Trend following is an investment strategy that involves identifying long-term trends in the financial markets and following them. The goal of trend following is to capture the majority of a market’s trend, whether it is up or down, and to exit the market when the trend changes. Despite the potential benefits of trend following, investors often make common mistakes that can negatively impact their returns. In this post, we will discuss the most common mistakes in trend following investing and how to avoid them.

The Most Common Trend Following Investing Mistakes

The most common mistake in trend following is chasing after trends. Investors may enter the market too late, after the trend has already been established, and end up buying at the top of the market. This mistake is often driven by the fear of missing out on potential returns. However, it is important to remember that trend following is a long-term strategy, and it is better to wait for confirmation of a trend before entering the market. In a study by Clare et al. (2018), the authors found that trend following strategies that are more selective in their entry signals tend to outperform less selective strategies in terms of risk-adjusted returns.

The second mistake is ignoring risk management. Investors may become too focused on capturing the trend and forget to consider the potential downside risk. It is important to have a plan in place for managing risk, including setting stop-loss orders and position sizing. According to a study by Li et al. (2017), incorporating risk management techniques such as stop-loss orders can significantly improve the risk-adjusted returns of trend following strategies.

Failing To Adapt To Changing Markets

Another classic error trend-followers succumb to is failing to adapt to changing market conditions. Trend following requires adaptability to changing market conditions. Trends can change quickly, and it is important to be able to recognize when a trend has ended and to exit the market. Failing to adapt to changing market conditions can result in significant losses. In a study by Tucker and Wesolowski (2015), the authors found that trend following strategies that incorporate adaptive learning techniques tend to outperform static trend following strategies.

The fourth mistake is overtrading. Overtrading is a common mistake in all types of investing, including trend following. This means that investors trade too frequently, often in response to short-term market fluctuations. Overtrading can lead to higher transaction costs and lower returns. In a study by Khandani and Lo (2011), the authors found that overtrading can significantly reduce the returns of trend following strategies.

It might sound ridiculous but next up is emotionally-driven decision making. Investors may become too attached to a particular position or trend and make decisions based on emotions rather than objective analysis. It is important to remain disciplined and stick to the strategy, even in the face of short-term market volatility. In a study by Kim and Kim (2019), the authors found that investor sentiment can significantly impact the returns of trend following strategies.

Trend following can be a highly effective investment strategy, but it is important to avoid these common mistakes in order to achieve long-term success. By remaining disciplined, managing risk, adapting to changing market conditions, avoiding overtrading, and making objective decisions, investors can capture the benefits of trend following while minimizing potential pitfalls.

source: Financial Wisdom on YouTube

What The Heck Is Trend Following? Riding The Wave?

Trend following is a fancy way of saying “riding the wave” in investing. Just like a surfer waits for the perfect wave to catch, a trend following investor waits for a trend to emerge and then jumps on board to ride it for as long as possible.

Think of it like this: You’re at a party and you notice that everyone is wearing neon green shirts. You’re not really a fan of neon green, but you notice that more and more people are wearing them. You start to think, “Hey, maybe I should get a neon green shirt too!” So, you go out and buy one, and before you know it, you’re the coolest person at the party. That’s trend following in a nutshell.

But, just like with fashion trends, not all trends in the market are worth following. For example, if you see a trend for pet rocks coming back into style, it might not be the best investment opportunity. However, if you notice a trend for renewable energy companies or electric cars, that might be worth jumping on board.

Here are some real-life examples of trend following in action:

- Bitcoin: When Bitcoin first emerged, it was seen as a risky investment. But as more and more people started investing in it, the value skyrocketed. Investors who jumped on board early were able to ride the trend and make a lot of money.

- Netflix: When Netflix first started out, it was a DVD rental service. But as the trend for streaming video emerged, Netflix was able to adapt and become a leader in the streaming industry. Investors who recognized this trend early were able to profit from Netflix’s success.

- Social media: When social media first emerged, it was seen as a fad. But as more and more people started using it, it became clear that social media was here to stay. Investors who recognized this trend early were able to profit from companies like Facebook and Twitter.

So, the key to trend following is to recognize emerging trends early and jump on board before everyone else does. But, like with anything in investing, there are risks involved. Just like a surfer can wipe out and get hurt, a trend following investor can suffer losses if they don’t manage risk properly. So, as with any investment strategy, make sure to do your research and proceed with caution.

source: Chat With Traders on YouTube

Risk Management For Trend Followers

One of the biggest mistakes that trend following investors can make is ignoring risk management.

Risk management is a crucial aspect of any investment strategy, including trend following. It involves identifying potential risks and implementing strategies to manage or mitigate those risks. When it comes to trend following investing, there are several risks that investors need to be aware of.

False Signals

One of the biggest risks of trend following investing is false signals. A false signal occurs when an investor enters the market based on a trend that turns out to be short-lived or nonexistent. This can result in significant losses if the investor does not have a plan in place for managing risk.

To mitigate this risk, trend following investors should use technical analysis tools to confirm trends and avoid entering the market too early. They should also implement stop-loss orders to limit potential losses in the event of a false signal.

Volatility

Another risk of trend following investing is volatility. Markets can be volatile, and trends can change rapidly. This can result in significant losses if the investor is not prepared.

To manage this risk, trend following investors should have a well-defined trading plan that includes guidelines for managing risk. This may include setting stop-loss orders and position sizing to limit potential losses in volatile markets.

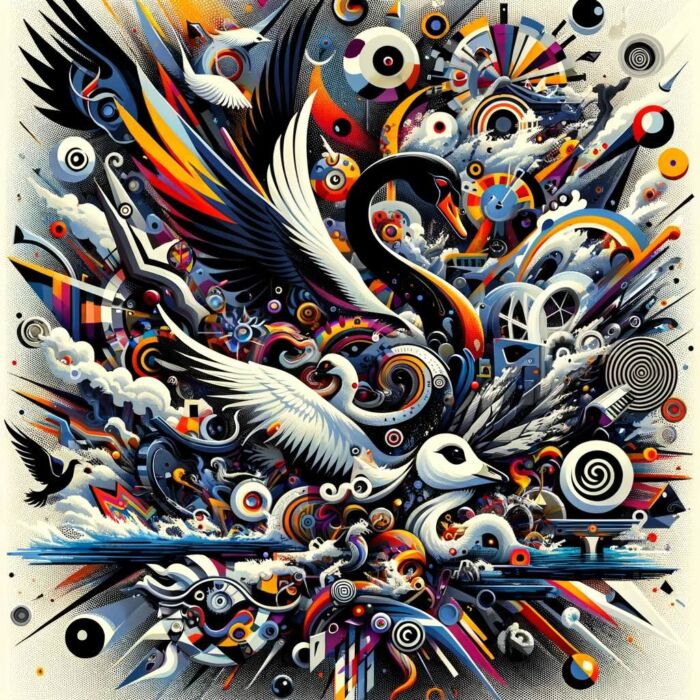

Black Swan Events

Black swan events are rare and unexpected events that can have a significant impact on the market. These events can be difficult to predict and can result in significant losses for investors.

To manage this risk, trend following investors should diversify their portfolios and have a plan in place for managing risk in the event of a black swan event. This may include holding a mix of asset classes and implementing risk management strategies such as hedging.

Ignoring risk management as a trend following investor can be a costly mistake. It is important to have a plan in place for managing potential risks and to implement that plan consistently. This requires discipline and patience, as well as a willingness to adapt and make changes as needed.

Rrisk management is a crucial aspect of trend following investing. By understanding potential risks and implementing strategies to manage or mitigate those risks, investors can increase their chances of success and achieve their investment goals. Remember, trend following investing is a long-term approach, and success requires patience and perseverance.

source: Richard Moglen on YouTube

What Type Of Personality Is Best Suited For Trend Following?

While there is no one-size-fits-all answer to what kind of personality is best suited for trend following investing, there are certain traits that can be beneficial for investors who want to succeed with this strategy.

Patience

Patience is a key trait for trend following investors. This strategy requires waiting for trends to emerge and then riding those trends for as long as possible. This can be a slow and sometimes frustrating process, and it requires the ability to remain patient and disciplined even when the market is volatile or unpredictable.

Discipline

Discipline is also essential for trend following investors. This strategy requires following a well-defined trading plan and sticking to it even when emotions are running high. It can be tempting to deviate from the plan when the market is moving quickly or when losses are mounting, but sticking to the plan is essential for long-term success.

Open-Mindedness

Trend following investing requires an open-minded approach to the market. Investors must be willing to adapt to changing market conditions and be open to new opportunities and strategies. This requires a willingness to learn and an ability to think creatively about investment opportunities.

Risk Tolerance

Trend following investing can be risky, especially for investors who do not manage risk properly. Investors who are best suited for this strategy are those who have a high tolerance for risk and who are willing to accept the potential losses that can come with this approach.

Perseverance

Finally, trend following investors must be able to persevere through difficult times. This strategy can be challenging, and there will be times when it feels like nothing is going right. Investors who are able to stay the course and persevere through these difficult times are more likely to succeed in the long run.

Trend following investing requires a combination of patience, discipline, open-mindedness, risk tolerance, and perseverance. While there is no one personality type that is best suited for this strategy, investors who possess these traits are more likely to succeed and achieve their long-term investment goals.

source: Financial Wisdom on YouTube

How To Become A Better Trend Following Investor

Trend following investing is a popular investment strategy that involves identifying and capturing trends in the market to generate profits. It is a long-term approach that requires patience and discipline, and it can be an effective way to diversify your portfolio and achieve your financial goals. If you want to become a better trend following investor, there are several things you can do to improve your skills and increase your chances of success.

1) Understand the Basics of Trend Following Investing

To become a successful trend following investor, you need to have a solid understanding of the basics. This includes knowing how to identify trends, how to manage risk, and how to exit the market when a trend ends. You should also be familiar with technical analysis tools like moving averages and trend lines, which can help you identify trends and make informed investment decisions.

2) Develop a Trading Plan

Having a well-defined trading plan is crucial for trend following investing. Your trading plan should include your investment goals, risk tolerance, and rules for entering and exiting the market. It should also include guidelines for managing risk, such as setting stop-loss orders and position sizing. By having a plan in place, you can avoid emotional decision making and stick to your strategy.

3) Practice Patience and Discipline

Trend following investing requires patience and discipline. It is important to wait for confirmation of a trend before entering the market, rather than trying to catch the beginning of a trend. You should also be willing to exit the market when a trend ends, even if it means taking a loss. By staying disciplined and sticking to your trading plan, you can avoid making impulsive decisions and increase your chances of success.

4) Learn from Your Mistakes

Making mistakes is a natural part of trend following investing. However, it is important to learn from your mistakes and use them as opportunities to improve your skills. This may involve analyzing your trades and identifying areas for improvement, or seeking feedback from other trend following investors. By learning from your mistakes, you can refine your strategy and become a better investor over time.

5) Stay Informed

Staying informed about market trends and developments is essential for trend following investing. This may involve reading financial news, following market analysts, or attending investment seminars. By staying informed, you can identify potential trends early and make informed investment decisions.

Becoming a better trend following investor requires a combination of knowledge, discipline, and practice. By understanding the basics of trend following investing, developing a trading plan, practicing patience and discipline, learning from your mistakes, and staying informed about market trends, you can increase your chances of success and achieve your investment goals. Remember, trend following investing is a long-term approach, and success requires patience and perseverance.

The Most Common Trend Following Mistakes: 12-Question FAQ

1) What is trend following in one sentence?

A rules-based strategy that buys strength and/or sells weakness to ride medium-to-long trends, exiting when the trend meaningfully reverses.

2) Why do investors repeatedly make the same mistakes with trend following?

Because of behavioral biases—FOMO, loss aversion, recency, and overconfidence—plus weak process design (unclear entries/exits, poor sizing, and ad-hoc changes).

3) Mistake: Chasing late entries. How do I avoid FOMO?

Require objective confirmation (e.g., price above/below a moving-average or breakout level and a volatility/ATR filter). Enter on signal; skip if distance from stop exceeds your max risk.

4) Mistake: Ignoring risk management. What’s the minimum viable plan?

Define per-trade risk (e.g., 0.5–1.0% of equity), a stop method (ATR, prior swing, MA cross), and portfolio-level risk caps (e.g., volatility target or max VaR). Pre-compute position sizes.

5) Mistake: Overtrading every wiggle. How can I cut noise?

Use higher-timeframe signals, require trend strength (ADX/DM or slope), add a minimum look-back, and batch orders. Track turnover, slippage, and costs; prune rules that add trades without edge.

6) Mistake: One market only. Why diversify?

Trends rotate. Trade a basket (equities, rates, FX, metals, energies, ags, crypto where suitable) with position limits and correlation controls so one choppy market can’t sink results.

7) Mistake: Vague exits. What are robust exit rules?

Pick one primary: trailing stop (e.g., 2–3× ATR), opposite breakout, or moving-average cross. Add a catastrophic stop and a time-stop for dead trades. Test that exits reduce drawdowns, not edge.

8) Mistake: Bad sizing and leverage. What’s safer?

Scale positions by volatility (ATR or recent sigma) so each trade risks similar capital. Keep gross and net exposure caps; avoid martingales; consider fractional Kelly ceilings well below 1×.

9) Mistake: Overfitting the backtest. How do I keep it honest?

Use simple rules, out-of-sample tests, walk-forward updates, and Monte-Carlo of trade sequences. Favor parameter ranges that work, not single “perfect” knobs.

10) Mistake: Ignoring regime shifts. How do I adapt without curve-fitting?

Allow periodic review windows, volatility filters, and dynamic risk scaling; define “no-trade” states (e.g., extremely low volatility/whipsaw) and rules to re-engage when trendiness returns.

11) Mistake: Forgetting frictions, liquidity, and taxes.

Model commissions, spread, slippage, borrow costs, and funding; set minimum instrument liquidity; prefer tax-efficient wrappers where possible; measure net results only.

12) Mistake: Abandoning the system during drawdowns. How do I stick with it?

Pre-declare pain thresholds (max drawdown, max losing streak), keep a run-book, and review process metrics (rule adherence, costs) monthly. If the system is within expected stats, don’t tinker.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

References:

Clare, A. D., Motson, N. L., & Sapuric, S. (2018). Trend-following, risk-parity and the influence of correlation. Journal of Asset Management, 19(4), 219-232.

Khandani, A. E., & Lo, A. W. (2011). What happened to the quants in August 2007? Evidence from factors and transactions data. Journal of Financial Markets, 14(1), 1-46.

Kim, H., & Kim, Y. (2019). Sentiment factors and trend-following investment. Pacific-Basin

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.