Value investing represents a disciplined, time-tested investment strategy that encompasses the acquisition of securities that appear underpriced from a fundamental perspective. This school of investing, pioneered by luminaries such as Benjamin Graham and Warren Buffett, underscores the crucial role of methodical analysis, margin of safety, and long-term approach, underpinning the conviction that the market often provides opportunities for discerning investors to purchase assets at a price considerably lower than their intrinsic worth.

Value investing, at its core, dwells on the presumption that market participants occasionally overreact to both favorable and unfavorable news, thus leading to significant mispricings. Value investors, cognizant of this market inefficiency, leverage these opportunities by acquiring securities that are trading for less than their intrinsic or book value. Essentially, value investors look past the vicissitudes of market sentiment, focusing instead on a company’s fundamental business operations and financial health.

Importance of Tools in Value Investing

In the vast and intricate world of value investing, the importance of using reliable analytical tools and frameworks cannot be overstated. These tools serve as the bedrock of informed decision-making, guiding investors in identifying undervalued assets, assessing the financial health of companies, and gauging the risk-return potential of their investment portfolios.

Employing the right tools can be the difference between a meticulously calculated investment and an unfounded speculation. These instruments offer valuable insights into a company’s balance sheet, income statement, and cash flow statement, facilitating a comprehensive understanding of the company’s performance metrics, solvency, liquidity, and profitability. Hence, they bolster the investor’s ability to discern solid, profitable businesses that are momentarily underappreciated by the market, paving the way for the discovery of hidden gems that can yield significant returns over the long term.

Introduction to the Piotroski F-Score

Emerging from the pantheon of such analytical tools is the Piotroski F-Score, named after its originator, Stanford accounting professor Joseph Piotroski. This score constitutes a crucial part of a value investor’s analytical repertoire, offering a straightforward yet effective mechanism for assessing the financial strength of a company.

The Piotroski F-Score gauges the health of a firm’s financial condition using nine specific criteria that are based on profitability, leverage, liquidity, source of funds, and operating efficiency. It transcends the conventional binary landscape of beat-or-miss earnings analysis, moving towards a more nuanced and comprehensive analysis of a firm’s financials. As such, it holds immense utility in augmenting the value investor’s decision-making process, providing a robust and reliable foundation upon which prudent, informed, and value-accretive investment decisions can be made.

This discussion marks the start of our journey towards understanding the inner workings of the Piotroski F-Score, shedding light on its conception, calculation, and application in the realm of value investing.

The Origin of the Piotroski F-Score

Brief biography of Joseph Piotroski

Hailing from a realm that seamlessly intertwines the practicalities of business with the rigor of academia, Joseph Piotroski stands as a distinguished figure who has made a substantial contribution to the arena of accounting and finance. Currently a professor of accounting at Stanford University’s Graduate School of Business, Piotroski boasts an illustrious career that transcends the conventional boundaries of scholarship.

Having earned his PhD from the University of Michigan, Piotroski has ardently dedicated his academic career to the study of financial reporting and disclosure practices, corporate restructuring, and international corporate governance. His scholastic endeavors, characterized by a unique blend of academic rigor and empirical acumen, have been instrumental in advancing the understanding of these intricate fields.

Explanation of Piotroski’s research and philosophy

Piotroski’s research philosophy is firmly grounded in the belief that a detailed analysis of a company’s financial statements can reveal a wealth of information that is often overlooked by the market, thereby paving the way for savvy investors to capitalize on these market inefficiencies. This philosophy is an extension of the fundamental premise of value investing – that markets aren’t always efficient, and that mispriced securities can be unearthed through rigorous and meticulous research.

In his exploration of financial accounting and its interplay with investing, Piotroski developed a distinctive approach towards the analysis of financial statements, delving deeper than most investors to uncover the true financial health of a company. His approach encapsulates a holistic view of a firm’s financial condition, factoring in elements of profitability, financial leverage, and operating efficiency.

“Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers”

One of Piotroski’s most notable contributions to the realm of investing is his seminal research paper titled “Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers”. Published in 2000, this groundbreaking work sheds light on the potential of financial statement analysis as a tool to distinguish between successful and unsuccessful investments within the domain of value stocks.

In this highly influential paper, Piotroski introduced his now widely recognized F-Score, a comprehensive scoring system that evaluates the financial health of a company. By developing a straightforward, yet powerful, nine-point scoring system, Piotroski provided investors with a new lens through which to assess the robustness of a firm’s financial condition.

This academic opus drew upon a vast reservoir of historical data, meticulously analyzing the performance of value stocks and the associated F-Score to substantiate its efficacy. The empirical evidence presented in the paper underscored the system’s effectiveness, illustrating that value firms with high F-Scores consistently outperformed their counterparts with low scores, thus substantiating the score’s utility as an essential tool in the value investor’s arsenal.

source: Financial Wisdom on YouTube

Understanding the Piotroski F-Score

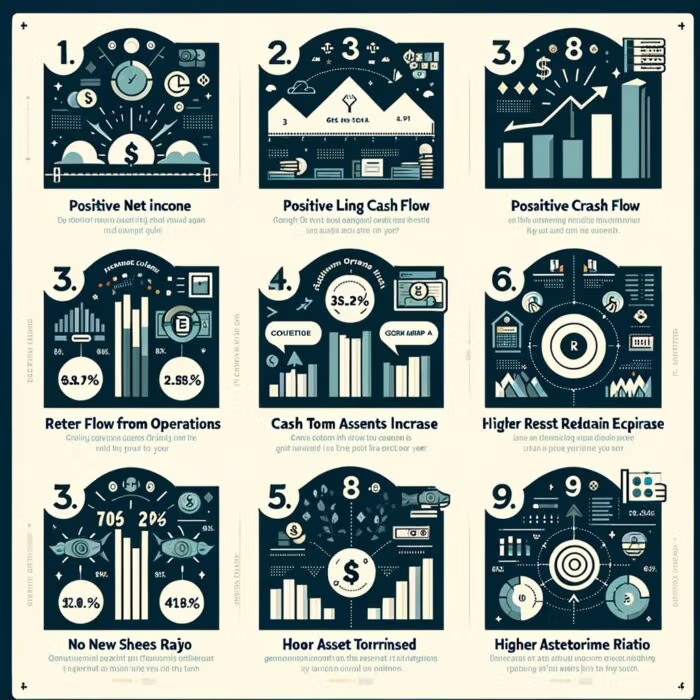

Explanation of the F-Score’s 9 financial signals

At the heart of the Piotroski F-Score lies a meticulous evaluation of a company’s financial signals, distributed across three key dimensions: profitability, leverage and liquidity, and operating efficiency.

Profitability signals:

The profitability dimension of the F-Score is illuminated through the lens of four specific signals: return on assets (ROA), cash flow return on assets (CFROA), change in return on assets (ΔROA), and accruals. These indicators collectively provide a panoramic view of a company’s profitability.

ROA signifies the net income generated per dollar of assets and reflects the company’s efficiency in using its assets to generate profits. CFROA, on the other hand, represents the cash earnings as a percentage of the firm’s total assets, offering a less malleable measure of a firm’s profit-generating prowess. The ΔROA measures the changes in ROA, thereby revealing the trend in profitability, while accruals assess the quality of earnings by measuring the difference between net income and net cash flow from operations.

Leverage, Liquidity, and Source of Funds signals:

The second cluster of signals scrutinizes the financial structure and liquidity of the firm, namely, the change in leverage (ΔLeverage), change in liquidity (ΔLiquidity), and equity issuance. ΔLeverage evaluates the variation in a company’s long-term debt ratio, thereby serving as an indicator of financial risk. ΔLiquidity examines changes in the current ratio, highlighting shifts in the firm’s short-term liquidity risk. The equity issuance signal discerns whether the firm has issued equity in the past year, which can signal financial distress.

Operating Efficiency signals:

The final triumvirate in the F-Score framework relates to the operating efficiency of the firm. The change in gross margin (ΔMargin) and change in asset turnover (ΔTurnover) signals are examined. An improvement in gross margin can be indicative of pricing power or cost controls, while an increase in asset turnover signifies greater efficiency in the usage of assets to generate sales.

How to calculate each signal:

The Piotroski F-Score is computed by assigning a score of one for each criterion that a company meets, culminating in an aggregate score ranging from 0 to 9. For profitability indicators, a score of one is given if the ROA and CFROA are positive, the ROA has increased from the prior year, and cash flow from operations is greater than net income. For leverage, liquidity, and source of funds indicators, a score of one is assigned if the company’s long-term debt ratio and the current ratio have decreased, and the company has not recently issued equity. Lastly, for operating efficiency indicators, a score of one is provided if gross margin and asset turnover have increased from the previous year.

How to interpret the total score:

Interpreting the F-Score requires an understanding of its numeric spectrum, which spans from zero to nine. A higher score signifies better financial health and lower insolvency risk, making the company a potentially attractive investment opportunity for value investors. Conversely, a lower score reflects poor financial health and higher risk, indicating that the firm may not be an optimal choice for value-oriented investment.

Typically, an F-Score of 7-9 is considered strong, suggesting that the company is fundamentally sound and potentially undervalued. A score of 4-6 represents average financial health, while a score of 0-3 suggests that the company is financially weak and may be overvalued. However, it is important to remember that the F-Score is just one tool in an investor’s toolbox and should be used in conjunction with other forms of analysis for the most comprehensive and accurate assessment.

source: Excess Returns on YouTube

The Significance of the Piotroski F-Score for Value Investors

How the F-Score helps identify strong value stocks

The fundamental raison d’être of the Piotroski F-Score within the ambit of value investing resides in its capacity to unearth value stocks that are not merely inexpensive, but also fundamentally robust. It goes beyond surface-level financial indicators, delving deep into a company’s financial health by scrutinizing nine key financial signals. This comprehensive analysis brings forth a nuanced understanding of a company’s financial position, thereby assisting value investors in distinguishing undervalued firms of high quality from so-called ‘value traps’.

The F-Score takes into account multiple aspects of a firm’s financial health – profitability, leverage and liquidity, and operational efficiency, which collectively provide a holistic view of the company’s strength. By systematically assessing these diverse facets and condensing them into a single numeric score, the F-Score aids investors in making informed decisions, based not on speculation, but on solid, quantifiable financial evidence.

A high F-Score can often be indicative of a financially robust company that may be underappreciated by the market, hence creating potential for significant capital appreciation once the market corrects its erroneous undervaluation. Consequently, the F-Score serves as a pragmatic tool in a value investor’s toolkit, instrumental in the identification of high-quality value stocks.

Role of the F-Score in mitigating risks

Risk management is an essential aspect of investing, and the Piotroski F-Score can play a pivotal role in mitigating risks associated with value investing. By providing an in-depth evaluation of a company’s financial health, the F-Score offers investors insights into potential red flags and risks that may not be immediately evident from a cursory glance at the company’s financial statements.

A low F-Score, for instance, can signal potential trouble, serving as a warning of deteriorating financial conditions, growing leverage, declining profitability, or operational inefficiencies. Such a score may deter investors from buying into a company that might seem attractive based on traditional valuation metrics, but is, in reality, a ‘value trap’. Thus, the F-Score provides a safety net against potentially unsound investments, playing a pivotal role in risk mitigation.

Comparison with other value investing tools and strategies

While the Piotroski F-Score has proved itself a powerful tool in the value investor’s arsenal, it does not exist in a vacuum. There exist numerous other strategies and tools in the realm of value investing, such as the Graham Number, Price/Book ratio, or Price/Earnings ratio, among others.

While these conventional methods primarily focus on valuation, the F-Score sets itself apart by delving into a company’s underlying financial health, encompassing factors like profitability, leverage, liquidity, and operational efficiency. Therefore, it supplements these traditional valuation metrics by providing a broader perspective on a company’s financial position.

However, the F-Score is not a panacea and should not be viewed as a replacement for other value investing tools and strategies. Instead, it should be seen as a complement to them. In essence, the most effective investment approach is one that harmonizes the insights of the F-Score with those of other valuation and financial health metrics, thus ensuring a comprehensive, well-rounded evaluation of potential investments. This synergistic approach embodies the ethos of value investing: rigorous, thorough, and informed decision-making aimed at identifying undervalued, high-quality stocks.

source: Elearnmarkets by StockEdge on YouTube

Practical Application of the Piotroski F-Score

Step-by-step guide to implementing the F-Score in investment decisions

The application of the Piotroski F-Score to real-world investing necessitates a methodical approach that melds the principles of value investing with the systematic framework of the F-Score.

The first step entails the identification of a potential investment, typically a company appearing undervalued based on traditional valuation metrics like Price/Earnings or Price/Book ratios.

The second step involves delving into the company’s financial statements to compute the nine elements of the F-Score. For each condition met, the company is awarded one point, culminating in a final score between zero and nine.

In the third step, this score is interpreted in the context of its numeric spectrum. A score of 7-9 often suggests a strong financial position and potentially undervalued investment opportunity, a score of 4-6 indicates an average financial health, and a score of 0-3 raises red flags about the company’s financial health.

The final step involves integrating the F-Score into a broader investment analysis framework, which could include further fundamental analysis, industry comparison, economic conditions, and personal investment goals.

Real-life examples of the F-Score at work

One prime example of the F-Score at work is its application during the aftermath of the 2008 financial crisis. Many banks were trading at apparently low valuations. However, an application of the F-Score revealed that many of these banks had scores below three, indicating poor financial health and making them risky investments. Investors employing the F-Score could thus potentially avoid these ‘value traps’.

Conversely, certain industrial companies during the same period had high F-Scores despite being undervalued by the market, suggesting strong fundamentals. Investors who identified these opportunities could have achieved significant capital appreciation as these companies recovered.

Potential pitfalls and limitations of the F-Score

Despite its utility, it is vital to recognize the limitations and potential pitfalls of the Piotroski F-Score. Primarily, the F-Score is backward-looking, relying on historical financial statement data. Thus, it may not fully capture future potential or risks that have not yet manifested in financial statements.

Additionally, the F-Score may not be as effective for growth companies, which may have high leverage or negative profitability in their early years, leading to a low F-Score. However, these companies could still represent attractive investment opportunities if their growth prospects are strong.

Lastly, the F-Score does not consider the firm’s competitive position, management quality, or industry dynamics, all of which can have significant impacts on future performance.

Therefore, while the F-Score is a valuable tool for value investors, it should not be used in isolation. Rather, it should be used in conjunction with other analysis methods to provide a comprehensive assessment of an investment opportunity. It serves as a starting point in the analysis, not the ending. It’s not a substitute for thorough research, but rather, a supplement to it.

source: VRDNation on YouTube

The Piotroski F-Score in the Modern Investment Landscape

Suitability of the F-Score in the era of digital transformation and fintech

In the midst of the digital transformation and fintech revolution, one may wonder about the relevance of traditional financial analysis tools like the Piotroski F-Score. While the investment landscape is unquestionably evolving, with new data sources and analysis tools becoming increasingly accessible, the fundamental principles underlying the F-Score retain their vitality.

The F-Score’s grounding in a company’s financial health – ascertained through profitability, leverage and liquidity, and operational efficiency signals – remains central to the assessment of any company, irrespective of the industry or the era. Thus, in a time of technological advancement and increased market complexity, the F-Score serves as a grounding mechanism, offering a systematic, evidence-based approach to identifying undervalued, financially strong companies.

Furthermore, the rise of fintech has made the implementation of the F-Score more efficient. With the advent of sophisticated investing platforms and software, investors can easily access and analyze a company’s financial data to calculate the F-Score, saving time and improving the accuracy of their analyses.

How the F-Score can be complemented with other contemporary investment tools

While the Piotroski F-Score provides an invaluable lens to examine a company’s financial health, it should not be the sole basis for investment decisions. The modern investor has a panoply of tools at their disposal, many of which can provide complementary insights.

For instance, machine learning algorithms can be used to predict future trends based on historical data. Meanwhile, sentiment analysis tools can provide insights into the market’s perception of a company, while network analysis can reveal complex relationships and influences within an industry. Furthermore, the proliferation of alternative data sources – ranging from social media chatter to satellite images – can provide unique insights that go beyond traditional financial statement analysis.

In essence, the F-Score should be seen as one element of a multifaceted investment strategy that incorporates both traditional and contemporary analysis tools. Together, these tools can provide a holistic view of a company’s prospects, enabling investors to make more informed decisions.

Thoughts on the future of the F-Score

As we look towards the future, it is likely that the Piotroski F-Score will continue to play a vital role in value investing. Its focus on fundamental financial health, combined with its systematic, evidence-based approach, ensures its relevance in any investment era.

However, the form and implementation of the F-Score may evolve with the advancement of technology. For instance, we may see the rise of automated platforms that incorporate the F-Score into their analysis algorithms, providing investors with instant evaluations of a company’s financial health.

Furthermore, the principles underlying the F-Score could also be applied to new domains, such as the analysis of ESG (Environmental, Social, and Governance) factors. By systematically assessing a company’s ESG performance, investors could gain insights into another aspect of a company’s health and potential for long-term success.

Regardless of how it evolves, the Piotroski F-Score will undoubtedly remain a foundational tool in the value investor’s toolkit, assisting them in their quest to identify high-quality, undervalued investments. Its future, like its past, will be characterized by its commitment to rigorous, evidence-based analysis, providing a touchstone of rationality in an ever-changing investment landscape.

source: Kostadin Ristovski, ACCA on YouTube

The Piotroski F-Score and its Relation to Behavioral Finance

Understanding Behavioral Finance

Behavioral finance stands at the confluence of psychology and financial theory, attempting to illuminate the seemingly irrational behaviors exhibited by investors in financial markets. It delves into the psychological factors, cognitive biases, and irrational behaviors that influence investment decisions, thereby deviating from the classical financial theory’s postulation of perfectly rational, wealth-maximizing investors.

Some of the principal constructs within this realm include loss aversion, wherein investors display a greater sensitivity to losses than equivalent gains; herding behavior, which manifests in investors’ proclivity to follow the crowd; and overconfidence, leading investors to overestimate their knowledge or predictive abilities.

Common Biases in Investment Decisions

A plethora of cognitive biases have been recognized within the field of behavioral finance, many of which can lead to suboptimal investment decisions.

For instance, the confirmation bias can cause investors to seek out information that aligns with their preexisting beliefs while discounting contradictory evidence, potentially leading to a misjudgment of a company’s value. The recency bias, on the other hand, may lead investors to give undue weight to recent events while neglecting historical trends, causing them to extrapolate short-term events into the future.

Moreover, the anchoring bias could cause investors to rely too heavily on the first piece of information they encounter (the “anchor”) when making decisions, potentially leading them to hold onto a losing investment for too long or sell a winning investment too soon.

How the F-Score Helps Counteract These Biases

The Piotroski F-Score, with its systematic and evidence-based approach, serves as an effective countermeasure against these cognitive biases.

By focusing on hard financial data, the F-Score mitigates the confirmation bias, as it does not allow room for investors to selectively interpret information. It presents an objective analysis of a company’s financial health, without being swayed by the investor’s preconceived notions or sentiments.

Against the recency bias, the F-Score’s focus on a broad set of financial signals—across profitability, liquidity, and operational efficiency—ensures that investors do not overemphasize recent events at the expense of a company’s broader financial performance.

In the face of the anchoring bias, the F-Score promotes flexibility, as the score will change as a company’s financial situation evolves. It thereby prevents investors from sticking rigidly to their initial evaluations, encouraging them to reevaluate their investments as new financial data becomes available.

Thus, the Piotroski F-Score emerges as an antidote to the cognitive biases that can skew investment decisions. By promoting a disciplined, data-driven approach, it aids investors in making rational, informed investment decisions, safeguarding them from the pitfalls of behavioral biases. In doing so, it underscores the tenets of value investing in an increasingly complex and psychological market environment.

Case Studies: Success and Failures with the Piotroski F-Score

Successful Investments Made Using the F-Score

The practical potency of the Piotroski F-Score is illuminated by numerous instances of successful investments guided by its application. One such case is that of Best Buy in the aftermath of the 2008 financial crisis.

At the time, Best Buy appeared undervalued, trading at a low Price/Earnings ratio. An analysis using the F-Score revealed a strong score of 8, indicating robust financial health despite the adverse economic environment. This high score was underpinned by strong profitability, solid cash flow from operations, and an improving gross margin. Investors who incorporated the F-Score into their analysis could have identified Best Buy as a strong value investment. Over the subsequent years, Best Buy’s stock price significantly appreciated, vindicating this value investment thesis.

Instances Where the F-Score Did Not Predict Performance Accurately

However, the Piotroski F-Score, despite its merits, is not infallible. There have been instances where it did not accurately predict a company’s future performance.

One example is that of the energy company, Enron. In the year 2000, Enron had an F-Score of 7, indicating good financial health. However, the high score was primarily due to manipulated financial statements which inflated profitability and concealed debt. Subsequently, Enron collapsed in one of the most infamous corporate fraud cases in history. This highlights the limitation of the F-Score: it is only as reliable as the financial statements on which it is based.

Lessons Learned from These Case Studies

These case studies underscore crucial lessons about the application of the Piotroski F-Score. They demonstrate the utility of the F-Score in identifying strong value investments, while also highlighting the importance of using it in conjunction with other analysis tools and approaches.

The success with Best Buy reinforces the value of the F-Score in identifying financially strong, undervalued companies. It also showcases how the F-Score can provide valuable insights during periods of economic uncertainty, helping investors distinguish between companies that are genuinely undervalued and those that are cheap for a reason.

The failure with Enron, however, underscores the importance of rigorous due diligence beyond the F-Score. It highlights the risk of fraudulent financial reporting and emphasizes the necessity for a holistic analysis that includes a thorough review of a company’s governance and the integrity of its management.

Overall, these case studies illustrate that while the Piotroski F-Score is a powerful tool for value investors, it should not be used in isolation. Rather, it should be one component in a multifaceted investment analysis framework that takes into account a wide range of financial and non-financial factors. By doing so, investors can make more informed, nuanced investment decisions and better manage their investment risks.

The Role of the Piotroski F-Score in Portfolio Diversification

The Importance of Portfolio Diversification in Risk Management

Portfolio diversification – the practice of spreading investments across a variety of assets to reduce exposure to any single investment’s risk – is a cornerstone of sound risk management. It is predicated on the principle that different assets will perform differently under various market conditions, hence, by holding a diverse portfolio, investors can buffer against individual asset volatility and potentially improve their risk-adjusted returns.

This concept is well encapsulated by the adage, “Don’t put all your eggs in one basket.” By holding a variety of investments, investors can insulate themselves against the idiosyncratic risks inherent to individual securities. This approach can help preserve capital and provide a more stable return profile over the long term.

How the F-Score Can Guide Diversification Efforts

The Piotroski F-Score can play an instrumental role in guiding portfolio diversification efforts. By providing an objective, quantitative measure of a company’s financial health, it allows investors to identify high-quality, undervalued stocks across a range of sectors and geographies.

An investor might, for instance, use the F-Score to identify the strongest companies within different industries, thereby ensuring that their portfolio is not overly concentrated in a single sector. Similarly, they might use the F-Score to find strong companies in different countries or regions, thereby achieving geographical diversification.

By incorporating the F-Score into their diversification strategy, investors can build a portfolio of undervalued, financially healthy companies across a range of sectors and geographies. This can help them reduce their portfolio’s exposure to individual company or sector risks, thereby contributing to more effective risk management.

Limitations of the F-Score in Diversification

Despite the value of the F-Score in portfolio diversification, it is important to acknowledge its limitations. The F-Score focuses solely on a company’s financial health and does not take into account other factors that might affect a company’s risk or return profile, such as its industry position, competitive dynamics, regulatory environment, or geopolitical risks.

Furthermore, while the F-Score can help identify financially strong companies, it does not provide any guidance on how to weight these companies within a portfolio. For instance, two companies might both have high F-Scores, but one might be much larger or more volatile than the other. Without considering these factors, an investor might end up with a poorly diversified portfolio, despite holding only high F-Score companies.

Hence, while the Piotroski F-Score can provide valuable insights for portfolio diversification, it should be used in conjunction with other analysis tools and approaches. A comprehensive diversification strategy should consider a range of factors, including a company’s financial health, its industry and geographical exposure, its size and volatility, and the correlation of its returns with other assets in the portfolio. By doing so, investors can construct a truly diversified portfolio that is resilient to a wide range of market conditions.

Advanced Topics: Modifying and Combining the Piotroski F-Score

Discussion on Possible Modifications to the F-Score

While the Piotroski F-Score has proven effective in its standard form, various modifications can potentially enhance its predictive power. However, these modifications should be approached with caution, understanding that they may also introduce new risks or limitations.

One possible modification is adjusting the weights assigned to the nine variables based on their relative importance. Although the traditional F-Score assigns equal weight to each factor, empirical research might suggest that some factors are more predictive of future performance than others.

Another modification could involve incorporating industry-specific factors. The standard F-Score is a one-size-fits-all measure, but certain variables might be more relevant in some industries than others. For example, in capital-intensive industries like manufacturing, asset turnover might be a particularly important indicator of performance, while in service-based industries, measures related to profitability might be more telling.

Ways to Combine the F-Score with Other Investment Indicators for a Comprehensive Analysis

The Piotroski F-Score can be effectively combined with a variety of other investment indicators to provide a more comprehensive analysis.

One popular approach is to use the F-Score in conjunction with valuation multiples like the Price/Earnings ratio or the Price/Book ratio. By identifying companies that are not only undervalued but also financially strong (as indicated by a high F-Score), investors can pinpoint promising value investment opportunities.

The F-Score can also be combined with growth indicators like revenue growth or earnings per share growth. This can help investors identify “growth at a reasonable price” (GARP) stocks – companies that offer both strong growth prospects and reasonable valuations.

Furthermore, the F-Score can be used alongside momentum indicators. Research has shown that combining value and momentum strategies can lead to superior investment returns, as the two approaches can complement each other effectively.

Understanding the Limitations and Risks of Such Modifications

While modifying and combining the Piotroski F-Score can enhance its utility, it is crucial to understand the associated limitations and risks.

Modifications to the F-Score, such as changing the weights or incorporating industry-specific factors, can increase its complexity and potentially introduce biases. Without rigorous testing, it’s hard to ascertain whether these modifications truly improve the F-Score’s effectiveness or merely introduce noise into the analysis.

Similarly, combining the F-Score with other indicators can lead to a more nuanced investment analysis, but it also requires a deeper understanding of each indicator’s strengths and weaknesses. Different indicators might send conflicting signals, and interpreting these signals can be challenging.

Therefore, any modifications or combinations should be undertaken with caution, relying on rigorous testing and a thorough understanding of the underlying principles. With careful application, however, these advanced approaches can potentially enhance the Piotroski F-Score’s utility, offering investors a more robust and comprehensive investment analysis tool.

12 Frequently Asked Questions About the Piotroski F-Score in Value Investing

What is the Piotroski F-Score?

The Piotroski F-Score is a nine-point scoring system developed by Stanford professor Joseph Piotroski to assess a company’s financial strength. It evaluates profitability, leverage and liquidity, and operational efficiency to help investors identify undervalued but financially robust value stocks.

Who created the Piotroski F-Score and why?

The F-Score was created by Joseph Piotroski, a Stanford accounting professor, in his 2000 paper “Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers.” He wanted a simple, evidence-based framework to distinguish between strong and weak value stocks, helping investors avoid value traps.

What are the nine signals used in the F-Score?

The nine signals are grouped into three categories:

Profitability: ROA, CFROA, ΔROA, Accruals.

Leverage/Liquidity/Funding: ΔLeverage, ΔLiquidity, Equity Issuance.

Operating Efficiency: ΔGross Margin, ΔAsset Turnover.

Each signal contributes one point when it meets Piotroski’s criteria, for a maximum score of nine.

How is the F-Score calculated?

A company earns 1 point for each criterion met across the nine signals. Points are then summed to create a total score between 0 and 9. High scores (7–9) indicate strong financial health, mid scores (4–6) suggest average health, and low scores (0–3) flag potential weakness or distress.

How should investors interpret different F-Scores?

7–9 → Financially strong, potentially undervalued companies.

4–6 → Average financial health; warrants closer analysis.

0–3 → Financially weak; may indicate value traps or higher risk.

This score is a starting point, not a guarantee — it should be used with other tools.

Why is the F-Score useful for value investors?

The F-Score allows value investors to separate strong value opportunities from value traps, using hard financial data. By focusing on fundamentals rather than market sentiment, investors can uncover undervalued companies that are fundamentally sound.

How does the F-Score compare to other valuation tools?

While tools like the Graham Number or P/E ratio focus mainly on valuation, the F-Score focuses on financial strength and quality. It complements these traditional metrics by adding a health check, helping investors identify which cheap stocks are actually worth owning.

What are the advantages of using the Piotroski F-Score?

Simplicity: Easy to calculate using financial statements.

Evidence-based: Backed by academic research.

Risk mitigation: Helps avoid companies with weak fundamentals.

Screening power: Useful for filtering large value stock universes efficiently.

What are the limitations of the F-Score?

Backward-looking: Based on historical financial data.

Vulnerable to accounting manipulation (e.g., Enron).

Less effective for early-stage growth firms with negative earnings.

Ignores qualitative factors like management quality or industry trends.

It should be combined with other analyses for best results.

How has the F-Score performed historically?

Piotroski’s research showed that high F-Score value stocks outperformed low F-Score value stocks by over 7.5% annually between 1976 and 1996. Real-world examples, like Best Buy after 2008, demonstrate how high F-Score companies can deliver strong returns when the market misprices their strength.

Can the F-Score be adapted or combined with other strategies?

Yes. Investors often combine the F-Score with valuation multiples, momentum indicators, or growth metrics to create hybrid strategies. For example, pairing high F-Score with low P/B can refine value screens, while combining it with momentum can enhance return profiles.

Is the Piotroski F-Score still relevant today?

Absolutely. Despite fintech and algorithmic advances, the F-Score’s fundamental focus remains timeless. Modern investors can calculate it faster with technology, integrate it into quant models, or combine it with alternative data to gain richer insights — but its core principles remain powerful.

Conclusion: Piotroski F-Score’s Importance in Value Investing

The quest for value, for finding high-quality assets at prices below their intrinsic worth, is an enduring pursuit central to successful investing. As we have explored in this discourse, the Piotroski F-Score serves as a potent tool in this endeavor, offering an analytically rigorous and systematic approach to assess the financial health of a company.

The F-Score, formulated by the erudite accounting scholar Joseph Piotroski, ingeniously amalgamates nine vital financial signals, covering profitability, capital structure and operating efficiency, into a single numerical score. Its strength lies in its ability to sift through the accounting noise and illuminate the underlying fiscal fitness of a company, making it an invaluable aid in differentiating prospective winners from probable losers.

Through real-world illustrations and a careful examination of successful and less fortunate investment decisions, we’ve shown that the F-Score, despite its simplicity, is remarkably effective in identifying undervalued, financially healthy companies. Furthermore, its utility extends beyond just stock selection, playing a significant role in portfolio diversification and risk management.

Adaptation in Individual Investing Strategies

However, while the Piotroski F-Score constitutes an essential tool in the value investor’s arsenal, it is, like any analytical tool, not without its limitations. It is a model based on historical financial data and, as such, its predictions are predicated on the assumption that past patterns will, to some extent, continue into the future. Moreover, it can be misled by accounting manipulations and may overlook factors external to a company’s financial statements, such as market conditions or management quality.

Therefore, as we conclude this intellectual journey into the heart of the Piotroski F-Score, we encourage you, the astute investor, not to view it as a magic bullet, but as one piece in a much larger analytical mosaic. It is hoped that this exploration inspires further inquiry and reflection, paving the way for you to incorporate the F-Score into your investment analysis in a manner that best aligns with your individual investment philosophy and risk tolerance.

Value investing, at its core, is both a science and an art, requiring the judicious blend of quantitative rigor and qualitative insight. In this realm, the Piotroski F-Score serves as a robust quantitative anchor, guiding investors in their search for true value. Armed with this knowledge, we encourage you to continue on your quest for value, combining the wisdom encapsulated in the F-Score with your own unique insights and intuitions.

Further Reading

Citations of Resources Used

- Piotroski, J. D. (2000). Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers. Journal of Accounting Research, 38, 1-41. This seminal work introduced the Piotroski F-Score and remains a cornerstone reference for understanding its fundamental principles.

- Fama, E. F., & French, K. R. (1992). The Cross‐Section of Expected Stock Returns. The Journal of Finance, 47(2), 427-465. This influential paper forms the backbone of modern value investing strategies and is important for understanding the context in which the Piotroski F-Score was developed.

- Graham, B., & Dodd, D. (1934). Security Analysis. McGraw-Hill. This classic text by the pioneers of value investing provides essential background knowledge and context.

- Piotroski, J. D., & So, E. C. (2012). Identifying Expectation Errors in Value/Glamour Strategies: A Fundamental Analysis Approach. Review of Financial Studies, 25(9), 2841-2875. This more recent work by Piotroski provides a deeper dive into the practical application of the F-Score.

Suggestion for Further Reading on Value Investing and the Piotroski F-Score

- Greenblatt, J. (2005). The Little Book That Beats the Market. John Wiley & Sons. This accessible read provides a practical guide to value investing that complements the more theory-oriented approach of the Piotroski F-Score.

- Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. John Wiley & Sons. An excellent resource for those interested in exploring other valuation methods in addition to the Piotroski F-Score.

- Shefrin, H. (2007). Behavioral Corporate Finance: Decisions that Create Value. McGraw-Hill. This book offers insights into behavioral finance, a field that intertwines with value investing and is relevant for understanding how the Piotroski F-Score can help counteract common biases.

- Piotroski, J. D., & Roulstone, D. T. (2004). The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm-specific information into stock prices. The Accounting Review, 79(4), 1119-1151. This paper presents an interesting extension of Piotroski’s work, examining how various market participants use information.

- Graham, B. (1949). The Intelligent Investor. Harper & Brothers. A must-read for any value investor, this book provides timeless wisdom on investment principles that remain relevant when applying the Piotroski F-Score.

Through these references and suggested readings, you can delve deeper into the captivating world of value investing and gain a more profound understanding of the Piotroski F-Score’s place within it. As you continue on your journey, may you find that the quest for knowledge, much like the pursuit of value, is a rewarding endeavor of its own.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.