Tactical Asset Allocation has been one of my personal favourite subject areas of study in recent months.

The ability to adapt dynamically to changing market environments and economic regimes is a massive advantage versus static asset allocation strategies.

In fact, I couldn’t imagine my portfolio at this point in time without some form of dynamic components.

With this in mind, I’m thrilled to have Raymond Micaletti of Relative Sentiment Technologies join us to discuss MOOD ETF as part of our “Strategy Behind The Fund” series.

It’s better known as the Relative Sentiment Tactical Allocation ETF.

Let’s turn things over to Ray to learn more!

Meet Raymond Micaletti of Relative Sentiment Technologies

Ray Micaletti, co-founder and CIO of Relative Sentiment Technologies, has over 20 years of experience at major investment banks, hedge funds, and asset management firms where his primary focus has been on developing and managing quantitative investment strategies.

In recent years, he has been at the forefront of developing several new techniques for tactical asset allocation–primarily involving relative sentiment, a topic on which he has published extensively.

A native of Western Pennsylvania, he currently resides in Palmas Del Mar, Puerto Rico with his wife and young son.

Reviewing The Strategy Behind MOOD ETF (Relative Sentiment Tactical Allocation ETF) with its creator Raymond Micaletti

Hey guys! Here is the part where I mention I’m a travel content creator! This the “Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of MOOD ETF?

For those who aren’t necessarily familiar with an “relative sentiment” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Relative sentiment is a measure that compares the positions, flows, or attitudes of institutional investors against those of retail investors.

The purpose of doing so is that decades of research have shown institutions tend to have better outcomes in financial markets than retail investors.

This dominance makes sense given the structural advantages institutions possess.

For instance, institutions have much better information networks than retail investors.

Institutions routinely have access to politicians, lobbyists, corporate CEOs, Federal Reserve governors, etc.

Institutions also have deeper pools of human capital.

Each year institutions hire a new crop of MBAs, CFAs, and PhDs armed with the latest computational tools and set them loose to discern the state of corporate and macroeconomic fundamentals.

Lastly, institutions set the prevailing market narrative.

That is, institutions, via research reports and media appearances, tell retail traders how they should be thinking about the market.

This obviously has the power to herd retail traders into doing the wrong thing at the wrong time.

(As an example, all we heard in Q4 2022 was about the impending recession, but while that was the narrative, institutions were buying equities in bulk while retail was selling.)

It should be noted that institutions don’t always win–if they did, the small trader would stop playing the game.

Just as a slot machine pays out every now and then to keep the customers coming back, so too do small traders win occasionally.

But as Damon Runyan said, “The race is not always to the swift, nor the battle to the strong, but that is the way to bet.”

In practice, relative sentiment can be measured in a variety of ways.

For equities, we use four different composite indicators (some use data on how investors are positioned, others use survey data), each giving a desired equity allocation between 0% and 100%.

We average the four to get our tactical portfolio’s overall allocation to equities.

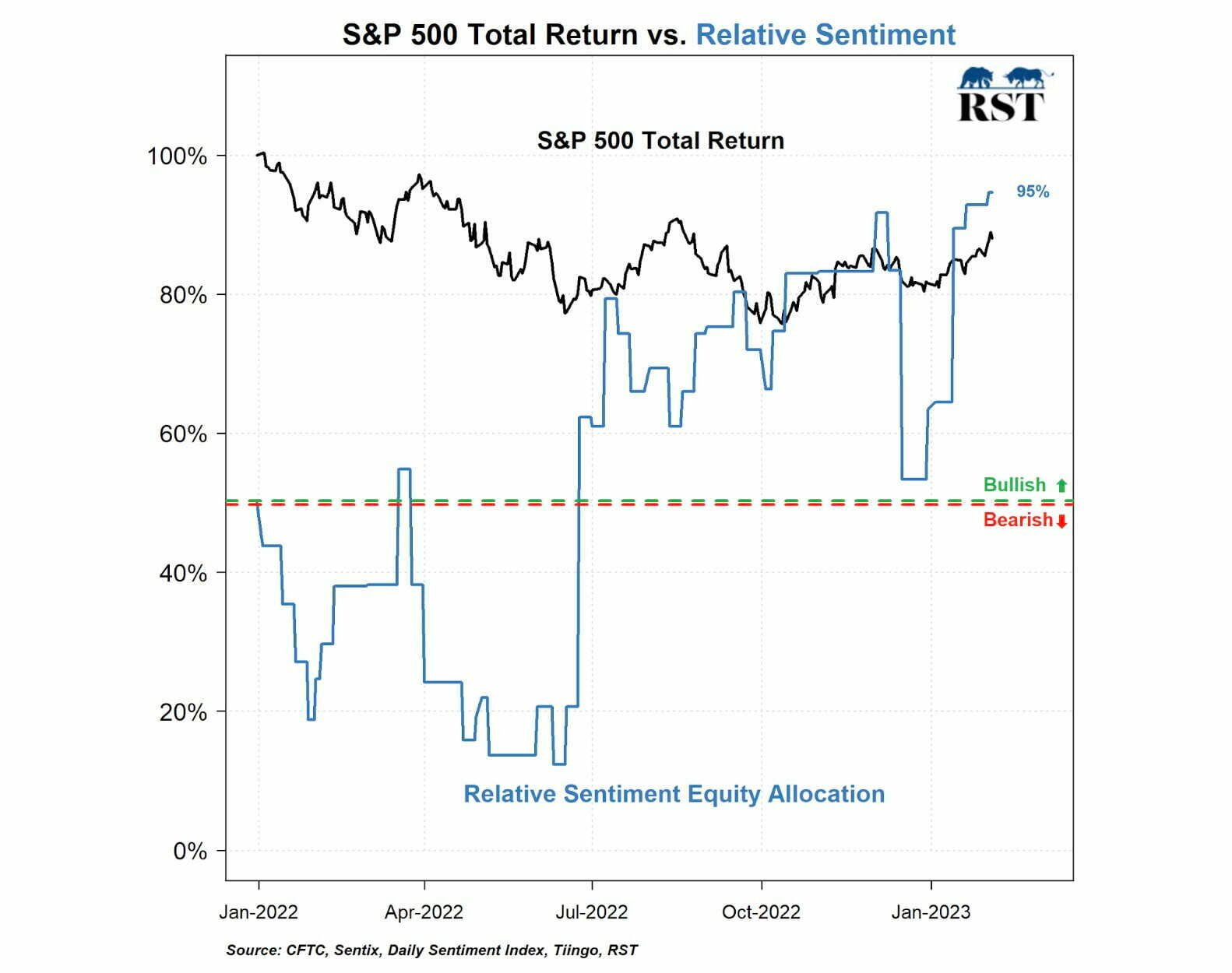

The chart below shows the evolution of our composite relative sentiment indicator versus the S&P 500’s total return starting from January 2022:

S&P 500 Total Return vs Relative Sentiment

As one can see, relative sentiment was in bearish territory the first half of 2022, then became quite bullish from early July onward and is currently at levels rarely seen (> 90%).

This indicates that institutions are much more bullish on equities than retail traders.

How it works in practice–at least in our implementation–is that our portfolio’s allocation to equities generally follows the blue line in the figure with the exception that we will only update the allocation if the new desired allocation is greater than 10 percentage points away from the current allocation.

For example, if we were sitting at 65% equities and the composite relative sentiment indicator updated its value to 70% equities, we would stay at 65%, but if the new desired equity allocation were 75% or greater, we would update it.

(The remainder of the portfolio is allocated to gold and bonds–both inflation-protected and nominal–using relative and retail sentiment measures.)

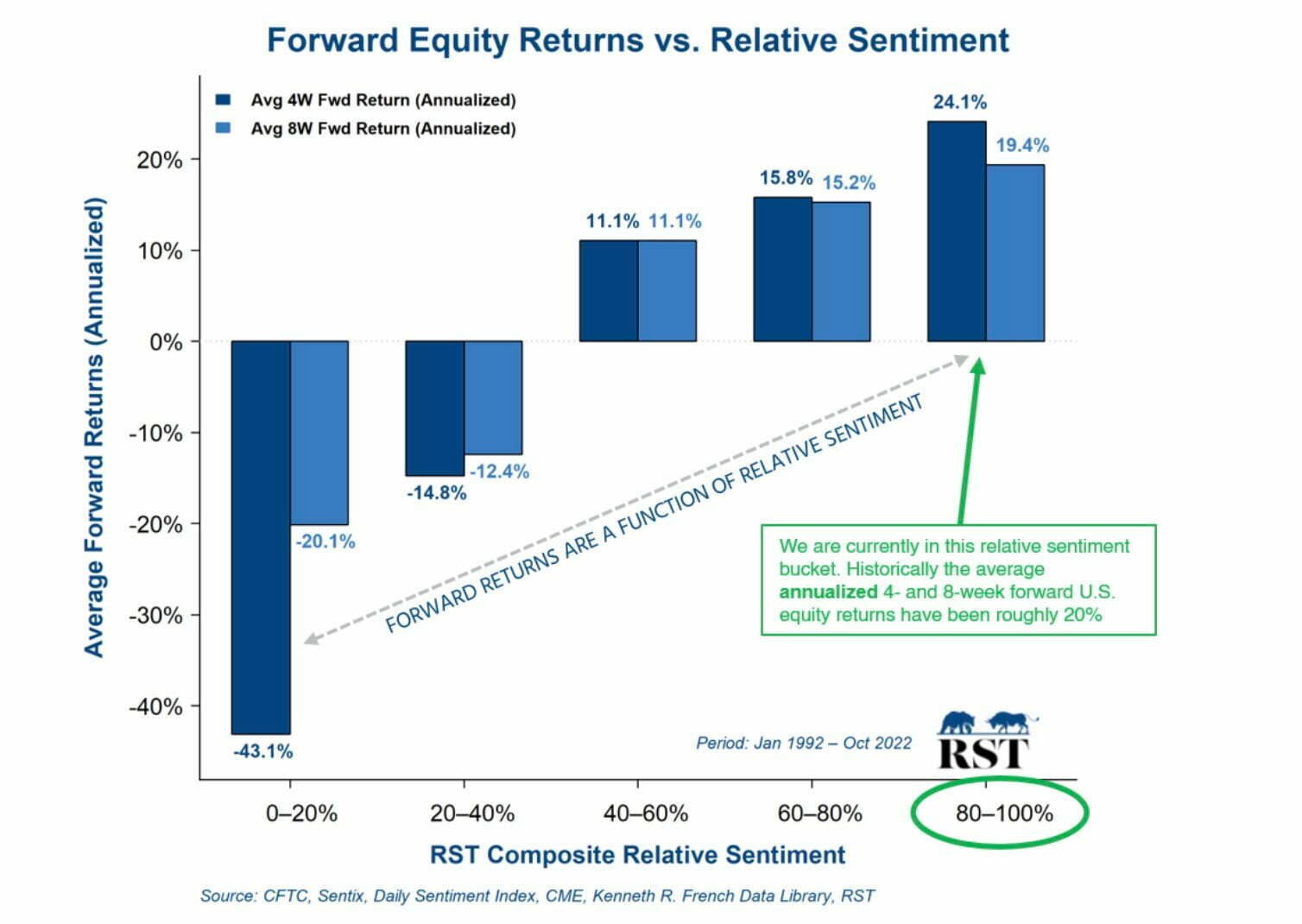

The interesting thing about this composite measure of relative sentiment is that it historically has had a monotonic relationship with forward returns.

That is, the higher the indicator, the higher the forward returns, and vice versa.

The chart below shows the annualized forward returns based on five buckets of composite relative sentiment: 0%-20%; 20%-40%; 40%-60%; 60%-80%; 80%-100%.

Forward Equity Returns vs Relative Sentiment

Unique Features Of Relative Sentiment Tactical Allocation ETF MOOD

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it an active ETF or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The strategy underlying our fund is pretty straightforward.

It can be thought of as a dynamic 60/40 in that, historically, the long-term average equity exposure has been 61%; the average bond exposure, 34%; and the average gold exposure, 5%.

But the allocations are not static, they change–in a systematic, rules-based way–based on the evolution of relative sentiment (as outlined above).

So that while, on average, the allocation profile may resemble a 60/40, at any given time, the fund may have substantially more or substantially less equities depending on the state of relative sentiment.

Moreover, the ETF wrapper allows us to be active with minimal tax consequences for the holders of the ETF.

We use no leverage and provide investors with familiar exposures (U.S. and Developed Markets equities, nominal and inflation-protected bonds, and gold).

The main wrinkle is that rather than having static allocations to those asset classes or using discretion to determine them, we align our allocations with the relative bullishness or bearishness of institutions compared to retail traders.

Our management fee is 65 bps and the underlying ETFs we use add, on average (depending on our allocation profile), 4-6 bps of additional management fees (we use the lowest cost ETFs in the respective asset classes).

source: Excess Returns on YouTube

What Sets MOOD ETF Apart From Other Tactical Asset Allocation Funds?

How does your fund set itself apart from other “tactical asset allocation funds” being offered in what is already a crowded marketplace?

What makes it unique?

From what we see in the marketplace, there are no funds that offer investors exposure to relative sentiment.

It’s a fairly new concept to most investors.

Most tactical funds base their allocations on value, momentum, cross-asset lead-lag relationships, or standalone sentiment.

Thus, our fund is currently completely unique in what it offers investors.

We recently did a study that showed the complementary nature of trend following and relative sentiment (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4235609) and the point we made in that paper played out exactly as outlined in real-time at the October lows.

At market troughs, trend following strategies have 0% allocation to equities (or are short).

In contrast, relative sentiment tends to have elevated allocations to equities are market troughs as the institutions identify the turning points and begin to get long.

In mid-October, when long-only trend following strategies had 0% allocation to equities, relative sentiment had 83% allocation to equities: https://x.com/RelSentTech/status/1622345789237350400?s=20&t=2J_tdJP4RjRihQ6vrMVmZQ

Thus, we offer investors a complementary strategy to their trend following holdings that can buffer the weaknesses of trend following (namely, staying in the market too long after it tops, and staying out of the market too long after it bottoms) and perhaps give them a different perspective on likely market outcomes.

What Else Was Considered For MOOD ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

When we designed the fund in late 2021, we considered adding Emerging Markets exposure as well, but the management fees for the biggest, most liquid EM ETFs were a bit too high (given our thinking at the time).

However, in the last several months we have uncovered a host of additional relative sentiment relationships (in currencies, commodities, credit spreads, the yield curve, factors, etc.) that might argue for inclusion in the not too distant future.

For example, relative sentiment works exceptionally well with the U.S. Dollar Index.

When the U.S. Dollar Index was rising in 2022, both equities and bonds were performing poorly (given the inflationary secular regime we are in).

Having the ability to take U.S. Dollar exposure based on relative sentiment would give the fund an additional dimension of diversification during risk-off periods (because being in bonds at such times might not be a solution).

Thus, we will continue to do research and if we find any relationships that seem worthy of inclusion, we will consider them.

source: New York Stock Exchange On YouTube

When Will MOOD ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

As a long-only fund, the environment in which the strategy would perform the worst on an absolute basis would be when equities, bonds, and gold are all falling at the same time.

This might correspond to an environment in which real interest rates are rising and growth is slowing or stagnating.

Conversely, the environment in which it would perform the best (in an absolute sense) is when all of those asset classes (or at least equities and bonds) are rising.

On a relative basis, it would do well when equities and bonds have negative correlations and equity relative sentiment is bearish and equities fall. In this case, it would be more allocated to bonds and gold and would sidestep much of the equity drawdown, while also generating positive returns from its exposure to bonds and gold.

Another situation in which it does well is when momentum is negative, but institutions are buying the dip (such as this past October at the mid-October lows).

Equities tend to have their best, most concentrated, returns in those short windows after institutions start buying after a substantial selloff.

A situation in which it could lag is when it turns bearish too early, which has happened several times prior to major market peaks.

For example, one of our relative sentiment indicators went to 0% equity allocation in July 2021, about 4 months before the broad market (VTI) peaked.

One vulnerability for relative sentiment is an exogenous event that changes market dynamics in an unforeseen way.

For example, in 2018, relative sentiment turned bearish in August.

The market peaked in September and fell 20% in the fourth quarter (Powell had said in early October with regard to rate hikes, “We’re nowhere near neutral.”).

Relative sentiment had a 7% allocation to equities that December and thus avoided most of the drawdown.

But in early January, Powell backtracked and pivoted.

The market took off higher and it took relative sentiment several weeks to adjust its allocation to a more bullish stance.

It was caught off guard.

At the same time, exogenous events could work in favor of relative sentiment.

During the COVID panic of March 2020, institutions were buying hand over fist starting in mid-March–during the thick of the bloodbath.

I recall my boss at the time getting annoyed at me (understandably given the immense uncertainty) saying that the smart money was buying: “I don’t want to hear about the ‘smart money’!”

Sure enough, though, on March 23rd, Powell came out and said he was buying up everything and the market bottomed and didn’t look back.

In general, we believe the fund can:

- Mitigate downside risk → by reducing equity exposure

- Capture upside return → by increasing equity exposure

- Hedge against inflation → by increasing allocations to TIPS or gold

- Hedge against deflation → by increasing allocations to nominal bonds and gold

- Reduce tax consequences → via the ETF wrapper

- Provide general stability → long-only, uses no leverage or derivatives, no exotic risk profile

Why Should Investors Consider Relative Sentiment Tactical Allocation ETF MOOD?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Our fund doesn’t ask investors to take any exotic risks.

Our portfolio consists of (broad-market/low-cost) U.S. and Developed Markets equities, nominal and inflation-protected bonds, and gold–all exposures that investors probably already have.

However, most investors might keep those allocations static or use discretion when adjusting them, and discretion is subject to human emotions and cognitive biases, which can lead to doing the wrong thing at the wrong time.

Relative sentiment is systematic, unemotional, and allows investors to align a portion of their portfolio with what institutions are doing relative to retail traders.

Given institutions’ track record of attaining better outcomes than individuals in the market, aligning one’s portfolio with what institutions are doing may have beneficial effects over time.

As an example, how many retail or RIA investors were getting long in October 2022?

Very few.

Institutions, however, were getting very bullish at the October lows (https://x.com/RelSentTech/status/1622345789237350400?s=20&t=ZTaYDE-pOUfpqi2p4lEwAQ).

Thus, exposure to relative sentiment would have given one a different perspective from what the prevailing market narrative was at the time.

source: The Meb Faber Show on YouTube

How Does MOOD ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

In a broader sense, we envision four different ways an investor can make use of relative sentiment in his or her portfolio.

- Core-satellite: If you believe in passive investing, carving out a portion of your equities and bonds (say 3% equities, 2% bonds) and substituting with relative sentiment will on average leave you with the same portfolio, but will opportunistically give you more exposure to equities when relative sentiment is high and less exposure to equities when relative sentiment is low, without you having to do any of the heavy lifting or worry about tax consequences (if in a taxable account).

- Factor diversification: If you believe in factors (value, momentum, quality, etc.), then relative sentiment can offer you factor diversification. As mentioned earlier, it complements trend following (by having lower equity exposure at market peaks and higher equity exposure at market troughs). We also believe relative sentiment meets all the criteria of an anomaly (https://alphaarchitect.com/2022/08/is-relative-sentiment-an-anomaly/), so it would naturally fit into a factor-based portfolio.

- Alternative exposure: Some investors may look at relative sentiment as an “alternative” type of fund. Thus, it could fit into an alternative sleeve–one where tracking error is expected and tolerated–in a larger portfolio.

- Model portfolio: Relative sentiment could be just one exposure in a broad portfolio of exposures (equities, bonds, commodities, gold, factors, etc.) optimized for risk and return.

The Cons of MOOD ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Right before launching, a friend who’s also a first-class quant investor and has his own RIA, said that financial advisors don’t always want an all-in-one solution.

They want their clients to see them as adding value and thus may shy away from a fund such as relative sentiment.

The Pros of MOOD ETF

On the other hand, what have others praised about your fund?

The fund is young, so we haven’t received a ton of praise to date, but in general people have commented favorably about how it was on the right side of equities in both the first half (very bearish) and second half (very bullish) of 2022 and into 2023.

source: Alpha Architect on YouTube

Relative Sentiment To Determine When To Take Or Avoid Gold Exposure

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

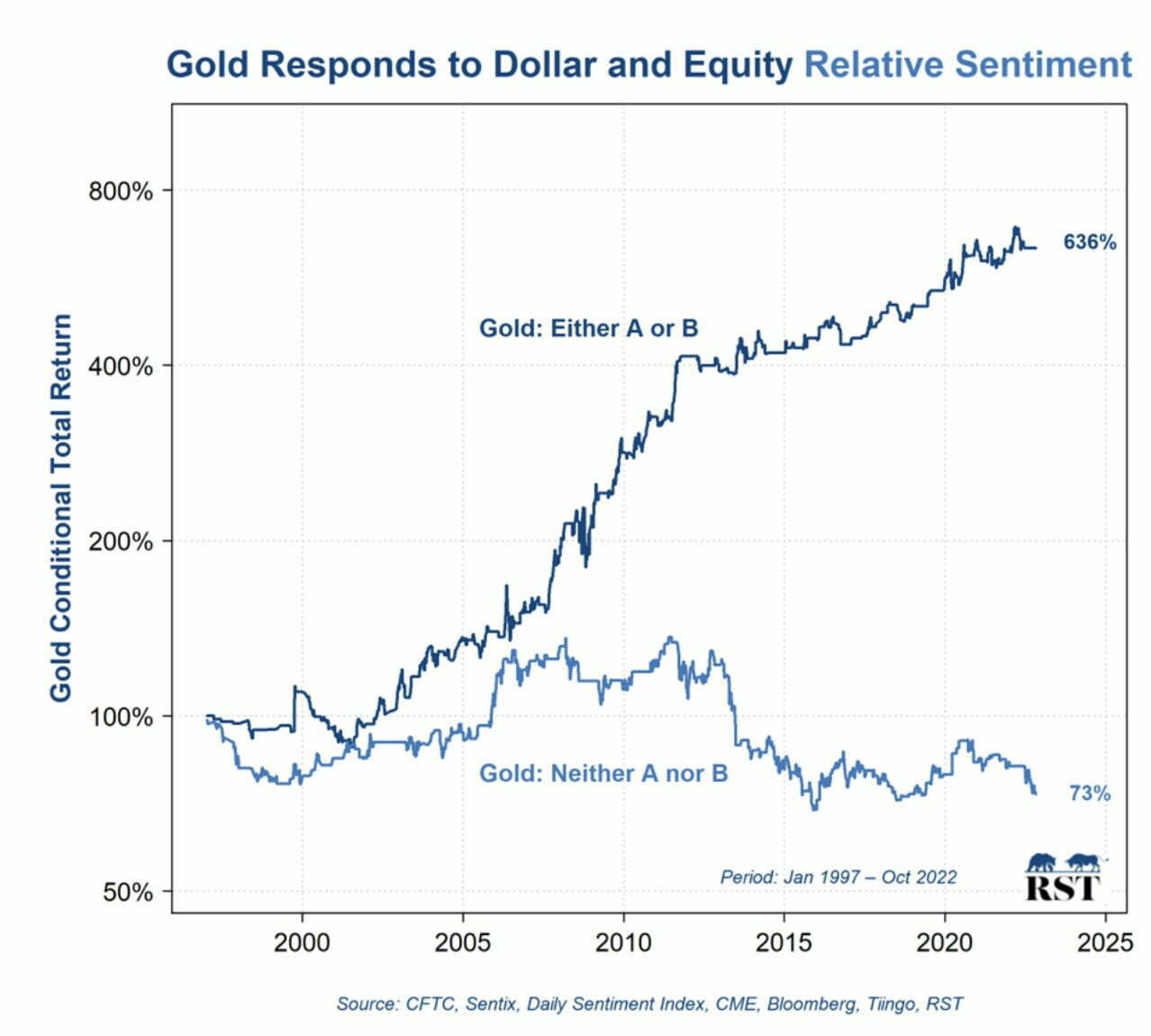

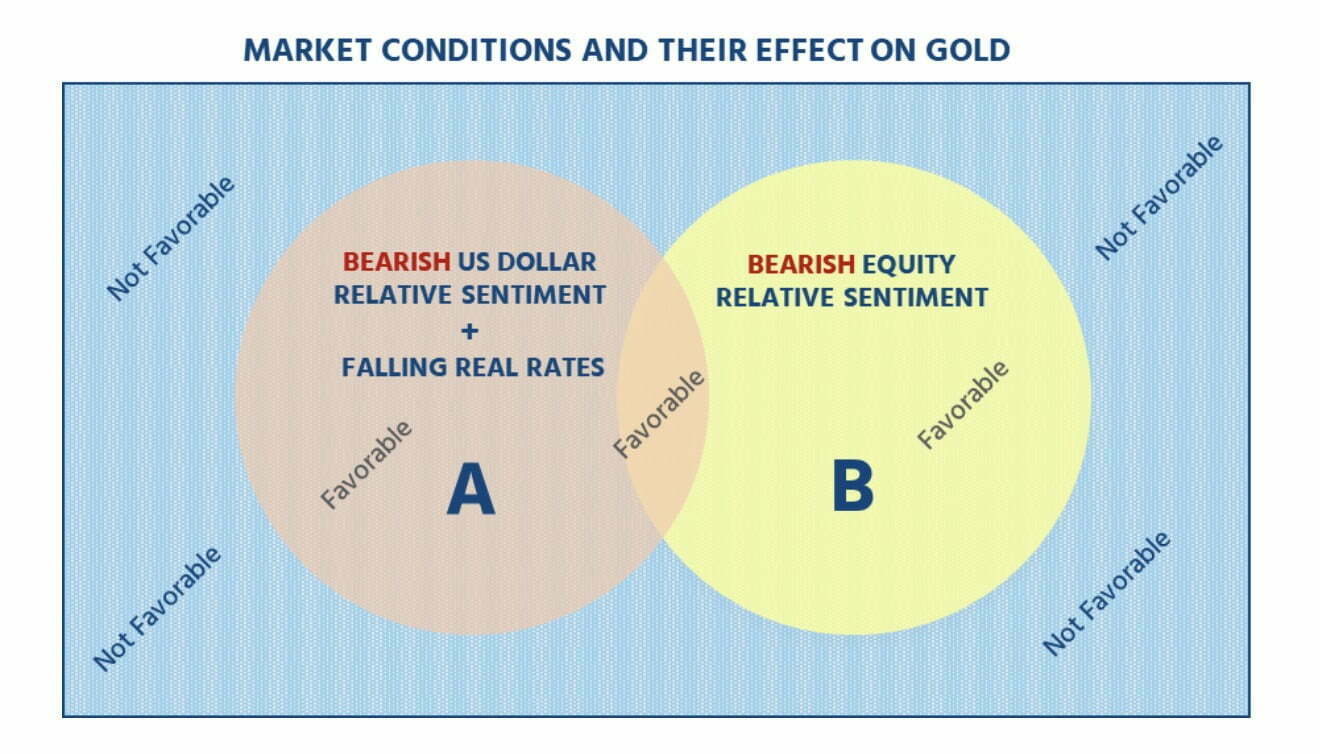

We would add that relative sentiment also appears to be a strong signal for determining when to take or avoid gold exposure.

Gold tends to do well if at least one of two conditions is met:

- Dollar relative sentiment is bearish and real interest rates have negative momentum (case A)

- Equity relative sentiment is bearish, i.e., less than 50% allocation to equities (case B)

The chart below shows golds performance when either A or B is true and then neither A nor B is true:

Gold Responds To Dollar and Equity Relative Sentiment

Market Conditions And Their Effect On Gold

This is the rationale for taking periodic exposure to gold when one of the above conditions is met.

MOOD ETF — Relative Sentiment Tactical Allocation Explained (with Raymond Micaletti): 12-Question FAQ for Strategy, Use-Cases, Risks, and Portfolio Fit

What is MOOD ETF in one sentence?

A rules-based, long-only tactical allocation ETF that tilts among equities, bonds (nominal and TIPS), and gold using institutional-vs-retail relative sentiment signals.

What exactly is “relative sentiment”?

It compares positioning/flows/surveys of institutions versus retail; when institutions are relatively more bullish than retail, equity allocation rises, and when they’re more bearish, it falls.

How are equity weights determined in practice?

Four composite relative-sentiment indicators each suggest 0–100% equity; MOOD averages them and updates only when the change exceeds ~10 percentage points, to reduce noise and turnover.

What does the rest of the portfolio hold besides equities?

The remainder is allocated to gold and bonds (both nominal and inflation-protected) based on related relative- and retail-sentiment measures to address different macro regimes.

Is this strategy static 60/40?

No. While the long-term average mix resembles ~60/40 with a small gold sleeve, allocations dynamically shift with sentiment—ranging from very low equity to high equity exposure.

Is leverage or derivatives used?

No. It is a long-only implementation using familiar, broad, low-cost underlying ETFs to express exposures.

When does MOOD tend to do best?

When institutional sentiment identifies turning points (e.g., post-selloff recoveries) or when equities and bonds are negatively correlated and sentiment favors the defensive sleeves.

When can it lag?

During benign, one-way equity bull markets dominated by momentum where rotating defensively or being cautious too early creates tracking error versus cap-weighted equity benchmarks.

How does MOOD complement trend following?

At troughs, simple trend models may be flat/short equities, while relative sentiment often turns risk-on sooner; pairing can mitigate each method’s weak spots around peaks and bottoms.

How does gold fit into the process?

Gold exposure increases when either dollar relative sentiment is bearish and real rates trend down, or when equity relative sentiment is below 50%; otherwise gold can be reduced.

Where could MOOD fit in a portfolio?

As a core-satellite sleeve replacing a small slice of stock/bond beta, a factor diversifier alongside value/momentum/trend, an alternatives sleeve, or one leg in a model portfolio.

What are the key risks?

Model and implementation risk, whipsaw in choppy regimes, periods when all sleeves (equities/bonds/gold) fall together, and potential tracking error versus static 60/40 or broad equity indexes.

Connect With Raymond Micaletti of Relative Sentiment Technologies

Thanks so much for taking part in the “The Strategy Behind The Fund” series!

How can others connect with you on social media and other platforms that you run?

It was my pleasure! Others can connect with me on LinkedIn (https://www.linkedin.com/in/raymond-micaletti/) or Twitter (https://x.com/RelSentTech).

Investors can also subscribe to our email list at www.relativesentiment.com.

And we put out a weekly commentary on LinkedIn (https://www.linkedin.com/company/relative-sentiment-technologies) that gives updates on relative sentiment.

Nomadic Samuel Final Thoughts

I want to personally thank Raymond for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Great article and very interesing approach!

Are the allocation decisions fully rules-based and systematic, or do they take discretionary decisions?

If I read it correctly, they allocate to gold if dollar relative sentiment is bearing and real rates momentum is negative. In a recent publication on Feb 12 in their LinkedIn page they say that momentum of real rates became positive, but that they believe that the Fed and Treasury will have to manufacture lower real rates. And they keep their current allocation to gold.

This seems like overrunning their models with discretionary decisions, but maybe I’m missing something?

Thank you very much! I reached out to Ray on Twitter and he responded as follows: “We rerun the allocations weekly on Wednesday after market close for Friday rebalancing. On Feb 8, real rate momentum was still negative. It turned positive the next day and has stayed positive and thus we exited gold yesterday.”

Thank you for following-up and for the clarification!