Charlie Munger, often known as the lesser-sung hero of the investment world, has long been the stalwart companion of Warren Buffett at Berkshire Hathaway, serving as the vice chairman of the behemoth conglomerate. He may not be as widely recognized as Buffett, but his impact on Berkshire Hathaway and the world of investing is nothing short of significant. Born in Omaha, Nebraska, in 1924, Munger’s wisdom, wit, and penetrating insights have made him a legendary figure among serious investors. His investment philosophy, revolving around discipline, patience, and value, has influenced a generation of investors and continues to illuminate the path for those seeking sustainable wealth creation.

This article aims to shine a spotlight on the insights and methodologies that define Munger’s investment approach, offering a comprehensive guide to those who aspire to invest like this titan of finance. By dissecting his investment principles and presenting them in an accessible format, we hope to enable our readers to benefit from Munger’s profound wisdom and apply these strategies to their own investment endeavors. This guide is not about quick fixes or flashy market tactics. Instead, it reveres the clear, consistent, and long-term thinking that has marked Munger’s illustrious career.

Expect in-depth discussions, practical examples, and plenty of personality as we journey into the mind of this financial sage. The principles and ideas we will explore transcend market trends and hot picks, leaning into the very essence of value investing. We will delve deep into Munger’s ‘latticework of mental models,’ discuss his philosophy of ‘always invert,’ and understand how his relentless pursuit of ‘moats’ has built one of the most resilient financial fortresses in history.

Get ready to glean pearls of wisdom from one of the greatest investment thinkers of our time. If you’re eager to learn, thirsty for wisdom, and unafraid to challenge the conventional wisdom, then this comprehensive guide to investing like Charlie Munger is tailor-made for you. So buckle up and prepare for a fascinating journey into the world of intelligent, disciplined, and patient investing.

Who is Charlie Munger?

Charles Thomas Munger, more widely recognized as Charlie Munger, was born on January 1, 1924, in Omaha, Nebraska, in the heartland of the United States. From the humble beginnings of a middle-class family, Munger charted an extraordinary path that led him to the summits of investment wizardry.

As a young man, Munger initially dabbled in meteorology, serving as a meteorologist for the US Army Air Corps during World War II. After the war, he took advantage of the GI Bill to study mathematics at the University of Michigan before moving on to Harvard Law School, where he graduated magna cum laude. However, it was after he left the confines of Harvard that Munger began his grand exploration of the financial markets, eventually developing the unique investment philosophy that he is celebrated for today.

Munger began his career as a real estate attorney but quickly moved into the realm of investments, eventually establishing his own investment partnership in 1962. It was around this time that his friendship with Buffett began to blossom. Munger’s legal firm had been involved in a business deal with Buffett, and the two found that they had a shared philosophy and perspective on investing and the world at large.

In 1975, Munger took on the role of Vice Chairman at Berkshire Hathaway, effectively serving as Buffett’s right-hand man. His role, while not as public-facing as Buffett’s, has been critical in shaping the company’s successful investment strategies. Munger’s sage advice and relentless pursuit of intrinsic value have helped steer the conglomerate toward some of its most rewarding investments.

Munger’s investment track record is nothing short of remarkable. His independent partnership generated compound annual returns of almost 20% before he wound it down in 1975 to focus on Berkshire Hathaway. His contribution to Berkshire Hathaway’s meteoric rise is immeasurable. The company’s per-share book value grew from around $19 when Munger joined in 1975 to more than $400,000 by the end of 2021, representing a compounded annual gain of around 20%.

He has also played a prominent role in investments made by Daily Journal Corporation, where he serves as chairman. For example, during the 2008-2009 financial crisis, Munger guided the company to invest its surplus funds in distressed bank stocks, leading to substantial gains as the market recovered.

Charlie Munger’s life and career encapsulate the very essence of patience, wisdom, and value. He has often been overshadowed by his more flamboyant partner, Warren Buffett, but make no mistake: Munger is a titan in his own right. His unique approach to investing and his relentless pursuit of value have shaped not only the fortunes of Berkshire Hathaway but also the practices of countless investors around the world. In this comprehensive guide, we continue to explore and learn from the teachings of this humble genius of the investment world.

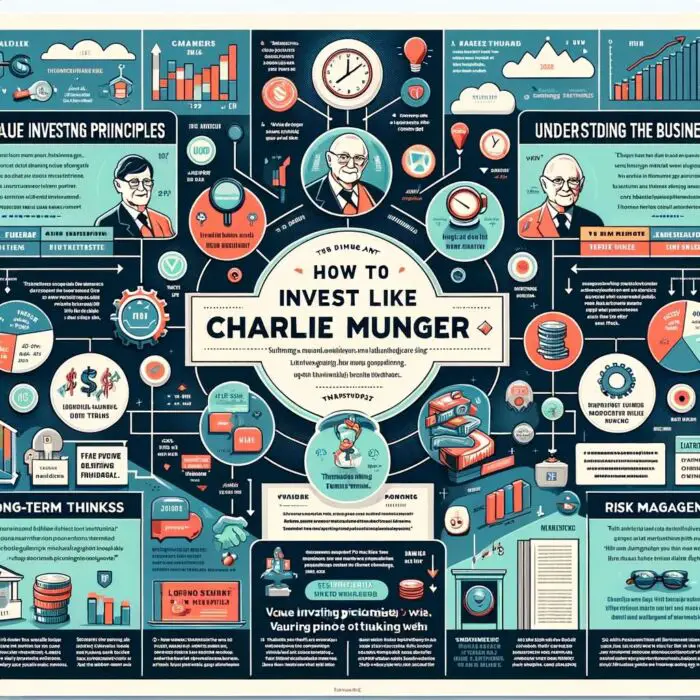

The Core Tenets of Munger’s Investment Philosophy

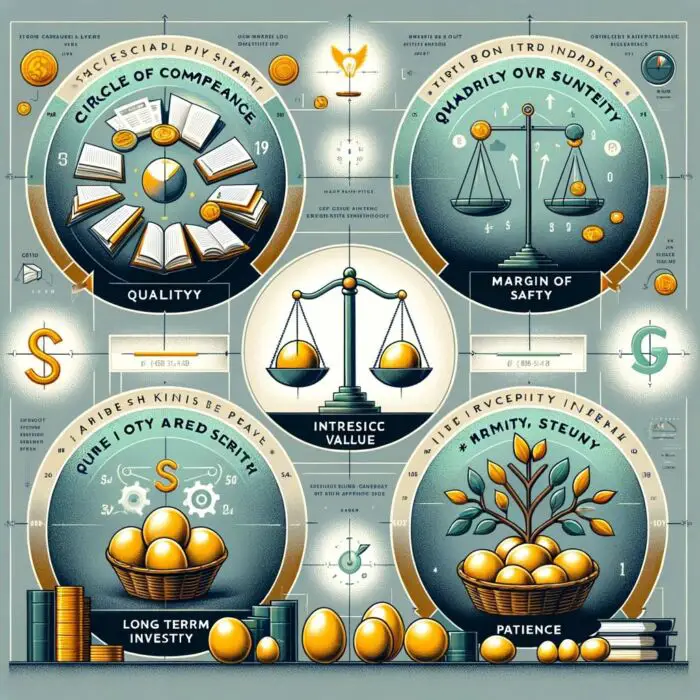

If you wish to understand the machinery behind Charlie Munger’s investment success, you must first delve into the fundamental principles that underpin his investing philosophy. Three core tenets have repeatedly surfaced in his talks, interviews, and shareholder letters: the ‘Circle of Competence,’ the concepts of ‘Intrinsic Value’ and ‘Margin of Safety,’ and his views on ‘Diversification versus Concentration.

Circle of Competence

First, let’s explore the ‘Circle of Competence.’ This principle revolves around the idea of focusing on businesses and industries you thoroughly understand. Munger believes that investors should invest only within their circle of competence, which includes sectors and companies they have substantial knowledge about.

Munger’s view is that it’s not about the size of the circle that matters, but rather knowing its boundaries. He often cautions against straying into areas outside of this circle, a misstep that he believes leads to poor investment decisions. Operating within one’s circle of competence provides an investor with a critical edge, allowing them to correctly interpret information and make intelligent predictions about future developments.

Intrinsic Value and Margin of Safety

Next, we arrive at the cornerstones of value investing: ‘Intrinsic Value’ and ‘Margin of Safety.’ Intrinsic value refers to the real, inherent worth of a business, independent of its current market price. Munger, like Buffett, seeks to invest in companies whose intrinsic value considerably exceeds their market price.

The intrinsic value can be determined through various methods, often involving in-depth financial analysis and projections about future cash flows. However, Munger also emphasizes qualitative factors like the quality of management, the company’s competitive position, and its ability to generate cash.

The ‘Margin of Safety’ principle is closely tied to the concept of intrinsic value. It refers to the difference between a stock’s intrinsic value and its market price. The larger this gap, the greater the margin of safety, which provides a buffer against potential losses should things not go as planned. Munger advocates for this principle as a key risk management tool, mitigating the downside if the intrinsic value was miscalculated or if unforeseen events negatively impact the business.

Diversification vs Concentration

Lastly, Munger has a distinct view on the topic of diversification versus concentration. The traditional investment doctrine advocates diversification to spread risks across many assets. However, Munger, like Buffett, is known for his skeptical views towards excessive diversification.

Munger often quips, “The idea of excessive diversification is madness.” He believes that it is better to focus on a few companies that are well within your circle of competence, have a high intrinsic value, and provide a large margin of safety. However, this concentrated approach necessitates a deep understanding of the chosen investments and a high tolerance for short-term volatility. Munger’s preference for a concentrated portfolio reflects his confidence in his investment decisions, harking back to his adherence to his circle of competence and his diligent pursuit of intrinsic value.

In the world of Munger, investing isn’t about chasing hot stocks or jumping on the latest market trend. It’s about clarity of understanding, patience, discipline, and calculated risk-taking. By integrating the principles of circle of competence, intrinsic value, margin of safety, and a preference for concentration over diversification, Munger has developed an investment philosophy that is not just successful but also enduring, providing valuable lessons for all investors.

source: WEALTHTRACK on YouTube

Understanding Quality Over Quantity in Investing

Charlie Munger’s investment philosophy stands as a powerful testament to the virtue of favoring quality over quantity. His approach underscores the significance of comprehending a business’s underlying quality, rather than obsessing over its stock price or market sentiment.

Quality Over Price

Munger’s focus on the quality of a business over its price is rooted in his deep understanding of value investing. He doesn’t scramble to pick up a stock simply because it’s cheap or has been recently hyped. Instead, he meticulously studies the inner workings of a company, evaluating its business model, competitive advantages, management quality, and financial strength.

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns,” Munger has famously said. This quote underscores his belief in the long-term correlation between a company’s fundamental performance and its stock price. Therefore, a high-quality business with robust operations and a strong track record of profitability is more likely to deliver superior returns over time, regardless of short-term price fluctuations.

This emphasis on quality also extends to the company’s management. Munger values leaders who are not only adept at running the business but also exhibit high ethical standards. This focus on integrity alongside competence demonstrates his belief that the long-term performance of a company is heavily dependent on the actions and decisions of its leaders.

Investing in Businesses You Understand

In the investment odyssey, Munger frequently advises voyagers to stick to their own path or, in other words, invest in businesses they understand. This isn’t merely a suggestion—it’s a cornerstone of his investment philosophy, the ‘Circle of Competence.’

In Munger’s eyes, investing is not a game of chance or a gamble on a hot tip—it’s about making informed and calculated decisions. He posits that an investor is more likely to make a sound decision when they deeply understand the business—its products or services, its competitive landscape, its revenue streams, and the challenges it might face. This understanding provides a solid foundation to assess the business’s quality and future prospects accurately.

Munger himself has confessed to passing up numerous investment opportunities in sectors or technologies he did not fully understand. Even in the face of potential high returns, he has chosen to err on the side of caution and stick to his circle of competence.

In a world that frequently gets swept up in the rush to capitalize on the next big thing, Munger’s philosophy serves as a grounding reminder of the importance of patience, diligence, and understanding in successful investing. His focus on quality over quantity, and his insistence on comprehending the fundamentals of a business, together form an investment blueprint that is as prudent as it is profitable. The path to investment success, according to Munger, is less about sprinting towards every opportunity and more about a thoughtful, measured walk within one’s circle of competence.

source: Independent Rat on YouTube

Long-Term Investing and Patience

A substantial part of Charlie Munger’s investing genius can be attributed to his ability to look beyond the short-term noise of the market and his unyielding patience. His belief in the power of long-term investing and his ability to wait for the right opportunities form the backbone of his investing approach.

The Power of Long-Term Investing

For Munger, investing is not a fast-paced sprint, but a marathon. His strategy is firmly rooted in long-term investment, a principle he has maintained throughout his career.

“We’re partial to putting out large amounts of money where we won’t have to make another decision,” Munger once said, highlighting his preference for a buy-and-hold strategy. His belief is that a great business will increase in value over time, and holding onto investments in such businesses can yield substantial returns in the long run. This approach has been fundamental to the success of Berkshire Hathaway, with investments in companies like Coca-Cola and American Express held for decades.

The long-term view allows Munger to look past the short-term volatility of the market, focusing instead on the fundamental performance of the business over time. He understands that good businesses may face temporary setbacks and that market sentiment may swing wildly from optimism to pessimism. Yet, over the long term, the quality of the business will shine through, and its stock price will reflect its intrinsic value.

‘Sitting On Your Hands’

A less spoken, but equally important aspect of Munger’s investment philosophy, is the concept of patience, often described as the ability to ‘sit on your hands.’ Munger has often stressed the importance of waiting for the right opportunity rather than jumping at every potential investment.

“The big money is not in the buying or the selling, but in the waiting,” Munger once said. He believes that investors often feel compelled to constantly buy or sell, driven by the fear of missing out or the desire to seem active. However, he emphasizes that sometimes the best action is inaction.

Patience, according to Munger, is crucial in waiting for the ‘fat pitch,’ a term borrowed from baseball that represents an investment opportunity that is well within your circle of competence, has a high intrinsic value, and provides a large margin of safety. Waiting for such an opportunity requires discipline and the ability to resist the market’s noise and the allure of quick profits.

Munger’s ability to hold onto investments for the long term and patiently wait for the right opportunities to invest have been instrumental in his success. His philosophy emphasizes that investing is not about constant action, but about thoughtful analysis, patience, and the courage to act decisively when the right opportunity comes along. As we continue our exploration into Munger’s investment wisdom, remember that patience is not just a virtue, but an essential skill in the investor’s toolkit.

Case Studies: Munger’s Investing Principles in Action

Examining Charlie Munger’s investment principles in action, through case studies of successful investments made by Berkshire Hathaway, provides a tangible perspective of his investment strategy. Two notable examples stand out, embodying Munger’s tenets: The Coca-Cola Company and See’s Candies.

Case Study 1: The Coca-Cola Company

Berkshire Hathaway’s investment in The Coca-Cola Company, initiated in 1988, provides a prime example of Munger’s principles at work. At the time, the soft-drink giant was undergoing a temporary downturn due to management missteps and had fallen out of favor with the market. However, Munger and Buffett, focusing on the company’s intrinsic value and its long-term prospects, recognized the opportunity and began acquiring shares.

This investment squarely fell within Munger’s (and Buffett’s) circle of competence. They understood the soft-drink business, with its steady cash flows and formidable brand power. Coca-Cola, as a business, had an enduring moat—its globally recognized brand and expansive distribution network—which ensured its competitive position in the industry.

Moreover, Munger applied the concept of a margin of safety. Despite Coca-Cola’s temporary struggles, the duo believed that the company’s market price significantly undervalued its true worth. They saw a large margin of safety and a tremendous upside potential.

Fast-forward to today, and the Coca-Cola investment remains one of Berkshire Hathaway’s most successful bets. The initial investment of $1 billion has grown multiple times over, demonstrating the power of long-term investing and patience.

Case Study 2: See’s Candies

See’s Candies, a lesser-known but equally illustrative example, showcases Munger’s investment philosophy in action. Berkshire Hathaway acquired See’s Candies in 1972 for $25 million. At first glance, See’s, a regional candy business in California, seemed an unassuming investment. However, Munger saw something special.

See’s Candies had a loyal customer base, commanded premium pricing due to its high-quality products, and had an excellent brand reputation—traits that Munger values highly. The company also possessed a moat in the form of its strong brand and customer loyalty. It was a business that Munger (and Buffett) understood and could predict with a high degree of certainty.

Over the years, See’s Candies has generated substantial cash flows for Berkshire Hathaway, far exceeding the initial investment. The company also taught Munger and Buffett the power of brand and qualitative factors, influencing their later investments in brand-heavy businesses like Coca-Cola.

Lessons Learned

These case studies reinforce the principles that underpin Munger’s investment philosophy. Both Coca-Cola and See’s Candies underline the importance of understanding the business (Circle of Competence), focusing on intrinsic value and the margin of safety, and the power of patience and long-term investing.

They demonstrate that sticking to industries you understand, waiting for the right opportunities, and staying invested for the long term can yield substantial returns. They also highlight the importance of focusing on businesses with durable competitive advantages, or moats, and high-quality management.

In the words of Munger, “Our job is to find a few intelligent things to do, not to keep up with every damn thing in the world.” These case studies are examples of those “few intelligent things” that have contributed immensely to the success of Berkshire Hathaway and the legendary status of Charlie Munger in the world of investing.

Applying Munger’s Investment Philosophy Today

Navigating the intricacies of the current investing landscape may seem more complex than in Charlie Munger’s early days, given the proliferation of investment options, the speed of information flow, and market volatility. However, the core tenets of Munger’s investment philosophy remain timeless and universally applicable, even in today’s dynamic environment. Here’s how you can incorporate Munger’s principles into your investing approach.

Adopting Munger’s Principles

To start, remember the ‘Circle of Competence.’ Identify sectors, industries, or types of businesses that you understand well and can confidently make predictions about. Don’t chase after the latest fad or invest in complex businesses simply because they’re the talk of the town. If you don’t understand it, you’re gambling, not investing. Stay within your circle.

Next, focus on the intrinsic value and the margin of safety. Look for businesses that, in your estimation, are worth more than their market price suggests. This will require thorough research and analysis, focusing not just on financial metrics but also on qualitative aspects like management quality, competitive position, and growth prospects.

Remember, diversification is not the end goal—quality is. Rather than spreading your investments thin across numerous stocks, concentrate on a few outstanding companies.

Lastly, cultivate patience. Don’t feel compelled to constantly trade or follow the crowd. As Munger emphasizes, the big money is made in the waiting. Be ready to hold onto your investments for the long term, and be patient enough to wait for the right opportunities to invest.

Practical Steps for Implementing Munger’s Approach

Here are some practical steps to help you implement Munger’s philosophy:

- Educate Yourself: Understand different industries and businesses. Continually expand your knowledge and, consequently, your ‘Circle of Competence.’

- Research and Analysis: Before investing, thoroughly research the company. Understand its business model, assess its financial health, evaluate its competitive position, and study its management.

- Value Assessment: Learn how to calculate the intrinsic value of a company. There are numerous methods, including discounted cash flow analysis, price-to-earnings ratios, and more. The goal is to estimate what the business is truly worth.

- Patience and Discipline: Do not rush into investments. Wait for opportunities that offer a margin of safety, and once you invest, be prepared to hold for the long term.

- Regular Review: Regularly review your investments to ensure they still meet your criteria. However, don’t be swayed by short-term market volatility. Focus on the long-term performance of the business.

- Ethics and Integrity: Remember, Munger invests in companies with good management ethics. Investment isn’t just about the numbers; it’s also about supporting businesses that align with your values.

Embracing Munger’s investment philosophy doesn’t promise overnight success, nor does it offer a formulaic approach to quick riches. It’s a structured framework built around discipline, patience, deep understanding, and ethical investing. It’s an approach that has been weather-tested across market cycles and proven successful over decades. As you incorporate these principles into your investing journey, remember that, in Munger’s words, “The big money is not in the buying and selling … but in the waiting.”

Conclusion: Charlie Munger’s Investment Philosophy

As we reach the conclusion of this deep dive into Charlie Munger’s investment philosophy, we find ourselves having traversed a landscape defined by the tenets of understanding, patience, and quality. Munger’s approach to investing, while seemingly simple in theory, demands discipline, discernment, and the courage to depart from the crowd.

Let’s recap the core principles of Munger’s philosophy:

- Circle of Competence: Stick to industries and businesses that you understand well. Expand your knowledge to gradually increase your circle.

- Intrinsic Value and Margin of Safety: Focus on the actual worth of a business rather than its market price. Look for a significant gap between value and price, providing a ‘margin of safety.’

- Quality Over Quantity: Rather than diversifying for the sake of it, concentrate your investments in a few outstanding companies.

- Long-Term Investing and Patience: Stay invested for the long term and wait patiently for the right opportunities to invest.

Applying these principles in today’s dynamic investment landscape can yield substantial benefits. It provides a solid framework for making informed investment decisions, potentially leads to superior long-term returns, and helps avoid the pitfalls of speculative investing. Following Munger’s approach, one can navigate the financial markets with an investor’s wisdom, rather than a speculator’s gamble.

However, investing like Charlie Munger is not without its challenges. It requires discipline to resist the allure of quick profits or the fear of missing out on the ‘next big thing.’ It also requires patience to wait for the right opportunities and to hold onto investments during market volatility. Additionally, it necessitates an appetite for continuous learning to understand different industries and businesses.

In conclusion, Charlie Munger’s philosophy offers not only a path to successful investing but also an approach to rational decision-making and ethical business practices. As we conclude this comprehensive guide, remember Munger’s belief that “all intelligent investing is value investing.” Embrace his principles, cultivate patience and discipline, and you’re on your way to investing like one of the greatest investment minds of our time—Charlie Munger.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.