Investing, much like navigating through different seasons, requires the right tools and strategies to weather the variances. Enter the All-Weather Portfolio – a timeless investing framework designed to stand resilient across various market conditions.

Defining the All-Weather Portfolio

This dynamic portfolio management strategy diversifies assets to balance the scales between risk and return. By distributing investments across multiple asset classes, it seeks to smoothen out the bumps along the turbulent journey of market swings, aiming to provide steady returns, come rain or shine.

The Importance of an All-Weather Portfolio

In the ever-fluctuating world of investing, stability can seem like a distant dream. From volatile stock market swings to fluctuating interest rates and unpredictable economic events, investors are often at the mercy of numerous uncontrollable factors. Herein lies the significance of an All-Weather Portfolio. By constructing a portfolio capable of withstanding both bullish and bearish markets, investors can shield themselves from extreme volatility. This strategic diversification is not just about weathering storms, but also about positioning for sunshine – capturing opportunities wherever they might emerge.

Gearing Up for the Journey Ahead

In this comprehensive guide, we’ll unfurl the map to building your very own All-Weather Portfolio. We’ll delve into the nitty-gritty of market dynamics, shed light on the critical role of diversification, and explore the key elements of an All-Weather Portfolio. Our journey will also take us through the wisdom of investing gurus like Ray Dalio and Harry Browne, whose insights have shaped the concept of All-Weather investing. So, whether you’re a seasoned investor looking to fortify your portfolio, or a novice trying to grasp the ropes, this guide is your companion to building a portfolio that not only endures but thrives, across every market season.

Understanding the Investment Climate: Explanation of market cycles

To understand the world of investing, one must first recognize its inherent dynamism. Much like the weather, financial markets are perpetually shifting, cycling through seasons of growth (bull markets) and contractions (bear markets). This cyclical dance is accompanied by volatility, the dramatic rises and falls in asset prices. This financial whirlwind can stir emotions, leading to reactive decisions that may prove detrimental in the long run. Understanding these market cycles and the concept of volatility is akin to knowing the climate of an unknown land – it allows us to prepare accordingly, enhancing our ability to navigate the investment terrain.

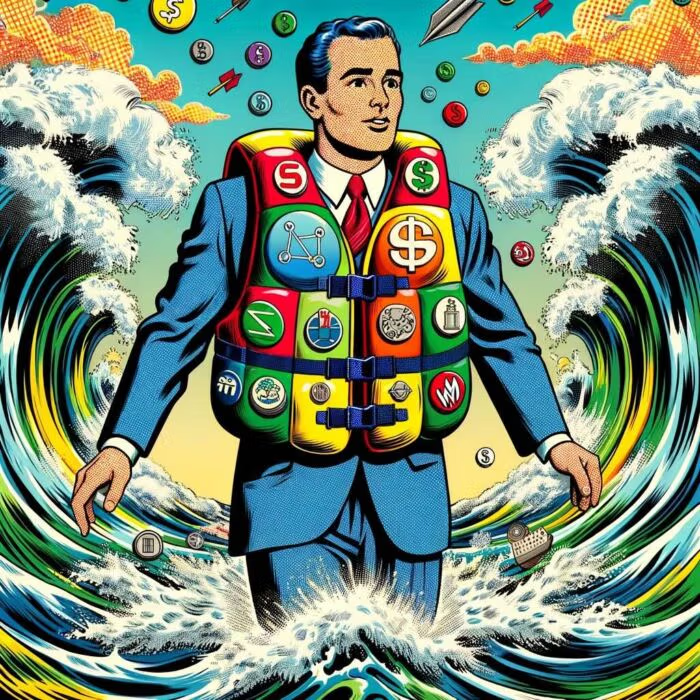

The Life Jacket of Diversification

As the old adage goes, don’t put all your eggs in one basket. In investing parlance, this timeless wisdom translates to diversification. By spreading investments across various asset classes like stocks, bonds, commodities, and real estate, diversification acts as a life jacket in turbulent financial waters. It’s an approach that mitigates risk by reducing the impact of any single asset’s performance on the overall portfolio. In essence, diversification helps ensure that a downfall in one investment can be cushioned by the performance of others.

Asset Allocation: The Compass of Investment

If diversification is the life jacket, then asset allocation is the compass, guiding investors through the investment journey. It involves deciding the proportion of your portfolio to dedicate to different asset classes, based on factors such as risk tolerance, investment horizon, and financial goals. Importantly, it’s not a ‘set-and-forget’ strategy. Asset allocation needs periodic tweaking, rebalancing the portfolio to keep it in line with your original plan, or to adjust to changing life circumstances. In weathering market changes, a well-thought-out asset allocation strategy can act as your North Star, keeping your investment journey on track amid the tempestuous seas of financial markets.

source: Marko – WhiteBoard Finance on YouTube

Elements of an All-Weather Portfolio

Imagine assembling a team where each member brings a unique skill, enabling the team to excel in varied scenarios. That’s exactly what diversification across different asset classes achieves in an All-Weather Portfolio.

The Versatile Cast of Asset Classes

- Stocks: The Growth Engines – Representing ownership in a company, stocks offer high growth potential. They tend to do well in prosperous times but can be vulnerable during downturns.

- Bonds: The Stability Providers – Essentially loans made to corporations or governments, bonds are less volatile than stocks and provide regular income, serving as shock absorbers during market downturns.

- Commodities: The Inflation Fighters – Whether it’s gold, silver, oil, or wheat, commodities can act as a hedge against inflation and add another layer of diversification.

- Real Estate: The Tangible Assets – Real estate investments, whether direct or through Real Estate Investment Trusts (REITs), can provide a steady income stream and potential appreciation, while also serving as a hedge against inflation.

- Cash or Cash Equivalents: The Safe Havens – While not expected to generate high returns, holding a portion in cash or equivalents (like short-term government securities) provides stability and liquidity.

The Tango of Correlation

Much like in a dance, in an All-Weather Portfolio, it’s not just about the individual performers but how they move together. This synchrony is measured by ‘correlation’ – a statistical concept that shows how two assets move in relation to each other. Assets with high positive correlation move in tandem, while those with negative correlation move in opposite directions. The magic of an All-Weather Portfolio lies in blending assets with low or negative correlation. This mix ensures that even if one asset class stumbles, others may dance on, keeping the overall portfolio performance balanced. It’s this intricate choreography of correlation that transforms a simple investment mix into a resilient All-Weather Portfolio.

source: Rob Berger on YouTube

The All-Weather Portfolio According to Ray Dalio

Navigating through the high seas of the investment world, Ray Dalio has earned his stripes as one of the most respected figures in finance.

Ray Dalio: The Captain of Bridgewater

As the founder of Bridgewater Associates, one of the world’s largest hedge funds, Dalio has a reputation for making bold and successful market predictions. His investment philosophy is built on radical transparency and the belief in understanding how the economic machine works. Much like a seasoned sea captain who studies the currents and weather patterns, Dalio’s approach revolves around recognizing and riding the waves of economic cycles.

The Dalio Blueprint: Unveiling the All-Weather Portfolio Strategy

Dalio’s All-Weather Portfolio strategy is a masterstroke in balancing risk and reward. It’s a carefully calibrated blend of asset classes designed to weather any economic season. The portfolio’s composition seeks to strike a balance, typically consisting of 40% long-term bonds, 30% stocks, 15% intermediate-term bonds, 7.5% gold, and 7.5% commodities. It aims to perform well across all economic environments – be it a period of growth, inflation, deflation, or recession. This strategic blend aims to smoothen the ride through tumultuous financial weather, ensuring the portfolio stays the course towards its investment goals.

Drawing from Dalio: Personalizing the All-Weather Approach

Dalio’s strategy offers valuable lessons for individual investors. Its core principle – creating a diversified portfolio designed to endure various economic climates – is universally applicable. However, it’s essential to adapt it to personal circumstances. Risk tolerance, financial goals, investment horizon, and personal beliefs about different asset classes are factors that would influence this adaptation. In essence, Dalio’s approach to investing is less about replicating his specific portfolio and more about understanding and applying his principles of risk balance, diversification, and being prepared for every economic season.

source: Optimized Portfolio on YouTube

The Permanent Portfolio Concept by Harry Browne

An acclaimed author and investment advisor, Harry Browne brought a fresh perspective to the world of investing.

Harry Browne: The Navigator of the Financial Seas

Much like a skilled mariner charting unknown waters, Browne crafted strategies that valued safety and simplicity. His investment philosophy pivoted around the idea of a ‘Permanent Portfolio’ – a concept that echoes through the corridors of modern investing, influencing many contemporary strategies, including Dalio’s All-Weather Portfolio.

The Permanent Portfolio: Browne’s Timeless Beacon

At the heart of Browne’s investment philosophy lies the ‘Permanent Portfolio’ concept – a simple yet profound approach to building a resilient investment portfolio. Browne’s idea was to divide investments equally across four asset categories – stocks for growth, bonds for income, gold for inflation protection, and cash for deflation protection. This evenly balanced asset allocation aimed to perform reasonably well across all economic conditions, turning the portfolio into a versatile financial vessel, ready to sail through calm and stormy economic seas alike.

Modernizing Browne: Adapting the Permanent Portfolio

Harry Browne’s strategy offers a sound blueprint for a well-rounded investment portfolio, but its beauty lies in its flexibility. Modern investors can adapt Browne’s strategy to fit the evolving investment landscape. For instance, the ‘cash’ quadrant can now include an array of cash equivalents like Treasury bills or money market funds. The ‘stocks’ component can span across diverse geographies and sectors, and the ‘bonds’ section can incorporate a mix of corporate and government bonds. By maintaining the core philosophy of diversification and economic preparedness, while tweaking specific elements to match individual circumstances and modern opportunities, Browne’s strategy can serve as a timeless compass for navigating the waves of the financial world.

source: Learn to Invest – Investors Grow on YouTube

Building Your All-Weather Portfolio

Setting the Course: Investment Goals and Risk Tolerance

Building your All-Weather Portfolio starts with defining your destination. This means outlining clear investment goals. Are you saving for retirement, a down payment on a house, your child’s education, or something else? Each goal will have its own time horizon and required return. Next, assess your risk tolerance. Like a seasoned mariner who knows how choppy seas they can endure, understanding how much financial fluctuation you can stomach will shape your investment journey.

The Art of Diversification: A Symphony of Asset Classes

Mastering diversification is akin to conducting a symphony, where each instrument plays a role in creating a harmonious melody. Similarly, every asset class plays its part in the overall performance of your portfolio. In the investing symphony, stocks, bonds, commodities, real estate, and cash equivalents are your instruments. A well-diversified portfolio includes a mix of these asset classes, each one humming a different tune that complements the others.

Striking the Balance: The Dance Between Growth and Risk

Creating an All-Weather Portfolio involves a delicate dance between growth and risk. While stocks offer growth, they come with higher volatility. Bonds, on the other hand, provide stability but lower returns. Commodities and real estate can offer a hedge against inflation, while cash offers a safety cushion. The goal is to blend these asset classes in a way that aligns with your risk tolerance and investment goals, ensuring you’re poised for growth without taking on more risk than you can handle.

Charting the Allocation: A Blueprint for an All-Weather Portfolio

Let’s bring this to life with an example. For a balanced All-Weather Portfolio, consider allocating 30% to stocks for growth potential, 40% to bonds for stability, 10% to commodities for inflation protection, 10% to real estate for diversification and income, and 10% to cash or cash equivalents for liquidity and safety. Remember, these percentages aren’t set in stone; they should be adjusted based on your personal circumstances and market conditions. The key lies in creating a portfolio capable of cruising through calm and stormy financial weather alike.

All-Weather Portfolio: Potential Challenges and Risks

All-Weather, Not All-Profit: Managing Expectations

Embarking on your investment voyage with an All-Weather Portfolio is a prudent strategy, but it’s essential to remember it’s not a magic ship promising smooth sailing always. Like any other investment strategy, it doesn’t guarantee profits or provide a shield against all losses. Instead, it’s designed to weather various economic seasons and mitigate volatility, creating a balanced performance across different market conditions. The goal isn’t necessarily to outperform the market at all times but to provide a smoother and more predictable investment journey.

The Diversification Dilemma: Avoiding Over-Diversification

In the pursuit of an All-Weather Portfolio, it’s easy to fall into the trap of over-diversification. This happens when you add more and more asset classes or investments, thinking it will reduce risk further. But this isn’t always true. It’s like adding too many ingredients to a recipe – instead of enhancing the flavor, it can make the dish bland and unappealing. Over-diversification can dilute potential returns and make the portfolio unwieldy to manage. The aim should be thoughtful diversification – creating a blend that balances risks and rewards without becoming overly complex.

The Adaptive Voyage: Adjusting to Changing Winds

An All-Weather Portfolio isn’t a ‘set-and-forget’ strategy. Just as a sailor adjusts the sails to changing winds, you need to adapt your portfolio to evolving market conditions and personal circumstances. The economic climate isn’t static; inflation rates, interest rates, and market trends shift over time, and your portfolio needs to reflect these changes. Similarly, as you move closer to your investment goals, you might need to adjust your asset allocation to reduce risk. Regular portfolio reviews and rebalancing are essential to ensure your All-Weather Portfolio remains seaworthy, regardless of how the economic seas churn.

source: Corey on Investing on YouTube

12-Question FAQ: Building an All-Weather Portfolio

1) What is an All-Weather Portfolio?

A diversified mix of assets designed to hold up across economic regimes (growth, recession, inflation, deflation) by balancing return drivers so no single environment dominates results.

2) Why build one?

To reduce big drawdowns, smooth returns, and avoid making all-or-nothing bets on any single asset class or forecast.

3) What are the core building blocks?

Equities (growth), high-quality bonds (stability/deflation), commodities and gold (inflation hedge), real estate/REITs (income + inflation linkage), and cash/T-Bills (liquidity and dry powder).

4) How does correlation improve resilience?

Combining assets with low or negative correlations means when one zigs (e.g., bonds in recessions), another may zag (e.g., stocks in expansions), dampening portfolio volatility.

5) What’s Ray Dalio’s classic All-Weather mix?

A reference allocation often cited: ~30% stocks, ~40% bonds split across durations (e.g., 15% intermediate, 25% long), ~7.5% gold, ~7.5% broad commodities, with modest cash. The spirit is risk balance, not exact percentages.

6) How does Harry Browne’s Permanent Portfolio differ?

It’s simpler and equal-weighted: 25% stocks, 25% long-term bonds, 25% gold, 25% cash/T-Bills—aiming for “good enough” in most climates with minimal tinkering.

7) What’s a practical blueprint I can adapt?

Example starting point: 30% global stocks, 40% bonds (mix of intermediate and some long duration), 10% commodities, 10% REITs, 10% cash/T-Bills. Adjust to your risk tolerance, time horizon, and rebalancing comfort.

8) How often should I rebalance?

Common cadences: semiannual or annual, or use tolerance bands (e.g., rebalance when an asset drifts 20–25% relative to its target weight). Keep it rules-based to avoid emotional timing.

9) What are the main risks?

It won’t “win” every year, can lag in roaring equity bull markets, and commodity/gold slices can be volatile. Over-diversification or ignoring fees/taxes can also erode results.

10) How can I implement with low-cost funds?

Use broad ETFs/mutual funds: total-market equity (US + international), intermediate and long-term Treasuries/investment-grade bonds, broad commodity index (excess-return + collateral in T-Bills), a gold fund, a REIT fund, and T-Bill/cash vehicles.

11) How do I tailor for age and goals?

Lengthen or shorten bond duration, dial equity up/down, and size inflation hedges (commodities/gold/REITs) based on your spending sensitivity to inflation and time to goal. Near goals, add more T-Bills/short bonds.

12) What’s the maintenance checklist?

Set targets aligned to objectives

Automate contributions

Rebalance on schedule/bands

Review fees/taxes/asset availability

Reassess risk tolerance and life changes annually

Conclusion: Components Of An All-Weather Portfolio

The All-Weather Portfolio: Your Financial Compass

As we dock at the conclusion of this insightful journey, let’s recall the pivotal role an All-Weather Portfolio can play in our financial voyage. It’s a strategic mix of diverse asset classes – stocks, bonds, commodities, real estate, and cash equivalents – designed to navigate through various economic climates. Like a seasoned mariner who knows when to adjust the sails or seek shelter in a storm, the All-Weather Portfolio aims to keep your investments steady across different market conditions, balancing growth potential with risk management.

Charting Your Course: The Importance of Guidance and Research

Constructing an All-Weather Portfolio isn’t a mere act of assembly. It’s a thoughtful process requiring a clear understanding of your financial goals, risk tolerance, and the investment climate. While this guide provides an outline, remember, every investor’s journey is unique. Therefore, it’s wise to consult with a financial advisor or dive deep into research before charting your investment course. Be it navigating market trends or understanding asset correlations, your knowledge and resources will be your lighthouses in the vast financial seas.

The Long Voyage: An All-Weather Portfolio and Wealth Building

Finally, it’s important to remember that an All-Weather Portfolio is more than just a short-term strategy; it’s a compass for your long-term wealth building journey. The goal isn’t just to weather financial storms but to keep advancing towards your financial goals, steadily and surely, regardless of the market climate. An All-Weather Portfolio isn’t about finding the fastest current but choosing a path that, while it may sometimes seem slower, will reliably get you to your destination. As you embark on your investment voyage, may your All-Weather Portfolio guide you towards prosperous shores.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.