Investing is both an art and a science, requiring a blend of strategic planning, disciplined execution, and an understanding of complex financial landscapes. Few have mastered this blend better than David Swensen, the revered Chief Investment Officer (CIO) at Yale University. Swensen’s innovative approach, known as the Endowment Model, has not only transformed Yale’s endowment into one of the most successful in the world but has also provided a blueprint for institutional and individual investors seeking sustainable, long-term growth.

source: Rob Berger on YouTube

We will explore the intricacies of David Swensen’s Endowment Model. We’ll also delve into its core principles, dissect its asset allocation strategies, and offer practical steps for investors aiming to incorporate these strategies into their own portfolios. Whether you are managing a personal investment portfolio or overseeing a large institutional fund, understanding and applying the Endowment Model can significantly enhance your investment outcomes.

David Swensen’s Impact as Yale University’s Chief Investment Officer

David Swensen’s tenure as CIO at Yale University, spanning over three decades, is a testament to his exceptional investment acumen. When Swensen took the helm in 1985, Yale’s endowment was modest compared to today’s standards. Under his leadership, the endowment grew exponentially, consistently outperforming its peers and setting new benchmarks for endowment performance globally. Swensen’s strategies emphasized diversification, alternative investments, and a long-term perspective, diverging from the traditional reliance on stocks and bonds.

Swensen’s success was not merely a product of market trends or favorable conditions; it was the result of meticulous planning, disciplined execution, and an unwavering commitment to his investment philosophy. His approach has since influenced numerous institutions and investors worldwide, making the Endowment Model a cornerstone of modern investment strategy.

Importance of a Diversified, Long-Term Investment Strategy

In an era marked by economic volatility and unpredictable market fluctuations, the importance of a diversified and long-term investment strategy cannot be overstated. Swensen’s Endowment Model champions this very approach, advocating for a balanced mix of traditional and alternative assets to mitigate risk and capitalize on growth opportunities. Diversification across various asset classes ensures that a portfolio is not overly dependent on any single investment, thereby reducing the impact of adverse market movements.

Moreover, a long-term perspective allows investors to harness the power of compounding, weather short-term market turbulence, and stay focused on achieving their financial goals. This disciplined approach fosters patience and resilience, essential qualities for navigating the complexities of the financial markets.

The Endowment Model: Core Principles

David Swensen’s Endowment Model is underpinned by several foundational principles that distinguish it from conventional investment strategies. These principles focus on diversification, alternative investments, and a steadfast commitment to long-term growth.

Diversification: Spreading Investments Across Different Asset Classes

Why Diversification Matters

Diversification is the bedrock of the Endowment Model. By allocating investments across a variety of asset classes, investors can significantly reduce portfolio risk. Different asset classes often respond differently to the same economic stimuli; thus, losses in one area may be offset by gains in another. This balance not only stabilizes returns but also enhances the overall performance of the portfolio.

For instance, during periods of economic downturn, traditional equities might underperform, while alternative investments like real estate or private equity could remain resilient or even appreciate. This non-correlated behavior ensures that the portfolio remains robust across varying market conditions.

Key Takeaways:

- Risk Reduction: Diversification minimizes the impact of poor performance in any single asset class.

- Enhanced Stability: A diversified portfolio is less susceptible to extreme volatility.

- Broader Growth Opportunities: Exposure to multiple asset classes increases the potential for capturing gains from various market segments.

Alternative Investments: Emphasizing Non-Traditional Assets

Swensen’s Endowment Model places a strong emphasis on alternative investments, which are assets outside the realm of traditional stocks and bonds. These include private equity, hedge funds, real estate, commodities, and other real assets. Alternative investments offer several advantages:

- Higher Returns: They often provide superior returns compared to traditional investments.

- Low Correlation: They typically have a low correlation with standard market indices, enhancing diversification.

- Inflation Hedge: Real assets like real estate and commodities can act as a hedge against inflation, preserving purchasing power.

Types of Alternative Investments:

- Private Equity: Investments in private companies with high growth potential. These can include venture capital, buyouts, and growth equity.

- Hedge Funds: Pooled funds that employ diverse strategies to generate high returns, including long/short equity, event-driven, and macro strategies.

- Real Estate: Direct investments in property or through Real Estate Investment Trusts (REITs), providing income through rents and capital appreciation.

- Commodities: Investments in physical goods such as gold, oil, and agricultural products, offering a hedge against inflation and market volatility.

Long-Term Focus: Holding Investments for Extended Periods

A long-term perspective is integral to the Endowment Model. By holding investments over extended periods, investors can capitalize on the power of compounding and ride out short-term market fluctuations. This approach encourages patience and discourages reactive decision-making based on temporary market movements.

Benefits of a Long-Term Focus:

- Compounding Growth: Reinvested earnings generate additional returns, accelerating portfolio growth.

- Reduced Impact of Volatility: Long-term holding mitigates the effects of short-term market downturns.

- Alignment with Financial Goals: A long-term strategy aligns investments with overarching financial objectives, fostering sustained growth and stability.

Asset Allocation Strategy

Asset allocation is the strategic distribution of investments across various asset classes to balance risk and return. Swensen’s Endowment Model emphasizes a diversified asset allocation to achieve optimal performance and manage risk effectively.

Equities: Significant Allocation to Domestic and International Stocks

Swensen advocated for a substantial allocation to equities, both domestic and international, as a cornerstone of growth. Equities offer higher return potential compared to other asset classes, making them a vital component of a growth-oriented portfolio.

Allocation Insights:

- Domestic Equities: Investing in U.S. companies provides exposure to a diverse and robust market. The U.S. equity market, being one of the largest and most liquid, offers numerous opportunities for growth.

- International Equities: Global diversification reduces dependence on any single economy and captures growth in emerging markets. International equities can provide exposure to sectors and industries not prevalent in the domestic market, enhancing diversification.

Benefits of Equities Allocation:

- Growth Potential: Equities historically offer higher returns over the long term compared to bonds and other asset classes.

- Dividend Income: Many equities provide dividend payouts, offering a steady income stream.

- Inflation Hedge: Equities can act as a hedge against inflation, as company revenues and profits tend to increase with rising prices.

Fixed Income: Limited Exposure to Bonds

Unlike traditional models that heavily rely on bonds for stability, Swensen recommended limited exposure to fixed income. Instead of focusing on traditional government or corporate bonds, he emphasized credit opportunities that offer higher yields and better risk-adjusted returns.

Fixed Income Strategy:

- Credit Investments: Investing in corporate bonds and other credit instruments to enhance returns. Credit investments can provide higher yields compared to government bonds, albeit with higher risk.

- Reduced Bond Allocation: Keeping traditional bond holdings minimal to avoid lower yields and interest rate risk. This approach ensures that the portfolio is not overly exposed to the potential underperformance of traditional bonds.

Advantages of Limited Fixed Income Exposure:

- Higher Yields: Credit investments can offer superior returns compared to traditional bonds.

- Diversification: Credit instruments add another layer of diversification within the fixed income segment.

- Risk Management: By focusing on credit opportunities rather than traditional bonds, the portfolio can achieve better risk-adjusted returns.

Alternative Assets: Major Allocation to Non-Traditional Investments

A significant portion of the portfolio is allocated to alternative assets, including private equity, hedge funds, and other real assets. These investments not only provide higher returns but also add diversification benefits due to their low correlation with traditional asset classes.

Key Alternative Assets:

- Private Equity: Investing in private companies or buyouts offers the potential for high growth and returns. Private equity investments often involve active management and strategic guidance to enhance company performance.

- Hedge Funds: Utilizing diverse strategies to generate alpha, hedge funds can employ long/short equity, event-driven, and macro strategies to achieve high returns.

- Real Assets: Direct investments in real estate, timberland, infrastructure, and commodities provide tangible assets that can appreciate over time and generate income through rents or leases.

Benefits of Alternative Assets Allocation:

- Higher Return Potential: Alternative assets often outperform traditional investments, offering superior returns.

- Enhanced Diversification: Their low correlation with traditional assets reduces overall portfolio risk.

- Inflation Protection: Real assets like real estate and commodities serve as a hedge against inflation, preserving purchasing power.

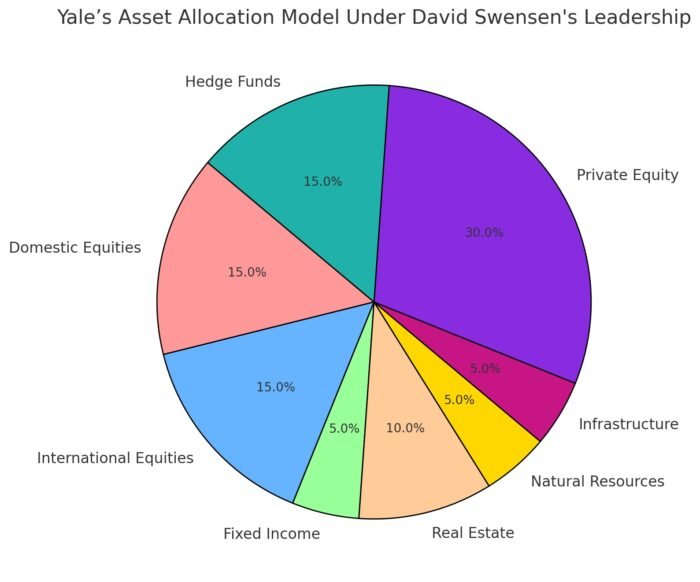

Example: Yale’s Asset Allocation Model Under Swensen’s Leadership

Under Swensen’s leadership, Yale’s endowment typically followed an asset allocation that exemplified the Endowment Model’s principles. Here’s a snapshot of Yale’s asset allocation during his tenure:

- Equities: 30%

- Domestic: 15%

- International: 15%

- Fixed Income: 5%

- Real Assets: 20%

- Real Estate: 10%

- Natural Resources: 5%

- Infrastructure: 5%

- Private Equity: 30%

- Hedge Funds: 10%

This diversified allocation allowed Yale’s endowment to achieve consistent returns while effectively managing risk. By balancing traditional equities with a substantial allocation to alternative assets, Yale’s portfolio was well-positioned to capitalize on growth opportunities and withstand market volatility.

Managing Risk

Effective risk management is paramount in the Endowment Model. Swensen employed several strategies to mitigate risk while maintaining the potential for high returns. These strategies ensure that the portfolio remains resilient in the face of economic downturns and market volatility.

Diversification Across and Within Asset Classes

Diversification extends beyond merely spreading investments across different asset classes. It also involves diversifying within each asset class to further reduce risk. By investing in a variety of sectors, regions, and strategies within each category, the portfolio becomes more resilient to specific risks.

Strategies for Enhanced Diversification:

- Within Equities: Investing in different industries and geographic regions ensures that the portfolio is not overly exposed to any single sector or market. For example, holding stocks in technology, healthcare, consumer goods, and energy sectors can balance out industry-specific downturns.

- Within Alternative Assets: Utilizing multiple hedge fund strategies or investing in various real estate sectors (commercial, residential, industrial) diversifies the risk within the alternative asset classes. This approach prevents the portfolio from being adversely affected by the poor performance of a single strategy or sector.

Active Management: Pursuing Higher Returns Through Expertise

Swensen preferred active management, especially in alternative investments, to achieve higher returns. Active managers possess the expertise to exploit market inefficiencies, conduct in-depth research, and implement strategic investment decisions that can generate alpha.

Benefits of Active Management:

- Potential for Superior Returns: Active managers aim to outperform benchmarks through skillful stock selection and strategic asset allocation.

- Flexibility: Active management allows for adjustments in response to changing market conditions, economic indicators, and emerging opportunities.

- Access to Specialized Knowledge: Active managers often have specialized knowledge and expertise in specific sectors or asset classes, enabling more informed investment decisions.

Illiquidity Premium: Embracing Less Liquid Assets for Higher Returns

Investing in less liquid assets, such as private equity and real estate, can offer higher returns as compensation for the increased risk and longer investment horizons. Swensen believed that the illiquidity premium is a valuable component of a diversified portfolio.

Understanding the Illiquidity Premium:

- Higher Returns: Less liquid assets often provide greater potential for long-term appreciation compared to more liquid investments.

- Risk Compensation: Investors are rewarded for locking in capital over extended periods, accepting the trade-off between liquidity and return.

- Portfolio Enhancement: Including illiquid assets enhances the overall return potential of the portfolio, contributing to higher compounding growth over time.

Example: Risk Management During Economic Downturns

During economic downturns, Swensen’s diversified approach allowed Yale’s endowment to maintain stability. For instance, during the 2008 financial crisis, while traditional asset classes like equities and bonds plummeted, alternative investments such as private equity and real assets often remained resilient or even thrived. This resilience cushioned the overall portfolio against severe losses and facilitated a swift recovery once market conditions improved.

Swensen’s strategy demonstrated that a well-diversified portfolio, rich in alternative assets, could navigate economic turbulence more effectively than one heavily reliant on traditional investments. This example underscores the importance of diversification and active management in managing risk.

The Importance of Manager Selection

Selecting the right investment managers is crucial for the success of the Endowment Model. Swensen placed immense importance on choosing top-tier managers who could deliver consistent, superior returns. The selection process was rigorous, focusing on managers who could align with Yale’s long-term objectives and possess the skills to navigate complex markets.

Choosing the Right Managers

Swensen sought managers with deep expertise, proven track records, and a clear investment philosophy. The selection process involved identifying managers who demonstrated exceptional skill, integrity, and alignment with Yale’s investment principles.

Criteria for Selecting Managers:

- Performance History: Consistent track record of strong returns, especially during various market cycles. Managers who can demonstrate their ability to perform well in both bull and bear markets are highly valued.

- Expertise: Specialized knowledge in their respective asset classes. For example, private equity managers should have experience in identifying and nurturing high-growth companies, while real estate managers should possess in-depth knowledge of property markets and development.

- Philosophy Alignment: Shared investment principles and strategies that complement Yale’s overall investment approach. Managers whose philosophies align with the Endowment Model are more likely to contribute positively to the portfolio’s performance.

Due Diligence: Rigorous Vetting of Investment Managers

A thorough due diligence process was essential to ensure that selected managers met Yale’s stringent standards. This involved comprehensive evaluations of their investment strategies, risk management practices, operational infrastructure, and ethical standards.

Due Diligence Steps:

- Background Checks: Assessing managers’ histories and reputations within the industry. This includes reviewing their past performance, management teams, and any regulatory issues or controversies.

- Performance Analysis: Reviewing historical performance data and consistency. Analyzing how managers performed across different market conditions provides insight into their ability to deliver sustained returns.

- Strategy Evaluation: Understanding the manager’s investment approach and risk management techniques. Evaluating whether their strategies align with the Endowment Model’s principles is crucial for ensuring compatibility.

- Operational Assessment: Examining the manager’s operational infrastructure, including risk management systems, compliance procedures, and administrative capabilities. Strong operational frameworks are indicative of a manager’s ability to execute their strategies effectively.

- Reference Checks: Speaking with current and former clients to gauge the manager’s reliability, communication skills, and overall performance. References provide valuable insights into the manager’s strengths and potential red flags.

Monitoring Performance: Ongoing Evaluation of Managers

Continuous monitoring of managers’ performance ensures that they remain aligned with Yale’s goals and adhere to their investment mandates. Regular performance reviews and assessments help identify any deviations or underperformance early on.

Monitoring Practices:

- Regular Reporting: Detailed performance reports and updates from managers, including insights into portfolio holdings, performance attribution, and strategic shifts.

- Performance Metrics: Comparing actual returns against benchmarks and expectations. Evaluating whether managers are meeting or exceeding their targets is essential for assessing their effectiveness.

- Engagement: Ongoing communication and relationship management with managers. Regular meetings and updates facilitate a collaborative relationship and provide opportunities to address any concerns or adjustments needed.

- Reassessment: Periodically reassessing managers’ strategies and performance to determine if continued collaboration is beneficial. This includes evaluating whether managers are adapting to changing market conditions and maintaining their competitive edge.

Adapting the Endowment Model for Individual Investors

While the Endowment Model was designed for large institutional investors, individual investors can adapt its principles to build robust and diversified portfolios. Although individual investors may face challenges in accessing alternative assets and top-tier managers, there are strategies to overcome these barriers and implement a similar investment approach.

Challenges for Individuals

Individual investors often encounter obstacles in accessing alternative assets and top-tier managers due to high minimum investment requirements and limited availability. However, with the right strategies and investment vehicles, these challenges can be mitigated.

Common Challenges:

- Access to Alternative Assets: Direct investments in private equity or hedge funds typically require substantial capital and are often restricted to institutional investors or accredited investors.

- High Minimum Investments: Institutional-grade investments often necessitate significant initial investments, making them inaccessible to individual investors with limited capital.

- Limited Information: Individual investors may lack the resources and expertise to thoroughly evaluate alternative investments and managers.

Implementing a Similar Strategy

Individual investors can emulate the Endowment Model by focusing on diversification, incorporating alternative investment options available to them, and maintaining a long-term investment horizon. Here are steps to implement a similar strategy:

Steps to Implement a Similar Strategy:

- Diversify Across Asset Classes: Ensure a mix of equities, fixed income, and alternatives to balance risk and return.

- Incorporate Available Alternatives: Utilize real estate investment trusts (REITs), commodity ETFs, or publicly traded private equity funds to gain exposure to alternative assets without the need for large capital outlays.

- Maintain a Long-Term Perspective: Commit to holding investments over extended periods to capitalize on growth and compound returns, avoiding the temptation to react to short-term market fluctuations.

- Leverage Low-Cost Investment Vehicles: Use index funds and ETFs to achieve broad diversification and minimize investment costs, maximizing overall returns.

- Regularly Rebalance the Portfolio: Periodically review and adjust the portfolio to maintain the desired asset allocation, ensuring alignment with long-term goals.

Utilizing Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) offer a practical way for individual investors to achieve broad diversification and gain exposure to various asset classes without the need for large capital outlays. These investment vehicles provide instant diversification across a wide range of securities within an asset class, making them ideal for implementing the Endowment Model’s principles.

Advantages of Index Funds and ETFs:

- Low Costs: Generally lower fees compared to actively managed funds, enhancing overall returns.

- Diversification: Instant exposure to a wide range of securities within an asset class, reducing unsystematic risk.

- Liquidity: Easy to buy and sell, providing flexibility and accessibility.

- Transparency: Holdings are typically disclosed daily, allowing investors to know exactly what they own.

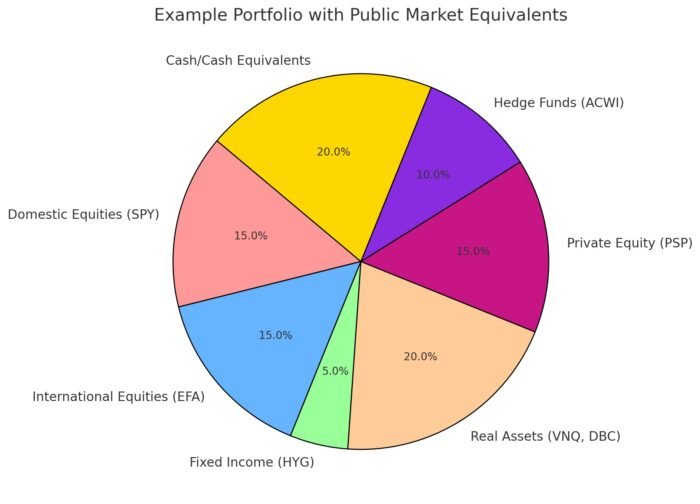

Example: Building a Portfolio with Public Market Equivalents

An individual investor can construct a portfolio mirroring Swensen’s asset allocation using publicly available funds. Here’s an example of how to achieve this:

- Domestic Equities: 15%

- S&P 500 ETF (e.g., SPY): Provides exposure to large-cap U.S. companies.

- International Equities: 15%

- MSCI EAFE ETF (e.g., EFA): Offers exposure to developed international markets outside of North America.

- Fixed Income: 5%

- High-Yield Corporate Bond ETF (e.g., HYG): Focuses on corporate bonds with higher yields, enhancing return potential.

- Real Assets: 20%

- REIT ETF (e.g., VNQ): Provides exposure to real estate investment trusts, generating income through property investments.

- Commodity ETF (e.g., DBC): Offers exposure to a diversified basket of commodities, including energy, metals, and agriculture.

- Private Equity: 15%

- Listed Private Equity ETF (e.g., PSP): Invests in publicly traded private equity firms, providing indirect exposure to private equity returns.

- Hedge Funds: 10%

- Multi-Strategy ETF (e.g., ACWI): Simulates hedge fund strategies by employing multiple investment approaches to generate alpha.

- Cash/Cash Equivalents: 20%

- Money Market Funds or High-Yield Savings Accounts: Provide liquidity and stability, serving as a buffer against market volatility.

This diversified portfolio captures the essence of the Endowment Model, balancing growth, income, and risk management. By utilizing publicly available funds, individual investors can effectively implement Swensen’s asset allocation principles without the need for substantial capital or access to exclusive investment vehicles.

Emphasizing Patience and Discipline

Patience and discipline are essential virtues in the Endowment Model, enabling investors to stay committed to their strategies despite market fluctuations. Swensen emphasized these qualities as key to achieving long-term investment success.

Long-Term Commitment

Swensen stressed the importance of a long-term commitment to investing. By focusing on long-term goals, investors can avoid the pitfalls of short-term market volatility and benefit from sustained growth. This commitment fosters a disciplined approach, ensuring that investors remain steadfast in their strategies regardless of market conditions.

Benefits of Long-Term Commitment:

- Compounding Growth: Reinvested earnings generate additional returns, accelerating portfolio growth over time.

- Reduced Transaction Costs: Fewer trades lower overall investment expenses, enhancing net returns.

- Strategic Focus: Aligning investments with long-term financial objectives promotes consistency and reduces the likelihood of impulsive decisions.

Avoiding Short-Term Distractions

Market noise and short-term events can lead to impulsive decisions that undermine long-term strategies. Swensen advised investors to remain focused on their long-term goals and not be swayed by temporary market movements. This disciplined approach helps in maintaining the integrity of the investment strategy, ensuring that decisions are based on fundamental principles rather than emotional reactions.

Strategies to Avoid Short-Term Distractions:

- Set Clear Goals: Define long-term financial objectives and stick to them, providing a roadmap for investment decisions.

- Regular Review: Periodically assess portfolio performance without overreacting to short-term changes, ensuring alignment with long-term goals.

- Stay Informed: Educate yourself about market trends and economic indicators without succumbing to hype or panic, maintaining a balanced perspective.

- Automate Investments: Utilize automatic investment plans to maintain consistency and reduce the influence of emotional decision-making.

Example: Swensen’s Patience During Market Downturns

During the 2008 financial crisis, Yale’s endowment remained steadfast in its investment strategy. While traditional asset classes plummeted, alternative investments like private equity and real assets held up relatively well. Swensen’s patience and disciplined approach allowed the endowment to recover swiftly and continue growing, demonstrating the power of a long-term focus.

This example underscores the importance of maintaining a disciplined, long-term perspective. By resisting the urge to make impulsive decisions during market turmoil, investors can preserve their portfolios and capitalize on opportunities as markets stabilize and recover.

Practical Steps to Implement the Endowment Model

Implementing the Endowment Model requires a structured approach to building and managing a diversified portfolio. Here are practical steps to help you get started:

Building a Diversified Portfolio

A diversified portfolio is essential to managing risk and achieving stable returns. Start by allocating your investments across different asset classes in alignment with the Endowment Model’s principles.

Steps to Build a Diversified Portfolio:

- Assess Your Risk Tolerance: Understand your comfort level with market volatility. This assessment will guide your asset allocation and investment choices.

- Determine Asset Allocation: Decide on the percentage allocation for equities, fixed income, and alternative assets based on your risk tolerance, investment horizon, and financial goals.

- Select Investments: Choose specific funds or securities within each asset class to achieve diversification. Focus on a mix of domestic and international equities, alternative investments, and other asset classes that align with the Endowment Model’s principles.

- Incorporate Alternative Assets: Utilize investment vehicles that provide exposure to alternative assets, such as REITs, commodity ETFs, and publicly traded private equity funds.

- Balance Growth and Stability: Ensure that your portfolio balances growth-oriented investments with stable, income-generating assets to achieve a harmonious mix of risk and return.

Selecting Investment Vehicles

Choosing the right investment vehicles is crucial for aligning your portfolio with the Endowment Model. Utilize a mix of mutual funds, ETFs, and other accessible investment options to gain exposure to various asset classes.

Investment Vehicles to Consider:

- Mutual Funds: Actively or passively managed funds offering diversification within asset classes. Mutual funds can provide exposure to specific sectors, regions, or investment strategies.

- ETFs: Cost-effective and flexible options for achieving broad market exposure. ETFs can track indices, sectors, or employ specific investment strategies, offering versatility and liquidity.

- REITs and Commodity Funds: Provide access to real estate and commodities without direct ownership. REITs offer exposure to income-generating properties, while commodity funds track the performance of various physical goods.

- Target-Date Funds: Automatically adjust asset allocation based on a predetermined timeline, aligning with long-term investment goals.

- Robo-Advisors: Automated platforms that create and manage diversified portfolios based on your risk tolerance and investment objectives, offering a hands-off approach to diversification.

Regular Portfolio Review

Maintaining alignment with your long-term goals requires regular portfolio reviews and rebalancing. Periodically assess your portfolio to ensure it remains diversified and adheres to your intended asset allocation.

Steps for Regular Portfolio Review:

- Monitor Performance: Track the performance of each investment relative to benchmarks. Assess whether your portfolio is meeting your expected returns and identifying any underperforming assets.

- Rebalance: Adjust your holdings to maintain your target asset allocation, selling overperforming assets and buying underperforming ones. Rebalancing helps manage risk and ensures that your portfolio remains aligned with your investment strategy.

- Adjust for Life Changes: Reevaluate your investment strategy as your financial situation or goals evolve. Major life events, such as marriage, the birth of a child, or retirement, may necessitate changes in your investment approach.

- Stay Informed: Keep abreast of market trends, economic indicators, and changes in the financial landscape. Informed decisions lead to better portfolio management and alignment with long-term goals.

Incorporating Technology and Tools

Leveraging technology can enhance portfolio management and streamline the implementation of the Endowment Model.

Tools and Technologies to Utilize:

- Portfolio Management Software: Platforms like Personal Capital, Mint, or Betterment offer tools for tracking and managing investments, providing insights into asset allocation and performance.

- Financial Calculators: Utilize online calculators to assess risk tolerance, project future growth, and determine optimal asset allocation.

- Robo-Advisors: Automated investment platforms that use algorithms to create and manage diversified portfolios based on your inputs, offering a convenient and cost-effective way to implement the Endowment Model.

- Educational Resources: Access online courses, webinars, and investment literature to deepen your understanding of the Endowment Model and enhance your investment strategies.

Key Takeaways from David Swensen’s Endowment Model

David Swensen’s Endowment Model offers a robust framework for building a diversified, resilient, and high-performing investment portfolio. The model emphasizes several key principles:

- Diversification: Spreading investments across various asset classes to mitigate risk and enhance stability.

- Alternative Investments: Incorporating non-traditional assets to enhance returns and reduce correlation with traditional markets.

- Long-Term Focus: Maintaining a patient and disciplined approach to benefit from compounding and ride out market volatility.

- Manager Selection: Choosing top-tier managers through rigorous due diligence to achieve superior returns.

- Risk Management: Employing strategies to manage and mitigate risks effectively, ensuring portfolio resilience.

These principles collectively create a foundation for sustained financial success, allowing investors to navigate the complexities of the financial markets with confidence and strategic insight.

Importance of Diversification, Alternative Investments, and a Long-Term Perspective

The Endowment Model underscores that a well-diversified portfolio, rich in alternative investments and guided by a long-term perspective, is essential for achieving sustained financial success. In an increasingly interconnected and volatile global economy, these principles provide a blueprint for building resilient portfolios capable of withstanding market fluctuations and capitalizing on growth opportunities.

Importance of Diversification: Diversification reduces the risk of significant losses by spreading investments across various asset classes, sectors, and geographic regions. It enhances the potential for stable returns and provides a buffer against market downturns.

Significance of Alternative Investments: Alternative investments offer higher return potential and lower correlation with traditional assets, enhancing overall portfolio performance. They provide exposure to unique opportunities that can drive substantial growth and income generation.

Value of a Long-Term Perspective: A long-term investment horizon fosters patience and discipline, enabling investors to stay committed to their strategies despite short-term market volatility. This perspective allows investors to harness the power of compounding and achieve their financial goals with sustained growth.

Encouragement to Adopt Swensen’s Strategies

Investing like David Swensen requires commitment, discipline, and a willingness to embrace a diversified and long-term approach. Whether you are an individual investor or managing a larger portfolio, incorporating the Endowment Model’s principles can significantly enhance your investment strategy.

Why Adopt Swensen’s Strategies?

- Proven Success: Swensen’s track record at Yale University demonstrates the effectiveness of the Endowment Model in achieving superior returns and managing risk.

- Resilience: A diversified portfolio rich in alternative investments is better equipped to withstand market turbulence and economic downturns.

- Sustainable Growth: A long-term focus aligns investments with enduring financial goals, promoting consistent growth and wealth accumulation.

By embracing diversification, seeking out alternative assets, remaining patient, and staying disciplined, investors can navigate the complexities of the financial markets successfully. The Endowment Model provides a comprehensive framework for building a resilient and high-performing investment portfolio, empowering investors to achieve their financial aspirations with confidence and strategic insight.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.