I made a promise to myself that as my knowledge as an investor expanded, I would have a green light to make changes to my portfolio.

I’m not seeking to tinker with my portfolio for the sake of merely making changes due to boredom or because I’m getting impatient with certain strategies.

In fact, it’s quite the opposite.

I’ll fiddle around with things only if I’ve become aware of new strategies or funds that I believe will improve the capital efficiency, diversification and optimization of my portfolio.

Soaking up new information like a sponge over the past three years has allowed me to forge an identity as an investor who is curious but ultimately skeptical.

I’ll allow my sponge to get saturated with new information but more often than not I’ll expel it out.

As an example, I’m not so obsessed with low fee products to the point that it gets in the way of me integrating a great strategy into my portfolio that costs a bit more to run.

Capital Efficiency For The Win

For instance, I now couldn’t imagine my portfolio without managed futures as one of the core strategies.

The diversification benefit of having an adaptive strategy that is uncorrelated with both stocks and bonds (that additionally can provide crisis alpha and strong positive long-term returns) is something I’m thrilled to have in my portfolio.

If my primary concern was finding single digit basis point ETFs this particular strategy, which involves taking adaptive long and short positions across a diverse set of assets, wouldn’t even be on my radar.

I’d be voluntarily boxing myself into a tiny corner.

Hence, I’ve been pondering over the past few months what is most important to me as an investor?

Is it capital efficiency for the win?

Do I care most about maximum diversification?

How about zeroing in on sophisticated optimization strategies that seek to outperform simple solutions?

Should I worry most about keeping costs as low as possible?

I’ve now come up with a set of priorities as an investor that make the most sense to me.

In other words, I’ve developed a code of conduct that allows me to make crucial decisions such as whether or not to add certain funds while axing others.

How I Make Important Portfolio Decisions To Add Or Remove Funds As A DIY Expanded Canvas Investor

Hey guys! Here is the part where I mention I’m a travel content creator as my day job! This investing opinion blog post is entirely for entertainment purposes only. Most investors should not use leverage in any way, shape or form. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

What I Care About The Most: Capital Efficiency To Expand The Canvas

I’ve come to the conclusion that capital efficiency is what I care about most as an investor.

Expanding the canvas of my portfolio to create space for diversifying alternative strategies such as managed futures, gold, long-short equity, global systematic macro, market neutral and arbitrage is the name of the game.

I’m not looking to shave down my traditional assets such as equities and bonds or make any compromises along the way.

Instead, I’m seeking to expand the canvas of my portfolio to create enough space for these traditional assets to remain and thrive whilst bringing in uncorrelated strategies where outstanding returns and risk management collide.

Hence, my goal with being as capital efficient as possible leads directly to my second highest priority.

Maximum diversification.

I’m seeking a portfolio that features as many diverse strategies as possible relative to an industry standard portfolio which offers up just market cap weighted stocks and aggregate bonds.

The goal for me is to assemble an all-weather portfolio that is robust, resilient and regime ready to handle any curveball or challenging economic environment thrown its way.

Finally, I’ll optimize whenever possible to pursue research supported strategies that offer higher expected returns.

However, I prefer optimization strategies that offer more diversification benefits than ones that don’t.

Thus, I’m more interested in a factor optimized long-short equity strategy (that offers lower correlations to markets) than I am a long only factor fund.

Finally, I’ll use fees as a tiebreaker to decide between great funds that offer similar strategies.

Clear Example Of How I Prioritize Funds

I absolutely love AVGE ETF as a fund that offers a core globally diversified equity strategy with significant value and profitability factor tilts.

I’d prefer that any day of the week to a market cap weighted strategy such as VT ETF.

However, if I’m comparing AVGE ETF to GDE ETF it’s an entirely different story.

I’ll take the efficient core GDE ETF (90 US Equities / 90 Gold) even though it is not factor optimized because it allows me to efficiently add gold into my portfolio without compromising my equity position.

The reason is clearcut and concise.

AVGE is an awesome fund but it’s merely a 100% canvas product.

The hierarchy of my decision making process prioritizes capital efficiency and maximum diversification ahead of optimization.

Therefore, GDE ETF makes the cut whereas AVGE ETF languishes on the sidelines.

Now if a new ETF launched that provided me with the same 90/90 equity/gold combination but instead offered AVGE as the equity sleeve replacement I’d be all over that in a heartbeat!

Factor optimization and global diversification (as opposed to US-only exposure) would make that hypothetical product even more attractive.

That would be a clear example of two similar funds passing the capital efficiency and maximum diversification stages with flying colours.

I’d be picking one over the other due to optimization (factor focused over market cap weighted) and diversification considerations (global over US).

Why I Removed DBMF ETF + KMLM ETF + UPAR ETF From My Portfolio

Having a clear set of goals and priorities has allowed me to make hard portfolio decisions with considerably less stress and discomfort.

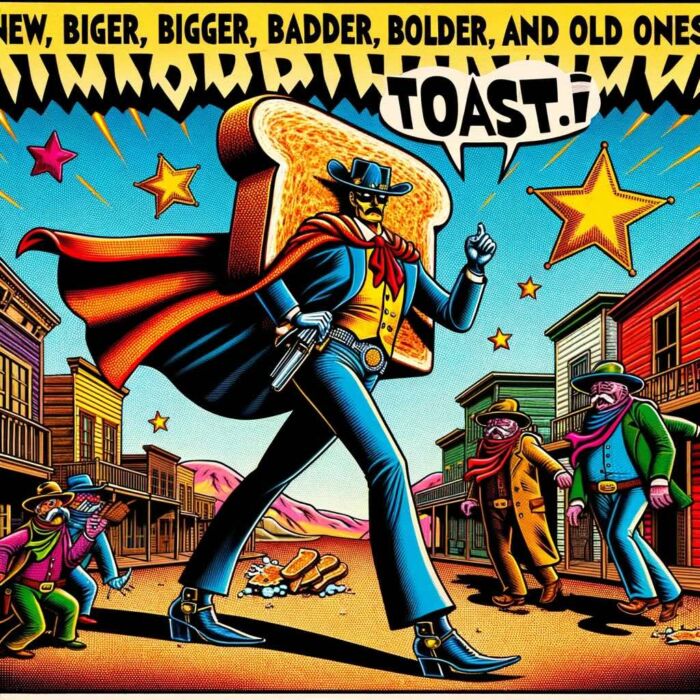

I recently said goodbye to two great managed futures funds in my portfolio.

KMLM ETF and DBMF ETF are no longer part of my portfolio?

Why?

They’re without a doubt two of the best managed futures ETFs!

They’re toast because a bigger, badder and bolder sheriff waltzed into town.

The new sheriff I’m referring to is RSBT ETF.

It’s better know as Return Stacked Bonds and Managed Futures ETF.

KMLM ETF and DMBF ETF offered me fantastic managed futures exposure to a diverse set of asset classes.

However, RSBT offers me the same thing PLUS a return stack of aggregate bonds added on top.

Hence, for every $1 I was spending on DBMF ETF and KMLM ETF I was getting $1 worth of managed futures exposure.

However, for every $1 I’m now spending on RSBT ETF I’m getting that same $1 of managed futures exposure but I’m additionally getting an extra $1 of aggregate bond allocation.

My goal of relentlessly seeing better ways to expand the canvas of my portfolio was fulfilled with the removal of KMLM ETF and DBMF ETF to make space for RSBT ETF.

RSBT now receives the 10% real-estate space that KMLM and DBMF once shared at 5% each.

The impact of adding 10% additional bonds to my portfolio with RSBT ETF allowed me to zoom out and examine my portfolio at large.

Could I now trim my bond exposure a bit elsewhere?

Yes.

UPAR ETF was a natural fund for me to consider eliminating with its bond centric exposure to long-term treasury, 10-Year and TIPs.

Although, it offers global equities, commodity producing equities and GOLD as a neat 168% expanded canvas product, I’ve already got plenty of bonds and gold with other funds.

Hence, I decided to oust UPAR at 10% in favour of creating space for RSSB ETF at 10%.

The 90/60 global equities combination allows me to increase my overall equity position while not sacrificing bonds.

Let’s compare the capital efficient consequences of these roster decisions overall.

Before I had 5% KMLM ETF + 5% DBMF ETF + 10% UPAR ETF which offered me the following exposures:

10% Managed Futures + 9.8% Bonds (Treasury + TIPS) + 5.1% Global Equities plus Commodity Producing Equities + 1.4% Gold

Now with 10% RSBT ETF + 10% RSSB ETF I have a more capital efficient configuration:

10% Managed Futures + 16% Aggregate Bonds + 9% Global Equities.

Overall, I’ve increased the capital efficiency of my portfolio by almost 10%!

That’s a huge win in my books!

Capital Efficient ETFs and Mutual Funds: Expanded Canvas Portfolio Upgrades?

If you’re seeking to improve capital efficiency to create a maximally diversified expanded canvas portfolio here are some potential options to consider.

Firstly let’s examine how we can upgrade a 60/40 portfolio.

Two of the most popular 100% canvas products are VBIAX Mutual Fund and AOR ETF.

VBIAX offers investors 60% US Equities and 40% Aggregate Bonds.

AOR is the global equivalent of that configuration.

For investors seeking capital efficient US equity and Aggregate bond exposure NTSX (90/60), Swan (70/90), PSLDX (100/100) and DSEEX (100/100) are all worth considering.

Going global would mean swapping out AOR ETF for recently minted RSSB (90/60).

In the managed futures space we’ve got stellar funds such as DBMF ETF, CTA ETF and KMLM ETF or PQTIX as a mutual fund.

For investors seeking to add managed futures in a more capital efficient manner products such as BLNDX (50 Global Equities / 100 Managed Futures), MAFIX (50 US Equities /100 Managed Futures) and RSBT (100% Aggregate Bonds / 100% Managed Futures) are worth considering.

It’s now possible to effortlessly add gold as a diversifying alternative without sacrificing equity exposure.

You could consider swapping a 100% Gold fund such as GLD ETF and replacing it with the likes of GDE ETF (90% US Equities / 90% Gold) or GDMN ETF (90% Gold Producing Equities / 90% Gold).

Unfortunately, there aren’t options available to efficiently add other diversifying strategies just yet.

For instance, there isn’t a market neutral anti-beta fund that is efficiently handcuffed with gold.

Nor is there a L/S equity fund that efficiently combines with a managed futures strategy.

However, we’re certainly blessed with some great building blocks right now.

Here are a couple of model portfolios that utilize these funds to their maximum expanded canvas potential.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

4 Fund / 4 Strategy Combination

40% RSSB – Return Stacked Global Stocks and Bonds ETF

30% BLNDX – Standpoint Multi-Asset Fund

20% RSBT – Return Stacked Bonds and Managed Futures ETF

10% GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund ETF

This 4 fund portfolio offers investors a globally diversified capital efficient 4 strategy combination.

Your overall exposures would be as follows:

60% Equities

44% Bonds

50% Managed Futures

9% Gold

Expanded Canvas Size: 163%

Your expanded canvas portfolio has the backbone of a 60/40 plus alternatives in managed futures and gold as uncorrelated diversifiers.

A risk parity simplified 2 fund version with an even grander expanded canvas would be as follows:

Risk Parity 2 Fund Combo

45% GDE – WisdomTree Efficient Gold Plus Equity Strategy Fund ETF

55% RSBT – Return Stacked Bonds and Managed Futures ETF

This 2 fund combination offers this exact exposure:

40.5% US Equities

40.5% Gold

55% Aggregate Bonds

55% Managed Futures Trend

Expanded Canvas Size: 191%

Here you’re allocating more aggressively towards less volatile strategies (managed futures and bonds) whereas you’re toning down your allocation to equities and gold.

There are loads of other expanded canvas combination to consider!

I’d love to hear how you’d assemble some of the building blocks mentioned above.

source: Raise Your Average on YouTube

How I Evolve My Portfolio: A Capital-Efficient Investor’s Playbook for Smart Changes

1) Why do I give myself “permission” to change my portfolio?

Because I see my investing approach as a learning journey, not a fixed doctrine. When I genuinely understand a new strategy, structure, or fund that can enhance capital efficiency, diversification, or optimization, I allow myself to adjust. I’m not tinkering out of boredom — I’m upgrading with purpose.

2) How do I decide when a change is warranted vs. when to stay the course?

I lean on a personal “green light” system: only when new information saturates my sponge, passes my skeptical filter, and aligns with my investing principles do I act. If it doesn’t meet those standards, I expel it. This keeps me from chasing every shiny object.

3) Why is capital efficiency my top priority?

Because capital efficiency expands my canvas. It allows me to add uncorrelated strategies (managed futures, gold, long-short equity, global macro) without sacrificing traditional equity or bond exposure. This gives me more levers for diversification and return generation.

4) How does diversification rank in my decision-making hierarchy?

Right after capital efficiency. I aim to build a robust, all-weather portfolio that can handle shifting economic regimes. My goal is to assemble multiple uncorrelated strategies, far beyond the standard 60/40 structure, to boost resilience and adaptability.

5) How do I view optimization in this hierarchy?

Optimization is important but comes after capital efficiency and diversification. I prefer strategies that offer diversification benefits first, then look for return enhancements. For example, I’ll favor a factor long-short equity fund over a long-only factor fund because it brings lower correlations to the table.

6) How do fees influence my fund selection?

Fees are a tiebreaker, not a primary driver. If two funds are equally strong in capital efficiency and diversification, I’ll choose the cheaper one. But I’m not dogmatic about ultra-low fees if a slightly pricier fund brings significantly better strategic value.

7) What’s an example of my decision-making hierarchy in action?

Take GDE vs. AVGE. AVGE is a fantastic globally diversified, factor-tilted equity fund. But GDE gives me 90% US equities + 90% gold in one wrapper — a capital-efficient, diversification-rich combo. Even though it’s not factor-optimized, GDE wins in my hierarchy.

8) How do I handle removing funds I actually like?

With clear priorities, I can make tough cuts without emotion. For example, I removed DBMF and KMLM (top managed futures ETFs) when RSBT arrived, offering managed futures plus bonds in one return stack. It wasn’t that DBMF/KMLM were bad — RSBT was simply better aligned with my goals.

9) Why did I remove UPAR ETF?

Because after upgrading to RSBT and RSSB, I had enough bond and gold exposure elsewhere. UPAR’s role overlapped with existing positions. By trimming it, I created room for more equity exposure via RSSB — further improving my capital efficiency and strategic balance.

10) How do I evaluate if a new fund deserves a slot?

I ask:

Does this fund increase capital efficiency versus what I currently hold?

Does it expand diversification without sacrificing core exposures?

Does it offer better optimization within my hierarchy?

If it checks those boxes, I consider swapping it in.

11) What are some capital-efficient ETFs and strategies I consider?

I look at stacked funds like NTSX (90/60), PSLDX (100/100), RSBT (bonds + managed futures), RSSB (global stocks + bonds), and GDE (equity + gold). I also integrate diversified strategies like managed futures, style premia, and trend-following where possible.

12) How does having a clear hierarchy make portfolio decisions easier?

It’s a mental model that eliminates noise. Instead of agonizing over every change, I follow my hierarchy:

1️⃣ Capital Efficiency → 2️⃣ Diversification → 3️⃣ Optimization → 4️⃣ Fees.

This framework allows me to zoom out, evaluate systematically, and act decisively when portfolio upgrades make sense.

Capital Efficient Investing: Nomadic Samuel Final Thoughts

Understanding your priorities and creating a hierarchy of needs is one of the most important things you can do as an investor.

It allows you to evaluate your portfolio with a clear goal in mind.

If you’re seeking to improve the capital efficiency and overall diversification of your portfolio you’ll weigh the benefits of integrating new funds into your portfolio versus the ones currently occupying space.

Does adding new fund XYZ offer me more capital efficient exposure than what I’m currently trotting out to the races?

If so, it probably makes sense to replace it with the new fund.

If the new fund increases my total exposure to another strategy can I now trim something else in my portfolio to create space to maximally diversify elsewhere?

These aren’t easy questions to answer.

Making Portfolio Roster Decisions Is Not An Easy Process

Making one roster move can potentially lead to others.

Thus, it’s important to look at the big picture when making such decisions.

In the past, I found it far more difficult to make portfolio decisions when I didn’t have a clear set of priorities in mind.

These days, I find it much easier to evaluate funds, make an informed decision and move on with my life.

However, at this point in the article I’m more interested in what you have to say!

Have you thought about what you value most as an investor?

What are your top priorities ranked from top to bottom?

Please let me know in the comments below.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Great write up as always. How do you like PCFIX for an expanded canvas small cap value play? 100% SCV 100% BND equivalent i believe.

That looks like an awesome fund Joe! I prefer SC and value over large cap MCW. It could either replace that exposure or go alongside it to diversify.

Very happy to have come across your blog! I’ve been doing research for my own portfolio, and was surprised by your comment about KMLM not being “expanded canvas”. Doesn’t it have up to 300% gross exposure to managed futures?