Global systematic macro (GSM) is an investment strategy that has gained significant traction among investors and hedge fund managers. It is a quantitative approach that involves trading in various financial markets, including currencies, commodities, and equities, with the aim of generating returns from market inefficiencies and mispricings.

GSM: Global Systematic Macro Approach

The GSM approach involves using sophisticated computer algorithms and data analysis to identify macroeconomic trends and market anomalies. It then uses these insights to create and execute trading strategies, which may involve taking long or short positions in various financial instruments, depending on the manager’s assessment of market conditions and risk.

The GSM strategy is often favored by investors looking for high returns and diversification in their portfolios. This is because it involves taking positions in multiple markets, spreading the risk and reducing the impact of market volatility. Additionally, the use of leverage can enhance returns, making GSM an attractive investment option for those looking for high returns.

Diversification: Key Advantage Of A Global Systematic Approach

One of the primary advantages of the GSM approach is diversification. Trading in multiple markets allows managers to spread their risk and reduce the impact of market volatility. This diversification can help to mitigate the risks associated with investing in a single asset class or market.

Furthermore, the use of quantitative models and algorithms can provide investors with a systematic approach to trading, which can help to eliminate the emotional biases that can lead to poor investment decisions. These models can also help to identify market anomalies that may not be apparent to the human eye, providing a competitive edge for managers who use this approach.

source: Bridgewater Associates on YouTube

GSM Approach: Potential Challenges

Despite its advantages, the GSM approach is not without its challenges. One of the primary challenges of the GSM approach is the risk of unexpected market events that may not be captured by the models. For example, geopolitical instability, natural disasters, or sudden changes in economic policy can have a significant impact on the financial markets, and these events may not be captured by the models used by GSM managers.

Another potential challenge for GSM managers is the constant need to update and refine their models to keep up with changing market conditions. This requires a significant investment in technology and data analysis, and even with the best models, there is always the risk of unforeseen market events.

Global Systematic Macro Performance Over The Past 20 Years

Despite these challenges, the GSM approach has proven to be a successful investment strategy for many managers. According to data from BarclayHedge, the Barclay Global Macro Index, which tracks the performance of systematic macro hedge funds, has produced an average annual return of 6.4% over the past 20 years.

One of the factors contributing to the success of the GSM approach is the availability of data. Today, there is more data available than ever before, and this data can be used to develop sophisticated models and algorithms that can provide valuable insights into market trends and anomalies.

Furthermore, advances in technology have made it easier for investors to access these data and use them to develop trading strategies. This has led to an increase in the number of quantitative hedge funds that use the GSM approach, as more managers have been able to develop and implement successful trading strategies.

Another factor contributing to the success of the GSM approach is the availability of skilled talent. The development of quantitative models and algorithms requires a highly skilled workforce, and many of the best and brightest minds in the field are drawn to the hedge fund industry.

Furthermore, the highly competitive nature of the industry has led to a focus on innovation and continuous improvement, as managers seek to gain a competitive edge over their peers. This has led to the development of increasingly sophisticated models and algorithms that can provide valuable insights into market trends and anomalies.

source: Blockworks Macro on YouTube

Risks Of Global Systematic Macro Investing

One of the key risks associated with the GSM approach is the risk of overfitting. This occurs when models are developed that are too closely tailored to historical data, making them less effective at predicting future market movements.

To mitigate this risk, many managers use a variety of techniques, such as out-of-sample testing and cross-validation, to ensure that their models are robust and effective at predicting future market movements.

Another risk associated with the GSM approach is the risk of model decay. This occurs when market conditions change in such a way that the models become less effective at predicting future market movements. To mitigate this risk, GSM managers must constantly monitor and update their models to ensure that they remain effective in predicting market movements.

source: Axis Direct on YouTube

GSM Major Players And Top Performers

Despite these risks, the GSM approach has proven to be a successful investment strategy for many managers. One example of a successful GSM manager is Bridgewater Associates, one of the world’s largest hedge funds, which has consistently produced strong returns using a systematic macro approach.

Bridgewater’s success can be attributed to its focus on data and analytics, as well as its commitment to continuous improvement and innovation. The company employs a team of over 150 data scientists and engineers, who are responsible for developing and refining its quantitative models and algorithms.

Another successful GSM manager is Two Sigma Investments, which uses a combination of artificial intelligence and machine learning to develop and execute its trading strategies. Two Sigma’s success can be attributed to its use of cutting-edge technology and its focus on innovation and continuous improvement.

source: Financial Wisdom on YouTube

Global Systematic Strategies That Investors Utilize

There are several different global systematic strategies that investment managers use to trade in the financial markets. Here are some of the main ones:

- Trend-following: Trend-following is a strategy that involves identifying trends in the markets and buying or selling assets based on those trends. For example, if a market is in an uptrend, a trend-following strategy would involve buying assets in that market, while if a market is in a downtrend, the strategy would involve selling assets in that market.

- Systematic macro: Systematic macro is a strategy that involves using quantitative analysis to identify macroeconomic trends and market anomalies. This approach involves analyzing a wide range of economic data, such as GDP, inflation, and interest rates, to identify opportunities to trade in various financial markets.

- Statistical arbitrage: Statistical arbitrage is a strategy that involves identifying pricing discrepancies between related assets and buying or selling those assets to profit from those discrepancies. This approach involves using statistical models to identify relationships between assets and to identify instances where those relationships break down, creating trading opportunities.

- Market-neutral: Market-neutral strategies involve taking long and short positions in different assets to neutralize the overall market exposure of the portfolio. This approach allows investors to profit from the relative performance of different assets, rather than from the direction of the overall market.

- Managed futures: Managed futures is a strategy that involves trading in futures contracts on various assets, such as commodities, currencies, and interest rates. This approach involves using quantitative analysis to identify trends and patterns in the futures markets, with the goal of generating returns from market inefficiencies and mispricings.

- Multi-asset: Multi-asset strategies involve trading in a variety of different asset classes, such as stocks, bonds, commodities, and currencies, with the goal of diversifying the portfolio and reducing overall risk. This approach involves using quantitative analysis to identify opportunities to trade in different asset classes and to optimize the overall portfolio allocation.

- Quantitative equity: Quantitative equity strategies involve using quantitative analysis to identify undervalued and overvalued stocks, with the goal of generating returns from stock selection. This approach involves using factors such as valuation, momentum, and quality to identify stocks that are likely to outperform or underperform the overall market.

- Seasonality: Seasonality is a strategy that involves identifying seasonal patterns in the markets and buying or selling assets based on those patterns. For example, some assets may exhibit a consistent seasonal pattern of outperforming during certain months of the year, and underperforming during others. Seasonality strategies seek to capitalize on these patterns by buying or selling assets at the appropriate times.

- Mean reversion: Mean reversion is a strategy that involves identifying assets that have moved too far away from their long-term average and betting on a return to that average. For example, if a stock price has fallen significantly below its long-term average, a mean reversion strategy would involve buying that stock with the expectation that it will eventually return to its average.

- Momentum: Momentum is a strategy that involves identifying assets that have exhibited strong recent performance and betting on a continuation of that performance. For example, if a stock has exhibited strong positive returns over the past few months, a momentum strategy would involve buying that stock with the expectation that it will continue to perform well in the near future.

- Volatility: Volatility strategies involve trading assets based on their expected level of volatility. For example, a volatility strategy may involve buying assets that are expected to have high volatility in the future, or selling assets that are expected to have low volatility.

- Carry: Carry strategies involve trading assets based on the interest rate differential between two countries. For example, a carry strategy may involve borrowing money in a currency with a low interest rate and investing that money in a currency with a higher interest rate, with the expectation of earning a profit from the interest rate differential.

- Options: Options strategies involve trading options contracts on various assets. For example, an options strategy may involve buying call options on a stock with the expectation of profiting from a rise in the stock price, or buying put options on a stock with the expectation of profiting from a decline in the stock price.

- Event-driven: Event-driven strategies involve trading assets based on specific events or news. For example, an event-driven strategy may involve buying a stock that is expected to benefit from a merger or acquisition, or selling a stock that is expected to be negatively impacted by a regulatory decision.

- Sentiment: Sentiment strategies involve trading assets based on market sentiment and investor psychology. For example, a sentiment strategy may involve buying assets when market sentiment is overly negative, or selling assets when market sentiment is overly positive.

- Risk parity: Risk parity is a strategy that involves allocating investments across different assets based on their risk levels. For example, a risk parity strategy may involve investing more heavily in assets that have lower risk levels, such as bonds, and investing less in assets that have higher risk levels, such as stocks.

- Fundamental: Fundamental strategies involve analyzing the underlying fundamentals of an asset, such as its financial performance, management quality, and industry trends, in order to make investment decisions. For example, a fundamental strategy may involve buying stocks that are undervalued relative to their earnings growth potential.

- Statistical arbitrage: Statistical arbitrage is a strategy that involves identifying pricing discrepancies between related assets and taking advantage of those discrepancies by simultaneously buying and selling those assets. For example, a statistical arbitrage strategy may involve buying one stock and shorting another stock in the same industry, with the expectation that the price differential between the two will eventually converge.

- Systematic value: Systematic value is a strategy that involves identifying undervalued assets based on certain financial metrics, such as price-to-earnings ratio or price-to-book ratio. For example, a systematic value strategy may involve buying stocks that have a low price-to-book ratio, with the expectation that the market will eventually recognize their true value.

- Multi-factor: Multi-factor strategies involve combining multiple quantitative factors, such as value, momentum, and volatility, to create a more comprehensive investment approach. For example, a multi-factor strategy may involve investing in stocks that exhibit both strong value and strong momentum characteristics.

- Machine learning: Machine learning strategies involve using complex algorithms to analyze large datasets and make investment decisions based on patterns and trends in the data. For example, a machine learning strategy may involve analyzing thousands of news articles to identify market trends and sentiment, and then using that information to make investment decisions.

- High-frequency trading: High-frequency trading strategies involve using advanced algorithms and computer programs to execute trades at high speeds in order to take advantage of small price movements in the market. For example, a high-frequency trading strategy may involve buying and selling large volumes of a stock in a matter of milliseconds in order to profit from tiny price fluctuations.

Take consideration that these strategies are not mutually exclusive, and investment managers may use a combination of different strategies to achieve their investment objectives. It is also worth noting that the strategies described above are not the only global systematic strategies used in the financial markets, and new strategies are constantly being developed and refined as technology and data analysis capabilities continue to evolve.

Some of these strategies, such as mean reversion and momentum, can be combined with others, such as seasonality or volatility, to create more complex and nuanced trading approaches. Additionally, the success of any global systematic strategy will depend on a variety of factors, including market conditions, data quality, and the skill and experience of the investment manager.

Each of these strategies can be used to create a unique investment approach, and they can be combined in different ways to create a diversified portfolio. It’s important to note that not all global systematic strategies will be successful in all market conditions, and it’s important to carefully analyze historical data and market conditions before implementing any investment strategy.

source: Excess Returns on YouTube

12 Question FAQ on Global Systematic Macro (GSM) Investing

What is Global Systematic Macro (GSM) in plain English?

GSM is a quantitative, rules-based way to trade big-picture themes across asset classes (rates, FX, equities, commodities, credit). Computers scour data for repeatable patterns—trend, carry, value, seasonality, risk premia—and execute long/short positions to harvest those edges with disciplined risk controls.

How is GSM different from discretionary global macro?

Discretionary macro relies on human judgment and narratives; GSM encodes hypotheses into testable rules, validates them on historical/out-of-sample data, and executes systematically. The aim is consistency, scalability, and lower behavioral bias, with performance driven by factor exposures rather than one-off “hero calls.”

What return drivers do GSM funds typically target?

Common building blocks include time-series momentum (trend), cross-sectional momentum, value (e.g., purchasing power parity in FX, term structure in commodities), carry (rate/roll yield), seasonality, quality/defensive tilts, and volatility risk premia. Many managers blend multiple signals to diversify model risk.

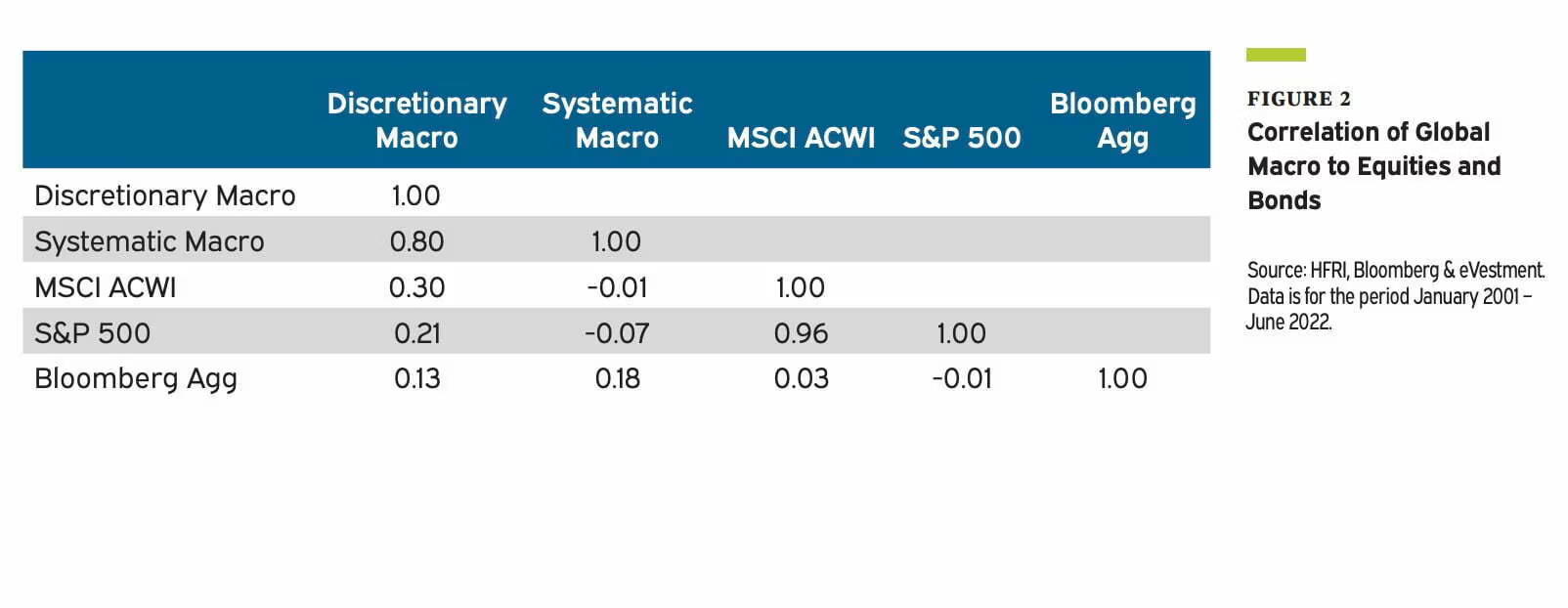

Why do investors add GSM to a portfolio?

GSM often shows low correlation to stocks and bonds, offers crisis-alpha potential via trend in major sell-offs, and provides multi-asset diversification. When implemented well, it can smooth portfolio volatility and improve risk-adjusted returns without relying on equity beta.

What are the main risks of GSM?

Model risk & overfitting: great backtests, weak live results.

Regime shifts/model decay: edges erode as markets change.

Execution slippage: costs, financing, and liquidity frictions.

Crowding/capacity: too much capital in similar signals compresses spreads.

Leverage & convexity: amplifies both gains and drawdowns if controls fail.

How do credible managers reduce overfitting/model decay?

They use clean data pipelines, strict train/validation/test splits, walk-forward analysis, stress/scenario testing, orthogonal signals, explicit complexity penalties, and post-launch performance gates. Live results are monitored with change-point detection and rapid de-weighting/retirement of decaying signals.

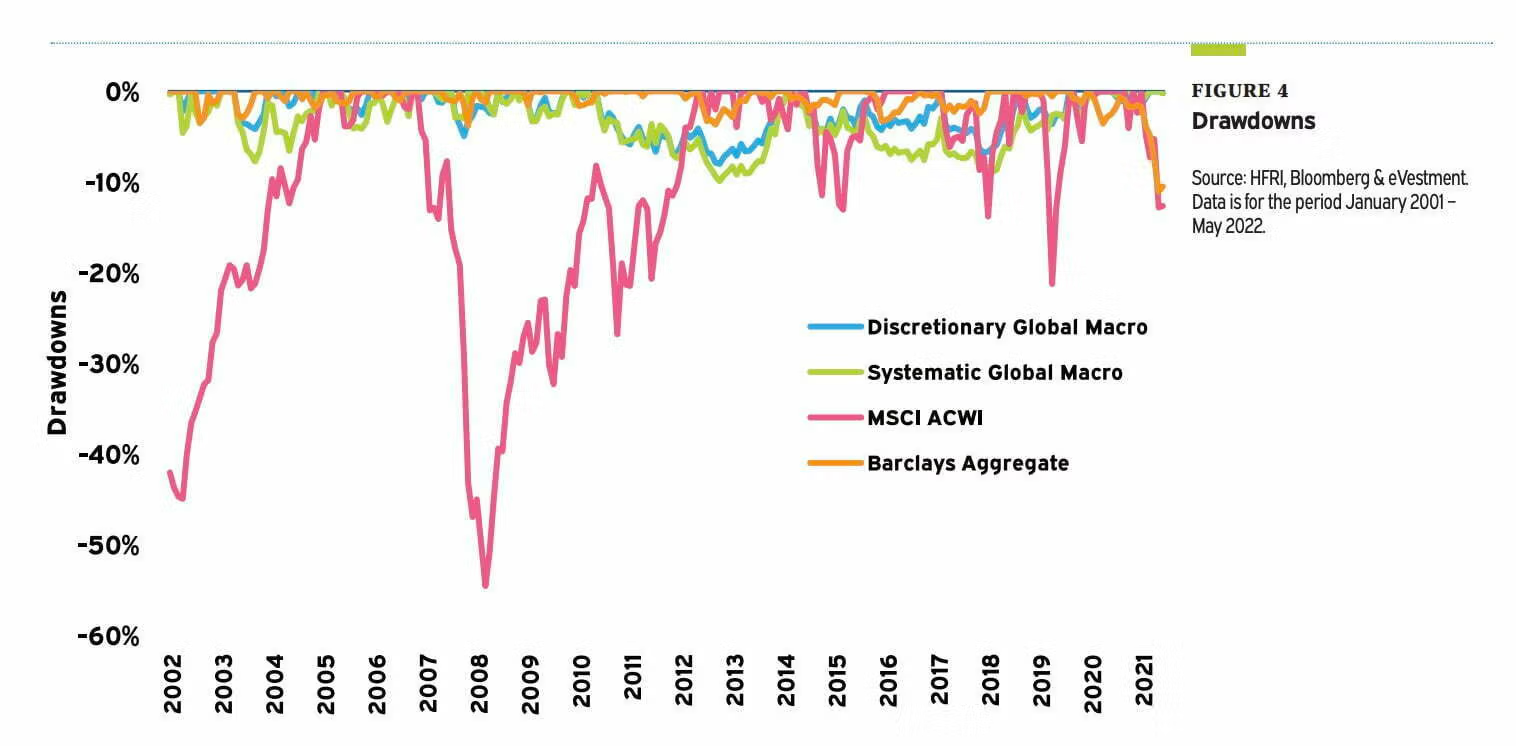

What should I expect for volatility and drawdowns?

GSM volatility targets vary (e.g., 8–15% annualized), with periodic drawdowns from signal crowding or sharp reversals. Trend filters can deliver “crisis alpha,” but choppy/mean-reverting markets can be challenging. Always read the strategy’s vol target, leverage limits, and historical peak-to-trough.

How do fees and costs impact GSM performance?

Return premia can be thin; fees, borrowing, futures rolls, and slippage matter a lot. Net performance depends on efficient execution, internal crossing, and capacity discipline. Compare managers on net Sharpe, capture in stress periods, and capacity policy, not just headline backtests.

What vehicles are available to access GSM?

’40 Act/UCITS funds & ETFs: daily liquidity, tighter leverage, lower capacity.

Private funds/LPs: broader instruments and leverage, but higher fees/lockups.

SMAs/overlays: bespoke exposures and integration with your existing assets.

Vehicle choice affects instruments used, leverage, liquidity, taxes, and fees.

How much should an investor allocate to GSM?

Typical diversified portfolios consider 5–15% to alternatives, with a slice (e.g., 3–10%) to GSM/managed futures depending on goals, risk tolerance, and what other diversifiers you own (e.g., options, alt credit). Size exposure to your max tolerable drawdown, not just to expected return.

How do I evaluate a GSM manager?

Use a structured checklist:

Process: signal set, research governance, de-biasing & validation.

Risk: vol targeting, tail controls, exposure & liquidity limits.

Execution: markets traded, cost budgeting, slippage tracking.

Evidence: live vs. backtest consistency, crisis behavior, factor attribution.

Ops: data lineage, model inventory, kill-switches, team & turnover, capacity.

Can GSM be combined with other strategies?

Yes—pairing GSM with equity, bond, and alternative sleeves (e.g., merger arb, alt credit, option hedges) can improve the overall Sharpe/correlation mix. Within GSM, multi-signal blends (trend + carry + value + macro fundamentals) can reduce single-factor whipsaw risk.

Educational only. Not investment advice. Past performance is not indicative of future results.

Global Systematic Macro Final Thoughts

In conclusion, the GSM approach is a quantitative investment strategy that involves trading in various financial markets with the aim of generating returns from market inefficiencies and mispricings. The approach involves using sophisticated computer algorithms and data analysis to identify macroeconomic trends and market anomalies, which are then used to create and execute trading strategies.

The GSM approach has several advantages, including diversification, systematic trading, and the use of leverage to enhance returns. However, it is not without its challenges, including the risk of unexpected market events, the need for constant model refinement, and the risk of overfitting and model decay.

Despite these challenges, the GSM approach has proven to be a successful investment strategy for many managers. The availability of data, advances in technology, and the availability of skilled talent have all contributed to the success of the GSM approach.

Examples of successful GSM managers, such as Bridgewater Associates and Two Sigma Investments, highlight the potential of this approach to generate strong returns and diversify portfolios. However, investors considering the GSM approach should be aware of the risks involved and should carefully evaluate the performance of any manager they are considering before making an investment.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.