If there is one thing that I’m relentlessly obsessed about on this blog, it is seeking out capital efficient puzzle pieces for my portfolio.

Fortunately, we’ve entered into the golden age of expanded canvas portfolios where fund providers are recognizing an opportunity in the marketplace to create capital efficient ETFs that allow savvy advisors and informed DIY investors the opportunity to assemble the capital efficient portfolios of their dreams.

No fund provider better exemplifies this than Simplify ETFs.

With this in mind, we’ll be zeroing in specifically on one of their most exciting new capital efficient treasury ETFs.

TUA ETF.

Better known as Simplify Short Term Treasury Futures Strategy ETF.

I’m delighted to have Harley Bassman return to share the strategy behind the fund.

Without further ado, let’s explore what makes TUA ETF such an intriguing portfolio puzzle piece.

Review Of The Strategy Behind TUA ETF (Simplify Short Term Treasury Futures Strategy ETF) with Harley Bassman

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of TUA ETF?

For those who aren’t necessarily familiar with “capital efficient treasury” investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

In a nutshell, capital efficient investing considers the “opportunity cost” of the funds used to invest in some asset.

It often involves the use of “derivatives” such as futures and options, but could also include mortgage loans.

For instance, say you own a bond that yields 5.0%, and you want to buy a house where you could borrow at 4.5%.

(A lower rate because the loan is secured by a house, not the promise to pay from a Corporation).

You could sell the bonds and buy the house, or you could take out a mortgage and keep the funds invested in the bond.

Here, you are being “capital efficient” because the return on the bond exceeds the financing cost for the house.

Yes, there is more risk here, but not a lot more.

In the financial markets one can sometimes “borrow” via futures or options at a lower cost than other sources of funds. While futures and options can be tricky, if you put pencil to paper and follow the money, you can see the advantage.

Please see my commentary “Leverage is not a Four-Letter Word“.

Unique Features Of Simplify Short Term Treasury Futures Strategy ETF TUA

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

TUA may be technically qualified as “active”, but it is far from that.

This fund buys 4.8 times the CBOT listed two-year US Treasury futures contract, offering almost identical performance.

As such, this ETF moves in a similar fashion as an equal investment in the UST 10yr bond because the “duration” of a 10yr is about 4.5 times as great as an investment in UST 2yr bonds.

Of course, since the 2yr and the 10yr can have rate changes that differ, they will perform differently, but with the Yield Curve the most INVERTED (2yr rate above 10yr rate) in over 40 years, this offers an interesting risk profile.

To be clear, this is pure leverage in the sense that it is 4.8 times the risk of the UST 2yr, but for accounts that have a targeted duration risk, it is a nice alternative.

What Sets TUA ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other treasury funds being offered in what is already a crowded marketplace?

What makes it unique?

What makes Simplify unique is that we provide direct access to futures in ETF form, at a low cost.

While many investors are familiar with futures trading, it can be functionally difficult to execute.

Most large bulge-bracket firms do not allow futures trading.

While it is possible to open a separate futures account at a firm such as Interactive Brokers, it can be an administrative hassle to move funds, and deal with the separate tax forms and account statements.

What Else Was Considered For TUA ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

This is an exceptionally interesting time to invest in short-maturity bonds since they now offer the highest yields in the market.

FED policy has elevated overnight interest rates to a level much higher than longer-term rates.

The problem, of course, is that when rates are eventually lowered by the FED, the dollar price movement of 2yr bonds is rather slim compared to 10yr or 30yr bonds.

This is the concept of “duration”.

We solve that by using the leverage of futures to offer a (usually) nice yield plus the significant price performance. (I will touch on the “usually” soon.)

Historically, the FED takes rates higher when inflation rises until the economy tips towards recession.

The notion is that a recession, by definition, means less demand for goods and services, and thus less price pressure for inflation.

Soon after the recession starts, the FED jams down rates to cushion the economy.

I suspect the FED will take rates to about 5.00% and then go on hold for the balance of the year.

When the economy slows, they will quickly pull rates lower, and this will be much faster for 2yrs than 10yrs or 30yrs.

So, the price performance of 4.8x the 2yr rate will be superior to 1x the 10yr or 0.5x the 30yr.

The timing of introducing TUA was strictly a function of the massive Yield Curve inversion as so many investors want to profit when short-term rates decline.

So, there wasn’t anything that got chopped.

This was about creating value for investors who want to make a strategic asset allocation that also offers some “recession protection” against other assets in their portfolios.

When Will TUA ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

Back testing TUA is unnecessary since it is direct ownership of the UST 2yr note, period.

That said, the use of leverage is important here as there is an embedded cost of borrowing to consider.

Usually, the cost of borrowing, known as the “implied Repo rate”, is lower than the yield of the UST 2yr, so the leverage is additive.

If the 2yr rate is 4.5%, and the borrow cost is 4.0%, then one is earning 4.8 time the difference (4.5% minus 4.0% times 4.8) plus the interest on the cash invested in 3-month bonds.

This is how TUA will generally yield more than the UST 2yr.

However, and this is important, if the FED were to raise overnight rates substantially above the 2yr rate, it is possible the “borrow cost” could rise above the 2yr rate and reduce the yield of TUA to below the UST 2yr.

This scenario is quite rare; I don’t think it has happened since Volcker jammed rates to 21% in 1980.

Conversely, this could be exactly the right time to buy a product like TUA, since massive inversions tend to happen immediately prior to a rate cutting cycle.

Why Should Investors Consider TUA Simplify Short Term Treasury Futures Strategy ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

I have no problem with the standard 60/40 portfolio for long-term investment.

As such, I feel quite comfortable suggesting 25% of one’s bond allocation being directed to TUA as the static yield is comparable, and there can be significant hedge value if we enter a recession and the FED cuts rates.

How Does TUA ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

While TUA could fit into a standard portfolio on a long-term basis, it can be especially valuable now given magnitude of inversion and the future direction of rates.

I would suggest buying TUA now, and after the FED cuts rates, switching to TYA, a functionally similar product that is 3.2x levered to the listed CBOT 10yr contract.

Owning this contract has been the “go to” trade for some of the most successful bond managers (you can guess the name).

The Cons of TUA ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Explaining how the leverage works, and the calculation of the yield.

Because futures contracts generally last only three months, we “roll” the futures every quarter.

So presently we own the March 2023 contract (TUH3) but will soon roll it to the June 2023 (TUM3) contract.

We will not know the “implied borrow rate” until we roll it, and that will be determined by the confluence of FED policy and market conditions.

Thus, we cannot project the coupon (yield).

We can easily model the price return profile, but not the yield.

This can be bothersome to some investors since bonds typically have a stated yield, which is why they are called “Fixed Income Securities”.

The trade-off is the potential for enhanced price performance, which a lot of investors and manager’s desire.

The Pros of TUA ETF

On the other hand, what have others praised about your fund?

Direct access to listed futures via an ETF in an ordinary investment account is a slam dunk winner.

Also, the fact that it has a stable construction (it is not actively managed except for the quarterly roll) means it can be easily modeled and risk profiled.

Capital Efficiency Investing Ideas

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

Circling back to the top, I’ll expand on the investment benefits of Capital Efficiency.

Let’s say one wants to invest $10,000 in 2yr USTs to profit when the FED cuts rates.

Instead of using the full $10,000, one could invest $2,083 ($10,000 divided by 4.8) into TUA and the balance into some other asset.

One then invests the balance into HYG (or our somewhat similar CDX ETF) to earn a higher yield.

If we enter a hard recession that hurts Junk bonds, the FED would cut rates and the fancy return on TUA would offset the losses on HYG.

I am not recommending this specific trade, but rather illustrating how we are helping people invest in a more capitally efficient way without having to open a futures account.

TUA ETF (Simplify Short Term Treasury Futures Strategy) — 12-Question FAQ

What is TUA in one sentence?

TUA is a capital-efficient Treasury ETF that seeks to deliver the price/yield profile of ~4.8× CBOT 2-Year U.S. Treasury futures, packaged in a simple ETF wrapper.

What does “capital efficient” mean here?

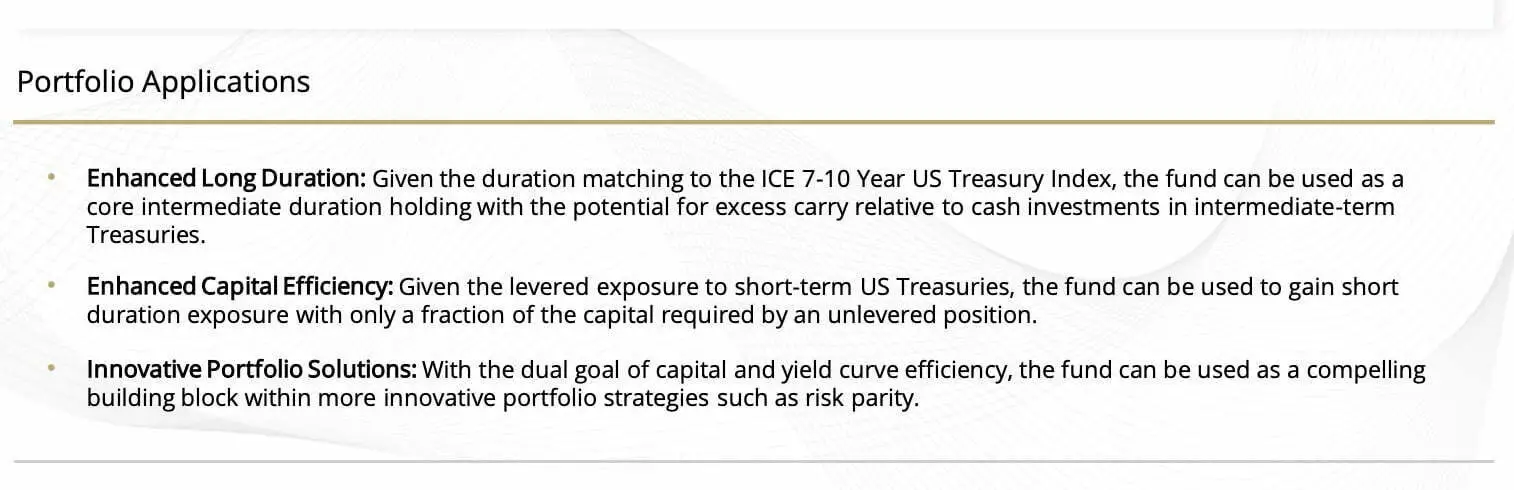

You can target a larger Treasury duration exposure with less upfront capital by using futures inside an ETF—freeing cash/allocations for other sleeves while maintaining your desired interest-rate sensitivity.

What exposure does TUA actually target?

The fund buys ~4.8× 2-Year U.S. Treasury futures. Because a 10-year note has ~4.5× the duration of a 2-year, TUA’s aggregate duration profile can behave somewhat like a 10-year exposure (paths can differ when 2s vs 10s move differently).

Is TUA active, passive, or rules-based?

It may be technically “active,” but is mechanical in practice: it holds the listed 2-year futures and rolls quarterly. There’s no tactical rate-timing overlay.

Does TUA use leverage?

Yes. TUA’s notional exposure is ~4.8× the cash invested, so you’re taking 4.8× the rate risk of a 2-year while keeping the convenience of an ETF account.

When might TUA shine?

In rate-cut cycles following deep yield-curve inversion, when 2-year yields fall quickly and implied financing (repo) stays below the 2-year yield—supporting both price appreciation and favorable carry.

When might TUA struggle?

If the financing/borrow cost (implied repo) rises above the 2-year yield (rare historically) or if the Fed hikes sharply while 2-year yields rise, pressuring prices and carry.

Why can’t you quote a fixed “yield” for TUA?

Because TUA rolls futures quarterly and the implied repo (financing) at each roll depends on Fed policy and market conditions. Price return can be modeled, but yield isn’t fixed like a traditional bond’s coupon.

How could TUA fit in a portfolio?

As a bond-sleeve enhancer. A common idea from the interview: consider allocating ~25% of your bond sleeve to TUA for comparable carry and potential recession-hedge convexity if cuts arrive. (Informational only, not advice.)

How is TUA different from other Treasury ETFs?

It offers direct listed-futures exposure inside an ETF, avoiding a separate futures account, margin logistics, and extra statements—while keeping a stable, modelable construction (other than the standard quarterly roll).

Any “cycle” pairing ideas?

One view: own TUA amid inversion and into rate cuts, then rotate to TYA (a related ETF using ~3.2× 10-year futures) after cuts, to align with changing duration opportunities. (Timing is uncertain; this is educational content.)

An example of capital-efficiency in practice?

Illustratively, instead of using $10,000 to buy 2-year Treasuries outright, someone could put ~$2,083 into TUA (≈$10,000 ÷ 4.8) and deploy the rest elsewhere—accepting added complexity/risks while targeting similar rate exposure. (Not a recommendation.)

Connect With Harley Bassman And Simplify ETFs

Harley’s Website: The Convexity Maven

Twitter: @ConvexityMaven / @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: TUA ETF

Nomadic Samuel Final Thoughts

I want to personally thank Harley for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

Be sure to check out Harley’s previous contribution to the “Strategy Behind The Fund” for Simplify Interest Rate Hedge ETF PFIX.

If you’re interested in learning more about Simplify ETFs I’ve reviewed the following strategies:

- Simplify Macro Strategy ETF FIG

- Simplify Managed Futures Strategy ETF CTA

- Simplify Intermediate Term Treasury Futures Strategy ETF TYA

- Simplify US Equity PLUS Downside Convexity ETF SPD

Also, special thanks to Eric McArdle (@EMcArdleInvest) for helping to coordinate things behind the scenes!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.