracts. Among this fascinating ecosystem, two predominant variants stand out, each offering a unique flavor of financial independence: Fat FIRE and Lean FIRE.

Fat FIRE can be thought of as the extravagant cousin within the FIRE family. It’s the choice of individuals who envision an early retirement that’s abundantly comfortable, often luxurious, and rich in discretionary spending. These folks don’t just aspire to retire early; they want to do so without sacrificing the high-quality, often high-cost lifestyle they are accustomed to. The Fat FIRE route might be seen as the road for those who want to live life king-size, on their terms, without the traditional constraints of employment.

Lean FIRE, on the other hand, is the embodiment of frugality, simplicity, and minimalism. It represents the path for those who are willing, often eager, to adopt a low-cost lifestyle both in the lead-up to and during their early retirement. It’s a model that exemplifies resilience, prudence, and contentment with less. It’s the philosophy of choice for those who value simplicity over material excess, who seek freedom from employment as early as possible, and who are willing to achieve this goal through a disciplined and pared-back lifestyle.

Though both Fat and Lean FIRE are bound by the common thread of financial independence, they represent different interpretations of the balance between comfort, luxury, and time freedom. Each approach, while leading to the same destination, offers a different journey, shaped by one’s values, tolerance for risk, lifestyle preferences, and financial goals. To embark on a successful voyage toward FIRE, it’s essential to understand these nuances and choose a path that aligns with your own aspirations and philosophy.

source: The Money Resolution on YouTube

Understanding the FIRE Movement

Brief History of the FIRE Movement

Like a great river that starts from a humble spring, the FIRE movement, now a potent force reshaping financial narratives, began from a modest point. The genesis of the FIRE movement can be traced back to a book published in 1992: “Your Money or Your Life” by Vicki Robin and Joe Dominguez. This pioneering work laid down the foundational stones of financial independence and posited the radical idea of retiring early.

Robin and Dominguez did not just write a book; they sparked a revolution, a quiet storm that began to pick up speed as it resonated with a growing audience. The philosophies they espoused struck a chord with many who found themselves disillusioned with the traditional paradigm of work-until-you’re-gray-and-old-and-then-retire.

With the advent of the digital age, the FIRE movement caught, well, fire. Personal finance blogs and online forums provided fertile ground for these ideas to take root and flourish. This digital wave allowed the principles of FIRE to disseminate across the globe, enabling a community of like-minded individuals to connect, share, and inspire each other.

From the depths of niche online spaces, the FIRE movement has exploded into mainstream consciousness, its tenets of financial independence and early retirement capturing the imagination of many who yearn for a life beyond the 9-to-5 grind.

Key Principles of FIRE: Savings Rate, Investment, Frugality, and Income Optimization

Like an intricate piece of machinery, the FIRE movement is powered by several core principles, each as critical as the other. Let’s put these cogs under the microscope.

- Savings Rate: The first, and perhaps most conspicuous, gear in the FIRE mechanism is the savings rate. It’s a simple yet powerful concept: the higher the proportion of your income that you save and invest, the quicker you can achieve financial independence. Most FIRE followers aim for a savings rate significantly higher than the commonly advised 20%, with some even reaching a stratospheric 70% or more. It’s a game of percentages, and in this game, the bigger, the better.

- Investment: Next, we have the investment engine, an essential part of the machinery that helps turn savings into wealth. By investing wisely and consistently, FIRE followers aim to grow their wealth over time, leveraging the magic of compound interest. This isn’t about get-rich-quick schemes or speculative bets but disciplined, long-term investing, often in broad, diversified index funds.

- Frugality: The essence of frugality permeates the philosophy of FIRE. But this isn’t about penny-pinching for its own sake; it’s about conscious consumption, about distinguishing between wants and needs, and valuing experiences over possessions. It’s about choosing to live below one’s means today to afford freedom tomorrow.

- Income Optimization: Lastly, but no less important, is income optimization. Achieving FIRE is not just about cutting costs but also about enhancing income. This could mean negotiating a raise, building a side hustle, or investing in education to increase earning potential. In the world of FIRE, every additional dollar earned is another soldier in the army marching towards financial independence.

These are the forces that drive the engine of FIRE, each principle interlocking with the others to create a powerful financial strategy. Understanding and harnessing these principles is akin to learning a new language – the language of financial independence. It’s a language that speaks of freedom, choice, and a life where you, rather than your paycheck, dictate your actions.

Defining Lean FIRE

source: Erin Talks Money on YouTube

Explanation of Lean FIRE

In the diverse universe of the FIRE movement, Lean FIRE emerges as a distinct constellation. It represents a path to financial independence and early retirement that is lean in its consumption, streamlined in its lifestyle, and rich in its philosophical underpinnings.

Embracing Lean FIRE means you’re ready to adopt a frugal lifestyle, living below your means with the aim of minimizing your expenses to maximize your savings. These savers and investors are willing to trade off a higher standard of living today for the privilege of achieving financial independence sooner. For them, freedom from the rat race is the golden prize, one that’s worth more than any material possession.

Typical Lifestyle and Budget Associated with Lean FIRE

The lifestyle associated with Lean FIRE is one of simplicity, minimalism, and frugality. Those who walk this path often choose to live in smaller homes or in low-cost-of-living areas, they adopt energy-efficient practices, drive used cars, and make full use of public transportation. They are the kings and queens of DIY, finding joy in self-reliance, in growing their food, mending their clothes, and maintaining their homes.

The budget associated with Lean FIRE is lean indeed. While it varies from person to person and place to place, those pursuing Lean FIRE aim to retire on annual expenses that are typically below the average household expenditure. It’s not uncommon for Lean FIRE enthusiasts to target an annual retirement budget of $40,000 or even less.

Advantages and Challenges of Lean FIRE

The Lean FIRE approach offers some distinct advantages. Firstly, it provides a path to financial independence at a younger age than traditional retirement plans or even other FIRE strategies. It also cultivates a sense of resilience, a mastery over one’s wants and needs that can be deeply empowering. Moreover, it encourages environmental sustainability through conscious consumption, creating a lifestyle that is not just lean, but green.

However, Lean FIRE isn’t without its challenges. Living on a tight budget can feel restrictive and may not allow for unexpected expenses or the occasional splurge. Lean FIRE also requires a high level of discipline and a willingness to forgo certain comforts and conveniences that others take for granted. There’s a risk that medical expenses, inflation, or other unforeseen circumstances could disrupt a Lean FIRE lifestyle, especially given the longer retirement horizon.

Case Study/Example of Someone who Achieved Lean FIRE

To illustrate the Lean FIRE philosophy in action, let’s consider the story of Mr. and Mrs. Frugalwoods. This couple, along with their two young children, live on a homestead in rural Vermont, having achieved financial independence in their early thirties.

Their journey started in the urban jungle of Cambridge, Massachusetts, where they decided to save as much as possible to achieve their dream of financial independence. Their approach was epitomized by extreme frugality: they cut their hair at home, walked or biked instead of owning a car, and only bought second-hand goods.

After years of disciplined savings and smart investments, they accumulated a nest egg sufficient to support their annual spending of around $40,000, including a paid-off home and land in rural Vermont. They’ve embraced a simple, DIY lifestyle, relishing their financial independence, spending time with their children, and pursuing their passion projects.

Their story serves as an inspiring example of what can be achieved with discipline, frugality, and a clear vision of what financial independence means to you. It embodies the heart of Lean FIRE – the idea that wealth is not about the things you own but the freedom to spend your time as you choose.

source: Erin Talks Money on YouTube

Defining Fat FIRE

Explanation of Fat FIRE

If Lean FIRE is the compact, fuel-efficient vehicle of the FIRE movement, Fat FIRE is the luxury sports car. It’s the path for those who want to achieve financial independence and retire early, without relinquishing the finer things in life. This approach is for individuals who are willing to work longer, save more, or leverage high-income skills to amass a larger nest egg that allows for a more opulent lifestyle in retirement.

In essence, Fat FIRE proponents aim to retire with enough savings to sustain a higher standard of living – a level of comfort that mirrors, or even surpasses, their pre-retirement lifestyle. They don’t just dream of leaving the rat race early; they envision doing so while savoring the best life has to offer.

Typical Lifestyle and Budget Associated with Fat FIRE

Those who tread the path of Fat FIRE often lead a lifestyle that is comfortable, if not luxurious. They may live in larger homes in desirable locations, drive newer vehicles, dine out regularly, and enjoy premium experiences, from travel to entertainment.

The budget associated with Fat FIRE is as hefty as the name suggests. Although the specifics depend on individual preferences and regional living costs, a Fat FIRE budget significantly exceeds the average household expenditure. It’s common for Fat FIRE followers to aim for an annual retirement budget of $100,000 or even more.

Advantages and Challenges of Fat FIRE

Choosing the Fat FIRE route comes with its perks. It provides a level of financial cushion and flexibility that Lean FIRE does not. This can lead to a higher standard of living, the ability to handle unexpected expenses with ease, and the freedom to indulge in experiences that require a heftier purse.

However, Fat FIRE also has its challenges. Achieving this level of financial independence requires a significant amount of wealth, which may necessitate longer working years, higher income, or a very high savings rate. It can be a more challenging goal to reach, especially for those who do not have high-income skills or jobs. Moreover, maintaining a high standard of living can also mean a higher burn rate in retirement, requiring more careful management of the retirement portfolio.

Case Study/Example of Someone who Achieved Fat FIRE

Consider the story of Sam Dogen from the Financial Samurai blog as an example of Fat FIRE. Sam was a high earner in the financial industry, who, after about 13 years of working, managed to retire in his early thirties with a considerable nest egg.

Sam’s approach to early retirement is characterized by luxury and comfort. He lives in a costly city – San Francisco – and enjoys traveling, fine dining, and other luxury experiences. His annual retirement spending is in the six figures, far surpassing the typical Lean FIRE budget.

Sam’s strategy involved not just aggressive saving and smart investing, but also building multiple income streams that include real estate, consulting, and income from his blog. His story exemplifies Fat FIRE, demonstrating that with high income, disciplined saving, and diversified income streams, it’s possible to retire early without giving up a luxury lifestyle.

In essence, Sam’s version of financial independence doesn’t mean living on the bare minimum. Instead, he has structured his life to continue generating income even in retirement, allowing him to live his desired lifestyle without worrying about depleting his savings. It’s a story of financial independence that’s fat with possibility, showing that FIRE and financial abundance can, indeed, go hand in hand.

source: Two Sides of FI on YouTube

Comparing Fat FIRE and Lean FIRE

Comparisons of the Lifestyle, Budget, and Requirements for Each Approach

In the colorful spectrum of the FIRE movement, Lean and Fat FIRE represent two distinct shades, each appealing in its unique way.

Lean FIRE advocates for a pared-down lifestyle, wherein one subsists on a leaner budget, often well below the national average. This style typically includes smaller homes, a more frugal diet, less frequent or less luxurious travel, and an overall less expensive lifestyle. It requires strict budgeting, resourcefulness, and the willingness to live below one’s means.

On the other end of the spectrum, Fat FIRE promotes a lifestyle that maintains, or even enhances, the comforts and luxuries of a pre-retirement life. This might involve larger homes, more frequent and luxurious travel, dining out, and generally a higher cost of living. Achieving Fat FIRE requires either a significantly higher income or a longer period of high savings and investing.

Determining Which FIRE Approach Suits You Best

Choosing between Lean and Fat FIRE isn’t merely a matter of financial arithmetic. It’s a deeply personal decision that reflects one’s values, desires, and vision of a good life.

Do you yearn for a simple, minimalist life unburdened by material excess? Are you eager to leave the workforce at the earliest opportunity, even if it means a more modest lifestyle? If so, Lean FIRE might sing to your soul.

On the other hand, do you enjoy the finer things in life? Do you prefer a retirement that doesn’t skimp on comforts and luxuries? Are you willing to work longer or strive for a higher income to afford a plush retirement? If that’s the case, Fat FIRE might be the melody that gets your feet tapping.

Discussion on the Trade-Offs of Each Strategy

Like any major life decision, choosing between Lean and Fat FIRE involves trade-offs. Understanding these trade-offs is essential to making an informed decision.

Lean FIRE allows for an earlier exit from the workforce, but it necessitates a more frugal lifestyle and a stricter budget. It may also provide less cushion for unexpected expenses or economic fluctuations. You get to gain freedom sooner, but the price is living on a shoestring budget, which may feel restrictive to some.

Conversely, Fat FIRE offers a more comfortable or even luxurious lifestyle, with more room for indulgences and unexpected costs. However, achieving Fat FIRE typically requires a higher income, a higher savings rate, or a longer period in the workforce. It’s a journey of delayed gratification, where you work harder and longer now to enjoy a more opulent retirement later.

The question isn’t which approach is objectively better—it’s about which one is better suited for you. This decision requires you to look inward, to examine your values, aspirations, and risk tolerance. It’s about choosing the path that aligns with your idea of a fulfilling life, a path that leads to your unique version of financial independence and early retirement.

In the end, whether you choose Lean FIRE or Fat FIRE, remember that the journey is just as important as the destination. Choose a path that not only leads to a desired future but also makes for an enriching, rewarding journey. After all, the heart of FIRE isn’t merely about retiring early; it’s about living a life that is true to who you are, a life that sets your heart on fire.

Key Strategies for Achieving FIRE

Common Investment Strategies within FIRE Movement

In the pursuit of FIRE, investing is not just a strategy—it’s the fuel that propels your financial vehicle towards your retirement goal. Whether you lean towards Lean or Fat FIRE, making your money work for you is essential.

The most common investment strategy within the FIRE movement is low-cost, long-term index fund investing. This is primarily through stock market index funds, which offer broad market exposure, low operating expenses, and low portfolio turnover. These funds are designed to mirror the performance of a specific market index, providing diversification and minimizing risk over the long term.

Real estate is another popular investment vehicle among FIRE enthusiasts. Whether it’s rental properties, real estate investment trusts (REITs), or house hacking, real estate offers potential income streams and tax advantages.

Regardless of the chosen investment strategy, the key is to start early, be consistent, and let the magic of compounding do its work.

The Role of Frugality and Saving

In the quest for FIRE, frugality isn’t just a strategy; it’s a lifestyle. It’s about more than just cutting coupons or avoiding lattes. It’s about mindfully managing resources, reducing waste, and prioritizing needs over wants. It’s about living efficiently, gaining satisfaction from maximizing the value of every dollar spent.

Saving, too, plays a pivotal role in the journey to FIRE. The higher your savings rate, the quicker you’ll reach financial independence. This often means minimizing living expenses, reducing discretionary spending, and avoiding consumer debt.

Frugality and saving are deeply interconnected, each reinforcing the other. Together, they can dramatically accelerate your path to FIRE, regardless of your income level.

The Importance of Income Generation and Optimization

While frugality and saving are vital in the pursuit of FIRE, they are only half the equation. The other half is income. Without a strong inflow, there’s only so much you can save, regardless of how frugal you are.

Income optimization could mean negotiating a higher salary, earning promotions, or switching jobs or industries for higher pay. For others, it might mean developing a side hustle or starting a small business.

Additionally, developing passive income streams, such as dividends from investments or income from rental properties, can help fuel your FIRE ambitions. The more income streams you have, the more resilient and flexible your financial life becomes.

Role of Planning and Discipline

FIRE is a journey that requires not just financial acumen, but also a great deal of planning and discipline. Planning involves defining your FIRE goals, creating a savings and investment strategy, and regularly monitoring and adjusting your plan as needed.

Discipline, on the other hand, is what keeps you on track. It’s the muscle that you flex when you choose to save instead of spend, to invest instead of splurge. It’s the force that keeps you marching towards your goal, even when the journey gets challenging or when temptation beckons.

However, it’s essential to remember that discipline doesn’t mean denying all pleasures or living a life of deprivation. Instead, it’s about making mindful decisions that align with your long-term goals. It’s about understanding that every financial decision you make today is a step towards—or away from—your desired future.

In the grand voyage to FIRE, investing, saving, income generation, planning, and discipline are your trusty navigators, guiding you towards your destination. Embrace them, and they’ll steer you towards a life of financial independence and early retirement—a life where you’re in the driver’s seat, charting your course.

Critics and Skeptics of the FIRE Movement

Discussion on Common Criticisms of FIRE

Like any significant social movement, FIRE has its fair share of critics and skeptics. Some critics argue that the FIRE movement is only feasible for those with high incomes and that it’s unrealistic for the average worker. They assert that it promotes an overly simplistic view of financial independence that fails to account for life’s many uncertainties.

Others express concern that FIRE encourages an unhealthy obsession with money and frugality, possibly at the expense of happiness and life enjoyment. They fear that such extreme saving and frugality could lead to a life of deprivation and missed experiences.

Additionally, some critics question the sustainability of a retire-early lifestyle, citing concerns about long-term healthcare costs, inflation, and the unpredictability of the market over many decades.

Addressing Potential Risks and Downsides

The criticisms of the FIRE movement, while sometimes harsh, do highlight important considerations for anyone on the path to FIRE. The reality is, achieving and sustaining FIRE does come with risks.

The possibility of a major market downturn is one such risk. An economic downturn early in one’s retirement could significantly deplete a retiree’s portfolio, making it more challenging to maintain a withdrawal rate that will last through their lifetime.

Similarly, healthcare costs, which are often hard to predict and can be quite high in later life, present another potential risk. Additionally, inflation can erode purchasing power over time, meaning your retirement pot might not stretch as far as you’d planned.

Understanding How to Manage These Potential Issues

While these risks are real, they’re not insurmountable. And, importantly, they’re not unique to FIRE; they’re inherent in any retirement plan. The key to managing these risks lies in careful planning, flexibility, and regular reassessment.

Diversifying investments can help mitigate the impact of market downturns. Also, maintaining a flexible withdrawal rate—being willing to cut back during lean years—can help preserve your portfolio.

Planning for healthcare costs is also essential. This could involve setting aside a healthcare-specific fund, investing in a Health Savings Account (HSA), or ensuring that you have adequate insurance coverage.

As for inflation, building some inflation protection into your portfolio—such as owning assets like stocks and real estate that tend to rise with inflation—can be a sound strategy.

And perhaps most importantly, it’s crucial to keep an open mind and remain flexible. The path to FIRE isn’t a one-time decision but a journey of constant adjustment and adaptation.

By addressing these criticisms head-on and planning for potential risks, followers of the FIRE movement can navigate towards their goal of early retirement with their eyes wide open, prepared for the journey’s twists and turns. Even amidst the critics and skeptics, the beacon of FIRE continues to burn bright for those determined to blaze their unique trail to financial independence and early retirement.

source: Five Minute Finance on YouTube

Conclusion: Fat FIRE vs Lean FIRE

We’ve embarked on an enriching journey through the vivid landscape of the FIRE movement, exploring its origins, principles, and the distinct paths of Lean and Fat FIRE. We’ve investigated the tools to fuel your FIRE journey, from the potency of investing and the art of frugality, to the power of income optimization and the compass of planning and discipline.

We’ve also tackled the criticisms of the movement head-on, acknowledging the potential risks and challenges while illustrating ways to navigate them. Our exploration highlighted that FIRE isn’t just a destination, but a journey—a personal voyage of financial self-discovery and empowerment.

Financial Goals and FIRE Strategies

As we bring our journey to a close, the invitation now falls to you. Reflect on your financial goals, your values, and your vision of a good life. What does financial independence mean to you? What kind of retirement do you envision? Are you drawn to the simplicity and early freedom of Lean FIRE, or does the comfort-laden path of Fat FIRE appeal more to you?

Consider how the principles of the FIRE movement align with your personal financial goals. Even if early retirement isn’t your ambition, the strategies of the FIRE movement—such as frugality, high savings rate, investing, and income optimization—can offer valuable guidance for achieving financial independence, however you define it.

Individuality of FIRE Paths: There’s No ‘One Size Fits All’ Approach.

Ultimately, FIRE isn’t a rigid doctrine—it’s a flexible framework. There’s no ‘one size fits all’ approach. Your FIRE journey should be as unique as your fingerprint, reflecting your values, your priorities, and your life circumstances. You’re the architect of your financial future, and FIRE provides the tools to help you design it.

Whether you’re a Lean FIRE minimalist finding joy in simplicity, a Fat FIRE enthusiast savoring life’s luxuries, or somewhere in between, remember that the essence of FIRE isn’t about how much you save or when you retire. It’s about living life on your terms. It’s about making your financial choices a conscious reflection of who you are and who you aspire to be.

So, let your journey to FIRE ignite a new relationship with money—one where money isn’t the end goal but a means to an end, a tool to forge a life of freedom, fulfillment, and financial peace. As you embark on your path, remember: the best FIRE to aspire to is the one that sets your life ablaze with joy, purpose, and independence.

Lean FIRE vs Fat FIRE Additional Resources

Books, Blogs, and Communities about FIRE Movement

Just as a journey of a thousand miles begins with a single step, so does your exploration of the FIRE movement. Luckily, you’re not alone on this path—there’s a vibrant community of like-minded explorers eager to share their experiences and wisdom.

Books such as “Your Money or Your Life” by Vicki Robin and Joe Dominguez, “The Simple Path to Wealth” by JL Collins, and “Early Retirement Extreme” by Jacob Lund Fisker offer profound insights into the philosophy and strategies behind the FIRE movement.

Online, there’s an abundant supply of blogs, each offering unique perspectives and invaluable advice. Mr. Money Mustache, Mad Fientist, and Financial Samurai are some of the trailblazers in the realm of FIRE, illuminating the path with their wisdom, experience, and insights.

Communities, too, play a crucial role in your FIRE journey, offering companionship, advice, and inspiration. Online forums such as the r/FIRE subreddit, the Early Retirement forums, or the Mr. Money Mustache forums are treasure troves of knowledge, advice, and camaraderie from fellow FIRE seekers.

Tools and Applications for Budgeting, Tracking Expenses, and Investment Tracking

Embarking on your FIRE journey is akin to setting sail on a financial adventure, and like any seasoned explorer, you’ll need the right tools to navigate your course. Thankfully, in this digital age, you have a wealth of resources at your fingertips.

For budgeting and tracking expenses, applications like Mint, YNAB (You Need A Budget), and Personal Capital can be invaluable allies. They can help you track your spending, create budgets, monitor your savings rate, and see where your money is going each month.

For investment tracking, Personal Capital also shines, offering robust investment tracking features. Additionally, apps like SigFig and Morningstar can help you monitor your portfolio, track your asset allocation, and assess your investment performance.

Lastly, don’t overlook the power of a good old-fashioned spreadsheet. Whether you use Google Sheets or Excel, a customized spreadsheet can be a powerful tool for budgeting, tracking expenses, and monitoring investments.

Remember, these resources aren’t just tools—they’re your companions on your journey to FIRE. They’re here to guide you, support you, and help you navigate your way towards financial independence and early retirement. So equip yourself, embark on your adventure, and let your journey to FIRE be an exciting voyage of financial discovery, empowerment, and freedom.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.