Earlier this week I listened to one of the most fascinating Investing Podcasts I’ve ever consumed since I became interested about the subject.

It was a comprehensive discussion between a Quant Legend, Autodidact Robotic Surgeon and a podcast host specializing in Futures and Options investing strategies.

No this isn’t a punchline to a joke.

This was an equal parts entertaining and serious conversation between a group of highly intelligent individuals at the apex of their respective careers.

Benn Eifert, the quant legend, is someone other professional quants admire in terms of his track-record, skill and overall knowledge of options and volatility focused strategies as a professional administering institutional mandates.

SurgiFi, a robotic surgeon by day and passionate investor on the side, is pursuing the best version of a portfolio he can possibly assemble to gain financial independence and build generational wealth by staying curious and acquiring new knowledge along his investing journey.

Jeff Malec, hosts one of the most popular podcasts “The Derivative by RCM Alternatives” on the subject of Futures and Options based strategies and is a successful professional with decades of experience under his belt.

The premise for the conversation taking place was to have a self-taught investor explore his recent learnings related to Options based investing strategies with a skilled professional that knows the ins and outs of that particular discipline like the back of his hand.

These kinds of investing conversations are refreshing, informative and anything but redundant.

We need more of them.

I referred earlier to the three gentlemen being at the apex of their given careers.

But what does it look like to be at the apex as a DIY investor?

It probably looks a lot like picking up the behemoth “Option Volatility and Pricing: Advanced Trading Strategies and Techniques” and reading this in your spare time while pursuing a demanding career.

That mammoth text could be used in a pinch as a self-defence weapon to knock someone out cold if dropped from a high enough vantage point.

The desire for a DIY investor to learn beyond basic market-cap weighted indexes and aggregate bonds is in short supply.

Most stop right there and are lured in by the low cost fees and simplicity of the products readily on display.

But the willingness to learn more about the derivative side of the investing equation with a goal of integrating easier to comprehend long-only investing strategies with more esoteric ones requires a rare level of curiosity as a DIY investor.

But here comes the ultimate dilemma.

After a certain amount of self-study you’ve reached a level of understanding and awareness of the potential benefits of managed futures and options based strategies but do you have to trade them yourself to unlock the magic?

That’s what we’re going to explore today.

The TL:DR version is likely a firm NO.

For the vast majority of us retail investors who are happy in our given careers it’s not likely feasible to trade on the side.

But being able to assemble the right puzzle pieces, that only recently have become available at the retail level, via a buy and hold asset allocation strategy is an entirely different story.

That’s a potential YES.

However, what exactly should a DIY retail investor know about options and managed futures before confidently being able to integrate them into an overall portfolio?

That’s what I believe needs to be unpacked thoroughly and is my primary goal with this article.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Compelling Reasons Not To Trade Options and Futures As A DIY Investor

Unless you’re aspiring towards being a professional trader/quant as a career it’s most likely not a good idea to do this on the side while pursuing a regular day job.

The theory alone is daunting enough to grasp entirely and yet actually trying to put things into practice at ground level is another story altogether.

Fumbling your way to eventual success likely requires being on the costly wrong side of most trades for potentially months/years on end.

Remember who you’re competing against.

The ones on the other side of the trade.

Skilled Pros.

Who have been at this for a long time.

Take it from those who have been doing this for decades when they say trading is hard.

When they caution it takes years of experience to integrate all of the theory while developing the right ground-level skills, systems and disciplined approach to trade options/futures successfully they’re not joking.

Unless you’re willing to put in the requisite amount of time while taking brutal lickings along the way it’s not likely worth it.

Learning To Make Travel Videos/Photos

I now have an unusual career of creating travel videos and other forms of media as my day job.

I first started getting into photography when I started backpacking around the world after teaching overseas in South Korea.

I remember distinctly visiting Angkor Wat in Siem Reap, Cambodia with a Dutch traveler.

The photos he took with his dSLR and relayed back to friends and family were magnificent pieces of art.

My photos with a craptastic point and shoot Casio camera sucked severely.

Not so much because of the difference in camera gear, although that mattered, but mostly given his knowledge about composition, lighting, framing and technical skills to adjust the aperture, shutter speed and stabilize the camera with a tripod.

He knew what he was going.

I didn’t have a “fill-in-the-blank” clue.

With a desire to get better at taking pictures/videos, I first learned the theory about composition, framing, rule of thirds and lighting while simultaneously learning how to operate a cameras aperture, shutter speed, iso, white balance and exposure compensation.

I had learned so much from reading, watching video tutorials and other forms of self-study that I now was ready to take picture perfect photos.

I bought a more serious camera and with all of that theory recently acquired surely my photos/videos would now be better.

Nope.

They still sucked.

It took years of traveling and effort and practice and effing up big time before I finally was able to capture the moment in a way that was satisfying.

It turns out that it takes a while to acquire a steady hand, a creative eye and technical touch to capture the moment.

I’m pretty sure trading options and futures is kinda similar in that regard.

You’re unlikely to be an overnight superstar.

Flick A Switch To Enjoy Electricity In Your Home

You can flick a switch to enjoy electricity at home and light up an entire room with just a millisecond of effort.

If you want to continuously enjoy the miracle of electricity in your life what skills does it require?

- The ability to flick a switch on and off

- Being able to unscrew a lightbulb when it burns out and screw a new one in

- Paying your utility bill on time

- Calling an electrician when steps 1-3 aren’t getting the job done

You could otherwise be an ignoramus about the entire subject at large and yet have light in your home when the sun has gone down.

You may or may not realize that Thomas Edison patented the incandescent light bulb in 1879 and that only a handful of generations have enjoyed such modern amenities.

Whether or not you’re aware that an electrical charge goes through a high-voltage transmission line before reaching a substation (where the voltage is lowered) before continuing via smaller power lines to reach your neighbourhood and eventually your home doesn’t change your capacity to benefit from it in your life.

Don’t get me wrong here.

I’d rather know more about it than less.

Yet it doesn’t impact your ability to benefit from it whether or not you’re an expert in the subject area or a numbskull dunderhead.

You flick on that switch in most homes and light comes on.

It’s indeed a miracle.

What a DIY Needs to Know In Order To Benefit From Futures/Options Strategies

Hopefully I haven’t alienated all of you at this point by discussing the skills and experience it takes to be a competent trader and/or photographer versus the capacity to enjoy electricity at home by knowing a few basics because all of this collides right here and right now.

Let’s assume you’ve learned enough as a curious DIY investor about futures and options trading strategies to recognize the following:

- You’re not going to trade them yourself

- You’re aware they’re beneficial and want to integrate them into your portfolio

What options do you have given those circumstances?

More importantly, what should you know at the very least about managed futures and long-volatility strategies in order to patiently slot them into a buy and hold investing strategy.

Let’s start with Managed Futures.

Managed Futures: DIY Cheat-Sheet

The first thing you should realize about Managed Futures is that it has a plethora of different names and strategies you can potentially pursue and confuse yourself over.

Liquid Alts doesn’t refer to the pink stuff you keep in your fridge for when you’ve overindulged in spicy Mexican or Indian cuisine.

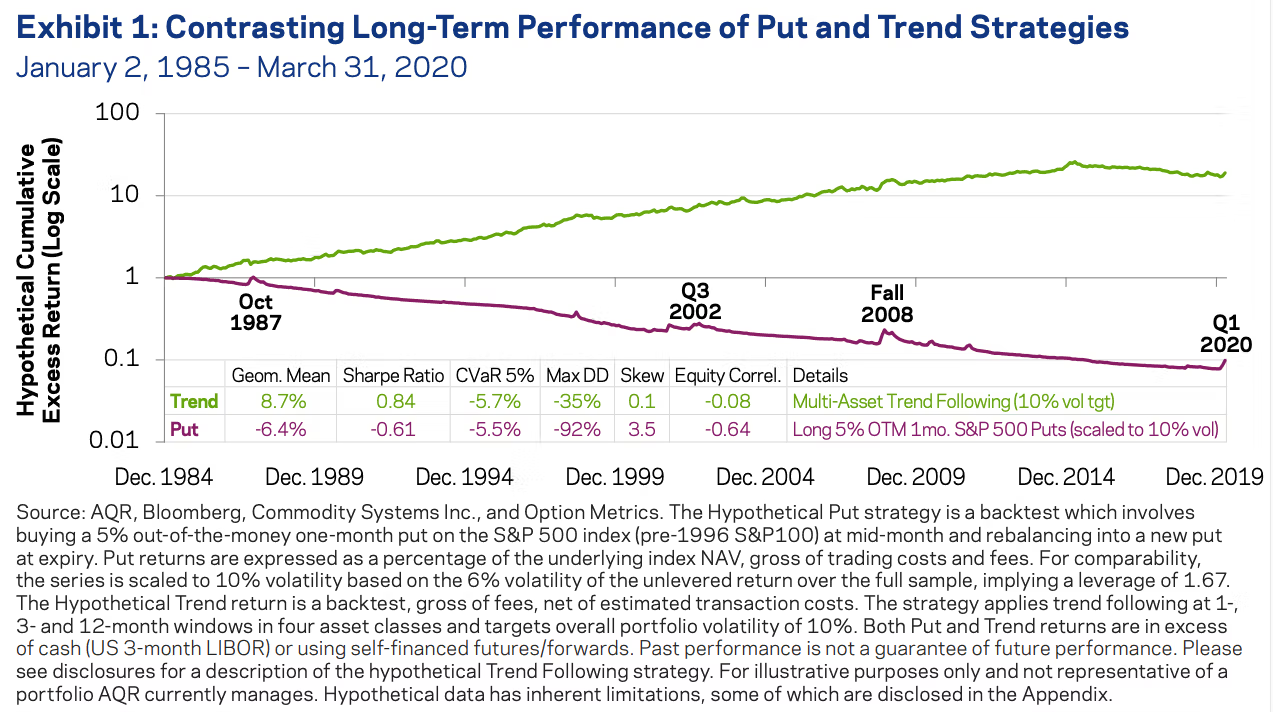

The most predominant Managed Futures strategy is Trend Following.

What exactly is trend-following?

It’s a rules based systematic way of going long/short futures equity, bond, commodity, metals and currency indexes depending on the direction of the particular line-items in question.

For instance, Gold is trending downward.

It goes short.

Bonds are trending upwards.

It goes long.

It’s a rules based system that doesn’t fight reality or get conflicted by human judgement by utilizing short, medium and long-term look-back periods.

It just says “yes” to reality.

It’s basically the equivalent of having a chameleon in your portfolio that is adaptive versus the long-only strategy of buy and hold equities and bonds.

It’s a brilliant diversifier given that it is uncorrelated to both buy and hold equity and bond strategies.

It’s adaptive characteristics handle the historically high commodity and metals volatility much better than long-only strategies.

Moreover, it’s referred to as crisis alpha given it tends to aid the classic line items in your portfolio when you need it the most.

When markets are down.

Why does it usually work so well when markets spiral downwards?

Because trends tend to be strongest under those circumstances.

Consider the initial months of 2022 as the ultimate example of the strategy thriving.

Equities clearly down.

Short.

Bonds deciding to join them on the skewer.

Short.

Commodities soaring.

Long.

By having a trend-following managed futures strategy in your portfolio you’re diversifying beyond merely buy and hold stocks and bonds by adding an alternative sleeve to your portfolio.

Overall, it has positive expected returns providing historically equity-like returns with only half the volatility.

But like any other investing strategy it struggles and underperforms too.

The 2010s were not kind in general for trend-followers.

When there are no clear trends, things tend to sway back and forth and get whipsawed.

That’s important to know.

Trend-Following Summary

- Positive Expected Returns (Equity-like with half the volatility)

- Uncorrelated to long-only stock and bond classic allocations (hence tremendous diversifier)

- Crisis Alpha dependable when you need it the most (when markets are clearly down)

- Ability to go Long/Short global equity, bond, commodity, metals, currency indexes

- It struggles just like any other investing strategy and will frustrate you at times (when trends are not strong or back and forth)

Options Long Volatility: DIY Cheat-Sheet

The easiest way to think about long-volatility options can be summarized in two words: “Portfolio Insurance”

It’s a strategy where you pay a premium for a policy that has a long-term negative expected return given that if it is not collected it goes to waste.

You’re basically betting against the market in order to hedge your losses should it actually go down.

And given how volatile markets have been in the 21st century it’s a prudent strategy worth integrating into a portfolio at large.

It typically involves buying out of the money PUT options at various strike points that expire at certain agreed upon contract date.

For instance you could buy a cheap out of the money PUT option for the S&P 500 at a strike price of 3000 that expires in December.

If the market goes down that much you’re protected.

If not it goes to waste.

This strategy works best when there are sudden violent marketplace downturns.

Think March 2020 or the fierce 1987 stock market crash.

Put strategies eat brutal rapid bear markets for breakfast.

Where they struggle is when it’s a slow grind down.

Where they’re a lost cause is when markets don’t go down at all.

Yet, you’re without a doubt thrilled in that scenario given that equity sleeve in your portfolio is likely reaching all-time highs.

Put Options Summary

- Portfolio Insurance

- Has a strike point and expiration date (ex: S&P 500 3000 expiring in December)

- Rapid brutal bear markets is when this strategy thrives

- Slow grinds down are a different story

- Should the market go up you get nothing and the seller of the Put collects the premium (just like in real life when your house doesn’t burn down)

Please Study More Than The See Spot Run Explanation I Provided

If you’re considering adding managed futures trend-following and/or options based long-volatility put please study more than the See Spot Run explanation I gave above.

That is just a Simple Simon qualitative explanation.

If you’re serious about learning more check out the following resources:

- Your Guide To Trend-Following from RCM Alternatives

- What Is A Put? – Put Definition – What Are Options? – How Does A Put Work from Investopedia

- Tail Risk Hedging – Contrasting Put and Trend Strategies by AQR

- The Derivative Podcast by RCM Alternatives

- Mutiny Fund Podcast featuring Jason Buck and Taylor Pearson

- Resolve Riffs featuring Adam Butler, Rodrigo Gordillo and Mike Philbrick

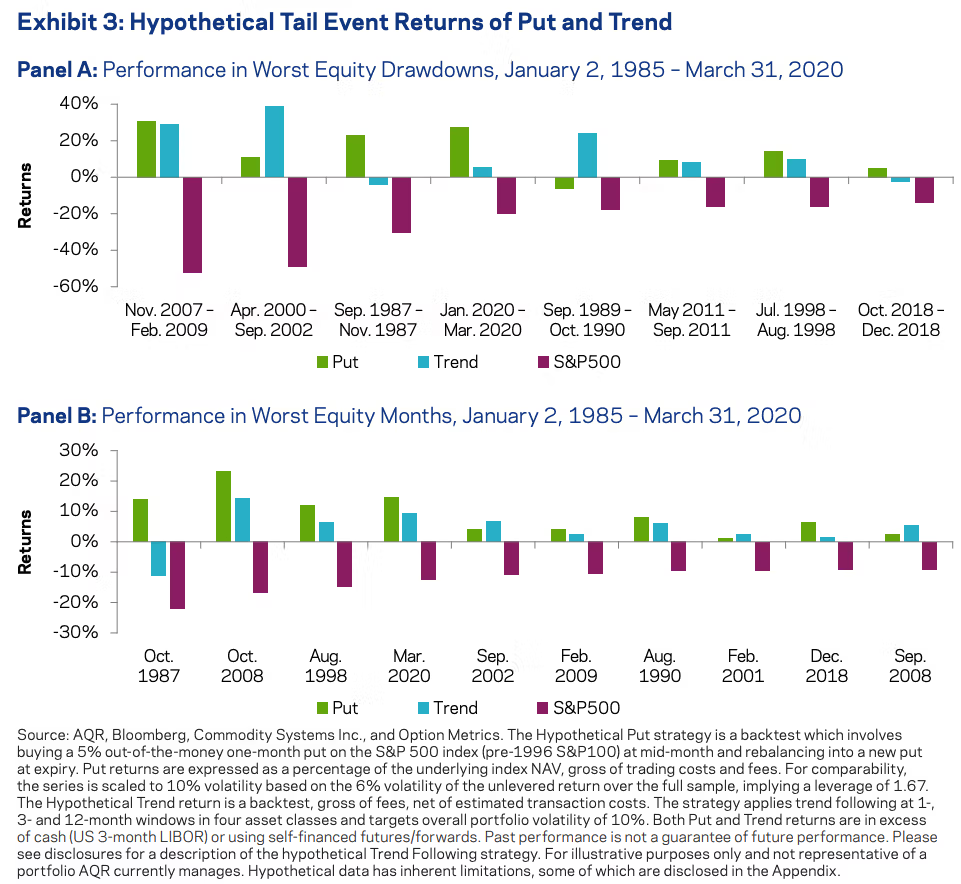

What’s Better: Trend vs Put

So you’re ready to integrate trend-following and/or put strategy into your portfolio but you can’t decide which one to choose.

Which is better?

In a word.

Both.

Both are better as you can clearly see from the example below.

In tandem they haven’t failed investors during market drawdowns with both shielding investors in 14 out of the 18 scenarios.

In three instances put strategies would have provided protection whereas trend didn’t.

And in one instance only trend came to the rescue.

A 2020 March-like fierce drawdown favours Put whereas the slower grind down in 2022 plays towards the Trend-Following wheelhouse.

If push came to shove I’d choose trend-following over put given its expected long-term positive returns in all market conditions.

Thus, I do allocate more to trend in my own portfolio.

But given the option to integrate both strategies into my portfolio I’m taking that free diversification lunch and doing what savvy quants refer to as diversifying my diversifiers.

Retail Products Now Available For Managed Futures and Options

As I’ve mentioned previously I’m not interested in trading managed futures or options myself.

Fortunately, in recent years ETFs and Mutual Funds offer these strategies for the DIY retail investor.

I’d much rather have the ReSolve team handle my managed futures mandate as part of HRAA.TO or Eric Crittenden trend-following for me over at REMIX.

I’m not going to strategically try and allocate Put strike points at various expiration dates when the Convexity Maven and Michael Green at Simplify can do it for me with CYA and/or FIG ETF.

Thus, what I have to decide as a DIY investor is how much of these strategies I want and how do I want them to coexist with my long-only equity and bond allocations.

That’s something you’ll want to figure out for yourself after preferably over 100s of hours of self-study.

Here is my DIY Portfolio (How Do I Invest My Money? Diversified DIY Quantitative Portfolio) in its current manifestation for those interested.

I further expand upon my strategy here: “Contrarian Expanded Canvas Portfolio | How I Invest“

I explain the funds I’ve selected (quadrant by quadrant) while examining my strengths and weaknesses as an investor and how life experiences have shaped my worldview.

Anyhow, I integrated trend-following into my portfolio before I came around to long volatility.

It wasn’t until I understood the rebalancing potential of having the put insurance kick in when equities are down the most that it started to make sense inside of my head.

Hence, the ability to buy equities when they’re scorched earth is what a put strategy offers investors from a strategic point of view.

Allowing you to stay the course when markets are down are the behavioural benefit of the strategy.

But you’ll have to come to those conclusions (or not) yourself as you learn more about managed futures and options strategies.

Managed Futures and Options ETFs and Mutual Funds

Here is a list of ETF and Mutuals that I’m aware of that offering access to managed futures and options based strategies.

Managed Futures

- $DBMF – Managed Futures Strategy ETF

- $KMLM – KFA Mount Lucas Index Strategy ETF

- $CTA – Simplify Managed Futures Strategy ETF

Options

- $CYA – Simplify Tail Risk Strategy ETF

- $TAIL – Cambria Tail Risk ETF

- $SVOL – SVOL Simplify Volatility Premium ETF

- $IVOL – Quadratic Interest Rate Volatility and Inflation Hedge ETF

Asset Allocation Funds (Futures + Options + More)

- $RDMIX – Rational/ReSolve Adaptive Asset Allocation Fund

- $FIG – Simplify Macro Strategy ETF

What DIY Investors Need to Know About Futures & Options — 12-Question FAQ

Why should a DIY investor even care about futures and options?

They add return streams that behave differently from long-only stocks and bonds. Used thoughtfully (often via funds), managed futures and long-volatility/option overlays can diversify, reduce drawdowns, and improve risk-adjusted outcomes without requiring you to become a trader.

Should most DIY investors trade futures and options themselves?

Generally, no. Professional trading is time-intensive, skill-dependent, and competitive. Most DIY investors are better served by allocating to skilled managers through ETFs/mutual funds than trying to implement complex strategies solo.

What’s the simple idea behind managed futures (trend following)?

It’s a rules-based system that can go long or short global futures (equities, bonds, commodities, currencies) based on price trends across multiple lookbacks. It aims to capture persistent moves and has historically been uncorrelated to traditional assets, often helping most during major equity/bond selloffs (“crisis alpha”).

When do managed-futures strategies tend to struggle?

In choppy, trendless markets with frequent reversals (whipsaws). Expect periods where signals flip and performance lags. Diversifying across speeds (short/medium/long lookbacks) and markets helps—but doesn’t eliminate—this risk.

What’s the plain-English of “long volatility” with options?

Think portfolio insurance. You pay premia (often via out-of-the-money puts or convex structures) that can surge in value when markets sell off quickly. Over the long run, the sleeve can have negative carry, but aims to pay off big in sharp drawdowns and improve rebalance opportunities.

When do long-volatility/put strategies shine…and when don’t they?

They shine in fast, violent selloffs (e.g., March 2020). They can lag in slow-grind declines and lose premia when markets rise or chop. Design (strike/tenor/roll rules) and manager skill matter.

Trend vs. puts: which is “better” for a DIY allocator?

They’re complements. Trends often help in prolonged moves (including commodity/inflation shocks). Puts often help in sudden crashes. Blending both can “diversify the diversifiers.”

How much should I allocate to these strategies?

No one size fits all, but many diversified allocators start around 5–20% combined for alternatives like managed futures and long-volatility, sized to be “enough to matter” yet small enough to stick with behaviorally.

What do I need to know before buying a fund?

Understand the mechanics, fees, and risks: signal design (for trend), option methodology (for long-vol), markets traded, risk targeting, expected tracking vs. peers, and how the sleeve interacts with the rest of your portfolio. Pre-commit to rebalance rules.

How do these sleeves actually help me behave better?

They can reduce peak-to-trough pain, provide dry powder to rebalance into cheap risk assets, and make it easier to stay the course during turmoil—arguably the biggest edge for a DIY investor.

What are examples of accessible vehicles?

Managed futures ETFs like DBMF, KMLM, CTA; long-vol/tail ETFs like CYA, TAIL; plus multi-strategy/alt allocation funds like FIG or mutual funds such as RDMIX. (Not recommendations—illustrative tickers to research.)

What’s a sensible first step for a curious DIY investor?

Do structured study (trend, options basics, historical role), define objectives (drawdown control, inflation hedge, crash protection), start small, and integrate into a written Investment Policy with funding source and rebalance plan.

Nomadic Samuel Final Thoughts

To close things off I want to thank once again SurgiFi, Jeff and Benn for inspiring this post.

Discussions between experts and students are often more informative than between two pros.

It’s fascinating to think that a DIY investor now has the opportunity to integrate the best of both worlds into a portfolio.

Long-only equity and bond allocations with Managed Futures and Options based strategies.

Those two spheres used to only collide for high net worth individuals and institutions.

There has never been a better time to be a DIY investor than right now given the potential strategies at your disposal and the low costs to implement them.

Yet that involves a degree of humility and the responsibility to educate yourself on the various topics as you continue your investing journey.

You’ve got all of the building blocks at your disposal.

Now go out there and build your very own Picture Perfect Portfolio.

That’s all I’ve got.

Ciao.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.