One of the most embarrassing moments of my life occurred during a dim sum lunch with a PR representative in Hong Kong.

My wife and I were in the city for a work project and we had received an invitation to go out for lunch.

We were given an address and we knew what neighbourhood we were meeting in, but that was the extent of our research. After all, it was just dim sum!

Up until then, my experience with dim sum was limited to Malaysia where it was all about outdoor plastic chairs, pushcart trolleys, boisterous conversations and shirtless men smoking cigarettes whilst reading the local newspaper.

I thought we were going out for the most casual of lunches and I couldn’t have been more wrong!

Because it was a rainy day, we hopped in taxi and we were a little surprised when our driver dropped us off at the International Commerce Center, a super glitzy skyscraper overlooking Victoria Harbour.

It turns out the restaurant we were going to was located on the 102 floor of the Ritz-Carlton Hotel.

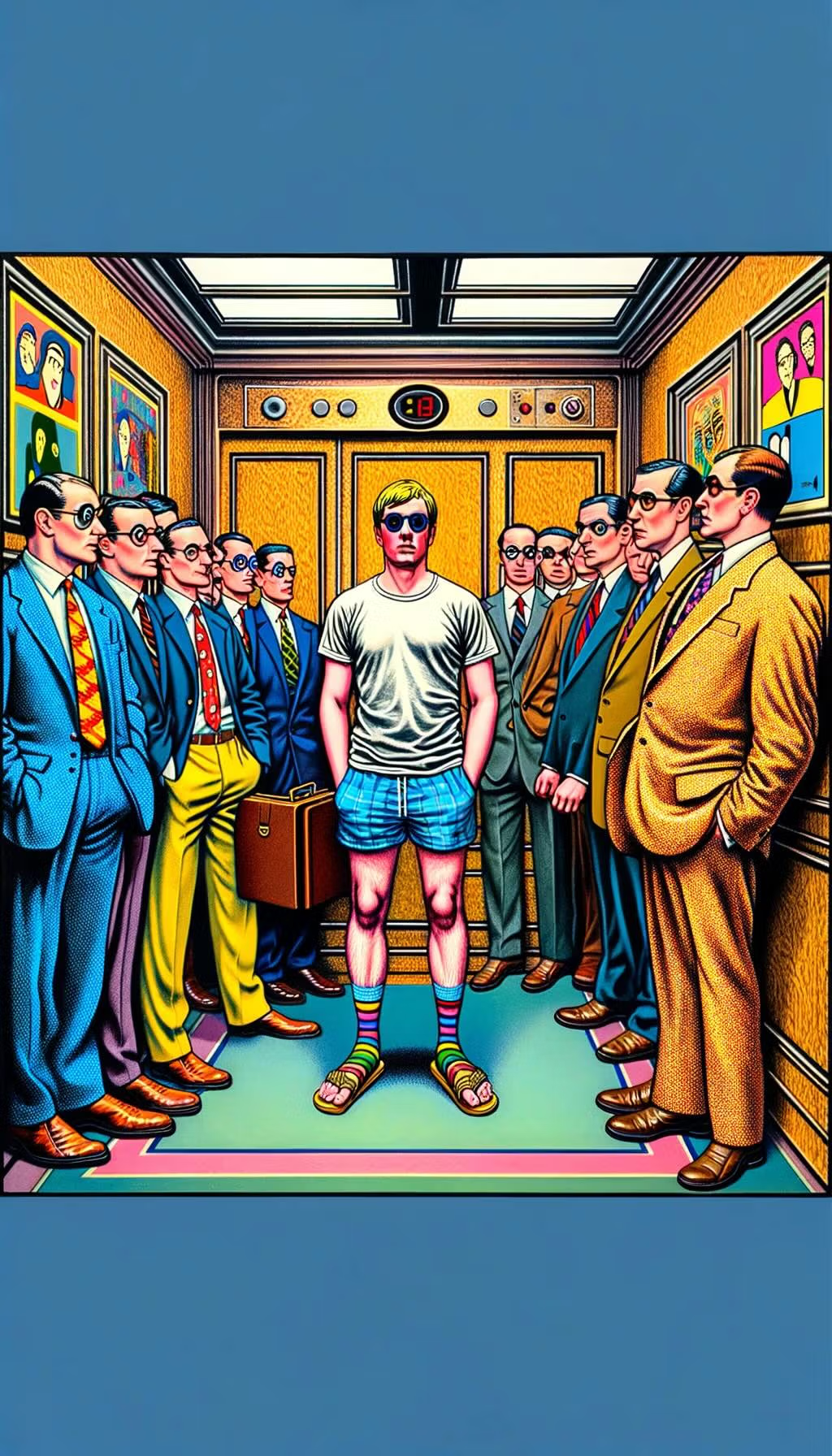

As I entered the elevator it became painstakingly obvious I was severely underdressed for the occasion.

Here I was decked out in a t-shirt, shorts and sandals, while men around me were sporting business suits.

As the elevator door opened my heart was beating like a drum.

The maître d’ quickly looked me over, asked if I was in the right place, and the proceeded to lead me to a backroom where I was presented with a bag containing shoes, a dinner jacket and trousers.

Apparently, I wasn’t the first idiot to arrive at this restaurant not dressed for the occasion.

However, I felt relieved as this seemed like a reasonable enough solution.

The only problem was that the trousers were for a man that was about 5’7 and 135 lbs.

And here I am 6’1 and 190 lbs.

I tried to put on the pants, but they were more like capri pants on me leaving my ankles and calves exposed.

Zip up the pants?

Forget about it.

The dinner jacket wasn’t any better.

Imagine a sausage casing.

The only thing that fit reasonably well were the shoes.

So out I came from the backroom dressed like some kind of farang freakshow waltzing my way to the table.

It actually looked about 10X worse than had I just remained woefully underdressed.

At that moment, if I could have crawled into a cave and died, I might have chosen that option.

Somehow, our host kept a straight face while my wife tried her best to contain her laughter.

We got through lunch, which featured dim sum with gold leaf and the best views of Hong Kong.

Style premia?

Zero that day.

But we’re not here to poke anymore fun at my fashion faux pas. Instead, let’s learn more about a fascinating alternative investing strategy.

What Is Style Premia?

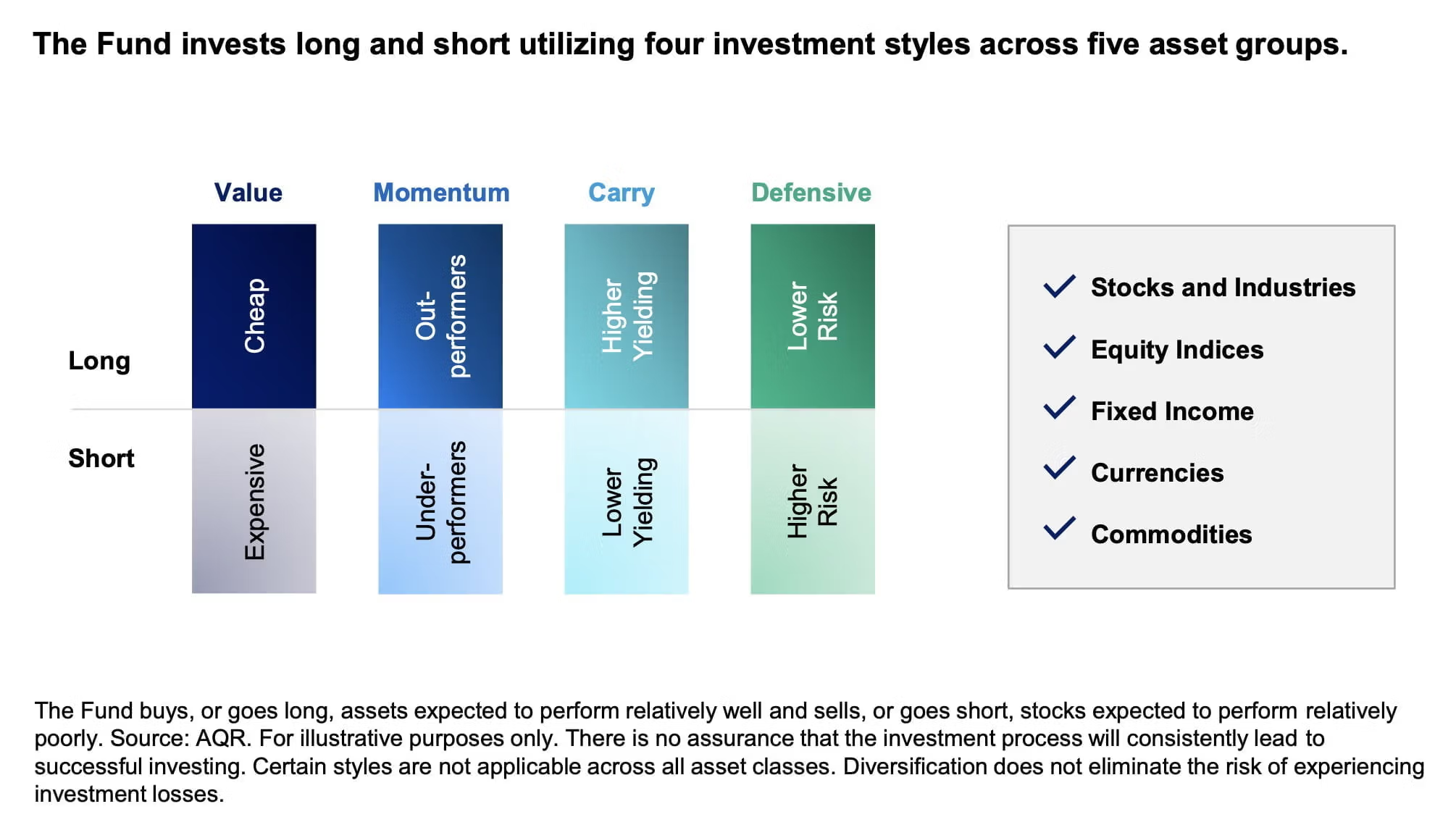

Style Premia is not related to how appropriately you dress for dinner; it’s a multi-strategy plus multi-asset class way of expressing long-short styles across research supported factors such as carry, defensive, value and momentum.

I like to think of it as a 4 x 4 tearing around in the mud.

You’ve got four asset classes:

- Equities

- Bonds

- Commodities

- Currencies

And you’re expressing four distinct investing styles:

- Value

- Momentum

- Carry

- Defensive

source: ReSolve Riffs on YouTube

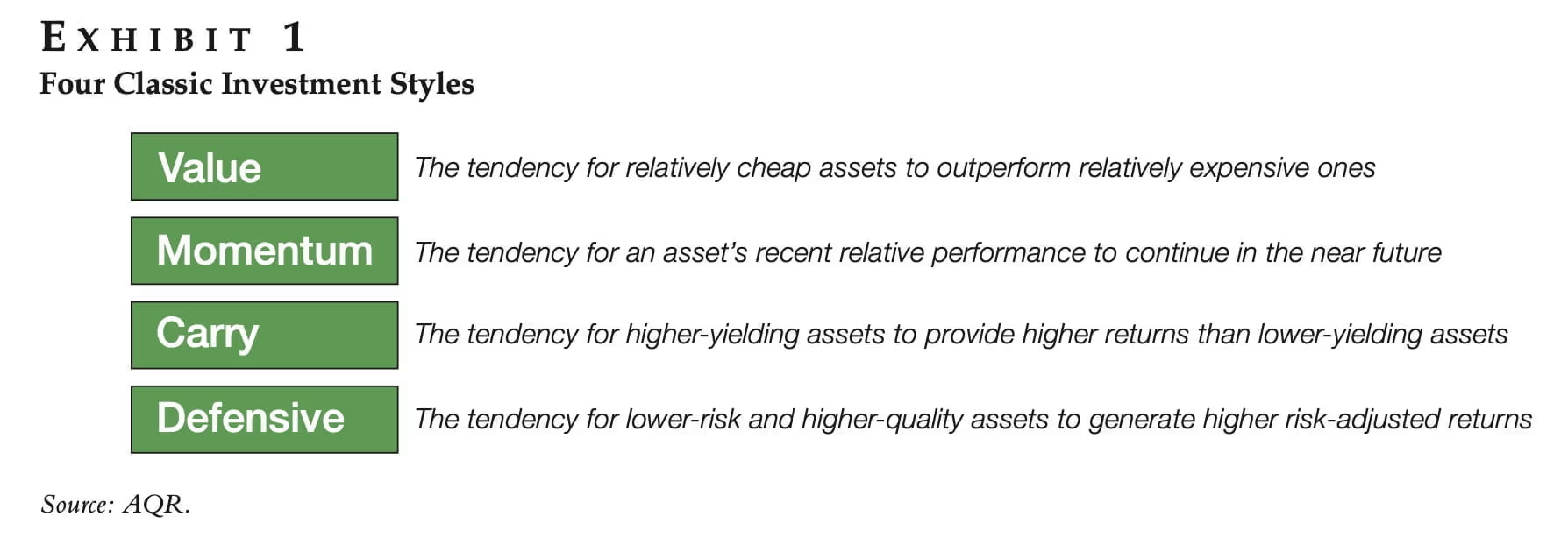

Style premia, in the world of finance, refers to investment strategies that aim to capture specific returns associated with distinct investment styles. These styles are based on systematic patterns or anomalies found in markets over time. The concept is grounded in the belief that certain characteristics of assets can predict higher returns. Here’s a breakdown of what constitutes style premia:

- Value: This style is based on the principle that stocks or assets priced below their intrinsic value will, over time, provide superior returns as the market corrects the mispricing. It’s akin to finding a high-quality item on sale; eventually, its price is expected to reflect its true worth.

- Momentum: Momentum investing involves capitalizing on the continuation of existing market trends. It operates on the premise that assets which have performed well in the recent past will continue to do so in the short-term future, and vice versa for poorly performing assets.

- Carry: In the carry trade, investors profit from the difference between the yields of two assets. For example, in currency markets, it might involve borrowing in a currency with a low interest rate and investing in a currency with a higher interest rate, profiting from the spread.

- Defensive (Low Volatility): Defensive or low volatility investing focuses on assets with lower risk and volatility compared to the market. The idea is that these assets will yield better risk-adjusted returns over time, as they are less susceptible to large market swings.

Style premia strategies involve going long (buying) assets that exhibit these desirable characteristics whilst going short (selling) assets that do not. The strategies can be applied across various asset classes, including equities, bonds, commodities, and currencies to systematically capture the desired exposures.

The appeal of style premia investing lies in its systematic approach that diversifies across different styles; investors can potentially reduce risk and enhance returns, as these styles tend to perform differently across various market environments.

Style Premia Potluck Dinner

Picture this as an episode of “The Investment Chef,” where strategies are not just strategies, but characters at a high-stakes potluck dinner.

- Value Investing: Meet Value Vick, the thrift shop connoisseur. He’s the guy who buys neon leg warmers and vinyl records for pennies and swears they’ll be worth a fortune. At the potluck, he brings a casserole he made from discounted, day-old bread and mystery meat he swears is prime rib. Everyone’s skeptical until Gordon Ramsay stops by, tastes it, and declares it a culinary masterpiece. Value Vick smirks, his dish is now the hit of the party.

- Momentum Investing: Then there’s Momentum Mandy. She’s on TikTok 24/7, catching trends before they’re cool. For the potluck, she brings the latest viral sensation: cloud eggs. Half the room thinks she’s a genius; the other half hasn’t even heard of cloud eggs yet. Mandy’s dish is popular until someone mentions they’re so last week, and suddenly, she’s in the kitchen whipping up dalgona coffee.

- Carry Trading: Carry Trader Carl walks in, a Monopoly millionaire, always collecting rent. He’s brought a fondue set, charging people a dollar to dip their snacks. It’s all fun and games until someone realizes they’re actually paying to eat their own food. Carl’s making a killing, though, and offers to share his profits if you’ll just let him set up a mini-bar next to the fondue station.

- Defensive Investing: Lastly, we have Defensive Dana. She’s wrapped in bubble wrap, carrying a salad made entirely of superfoods. It’s designed to survive a nuclear fallout and still provide 100% of your daily vitamins. Dana’s corner of the table is for those who want to play it safe, avoiding the rollercoaster of food poisoning from Uncle Value’s mystery meat casserole.

Combine all these personalities at the potluck, and you’ve got the Style Premia strategy: a smorgasbord of investing tactics that might seem quirky on their own but together aim to conquer the buffet of alternative strategies. It’s a blend of finding hidden gems, riding the wave of popularity, making money off literally anything, and always having a safety net (made of kale, probably). Because in the end, why put all your eggs in one basket when you can spread them across a buffet while you’re at it?

Uncorrelated Strategy + Absolute Return Potential

The concept of style premia strategies revolves around the aim to deliver absolute returns, which means trying to generate positive returns irrespective of the broader market’s direction. This ambition sets style premia apart from traditional equity or bond investments, which often depend on market trends for performance.

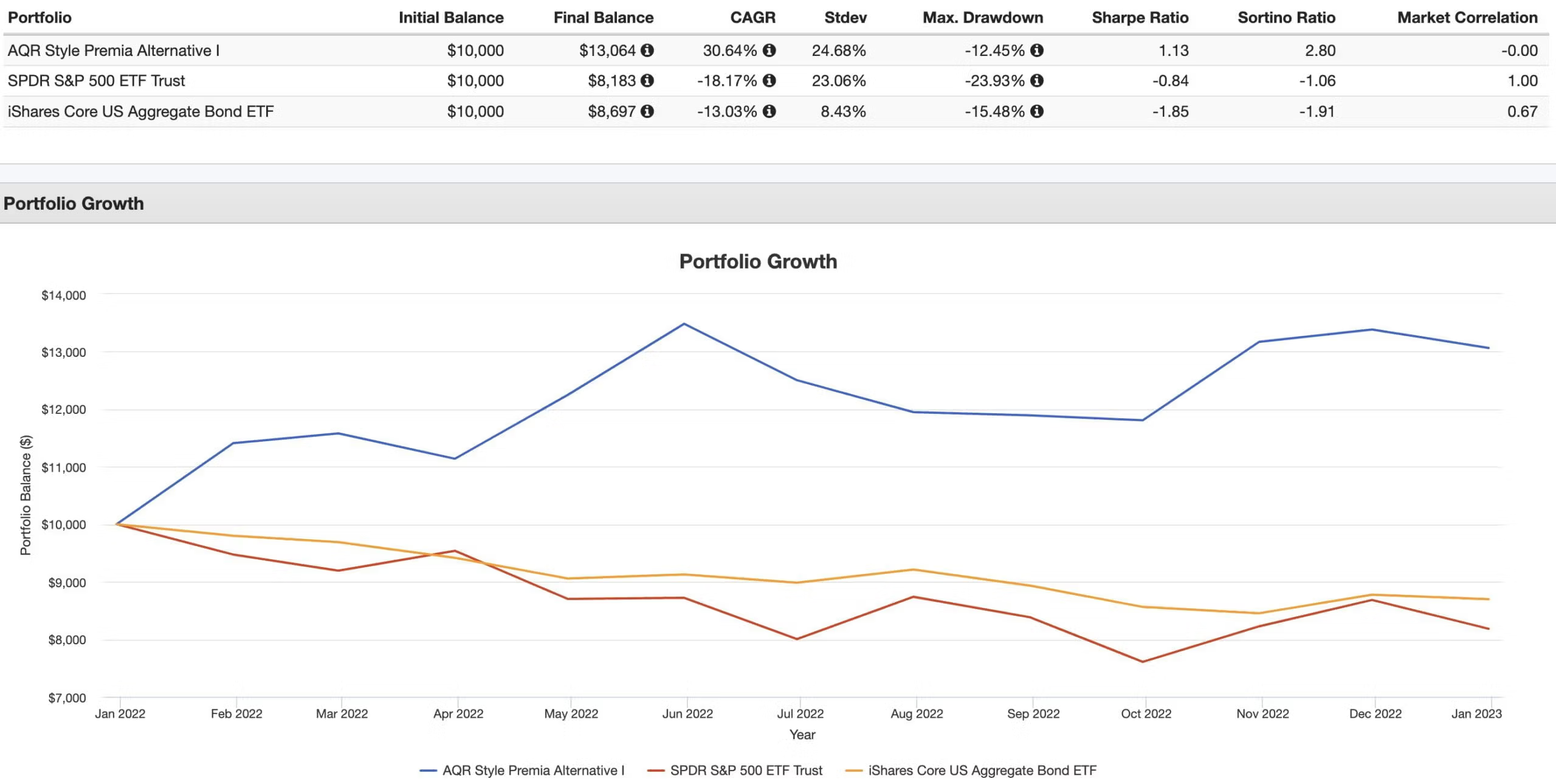

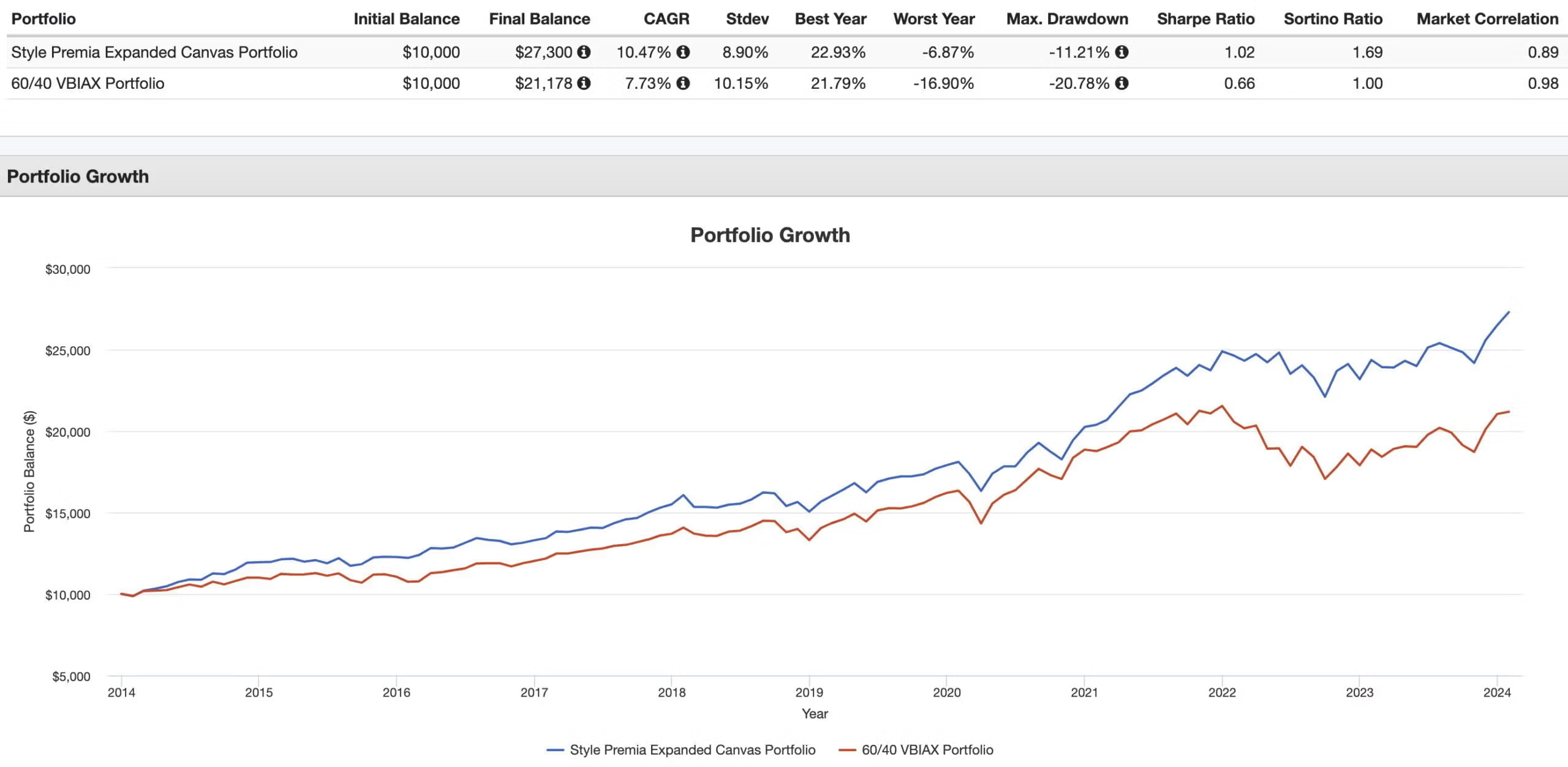

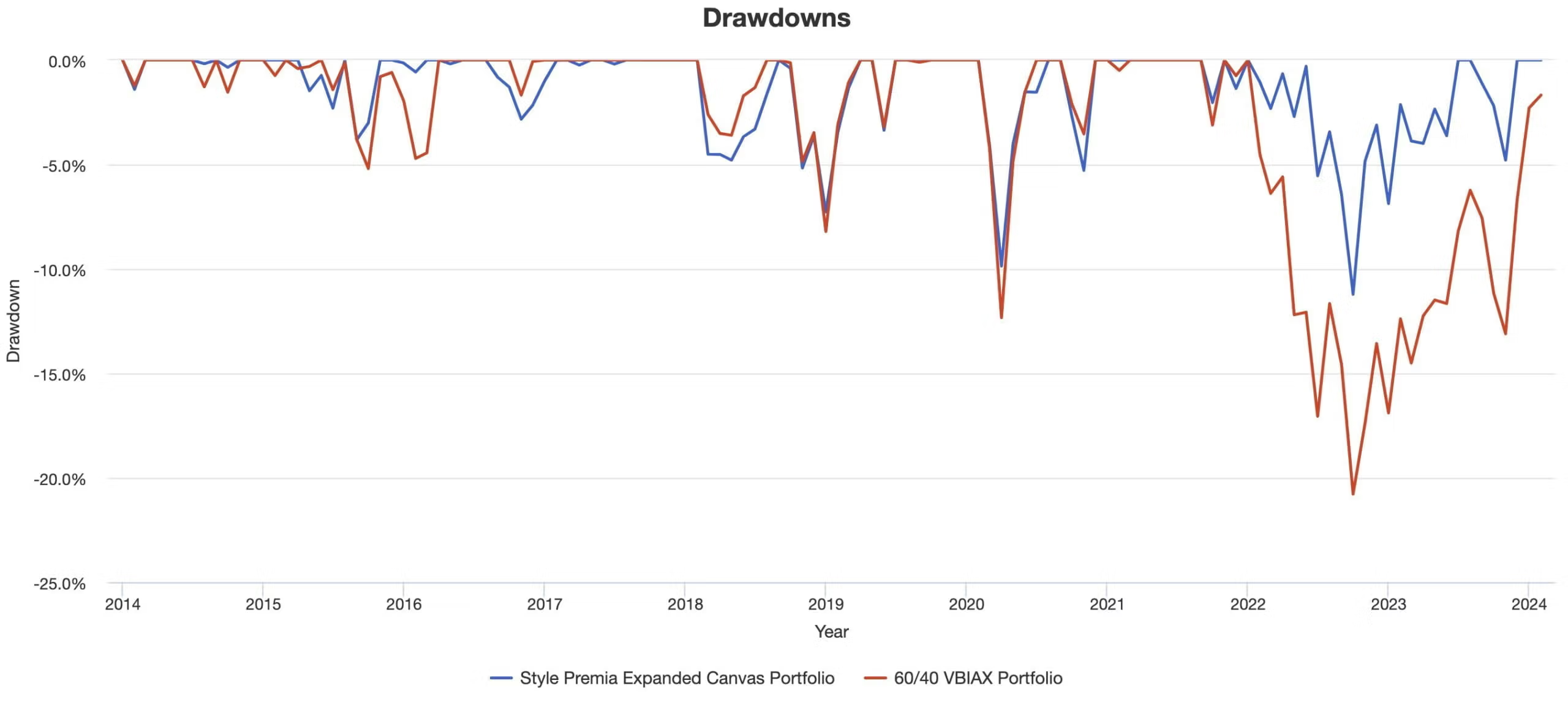

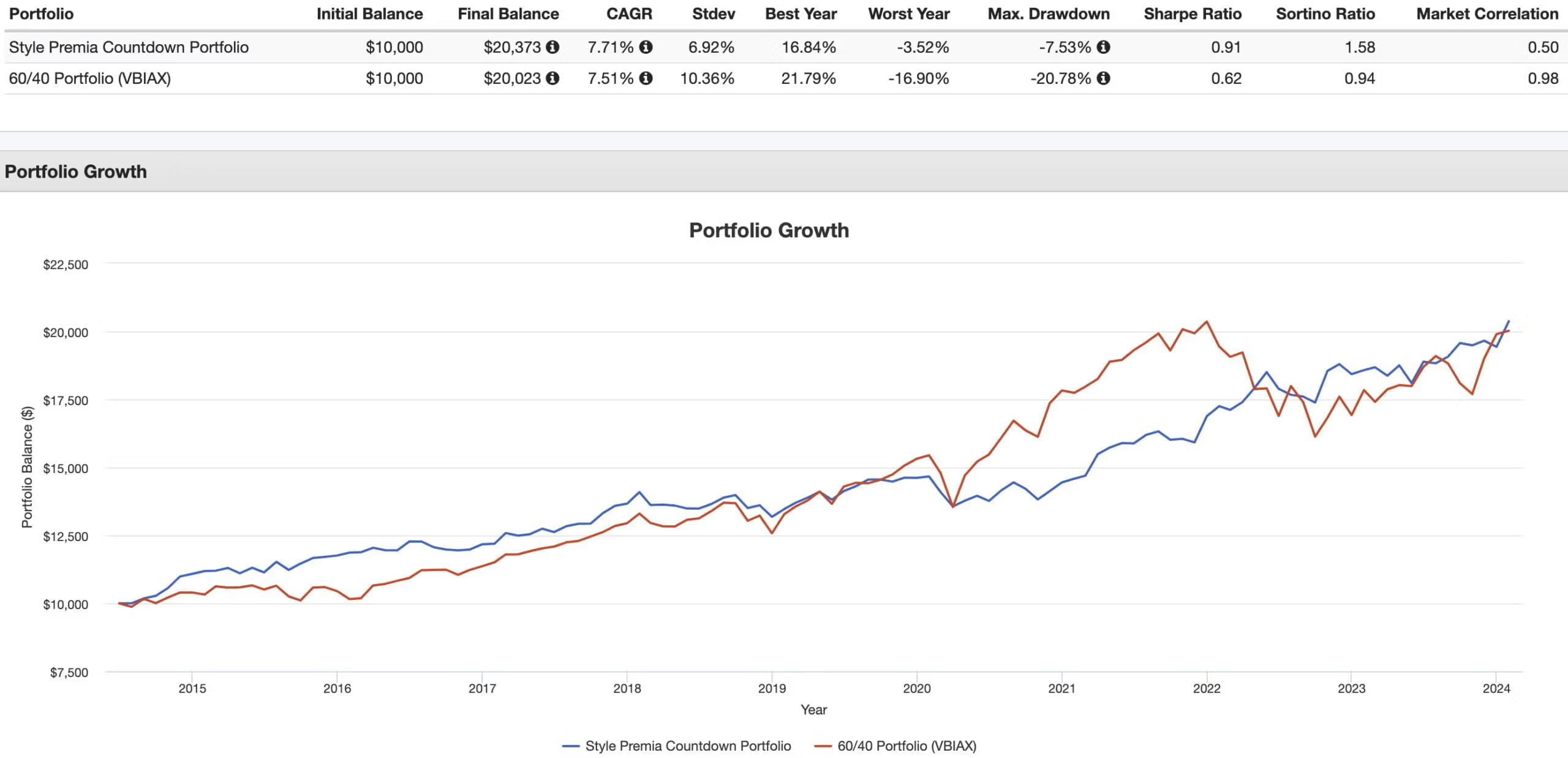

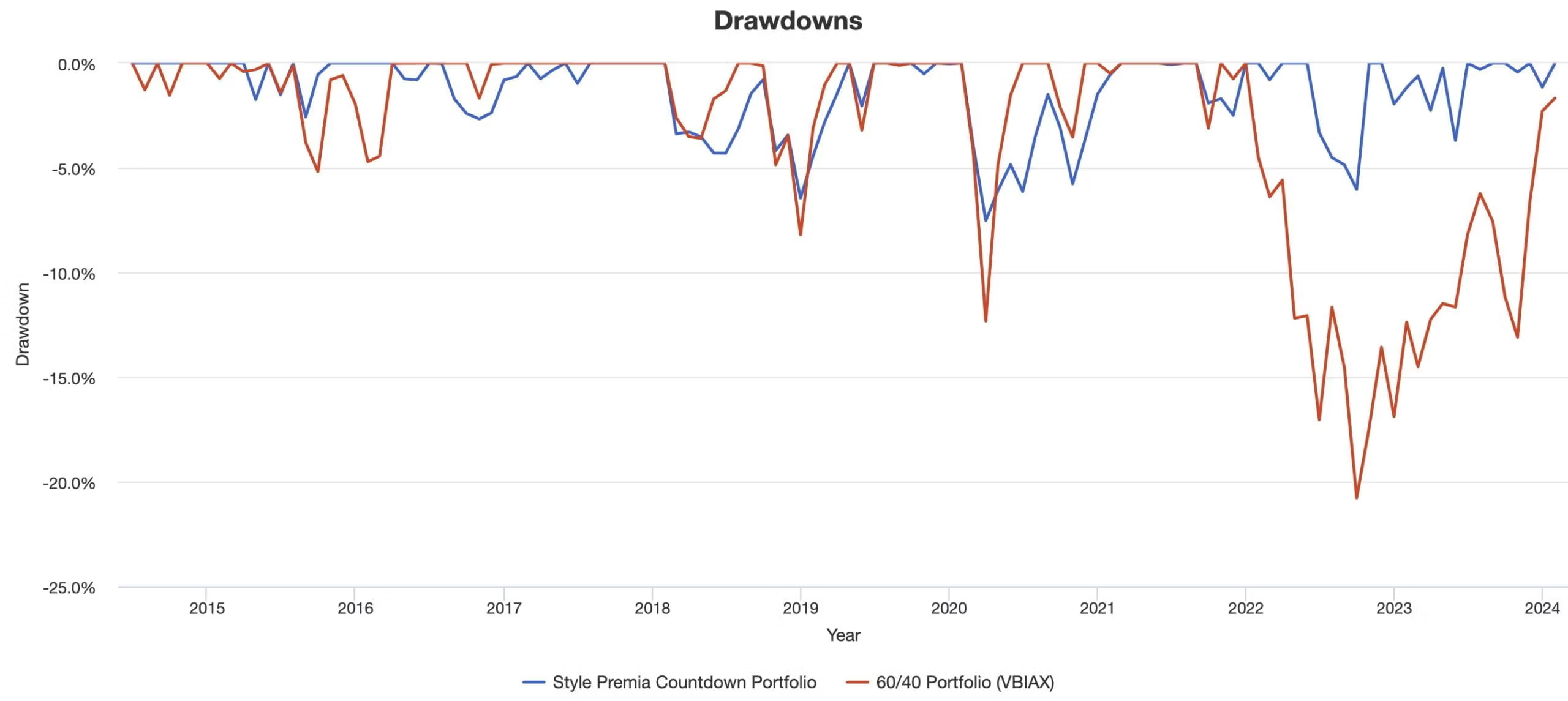

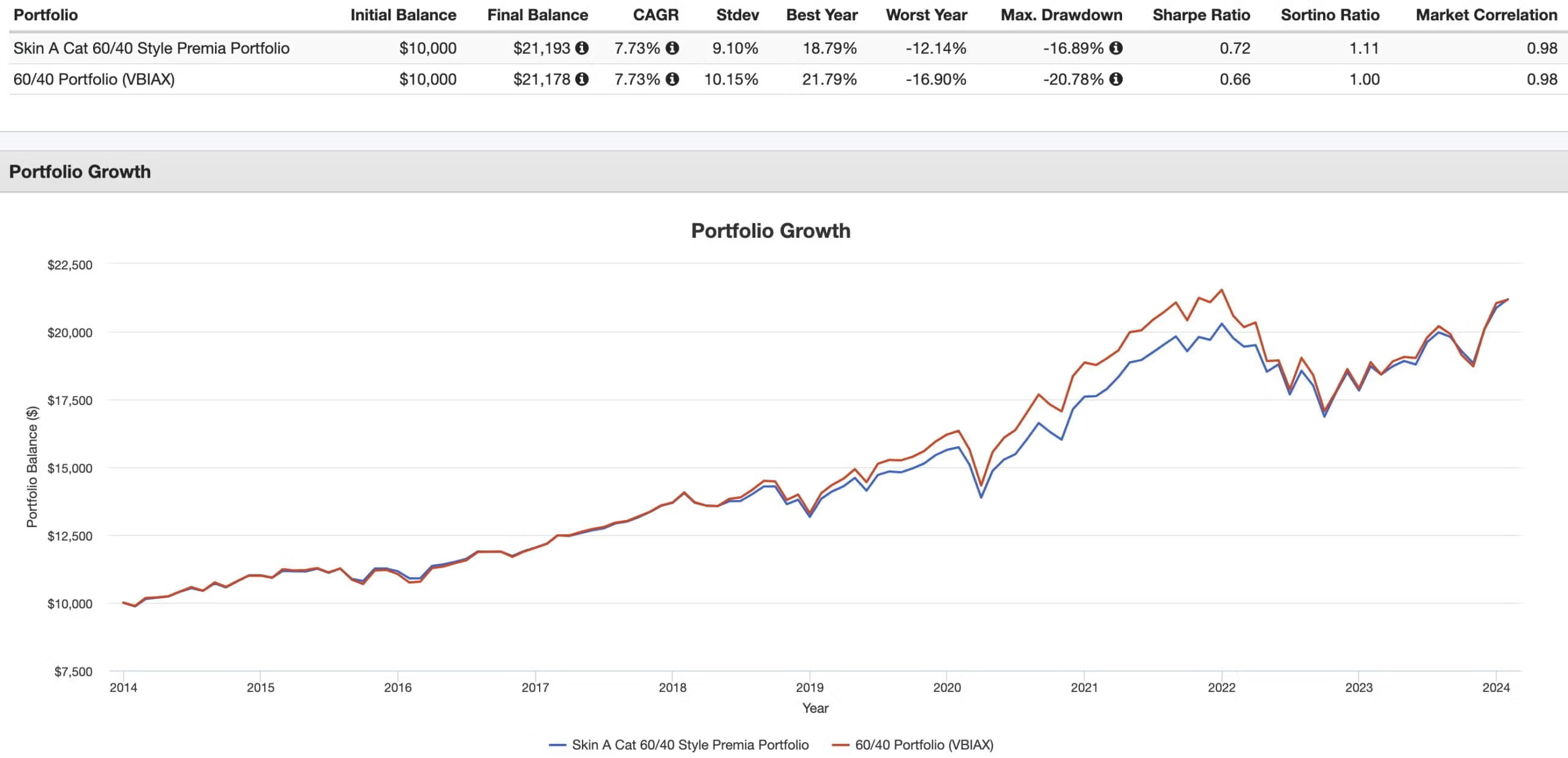

Its returns in 2022 provide a perfect example of this:

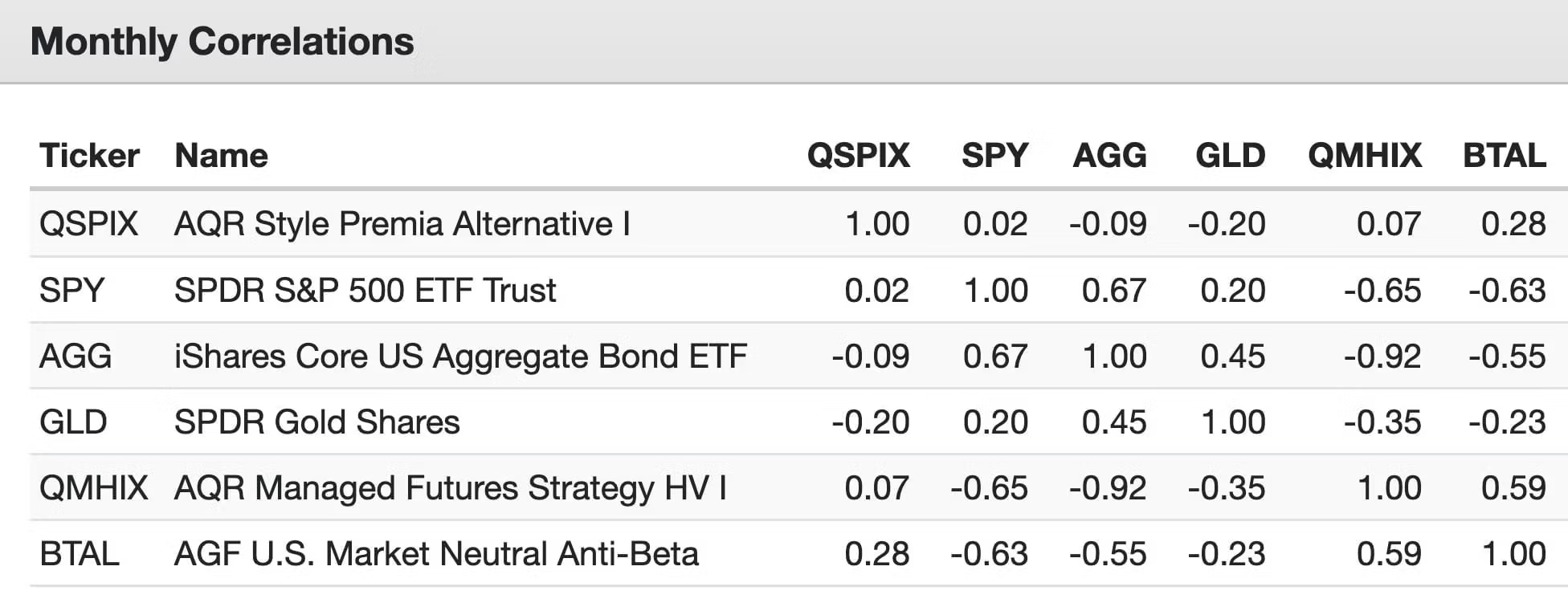

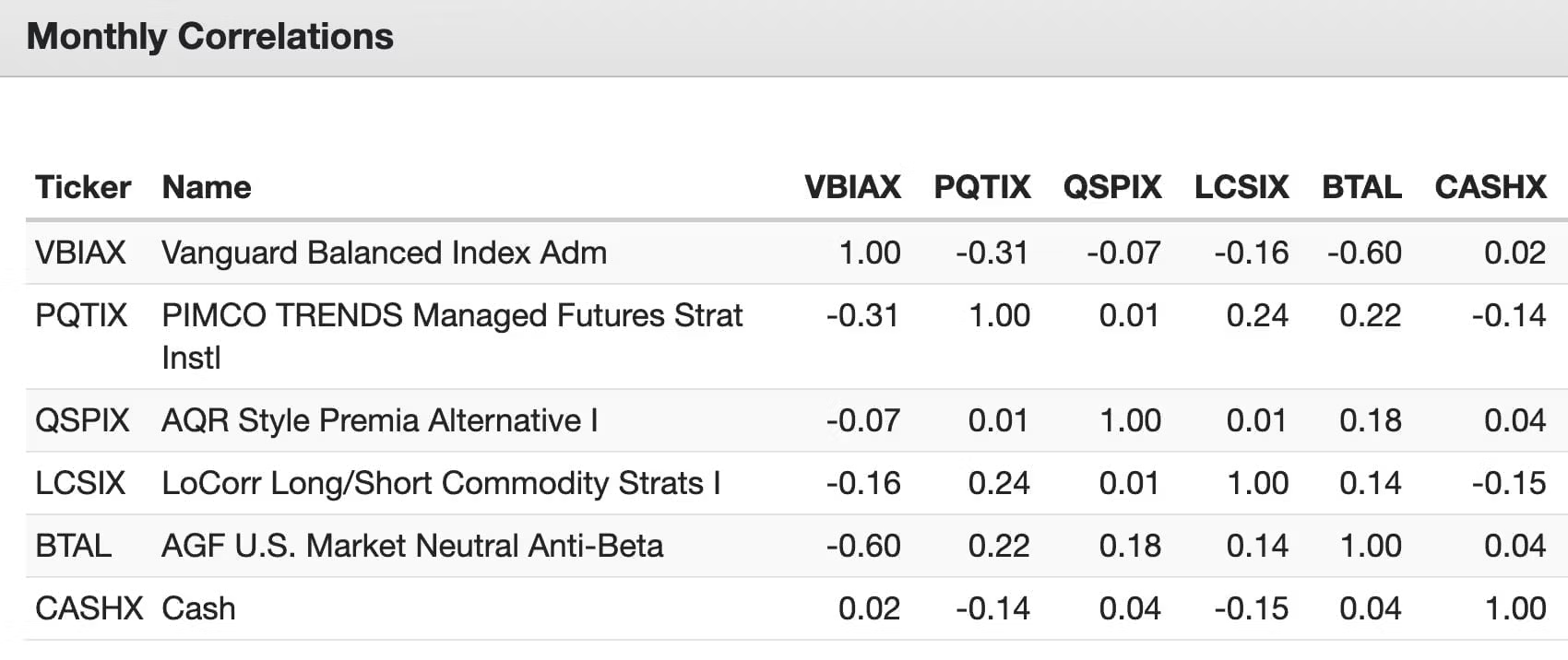

Style premia strategies often exhibit low correlation with traditional asset classes like stocks and bonds. This characteristic is pivotal for absolute return strategies, as it allows these investments to potentially generate positive returns even when traditional markets are flat or declining. What’s fascinating is that style premia is also uncorrelated with many other alternative strategies!

Hence, there is a tremendous diversification benefit to integrating it into a portfolio that has traditional assets (equities and bonds) and an alternative sleeve (managed futures, gold, market neutral, etc).

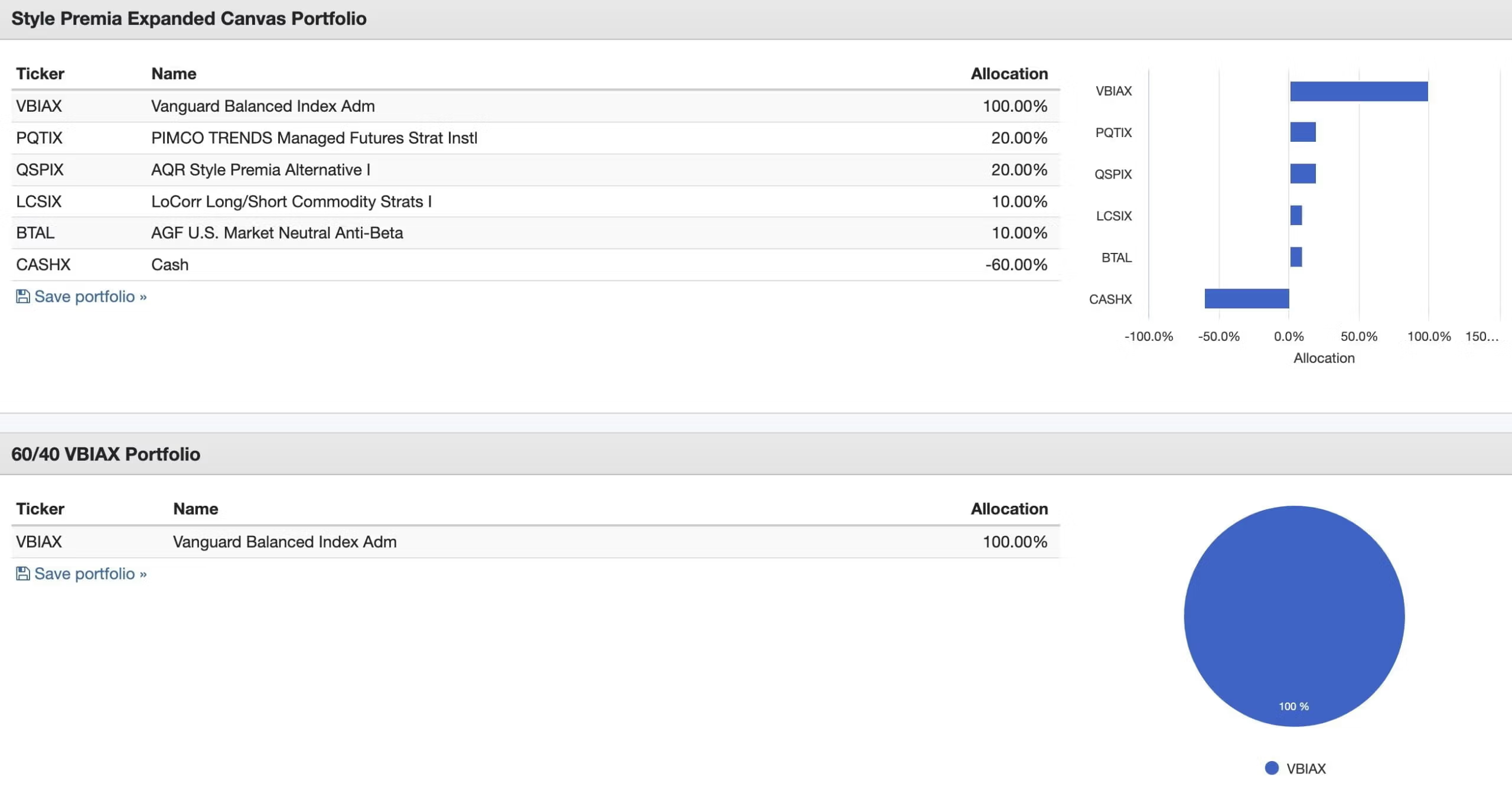

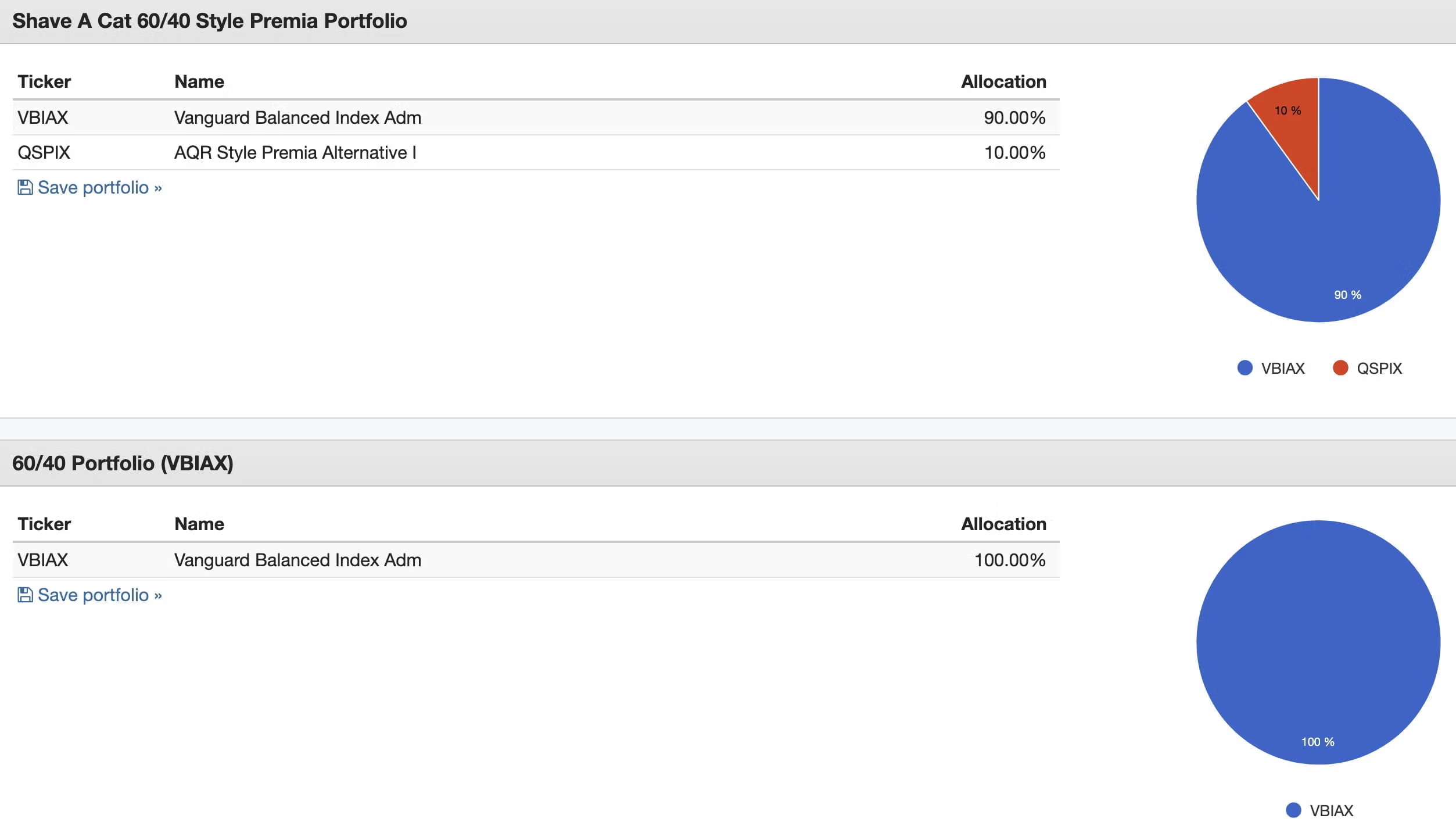

The question you need to ask yourself as an investor is whether or not you want to shave down (existing exposures) or expand the canvas (create space with capital efficient funds) to make room for it all.

Review of AQR Style Premia Alternative Mutual Fund : Reviewing QSPIX Fund

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

AQR Capital Management: OG Alternative Investment Provider

AQR Capital Management is without a doubt the OG Alternative fund provider.

Here is their complete roster of alternative funds:

AQR Complete Alternative Funds List

Single Strategy

AQR Diversified Arbitrage Fund – I: ADAIX / N: ADANX / R6: QDARX

AQR Equity Market Neutral Fund – I: QMNIX / N: QMNNX / R6: QMNRX

AQR Long-Short Equity Fund – I: QLEIX / N: QLENX / R6: QLERX

AQR Macro Opportunities Fund – I: QGMIX / N: QGMNX / R6: QGMRX

AQR Managed Futures Strategy Fund – I: AQMIX / N: AQMNX / R6: AQMRX

AQR Managed Futures Strategy HV Fund – I: QMHIX / N: QMHNX / R6: QMHRX

AQR Risk-Balanced Commodities Strategy Fund – I: ARCIX / N: ARCNX / R6: QRCRX

AQR Sustainable Long-Short Equity Carbon Aware Fund – I: QNZIX / N: QNZNX / R6: QNZRX

Multi-Strategy

AQR Alternative Risk Premia Fund – I: QRPIX / N: QRPNX / R6: QRPRX

AQR Diversifying Strategies Fund – I: QDSIX / N: QDSNX / R6: QDSRX

AQR Style Premia Alternative Fund – I: QSPIX / N: QSPNX / R6: QSPRX

AQR Multi-Asset Fund – I: AQRIX / N: AQRNX / R6: AQRRX

AQR Style Premia Alternative Fund Overview, Holdings and Info

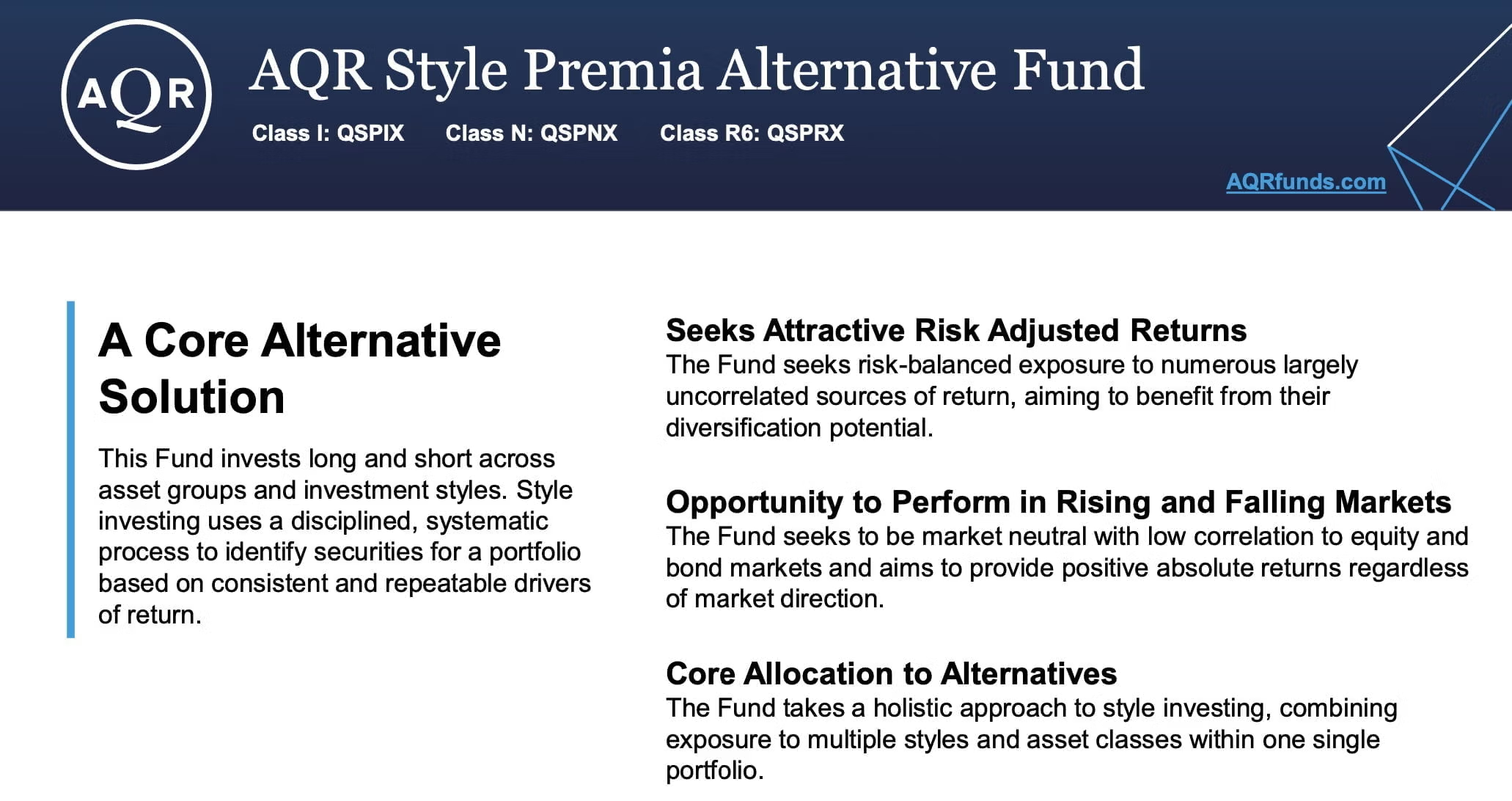

The investment case for “AQR Style Premia Alternative Fund” has been laid out succinctly by the folks over at AQR Capital Management: (source: fund landing page)

So what is really the difference between QSPIX and QRPIX ? TIA !

QRPIX was designed with slightly more tax efficiency in mind. Its vol target is also 8% versus 10% for QSPIX