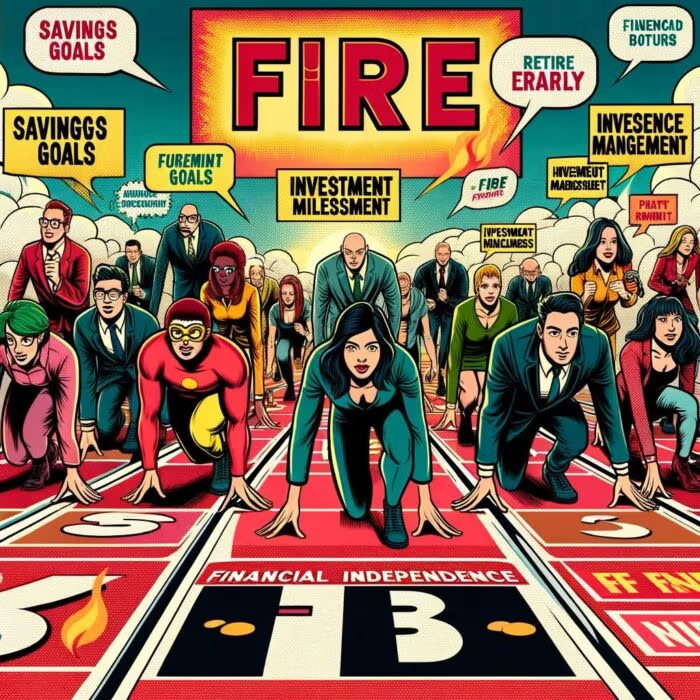

Financial Independence, Retire Early (FIRE) is a lifestyle and financial movement with the goal of gaining financial independence and retiring at an age much earlier than the conventional retirement age. It encourages strict savings and investing strategies to amass enough wealth that one can live off their investments, essentially ‘retiring’ from the need to work for income. Participants in this movement often aim to save 50-70% of their income, invest it wisely, and maintain a frugal lifestyle to achieve their goal of financial independence.

The Purpose of Sharing Case Studies and Their Significance

Sharing case studies about the successful implementation of the FIRE movement allows us to understand the practical applications, the challenges, and the triumphs involved in this journey. They offer first-hand experiences, insights and strategies that have proven effective in real life, providing a valuable resource for those aspiring to embark on a similar path. These stories of success not only inspire but also educate, delivering tangible takeaways for everyone from beginners to advanced FIRE followers.

Success Stories Of Early Retirement

This article will delve into several success stories of early retirement through the lens of the FIRE movement. It is designed to be engaging and informative, offering an in-depth look at each individual or family’s journey to financial independence. Each section will focus on one case study, starting with a brief introduction of the individuals involved, their motivations for pursuing FIRE, and their initial financial circumstances. This will be followed by a detailed narrative of their journey, outlining the steps they took, the challenges they faced, and the strategies they employed. Finally, the outcomes of their efforts will be highlighted, showing the impacts and benefits of the FIRE lifestyle on their lives.

This comprehensive exploration will not shy away from the difficult aspects of their stories, ensuring an authentic, balanced representation of the FIRE movement. It aims to be a resource full of practical tips and emotional resonance, a testament to the determination and dedication that goes into achieving financial independence and early retirement. The journey may be challenging and the road to success not linear, but these stories demonstrate that with the right strategies and mindset, the rewards of FIRE can be immense.

Case Study 1: The Young Achiever

Meet Lucas, an individual who truly embodies the phrase “age is just a number.” Born and raised in the rural Midwest, Lucas grew up in a middle-class family where hard work and frugality were woven into the fabric of daily life. A curious and diligent student, he was fascinated with technology and studied Computer Science in college. Upon graduation at the age of 22, he landed a well-paying job at a tech company in Silicon Valley.

Discovering FIRE and the Journey

Lucas first stumbled upon the concept of FIRE while scrolling through a financial blog during his lunch break. The idea immediately resonated with him. He was intrigued by the idea of not being beholden to a 9-5 job for the rest of his life and having the freedom to pursue his own interests and passions.

Lucas knew he was in a privileged position with a high-income job at a young age, so he set out to make the most of it. He began by analyzing his finances and creating a strict budget, limiting his expenses and avoiding the high-cost lifestyle that was prevalent among his colleagues in Silicon Valley.

Even though his salary was substantial, he opted for a modest apartment and drove his old college car. He cooked at home instead of eating out and indulged in free or inexpensive hobbies like hiking and reading. Lucas started investing heavily in index funds, adopting a “buy and hold” strategy and steering clear of risky investment vehicles.

However, the journey wasn’t always smooth sailing. He had to face criticism and skepticism from peers who did not understand his choices, and there were moments of temptation and doubt. Yet, Lucas stayed committed to his goal, fueled by his vision of financial independence.

Success Story and Lessons Learned

After eight years of unwavering discipline and smart financial decisions, Lucas achieved his goal at the age of 30, becoming financially independent with a substantial portfolio that could cover his living expenses indefinitely.

The journey taught him valuable lessons. He learned about the power of compound interest and the importance of consistent investing. He found that having a clear goal was crucial in maintaining motivation, and that every penny saved was a step closer to financial independence.

Moreover, Lucas discovered that his frugal lifestyle not only helped him achieve FIRE but also led to a life less cluttered by material possessions, which he found liberating. He realized that he enjoyed cooking, found peace in nature, and discovered a love for reading—hobbies that cost little but brought immense satisfaction.

Lucas’ story is a testament to the possibilities that the FIRE movement can bring, especially when started at a young age. His path wasn’t easy, but it was worth it. Now he enjoys the freedom to work on passion projects and the ability to spend his time as he wishes, thanks to the choices he made. His journey emphasizes that FIRE is not about deprivation, but about making intentional choices that lead to a life of independence and satisfaction.

source: Road to FIRE on YouTube

Case Study 2: The Late Bloomer

Meet Martha Sullivan, a fifty-year-old high school English teacher from Birmingham, Alabama. She’s an affable woman with a penchant for literature and an endearing southern drawl. She is the epitome of resilience, optimism, and proof that it is never too late to change one’s financial destiny.

Martha was born and raised in a modest family, where the concept of savings was as foreign as a snowfall in the heart of Alabama summer. Money was perceived as a resource for immediate use, not long-term security. Martha carried this mindset into adulthood, living paycheck to paycheck with very little in the way of savings.

Martha’s life took an unexpected turn when she was 47. After an emotional breakup with her long-term partner, she was faced with the stark reality of financial instability. What little savings she had were drained, and she found herself struggling to make ends meet on her teacher’s salary.

Their introduction to FIRE and their journey

Martha’s wake-up call came one afternoon at a staff meeting when a new colleague, 27-year-old Lisa, introduced her to the FIRE movement – Financial Independence, Retire Early. Lisa explained how she was aggressively saving and investing with an aim to retire by 40. She spoke with such fervor and conviction that Martha found herself intrigued.

Eager to learn more, Martha delved headlong into FIRE blogs, podcasts, and books, educating herself about savings rates, investment strategies, frugal living, and early retirement. She quickly realized the FIRE movement was more than just about retiring early; it was about gaining control over one’s financial life.

Martha made significant changes to her lifestyle. She sold her car and used public transport, started cooking at home instead of eating out, and even picked up a side hustle tutoring students in English. She also started investing aggressively in low-cost index funds, following the principles of the FIRE movement.

Their success story and the insights they gained

Three years later, at 50, Martha had a nest egg she’d never have thought possible a few years ago. She had managed to save and invest over $150,000. She was far from retiring early but felt a sense of financial security and independence she had never known before.

Martha didn’t stop there. She became an active member of the FIRE community, attending meetings, contributing to online forums, and even starting her own blog to inspire other late bloomers. She also continued to grow her savings and investments, with a new goal of retiring comfortably at 65.

The late bloomer’s tale carries significant lessons about financial independence. Martha’s journey underscores the fact that it’s never too late to start. It tells us that financial independence is not just about retiring early, but about taking control of your financial destiny. And perhaps most importantly, it is a reminder that success is not always about where you end up, but the progress you make and the knowledge you gain along the way.

Martha’s story illustrates the transformative power of the FIRE movement, not just in achieving financial goals but in sparking personal growth and resilience. Through her journey, Martha found more than financial independence; she found her voice, her strength, and a community that shares her values and aspirations.

Case Study 3: The Family Path

The Andersons are your typical American family from Boise, Idaho. Tom, a software engineer, and Anna, a pediatric nurse, are parents to three energetic children: Ben, 15, Lisa, 12, and baby Noah, who’s just 2. Despite a comfortable lifestyle with two stable incomes, the Andersons were living paycheck to paycheck, falling into the common trap of lifestyle inflation. They were burdened by car loans, a hefty mortgage, and the myriad of expenses that come with raising three children. As far as financial planning went, they had some retirement savings, but they hadn’t given serious thought to when or how they might retire.

How they found out about FIRE and their collective journey

Their introduction to FIRE came when Tom stumbled upon a blog post about the movement during a late-night internet surf. Intrigued, he plunged himself into more in-depth research, and the more he read, the more he believed in the potential of this lifestyle. Tom presented the idea to Anna, who, initially skeptical, began to see its merit when they started charting out their financial future.

Realizing that this was not just a personal journey but one that involved the whole family, they began involving their children in discussions about money, savings, and financial independence, hoping to inculcate these values early on. They made a family budget, began tracking expenses, and set saving and investing goals.

To achieve their new goals, the Andersons made some significant lifestyle changes. They downsized their home, trading their large suburban house for a modest, cozy one that fit their needs better and dramatically reduced their mortgage payments. They also sold one of their cars, began meal planning to save on groceries, and cut out unnecessary subscriptions and luxuries.

Their success story and the wisdom they acquired

Fast forward to five years later, the Andersons have been able to pay off all their debt, including their mortgage, and increase their net worth to over half a million dollars. They are well on their way to achieving their goal of financial independence by the time they reach their early fifties.

But the financial success is just a part of the story. The real win for the Andersons has been the change in their family dynamics and the values they have imparted to their children. Ben, now a high school junior, works part-time and saves half of his paycheck. Lisa, a budding artist, sells her work online and invests her earnings.

More than the monetary gains, it is the life wisdom they have acquired that they cherish. They have learned to live below their means without feeling deprived, found joy in simplicity, and realized the importance of financial education for their children.

Through their journey, they discovered that the essence of FIRE is not just about amassing wealth or retiring early, but about gaining control over their financial future, spending mindfully, and teaching their children the value of financial independence. Their story is a testament to the idea that FIRE is not just an individual pursuit but a lifestyle that can transform families and shape the financial futures of generations to come.

source: Big Think on YouTube

Case Study 4: The Career Changer

Meet Raj Patel, a 35-year-old, successful corporate attorney based out of San Francisco, California. Raj’s resume boasts an Ivy League education and employment at a top law firm. His lifestyle was one of luxury, complete with a high-rise apartment, brand-new sports car, and vacations to exotic locales. But beneath this glitzy surface was a deep-seated dissatisfaction. Raj worked tirelessly, often clocking in 70-hour work weeks, leaving him with little time or energy to pursue his true passion: writing.

How they came across FIRE and their journey

Raj’s introduction to the FIRE movement came during a late-night browsing session, a brief reprieve from his grueling work schedule. A blog post titled “Retire Early, Live Freely” caught his attention. Intrigued, he delved deeper into the FIRE lifestyle, absorbing information about savings rates, investing, and early retirement.

Fascinated by the possibility of breaking free from his all-consuming career, Raj took his first steps towards financial independence. He downgraded his high-end apartment for a cozier and more affordable place in Oakland, traded his sports car for a bike and public transportation, and put a halt to his impulsive luxury purchases. He started to aggressively save and invest his sizable income.

Their success story and valuable takeaways

Five years into his FIRE journey, Raj, now 40, has managed to accumulate a portfolio worth over $1.2 million. He has successfully cut his ties with his former law firm and transitioned to a full-time writing career. Despite earning significantly less than his law firm days, his frugal lifestyle and substantial investments allow him to live comfortably and pursue his passion without financial stress.

Raj’s story, however, is not just about the money he has saved or the high-profile career he left behind. It is about the liberation he found in the FIRE movement, the ability to live his life on his terms, and the opportunity to pursue his passion. He often says, “FIRE didn’t just make me financially independent; it made me life independent.”

His journey has taught him and those who follow his story that money should be a tool to aid your life’s passions, not a chain that ties you down. It also demonstrates that the FIRE lifestyle doesn’t mean retiring from work altogether; it means having the financial independence to choose the work that fulfills you.

Raj’s career change wasn’t simply a professional shift; it was a profound lifestyle transformation that realigned his life with his passion and values. His story stands as an inspiring example of how the FIRE movement can empower individuals to reclaim their time, passion, and, ultimately, their life.

source: The Money Resolution on YouTube

Common Themes and Lessons from the Case Studies

The Different Paths to FIRE and the Core Strategies Shared

Financial Independence, Retire Early (FIRE) is not a one-size-fits-all formula; it’s an ideology that takes on different shades for different individuals. Each case is unique, painted with individual experiences, yet several fundamental strategies are commonly shared across the spectrum.

- Frugality: No matter the path, frugality is a common trait among those pursuing FIRE. Some individuals chose extreme measures, such as living in a van or tiny houses, while others simply curtailed dining out or vacation expenses. Regardless of the degree, each made a conscious decision to live below their means to maximize savings.

- High Savings Rate: A high savings rate is a fundamental pillar of the FIRE movement. Whether achieved through a high-income profession, like tech or finance, or through a middle-income job supplemented by side hustles, the goal remains to save a substantial percentage of income – often 50% or more.

- Investing: A common thread woven into the fabric of each FIRE journey is the emphasis on investing. Many individuals pursued low-cost index funds, real estate, or a combination of both, aiming for the power of compound interest to expedite their path to financial independence.

- Lifestyle Design: Achieving FIRE is not just about money, but about creating a life one doesn’t need a vacation from. Every case involved intentional lifestyle design, whether that meant moving to a cheaper area, adopting minimalism, or even transitioning to a nomadic lifestyle.

The Benefits and Challenges Faced by Each Case

While the pursuit of FIRE brings numerous benefits, it doesn’t come without its fair share of challenges.

- Benefits:

- Freedom: The most striking benefit seen across the cases was the newfound freedom – freedom from the 9-to-5 grind, freedom to travel, or simply the freedom to spend time on hobbies or with loved ones.

- Personal Growth: Many FIRE adherents reported that their journey led to immense personal growth. They developed skills like budgeting, investing, and even hands-on skills like gardening or DIY home repairs.

- Stress Reduction: With a financial cushion, many found a significant reduction in stress. The constant worry about money diminished, providing a sense of security and peace.

- Challenges:

- Social Perception: One of the most pervasive challenges was dealing with societal norms and the perception of early retirement. Many faced questions and skepticism from friends, family, and colleagues.

- Life After FIRE: Finding purpose and staying engaged after achieving FIRE was another common challenge. Many struggled with a sudden abundance of free time and the need to find fulfilling activities to fill it.

- Inflation and Market Volatility: Financial challenges were not absent. Market volatility, inflation, and unplanned expenses were constant worries that needed careful planning and strategy.

Insights on How Varied Lifestyles and Circumstances Can Adapt to FIRE

The journey to FIRE is flexible and can be tailored to a wide array of lifestyles and circumstances. Here are some insights:

- Single Parents: Single parents might find FIRE challenging due to the additional financial responsibilities, but it’s not impossible. By making lifestyle changes, such as opting for cheaper housing or transportation, and by pursuing a high-income job or side hustle, they can build a path towards FIRE.

- High-Income Earners: High-income earners often face lifestyle inflation, but if they can resist this temptation, they have a distinct advantage. With high saving and investing rates, they can expedite their journey to FIRE.

- Digital Nomads: Digital nomads have an inherent advantage with a lower cost of living in many countries. If they can balance their income and expenses effectively, they can leverage their lifestyle to achieve FIRE.

- Late Starters: It’s never too late to start the FIRE journey. Even if starting late, by aggressively saving, investing wisely, and perhaps extending the retirement timeline, one can still achieve financial independence.

The journey to FIRE is a personal one, with no set formula or timeline. It’s as much about the destination as it is about the journey itself. By examining these various paths, we can gain valuable insights and perhaps find inspiration for our own financial independence journey.

12-Question FAQ: FIRE Case Studies — Success Stories of Early Retirement

1) What is FIRE and why do case studies matter?

FIRE (Financial Independence, Retire Early) is a framework for saving aggressively, investing simply, and designing a life where work is optional. Case studies turn abstract rules into real playbooks—showing trade-offs, timelines, and what actually worked.

2) What do most successful FIRE stories have in common?

Four pillars show up repeatedly: high savings rate, low-cost diversified investing, intentional lifestyle design, and time (letting compounding work). Mindset (consistency > intensity) ties them together.

3) How high is a “high” savings rate in these stories?

Common ranges are 40–70% during the build phase. The exact rate depends on income, cost of living, and how aggressively people optimize big line items (housing, transport, food).

4) What investment approach do most case studies use?

Mostly low-cost index funds (total market/All-World + bonds) or a core index portfolio with measured real estate exposure. Simplicity and fees under control beat complexity most of the time.

5) How long did it take people in these case studies to reach FI?

Typical ranges: 7–20 years. High earners who avoid lifestyle creep can compress timelines; families or late starters often aim for Coast/Barista FI or a later FI date while increasing security.

6) What were the biggest levers to move the needle fast?

Optimizing the “Big Three”: housing (downsize/house-hack/geoarbitrage), transportation (fewer cars/biking), and food (meal planning). Income upgrades (promotions, career pivots, side income) were the second engine.

7) What roadblocks did they hit—and how were they handled?

Social pressure & FOMO: countered with clear goals and community support.

Market volatility: stayed the course, rebalanced, held 1–3 years of cash/short bonds.

Unexpected expenses (health, home, kids): larger emergency funds and insurance.

8) How do families adapt FIRE to kids, mortgages, and college?

They budget together, teach kids money skills, prioritize emergency funds, and plan college via 529s/scholarship strategies. Many swap the big house for a modest one and gain years on the timeline.

9) Is FIRE possible for late starters?

Yes—by increasing savings rate, delaying full retirement (or adopting Barista FI), downsizing costs, and optimizing taxes. “Late” still compounds when paired with an intentional plan.

10) What happens after “retirement”—how do people spend their time?

Common themes: purposeful work (passion projects, part-time), travel on a budget, volunteering, and deepening relationships. The happiest case studies planned post-FI purpose as carefully as finances.

11) What risk controls showed up across success stories?

Diversification across asset classes.

Cash buffer for 1–3 years of spending.

Dynamic spending rules (trim increases after rough years).

Adequate insurance (health, disability, liability, homeowners).

12) What practical first steps can readers copy today?

Track a 12-month spend, pick a target FIRE number (spend ÷ withdrawal rate), automate investing in low-cost funds, attack a Big Three expense, and write a one-page Investment Policy Statement.

source: Jamila Musayeva on YouTube

Conclusion: FIRE Case Studies and Lessons Learned

Our deep dive into the different paths to Financial Independence, Retire Early (FIRE) has been a riveting expedition, exploring varied landscapes of personal finance. From the hushed corridors of frugality to the bustling bazaars of investing, we have traversed through the common threads that bind these unique journeys together.

Whether it’s the digital nomad, minimizing living costs by hopping from one low-cost destination to another or the high-income earner staving off lifestyle inflation to maximize their savings, the paths to FIRE are as varied as they are intriguing. What’s shared, though, is the tenacity, resilience, and a clear vision of the future.

The lessons learned here are plentiful. Frugality and high savings rates are key, but so are investing wisely and designing a lifestyle that is both sustainable and enjoyable. The challenges faced, such as societal pressure, finding purpose post-FIRE, and financial uncertainties like inflation and market volatility, add depth to these experiences. They serve as important reminders that the path to FIRE is not always a straight line; it comes with twists, turns, and plenty of learning opportunities.

Pursue a FIRE Journey

To the readers seeking inspiration to embark on your own FIRE journey, remember this: each path is as unique as the individual walking it. You may find elements of your own life reflected in the stories shared here, but your journey will inherently be your own, shaped by your experiences, dreams, and circumstances.

If anything, these case studies illustrate that the pursuit of FIRE isn’t exclusive to high-income earners or the extraordinarily frugal. It’s for anyone armed with the desire for financial freedom and the readiness to make informed and intentional financial decisions. It’s about creating a life that aligns with your values and not just your paycheck.

Don’t be intimidated by the scale of the savings rate or the size of the investment portfolio. Instead, focus on the possibilities that come with financial independence. Begin with small steps. Let the stories of others inspire you, not overwhelm you.

Flexibility and Adaptability of the FIRE Lifestyle

The world of FIRE is not a rigid framework, but a fluid concept that ebbs and flows with the rhythm of your life. It adapts to you, your lifestyle, your dreams, and your circumstances.

What stands out from these case studies is the chameleon-like quality of FIRE. It sheds old skin and adapts, providing a roadmap that can be tweaked to suit different income levels, lifestyles, and individual goals. It’s this flexibility that makes FIRE an accessible and desirable path to many.

As we wind down this journey through the varied landscape of FIRE, let us not forget that the goal of this movement is not simply to retire early but to attain a level of financial comfort that allows one to make life decisions without being overly stressed about the financial impact. It’s about harnessing your financial prowess to fuel your life goals.

In conclusion, the path to FIRE isn’t just a financial journey but a personal one, etching deep lines of growth, wisdom, and ultimately freedom. Whether you’re just starting, midway, or close to your destination, embrace the lessons, enjoy the journey, and above all, keep the FIRE burning.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.