Warren Buffett—often called the “Oracle of Omaha”—stands as one of the most prominent and successful investors in modern history. His net worth has soared into the tens of billions of dollars, and he continues to be regarded as a go-to authority for common-sense wisdom in both business and life. But beyond the numbers, part of Buffett’s enduring appeal lies in his ability to break down complex financial concepts into compelling, relatable stories. His folksy anecdotes are rooted in everyday life, featuring baseball metaphors, punch cards, snowballs, and even family businesses. These stories possess a staying power: they stick in people’s minds and guide how individuals and organizations approach strategy, investment, and leadership.

In a world where information moves at lightning speed and markets can fluctuate based on a single tweet, Buffett’s timeless lessons offer a grounding force. His anecdotes provide moral and ethical frameworks for business decision-making; they are not merely about maximizing profits, but also about retaining integrity, nurturing valuable relationships, and thinking long-term. Every year, Buffett’s annual letters to Berkshire Hathaway shareholders are dissected line-by-line by professional money managers, business professors, and students alike, searching for insights into his mindset.

Indeed, for nearly six decades, Buffett has outperformed the markets. Thus, turning Berkshire Hathaway from a struggling textile firm into a global conglomerate. This transformation is the result of his disciplined approach to capital allocation, his legendary knack for spotting undervalued companies, and the pragmatic lens through which he views the world. His portfolio ranges from insurance powerhouses like GEICO to consumer favorites like Coca-Cola, all acquired with a steady focus on intrinsic value.

This blog post focuses on some of Warren Buffett’s most popular and illuminating anecdotes. It doesn’t merely recount the tales. It delves deeply into the lessons underpinning each one and looks at how they might be applied in different contexts—whether you’re a budding entrepreneur, a seasoned executive, or someone simply trying to manage their personal finances wisely. After all, Buffett has repeatedly emphasized that you don’t need a PhD in economics or a high IQ to succeed in investing; you need emotional discipline, common sense, and a willingness to learn from the best.

![]()

We’ll journey through five carefully chosen anecdotes that capture the essence of Buffett’s philosophy:

- The “Punch Card” Approach to Investing.

- The Snowball Effect of Compounding.

- The “Waiting for the Fat Pitch” Baseball Analogy.

- The Story of “Mrs. B” and Nebraska Furniture Mart.

- The “20-Slot Rule” on Personal Relationships.

Anecdote #1: The “Punch Card” Approach to Investing

Background of the Punch Card Analogy

One of the most iconic Buffett anecdotes revolves around the idea of having a “punch card” for your life’s investment decisions. He often describes a scenario in which, at the beginning of your investing career, you receive a card with exactly 20 punches. Each time you make a significant investment, you punch a hole in the card. Once you’ve used up all 20 punches, you cannot invest in anything else for the rest of your life. This story, while metaphorical, reflects Buffett’s belief that selectivity in investment decisions is paramount.

This anecdote stems from the broader Buffett philosophy that you don’t need to invest in every flashy opportunity that comes along. Instead, success can come from focusing your energy—and capital—on a few exceptional chances that offer real long-term value. Rather than diversifying blindly or trading incessantly, Buffett suggests that limiting the quantity of your major decisions can dramatically improve their quality. The cardinal sin for many investors is the inability to resist impulse buying and quick selling when markets experience euphoria or fear.

Punch Card Story Details

In practical terms, imagine physically holding a card with 20 holes. Each time you purchase a stock or decide to invest a substantial chunk of money into a venture, you punch one hole. This means you have to be incredibly thorough in your due diligence. You can’t just go on a hunch or be swayed by market hype. If you only had 20 opportunities, you would make sure each one of those decisions stands on rock-solid analysis. When the stakes are that high, you spend more time evaluating financial statements, studying the management team, and understanding the market environment. You keep your emotions in check, because once you use a punch, there’s no turning back.

The “punch card” metaphor also dovetails with Buffett’s disdain for overtrading. He argues that every additional trade introduces the potential for errors and transaction costs. Plus, it can feed emotionally driven decisions. If you’re jumping in and out of positions, you may be chasing short-term gains without fully appreciating the underlying value of the businesses you’re investing in. Buffett’s track record suggests that buying quality companies and holding them for decades often outperforms rapid-fire trades seeking to exploit micro-trends.

Key Lessons from the Punch Card

- Quality Over Quantity:

Buffett’s punch card story tells us to search for top-tier investments that have sustainable competitive advantages, often referred to as “moats.” If you only have a handful of bets to make, each one must meet a high standard for quality, durability of earnings, and growth potential. - Patience and Discipline:

The essence of the punch card analogy is patience. It encourages you to wait for the truly great opportunities rather than settling for mediocrity. Many investors find it difficult to remain on the sidelines, but Buffett’s story underscores the advantage of waiting until the odds are squarely in your favor. - Avoid Overtrading:

Too many investors engage in frequent buying and selling, incurring transaction costs and potentially making emotionally charged decisions. The 20-punch limit acts as a psychological guardrail, ensuring you treat each investment as a big decision that needs thorough vetting. - Long-Term Focus:

Because you can’t afford to make frivolous moves, you’re more likely to choose companies and assets with strong, long-term growth prospects. This naturally aligns with Buffett’s preference for “buy and hold” strategies that minimize the tax burdens and transaction costs of frequent trading.

Business Application of the Punch Card Analogy

While the punch card anecdote is most often applied to investing, it also has major implications for general business strategy. For instance, consider corporate executives who face numerous opportunities to expand product lines, enter new markets, or engage in mergers and acquisitions (M&A). Adopting a punch card mindset means approaching each major decision with caution and depth of thought:

- Strategic Initiatives: If you were only allowed a few big strategic moves during your tenure as CEO, which would you prioritize? How would you ensure they align with your company’s core strengths and long-term vision?

- Hiring Top Talent: When it comes to building your leadership team, applying the punch card rule can mean taking the time to hire exceptionally well, as each key hire drastically shapes the organization’s future. Rather than filling roles hastily, you ensure the person is an ideal cultural and skill fit.

- Resource Allocation: Companies often have limited resources—time, capital, and human talent. Selecting where to deploy these resources can define success or failure. Adopting a punch card perspective would drive home the seriousness of each resource allocation decision.

Anecdote #2: The Snowball Effect of Compounding

The Snowball Background

Another signature story that Warren Buffett tells, and which has even inspired the title of a biography about him (The Snowball: Warren Buffett and the Business of Life by Alice Schroeder), is the concept of a snowball rolling downhill. In a region like Omaha, Nebraska, where Buffett grew up, snow is a familiar part of the winter season. If you start at the top of a hill with a small snowball and roll it down, it gains more snow. As it grows larger, it can gather more snow more quickly, creating a self-reinforcing cycle. In financial terms, this is akin to the phenomenon of compounding.

Buffett has repeatedly underscored that time is the single most powerful ally of an investor. When you allow gains to build upon previous gains, the growth can become exponential rather than linear. This is why Buffett advocates that one should start investing as early as possible. Even small amounts, given enough time, can turn into considerable wealth. The entire principle stands or falls on the ability to let interest, dividends, and reinvested earnings accumulate without interruption.

Story Details and Insights

In simpler terms, the snowball effect arises when earnings are reinvested, leading to higher subsequent earnings, which in turn can be reinvested again. For instance, if you invest $1,000 in a stock that returns 10% annually, you earn $100 in the first year. If you reinvest that $100, in the second year you earn interest on $1,100. Over many years, these incremental gains stack up, producing a curve of returns that looks less like a straight line and more like a steeply rising slope. Buffett has famously said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” It is a simple concept with extraordinary power.

Another dimension to this anecdote is the mental image: starting small is not a disadvantage. Many first-time investors feel discouraged because they think they don’t have enough capital to make a difference. Buffett’s snowball story demolishes that misconception. So long as you consistently invest—month after month, year after year—and remain patient, your figurative snowball can become enormous over the decades.

Key Lessons from the Snowball Effect

- Start Early, Stay Invested:

The power of compounding is amplified by time. The earlier you start, the more your returns can build upon themselves. Therefore, delaying investment, even by a few years, can have a dramatic impact on the final outcome. - Consistency Matters:

Building a large snowball requires consistent effort. In financial terms, that means regularly contributing to your investment accounts, whether during bull markets or bear markets. Consistency smooths out volatility and leverages the full advantage of dollar-cost averaging. - Reinvest Earnings:

Rather than taking your dividends or interest payments as cash, plow them back into the market. This reinvestment is what supercharges growth, allowing you to earn returns on your returns. - Avoid Interruptions:

Compounding works best when it’s uninterrupted. Panic-selling during market downturns or liquidating accounts to fund impulsive purchases can effectively stop the snowball in its tracks. Patience and discipline are vital to maintaining this momentum.

Business Applications of the Snowball Metaphor

Beyond personal investing, the snowball analogy resonates in the broader business context. Profit reinvestment is a powerful strategy for growth. For example, a company can use its free cash flow to upgrade equipment, fund research and development, or expand its footprint. Over time, these investments produce incremental returns, which can be reinvested again, fueling a cycle of exponential growth.

- Scaling Through Reinforced Success: If your core product is successful and generates cash, investing that cash into marketing or new product development can help capture bigger market share, which then generates even more revenue to reinvest.

- Brand Building: A strong brand tends to create a virtuous cycle—customer loyalty leads to repeat sales, which builds the brand further, which in turn attracts even more customers. This can be seen as a “snowball” effect in the realm of branding and reputation.

- Corporate Culture: A company culture of learning, sharing knowledge, and continuous improvement can create a compounding effect in terms of employee skills and organizational efficiency. Each incremental improvement sets a new baseline for the organization, making it easier to tackle bigger challenges over time.

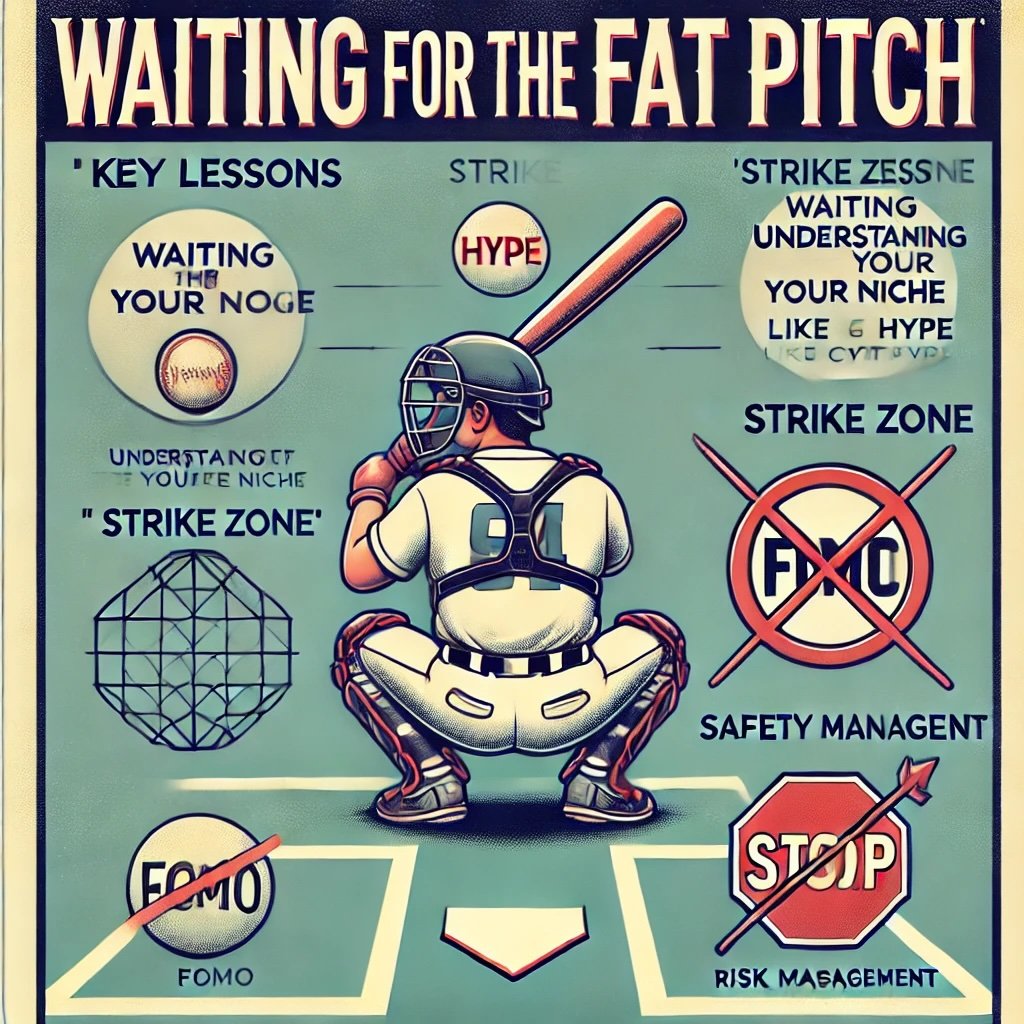

Anecdote #3: “Waiting for the Fat Pitch” (Baseball Analogy)

Background and Context

Buffett is known for using baseball metaphors to illustrate key investment principles. In particular, he draws parallels between investing and batting in baseball, emphasizing the strategic advantage of “waiting for the fat pitch.” In baseball, a batter stands at home plate, and the pitcher throws the ball across the strike zone. If the pitch doesn’t look good, the batter can let it go by, possibly incurring a strike. Eventually, if three strikes pass, the batter is out. But in the metaphorical game of investing, Buffett points out that you can stand at the plate indefinitely. You’re not obligated to swing at any pitch until you see one that is clearly in your “sweet spot.”

Story Details

Buffett’s analogy speaks to the notion that in investing, unlike baseball, you’re not penalized for inactivity (aside from potential opportunity costs). If an investor chooses to sit on cash while waiting for a truly outstanding opportunity, that’s perfectly acceptable. You won’t accumulate “strikes” simply because you haven’t bought anything. And because you’re not forced to swing, you can wait until you see a pitch—a stock, bond, or business acquisition—that is evidently attractive.

This goes against the grain of the hyperactive approach in financial markets, where traders buy and sell multiple times a day. Buffett suggests that you’d be more successful by dedicating time to analyzing opportunities thoroughly and only acting when something stands out as an obvious winner. This approach requires incredible patience and a willingness to look foolish to those who believe you’re “missing out” on the action.

Key Lessons from “Waiting for the Fat Pitch”

- Patience is a Virtue:

The hallmark of Buffett’s success is a willingness to pass on investments that do not meet stringent criteria. He’s comfortable with underperforming cash for extended periods if he believes no good opportunities are available. - Play in Your Zone:

Buffett advises investing in areas you understand—your personal “strike zone.” Whether you’re focusing on consumer goods, technology, or real estate, deep knowledge in a narrower domain often outweighs a cursory understanding of a broad set of industries. - Avoid FOMO (Fear of Missing Out):

Markets can generate excitement, with new IPOs or cryptocurrency mania tempting people to swing for the fences. Buffett’s baseball analogy advises staying disciplined, not bowing to peer pressure or media hype. - Risk Management:

Waiting for the fat pitch also implies a risk management strategy. By only swinging at pitches you’re highly confident you can hit, you reduce the likelihood of making a bad investment. This is Buffett’s way of emphasizing capital preservation.

Business Application of the Baseball Analogy

“Waiting for the fat pitch” has broader applications than just the stock market. In business strategy, timing and selectivity can differentiate great leadership teams from mediocre ones:

- Mergers and Acquisitions: Companies often feel compelled to grow quickly through acquisitions. Buffett’s approach implies a more careful process, doing fewer deals but of higher quality.

- New Product Launches: If your R&D team has multiple ideas, prioritize those that align strongly with your brand’s capabilities and your market’s needs. Don’t rush to release products solely to keep pace with competitors.

- Strategic Partnerships: Collaborating with other companies can be beneficial, but it’s crucial to ensure alignment of values, objectives, and competencies before jumping in.

Anecdote #4: The Story of “Mrs. B” and Nebraska Furniture Mart

Background of Mrs. B

Among Buffett’s all-time favorite anecdotes is the story of Rose Blumkin, affectionately known as “Mrs. B.” She was an immigrant from Russia who founded Nebraska Furniture Mart (NFM) in 1937. Having arrived in the U.S. with virtually no money and limited formal education, Mrs. B epitomized the American Dream through her relentless work ethic, emphasis on value, and unstoppable determination to satisfy customers.

Buffett’s admiration for Mrs. B runs deep. He once famously said that Mrs. B told him she’d “rather wrestle grizzlies in Montana” than attend an MBA class. While that was a humorous exaggeration, it captured the no-nonsense approach that made her so successful. She built a furniture empire out of a pawn shop in Omaha by offering quality merchandise at rock-bottom prices, undercutting competitors and quickly gaining market share.

Key Elements of the Mrs. B Story

1. Customer-Centric Focus

Mrs. B believed that if you treat the customer right, the business will take care of itself. This meant offering products at prices so low that customers felt like they were getting an incredible deal. Word-of-mouth became Nebraska Furniture Mart’s most powerful marketing tool.

2. The Legendary Deal

Buffett was so impressed by her operation that in 1983, he acquired a majority stake in Nebraska Furniture Mart for Berkshire Hathaway. The deal was famously sealed with a handshake, reflecting the mutual trust and respect between Buffett and Mrs. B. At the time of the acquisition, her store was already doing tens of millions of dollars in annual revenue—testament to how a singular focus on value can build a formidable business, even in a competitive retail environment.

3. Work Ethic and Integrity

Mrs. B worked well into her 90s. Her presence on the sales floor was emblematic of her hands-on leadership style. She was fiercely protective of her store’s reputation and was known to send back truckloads of merchandise if she thought it wasn’t priced fairly enough for the consumer.

Lessons from Mrs. B and Nebraska Furniture Mart

- Simplicity and Transparency:

Selling quality goods at rock-bottom prices seems almost too simple a strategy, but it worked wonders. In a market cluttered with marketing spin, Mrs. B’s straightforward approach stood out. - Customer Trust as a Competitive Edge:

Satisfied customers not only return, they also become brand ambassadors. Mrs. B turned this dynamic into a sustainable advantage by ensuring that no competitor could underprice her business. - Long-Term Orientation:

Mrs. B was not about quick wins. She built her customer base gradually, sacrificing short-term profit margins for higher sales volume and long-term loyalty. This principle aligns with Buffett’s philosophy of delayed gratification and compounding. - Hard Work and Integrity:

Buffett is famously drawn to leaders who display high character, and Mrs. B demonstrated this in spades. Trustworthiness, authenticity, and an unyielding commitment to her mission made her a magnetic figure in the Omaha business community.

Business Applications

While it may seem like Mrs. B’s story is unique to retail, the lessons are broadly applicable:

- In Pricing Strategy: Aggressive, value-driven pricing can create a moat around your business by making it extremely difficult for competitors to beat your value proposition. Think of companies like Costco or Southwest Airlines, which have similarly grown massive loyal followings with transparent, consumer-friendly models.

- In Company Culture: A founder or leader’s personal work ethic and dedication set the tone for the entire organization. Mrs. B’s hands-on approach and unwavering focus on fairness likely influenced employees to uphold similar standards.

- In Entrepreneurship: Starting a business with limited resources is daunting, but Mrs. B’s story shows that dogged perseverance, coupled with a clear value proposition, can overcome significant hurdles. When an entrepreneur zeroes in on providing unmatched value, the market can respond in surprising and bountiful ways.

Anecdote #5: “20-Slot Rule” on Personal Relationships

The Personal Adaptation of the Punch Card Concept

Buffett occasionally talks about applying a “punch card” or “20-slot” rule in a more personal context—this time, to relationships rather than investments. The idea is that relationships in life, much like investments, can benefit from quality over quantity. Rather than trying to maintain superficial connections with hundreds of acquaintances, one should invest deeply in a smaller circle of close friends, family, mentors, and business associates.

Story Details

This is not an anecdote in the sense of a single narrative but rather an extension of Buffett’s worldview. He often references the value of reputational capital and the importance of associating with people who are “better than you,” in the sense that they can inspire you to grow. In business settings, this means choosing partners and team members carefully, ensuring that their ethics, vision, and capabilities align with your own. In personal life, it means dedicating time to those whose presence genuinely enriches your life.

Buffett’s perspective also resonates with the notion that your reputation is partly determined by the company you keep. If you align yourself with high-quality individuals, you’re likely to embody or adopt their positive traits. Conversely, associating with unscrupulous or negative influences can harm your reputation and lead to poor decision-making. The 20-slot idea is that you have only so many “slots” in your life for deeply influential relationships. Use them wisely.

Key Lessons from the “20-Slot Rule”

- Prioritize Depth Over Breadth:

Having thousands of superficial connections—especially in the era of social media—doesn’t necessarily translate to meaningful support, growth, or fulfillment. Deeper relationships require time, emotional investment, and mutual respect. - Align with Values:

Buffett emphasizes integrity as the single most important trait for trust in relationships. Before you allow someone into your inner circle, consider whether their values and goals align with your own. - Quality of Exchange:

Nurturing relationships is not just about personal gain. Buffett’s relationships with business partners like Charlie Munger showcase how mutual value creation—intellectual, financial, ethical—can occur when two or more individuals genuinely respect each other’s contributions. - Long-Term Commitment:

True friendship or partnership is a long-term commitment, much like a long-term investment. Strengthening such bonds requires consistent maintenance—time, honesty, and shared experiences.

Business and Life Applications

- Networking: Instead of trying to collect business cards, focus on building a handful of strong professional relationships. These deeper connections are far more likely to result in fruitful collaborations, references, and lasting trust.

- Team Building: When you assemble your core team within a startup or established company, consider the intangible value of trust, alignment, and cultural fit. Selecting the right people to fill those “20 slots” can be a game-changer for long-term success.

- Mentorship: Mentors can shape your growth significantly. By being selective and nurturing these relationships, you can accelerate your learning curve and avoid costly mistakes.

- Personal Life: Family and close friends often form the backbone of emotional well-being. Buffett’s approach suggests that the emotional ROI from investing in those closest to you is immeasurable.

Underlying Themes and Takeaways

1. Long-Term Orientation

All of Buffett’s anecdotes consistently reinforce the idea of thinking in decades rather than weeks or months. Whether it’s the punch card, the snowball, or waiting for the fat pitch, each underscores the power of patience and the rewards of eschewing short-termism. In business, a long-term mindset encourages robust planning, consistent reinvestment in core competencies, and the fostering of customer loyalty. In personal finance, it strengthens the discipline needed to let compound interest operate without interruption.

2. Discipline and Patience

Discipline is woven into nearly every story Buffett tells. The punch card anecdote demands you be selective; the fat pitch metaphor recommends you refrain from swinging until the odds are clearly in your favor. This discipline, combined with patience, has been a cornerstone of Buffett’s success. Most people are hardwired to seek immediate gratification, making it psychologically challenging to wait for the perfect investment or the right business opportunity. Buffett’s anecdotes guide listeners and readers to recognize the virtue in biding your time.

3. Integrity and Ethics

The story of Mrs. B is a shining example of how integrity and honesty can form the basis of a flourishing enterprise. Buffett has repeatedly stated that he looks for three qualities in a person: intelligence, energy, and integrity—and if they don’t have integrity, the other two will kill you. In every one of Buffett’s anecdotes, good character and ethical behavior are placed on a pedestal. This principle has served him well, attracting business partners and leaders who share similar values and are thus more likely to drive sustainable success.

4. Simplicity

Despite being one of the most famous investors on Earth, Buffett’s stories often center on easily understandable concepts like rolling snowballs, punch cards, or baseball pitches. This reflects his broader approach to investing: he avoids overly complex business models and invests only in industries and companies he understands. Simplicity reduces room for error, clarifies decision-making, and can be communicated effectively to stakeholders.

5. Relationship Capital

Finally, the “20-slot rule” underscores the importance of relationships in Buffett’s worldview. Whether these relationships are business partnerships, personal friendships, or mentorships, the care and selectivity with which Buffett approaches them speaks to how vital he believes they are for a fulfilling and successful life. Trust, loyalty, and mutual respect are intangible assets that can compound in value just like financial investments.

Warren Buffett’s Favorite Anecdotes in Business — 12-Question FAQ

What is the essence of Buffett’s “punch card” analogy?

It’s a thought experiment: imagine you only get 20 lifetime investment punches. You’d study harder, be more selective, and avoid impulse trades. The lesson is quality over quantity—few, deeply-researched decisions in your circle of competence, held for the long run.

How does the “snowball” metaphor translate to real-world compounding?

Start small, keep rolling. Reinvest dividends/earnings, avoid interruptions, and let time magnify results. Compounding is exponential only if you stay invested, resist churn, and keep adding “snow” through regular contributions.

What does “waiting for the fat pitch” actually look like in practice?

Patience over activity. You’re not penalized for passing on mediocre pitches. Keep cash or do nothing until valuation, business quality, and timing align. Swing big only when odds are clearly in your favor.

Why is the Mrs. B (Nebraska Furniture Mart) story so central to Buffett’s playbook?

It showcases relentless customer value, integrity, and price discipline. Buffett bought NFM on a handshake because Mrs. B built an unbeatable moat—rock-bottom prices, trust, and execution—proving simple models win when done superbly.

How does Buffett apply the “20-slot rule” to relationships?

Treat relationships like scarce slots. Prioritize integrity, reciprocity, and long-term fit. A small circle of high-character partners, mentors, and teammates compounds opportunity and protects reputation.

What common thread ties these anecdotes together?

A triad: simplicity, discipline, and time. Simple businesses you understand, disciplined selection and behavior, and time for compounding—financial and relational—to work its quiet magic.

How do these stories shape capital allocation?

They create filters: only allocate to durable moats at fair prices (punch card), let winners run (snowball), and avoid diworsification (fat pitch). Capital follows conviction, not quotas.

What’s the behavioral edge these anecdotes cultivate?

Emotional restraint. They counter FOMO, activity bias, and narrative chasing. By pre-committing to selectivity and patience, you sidestep costly, adrenaline-driven mistakes.

How can entrepreneurs use the punch card idea beyond investing?

Limit “big bets” to a few needle-movers: flagship products, critical hires, or category-defining partnerships. With scarce punches, strategy sharpens, due diligence deepens, and execution quality rises.

What operational lessons come from Mrs. B’s story?

Moats can be built on cost, culture, and customer obsession. Price transparently, police quality, empower front-line judgment, and let trust be your cheapest—and strongest—marketing.

How do these anecdotes inform risk management?

Don’t swing at marginal pitches; insist on margin of safety. Keep liquidity to exploit dislocations. Concentrate in what you truly understand; diversify only to the point of sleeping well.

What’s the best “first step” to live these principles tomorrow?

Write your filters: business must-haves, valuation guardrails, and red flags. Pre-decide when you’ll act (fat pitch), how you’ll hold (snowball), and what you’ll skip (protect your punches and slots).

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

The terrible illustrations for this article, which I can only assume are AI generated, really detract from it’s credibility. I mean, it’s Warren Buffet, so we’ve got his reputation, but somehow the AI illustrations make it seem cheap and superficial.