In the world of investment, where every financial decision is a calculated bet on the future, astute investors know there’s one thing that’s never a gamble: the value of disciplined, careful, and comprehensive portfolio monitoring. It is a corner-stone upon which all prosperous investment edifices are built, and a force that steadies the sails when the financial seas get rough. Portfolio monitoring is, in essence, the continuous upkeep of your investments, the vigilant eye you keep on the pulse of your portfolio’s health and growth.

Portfolio monitoring is as integral to successful investing as the compass is to the sea-faring captain. It provides not just the direction, but also the pace, the depth, and the resilience of your financial journey. The tools of the trade are your investments, but the fuel that propels them forward is astute monitoring. Without a firm hand on the pulse of your portfolio, your investment strategy could be as effective as sailing without a compass.

The Labyrinth Of Portfolio Monitoring

In this comprehensive guide, we will venture into the labyrinth of portfolio monitoring. We will start from the essentials: understanding why we need to monitor our portfolio and how to get started. We will then delve into the different tools at your disposal, from the traditional to the high-tech, that can help you keep a constant watch over your investments.

Then, we will shed light on the different strategies that seasoned investors employ for monitoring. These strategies will not only keep your portfolio in check but will also provide you with insights to make the most out of your investments.

We will finally conclude with some practical tips on staying on top of your investments and how to use the knowledge gained from monitoring to guide your future financial decisions. This guide is meant for those who appreciate the beauty of a well-tended financial garden and are ready to put in the time and effort to ensure its bloom.

So buckle up, as we embark on this journey, and discover the secrets of mastering the art of portfolio monitoring. Along the way, you’ll learn to keep a keen eye on your investments, predict storms before they hit, and sail your way to the safe harbor of financial prosperity. Like any master artist, you will have your own style, your own method of interpretation, and your own touch. This is not just about making money – it’s about crafting a financial narrative that is uniquely and irrefutably yours.

The Purpose of Portfolio Monitoring

In the grand scheme of financial prosperity, portfolio monitoring serves as the North Star, guiding and realigning your investment journey to align with your financial goals. A well-monitored portfolio isn’t just an array of stocks, bonds, and other assets; it’s a dynamic roadmap that reflects your financial aspirations and navigates you towards them.

Just as a craftsman meticulously shapes each piece of his creation, a successful investor uses portfolio monitoring to align each investment with their financial objectives. It could be building a nest egg for retirement, financing your child’s college education, or simply growing your wealth. Portfolio monitoring helps you track the progress of your investments towards these goals. It is your compass in the financial wilderness, ensuring that each decision you make takes you one step closer to your intended destination.

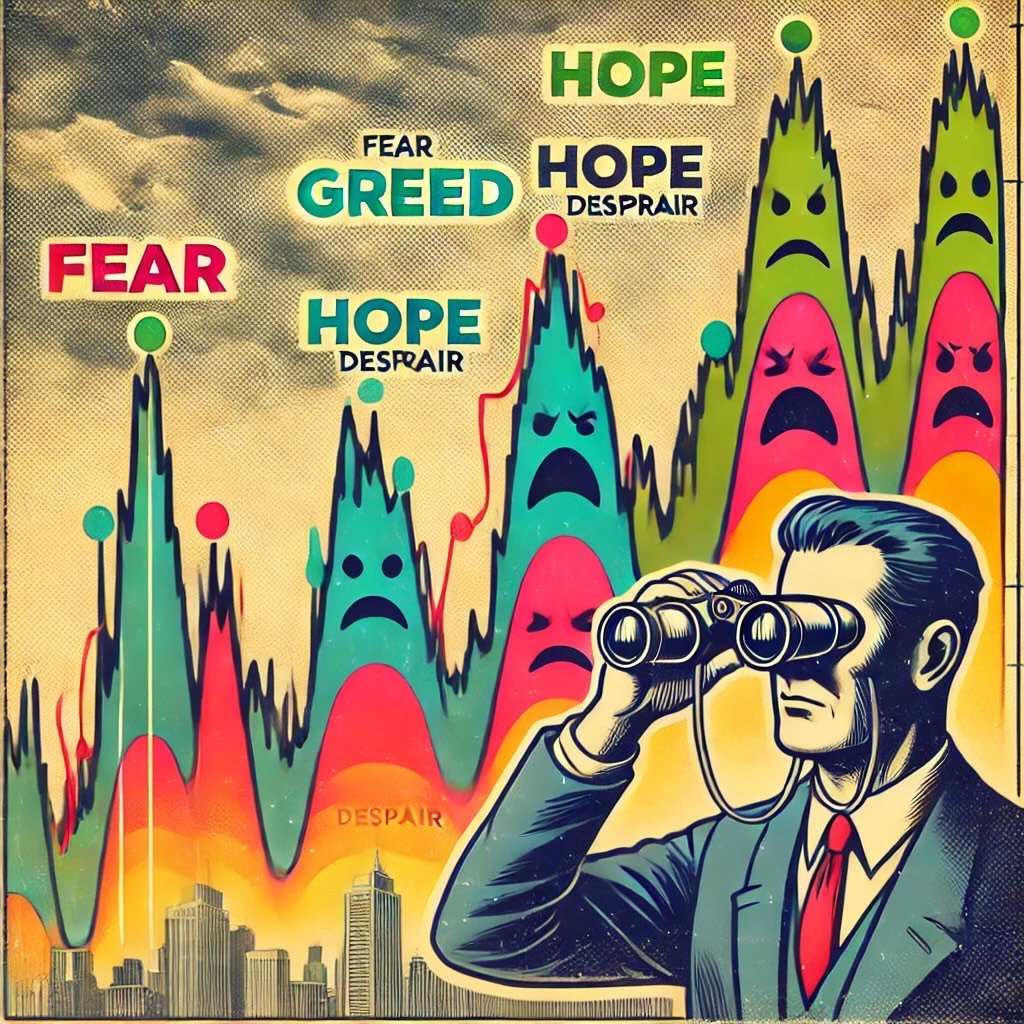

But even the most carefully crafted plan is subject to the whims of financial markets, and that’s where the role of monitoring in risk management comes into play. Just as a ship captain constantly checks the weather to avoid storms, a prudent investor uses portfolio monitoring as a radar to spot financial threats lurking in the market depths.

Monitoring your portfolio allows you to identify and assess risks, such as a sudden drop in a stock’s value or a bond defaulting. A detailed evaluation of your portfolio can shed light on how diversified your investments are and where vulnerabilities might lie. By identifying these risks ahead of time, you have the opportunity to mitigate them, adjust your sails, and steer your investment ship away from potential harm.

Portfolio Monitoring Is A Treasure Map

But it’s not just about risk management; portfolio monitoring is also a treasure map that can lead you to golden opportunities. The financial world is in a state of constant flux, with new prospects emerging and old ones receding. Your investment strategy, too, needs to be dynamic to tap into these opportunities.

Constant monitoring of your portfolio can help you identify trends and patterns, revealing investment opportunities you may have otherwise overlooked. It might lead you to realize that one asset class is underperforming while another is booming, prompting you to rebalance your portfolio to maximize returns. Or it could highlight an emerging market that is ripe for investment, providing you with the chance to ride the wave of growth.

Moreover, portfolio monitoring serves as your trusty co-pilot, helping you make course corrections as needed. The journey to financial success is rarely a straight path. There are often twists, turns, and detours. Regularly monitoring your portfolio allows you to reassess your financial goals and realign your investment strategy accordingly. You might need to change your asset allocation, invest more to meet your goals, or even revise your goals based on new life circumstances.

As we journey further into this exploration, remember this: portfolio monitoring isn’t a passive, administrative task. It’s an ongoing conversation with your investments, a dynamic dance that requires you to listen, respond, and sometimes lead. It’s through this interaction that you can carve out a successful financial story, sailing smoothly over the waves of prosperity.

source: Rob Berger on YouTube

Key Components of Portfolio Monitoring

Portfolio monitoring is a symphony of several components, each playing a significant role in maintaining the balance and health of your investments. Like a well-rehearsed orchestra, these components—performance measurement and benchmarking, asset allocation, diversification, and risk assessment—come together to create a harmonious financial opus.

The overture of portfolio monitoring starts with performance measurement and benchmarking. These are the metronomes that keep your investments in tempo. They enable you to gauge whether your investments are performing as expected, dancing to the rhythm you’ve set. Performance measurement involves tracking the returns on your investments, both individually and collectively. It’s akin to a financial performance review, assessing whether each asset is pulling its weight.

But evaluating performance in a vacuum is like trying to dance without music. It lacks context, rhythm, and purpose. That’s where benchmarking comes in. A benchmark, such as the S&P 500 or the FTSE 100, provides a comparative baseline to measure your portfolio’s performance against. It’s the symphony’s conductor, leading the tempo and setting the pace. If your portfolio consistently underperforms compared to the benchmark, it might be time for a tune-up.

Next on the score sheet comes the monitoring of asset allocation and diversification. If performance measurement is the rhythm, asset allocation is the melody of your financial symphony. It involves deciding what proportion of your portfolio to invest in different asset classes—stocks, bonds, real estate, etc.—based on your financial goals and risk tolerance. Regular monitoring ensures that this melody remains harmonious and in tune with your objectives.

Diversification Is The Finishing Touches Of Your Composition

Diversification is the counterpoint to your financial melody, the arrangement that gives depth and texture to your composition. It involves spreading your investments across various assets, sectors, and geographical locations to mitigate risk. If one asset stumbles, the others can keep the symphony going. Regularly monitoring your diversification strategy ensures that your portfolio isn’t overly exposed to a single instrument that could hit a sour note.

Finally, the crescendo of the portfolio monitoring symphony is risk assessment. Like the virtuoso who brings everything together, risk assessment is what ensures your financial performance is not a one-hit wonder, but a timeless masterpiece. It involves identifying, analyzing, and evaluating the potential hazards that could undermine your portfolio’s performance.

Risk can be market-related, tied to specific investments, or linked to broader economic or political developments. Regular risk assessments allow you to spot these potential pitfalls and adjust your strategy accordingly, helping you stay in harmony with your financial goals.

Together, these key components of portfolio monitoring create a harmonious whole, each bringing its unique note to the financial composition. With them, your portfolio is more than just a collection of investments—it’s a symphony of financial growth and prosperity, each component playing its part in creating your unique financial opus.

source: Hamish Hodder on YouTube

Tools and Techniques for Portfolio Monitoring

Just as an artist has their palette of colors, an investor has a variety of tools and techniques at their disposal to master the art of portfolio monitoring. The canvas of financial prosperity can be painted with different shades of digital platforms, robo-advisors, financial advisors, and various analytical techniques.

In the digital age, the paintbrush for portfolio monitoring often takes the form of digital platforms. These are software applications or online services that allow you to keep an eye on your portfolio from anywhere, at any time. They provide real-time updates on your investments, offering insights into performance, risks, and opportunities at the touch of a button. The convenience and accessibility these platforms offer make them the go-to tool for many modern investors. They are your palette of colors, providing a broad overview of your investments and their performance.

But perhaps you’re seeking more than just a palette—you want a guide, a mentor, or even a collaborator in your financial painting. Robo-advisors and financial advisors serve this purpose. Robo-advisors, powered by complex algorithms and artificial intelligence, offer automated investment advice tailored to your financial goals and risk tolerance. They’re like having a tireless, dedicated artist working behind the scenes, mixing the perfect colors and suggesting the right strokes.

Financial advisors, on the other hand, bring a human touch to the art of portfolio monitoring. They provide personalized advice based on their expertise and understanding of your financial situation and goals. With their wealth of experience, they can help you navigate complex investment scenarios and make well-informed decisions. They are the seasoned artists guiding your hand as you create your financial masterpiece.

The Right Techniques For Portfolio Monitoring

But what good is a paintbrush without the right technique? The artistry of portfolio monitoring lies as much in the tools as it does in the techniques you use to interpret the information they provide. These techniques include technical analysis, fundamental analysis, and quantitative analysis.

Technical analysis is like studying the brushstrokes of past masters to understand their techniques. It involves looking at past market trends and price movements to predict future performance. Fundamental analysis, on the other hand, is akin to understanding the inspiration behind a piece of art. It involves evaluating the intrinsic value of an investment based on factors like earnings, assets, and the economic environment.

Finally, quantitative analysis is the science behind the art. It involves using mathematical models and statistical techniques to analyze financial data and predict future trends. These three techniques used together provide a comprehensive understanding of your portfolio’s performance and potential.

To use these tools and techniques effectively, consider your financial goals, risk tolerance, and personal comfort with technology. Choose a mix that aligns with your investment strategy and offers a blend of convenience, insight, and control. Use the analytical techniques to interpret the data these tools provide and inform your investment decisions.

Remember, the canvas of your financial prosperity is vast and diverse, ready to be painted with the colors of your choice. Your tools and techniques are your paintbrush and palette, helping you create your unique masterpiece in the art of portfolio monitoring. With them, you’ll not only monitor your portfolio effectively but also discover new opportunities, mitigate risks, and steer your investments towards your financial goals.

source: Prana Wealth on YouTube

Regular Portfolio Reviews and Rebalancing

Just as a maestro periodically fine-tunes each instrument in an orchestra to ensure a flawless performance, a savvy investor undertakes regular portfolio reviews and rebalancing to ensure their investments are on the path to prosperity. This regular review and rebalancing act as the meticulous tuner, refining your portfolio’s performance and keeping it in perfect harmony with your financial goals.

Regular portfolio reviews are the meticulous soundchecks before the grand concert that is your financial future. They give you an opportunity to take a step back and assess the performance of each investment, checking whether it’s playing in tune with your financial goals. These reviews can reveal if an asset is underperforming or if an opportunity is being overlooked, giving you the insight you need to make informed financial decisions. It’s like having an all-access backstage pass, letting you see behind the curtain and understand how your investments are working together to create your unique financial symphony.

Portfolio rebalancing, on the other hand, is the act of fine-tuning each instrument in your financial orchestra. It’s a process that involves adjusting the proportions of different assets in your portfolio to maintain the desired level of risk and return. Over time, some investments may perform better than others, causing your portfolio to drift from its original asset allocation. Rebalancing helps you realign your portfolio with your financial goals and risk tolerance, ensuring your investments remain harmonious and balanced.

Consider a symphony that starts with a beautiful melody played by the violins but gradually becomes dominated by the percussion. While the percussion might provide a powerful beat, the melody gets lost in the noise.

Rebalancing Restores Your Portfolio

In the same way, a portfolio that becomes dominated by one type of investment can expose you to unnecessary risk. Rebalancing helps restore the original melody, ensuring each instrument—each investment—plays its part in creating your financial symphony.

So, when and how should you fine-tune your financial orchestra? While there’s no one-size-fits-all answer, a common guideline is to review your portfolio at least once a year or when there’s a significant change in your financial situation or goals. You might also consider rebalancing if the actual allocation of your assets drifts significantly from your target allocation—say, by 5% or more.

The act of rebalancing can involve selling overperforming assets and buying underperforming ones to restore your portfolio’s balance. While this might seem counterintuitive—after all, why sell a winning horse?—remember that rebalancing is about risk management and long-term performance, not short-term gains. It’s about maintaining the harmony of your financial symphony, ensuring each investment plays its part in achieving your financial goals.

With regular reviews and rebalancing, you’ll not only keep your portfolio in tune but also ensure it continues to reflect your financial goals and risk tolerance. It’s the final touch in mastering the art of portfolio monitoring, the grand finale that brings your financial symphony to a successful close.

source: The Dream Green Show on YouTube

Case Studies: Effective Portfolio Monitoring in Action

Just as a music lover can gain inspiration from listening to a well-orchestrated symphony, investors can learn valuable lessons from studying successful portfolio management cases. Let’s strike up the band and delve into a couple of real-world concertos, examining the strategies employed and the harmonious financial music that resulted.

First, let’s look at the magnum opus of none other than the Oracle of Omaha, Warren Buffett. Buffett’s investment company, Berkshire Hathaway, serves as an inspiring example of effective portfolio monitoring. Their portfolio boasts an eclectic mix of companies from various industries, from technology behemoth Apple to confectionery and beverage giant Coca-Cola.

The key to Buffett’s success lies in his meticulous monitoring, detailed analysis, and patient investment approach. Instead of chasing quick wins, he focuses on long-term value. Buffett and his team regularly review their investments, examining the fundamentals of the companies they invest in, including their financial health, competitive position, and management quality.

They are not swayed by short-term market fluctuations but look for companies with sustainable competitive advantages—a strategy that has proved incredibly profitable over the long run. This masterpiece teaches us that effective portfolio monitoring isn’t just about keeping an eye on your investments, but understanding the businesses behind them.

Understand The Businesses Behind Them

Our second maestro is Ray Dalio, the founder of Bridgewater Associates, one of the world’s largest hedge funds. Dalio’s approach to portfolio monitoring and management is a symphony of risk mitigation and diversification, called the ‘All Weather’ strategy.

Dalio’s masterpiece centers on creating a balanced portfolio that can weather any market condition. To achieve this harmony, he uses advanced quantitative models to monitor risk and rebalance the portfolio regularly. The All Weather strategy seeks to maintain a stable mix of investments that can perform well across different economic environments, whether inflation is rising or falling, or the economy is growing or contracting.

This strategy, underpinned by regular monitoring and rebalancing, has delivered consistent returns for Bridgewater, even during economic downturns. Dalio’s opus teaches us that effective portfolio monitoring involves managing risk and ensuring your investments remain balanced, regardless of market conditions.

In both these maestros’ concertos, we see how regular reviews, diligent analysis, and strategic rebalancing—hallmarks of effective portfolio monitoring—play pivotal roles. From Buffett’s focus on understanding the fundamentals to Dalio’s commitment to risk management and balance, they show us that the art of portfolio monitoring involves much more than just tracking investment performance.

Instead, it’s about maintaining a symphony of diverse investments, each playing its part to create a harmonious whole. It’s about tuning out the market noise to focus on the long-term performance. And it’s about regularly fine-tuning your portfolio to ensure it remains in harmony with your financial goals, regardless of the economic weather. So, pick up your conductor’s baton, and let the music of effective portfolio monitoring guide your investments towards financial prosperity.

source: Your Money, Your Wealth on YouTube

Conclusion: Significance of portfolio monitoring in investment success

As our symphony draws to a close, we look back on the music we’ve made together and appreciate the artistry of portfolio monitoring. Its significance cannot be overstated—it is as crucial to your investment success as the conductor is to the orchestra. The conductor doesn’t merely start the music; they guide it, shape it, and perfect it from beginning to end. Similarly, portfolio monitoring is not a one-and-done task but a continuous, active process that guides your investments towards their full potential.

In the grand concert hall of investing, portfolio monitoring serves as the eyes, ears, and hands of the maestro. It gives you the vision to see where your investments stand, the ability to listen to the market’s rhythm, and the control to conduct your financial orchestra. Regular portfolio reviews, strategic rebalancing, performance measurement, and risk assessment are the notes that create the harmonious melody of your financial success.

But just as a symphony is not a single note repeated, portfolio monitoring is not a static endeavor. It’s a dynamic process that evolves with your financial goals, the market environment, and the changing rhythms of the global economy. It’s a symphony that never truly ends but continuously builds on its past movements, growing richer and more nuanced over time.

Portfolio Monitoring Is Not A Static Endeavour

In this musical journey, the most powerful instrument you possess is your commitment to staying engaged with your portfolio and embracing continuous learning. Just as the best musicians never stop honing their craft, the most successful investors never cease to learn, adapt, and improve. They listen to the music of the market, learn its patterns and rhythms, and adjust their strategies accordingly.

As you step into the role of conductor of your financial orchestra, remember that the art of portfolio monitoring is as much about understanding the music as it is about making it. It’s about hearing the harmony and dissonance, recognizing the solos and symphonies, and knowing when to play forte or pianissimo. It’s about being so in tune with your investments that you can hear when they’re hitting the right notes—and when they need a bit of fine-tuning.

With this knowledge, the baton is in your hands. Take your place at the podium and guide your financial symphony towards a crescendo of success. Remember, the music of investing doesn’t just play itself—you must be the maestro who brings it all together. So, tune your instruments, raise your baton, and let the art of portfolio monitoring guide you towards your unique symphony of financial prosperity.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Staying on top of portfolio performance is essential for making informed investment decisions. Regularly monitoring metrics like returns, risk, and asset allocation helps ensure your portfolio aligns with your financial goals.