Investing can often feel like navigating a maze filled with jargon, complex strategies, and ever-changing market conditions. For many, the world of finance is intimidating—a playground seemingly reserved for Wall Street titans and financial wizards. But what if there was a way to simplify investing without sacrificing returns? Enter Joel Greenblatt and his renowned Magic Formula Investing.

source: The Swedish Investor on YouTube

Who Is Joel Greenblatt?

Joel Greenblatt isn’t just another name in the investment world; he’s a trailblazer who has left an indelible mark on value investing. Born in 1957, Greenblatt graduated from the Wharton School at the University of Pennsylvania, where he honed his financial acumen. He later founded Gotham Capital in 1985, a hedge fund that delivered an astounding annualized return of 40% over two decades. Yes, you read that right—40% per year!

But Greenblatt’s contributions extend beyond impressive returns. He’s a professor at Columbia University’s Graduate School of Business, where he shares his wealth of knowledge with aspiring investors. He’s also a best-selling author, with books like “You Can Be a Stock Market Genius” and “The Little Book That Beats the Market” demystifying complex investment strategies for the everyday person.

The Birth of Magic Formula Investing

In 2005, Greenblatt introduced the world to Magic Formula Investing through his book “The Little Book That Beats the Market.” The premise was simple yet revolutionary: a systematic, disciplined approach that enables individual investors to outperform market averages by focusing on undervalued, high-quality companies. The Magic Formula distills the essence of value investing into a straightforward strategy that even those new to investing can grasp.

Why Is It Significant?

Magic Formula Investing is significant because it democratizes investing. It breaks down barriers by eliminating the need for extensive financial analysis or reliance on speculative tips. Instead, it empowers investors to make informed decisions based on fundamental business metrics. The formula’s simplicity doesn’t undermine its effectiveness; in fact, its straightforward nature is one of its greatest strengths.

Moreover, the Magic Formula has stood the test of time. Various backtests and studies have shown that it can generate returns that outperform market indices over the long term. It’s not just a theoretical model confined to textbooks; it’s a practical tool that has been validated in real-world markets.

Joel Greenblatt and Magic Formula Investing

So, why are we here? The world of investing is filled with noise—complex strategies, conflicting advice, and emotional pitfalls. This article aims to cut through that noise by:

- Exploring Joel Greenblatt’s Investment Philosophy: Understanding the man behind the formula gives context to its effectiveness.

- Demystifying Magic Formula Investing: Breaking down how it works, the principles it stands on, and why it matters.

- Guiding You on Implementation: Providing a step-by-step approach to applying the Magic Formula in your own investment journey.

- Highlighting Benefits and Drawbacks: Offering a balanced view to help you make informed decisions.

- Encouraging a Disciplined, Long-Term Perspective: Emphasizing the importance of patience and consistency in investing.

By the end of this read, you’ll not only understand what Magic Formula Investing is but also how to apply it effectively. Whether you’re a seasoned investor looking to refine your strategy or a novice eager to dip your toes into the investing waters, there’s something here for you.

So grab a cup of coffee, settle in, and let’s embark on a journey to simplify investing and potentially enhance your financial future. Ready to unlock the magic? Let’s dive in!

Understanding Magic Formula Investing

Now that we’ve set the stage, it’s time to delve into the heart of Magic Formula Investing. At first glance, it might sound like a gimmick—a “get rich quick” scheme wrapped in financial jargon. But rest assured, it’s rooted in solid value investing principles that have been endorsed by legends like Benjamin Graham and Warren Buffett.

The Foundation: Value Investing Principles

Before we unpack the Magic Formula, it’s essential to understand the bedrock upon which it’s built: value investing. This investment philosophy revolves around identifying stocks that appear to be trading for less than their intrinsic or book value. Value investors seek out companies that the market has undervalued, betting that their true worth will be recognized over time.

Key tenets of value investing include:

- Margin of Safety: Buying securities at a significant discount to their intrinsic value to minimize downside risk.

- Intrinsic Value Assessment: Determining a company’s true worth based on fundamentals, not market sentiment.

- Long-Term Perspective: Being patient and allowing the investment thesis to play out over time.

The Magic Formula Explained

So, how does the Magic Formula fit into this? Simply put, it’s a rules-based strategy that ranks companies based on two key metrics:

- Return on Capital (ROC): This measures how efficiently a company generates profits from its capital. A higher ROC indicates a company is using its resources effectively to produce earnings.

- Earnings Yield: This is the inverse of the Price-to-Earnings (P/E) ratio. It shows how much a company earns relative to its stock price. A higher earnings yield suggests the stock is undervalued.

By combining these two metrics, the Magic Formula seeks to identify companies that are both high-quality (good ROC) and undervalued (high earnings yield).

The Ranking Process

Here’s how the Magic Formula works in practice:

- Step 1: Calculate the ROC and earnings yield for a broad universe of stocks.

- Step 2: Rank all the companies based on ROC, with the highest ROC getting the best rank.

- Step 3: Rank all the companies based on earnings yield, with the highest yield getting the best rank.

- Step 4: Add the two ranks for each company to get a combined score.

- Step 5: Sort the companies based on their combined scores. The lower the score, the better the rank.

This process yields a list of companies that excel in both profitability and value—a sweet spot for investors.

Why Focus on ROC and Earnings Yield?

- Return on Capital (ROC): This metric goes beyond basic profitability. It assesses how well a company is generating profits from its capital investments. A high ROC indicates that management is efficient and the business model is strong.

- Earnings Yield: This metric helps identify undervalued stocks. A high earnings yield means you’re paying less for each dollar of earnings, which could signal a bargain.

By focusing on these metrics, the Magic Formula filters out companies that might be cheap for a reason (like declining businesses) and zeroes in on those that are both profitable and undervalued.

The Underlying Philosophy

The genius of the Magic Formula lies in its simplicity and discipline. It removes emotion and speculation from the equation. Instead of chasing trends or hot stocks, you’re following a systematic approach based on fundamental data.

The formula operates on the belief that markets are not always efficient in the short term. Mispricings occur, and by adhering to a disciplined strategy, investors can capitalize on these inefficiencies.

Does It Really Work?

Multiple studies and backtests have shown that the Magic Formula can outperform the market over extended periods. However, it’s crucial to understand that it’s not a guarantee of short-term success. There will be periods of underperformance, which is where discipline and a long-term perspective come into play.

Limitations to Consider

While the Magic Formula is powerful, it’s not infallible. It primarily relies on quantitative metrics and doesn’t account for qualitative factors like management changes, industry disruptions, or macroeconomic shifts. Therefore, it’s advisable to use it as a tool within a broader investment strategy, possibly supplemented with additional research.

Summing It Up

Magic Formula Investing simplifies the complex world of stock selection by focusing on two key metrics that capture a company’s quality and value. It’s a disciplined, rules-based approach that empowers investors to make rational decisions free from emotional bias.

In the next section, we’ll delve deeper into the core principles that make the Magic Formula tick and explore how you can leverage them in your investment journey.

Core Principles of Magic Formula Investing

Understanding the mechanics of the Magic Formula is one thing, but grasping the underlying principles is what truly empowers you to apply it effectively. Let’s unpack the core tenets that make this strategy a compelling approach for individual investors.

Value and Quality: The Dual Focus

At the heart of Magic Formula Investing is the dual emphasis on value and quality. This isn’t about choosing one over the other; it’s about finding companies that excel in both areas.

Value: Seeking Undervalued Stocks

- High Earnings Yield: By focusing on companies with a high earnings yield, the formula identifies stocks that are undervalued relative to their earnings.

- Market Inefficiencies: The strategy capitalizes on the market’s tendency to misprice stocks in the short term due to overreactions or neglect.

- Buying at a Discount: This aligns with the classic value investing principle of purchasing stocks below their intrinsic value, providing a margin of safety.

Quality: Identifying High-Performance Companies

- High Return on Capital (ROC): Companies with a high ROC are efficient at generating profits from their capital investments.

- Sustainable Competitive Advantage: A high ROC often indicates strong management, effective business models, and competitive moats.

- Long-Term Growth Potential: Quality companies are more likely to sustain earnings and grow over time.

By marrying these two elements, the Magic Formula aims to assemble a portfolio of robust businesses available at attractive prices.

Simplicity: Streamlining Stock Selection

One of the most appealing aspects of the Magic Formula is its simplicity. Investing doesn’t have to be complicated, and Greenblatt’s strategy proves that.

- No Complex Models Needed: You don’t need to build intricate financial models or projections.

- Accessible Metrics: ROC and earnings yield are straightforward to calculate or readily available on financial platforms.

- Time-Efficient: The formula reduces the time spent on analysis, making it suitable for investors who can’t dedicate hours to research.

This simplicity doesn’t just make the strategy accessible; it also minimizes the potential for errors that can arise from overcomplicating the investment process.

Long-Term Perspective: Patience Is Key

Investing is a marathon, not a sprint, and the Magic Formula is designed with this in mind.

- Allowing the Strategy to Work: Markets may take time to recognize the true value of undervalued stocks.

- Weathering Volatility: Short-term market fluctuations are inevitable, but a long-term outlook helps investors stay the course.

- Historical Outperformance Over Time: The formula has shown to outperform benchmarks over multi-year periods, reinforcing the importance of patience.

Remember, even the best strategies can underperform in the short term. Staying committed is crucial for realizing the full benefits.

Discipline: Sticking to the Formula

Emotional decision-making is one of the biggest pitfalls in investing. The Magic Formula emphasizes discipline to mitigate this risk.

- Avoiding Emotional Bias: By adhering strictly to the formula, investors reduce the influence of fear and greed.

- Consistent Application: Regularly updating the portfolio according to the formula’s rankings ensures consistency.

- Ignoring Market Noise: The strategy encourages investors to focus on fundamentals rather than reacting to news or trends.

Discipline isn’t just about following rules; it’s about cultivating the mindset required to execute the strategy effectively.

Diversification: Spreading Risk

While not explicitly a part of the formula, diversification complements its principles.

- Building a Broad Portfolio: Investing in a range of companies from different sectors reduces company-specific risk.

- Mitigating Drawbacks: Diversification helps cushion the portfolio against underperformance from any single stock.

- Enhancing Returns: A well-diversified portfolio increases the chances of capturing high-performing stocks.

Greenblatt recommends holding a portfolio of around 20 to 30 stocks to achieve adequate diversification while still benefiting from the formula’s focus.

Transparency: Understanding What You Own

The Magic Formula promotes transparency by focusing on easily understandable metrics.

- Clarity in Selection: Investors know exactly why each stock is included—because of its ROC and earnings yield rankings.

- Empowerment Through Knowledge: Understanding the rationale behind each investment boosts confidence and reduces anxiety.

- Ease of Monitoring: Simple metrics make it easier to track performance and make adjustments as needed.

This transparency fosters a sense of control and engagement, which is valuable for long-term investment success.

Realism: Acknowledging Limitations

Finally, the Magic Formula is grounded in realism.

- No Guarantees: It doesn’t promise instant riches or foolproof success.

- Accepting Market Realities: Acknowledges that markets are unpredictable in the short term.

- Adaptive Strategy: While disciplined, the strategy can be adjusted or supplemented with additional research if desired.

Understanding that no strategy is perfect prepares investors for the journey ahead and helps set realistic expectations.

Bringing It All Together

The core principles of Magic Formula Investing—value and quality, simplicity, long-term perspective, discipline, diversification, transparency, and realism—combine to create a robust investment strategy. These principles not only guide stock selection but also shape the investor’s mindset, which is equally important.

By embracing these principles, you’re not just following a formula; you’re adopting a holistic approach to investing that can enhance your financial well-being over time.

In the next section, we’ll get practical. We’ll walk through how to implement the Magic Formula in stock selection, build a diversified portfolio, and maintain the discipline required to stick with the strategy.

Implementing the Magic Formula in Stock Selection

Understanding the theory is one thing; putting it into practice is another. This section will provide a step-by-step guide on how to implement the Magic Formula in your own investing. We’ll cover everything from identifying suitable companies to building and maintaining your portfolio.

Step 1: Define Your Investment Universe

Before you start crunching numbers, you need to decide which stocks you’ll consider.

- Market Capitalization: Greenblatt suggests focusing on mid to large-cap stocks to ensure liquidity. Typically, companies with a market cap above $50 million are suitable.

- Exclusions: Avoid financial companies and utilities, as their financial structures can distort ROC and earnings yield calculations.

- Geographical Focus: While the original formula was designed for U.S. stocks, it can be adapted to other markets with available data.

Step 2: Calculate Return on Capital (ROC)

Next, calculate the ROC for each company in your universe.

- Formula: ROC = EBIT / (Net Working Capital + Net Fixed Assets)

- EBIT: Earnings Before Interest and Taxes.

- Net Working Capital: Current Assets – Current Liabilities.

- Net Fixed Assets: Total Fixed Assets – Accumulated Depreciation.

- Purpose: This measures how efficiently a company generates profits from its capital.

Step 3: Calculate Earnings Yield

Now, compute the earnings yield for each company.

- Formula: Earnings Yield = EBIT / Enterprise Value

- Enterprise Value (EV): Market Capitalization + Debt – Cash.

- Purpose: This assesses how much you’re paying for each dollar of earnings, considering both equity and debt.

Step 4: Rank the Companies

With both metrics calculated, rank the companies.

- ROC Ranking: Assign a rank based on ROC, with 1 being the highest ROC.

- Earnings Yield Ranking: Assign a rank based on earnings yield, with 1 being the highest yield.

- Combined Ranking: Add the two ranks for each company to get a total score.

Step 5: Select Top-Ranked Companies

Choose the companies with the lowest combined scores.

- Number of Stocks: Aim for 20 to 30 stocks to achieve diversification.

- Sector Diversification: Ensure you’re not overly concentrated in a single industry.

- Equal Allocation: Allocate an equal amount of capital to each selected stock.

Step 6: Build Your Portfolio

Now it’s time to invest.

- Purchase Stocks: Buy shares in each selected company, allocating equal funds to each.

- Transaction Costs: Be mindful of brokerage fees, which can impact returns, especially for smaller portfolios.

- Record Keeping: Maintain a log of purchase prices, dates, and other relevant details.

Step 7: Maintain Discipline and Rebalance

The Magic Formula requires periodic rebalancing.

- Holding Period: Hold each stock for about one year.

- Tax Efficiency: For taxable accounts, sell winners after holding for more than one year to benefit from long-term capital gains tax rates.

- Sell Losers Earlier: Consider selling losing positions after 11 months to harvest tax losses.

- Annual Reassessment: After one year, repeat the ranking process and adjust your portfolio accordingly.

- Stay the Course: Stick to the formula even during periods of underperformance.

Tips for Maintaining a Disciplined Approach

Avoid Emotional Decision-Making

- Ignore Short-Term Volatility: Focus on the long-term strategy rather than daily market fluctuations.

- Trust the Process: Remember that the Magic Formula is designed to work over time.

Keep It Simple

- Stick to the Metrics: Don’t complicate the process by adding additional criteria unless you have a strong reason.

- Use Available Tools: Utilize online resources or software that can automate calculations and rankings.

Be Patient

- Allow Time for Performance: It may take several years to see significant results.

- Understand Market Cycles: Recognize that no strategy outperforms in every market condition.

Potential Pitfalls and How to Avoid Them

Overtrading

- Limit Transactions: Frequent buying and selling can erode returns due to transaction costs.

- Follow the Annual Rebalancing Schedule: Resist the urge to make adjustments outside of the planned intervals.

Ignoring Qualitative Factors

- Supplemental Research: While the formula focuses on quantitative metrics, consider qualitative aspects if you have the expertise.

- Stay Informed: Be aware of major events that could significantly impact a company’s prospects.

Concentration Risk

- Diversify Sufficiently: Don’t allocate too much capital to a single stock or sector.

- Monitor Correlations: Be cautious of companies that may be affected by the same risks.

Tools and Resources

Online Screeners

- Magic Formula Investing Website: Greenblatt provides a free resource that calculates rankings based on his methodology.

- Financial Platforms: Websites like Yahoo Finance, Google Finance, or specialized investment platforms can help you access necessary data.

Books and Publications

- “The Little Book That Beats the Market” by Joel Greenblatt: A must-read for understanding the strategy in depth.

- Investment Forums and Blogs: Engaging with a community can provide additional insights and support.

Customizing the Formula

While the Magic Formula is designed to be simple, some investors choose to tailor it.

- Adjusting Metrics: Some investors modify the ROC or earnings yield calculations to suit their preferences.

- Adding Filters: You might exclude companies with excessive debt or other red flags.

- Combining Strategies: Integrate the Magic Formula with other investment approaches for a hybrid strategy.

Final Thoughts on Implementation

Implementing the Magic Formula isn’t about chasing the latest stock tip or reacting to market hype. It’s about adopting a systematic, disciplined approach that leverages proven investment principles.

By following these steps and maintaining the discipline to stick with the strategy, you’re positioning yourself to potentially achieve superior returns over the long term.

In the next section, we’ll explore the benefits and drawbacks of Magic Formula Investing, providing a balanced view to help you decide if it’s the right strategy for you.

Benefits and Drawbacks of Magic Formula Investing

No investment strategy is without its pros and cons, and the Magic Formula is no exception. Understanding both sides will help you make an informed decision about whether this approach aligns with your investment goals and risk tolerance.

Benefits of Magic Formula Investing

Simplicity and Accessibility

- Easy to Understand: The formula relies on straightforward metrics that are accessible to most investors.

- No Need for Expert Analysis: You don’t have to be a financial guru to implement it effectively.

- Time-Efficient: The systematic approach saves time compared to more complex strategies.

Historical Performance

- Outperformance: Backtests and historical data suggest the Magic Formula can outperform market averages over long periods.

- Consistent Returns: The focus on quality and value tends to yield more stable performance.

Discipline and Objectivity

- Reduces Emotional Bias: By following a set formula, you minimize the impact of emotions on investment decisions.

- Systematic Approach: The strategy provides clear guidelines, reducing uncertainty.

Suitable for Individual Investors

- Low Barrier to Entry: You don’t need significant capital to get started.

- Flexibility: Can be adapted to various markets and investment horizons.

Diversification

- Broad Portfolio: Encourages investing in multiple stocks across different sectors, reducing company-specific risk.

Drawbacks and Criticisms of Magic Formula Investing

Market Volatility and Underperformance

- Short-Term Underperformance: The strategy may lag the market during certain periods, which can test investor patience.

- Volatility: Like any equity-focused strategy, it’s subject to market swings.

Reliance on Quantitative Metrics

- Ignores Qualitative Factors: The formula doesn’t account for management quality, industry trends, or macroeconomic factors.

- Potential for Value Traps: High earnings yield and ROC may sometimes indicate underlying issues not captured by the metrics.

Transaction Costs and Taxes

- Frequent Trading: Annual rebalancing can incur transaction fees and tax liabilities, impacting net returns.

- Tax Implications: Short-term capital gains taxes can reduce profitability if not managed properly.

Not Foolproof

- No Guaranteed Success: Past performance doesn’t ensure future results.

- Market Efficiency: Critics argue that as the strategy becomes more popular, its effectiveness may diminish due to increased competition.

Applicability Limitations

- Exclusions Required: Financial companies and utilities are often excluded, which might limit diversification.

- Data Availability: Accurate calculation requires reliable financial data, which may not be readily available for all markets.

Strategies for Addressing Drawbacks

Diversification and Patience

- Hold a Broad Portfolio: Investing in a larger number of stocks can mitigate the impact of any single underperformer.

- Long-Term Commitment: Staying invested over multiple years increases the likelihood of realizing the strategy’s benefits.

Supplementing with Qualitative Analysis

- Additional Research: Consider looking into qualitative factors for top-ranked companies.

- Red Flag Checks: Screen for companies with significant legal issues, management turnover, or declining industries.

Managing Costs and Taxes

- Choose Low-Cost Brokers: Minimizing transaction fees can improve net returns.

- Tax-Efficient Strategies: Utilize tax-advantaged accounts or consider tax implications when timing sales.

Customization

- Adjust Criteria: Modify the formula to include additional metrics or filters that address specific concerns.

- Combine Strategies: Integrate elements from other investment approaches to create a more robust strategy.

Is Magic Formula Investing Right for You?

The suitability of the Magic Formula depends on various factors:

- Investment Goals: If you’re seeking long-term capital appreciation and are comfortable with potential short-term underperformance, it could be a good fit.

- Risk Tolerance: The strategy involves equity investments, which carry inherent risks.

- Time Commitment: While less time-intensive than other strategies, it does require annual reviews and rebalancing.

- Belief in Value Investing: If you align with value investing principles, the Magic Formula offers a systematic way to apply them.

Expert Opinions and Criticisms

Some financial experts praise the Magic Formula for its simplicity and effectiveness, while others caution against relying solely on quantitative metrics.

- Supporters Highlight:

- The empirical evidence supporting its long-term outperformance.

- The behavioral finance aspect, where disciplined strategies can outperform emotional decision-making.

- Critics Point Out:

- The changing market dynamics that may reduce the formula’s effectiveness.

- The risk of oversimplification by ignoring qualitative factors.

Final Thoughts on Benefits and Drawbacks

Magic Formula Investing offers a compelling blend of simplicity, discipline, and historical performance. However, it’s not a one-size-fits-all solution. Being aware of its limitations and potential drawbacks allows you to make adjustments that suit your personal investment profile.

By addressing the drawbacks through diversification, patience, and possibly supplementing the formula with additional analysis, you can enhance the strategy’s effectiveness.

In our final section, we’ll provide practical steps for starting your journey with Magic Formula Investing, along with resources to support you along the way.

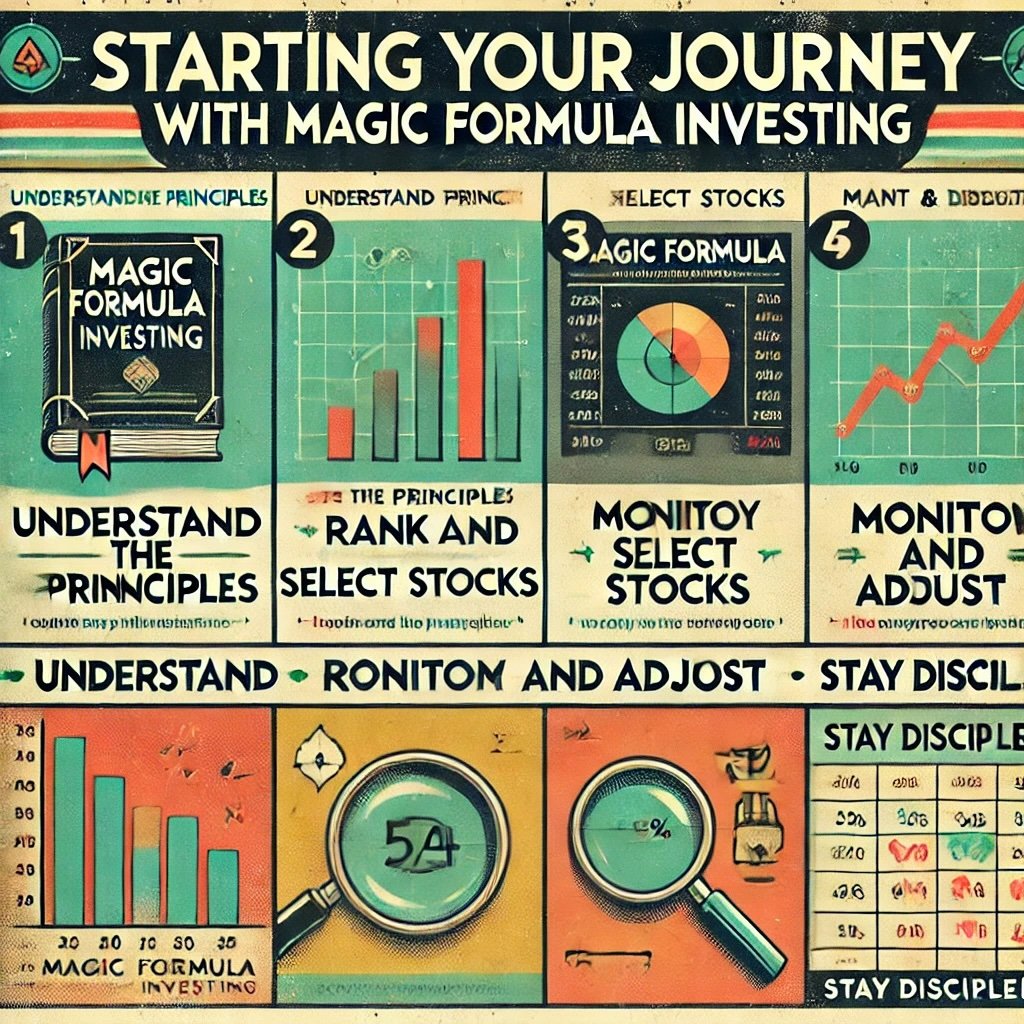

Starting Your Journey with Magic Formula Investing

Embarking on any new investment strategy can feel daunting, but with the right approach and resources, you can set yourself up for success. This final section will provide practical steps to apply the Magic Formula to your portfolio, along with resources to deepen your understanding and support your journey.

Practical Steps for Applying the Magic Formula

Step 1: Educate Yourself

- Read the Foundational Texts: Start with Joel Greenblatt’s “The Little Book That Beats the Market” to grasp the fundamentals.

- Understand the Metrics: Ensure you’re comfortable with calculating and interpreting ROC and earnings yield.

Step 2: Set Up Your Investment Platform

- Choose a Brokerage: Select a brokerage that offers low transaction fees and easy access to the stocks you’re interested in.

- Consider Tax-Advantaged Accounts: If possible, use accounts like IRAs or 401(k)s to minimize tax liabilities.

Step 3: Gather the Necessary Data

- Use Online Tools: Websites like the Magic Formula Investing site provide free rankings based on Greenblatt’s methodology.

- Financial Software: Consider investing in financial analysis software if you prefer a hands-on approach.

Step 4: Create Your Initial Portfolio

- Select Stocks: Choose 20 to 30 top-ranked stocks based on the Magic Formula.

- Allocate Funds: Decide how much capital to invest and allocate it equally among the selected stocks.

- Execute Trades: Purchase the stocks through your brokerage account.

Step 5: Monitor and Rebalance Annually

- Set Calendar Reminders: Mark your calendar for annual reviews.

- Recalculate Rankings: Update the rankings to see if any changes are needed.

- Adjust Portfolio: Sell stocks that no longer meet the criteria and purchase new ones that do.

Step 6: Stay Disciplined

- Stick to the Plan: Resist the urge to deviate from the strategy based on market news or short-term performance.

- Avoid Overtrading: Limit adjustments to the scheduled annual rebalancing unless significant events warrant action.

Resources and Tools for Learning and Support

Books and Publications

- “The Little Book That Beats the Market” by Joel Greenblatt: The foundational text for Magic Formula Investing.

- “You Can Be a Stock Market Genius” by Joel Greenblatt: Offers deeper insights into value investing strategies.

- Investment Magazines and Journals: Publications like Barron’s and The Wall Street Journal can keep you informed about market trends.

Online Platforms

- MagicFormulaInvesting.com: Greenblatt’s official site provides free stock screenings based on the Magic Formula.

- Financial News Websites: Sites like Yahoo Finance, Seeking Alpha, and Investopedia offer valuable information and analysis.

Educational Courses

- Online Courses: Platforms like Coursera, Udemy, and Khan Academy offer courses on value investing and financial analysis.

- Workshops and Seminars: Attend investment seminars or webinars to enhance your knowledge.

Community and Networking

- Investment Forums: Engage with communities on platforms like Reddit’s r/investing or investing-focused Discord servers.

- Local Investment Clubs: Joining a local group can provide support and shared learning experiences.

Final Thoughts on the Relevance of Magic Formula Investing Today

In today’s fast-paced, technology-driven markets, the simplicity and discipline of Magic Formula Investing offer a refreshing alternative to more speculative approaches.

- Resilience in Changing Markets: While market dynamics evolve, the fundamental principles of value and quality remain relevant.

- Empowerment Through Knowledge: Understanding and applying the Magic Formula can boost your confidence as an investor.

- Accessibility: The strategy is suitable for investors with varying levels of experience and capital.

Encouragement to Try the Strategy

If you’re seeking a systematic, disciplined approach to investing that doesn’t require you to predict market movements or become a financial analyst, the Magic Formula might be the strategy for you.

- Test the Waters: Consider starting with a smaller portion of your portfolio to gain comfort with the strategy.

- Track Performance: Keep detailed records to assess how the strategy works for you over time.

- Be Open-Minded: While no strategy is perfect, the Magic Formula offers a solid foundation that can be adapted to your needs.

A Recap of Key Takeaways

- Understand the Core Principles: Value and quality are the pillars of the Magic Formula.

- Maintain Discipline: Consistency is crucial for long-term success.

- Be Patient: Allow the strategy time to work, and don’t be swayed by short-term market fluctuations.

- Stay Informed: Use available resources to enhance your understanding and stay updated.

Closing Thoughts

Investing doesn’t have to be a convoluted maze of complex strategies and insider knowledge. Joel Greenblatt’s Magic Formula Investing demystifies the process, offering a clear, disciplined path to potentially outperform the market.

By focusing on companies that are both high in quality and undervalued, and by maintaining a long-term perspective, you position yourself to reap the rewards that disciplined investing can offer.

So why not give it a try? With the knowledge and tools at your disposal, you have everything you need to start your journey toward investing like Joel Greenblatt.

Happy investing!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.