There comes a point in time in your life when you realize that following the herd is a bad idea.

If health, fitness and anti-aging protocols are of primary concern then following a standard American diet and sedentary lifestyle is far from bueno.

A life committed to a forty hour plus workweek in a soul-sucking job in tandem with a conspicuous consumption lifestyle isn’t the yellow brick road to fulfilment and happiness.

And the industry standard 60/40 portfolio is at best a mediocre attempt at asset allocation in the sense that it’s all fine and dandy during times of prosperity but is clearly suboptimal during other more challenging economic regimes.

There are clearly better ways to compound my friends.

Fortunately, we’re joined today by a guest who has assembled one of the best all weather / all-season approaches to constructing an adaptive portfolio that is prepared for all economic regimes.

I’m thrilled to have Eric Crittenden of Standpoint Funds join us to take part in the “How I Invest” series on Picture Perfect Portfolios.

His long equity plus adaptively dynamic multi-asset class trend-following systematic style of investing has thrived since he launched his BLNDX – REMIX mutual fund.

It’s better known as Standpoint Multi-Asset Fund.

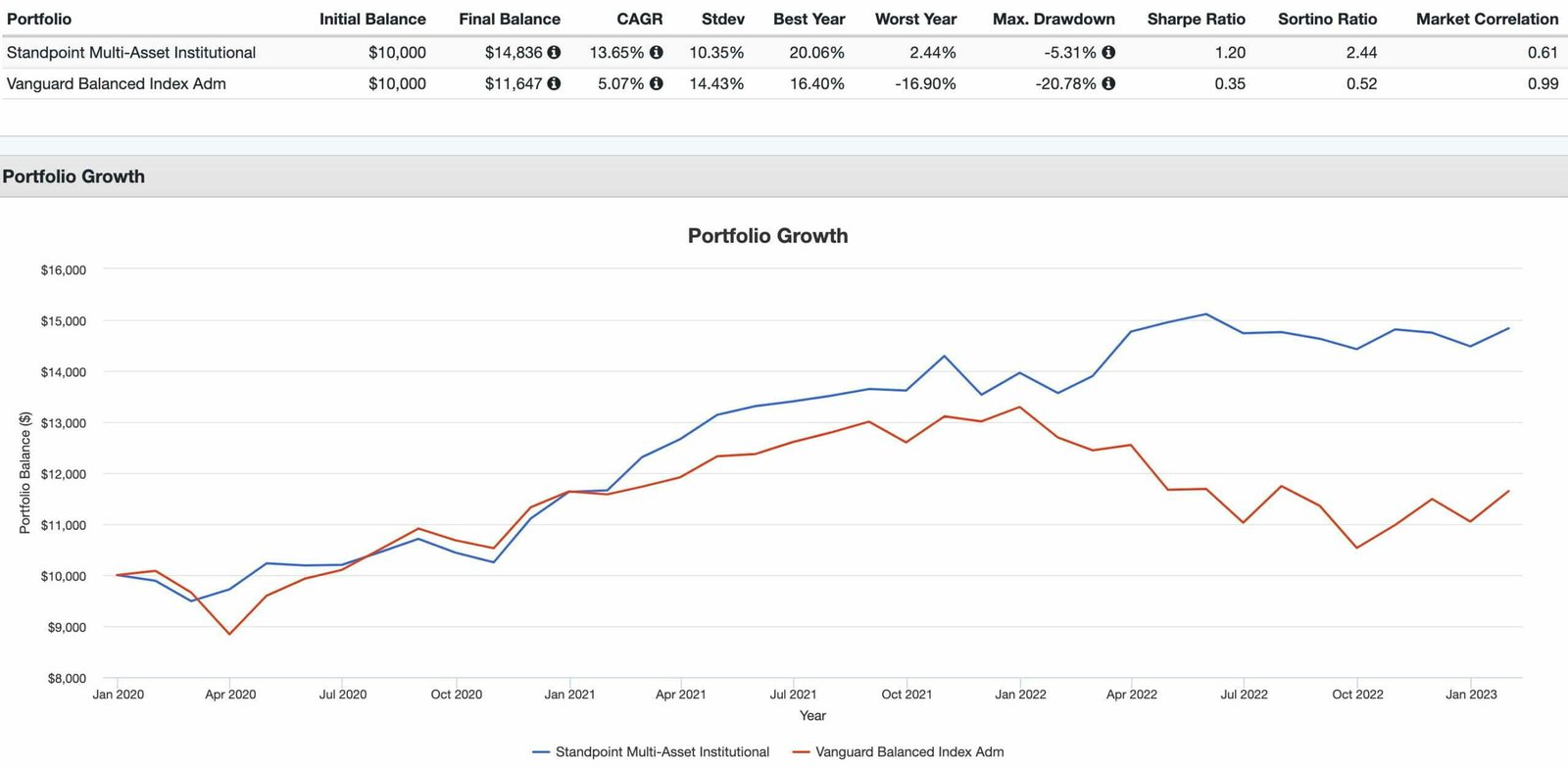

It’s beaten the tar out of a milquetoast 60/40 portfolio since its inception.

Standpoint Multi-Asset Fund vs Vanguard Balanced Index

Better yet, it has adaptively handled all of the challenges thrown its way.

Consider March 2020 (beginning of the pandemic) and 2022 as the ultimate example of how it adapted to turbulent market conditions whereas the static 60/40 portfolio rigidly floundered.

The strategy of Eric’s fund and his specific style of investing is fascinating but he’s also one of the most astute and self-aware people in the industry.

He understands the challenges investors face in terms of sticking with non-traditional investing strategies.

In many regards, his fund addresses those concerns head on by combining a long-only equity strategy (what most investors are familiar with) with an adaptive trend-following approach (what many investors don’t realize that they need) in a manner that allows them to stay the course.

Let’s turn things over to Eric Crittenden to find out more.

Meet Eric Crittenden of Standpoint Funds

Today I think people would describe me as a practical contrarian, someone who does not constantly fight the status quo, but expects it to be horribly wrong at times, and seeks to be prepared.

In college I studied meteorology, public health, economics, finance, and computer science.

The courses/topics that influenced my career most are cognitive biases and critical thinking (psychology), database design and array math (computer science), non-linear systems (meteorology and public health), supply/demand and integrated systems (economics), time value of money and compound interest (finance).

My first jobs out of college were analytical in nature.

I worked for a large family office and then a couple of different hedge funds, mainly down in the trenches of accounting, programming, database management, and research.

Eventually I realized my passion was in designing complete systems and portfolio management methods that emphasized durability and resilience.

I had to start my own firm to pursue this fully.

How I Invest with Eric Crittenden of Standpoint Funds: A Globally Diversified Dynamic Multi-Asset Class Trend Following Approach

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Understand Your Edge, Manage Risk and Have Realistic Expectations

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

My biggest influences were primarily people that focused on managing risk, understanding your edge, and having realistic expectations.

Tom Basso and Charlie Munger come to mind immediately.

Studying firms like AHL, Transtrend, Millburn, and Chesapeake also expedited my learning.

Some of my views have changed since I first entered the industry.

I used to fall victim to something I call the “smallcap bias”.

It is the belief that for something to be valuable, it must be scarce. I spent years pursuing esoteric “opportunities” in small, hard to trade, markets.

After an evaluation of my results, and considering the excellent results of firms that are too large to meaningfully participate in such markets, I was comfortable accepting that scarcity hasn’t translated into significant value in this context.

Another faulty view I held was the result of something I call “complexity bias”.

I’ve made it a point to critically analyze both success and failure in my industry.

To this day I’m still surprised to find that successful firms generally do 1 to 3 relatively simple things well, while unsuccessful firms often fail because of some unexpected fragility in their complex processes.

I’m convinced that simple (not necessarily easy) is a better foundation than complex.

As for podcasts and white papers, the folks at Resolve Asset Management, Newfound Research, Mutiny Fund and RCM do a great job producing educational materials.

Regarding authors, I’ve really enjoyed books from Michael Covel, Tom Basso, Andreas Clenow, Antti Ilmanen, John Mauldin, and Michael Mauboussin.

Mental Models: In Pursuit Of Objective Truth

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I grew up in a military family that frequently moved around the country.

I went to 10 different schools in 12 years, spread out over the west coast, mid-west, and the south.

Very early in life I learned that adults have high-conviction beliefs that conflict by region.

For example, I was taught three different versions of the causes of the American Civil War, that couldn’t all be objectively true.

The cognitive dissonance experienced as a child caused me to develop a mental framework for accumulating knowledge, in such a way that objective facts are treated as special, while subjective narratives and opinions are kept separate, and challenged.

I wish I could claim this framework served me well in all aspects of life, but that was not the case.

In social situations, especially when there is a strong bureaucracy involved, pursuit of objective truth is not the path to making friends and allies.

It turns out most people do not like having their beliefs questioned.

Who would have guessed that?

Unable to abandon my mental models, I eventually migrated toward hobbies and disciplines that were less hostile to the pursuit of objective truth.

Over time I evolved into a patient, disciplined person that was willing and able to bear responsibility for results.

Systematic investing was a perfect fit for me.

source: Louis Llanes on YouTube with managed futures expert Eric Crittenden

Partner With Reliable People And Let Them Help You

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

I would tell my younger self the following:

- The consensus view is wrong at critical inflection points; objective truth is right

- Trust the foundation you build; don’t keep redoing the same work

- Partner with reliable people and let them help you; scale requires teamwork

- The status quo bureaucracy isn’t your enemy; it’s the reason your edge is enduring

- Markets are ecosystems, contribute in a productive manner to earn a sustainable risk premium

Dynamically Structured Portfolio Focused On Trend-Based Investments

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

Much of our portfolio is dynamically structured with a focus on trend-based investments.

This means that its composition changes as market conditions evolve, and new opportunities arise.

We seek to include a wide range of global asset classes in our portfolio, including commodities, currencies, equities, and bonds.

This helps to reduce the overall risk in the portfolio and to increase opportunities in different types of market environments.

Many commodity markets, such as natural gas, cotton, coffee, cocoa, and carbon credits, have demonstrated valuable diversification qualities due to their unique price behavior relative to other asset classes.

In 2020, during the outbreak of COVID-19, our short exposure to energy markets, including crude oil, gasoline, and heating oil, significantly benefited the portfolio.

Similarly, in 2022, our ability to be short global bonds and various currencies was also a significant contributor to the portfolio’s performance.

It’s hard to say when our portfolio would perform best or worst.

In my experience those words are subjective and mean different things to different people.

Our strategy was designed to remove as much uncompensated cyclical risk as is reasonably possible.

The goal is to be effective at compounding wealth in a risk-managed, highly diversified manner, over time.

source: Mutiny Fund on YouTube with trend-follower Eric Crittenden

Systematic, Risk Managed, Multi-Asset Investing Is Not What You See In The Movies

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

I would describe these people as “intuitive engineers”.

People that can build things, evaluate them, and understand how the parts work together.

Skeptics, that stress test things and prepare for the worst-case scenarios.

Self-motivating individuals that seek responsibility and accountability but also demand the authority and flexibility to do things “right”.

A solid understanding of the cognitive biases that plague the industry is a must.

Finally, I would point out that the lack of a need for excitement and drama is probably essential too.

Systematic, risk-managed, multi-asset investing is not what you see in the movies.

Targeted Level Of Volatility: Lower or Raise Your Risk Level

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

The simple answer would be to lower/raise our targeted risk level.

Systematic programs like ours generally have some targeted level of volatility or drawdown that can easily be set, like a thermostat, to the desired value.

Inability To Learn From Others’ Failures = Largest Inefficiency In The World

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

I think my greatest strength is the ability to learn from failure, particularly vicariously, through the experiences of others.

The inability to learn from others’ failures is probably the largest inefficiency in the world.

Learn what clearly doesn’t work and then go another way in search of opportunities.

Another strength is my willingness to do nothing, when warranted, which is often.

It’s harder than it sounds, especially in an industry where the “illusion of progress” is the foundation of most marketing departments.

Charlie Munger probably does the best job of articulating the importance of not meddling when things are working.

My greatest weakness is probably the “small cap” bias mentioned in a prior answer. That one will probably stay with me forever since it’s true in most aspects of life.

source: ReSolve Asset Management on YouTube with guest Eric Crittenden

Psychologically Uncomfortable Act Of Buying Rising Markets & Selling Falling Markets

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

Trend following approaches are profitable because they provide liquidity to hedgers.

Professional hedgers are not profit-seeking participants in the markets.

They generally seek negative correlation to some aspect of their business that is profitable.

Hedgers generally sell rising markets to lock-in profit margins and buy falling markets to lock-in input costs.

This form of hedging shares the “risk transfer” characteristics of insurance, which generally is not a free service.

Trend following participants perform the psychologically uncomfortable act of buying rising markets and selling falling markets.

The result is a symbiotic relationship in which a risk premium flows from the hedgers to the trend followers over time.

That is my belief.

It can not be proven.

Any evidence is circumstantial since the markets are anonymous.

This, in my opinion is a good thing.

If it were provable, more people would do it, and my margins would shrink.

A commonly held industry belief that I do not share is that a buy and hold portfolio comprised of equities and bonds is suitable for nearly all investors.

I understand why people feel this way.

Such a portfolio is convenient, scalable, reasonably tax efficient, and has worked well in most market environments over the last 40 years.

My objections are twofold.

1) The widespread acceptance of a default equity/bond portfolio occurred during a period of declining interest rates, which strongly enhanced the returns from bonds, 2) In the 40 years prior to 2022, investors have not experienced a period when equities and bonds declined, meaningfully, in value at the same time.

There is no rule that equities and bonds must be uncorrelated.

I don’t seek to belittle an equity/bond portfolio, I just think it’s incomplete.

There is more diversification to be had from other asset classes.

Careful To Avoid Meddling With A Process That’s Delivering The Desired Results

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

We are very comfortable with our strategy the way it is.

Research is always an ongoing process, especially when it comes to evaluating new, emerging futures markets.

However, we are very careful to avoid meddling with a process that’s already delivering the desired results.

source: Blockworks Macro on YouTube

The Portfolio Eric Crittenden Would Never Own

What would be the ultimate anti-Eric Crittenden portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

The ultimate anti-me portfolio would consist of most forms of arbitrage, discretionary stock picking, and standard venture capital strategies.

These types of strategies do not appeal to me primarily because they tend to be highly correlated with equities during bear markets.

I suspect the popularity of these types of strategies has to do with their ability to be paired with convincing narratives.

I’m sure they serve a purpose in the marketplace; it just isn’t to diversify equity risk.

source: Trend Following on YouTube

Dynamic Multi-Asset Class Trend Following with Eric Crittenden of Standpoint Funds — 12-Question FAQ

What is Standpoint’s core strategy in one sentence?

A long-equity plus dynamic, multi-asset trend-following system that adapts across global futures (commodities, currencies, rates, equity indexes) to compound steadily through varied economic regimes.

Why pair long equities with trend following?

Equities provide long-run growth most investors recognize, while trend following adds an adaptive, low-correlated return stream that has historically helped during crises (e.g., 2020 shock, 2022 stock-bond drawdowns), improving overall durability.

Which markets does the trend program trade?

A broad global set—commodities (energy, ags, metals, softs), currencies, global bonds/rates, and equity index futures—so multiple independent trends can contribute at different times.

How “dynamic” is the portfolio?

Positions are systematic and responsive: exposures shift with price trends—able to be long, short, or flat—so the mix evolves as market conditions change rather than staying static like a 60/40.

What philosophy guides design choices?

“Simple, not easy”: do a few robust things well, manage risk first, avoid unnecessary complexity, and respect behavioral realities so investors can actually stick with the process.

How is risk managed day to day?

Systematic position sizing and diversification across many markets, with a targeted volatility/drawdown “thermostat” that can be set higher or lower to match client risk preferences.

When does this approach tend to help most?

During prolonged or sharp dislocations—when major assets trend down or diverge—trend systems can go short laggards/long leaders, potentially cushioning losses and providing rebalancing capital.

When can it lag?

In whipsawing, range-bound markets without persistent trends, the adaptive sleeve may chop around and underperform static stock/bond mixes for a time.

What behavioral edge is required from investors?

Tolerance for looking “different” versus benchmarks, patience through flat/tricky trend periods, and an appreciation that diversification means some sleeves will underwhelm while others carry the load.

How could someone dial the risk up or down?

By adjusting the strategy’s volatility target (the “thermostat”): lower for a toned-down profile; higher for a more aggressive path—without changing the underlying process.

What are the main trade-offs vs. a simple 60/40?

More moving parts and tracking error relative to common benchmarks; potential for underperformance in non-trending phases—exchanged for improved crisis robustness and a more all-weather return profile.

Where can investors learn more about this style?

Look to Standpoint’s materials and thoughtful educators in the space (e.g., research from trend/managed-futures practitioners), plus books on systematic/behavioral investing and risk management.

Connect With Eric Crittenden Of Standpoint Funds

Thanks so much for taking part in the “How I Invest” series!

How can others connect with you on social media and other platforms that you run?

My pleasure. I love your work.

People can find out more at:

Standpoint Funds: https://www.standpointfunds.com/

Twitter: https://x.com/StandpointFunds

LinkedIn: https://www.linkedin.com/company/standpoint-asset-management/

YouTube: https://www.youtube.com/@standpointfunds

Nomadic Samuel Final Thoughts

I want to personally thank Eric Crittenden for taking the time to participate in the “How I Invest” interview series by contributing thoughtful answers to all of the questions!

I’d highly recommend checking out Eric’s previous contribution to the “Investing Legends” series where we covered “Trend Following and All Weather Investing“.

I’ve also reviewed Eric’s flagship mutual fund BLNDX REMIX: Standpoint Multi-Asset Fund.

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.