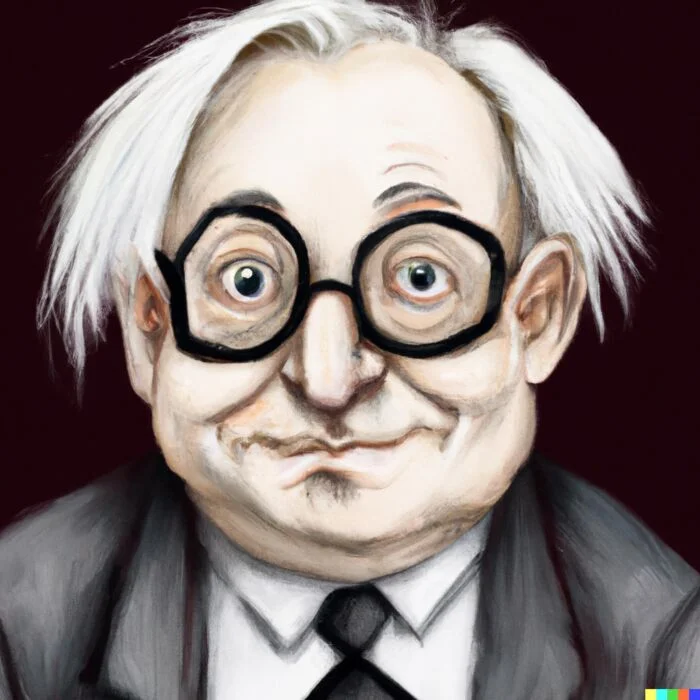

Charlie Munger, the Vice Chairman of Berkshire Hathaway, is renowned globally for his acumen and wisdom in the realm of investing. He is perhaps best known as the trusted partner of Warren Buffett, one of the wealthiest and most successful investors in the world. However, Munger’s contributions to the field of investing extend far beyond this partnership.

His unique investment philosophy, an extension of traditional value investing principles, revolves around patience, discipline, and rationality. He champions the idea of ‘waiting for the right pitch’, emphasizing the importance of patience and a discerning eye in selecting the right investment opportunities. His approach is heavily grounded in understanding the fundamentals of a business, considering the long-term prospects, and buying at a price below intrinsic value, embodying the very spirit of value investing.

Charlie Munger’s Stock Picking Strategies

This article aims to unravel the principles and strategies that govern Munger’s stock picking approach. It presents an in-depth exploration of the fundamental tenets that guide Munger’s investment decisions, drawing upon his extensive experience, insightful speeches, and enlightening writings.

We’ll delve into his concept of the ‘Circle of Competence’, the principle of ‘Intrinsic Value’, and his firm belief in the practice of patience and discernment when it comes to choosing stocks. Using real-life examples from Berkshire Hathaway’s investment history, we’ll demonstrate these principles in action. Furthermore, the article will provide insights into how individual investors can implement Munger’s strategies in their investment portfolios, adapting his wisdom to navigate the contemporary investment landscape.

Understanding Charlie Munger’s Investment Philosophy

Charlie Munger’s investment philosophy is rooted in the principles of value investing, albeit with his unique interpretations and additions. At the core of his philosophy lies a steadfast commitment to rationality. Munger believes that one should only invest in businesses that they rationally understand and can evaluate.

Deep Dive into Charlie Munger’s Core Investment Beliefs

Another cornerstone of his philosophy is the concept of ‘Circle of Competence’. Munger insists that investors should focus on areas they know best and avoid stepping outside of their knowledge domain when making investment decisions.

Munger also promotes the idea of ‘Intrinsic Value’, advocating that investors should aim to determine a company’s true worth based on its fundamentals and then invest only if the market price is significantly below this value, thus providing a ‘Margin of Safety.

Patience and long-term thinking form another essential part of his philosophy. Munger often emphasizes the idea of ‘waiting for the right pitch’, encouraging investors to wait for the perfect opportunity rather than rush into suboptimal investments.

Finally, Munger stresses the importance of ethics and integrity, both in the companies one invests in and in one’s behavior as an investor.

How These Beliefs Inform Munger’s Stock Picking

Munger’s core investment beliefs profoundly shape his stock picking approach. His focus on rationality ensures that he only invests in businesses that he can understand and rationally evaluate. This philosophy is seen in his preference for simple, easy-to-understand businesses with consistent earnings.

The ‘Circle of Competence’ principle guides him to invest in industries and companies he is familiar with. It helps him identify his knowledge boundaries and avoid potential investment pitfalls outside his domain of understanding.

By adhering to the ‘Intrinsic Value’ principle, Munger ensures that he only picks stocks trading below their true worth, hence protecting his investments and increasing potential returns.

His belief in patience and long-term focus can be seen in his tendency to hold onto his investments for extended periods, often several decades, allowing the power of compounding to work in his favor.

Lastly, his focus on ethics and integrity leads him to pick companies with honest, competent management and ethical business practices. It’s a belief that aligns with his famous dictum, “It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

source: New Money on YouTube

The ‘Circle of Competence’ and Stock Picking

Explanation of the ‘Circle of Competence’ Concept

Charlie Munger’s ‘Circle of Competence’ is a central concept in his investment philosophy. The idea is straightforward but profoundly impactful – investors should stick to industries and businesses they know well. In other words, one’s investments should lie within their ‘Circle of Competence’. This circle is not static but can be expanded through continuous learning and experience.

The philosophy behind the ‘Circle of Competence’ is that when investors operate within areas they deeply understand, they are more likely to make sound, informed investment decisions. Conversely, venturing outside this circle increases the likelihood of errors due to lack of understanding or information.

Role of ‘Circle of Competence’ in Munger’s Stock Selection Process

The ‘Circle of Competence’ plays a critical role in Munger’s stock picking strategy. It’s evident in the way Munger and his long-time business partner, Warren Buffett, have steered Berkshire Hathaway’s investment portfolio. They have consistently chosen businesses within industries they are intimately familiar with and can predict with a reasonable degree of certainty.

This is why you’ll see Berkshire Hathaway’s portfolio filled with insurance, consumer goods, and utility companies – sectors that Munger and Buffett understand deeply. A classic example is Berkshire’s significant stake in Coca-Cola, a company with a simple business model and a product that both Munger and Buffett have understood and enjoyed personally.

By confining their stock picking to their ‘Circle of Competence’, Munger and Buffett have been able to accurately assess the value and future prospects of companies, enhancing their investment decision-making process. For Munger, the ‘Circle of Competence’ serves as both a guiding principle and a protective moat, aiding him in selecting winning stocks while steering clear of potential investment disasters.

source: valueinvestorsportal on YouTube

‘Intrinsic Value’ and Stock Selection

Explanation of ‘Intrinsic Value’

Intrinsic Value’ is a fundamental concept in value investing, central to the investment philosophies of both Charlie Munger and Warren Buffett. The intrinsic value of a stock refers to the actual or true value of that stock, which may not necessarily align with its current market price.

Intrinsic value takes into account a multitude of factors such as a company’s tangible and intangible assets, earnings potential, and overall business prospects. Estimating intrinsic value is a complex process involving rigorous financial analysis, industry research, and an evaluation of macroeconomic factors.

While intrinsic value can be challenging to quantify, and different investors may arrive at different values, it is a vital tool for determining whether a stock is undervalued or overvalued, providing a more comprehensive picture of a company’s value than market price alone.

How Charlie Munger Uses Intrinsic Value for Stock Picking

Intrinsic value plays a vital role in Munger’s stock selection process. He looks for stocks whose market price is significantly below their intrinsic value, a concept known as the ‘Margin of Safety’. By purchasing stocks at a price lower than their intrinsic value, Munger safeguards his investments against uncertainties and market volatility while setting the stage for potential profit when the market price eventually converges with the intrinsic value.

One of the primary examples of this strategy is Berkshire Hathaway’s investment in Coca-Cola in 1988. Despite the market being bearish about Coca-Cola due to short-term concerns, Munger and Buffett, recognizing the company’s robust brand and global reach, estimated a high intrinsic value for the company. They saw a significant margin of safety and seized the opportunity, resulting in one of their most profitable investments.

Munger’s focus on intrinsic value reflects his preference for investing based on rational analysis and long-term business performance rather than short-term market fluctuations, providing a compass for navigating the often turbulent waters of the stock market.

source: The Financial Times on YouTube

Patience and Discernment in Stock Picking

Charlie Munger’s Approach of ‘Waiting for the Right Pitch’

Borrowing a baseball analogy, Charlie Munger often emphasizes the importance of ‘waiting for the right pitch’. Unlike a baseball game where a player is penalized for not swinging at a good pitch, there are no such penalties in investing. Investors can wait indefinitely until they find a stock that meets all their criteria – a company they understand, at a price significantly below its intrinsic value, and with good long-term prospects.

Munger often relates this to the discipline of not being tempted to make investments just for the sake of activity. An investor’s success doesn’t come from the quantity of transactions, but from the quality of a few well-judged investments. Hence, Munger stresses the importance of patient discernment, even if it means long periods of inactivity.

The Importance of Patience and Discernment in Munger’s Stock Picking Process

Patience and discernment form the bedrock of Munger’s stock picking process. The financial markets are filled with noise and distractions, and it can be tempting to follow the herd or be swayed by short-term trends. However, Munger advises investors to resist these temptations.

Instead, Munger’s strategy involves patiently waiting for an opportunity that aligns perfectly with his investment criteria. This requires a discerning eye to separate the wheat from the chaff and identify genuinely valuable investment opportunities amidst market noise.

By combining patience with rigorous discernment, Munger’s approach allows for the minimization of errors and the maximization of opportunities, leading to superior long-term investment returns. This philosophy underscores Munger’s belief in the value of understanding a business deeply, estimating its intrinsic value accurately, and waiting patiently for the right opportunity to invest.

source: Cooper Academy on YouTube

Case Studies: Munger’s Stock Picking in Action

Berkshire Hathaway’s Investments that Exemplify Munger’s Stock Picking Strategies

There are several notable examples of Munger’s stock picking strategies in Berkshire Hathaway’s investment portfolio.

One such example is the company’s long-term investment in Coca-Cola. In the late 1980s, many investors were bearish about Coca-Cola due to short-term challenges. However, Munger and Buffett, understanding the company’s strong global brand and robust business model, identified a significant gap between the market price and the intrinsic value of Coca-Cola’s stock. They patiently waited for the right opportunity to invest, leading to one of Berkshire Hathaway’s most profitable investments.

Another example is Munger’s decision to invest in See’s Candies. Munger recognized the company’s strong brand, loyal customer base, and excellent management. Despite the company being a bit more expensive in terms of valuation ratios at the time of purchase, Munger saw the intrinsic value in its durable competitive advantages and capacity to raise prices over time, which led to outstanding returns.

Key Takeaways from these Case Studies

These case studies underline several important aspects of Munger’s stock picking strategies. Firstly, they show the value of focusing on the intrinsic value of a business rather than short-term price movements. Both Coca-Cola and See’s Candies faced challenges at the time of purchase, but a focus on their long-term potential led to successful investments.

Secondly, these case studies highlight the importance of patience in investing. In both cases, Munger waited until he found the right opportunities, reinforcing the idea of ‘waiting for the right pitch.

Lastly, these examples underline the benefits of investing in businesses that are easy to understand and operate within the investor’s ‘Circle of Competence’. By sticking to industries and companies they understood well, Munger and Buffett were able to make more accurate assessments about these companies’ future prospects.

These insights serve to illuminate Munger’s investment strategies and how they can be applied by individual investors in their stock picking process.

source: Investor Center on YouTube

Applying Charlie Munger’s Stock Picking Strategies Today

In the fast-paced and ever-changing world of investments today, Charlie Munger’s stock picking strategies remain as relevant as ever. The proliferation of information, increasing market complexity, and shifting investor sentiments can make it easy for investors to lose sight of core investment principles. However, Munger’s philosophies serve as a timeless guide.

His emphasis on understanding a company’s intrinsic value cuts through the noise of short-term price fluctuations and market sentiment. It encourages investors to focus on the fundamentals of a business, thereby avoiding the pitfalls of speculative or momentum investing. This approach has proven successful across various market cycles and economic conditions, underscoring its enduring relevance.

How Individual Investors Can Implement Munger’s Stock Picking Strategies

For individual investors looking to implement Munger’s strategies, the first step is to identify and understand their ‘Circle of Competence’. This involves sticking to industries or companies they know well and can make informed judgments about.

Next, investors should strive to estimate a company’s intrinsic value. This process involves deep analysis of a company’s financials, understanding its business model, competitive advantages, and growth prospects. It requires discipline and patience, but it’s an integral part of the investment decision-making process.

Lastly, it’s crucial to adopt the ‘waiting for the right pitch’ mindset. This means not rushing into investments, but patiently waiting for opportunities that offer a significant margin of safety.

By following these principles, individual investors can better navigate the investment landscape, make more informed decisions, and ultimately achieve more successful long-term investment outcomes.

Conclusion: Charlie Munger’s Timeless Stock Picking Strategies

Throughout the article, we’ve explored Charlie Munger’s timeless stock picking strategies that have been instrumental in the enormous success of Berkshire Hathaway. Munger’s approach centers on understanding one’s ‘Circle of Competence’, accurately assessing a company’s intrinsic value, and patiently waiting for the right investment opportunity. Through case studies such as Coca-Cola and See’s Candies, we have seen the application and results of these principles in real-world investing.

Importance and Relevance of these Strategies in Modern Investing

As we navigate the increasingly complex investing landscape of the 21st century, Munger’s wisdom remains remarkably relevant and practical. His strategies cut through the noise and frenzy of the market, reminding us of the core principles that underpin successful investing. They offer guidance that is not only beneficial for experienced investors but is especially useful for individual investors.

Despite changes in market dynamics, technologies, and trends, the fundamentals of good investing, as championed by Munger, remain the same. Understanding the business, assessing its true worth, and patient discernment still form the bedrock of successful stock picking.

Therefore, as we continue to invest in a world of endless possibilities and relentless change, let’s remember Munger’s words, “It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.” It is perhaps this combination of wisdom, patience, and discipline that will guide us in our investing journey, helping us pick winners while avoiding unnecessary risks.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.